-

CENTRES

Progammes & Centres

Location

[India’s Energy Sector: About to Take-off?]

“Despite the speed of change, India accounted only for 4.9 percent of global energy consumption while China accounted for 23 percent. But India accounted for over 34 percent of global consumption increment which is more than half of China’s contribution of net increment in consumption in 2014. India did not score well in the production of hydrocarbons. India produced only 23.2 percent of its gross oil consumption in 2014, the lowest proportion ever according to BP. Natural gas production and consumption continued to decline with both much below their peak levels in 2011. In contrast fossil fuel consumption growth in China was led by natural gas at 8.6 percent…”

Energy News

[GOOD]

Subsidy delivery reform that has saved billions of rupees should be accelerated!

Congestion in transmission networks holding up flow of cheap power is unacceptable!

[UGLY]

India’s solar push may end up as a perverse subsidy to the rich by the poor if it is going to create employment in China and USA!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· India’s Energy Sector: About to Take-off? (Part I)

ANALYSIS / ISSUES…………

· Power Sector Slippages: Historical Analysis

DATA INSIGHT………………

· Green House Gas Emissions in Major Cities

[NATIONAL: OIL & GAS]

Upstream…………………………

· PM launches OVL oil block project in Kazakhstan

· Videocon plans to invest $2.5 bn in Brazil O&G

· ONGC to cut gas production by 40 percent

· RIL to relinquish 2 gas finds, carry out DST on 3 other discoveries

Downstream……………………………

· MHI bags IOC contract for two LNG storage tanks at Ennore

Transportation / Trade………………

· IOC-Adani combine bid for CNG licence in 5 cities

· GAIL to offer foreign shipbuilders 5 yrs for making LNG carriers

· CPPB, JSIW and ILFS top bidders for Jagdishpur-Haldia project

· Modi's Russia, Central Asia visit to boost energy, trade ties

· Worthwhile Gases to supply LPG to TN

· India takes 23 percent less Iranian oil Jan-June vs a year ago

· IGL surges on favorable court ruling in gas rate case

Policy / Performance…………………

· India looking to import LNG from Canada

· RIL, Essar Oil to gain from likely price cut in some Saudi crudes

· NRL looks to develop oilfields, export to Myanmar

· India saved $2 bn by reforming fuel subsidiary delivery: Oil Minister

· Subsidised LPG sales under DBT down by 25 percent: Subramanian

· Petrol prices cut by 31 paise per litre, diesel by 71 paise

[NATIONAL: POWER]

Generation………………

· NHPC to develop hydroelectric projects in Darjeeling

· Chhattisgarh scores 34 percent hike in power generation

· NTPC Simhadri in expansion mode

· BHEL commissions Sudan's largest power project

· R&R site for Odisha UMPP to be finalised soon

Transmission / Distribution / Trade……

· Coal import dependence to reduce if CIL output rises

· UP govt departments top list of power bill defaulters

· PGCIL clears ` 22.4 bn for Green Energy Corridor project

· Transmission of power from Tripura to Bangladesh next year

· Delhi discoms can save up to ` 8.8 bn if purchase from exchanges: IEX

· CERC panel bats for enhancement in central, state transmission systems to address congestion

· India coal imports flat in June as local supply jumps

· Poor transmission network chokes power supply to Rajasthan, UP & Punjab

· Why not sell coal from Chhattisgarh mines to JPL: HC to CIL

Policy / Performance…………………

· Govt flips the switch to 20 year power plan

· ECIL hands over critical nuclear monitoring equipment to JNPT

· Another power tariff hike in the offing in Delhi

· AERB yet to clear Kovvada nuclear plant site: CPI(M)

· Madras HC orders a stay opening tender for ` 80 bn thermal power project

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· CNOOC's new output to lift China's oil production from 2014 record

· KazMunaiGas plans to divest 50 percent stake in Kashagan

· Shell will develop the Appomattox oil field in the US Gulf of Mexico

· Tullow enjoys strong oil production in West Africa

· Statoil finds oil, gas near Gina Krog field in the North Sea

Downstream……………………

· Thailand's IRPC to cut refinery run rate in third quarter

· Pertamina plans to spend $25 bn to upgrade 4 oil refineries in Indonesia

· China's diesel exports may return after going missing in action

Transportation / Trade…………

· Gazprom delays gas pipelines to link to Turkish line

· Tanker arrivals create volatility in US oil stocks

· France's Engie signs deal to supply LNG to Beijing Gas Group

· Russia stops gas supplies to Ukraine

· Azeri SOCAR's first-half oil shipments via Russia up 33 percent

· Wood Group bags Origin's pipeline contract for HBWS gas project in Victoria

· Ukraine halts Russian gas imports after pricing talks fail

· Russia seen extending oil-sales lead with second China pipeline

· Cheniere starts building 5th train of Sabine Pass LNG project

· Eni will sell LNG from Jangkrik field to Pertamina

Policy / Performance………………

· China extends Xinjiang oil block bids to non-state companies

· Nigerian President denies oil savings account to be depleted

· Canadian 2015 capital spending plans decline on O&G

· Tanzanian lawmakers pass disputed petroleum bill

· BP reaches $18.7 bn settlement over deadly 2010 spill

· Mexico plans auction of 244 oil fields by 2019 to boost output

· Uganda short-lists 17 companies in first oil-licensing round

[INTERNATIONAL: POWER]

Generation…………………

· JAKS to build US$1.8 bn power plant in Vietnam with China partner

· Inter RAO will build a 440 MW CCGT project in Ufa

· Nigeria's Transcorp plans to increase power generation capacity to 2.5 GW

· Scottish Power Company to construct power plant

· Cameroon needs to invest US$6.3 bn in its power sector

· Egbin Power hits over 1 GW generation milestone

Transmission / Distribution / Trade……

· Four Asian countries to ink deal on power transmission

· EnviroMission to deveop Harcuvar transmission project in Arizona

· EIB lends €500 mn to RTE to upgrade French electricity transmission grid

Policy / Performance………………

· UK energy consumers paying $1.9 bn too much

· Indonesia plans 1.5 percent tax on coal exports for IUPs as of August 2015

· Germany agrees to mothball 2.7 GW of lignite-fired power plants

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Railways to light up stations with solar power

· Kalam inaugurates mini solar plant in Kannauj district of UP

· US Ex-Im Bank suspends $1 bn loan for energy in India

· GERMI launches android app for gauging solar power potential

· China puts up awareness ads showing environmental issues in India

· ReNew Power, China’s Hareon Solar to jointly set up 72 MW solar plant in AP

· Adani group signs MoU with TN for ` 45.3 solar park

· New rules: Availability-based rate for renewable power

· India's climate pledge 'critically important': UN climate chief

· Govt's $100 bn solar push draws foreign firms as locals take backseat

· MNRE wants one Act for all green energy policies

· ZSI monitoring climate change impact on Sundarban animals

· Javadekar launches web portal for online application for Environment Clearance

· Rays Power Infra announces foray into wind and transmission sector

GLOBAL………………

· Carbon Tracker sees $283 bn of LNG projects as uneconomic

· Oman to build first solar power plant

· Kengen will start building 400 MW Meru wind project in 2016

· Japanese power companies consider 35 percent cut in CO2 emissions by 2030

· DECC faces 90 percent staff budget cuts that risk UK's climate plans

· China urged to make deeper cuts in coal use for climate pledge

· German wind-to-hydrogen plant takes car-fuel battle to Tesla

· China, Brazil shift climate talks into fast lane with pledges

· Russia’s effort to limit pollution is going up in smoke

· South Korea plans 37 percent reduction in GHG emissions by 2030

[WEEK IN REVIEW]

COMMENTS………………

India’s Energy Sector: About to Take-off? (Part I)

Lydia Powell and Akhilesh Sati, Observer Research Foundation

|

I |

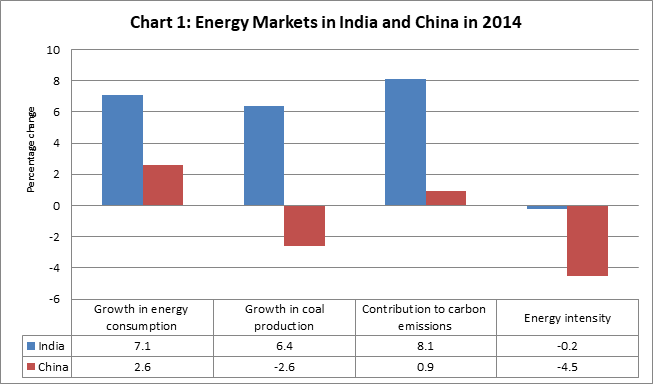

ndia is compared with China as a matter of routine on almost everything. Except when political models are compared, India rarely comes out ahead. The energy sector is no different. The Chinese energy basket is roughly four times the size of the Indian energy basket (if non-commercial energy is included) and six times the size of the Indian energy basket (if non-commercial energy is excluded). Even though China and India have comparable population numbers, India is a distant second or third to China on most energy parameters. This may be about to change, at least in terms of rate of change (albeit from a smaller base) if not in terms of absolute levels of change (Chart 1).

Source: BP Statistical Review 2015

BP’s Statistical Review of World Energy Markets for 2015 that captures energy developments at the national, regional and global level for the calendar year 2014 observes that India posted an all time high in energy consumption growth in 2014 and that India regained the number two position in energy consumption growth from the United States. India’s energy consumption increased by 7.1 percent in 2014 compared to China’s 2.6 percent, China’s slowest since 1998 and less than half the ten year average growth rate of 6.6 percent. On the other hand, Indian coal production increased by 6.4 percent while China’s coal production declined by 2.6 percent. India’s coal production reached a high of 644 million tonnes (mt) with output growing by 38.9 mt, the largest increase in the world for 2014 and the largest ever increase for India.

Despite the speed of change, India accounted only for 4.9 percent of global energy consumption while China accounted for 23 percent. But India accounted for over 34 percent of global consumption increment which is more than half of China’s contribution of net increment in consumption in 2014.

Source: BP Statistical Review 2015

India did not score well in the production of hydrocarbons. India produced only 23.2 percent of its gross oil consumption in 2014, the lowest proportion ever according to BP. Natural gas production and consumption continued to decline with both much below their peak levels in 2011. In contrast fossil fuel consumption growth in China was led by natural gas at 8.6 percent.

The fastest growing fuel in India in 2014 was renewable energy which is now six times larger than it was ten years ago. Surprisingly bio-fuels recorded the fastest growth of a staggering 29 percent among renewables. One would have thought that it would be solar energy, given the heavy push that it is receiving. India emerged as the largest contributor to global carbon emissions in 2014 with 8.1 percent growth in carbon emissions compared to China’s 0.9 percent. India’s energy intensity decreased by 0.2 percent, much lower than the ten year average of -1.1 percent. In contrast China’s energy intensity decreased by 4.5 percent.

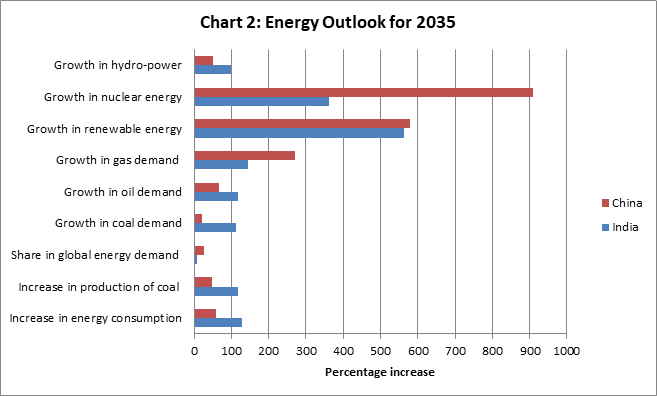

BP’s long term projections for 2035 which presents only one ‘most possible’ scenario puts India in the lead but only in terms of growth (Chart 2). By 2035, India’s energy production led by coal is expected to increase by 117 percent compared to 47 percent growth in China. Energy consumption in India is expected to increase by 128 percent compared to 60 percent in China. China’s share in global energy demand is expected to increase from 22 percent to 26 percent by 2035 while India’s share in global energy demand is expected to double to 8 percent.

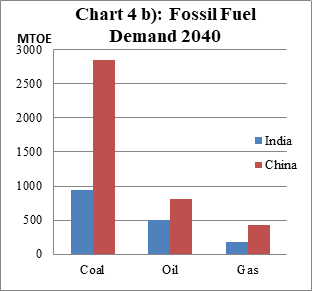

India’s dependence on fossil fuels is expected to decline to 87 percent from 92 percent today. India’s oil imports are expected to increase by 161 per cent, coal imports by 96 percent and gas imports by 270 percent by 2035. BP expects natural gas to lead fossil fuel growth in demand with an expansion of 145 percent (compared to 270 percent expansion in China) by 2035, followed by oil at 117 percent (compared to 67 percent expansion in China) and coal at 112 percent (compared to just 21 percent in China). Overall renewable energy is expected to expand by 564 percent (compared to 580 percent in China) followed by nuclear at 363 percent (compared to 910 percent in China) and hydro at 98 percent (compared to 50 percent in China).

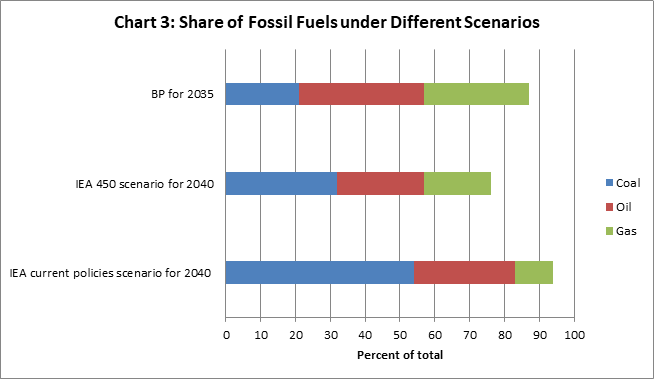

Source: BP Statistical Review 2015 & World Energy Outlook 2014

A surprising projection from BP that differs markedly from projections by the International Energy Agency (IEA) as well as projections by domestic agencies is that it expects ‘oil’ to ‘remain’ the dominant fuel with a share of 36 percent followed by gas at 30 percent and coal at 21 percent (Chart 3). Even the most pessimistic scenario of the IEA does not give oil and gas higher shares than coal.

For example the 450 scenario of the IEA which minimises expansion of fossil fuels and maximises the expansion of renewables projects a share of 32 percent for coal in 2040 followed by a share of 24 percent for oil and 11 percent for gas. BP also appears to be far more optimistic on the prospects for gas demand growth in India compared to other projections. The assumptions behind BP’s projections are not specified. Three observations can be made at this point.

The first is that projections only reflect assumptions made today not reality that will unfold tomorrow. India’s energy basket may look very different from what is projected by IEA or BP by 2040. No agency projected that more than two thirds of Indians will get their first mobile phones before they get their first light bulb. Something similar could happen in the energy sector if there is a break-through technology that rivals the mobile communications technology of the last decade.

Second it would be incorrect to conclude that China is deliberately moving away from coal and other fossil fuels to clean itself up while India continues to indulge in using fossil fuels. China embarked on a path of high-investment, high-energy growth over a decade ago. This growth is winding down naturally. This growth phase not only lifted more than 500 million out of poverty but has also given China the wealth to indulge in other forms of energy. India has barely begun its growth spurt.

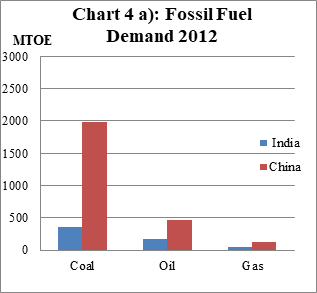

Third it would be unwise to get carried away by India’s energy demand taking off. India’s energy take-off is not necessarily because it has ‘taken-off’ the way China’s did in the last decade. India’s energy demand is growing at a more or less steady phase but India’s growth appears larger because China’s growth is not as large as it used to be (Chart 4 a & Chart 4 b).

Source: World Energy Outlook 2014

to be continued.......

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

ANALYSIS / ISSUES……………

Power Sector Slippages: Historical Analysis[1]

Ashish Gupta, Observer Research Foundation

|

Five Year Plan |

Power Generation Capacity Target (MW) |

Actual Achievement (MW) |

Reason for Slippages |

|

1st Five Year Plan (1951-56) |

1,300 |

1,100 |

The first legislation over the power sector was in 1887. This was repealed by Electricity Act, 1903 and then by Indian Electricity Act, 1910. After Independence the Electricity Act, 1948 was enacted This laid the foundation for the Indian Power sector.

Per capita consumption was merely 30.9 kwh. |

|

2nd Five Year Plan (1956-61) |

3,500 |

2,250 |

The slippages were due to project execution delays at Rihand, Koyna, Hirakud and Bhakra-Nangal.

Per capita consumption improved slightly to 45.9 kwh. |

|

3rd Five Year Plan (1961-66) |

1,040 |

4,520 (not an achievement) |

Sino-Indian War and Indo-Pak War in 1962 and 1965 delayed the implementation of many power projects.

Per capita consumption further improved to 73.9 kwh. |

|

4th Five Year Plan (1969-74) |

9,264 |

4,519 |

Many power projects were behind schedule during the 4th Plan period due to war in the last Plan. There were power cuts and staggering of loads in many regions.

Per capita consumption reached to 126.2 kwh. |

|

5th Five Year Plan (1974-79) |

12,499 |

10,202 |

The slippages were mostly from the last Plan.

Per capita consumption slightly improved to 171.6 kwh. |

|

6th Five Year Plan (1980-85) |

19,666 |

14,226 |

At the end of March, 1980 the generation capacity of 29,665 MW were sanctioned. Of this 19,666 MW was commissioned during the plan comprising of 13,846 MW thermal, 5,130 MW of Hydro and 690 MW of Nuclear.

Per capita consumption further improved to 228.7 kwh. |

|

7th Five Year Plan (1985-90) |

22,245 |

21,401 |

Poor capacity utilisation vitiated the working of many utilities.

Per capita consumption rose to 329.2 kwh. |

|

8th Five Year Plan (1992-97) |

30,533 |

16,423 |

The reasons for slippages included inadequate financial support to the State and Central power sector projects.

Per capita consumption reached to 464.4 kwh. |

|

9th Five Year Plan (1997-02) |

40,245 |

19,015 |

The reason for the shortfall in capacity additions included delay in land acquisition, environmental clearances, Rehabilitation & Resettlement issues and law and order problems.

Per capita consumption further improved slightly to 559.2 kwh. |

|

10th Five Year Plan (2002-07) |

41,110 |

21,130 |

Procedural and administrative delays continued and led to slippages.

Per capita consumption rose to 671.9 kwh. |

|

11th Five Year Plan (2007-12) |

78,000 |

54,964 |

54,965 MW generation capacity was added as against the total capacity addition of 56,618 MW in the 8th, 9th and 10th Plans taken together.

Per capita consumption reached a level of 884 kwh. |

|

12th Five Year Plan (2012-17) |

64,790 Coal Based capacity addition target till 2014-15 |

Achievement will be given at the end of the Plan |

34,455.5 MW coal based capacity added till 2014-15.

Ø 1,197 MW hydro generation capacity was also added during the concerned period. Ø 1,000 MW nuclear capacity was also added till 2014-15. Per capita consumption during the period still remains very low and stands at 957 kwh (provisional). |

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

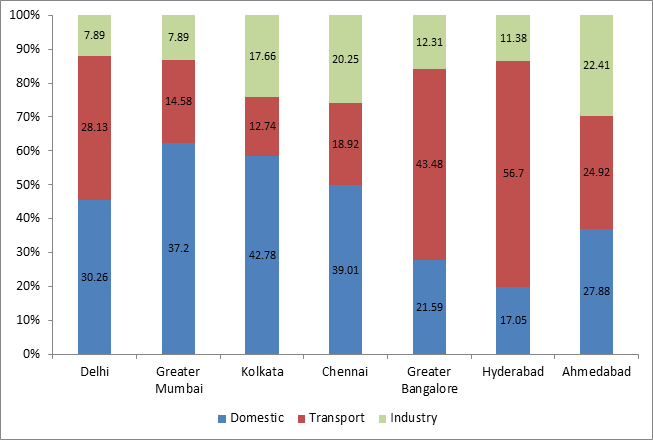

Green House Gas Emissions in Major Cities

Akhilesh Sati, Observer Research Foundation

|

City |

Total GHG Emissions (Million Tonnes of CO2 equivalent) |

|

Delhi |

38.63 |

|

Greater Mumbai |

22.78 |

|

Kolkata |

14.81 |

|

Chennai |

22.09 |

|

Greater Bangalore |

19.8 |

|

Hyderabad |

13.73 |

|

Ahmedabad |

9.12 |

Sector-wise GHG Emissions (% Share in Total)

Source: Study on ‘GHG footprint of major cities in India’ by the Centre for Ecological Sciences, Indian Institute of Science, (IISc) Bangalore, quoted in Lok Sabha, Starred Question No. 486, answered on 28.04.2015.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

PM launches OVL oil block project in Kazakhstan

July 7, 2015. Prime Minister (PM) Narendra Modi launched maiden drilling by ONGC Videsh Ltd (OVL) in the Satpayev oil block of Kazakhstan where the Indian firm is investing USD 400 million. OVL, the overseas arm of Oil and Natural Gas Corp (ONGC), had bought 25 percent of Satpayev oil block in 2011. It paid USD 13 million as a signing amount to Kazakhstan. In addition, it paid USD 80 million as a one-time assignment fee to KazMunaiGas (KMG). OVL had committed a minimum exploration investment of USD 165 million and an additional optional expenditure of USD 235 million to the project. The company has already invested USD 150 million in Satpayev and will invest a total of USD 400 million in exploration. The Satpayev block, measuring 1,582 sq km, is located in the North Caspian Sea, in water depths of 6-8 m, and has two prospective areas that hold an estimated 256 million tonnes of oil and natural gas resources. It lies near four major discoveries. OVL estimates a peak output of 287,000 barrels per day from the Satpayev and Satpayev Vostochni (East) structures. Delays and cost overruns have dogged Kazakhstan's efforts to expand offshore production of oil and gas. OVL had planned to drill two exploration wells on Satpayev in 2014 and 2015 but delivery of a drill rig has been delayed and will start drilling next month. (www.business-standard.com)

Videocon plans to invest $2.5 bn in Brazil O&G

July 3, 2015. Videocon Industries Ltd., an Indian maker of consumer electronics with ambitions to become a major energy producer, plans to invest as much as $2.5 billion over three years in Brazilian oilfields, Chairman Venugopal Dhoot said. The scope for oil from its blocks in the South American country is four times higher than the largest field in India and the company will pursue expanding its energy operations there, Dhoot said. Dhoot is seeking to reposition Videocon as an oil & gas (O&G) explorer with stakes in at least eight hydrocarbon blocks in countries including Indonesia and East Timor. It is exploring “more and more,” with mergers and acquisitions being one of the key opportunities, the company said. Dhoot said the Aurangabad, Maharashtra-based company will be known as an oil and gas firm. In the 18-month accounting period ended Dec. 31, consumer durables accounted for 90 percent of the ` 171 billion ($2.7 billion) in sales, according to the company. He plans to reverse this in the next three years, he said. Videocon owns stakes in 10 exploration blocks in Brazil through a joint venture with an upstream unit of Indian refiner Bharat Petroleum Corp. Many of them are operated by Petroleo Brasileiro SA (Petrobras), which is selling assets to reduce debt that stands at an industry-high of $125 billion. (www.bloomberg.com)

ONGC to cut gas production by 40 percent

July 3, 2015. Oil and Natural Gas Corp (ONGC) will cut gas production from its biggest fields in the Arabian sea by about 40 percent as it carries out repair work on a pipeline that carries the gas to shore. ONGC produces 33 million standard cubic meters per day of natural gas from the Bassein field in the western offshore. The gas is carried to shore by two under-sea pipelines, a 42-inch line and a 32-inch line. The company plans to carry out repair work on the 42-inch pipeline that carries natural gas from the Bassein field to Hazira, from July 7 to 27. GAIL India Ltd, which sells gas produced from the ONGC fields to the customers, has been intimated of the shutdown. (economictimes.indiatimes.com)

RIL to relinquish 2 gas finds, carry out DST on 3 other discoveries

July 1, 2015. Reliance Industries Ltd (RIL) has decided to relinquish two discoveries and carry out the controversial Drill Stem Test (DST) at three discoveries to confirm the viability of gas reserves following a cabinet decision that offered a way out of the logjam between the operators and the regulator. The government had offered RIL and Oil and Natural Gas Corporation (ONGC) the option to relinquish the block, conduct DST or develop the discovery without conducting DST in a ring-fenced manner. A disagreement between the Directorate General of Hydrocarbons and the operators on the utility of DST for confirming the potential of reserves had held back development of associated gas reserves of about 90 billion cubic metres worth ` 1 lakh crore. RIL and its partners BP and Niko have informed the government that they would relinquish discoveries D-40 in NEC-25 block off the Odisha coast and D-31 in KG D6 block. The operator will, however, conduct DST on discoveries D-32 in NEC-25 block and D-29 and D-30 in KG D6 block. The contractor will undertake DST in one of the drilled appraisal wells related to the discoveries and separately submit budget estimates for DST. (economictimes.indiatimes.com)

Downstream………….

MHI bags IOC contract for two LNG storage tanks at Ennore

July 6, 2015. Indian Oil Corp (IOC) has awarded a contract to build two football stadium-sized LNG storage tanks at its upcoming Ennore LNG import terminal in Tamil Nadu to Mitsubishi Heavy Industries Ltd (MHI) of Japan. This is also the first LNG storage tank order that MHI has received from India. The high-capacity LNG storage tanks will have a capacity to hold 180,000 cubic meters of gas each and will be installed at a liquefied natural gas (LNG) terminal that IOC will build near Ennore port, about 25 kilometers north of Chennai on the Bay of Bengal. IOC plans to build a terminal to import gas turned into liquid at minus 160 degrees Celcius (LNG) in ships at Ennore at a cost of ` 5,150 crore by 2019. Tamil Nadu government enterprise, TIDCO has 5 percent stake, while IOC has 45 percent holding in the project. The balance 50 percent will be for a strategic partner like LNG supplier. Till such a strategic partner is roped in, ICICI and IDFC have agreed to hold 50 percent interest. Ennore will be the third LNG terminal on the east coast with GAIL India Ltd building a facility at Kakinada in Andhra Pradesh and Petronet LNG Ltd proposing a 5 million tonnes facility at Gangavaram in Andhra Pradesh. India currently has four LNG import terminals, all on the west coast -- Dahej and Hazira in Gujarat, Dabhol in Maharashtra and Kochi in Kerala. (economictimes.indiatimes.com)

Transportation / Trade…………

IOC-Adani combine bid for CNG licence in 5 cities

July 7, 2015. Indian Oil Corp (IOC)-Adani Gas combine has bid for a licence to retail CNG in five cities including Haridwar in the 5th round of city gas bidding that saw no bids for as many as eight cities. Besides Haridwar, IOC Adani combine bid for Tumkur, Belgaum and Dharward districts in Karnataka and Udham Singh Nagar in Uttarakhand, according to information available from Petroleum and Natural Gas Regulatory Board (PNGRB). GAIL India Ltd through its subsidiary GAIL Gas bid for Tumkur and Dharward and in consortia with Bharat Petroleum Corp Ltd (BPCL) for Haridwar, Udham Singh Nagar and Belgaum. GSPC Gas bid for Banaskantha district in Gujarat while Maharashtra Natural Gas Ltd bid for rights for Ahmadnagar district in Maharashtra. Hindustan Petroleum Corp Ltd (HPCL) in joint venture with Andhra Pradesh Gas Distribution Corp Ltd bid for licence to retail CNG and piped cooking gas in East Godavari, Krishna and West Godavari districts of Andhra Pradesh. Lesser known firm, Megha Engineering & Infrastructure Ltd put in bids for East Godavari, Belgaum, Krishna, West Godavari, Tumkur and Dharward districts. PNGRB said no bids were received from Badaun, Aligarh and Bulandshahr district in Uttar Pradesh, Lathur and Osmanabad in Maharashtra, Shivpuri in Madhya Pradesh and Bidar in Karnataka. Besides there were single bids for Dhar district in Madhya Pradesh and Dahod in Maharashtra and PNGRB has decided to retender them. (economictimes.indiatimes.com)

GAIL to offer foreign shipbuilders 5 yrs for making LNG carriers

July 7, 2015. GAIL India will offer foreign shipbuilders five years to make liquefied natural gas (LNG) carriers in India, double the time allowed to deliver ships from their home shipyards — a concession it hopes will attract foreign firms to locally manufacture ships proposed to be chartered by the Indian gas company. As part of Prime Minister Narendra Modi's 'Make in India' initiative, GAIL is insisting foreign shipbuilders to build in India at least a third of the 11 LNG carriers it plans to charter for about 20 years beginning 2017 to transport LNG from the US. GAIL plans to charter these carriers from one or more shipping lines, which will have to purchase LNG carriers from the shipbuilders that meet the local production criteria prescribed by the Indian firm. (economictimes.indiatimes.com)

CPPB, JSIW and ILFS top bidders for Jagdishpur-Haldia project

July 6, 2015. China Petroleum Pipeline Bureau (CPPB), JSIW Infrastructure and Infrastructure Leasing & Financial Services (ILFS) have emerged front-runners in the race to lay pipelines in the first phase of the Jagdishpur-Haldia Pipeline project that has finally taken off after nearly eight years of uncertainty, induced by unavailability of gas as well as customers. Laying of the 2,050-km pipeline is closely linked to the revival of fertiliser units in Barauni in Bihar and Gorakhpur in Uttar Pradesh and is widely seen as an effort by the NDA government to portray itself as the harbinger of economic progress in poll-bound Bihar, where the BJP and allies are locked in a keen contest with the incumbent coalition of Janata Dal (United) and Rashtriya Janata Dal. The pipeline will supply customers with imported liquefied natural gas. A shortage of locally produced gas, mainly due to a dramatic decline in the output from Reliance Industries' KG D6 field, was one of the main reasons delaying the setting up of the Jagdishpur-Haldia pipeline. The two fertiliser units and Indian Oil Corp's refinery in Barauni will be the anchor customers, critical for the viability of any pipeline, especially at a time when less than half of India's existing gas pipeline network is being utilised, squeezing operators' profits. India plans to double its gas pipeline network to 30,000 km in five years, but scarcity of local cheaper gas and reluctance of consumers to pay for pricey imports have clouded prospects. (economictimes.indiatimes.com)

Modi's Russia, Central Asia visit to boost energy, trade ties

July 5, 2015. Prime Minister Narendra Modi's forthcoming visit from July 6-13 to Russia as also five Central Asian countries is expected to boost strategic and economic ties with the region, India Inc said. Terming Modi's visit to Central Asia a "landmark" event to revitalise our ancient links with the region, the Confederation of Indian Industry (CII) estimated that trade with the five Central Asian countries of Kazakhstan, Turkmenistan, Tajikistan, Uzbekistan and Kyrgyzstan can grow manifold from the small base of USD 1.4 billion currently. Stressing on the need to develop more transport corridors to connect India to the Central Asian region, the CII said priority must be given to the TAPI (Turkmenistan-Afghanistan- Iran-Pakistan) pipeline project. It also recommended the energy sector be accorded high priority, as Kazakhstan is a significant oil producer while the other countries are estimated to have large reserves of natural gas. The CII said major areas of opportunity for India in Central Asia include oil and gas, minerals and metals, agricultural products, pharmaceuticals, textiles and chemicals. India's exports to the five Central Asian countries at USD 604.32 million and its imports at USD 775.73 million. Kazakhstan is India's largest trading partner among the five countries, and trade has seen a rapid expansion as India is sourcing mineral fuels from the country. (www.deccanherald.com)

Worthwhile Gases to supply LPG to TN

July 3, 2015. Worthwhile Gases Pvt Ltd, a Chandigarh-based LPG provider, will supply non-subsidised liquefied petroleum gas (LPG) cylinders, my gas, to Tamil Nadu (TN) beginning August 15. The company buys LPG from Qatar. It has entered into a master franchise alliance with VM Agencies for this purpose. Torus Energy Company, the US based energy management solution provider, supports backend processes and procures regular supply of cylinders for Worthwhile Gases. The company offers 6 kg, 15 kg and 17 kg LPG cylinders at ₹ 392, ₹ 981 and ₹ 1112 for domestic and industrial purposes respectively. Worthwhile Gases said the LPG cylinders are sold at ₹ 62 per kg, five rupees less than the rate determined by the government. According to oil industry, bulk LPG requirement in Tamil Nadu is 1.2 million tonnes per annum while the availability is 0.4 million tonnes. Worthwhile Gases said ‘my gas’ will be able to meet about 2 percent of that demand. The company has tied up with an operational bottling plant with a capacity of 1,000 tonnes in Thiruvallur district. The company plans to set up franchisees in six Chennai, Coimbatore, Madurai, Tiruchi, Tiruppur and Salem with a focus on bulk, industrial and commercial sales. Worthwhile Gases said a plan to launch quantity based supply of gas to the consumers is in the pipeline. The company will invest ₹ 15 crore to set up LPG blending and bottling plant with a capacity of 1,000 tonnes in Tamil Nadu. (www.thehindubusinessline.com)

India takes 23 percent less Iranian oil Jan-June vs a year ago

July 2, 2015. India's oil imports from Iran fell by about 23 percent over January-June as refiners curtailed shipments in the early months of the year to keep volumes within the limits allowed under an interim nuclear deal in place since the end of 2013. India shipped in 216,500 barrels per day (bpd) of oil from Iran in the first six months of 2015 compared with 281,000 bpd a year ago, according to preliminary data from trade sources and a report. In March, Indian refiners had halted imports from Iran for the first time in at least a decade to meet a fiscal year target of 220,000 bpd, dragging down the average daily purchases for the January-June period. India, the world's fourth biggest oil consumer and Iran's top client after China, received 283,900 bpd oil from the OPEC member in June, a decline of about 23 percent from May but up about 70 percent from the same month last year. For April-June, India's first fiscal quarter and the first three months of annual contracts with Iran, India shipped in nearly 50 percent more oil from Tehran at 306,000 bpd compared with the same period last year, the data showed. (in.reuters.com)

IGL surges on favorable court ruling in gas rate case

July 1, 2015. Indraprastha Gas Ltd (IGL) surged to the highest level in three years in Mumbai after India’s top court said the industry regulator doesn’t have the jurisdiction to set prices for transporting natural gas. IGL, a gas retailer in New Delhi, gained as much as 18 percent to ` 492, the most since June 1, 2012, and traded at ` 464. GAIL India Ltd reversed losses to climb as much as 2.3 percent. The regulator had appealed to the top court after the Delhi High Court ruled in favor of IGL in 2012. The city gas retailer had challenged the regulator in the high court after it cut pipeline transportation rates by 63 percent and gas-compression prices by 59 percent. (www.bloomberg.com)

Policy / Performance………

India looking to import LNG from Canada

July 7, 2015. India is looking to import liquefied natural gas (LNG) from Canada to meet its requirements. Oil Minister Dharmendra Pradhan met Canadian Minister for Natural Resources Greg Rickford at the second India-Canada Ministerial Energy Dialogue in Calgary to discuss enhancing energy cooperation between the two countries. The areas of cooperation discussed at the meeting included oil, natural gas, clean energy, power transmission and skill development. Indian Oil Corp (IOC) has already taken a 10 percent stake in the Pacific NorthWest LNG, while real estate firm Hiranandani Group has announced plans to develop a 4.5 million tonnes per annum LNG export terminal in Melford, Nova Scotia at an estimated cost of $3.3 billion by 2020. Both the ministers highlighted Canada and India's growing energy partnership, by strengthening government and business relationships, to help create jobs and long-term economic prosperity for both countries. While India is fourth-largest energy consumer, Canada is a secure, reliable and responsible producer and supplier of energy to the world and has the resources and expertise needed to support India's growing energy needs. India, in 2009, had for the first time imported Canadian oil. In 2014, India imported 1,500 barrels of Canadian oil per day. In March 2014, IOC acquired 10 percent stake in an integrated LNG project -- Pacific Northwest LNG proposed at Lelu Island, British Columbia. Canada and India will also work together to enhance skill development and share knowledge to accelerate the adoption of clean energy technologies. The third India-Canada Ministerial Energy Dialogue will be held in India in 2016. (economictimes.indiatimes.com)

RIL, Essar Oil to gain from likely price cut in some Saudi crudes

July 3, 2015. Reliance Industries Ltd (RIL) and Essar Oil are set to gain from a likely cut in prices for medium and heavy grades of crude oil sold by Saudi Arabia to Asia, according to industry watchers. Saudi Arabia, traditionally the top exporter of crude to India, is reported to be considering a cut in prices of the medium and heavy grades of crude used by complex refiners, while leaving price of its most popular export, light crude, unchanged. According to a survey of four refiners and traders, the Arab Heavy crude price could fall as much as 70 cents a barrel in August, while Arab Light could post a small drop of up to 20 cents. RIL, Essar Oil to gain from likely price cut in some Saudi crudes. Indian equity analysts said the price cut could benefit the crack spread, which is the difference between price of crude oil and petroleum products extracted from it, of these private sector refiners. (economictimes.indiatimes.com)

NRL looks to develop oilfields, export to Myanmar

July 3, 2015. Assam-based Numaligarh Refinery Ltd (NRL) is looking at going upstream to develop marginal oilfields in the Northeast region and building a 450 km pipeline to Moreah in Manipur to help export diesel and petrol to Myanmar. The move is part of the Union petroleum and natural gas ministry's ambitious plan to bring down imports of petroleum to 67% of total demand by 2022 from 77% now. NRL is anchoring the ministry's project of preparing a hydrocarbon vision document for Northeast India. The firm plans to send a small quantity of petrol or diesel to Myanmar as a trial consignment to explore the possibility of exports. Numaligarh Refinery can export to north and central Myanmar where presently private parties are selling petrol and diesel. The NRL board has already cleared a project to increase its refining capacity to 9 million metric tonnes per annum (mmtpa) from 3 mmtpa now. Bharat Petroleum's board will examine the proposal, which will require investment of ` 20,000 crore, on July 14. After the expansion, the refinery will process imported crude oil too, which is envisaged to be transported from a port in East India to Numaligarh through a new pipeline. (economictimes.indiatimes.com)

India saved $2 bn by reforming fuel subsidiary delivery: Oil Minister

July 2, 2015. India has saved $2 billion in the last one year by taking steps to reform fuel subsidiary delivery, Oil Minister Dharmendra Pradhan said, insisting that the government is working to cut the leakages and not the subsidy. He said that this is what his ministry has successfully worked on in the last one year. Pradhan was visiting the US en route to attend an energy meeting in Canada. He said JAM - Jan Dhanprogramme, Aadhar (key to identity beneficiaries) and mobile for delivery – has reformed fuel subsidiary delivery in India. He explained that 'Pahal' programme is successfully delivering LPG subsidies to the people in India. Noting that $8 billion was spent on LPG subsidy previous year, Pradhan claimed the steps taken by the government has reduced LPG subsidy to $6 billion. He said that the benefits of the programme outweigh the cost – recurring savings in LPG will offset one time set up costs. Pradhan said so far more than seven lakhs people have volunteered to give up their LPG subsidiary benefits. When asked about expanding this to kerosene subsidies as well, Pradhan said this is maintained by the State Governments which varies from state to state. Pradhan said Andhra Pradesh recently offered that this pilot project be expanded to the entire state. (www.firstpost.com)

Subsidised LPG sales under DBT down by 25 percent: Subramanian

July 2, 2015. Sales of subsidised LPG cylinders under the Direct Benefit Transfer scheme (DBT) have come down by about 25 percent as most “ghost beneficiaries” have been eliminated, the Chief Economic Advisor (CEA) Arvind Subramanian said. Subramanian cautioned that the government should make sure genuine beneficiaries are not excluded. Under Pahal, earlier known as DBT, LPG cylinders are sold at market rates and consumers get the subsidy directly in their bank accounts. This is done either through an Aadhaar or a bank account linkage. Pahal looks to cut down diversion and eliminate duplicate or bogus LPG connections. The CEA said that because of schemes like Pahal, Jan Dhan and Aadhaar, institutional arrangement has improved and “things are now working”. (www.thehindu.com)

Petrol prices cut by 31 paise per litre, diesel by 71 paise

July 1, 2015. Fuel retailers have lowered petrol and diesel prices by ` 0.31 a litre and ` 0.71 a litre, respectively, after aligning them with international prices and adjusting for foreign exchange rates. In Delhi, petrol will cost ` 66.62 a litre, while diesel will be available at ` 50.22 a litre. In other places, there will be marginal variations due to local levies. During the last revision a fortnight ago, price of petrol was increased by ` 0.64 a litre and diesel was cut by ` 1.35 a litre. Indian Oil Corp (IOC) said the combined impact of the movement of prices in international oil markets and the rupee-dollar exchange rate are reflected in price changes of petrol and diesel. The exchange rate is important as the country imports about 80% of the oil it consumes. Local petrol and diesel prices are reviewed every fortnight and adjustments made based on the global rates of the products. (economictimes.indiatimes.com)

[NATIONAL: POWER]

Generation……………

NHPC to develop hydroelectric projects in Darjeeling

July 6, 2015. NHPC said it will set up 4 hydroelectric projects with a total generation capacity of 293 MW in the Teesta Basin of Darjeeling. The four projects are -- Teesta Low Dam-V, Teesta low dam I & II combined, Teesta Intermediate Stage and Rammam Stage-I, all located in District Darjeeling of West Bengal, it said. These projects shall be developed on build, own, operate and maintain basis by NHPC. (economictimes.indiatimes.com)

Chhattisgarh scores 34 percent hike in power generation

July 6, 2015. Chhattisgarh has recorded 34 percent increase in thermal power generation in the year ending November 2014 thus taking overall generating capacity to 16,000 MW. With the commissioning of an additional 21,000 MW from 19 ongoing projects by March next year, Chhattisgarh alone would contribute 25 percent of the total generating capacity projected for the 12th Plan period. Since the states creation in 2000, the power demand spurted from 900 MW to 3,550 MW with consumers increasing from 18.91 lakh to 41 lakh. The Chhattisgarh State Power Generating Company Ltd's output touched 2,424 MW last December and is likely to increase to 3,280 MW by the end of the 12th Plan period. (news.webindia123.com)

NTPC Simhadri in expansion mode

July 5, 2015. NTPC Simhadri Super Thermal Power Station at Parawada will expand its capacity from 2,000 MW to 3,600 MW. The company will need 800 acres for the project. It will involve an investment of ` 5 crore to ` 6 crore for production of each megawatt. It will be developed with ultra super critical technology with higher efficiency and less coal consumption and emissions compared to existing technologies followed at various power plants. NTPC is also in talks with Rashtriya Ispat Nigam Ltd, the corporate entity of Visakhapatnam Steel Plant for a joint venture to set up a 250x2 MW power plant on the land belonging to the latter in the city at Ukkunagaram. (www.thehindu.com)

BHEL commissions Sudan's largest power project

July 1, 2015. Bharat Heavy Electricals Ltd (BHEL) said it has commissioned Sudan's largest power plant. BHEL has executed this project on Engineering, Procurement and Construction (EPC) basis. It has designed, manufactured, supplied and installed the complete power project (4 units of 125 MW each) including associated civil works. The company has also constructed a canal from the White Nile River to supply water for the project. The project is funded by the India's Line of Credit of USD 350 million. The Kosti plant is BHEL's largest oil-fired thermal power plant in the overseas market. It is also BHEL's first crude oil fired thermal power plant in Africa and comes on the heels of the successful completion of BHEL's 28 MW Nyaborango Hydro project in Rwanda. (www.business-standard.com)

R&R site for Odisha UMPP to be finalised soon

July 1, 2015. The rehabilitation & resettlement (R&R) site for the 4,000 MW ultra mega power project (UMPP) being set up near Bhedabahal village in Sundargarh district is expected to be finalised soon. Non-finalisation of bidding terms by the central power ministry has delayed the implementation of the UMPP. In December last year, the Union power ministry decided to cancel the bidding process for Odisha and Tamil Nadu UMPPs. The bidding process was initiated in 2012. The ministry instead, decided to have a re-look at the standard bidding documents and constituted a committee for the purpose. The power ministry's decision to revise the standard bidding documents stemmed from the pull out of the private players from the bidding process. (www.business-standard.com)

Transmission / Distribution / Trade…

Coal import dependence to reduce if CIL output rises

July 7, 2015. Dependence on coal imports will reduce to up to 8 percent only if Coal India Ltd (CIL) meets the production of 1,000 million tonnes by 2020 and if auctioned coal mines are able to achieve their peak capacity in a timely manner, according to an ICRA survey. However, dependence on coal imports is likely to remain high in the near to medium term till FY19 and gradually moderate thereafter, given the overall challenges in coal mine development as well as risk of delays in ramp up of coal output by the allottees of Schedule II and III mines, according to ICRA. According to ICRA, the progress on tie-up of new long term power purchase agreements (PPAs) by state distributions companies, continues to remain slow with sizeable generation capacity having no long-term PPAs. (profit.ndtv.com)

UP govt departments top list of power bill defaulters

July 6, 2015. Uttar Pradesh (UP) government departments are among the top defaulters of the energy department and together account for a third of the power bill arrears of the UP Power Corporation Ltd (UPPCL). The total outstanding receivables of UPPCL till February 2015 were at a whopping ` 23,890 crore spanning both government and non-government departments. Of this, the government departments and agencies alone account for about ` 8,000 crore. Five of the top defaulters viz. irrigation, local bodies, Jal Sansthan, Jal Nigam and river pollution departments, alone account for ` 2,053 crore of total dues. Recently, UP power tariffs have been increased by over 10 percent amid vociferous protests by the opposition parties and consumer bodies. UP Rajya Vidyut Upbhokta Parishad president Avadhesh Kumar Verma lamented UPPCL had failed to realise its total bills and thus the outstanding was increasing every year. He claimed if the power companies had only managed to recover arrears from consumers, their cash position would have been much better. In the latest figures released by Central Electricity Authority (CEA) for the month of May 2015 regarding maximum and minimum energy demand and availability, UP clocked power shortage of 11.6 percent against all India average of power shortage at 2.3 percent. During May 2015, the maximum demand and availability of energy in UP stood at 14,696 MW and 12,991 MW respectively, which means shortage of 1,705 MW. CEA functions under the union power ministry. While, UP reported power shortage of 11.6 percent, Chandigarh, Delhi, Haryana, Madhya Pradesh, Punjab and Rajasthan have recorded balanced maximum energy demand and availability status. Bihar stood a distance second with 3 percent power shortage during May 2015, followed by Uttarakhand (2 percent), Gujarat (0.9 percent), Maharashtra (0.8 percent) and Andhra Pradesh (0.1 percent). (www.business-standard.com)

PGCIL clears ` 22.4 bn for Green Energy Corridor project

July 6, 2015. Power Grid Corporation of India Ltd (PGCIL) said its board has approved a ` 2,247.37 crore investment plan for the third part of the inter-state electricity transmission project. In April, PGCIL had said its board has approved investment for Green Energy Corridors: Inter-State Transmission Scheme-Part A and B at an estimated cost of ` 1,479.30 crore and ` 3,705.61 crore, respectively. The Green Energy Corridor project is aimed at transmission of renewable energy from generation points to the load centres by creating intra-state and inter-state transmission infrastructure. The intra-state transmission component is being implemented by respective states while PGCIL is executing the inter-state part. (economictimes.indiatimes.com)

Transmission of power from Tripura to Bangladesh next year

July 4, 2015. Transmission of 100 MW of power from Tripura to neighbouring Bangladesh will begin next year, Principal Secretary S K Rakesh said. As part of the commitment made by Prime Minister Narendra Modi during his Dhaka visit, the Ministry of Power has given its nod to sell 100 MW power to Bangladesh from Tripura, He said. He said this decision had been taken in the meeting of the ministry in Delhi. Sixty five transmission towers are being erected by Power Grid Corporation of India Ltd for transmission of power from Sryamaninagar here to South Comilla in Bangladesh via Bishalgarh in Sipahijala district. The National Vidyut Vyapar Nigam Ltd, a subsidiary of NTPC, will fix the tariff of power, he said. (www.deccanherald.com)

Delhi discoms can save up to ` 8.8 bn if purchase from exchanges: IEX

July 3, 2015. Power distribution companies in Delhi can save up to ` 889 crore annually if they purchase cheap electricity from exchanges instead of going for costly long-term purchase agreements with generating stations, Indian Energy Exchange (IEX) told Delhi Electricity Regulatory Commission recently. IEX said that discoms can replace costlier long-term power by procuring from exchanges as prices were lower. It suggested that discoms can continue paying fixed charges under long term power purchase agreements (PPAs) and substitute where energy charge is higher than IEX prices. Long term PPAs have two charges capacity charges which are fixed and paid irrespective of whether discoms purchase or not while variable charges or energy charges are paid corresponding to the number of units purchased. IEX suggested discoms should start with replacing 50 MW power and then scale up by 100 MW after 4-5 days, assessing constraints, if any. (economictimes.indiatimes.com)

CERC panel bats for enhancement in central, state transmission systems to address congestion

July 3, 2015. Amidst the increasing transmission congestion in northern and southern regions, a high power panel appointed by the Central Electricity Regulatory Commission (CERC) has suggested a slew of recommendations, including putting in place a mechanism to monitor critical lines on a quarterly basis to mitigate short and medium term constraints, to accelerate transmission capacity enhancement through public and private sector routes and expedite transmission development, especially at state level. The panel emphasised the need to enhance transfer capability such as converting single circuit line to double circuit, upgrading 220 kV system to 400 kV, beefing up existing towers and re-conductoring. Indian Energy Exchange, one of the two power exchanges has said the congestion in transmission caused loss of 3.1 billion units of electricity on it in 2014-15. Association of Power Producers said generation segment is in high growth phase with 23,000 MW capacity added in this year and another about 50,000 MW expected in next 2 years. (www.business-standard.com)

India coal imports flat in June as local supply jumps

July 2, 2015. India's coal imports in June were largely flat at 20.18 million tonnes from a year ago, provisional data from commodities trader mjunction showed, as state behemoth Coal India ramped up supplies under a sustained government push. Reviving output from India's nationalised coal industry has been one of Prime Minister Narendra Modi's achievements, one he hopes will secure uninterrupted power to all and eat into an annual coal import bill of about $15 billion. Coal India's April-June output rose 12 percent to 121.3 million tonnes as it opened new mines and received environmental approvals to expand existing ones. The government wants to double its output to 1 billion tonnes by 2019/20, and stop imports of power-generating coal by then. Government data on coal imports into India, the third largest buyer in the world, generally lags and varies from data from private firms such as mjunction, which collects information from more ports and includes additional coal grades. (in.reuters.com)

Poor transmission network chokes power supply to Rajasthan, UP & Punjab

July 2, 2015. Companies such as Tata Power, Adani Power, GMR Energy and Jindal India Thermal are unable to sell electricity due to a severe congestion in the transmission grid, preventing transfer of power from about 25,000 MW of capacity in surplus regions to northern India and leaving states like Punjab and Uttar Pradesh (UP) in the dark. Grid managing agency Power System Operation Corporation (POSOCO) is curtailing transportation of power from the eastern region to the north for 20 days to prevent grid collapse, industry sources said. Because of this, power companies are unable to honour their short-term contracts and distribution companies are either load-shedding or buying costlier power from spot markets, they said. Transmission has for long been a neglected area in India. Globally, every rupee spent on generation is matched with an equal amount on transmission. India, however, spends only about a fourth on transmission in comparison to generation. Power transmission capacity has failed to grow in tandem with the growth of generation capacity. While installed power generation capacity has grown by 50% over the last five years, transmission capacity has grown only by 30%. Most power plants in eastern and western India have signed power purchase agreements with northern region utilities. But, there is no capacity in key power corridors to ship this power, making these plants idle. Power project developers are incurring losses due to cost overruns and their inability to utilise plants at full capacity is escalating the troubles. Power generating firms in surplus states like Madhya Pradesh, Odisha and Chhattisgarh are facing losses. Some power developers have asked POSOCO to allow direct transfer of power from the eastern region to the north, saying some margin is available in the east-north corridor. (economictimes.indiatimes.com)

Why not sell coal from Chhattisgarh mines to JPL: HC to CIL

July 1, 2015. Delhi High Court (HC) suggested to Coal India Ltd (CIL) to sell to Jindal Power Ltd (JPL) the coal it has started to mine from two Chhattisgarh mines if it did not have the space to store the mineral. It moved the application as the HC on May 27 had kept in abeyance a letter issued by CIL cancelling the e-auction in which JPL had won 49,000 metric tonnes of coal to be mined from the two mines. CIL put before the bench three options - selling the coal by way of a fresh e-auction, selling it to those companies with whom the public sector unit has a fuel supply agreement or sale to National Thermal Power Corporation Ltd (NTPC) - and asked the court which method should it go for. The counsel for CIL told the court that the problem was that after it had received environmental clearance, it had commenced mining and now the mineral was accumulating at the site with no space to store it. It also sought clarity on whether the court's May 27 order would prohibit it from selling the coal it was mining. The court only suggested that CIL can sell the coal it was mining to JPL or hold a fresh e-auction in which the power company can participate and did not pass any order. (www.moneycontrol.com)

Policy / Performance………….

Govt flips the switch to 20 year power plan

July 7, 2015. The Narendra Modi government would soon launch a 20-year plan for the sector to keep pace with growing generation and its poll promise of '24x7 power for all'. The plan, titled 'Perspective Transmission Plan for 20 Years' is being circulated to all states and sector stakeholders for their feedback. The total investment envisaged is ` 2.6 lakh crore during the 13th Plan (period). According to the current draft, ` 1.6 lakh crore investment in transmission would come from states and the balance ` 1 lakh crore from the Power Grid Corporation of India Limited (PGCIL). Power ministry said the project allotment would undergo changes, with PGCIL having overcapacity projects and the government pushing for more private investment in the sector. Transmission projects, totalling ` 1 lakh crore, would be outbid in the coming six months through a tariff-based competitive bidding (TBCB), Minister for Coal, Power and Renewable Energy Piyush Goyal, said. The expected transmission network by the end of the 12th Plan period in 2017 will be 3,60,000 circuit kilometres (Ckm) though the current status is 37,140 Ckm. The final draft of the transmission plan would be ready by September and projects would be outbid accordingly. The plan was prepared last year by the Central Electricity Authority (CEA) along with the Power System Operation Corporation Limited (POSOCO) and PGCIL. The government is planning to increase the size of projects and the scope of work in transmission to prevent congestion in the network. Interstate lines, with a capacity of around 56,000 MW, are being planned to be built by end of the 13th Plan. The focus would be on new technology such as high voltage direct current (HVDC) and the load forecast would be improved. The ministry is also working on the plan of a general network access (GNA) for power transmission. (www.business-standard.com)

ECIL hands over critical nuclear monitoring equipment to JNPT

July 6, 2015. Hyderabad headquartered state-owned electronics firm Electronics Corporation of India Ltd (ECIL) has handed over a critical homeland security system - radiological detection equipment (RDE) to India's largest container port Jawaharlal Nehru Port Trust (JNPT) at Mumbai. The equipment helps monitor the transport of illicit nuclear material at entry and exit points of the country in the context of increasing nuclear terrorism. ECIL said its chairman and managing director P Sudhakar has handed over the equipment JNPT's chairman in-charge Neeraj Bansal in the presence of India's Atomic energy secretary and Atomic Energy Commission's Chairman RK Sinha. ECIL said RDE consists of vehicle monitors, pedestrian monitors, radiation survey meter and isotope identifiers. The equipment acts as detection device that provide a passive, non-intrusive means to screen containers and pedestrians for the presence of nuclear and radioactive materials. The Atomic Energy Secretary Sinha complimented ECIL for developing the critical homeland security system to the international standards and deploying them at all the major seaports of India, which strengthens the national security. JNPT's Chairman in-charge Bansal said the installation of this equipment promotes compliance to international agreements and enhances trade opportunities. (economictimes.indiatimes.com)

Another power tariff hike in the offing in Delhi

July 4, 2015. Delhiites, already reeling under a recent power tariff increase, will have to brace themselves for another three-four percent rise in rates, as the Delhi Electricity Regulatory Commission (DERC) will go for an annual tariff determination exercise soon. This has left the Aam Aadmi Party (AAP) government in the national capital in a spot. The party, which came to power on promises of cheap power and water, is already finding it tough to explain the rise in power rates last month. It is trying to put the blame on private power distribution companies. Though power minister Satyendra Jain assured citizens the government had urged the DERC to "roll back" last month's rate rise, not only will there be no rollback, power is set to become more expensive. Also, the promise of consumers being "compensated" for unscheduled power cuts will not materialise any time soon, as this isn't feasible in the current set-up. DERC had announced a power rate rise of four percent in New Delhi Municipal Corporation areas, four percent in areas under Tata Power and six percent in BSES Yamuna Power Ltd and BSES Rajdhani Power Ltd areas. At that time, the power minister had lost no time in writing to DERC, urging for a "rollback". Despite the AAP government's assurances of compensating consumers to the tune of ` 50/hour for the first two hours of unscheduled power cuts, followed by ` 100 for every subsequent hour of power cuts, these aren't seen as materialising any time soon. Even as the government has written to DERC to penalise distribution companies for unscheduled power outages so that consumers can be compensated, sources say this is far removed from reality. (www.business-standard.com)

AERB yet to clear Kovvada nuclear plant site: CPI(M)

July 2, 2015. The CPI(M) demanded that the proposal for a nuclear power plant at Kovvada in the Ranasthalam area of Srikakulam district should be withdrawn immediately as the Atomic Energy Regulatory Board (AERB) has not given a site clearance certificate either to the State Government or the Nuclear Power Corporation of India Ltd (NPCIL). The party released a copy of the letter purportedly written by the AERB stating that a lot of mandated conditions need to be met before finalizing the site. At a crucial meeting organised to chalk out an action plan to block the project, the party’s State Secretariat member Ch. Narasinga Rao, Srikakulam wing president Bhaviri Krishnamurthy, CITU General Secretary D. Govinda Rao and others said that the State Government had no business to begin land acquisition without first obtaining a site clearance certificate from the AERB. The meeting decided to take up a massive agitation in Visakhapatnam when Prime Minister Narendra Modi visits that city shortly. Krishnamurthy alleged that the Government was harassing people by clamping a ban on land transactions and denying all welfare benefits to the people of Kovvada and surrounding villages. (www.thehindu.com)

Madras HC orders a stay opening tender for ` 80 bn thermal power project

July 1, 2015. The Madras High Court (HC) ordered an interim stay on opening the tenders for the ` 8,000 crore Udangudi super critical thermal power project in Tuticorin district of Tamil Nadu. The project will not be taken forward until the main case, filed by an Indo-Chinese consortium, is disposed of by the HC. The project consortium sought a direction to close/lodge the tender for the 2x660-MW Udangudi supercritical thermal power project published in the state bulletin and further sought to quash it. The Chinese firm outbid public sector BHEL by about ` 137 crore, with cumulative savings amounting to ` 1,400 crore, according to the original petition. (www.business-standard.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

CNOOC's new output to lift China's oil production from 2014 record

July 6, 2015. China's crude oil output looks set to rise this year from a record in 2014 as new production from third largest producer China National Offshore Oil Corporation (CNOOC) helps to counter reductions from its two bigger rivals. Output growth from China would add to a global glut even as exporters such as the Organization of the Petroleum Exporting Countries (OPEC) and Russia produce at near record highs and U.S. shale producers keep ramping up output. With the global oversupply as much as 2.6 million barrels per day (bpd), international crude prices have been nearly cut in half over the past year. CNOOC spent 107 billion yuan ($17 billion) on capital expenditures in 2014. Despite recent cost cuts, CNOOC has said it has already added at least 40,000 bpd of crude output this year. And it aims to increase daily domestic oil and gas output in China by at least 135,000 barrels of oil equivalent by the end of 2015, according the company. China, the world's fourth biggest oil producer, raised its output in the first five months of this year by 1.8 percent from a year ago to 4.25 million bpd, compared with growth of just 0.1 percent over the same period in 2014. In 2014, China produced an annual record 4.2 million bpd. The bank expects China's production to rise 1.6 percent this year, although growth could stall or decline in 2016. (www.reuters.com)

KazMunaiGas plans to divest 50 percent stake in Kashagan

July 3, 2015. Kazakhstan national oil and gas company KazMunaiGas plans to sell 50% of its 16.81% stake in the Kashagan oil field to the sovereign wealth fund Samruk-Kazyna to raise around US$4.7 bn and cut its US$17.92 bn debt. The Kashagan oil field is developed by the North Caspian Operating Company consortium (NCOC), a joint venture of KazMunaiGas, Eni, ExxonMobil, Shell, Total, CNPC and Inpex. NCOC expects to restart production in the second half of 2016 at a pace of 90,000 bbl/d in the first few months. Production would soon be doubled to 180,000 bbl/d to eventually reach 370,000 bbl/d in late 2017. (www.enerdata.net)

Shell will develop the Appomattox oil field in the US Gulf of Mexico

July 2, 2015. Shell has made a final investment decision (FID) on the development of the Appomattox deep-water development in the United States (US) Gulf of Mexico. The group will build a new platform to operate the Appomattox and Vicksburg fields, with an average peak production of about 175,000 boe/d. Production is expected to start by 2020. Shell discovered Appomattox in 2010 and Vicksburg in 2013. Their resources are estimated at 650 mboe. (www.enerdata.net)

Tullow enjoys strong oil production in West Africa

July 1, 2015. Independent producer Tullow Oil reported that it had seen strong oil production from its West African operations during the first half as the company took action to "re-set" its business. During the first six months of 2015, Tullow's West Africa working-interest oil production averaged 66,500 barrels per day. The firm said that, as a result of strong performance from its Jubilee field offshore Ghana, it was increasing its production guidance for West Africa to between 66,000 and 70,000 bopd from 63,000-to-68,000 bopd Tullow reported that the TEN Project, also offshore Ghana, is continuing to make "excellent progress" and has remained within budget and on schedule for first oil in mid-2016. (www.rigzone.com)

Statoil finds oil, gas near Gina Krog field in the North Sea

July 1, 2015. Norway's Statoil has made a small oil and gas discovery near the Gina Krog field in the North Sea, the Norwegian Petroleum Directorate reported. Statoil, operator of the Gina Krog Unit, has completed the drilling of wildcat well 15/6-13 and appraisal wells 15/6-13A and 15/6-13B with the wells encountered oil and gas. The wells were drilled some 150 miles west of Stavanger and directly northeast of the Gina Krog field. (www.rigzone.com)

Downstream…………

Thailand's IRPC to cut refinery run rate in third quarter

July 6, 2015. Thailand's IRPC PCL plans to cut the run rate at its refinery by 6 percent to 180,000 barrels per day (bpd) in the third quarter due to lower seasonal demand, the country's third largest oil refiner said. The lowered run rate is still 5 percent higher than the 173,000 bpd utility rate in the same period of 2014, the company said. Third quarter domestic demand for gasoline is expected to drop 1 percent from the second quarter due to lower travel demand during the rainy season, IRPC said. The second quarter typically sees higher demand for gasoline due to Thailand's public holidays falling in that period. IRPC, 38.5 percent owned by the country's top energy firm PTT PCL, operates a 215,000 bpd refinery, making oil products including gasoline, diesel, naphtha and LPG. (af.reuters.com)

Pertamina plans to spend $25 bn to upgrade 4 oil refineries in Indonesia

July 3, 2015. Pertamina is reportedly planning to upgrade its four oil refineries in Indonesia with an investment of $25 bn, to meet increasing demand for crude oil. As part of the project, the company will upgrade refineries in Cilacap, Central Java; Balikpapan, East Kalimantan; Balongan, West Java; and Dumai, Riau. The upgrades are scheduled to be carried out until 2021. Japanese firm JX Nippon Oil and Energy and Saudi Aramco have expressed interest to participate in the project. The Balikpapan refinery upgrade is planned to be carried out in partnership with Japan's JX Nippon Oil and a deal will be finalized in November, reported Jakarta Post. The project is expected to increase the refinery's production capacity to 360,000 barrels per day from the current 260,000 barrels per day. Pertamina operates six refineries in Indonesia as well as in Kasim in West Papua and Plaju in South Sumatra. (refiningandpetrochemicals.energy-business-review.com)

China's diesel exports may return after going missing in action

July 2, 2015. One of the little mysteries this year in Asian oil markets has been the drop in China's diesel exports. Customs data show that China exported 1.303 million tonnes of diesel in the first five months of the year, a drop of 24 percent over the same period in 2014. This equates to about 64,700 barrels per day (bpd), which is a substantial drop on the 82,000 bpd China exported over the whole of 2014. It also means that Chinese refiners have come nowhere close to using their export quotas for diesel in the first half of 2015, even if the June data does show a substantial ramping up of diesel exports. Refiners are able to export as much fuel as they receive government quotas for, and the diesel allowance was 2.62 million tonnes for the first half of 2015, according to a report from pricing and news agency Platts. China's June exports of gasoil, the broad term for diesel fuels, to reach 210,000 tonnes, which would bring the first half total to about 1.5 million tonnes. This would be only 57 percent of the allowed quota for diesel exports. (www.reuters.com)

Transportation / Trade……….

Gazprom delays gas pipelines to link to Turkish line

July 6, 2015. Gazprom has told pipeline makers to suspend deliveries of pipes for expanding Russia's network to be connected to the proposed Turkish Stream project. The delay is another snag in Moscow's plans to build a gas pipeline via the Black Sea to Turkey, and on to south Europe in order to bypass Ukraine. Gazprom is building the Southern Corridor, a 2.506-km (1,566 miles) long gas pipeline network on Russian territory, to allow it to boosting supplies to Turkey. The company said that the construction of the network was going according to a plan. Under Gazprom's plans, the Turkish Stream pipeline will be split into four lines with a total capacity of 63 billion cubic metres a year. The first line, due to be launched next year, is to supply just Turkey. However, Russia and Turkey have yet to agree on the price of the gas. Turkish energy company BOTAS has threatened Gazprom with international arbitration if a price deal is not reached. Russian companies Severstal, Chelpipe,, OMK and TMK are the leading suppliers of gas pipelines. (www.reuters.com)

Tanker arrivals create volatility in US oil stocks

July 6, 2015. U.S. crude stocks unexpectedly rose by almost 2.4 million barrels, breaking a run of eight consecutive weekly declines and sending oil prices sharply lower. Tanker arrivals create quite a bit of “noise” in the weekly inventory data which can easily be confused with shifts in the supply-demand balance over short periods. Reported crude stockpiles are driven by three factors: domestic crude production, crude imports, and refinery runs. Domestic output is fairly constant week to week, but imports and runs are highly variable. In 2014, U.S. refineries processed an average of 15.8 million barrels per day (bpd). Domestic crude production was around 8.7 million bpd in 2014 and the country imported around 7.3 million bpd of crude, according to the Energy Information Administration (EIA). Almost 3 million bpd of imported oil arrived by pipeline or train from Canada, while most of the remaining 4.5 million bpd from other destinations came by tanker. The typical very large crude carrier (VLCC) or supertanker employed in long-distance voyages carries around 2 million barrels of oil. So, the United States receives the equivalent of two to three VLCC cargoes per day or around 15-16 per week. Imported crude is reported only once it has been cleared through U.S. Customs. But there is significant variability around these daily and weekly averages. The timing of individual tanker arrivals and completion of customs formalities therefore has a major impact on reported imports for a given week. From one week to the next, imports can vary by up to 2.5 million bpd or as much as 15-20 million barrels per week. The one-week change in imports has a standard deviation of almost 750,000 bpd or about 5.2 million barrels per week. Fluctuations in imports, as much as refinery runs, have a major impact on the one-week reported change in stock levels. The entire stock change seems to have come from a big boost in imports, which rose by almost 750,000 bpd or 5.2 million barrels per week. The increase in imports, and reported turnaround in stocks from a 5-million-barrel drawdown to a build of 2.4 million, was well within the normal variability for both the import series and reported inventories. (www.reuters.com)

France's Engie signs deal to supply LNG to Beijing Gas Group

July 2, 2015. French gas utility Engie signed a € 100 million ($110.77 million) deal to supply liquefied natural gas (LNG) to China's Beijing Gas Group, the French government said. The deal for three cargoes of 150,000 cubic metres of LNG from Norway or Africa is for delivery this winter and was signed during a visit to France by Chinese Prime Minister Li Keqiang. It precedes the signature of a 10-year supply deal for which the price is still being negotiated. (af.reuters.com)

Russia stops gas supplies to Ukraine

July 2, 2015. Russia has suspended gas supply to Ukraine after Ukraine announced that it would stop buying gas from Russia from 1 July 2015 until new supply conditions are agreed. European Union-mediated negotiations over gas prices and gas supplies for the next three to six months have just been halted and will resume in September 2015. Russian gas giant Gazprom will continue to transit gas through Ukraine for western European customers. (www.enerdata.net)

Azeri SOCAR's first-half oil shipments via Russia up 33 percent

July 2, 2015. Azerbaijan's SOCAR shipped 678,046 tonnes of oil via Russia in the first half of 2015, up from 508,222 tonnes in the same period last year, the state energy company said. SOCAR said that it had signed a one-year contract with Russian oil pipeline operator Transneft to transport 1.7 million tonnes of oil through the Baku-Novorossiisk pipeline, up from 1.02 million tonnes in 2014. SOCAR had planned to halt oil exports via Russia in February 2014, opting instead to send the bulk of its crude through the Baku-Tbilisi-Ceyhan pipeline and retaining some to cover rising domestic demand for oil products. The company reversed its plans later that month. Oil exports via Russia for the whole of 2013 totalled 1.75 million tonnes, down from 2.06 million in 2012. (af.reuters.com)

Wood Group bags Origin's pipeline contract for HBWS gas project in Victoria

July 2, 2015. Wood Group plc disclosed that it has secured a $1 million contract with Origin Energy to provide detailed design engineering for the onshore pipelines related to the Halladale, Black Watch & Speculant (HBWS) Natural Gas Project in South West Victoria, Australia. The scope of work will see Wood Group Kenny (WGK) perform the detailed design of onshore raw gas and Mono-Ethylene Glycol (MEG) pipelines from the well pad to the gas plant. Construction of the pipelines is anticipated to commence in 3Q/4Q 2015. (www.rigzone.com)

Ukraine halts Russian gas imports after pricing talks fail

July 1, 2015. Ukraine halted natural gas imports from Russia after energy officials from the two countries failed to agree on quarterly prices, state transport monopoly Ukrtransgaz said. Talks in Vienna between Russia and Ukraine on gas supplies fell apart. Russia has proposed keeping prices unchanged from the second quarter at $247 per 1,000 cubic meters with a discount of around $40 per 1,000 cubic meters. Kiev wants better terms. Ukrainian state energy firm Naftogaz said after talks that it would stop buying gas from Russia until new terms had been agreed. Energy Minister Volodymyr Demchyshyn said Ukraine would buy gas from other sources and there would be another round of talks with Russia in September. On June 30, Ukraine received 22.9 million cubic meters of gas from Slovakia, 11.0 million from Russia and 2.7 million from Hungary. Ukraine expects to receive 13.6 million cubic meters of gas from Slovakia, Ukrtransgaz said. Ukraine, whose relations with Russia are at rock-bottom following Moscow's annexation of Crimea and its backing for Ukrainian separatists, began large imports of gas from Europe in 2013 in a bid to reduce its energy dependence on Russian supplies. (www.reuters.com)

Russia seen extending oil-sales lead with second China pipeline