-

CENTRES

Progammes & Centres

Location

[Environmental issues persist not because of mining but due to Institutional failure!]

“The Indian mining industry contributes significantly to the economic development of the country and more specifically to the advancement of the less developed regions. Therefore mining cannot be singled out as target by environmentalists. The government has given due consideration to environmental problem but it lacks institutional capacity to check compliance of laws. These failures happen due to untargeted subsidies that provide incentives for excessive use of natural resources…”

Energy News

[GOOD]

There is nothing unnatural about India, the fastest growing economy also being the fastest growing carbon emitter!

If INR1.2 trillion worth of power capacity cannot translate into electricity access for 1.3 billion people there is something seriously wrong with the country!

[UGLY]

A quiet euthanasia may be better for Dabhol than yet another revival plan!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Environmental issues persist not because of mining but due to Institutional failure!

ANALYSIS / ISSUES…………

· Six Myths on Common but Differentiated Responsibilities

DATA INSIGHT………………

· Natural Gas & Power Sector in India

[NATIONAL: OIL & GAS]

Upstream…………………………

· RIL to defer gas field development if price outlook uncertain

· Rajasthan stakes claim on gas from Cairn India’s Barmer fields

Downstream……………………………

· India asks refiners to buy dollars, euros to settle Iran oil dues

· RIL to shut crude unit at Jamnagar refinery for maintenance

Transportation / Trade………………

· Govt bans oil trade with ISIS-linked organisations

· TAPI to top Modi talks agenda in Turkmenistan

· IOC buys spot LNG cargo from Vitol

· ONGC Hazira sales premium at over 3 month low

Policy / Performance…………………

· India grants one year extension to Iranian ship insurers

· India to auction O&G blocks in 2015-2016 fiscal

· Oil Ministry to invest ` 13 bn in Telangana

[NATIONAL: POWER]

Generation………………

· Jindal eyes acquisitions in power sector

· Kundankulam nuclear plant shut down for annual maintenance

· NTPC thermal project’s first unit gets operational

Transmission / Distribution / Trade……

· RGPPL plans Dabhol power plant revival, inks purchase agreement with Railways

· Indian power plants find ` 1.2 trillion of capacity has no takers

· Consumer body seeks privatisation in transmission sector

· New scheme to supply uninterrupted power to Haryana rural areas

· PPAs force MP to buy power at high prices

· DERC-discoms tiff likely over power purchase costs

Policy / Performance…………………

· AP govt to buy out power projects

· Kejriwal’s power bill was misinterpreted: AAP govt

· PM to launch power development scheme in Varanasi

· MERC allows Tata, Reliance, Mahavitaran to hike power tariff in Mumbai

· 54 percent electricity stolen or lost in Bihar: Govt

· Cabinet note moved on CBM policy

· 8 coal mines to be auctioned after 10 in round 3: Coal Secretary

· Bangladesh to receive 1.1 GW of power from India from January

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· US crude oil production for April rises to most since 1971: EIA

· Mexico's proven and probable oil reserves dip 7 percent in 2014

· Talks ongoing to restart closed Libyan oilfields, output stable: NOC

· Indonesia sets oil and gas production targets for 2016

Downstream……………………

· Grand opening held for $430 mn oil refinery at Dickinson

Transportation / Trade…………

· China’s slowing gas demand raises supply concern in Australia

· Magellan Midstream and LBC to build crude oil pipeline in US

· OPEC oil output hits 3 year high in June on Iraq

· New oil bull market in sight as Brazil, Iraq cut output targets

· Turkey-Russia gas pipeline deal said to stall on price clash

· Origin Energy expects Chinese LNG buyer to fulfill contract

· Gazprom plans to launch Nord Stream-2 gas pipeline project in 2019

· US light oil exports double in May, mostly to Europe

· China's CNPC signs contract to build second pipeline for Russian crude

· Anadarko in talks with Jera to supply LNG from Mozambique project

· Asia oil pricing change to raise trade volumes

· UAE's ADNOC finalizes July 2015-June 2016 diesel term contract

· CNOOC plans 4 bcm per year LNG import terminal in Wuhu

· Saudi Arabia loses spot as top crude supplier to India, China

Policy / Performance………………

· Russia-Ukraine gas talks focus on price

· Israel unveils gas plan in move to unblock regulatory logjam

· BP's chief economist sees US shale weathering oil surplus

· Nigeria’s APC says govt must scrap oil-industry bill

· Japan May LNG average import price hits lowest since 2009

· Polish minister to meet builder Saipem on delayed LNG terminal

[INTERNATIONAL: POWER]

Generation…………………

· Summit to build $1 bn power generation facilities in Bangladesh

· Vattenfall divests its Nordjylland coal-fired power plant in Denmark

· PLN to build power plants with total capacity of 500 MW in NTB

Transmission / Distribution / Trade……

· EIB lends €325 mn to Iberdrola to install 3.2 mn smart meters in Spain

· RP Energy faces transmission problem

· Elering acquires Gazprom's 37 percent stake in Estonian gas transmission grid

Policy / Performance………………

· Canada and UK sign MoU to develop nuclear energy projects

· Germany's oldest remaining nuclear plant shuts down

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· TN govt, Adani likely to sign solar deal

· Suzlon to focus on domestic market, plans offshore mills in Gujarat

· India is now world's fastest-growing major polluter

· Indian Railways to float tenders to procure solar energy

· NTPC to spend ` 10 bn on research and development in 6 yrs

· First Solar starts commercial operation of 20 MW solar plant

· Maharashtra govt to allow wind energy project developers to upgrade tech

· IICT's waste-to-biogas tech draws good response

GLOBAL………………

· China promises further pollution limits for UN climate deal

· New CO2 rules should aid Keystone XL approval, TransCanada says

· Gurmat signs $720 mn finance agreement for 170 MW geothermal project in Turkey

· Nobel prize winner Tirole says carbon price needed for climate

· GE will take part to 240 MW Ararat wind project in Australia

· Alberta strengthens greenhouse gas strategy

· SC blocks Obama administration plan on power plant emissions

· Fossil fuel divestment alone will not halt climate change: Bill Gates

· DP CleanTech to build three straw-fired biomass power plants in China

· Japan has added 19 GW of renewable capacities since July 2012

· EDF acquires 200 MW Salt Fork wind project in Texas

· District court orders Dutch govt to speed up GHG emissions cuts

[WEEK IN REVIEW]

COMMENTS………………

Environmental issues persist not because of mining but due to Institutional failure!

Ashish Gupta, Observer Research Foundation

|

A |

multi-cultural developing society like India provides enormous challenges in the environmental, cultural, social, political and economic arenas. Even more difficult for India is to strike a balance and harmony between, social, economic and environmental needs of the country. On the policy front, India has a number of legislations covering the entire spectrum of the environmental management.

Environment related legislation is covered in depth under the Environment Protection Act, 1986, the Air (Prevention and Control of Pollution) Act, 1981, the Water Cess Act, 1977 and the Water (Prevention and Control of Pollution) Act, 1981. Whereas the legislative framework for forest management and biodiversity are broadly contained in the Biodiversity Act, 2002, the Forest Conservation Act, 1980, the Wildlife Protection Act, 1972 and the Indian Forest Act, 1927. Apart from these there are many other pieces of legislation and policies that make a valuable contribution to environmental management. These legislative frameworks recognise the need for sustainable development and have led to formulation of desired strategies to give effect to such recognition.

The biggest environmental dilemma for India is the trade-off between reducing environmental degradation and poverty reduction. The main reasons for environment degradation in the country are seen as population growth, poverty, inappropriate technology & consumption choices, unplanned urbanisation, water intensive agriculture and polluting industries that have changed he relationship between people and the ecosystem. Such environmental degradation impacts soil fertility, air quality, forest cover, quality of water, wildlife and fisheries and has an adverse impact on the people particularly the rural poor and tribal population whose livelihood is dependent on these natural resources. Having said that, poverty itself can accelerate environment degradation as long as administrative, and informal institution failure persists. However criticism for environmental degradation is limited to coal mining activities.

Coal mining does have some negative environmental impacts but in terms of cost benefit analysis it contributes much more for the states in terms of material income and employment generation. The only thing that is missing is compliance with environmental laws and monitoring of the ongoing projects.

For instance, as per Jharkhand State Council report, mining and quarrying accounts for 14.3 percent of the State Domestic Product. The industry provides both direct and indirect employment. Indirect employment is provided through ancillary activities which include overburden removal, crushing/grinding, beneficiation and upgradation of ores, sizing and washing, downstream refining, loading/unloading at mines/railway site, truck transportation, waste dump stabilization, rehabilitation, canteens, rest house management, construction of housing for mine workers, maintenance of workshops, watch and ward staff, hospitals/medical facilities, etc.

According to the US-based National Mining Association[1]:

According to the U.S. Bureau of Economic Analysis Industry multiplier data, coal mining has an employment multiplier of 4.4 whereas oil and gas extraction have a multiplier of 6.9[2]. Mining has a proven record of generating economic wealth.

The mining sector has made a substantial contribution in the development of India’s mineral rich states, which would have otherwise fallen off the development path. These include, Chhattisgarh, Jharkhand and Orissa. During the 14 years period (FY94-08), these states have witnessed a robust growth in their GDP on the back of higher activities in the mining and quarrying and manufacturing sectors[3].

The Indian mining industry contributes significantly to the economic development of the country and more specifically to the advancement of the less developed regions. Therefore mining cannot be singled out as target by environmentalists.

The government has given due consideration to environmental problem but it lacks institutional capacity to check compliance of laws. These failures happen due to untargeted subsidies that provide incentives for excessive use of natural resources.

The government must incorporate costs associated with depletion of natural resources so as to change the perception that these resources are free. Post project monitoring at regular intervals is also necessary to keep a check on any loss in biodiversity or environmental degradation. Also enabling Panchayati Raj institutions, local informal bodies and urban local bodies to undertake monitoring of compliance with environmental management plans will be good initiative in this direction.

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

Six Myths on Common but Differentiated Responsibilities

(6th Session of Intergovernmental Negotiations on Post-2015 Development Agenda Negotiations on Post-2015 Development Agenda June 23, 2015)

Intervention by Mr. Amit Narang, Counsellor, Permanent Mission of India on, Common but Differentiated Responsibilities

|

F |

irstly, it would be a grave remission not to refer to the World Summit (on Sustainable Development) outcome document of 2005 in this political declaration. It was adopted at the level of our Heads of State and Government exactly a decade ago and is a landmark document. We would request that it be referenced along with other important documents and declarations.

Secondly, we would also find it remiss if through this declaration world leaders do not pronounce themselves on the urgent imperative of reform of global governance, in particular the institutions responsible for maintenance of peace and security. Especially since Peace is one of the five main themes now for this document, it is important that the important ideal of enhancing the legitimacy and representativeness of institutions of global governance, including that of the United Nations Security Council be unequivocally affirmed in the Declaration.

I would like to turn now to share some thoughts on the issue of common but differentiated responsibilities, the inclusion of which in the zero draft has drawn several comments.

It is time perhaps to de-bunk some of the myths about this principle. I would like to focus on 6 such myths.

In doing so, my intention is to make a constructive contribution to our collective understanding of this key principle and its central role in the development debate.

I am doing so in the spirit of what Joseph Joubert stressed - “The aim of argument or discussion is not victory but progress”.

Myth No. 1: The principle of differentiation is in contradiction to a universal agenda

Famous atomic scientist Neils Bohr said “The opposite of a correct statement is a false statement. But the opposite of a profound truth may well be another profound truth”.

Likewise, universality is not in contradiction to differentiation. Both are important.

The notion of a universal agenda is dear to us too, as for us it signifies that this time around developed countries will join developing countries in taking action, and will also be held accountable for their actions across all goals and targets.

However, universality of relevance does not correspond to uniformity in application. To be meaningful, a universal agenda can and indeed must be a differentiated one.

Myth No. 2: This principle is a historical relic and has no contemporary relevance

It was in September 2013, less than 18 months ago, when the world leaders while mandating the elaboration and adoption of a post-2015 development agenda, unequivocally reaffirmed the validity and application of this principle.

In July 2014, less than a year ago, the international community decided by consensus that the principle of CBDR (Common But Differentiated Responsibilities) will apply to the SDGs (Sustainable Development Goals); a decision that was welcomed and endorsed by the General Assembly.

Also in 2014, the principle of common but differentiated responsibilities was reaffirmed by Ministers participating in the meeting of the High Level Political Forum, an institution that is going to be the home of the new agenda and the SDGs.

The point here is that this principle is neither outdated nor irrelevant. Indeed, it has been reaffirmed and validated multiple times in the last few years, including at the leaders' level.

This issue has in fact a wider implication. There has been a disturbing tendency across several platforms for not honouring agreements and reopening them even before the proverbial ink on the paper dries. We are witnessing this yet again in this process both with this principle and the Introduction to the OWG (Open Working Group) report, which is sought to be jettisoned.

If the new agenda has to succeed, trust would have to be built that agreed commitments will be honoured and they will not be reopened or indeed re-interpreted for political expediency.

Myth No. 3: This principle is only applicable to environmental action

Even when it is sometimes grudgingly accepted that this principle is valid, it is contended that it narrowly applies to the environmental dimension and not to the development agenda as a whole. It is true that Rio principle 7 speaks of historical responsibilities in the context of global environmental degradation and the larger capacity for taking action of those who have over-occupied the environmental space.

However, the hallmark of the new agenda and the SDGs is that environmental action has been effectively mainstreamed across all goals and targets. This is also something which differentiates this agenda from the MDGs (Millennium Development Goals), which primarily addressed the social pillar.

Environmental action is not a silo anymore, it underpins the entire agenda. Ipso facto, it is only natural that this principle is equally valid for the entire agenda too.

Myth No. 4: This is merely a political principle and has little or no professional relevance

Just to take two recent examples, the principle of common but differentiated responsibilities has been reaffirmed at the technical level twice in just the past one year alone.

The Intergovernmental Committee of Experts on Sustainable Development Financing, which had experts from 30 countries including many developed countries, confirmed the continued validity of this principle.

Even more importantly perhaps, the Committee on Development Policy, which is an expert body mandated to provide inputs and independent advice to the ECOSOC (Economic and Social Council) on emerging cross-sectoral development issues and on international cooperation for development, in its report on 'Global governance and global rules for development in the post-2015 era’, identified CBDR as one of the 5 central principles, arguing that it embodies equity in the formulation of international law.

Myth no. 5: North South divide in international cooperation has already vanished and those who invoke this principle are flogging a dead horse

Not quite.

It is a matter of fact not fiction that even today the developed countries continue to over-occupy the global economic, ecological and governance space. We have spoken about the economic dimension earlier to indicate how the Gini coefficient of international inequality has increased from three decades earlier. In the environmental sphere, the case is well known and may not need much elaboration. Taken together, the OECD economies account for almost 40% of global emissions as compared to their 17% population share. While the focus has mostly been on the recent growth of some large developing countries, it needs to be remembered that exceptions do not a rule make.

But it is really international governance where the rhetoric of 'shared responsibilities' meets its waterloo.

And no, I am not talking about the Security Council, where of course the time stopped changing after 1945.

No, I am talking about international governance in development, issues that are at the heart of this agenda.

The most topical example is of course norm-setting on international tax cooperation, which continues to be an exclusive monopoly and this exclusive right is being defended even today in the parallel process of FfD (Financing for Development).

Reform of international financial institutions (IFIs) continues to be stalemated and the notion of equitable geographic representation for selecting the heads of these IFIs continues to be resisted.

Let us also look inwards at this very institution, the United Nations in particular its Funds and Programmes which will ultimately lead the implementation of this agenda. The executive boards of all the funds and programmes of the UN continue to be over-represented by developed countries, and this inequity is defended even today in the name of efficiency.

The share of Western Europe and Others Group in the Governing Bodies of entities engaged in operational activities for development is almost 25% as compared to their share in UN membership of 15%. In the Executive Boards of UNDP, UNICEF, UNAIDS, UNFPA and WFP (World Food Programme) the seat share of WEOG (Western European and Other Group) is as much as 33%.

Not exactly a flat world, is it?

It is obvious therefore that for the rhetoric of shared responsibilities to be taken seriously, its proponents will have to visibly walk the talk.

Words will have to translate into action.

Myth no. 6: The principle of common but differentiated responsibilities means inaction by some on a global agenda

The fact is that the principle of CBDR has never been about action only by developed countries. Developing countries, including my own, have been and are fully committed to contributing to the global objective of ending poverty and achieving sustainable development.

We have all signed up to the SDGs, haven’t we?

The fact is that this principle is not about differentiated responsibilities only. Its main thrust is on common responsibility of all. But common responsibilities must be differentiated due to our different starting points, historical footprints, and development levels.

To conclude

The principle of common but differentiated responsibilities is a call for action, it is a call for ambition, but above all it is a call for equity, a fundamental principle that underpins the UN Charter and the Millennium Declaration and a fundamental article of faith that cannot be left behind in the Post-2015 Development Agenda.

Views are those of the author

Courtesy: Third World Network

Natural Gas & Power Sector in India

Akhilesh Sati, Observer Research Foundation

|

STATE |

INSTALLED CAPACITY (MW) |

% SHARE (ALL INDIA) |

|

ANDHRA PRADESH |

7544.9 |

31.2 |

|

DELHI |

2208.4 |

9.1 |

|

GUJARAT |

7580.41 |

31.4 |

|

HARYANA |

431.59 |

1.8 |

|

MAHARASHTRA |

3207 |

13.3 |

|

RAJASTHAN |

749.33 |

3.1 |

|

TELENGANA |

35 |

0.1 |

|

UTTAR PRADESH |

1493.14 |

6.2 |

|

UTTRAKHAND |

900 |

3.7 |

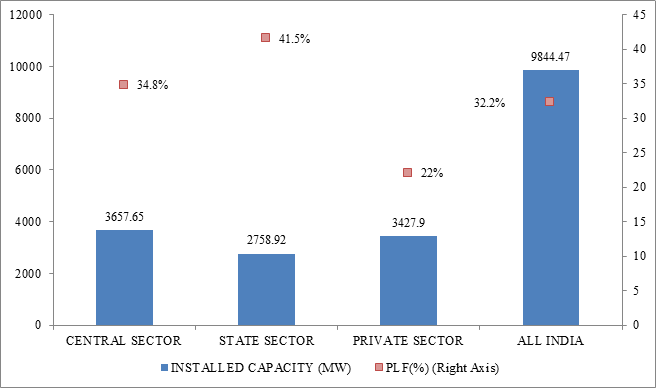

Sector-wise Plant Load Factor (April, 2014 - January, 2015) of (Operational) Natural Gas Power Plants

Source: Lok Sabha, Un-starred Question No. 6859.

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

RIL to defer gas field development if price outlook uncertain

June 29, 2015. Reliance Industries Ltd (RIL) may defer development of R-Series and other satellite gas fields in the eastern offshore KG-D6 block if the gas price outlook was uncertain, its junior partner Niko Resources of Canada said. RIL has made 19 oil and gas discoveries in the KG-DWN-98/3 block in the Bay of Bengal and so far only three - Dhirubhai-1 and 3 gas and MA oil and gas fields, have been brought to production. Multi-billion dollar development plans for five other finds including the significant R-Series have been approved. RIL is the operator Krishna Godavari basin KG-D6 block with 60 percent interest while Niko has 10 percent. BP plc of UK has the remaining 30 percent stake. Niko said on expectations of natural gas prices doubling to USD 8.4 per million British thermal unit from April 1, 2014, the focus in the 2013-14 fiscal shifted to developing and appraising the assets in the KG-D6 Block. (www.business-standard.com)

Rajasthan stakes claim on gas from Cairn India’s Barmer fields

June 28, 2015. The Rajasthan government has laid claim on Cairn India’s Barmer gas, making it difficult for the Anil Agarwal Group company to sell the fuel outside. In fiscal year 2015, average gas production from Raageshwari Deep Gas field in the block was 0.4528 million standard cubic metres a day (mmscmd), which Cairn expects to raise to 0.7075 mmscmd by fiscal 2016. The State has made its claim not only for the existing output but also any incremental gas that Cairn produces from the producing fields. Cairn and ONGC, partners in the Barmer block, have more than doubled their gas production estimates from the Raageshwari fields. According to estimates drawn by the partners, the cumulative gas production till May 2020 will help meet almost 2.5 mmscmd or 90 million standard cubic feet a day (mmscfd) of gas demand — both sales plus internal.

ONGC and Cairn have drawn up a $690 million plan to develop the gas reserves in the Raageshwari Deep Gas field. Of the total, about $243 million is earmarked for drilling and completion of new wells, while $311.20 million is allocated for surface facilities and laying of pipelines. Besides, the gas project depends on Cairn’s proposal to get another 10-year extension as the contract for the Barmer block expires in 2020. According to the Rajasthan contract, the operator can get unconditional extension for five years if it is producing oil, and 10 years in case of expected gas production. Barmer is essentially an oil producing block. Though the production sharing contract — signed between the government and the operators to develop and produce hydrocarbons — for the Barmer block ends in May 2020, the joint venture has prepared a profile till December 2030, indicating cumulative gas production of 358.9 billion cubic feet with a resultant recovery factor of 46.8 percent of initial gas. (www.thehindubusinessline.com)

Downstream………….

India asks refiners to buy dollars, euros to settle Iran oil dues

June 30, 2015. India has asked refiners that owe about $6.5 billion to Iran for oil imports to build up dollar and euro balances to avoid downward pressure on the rupee if six world powers and Tehran reach a final nuclear deal. Local refiners still owe Iran about 55 percent of the bill for crude bought since February 2013, when a route to pay for Iranian oil through Turkey's Halkbank was stopped under pressure from U.S. and European sanctions. Once an agreement is reached, Iran would likely ask for payment of its oil dues, India's oil ministry said in a letter to refiners. India, despite agreeing to a U.S. request to curb oil imports from Iran to help force a deal, is keen to rebuild its trade relationship with the OPEC member state. The letter was sent to five refiners - Indian Oil Corp, Mangalore Refinery and Petrochemicals Ltd, Essar Oil, Hindustan Petroleum Corp and HPCL-Mittal Energy Ltd. The oil ministry advised refiners to make arrangements and seek approvals from the Reserve Bank of India (RBI) to make the payments.

The companies are depositing 45 percent of their oil payments in a rupee-denominated account at an Indian state bank that Iran is allowed to use to buy non-sanctioned goods such as food and medicines from the South Asian nation. Two refiners confirmed they have approached State Bank of India to open dollar and euro accounts, and SBI has in turn applied to RBI for approval to pay Iran. India's imports of Iranian crude oil rose by 66 percent in May from a year earlier to their highest level since March 2014. Two months earlier India had imported no oil from Iran for the first time in at least a decade. India extended approval to two Iranian insurers to cover container and tanker vessels calling at Indian ports by a year to June 25, in a move that will aid oil imports from Tehran. (www.rediff.com)

RIL to shut crude unit at Jamnagar refinery for maintenance

June 29, 2015. Reliance Industries Ltd (RIL) will next month shut a crude oil processing unit at its only-for-exports refinery at Jamnagar in Gujarat for 10 days to carry out maintenance work. The SEZ unit of Jamnagar refinery of RIL is planning to shut down one crude distillation unit (CDU) for routine maintenance and inspection activities in the first half of July for about 10 days, the company said. RIL’s 29 million tons a year Jamnagar SEZ refinery has two CDUs of 290,000 barrels per day each. RIL’s 33 million tons a year older refinery adjacent to the SEZ unit and catering to domestic requirements, will however continue to operate normally. All other units at the Jamnagar refinery complex are planned to operate at normal throughput. The two refineries together constitute the single largest refining complex in the world. (www.financialexpress.com)

Transportation / Trade…………

Govt bans oil trade with ISIS-linked organisations

June 30, 2015. India banned trade with Islamic State-linked entities in oil and other products, complying with a UN resolution to act against militants active in oil-rich countries such as Iraq, Syria and Libya. Iraq's Prime Minister Haider al-Abadi earlier this month urged the international community to help prevent the group from gleaning profits from oil smuggling. (www.business-standard.com)

TAPI to top Modi talks agenda in Turkmenistan

June 29, 2015. The $10 billion TAPI gas pipeline project will top the agenda of Prime Minister Narendra Modi during his visit to the Central Asian country of Turkmenistan early next month. Modi, who will be in the Turkmen capital of Ashgabat on July 10-11, will hold discussions with President Gurbanguly Berdimuhammadov on the Turkmenistan-Afghanistan-Pakistan-India (TAPI) gas pipeline project, which is gathering speed after many years.

TAPI is expected to bring Turkmen natural gas from its giant Dauletabad and Galkynysh gas fields to Pakistan and India. The pipeline aims to export up to 33 billion cubic meters of natural gas per year through the 1,800-km pipeline from Turkmenistan to Afghanistan, Pakistan and India. (www.business-standard.com)

IOC buys spot LNG cargo from Vitol

June 26, 2015. Indian Oil Corp (IOC) has awarded a tender to buy a liquefied natural gas (LNG) cargo for delivery in mid-July to trader Vitol. This is the second spot cargo procured directly by the country's biggest refiner that has turned its focus to expanding its gas business. Previously it bought a cargo from Excelerate. The delivered price was just above $7 per million British thermal units (mmBtu). The 3.1 trillion British thermal units cargo will be delivered at Dahej Terminal in Gujarat. Petronet LNG (PLNG) operates the 10 million tonnes a year Dahej terminal and has a long-term deal with Qatar's Rasgas to annually buy 7.5 million tonnes of the super cooled gas. But demand for costly LNG procured under the long-term, oil-linked deal has dwindled as LNG is cheaper in Asian spot markets, trading at about $7.20 per mmBtu. India has for the first time used an option under the deal with Rasgas to take 10 percent less LNG. (in.reuters.com)

ONGC Hazira sales premium at over 3 month low

June 24, 2015. Oil and Natural Gas Corp (ONGC) sold a July naphtha cargo at $16 a tonne above Middle East quotes on a free-on-board basis, traders said, making this the lowest premium the company has received in more than three months for a naphtha cargo sold out of Hazira.

ONGC sold the 34,500-tonne cargo late to Japan's Petro-Diamond for July 12-13 loading from Hazira. The fresh premium was about 30 percent lower than the average premium of $23 a tonne ONGC got for two cargoes sold out of the same port for June loading. The last time ONGC, which also exports naphtha from Mumbai, received a premium lower than $16 was in January 2015 when it sold a February 8-9 loading cargo to Unipec. Traders said expectation of high volumes of western naphtha coming to Asia in July had hurt sentiment. (economictimes.indiatimes.com)

Policy / Performance………

India grants one year extension to Iranian ship insurers

June 29, 2015. India has extended approval to two Iranian insurers to cover container and tanker vessels calling at Indian ports by a year to June 25, a government notification said, in a move that will aid oil imports from Tehran. The extension will help India receive its crude imports from Tehran in Iranian vessels, while exports of non-oil commodities and industrial goods are largely handled by vessels operated by Hafez Darya Arya Shipping Co. India, the world's fourth-biggest oil consumer and Iran's top client after China, shipped in 66 percent more oil from Tehran in May from a year ago. (in.reuters.com)

India to auction O&G blocks in 2015-2016 fiscal

June 26, 2015. The next round of auction of oil and gas (O&G) blocks under the New Exploration Licensing Policy (NELP) will be held by the end of 2015-16 fiscal, Petroleum and Natural Gas Minister Dharmendra Pradhan said. The minister said that the government is mulling to introduce "open acreage" system and also plans to change the formula for production sharing agreement. NELP-IX auction was conducted in 2012. He said the government is contemplating to make three major changes in the auctioning system that includes abolishing block auctioning by bringing "open acreage" system in which the bidding and award of acreages will be a continuous, demand-based process. The government is also planning to allow the bidder or contractor to extract any unconventional hydrocarbons (other than oil and gas) if found, he said. (economictimes.indiatimes.com)

Oil Ministry to invest ` 13 bn in Telangana

June 26, 2015. The Oil Ministry will invest over ` 1,300 crore in Telangana State on the new projects as well as on expansion of the existing ones this year, Union Minister for Petroleum and Natural Gas Dharmendra Pradhan said. The investment would go into setting up two new LPG bottling plants in northern Telangana and doubling the capacity of two plants of IOC with over ` 300 crore, strengthening CNG/PNG supply facilities in Hyderabad so that all two/three/four-wheelers could use the most efficient fuel with ` 100 crore investment, supply of piped gas for domestic needs and supply of natural gas to Ramagundam fertiliser plant. Further, ` 250 crore would be spent in Telangana as part of East-South trunk pipeline from Paradeep port being implemented by the HPCL with an investment of ` 2,500 crore and another pipeline from Western Coast to Hyderabad as part of the “necklace fuel line network” and setting up a product terminal of IOC on the outskirts of Hyderabad, the Minister explained. He assured people of Telangana that the NDA Government was committed to provide clean fuel (cooking gas) to all households in the State in the next two years. On the New Exploration and Licensing Policy-X, the Union Minister said that it would be finalised by the year-end with more transparent provisions including introduction of progressive sharing model, open-acreage policy and permission to explore unconventional hydrocarbons. The Minister said the deregulated policy on petrol and diesel had brought down the fuel subsidy bill to ` 50,000 crore this year from ` 77,000 crore last year. (www.thehindu.com)

[NATIONAL: POWER]

Generation……………

Jindal eyes acquisitions in power sector

June 26, 2015. The JSW Group, known for taking over stressed assets and turning them around, is scouting for acquisitions in the power sector. Sajjan Jindal, Chairman, JSW Group, said the power sector is in a consolidation phase and there are some assets available at attractive prices. Last year, JSW Energy acquired two hydro-electric projects of Jaiprakash Power Ventures for ₹ 9,700 crore. Under the terms of the deal, JSW Energy will acquire the 300 MW Baspa II hydroelectric project and 1,091 MW Karcham Wangtoo hydro-electric projects in Himachal Pradesh. (www.thehindubusinessline.com)

Kundankulam nuclear plant shut down for annual maintenance

June 24, 2015. The first 1,000 MW unit at Kudankulam Nuclear Power Project (KNPP) will be shut down for annual maintenance and refuelling activities, Nuclear Power Corp of India Ltd (NPCIL) said. KNPP said that the first unit will be shut down for a period of 60 days for annual maintenance and refuelling. KNPP said the unit will resume generation of 1,000 MW after these activities. As to the status of second unit at the KNPP, test reports of the hot run have been submitted to the Atomic Energy Regulatory Board (AERB) for review. The NPCIL has set up two 1,000 MW nuclear power plants at Kudankulam in Tirunelveli district in Tamil Nadu. Both the units are supplied by Russian company Rosatom. The first unit was connected to the southern grid in December 2014 and is now operating at around 60 percent capacity. According to NPCIL, the second unit at Kudankulam has achieved a physical progress of 98.23 percent as on May 2015. (zeenews.india.com)

NTPC thermal project’s first unit gets operational

June 24, 2015. After battling a series of ethnic riots and law and order problems that resulted in additional cost and time, the first 250 MW unit of the National Thermal Power Corporation's (NTPC) Bongaigaon Thermal Power Project at Salakati in Kokrajhar district was commissioned. This project is also NTPC's first venture in the NE region. The ` 4735 crore project was awarded to NTPC in 2008, two years after the foundation stone was laid by former Prime Minister Manmohan Singh.

According to the original schedule, two units of the project were slated to be commissioned in 2011-12. The NTPC project replaced the erstwhile 4X60 MW Bongaigaon Thermal Power Station (BTPS), which was shut down in 2002 due to its high fuel cost of generation. The Centre decided not to revive BTPS and instead asked the NTPC to set up a completely new thermal project, which was initially 500 MW (2 x 250 MW) and later enhanced to 750 MW (3 x 250). (timesofindia.indiatimes.com)

Transmission / Distribution / Trade…

RGPPL plans Dabhol power plant revival, inks purchase agreement with Railways

June 29, 2015. The Ratnagiri Gas Power Project Ltd (RGPPL) has drafted a comprehensive plan for the revival of the debt-ridden Dabhol power plant, which has been lying defunct for years, and is in the process of finalising a power purchase agreement with the Indian Railways. As per the plan, the Indian Railways has agreed to purchase 500 MW power produced by the Dabhol plant, located at Anjanwel, in Maharashtra’s Ratnagiri district. Two hundred of the 500 MW power will be used in Maharashtra, 100 MW in West Bengal, 150 MW in Madhya Pradesh and another 50 MW in Chhattisgarh, Maharashtra government said. The Ministry of Power has already issued a letter earlier this month for temporary allocation of 500 MW from the 1,967 MW Dabhol power plant to the Indian Railways, and a formal power purchase agreement is currently being finalised. The plant recently secured 1.98 million standard cubic feet per day of gas, and has proposed a sale price of ` 6.15 per unit. Of this, it will charge ` 4.70 per unit to the Railways and the rest ` 1.45 per unit is proposed to be bridged through support from the Union government’s Power System Development Fund. The Dabhol project has been in troubled waters ever since work started in 1992 with first the initial developer Enron’s bankruptcy, change in the source of fuel, issues over the power purchase price and so on. The Central Electricity Regulatory Commission and the power regulators of Maharashtra, Chhattisgarh, Madhya Pradesh and West Bengal will waive transmission utility charges and losses. Besides, the states are also expected to give their assent for distribution open access, which allows a consumer to migrate to a service provider of his choice upon payment of a cross-subsidy charge to his existing provider. The Maharashtra State Electricity Distribution Company Ltd (MSEDCL) had terminated its power purchase agreement for the Dabhol plant, saying it could not afford to buy power at ` 5.50 per unit as proposed by RGPPL. (indianexpress.com)

Indian power plants find ` 1.2 trillion of capacity has no takers

June 29, 2015. At a time when almost a third of India’s 1.3 billion citizens have no access to electricity, power plants worth about ` 1.2 trillion are struggling to find customers. High interest rates and weak industrial demand have coupled with India’s unusually cool summer and unseasonal rains to curtail electricity usage. That’s left some 20 GW of capacity—enough to power New Delhi thrice over—without long-term supply contracts, according to the association of power producers. Power plants sell to electricity retailers, preferably on long dated contracts. And the financial health of those retailers, controlled by state governments and forced to supply power to farmers and the poor at subsidized prices, is worsening. India’s electricity retailers have accumulated losses of ` 2.5 trillion and lose ` 70,000 crore every year, according to the first-year report card of Prime Minister Narendra Modi’s government. Reviving the distribution companies will be crucial to Modi’s election pledge of providing round-the-clock electricity to every household in the country by 2019. India’s installed capacity is 272.5 GW, according to the power ministry. It costs roughly ` 6 crore to set up a megawatt, said PwC India, so 20 GW translates to about ` 1.2 trillion. India’s electricity supply has improved in the three years since a major power failure darkened vast swathes of the country’s north. And the government has approved investment of ` 1.1 trillion to upgrade distribution and transmission infrastructure across the nation. Still, the electricity retailers lose about ` 1 on every kilowatt hour sold, according to the power producers association. And state governments aren’t always assiduous in making their subsidy payments on time, forcing distributors to cut purchases and forcing outages, PwC India said. (www.livemint.com)

Consumer body seeks privatisation in transmission sector

June 29, 2015. Seeking privatisation of power transmission sector in order to boost efficiencies, Ahmedabad-based Consumer Education Research Society (CERS) has written a letter to Piyush Goyal, Minister of State with Independent Charge for Power, Coal and New & Renewable Energy in the Government of India against the Power Grid Corp of India Ltd (PGCIL)'s monopoly in the sector. An active NGO in the power sector, CERS has alleged that while power generation capacity has increased in the country, PGCIL has failed to its pace in terms of transmission network, thereby creating inefficiencies in the sector. In its letter, CERS has called for a break in PGCIL's monopoly in transmission by allowing privatisation of the sector. The CERS letter mentions that power generation capacity in India has increased by 22,566 MW in 2014-15 but due to bottleneck in transmission sector, electricity consumers of India are deprived of this benefit. The government now plans to invite bids for four major projects worth ` 4,000 crore. Private sector contributes 38 percent to generation capacity of 2,72,000 MW against 3 percent of transmission sector. Private sector participation and competitive bidding promotes and results in lowering tariff for consumers. Of the five major projects won by the private sector which were scheduled to be commissioned between 2012 and 2015; only three have been commissioned. (www.business-standard.com)

New scheme to supply uninterrupted power to Haryana rural areas

June 28, 2015. The Haryana Government said it will launch “MharaGaon-JagmagGaon” scheme, aimed at supplying uninterrupted power to rural consumers besides strengthening distribution network and realising outstanding payments. According to the scheme, to be launched on July 1, out of the 90 constituencies all over the State, 83 with rural domestic supply (RDS) feeder will be benefited. In each constituency, one feeder with least losses has been selected on pilot basis to be given the advantages as per the scheme.

With the launch of the scheme, the power supply of the selected village will be immediately increased from existing 12 hours to 15 hours. With the replacement of defective meters and shifting of existing ones outside the premises of consumers besides replacement of naked wires with Aerial Bunched Cable, the supply would be increased from 15 hours to 18 hours per day. Consequently, with the improvement in the billing and collection efficiency up to 90 percent, the supply time will be increased to 21 hours a day. The scheme will include holding of BijliPanchayats in every constituency for release of new connections, replacement of defective/damaged electro-mechanical meters, correction of erroneous bills and regularisation of unauthorised loads, Uttar Haryana BijliVitran Nigam said. (www.thehindu.com)

PPAs force MP to buy power at high prices

June 27, 2015. Long-term power purchase agreements (PPAs) between private independent power producers (IPPs) and state government coupled with a low demand has put Madhya Pradesh (MP) in a piquant situation. Despite 75% of state-owned thermal power generation units being shut down Madhya Pradesh, is still forced to purchase and sell power to other states leading to heavy losses. Presently, only 20% of state's power requirements are being fulfilled by state-owned thermal plants. Of the average requirement of about 4,000 MW state-owned thermal plants are producing only 850 MW. The PPAs makes it mandatory on the state to purchase power irrespective of demand. Thus government has no option but to sell the surplus power to states and entities needing it. However, since onset of monsoon has been good and other sources including hydro-electric generation picking up demand is less and hence sale price of per unit is lower compared to purchase price. Experts said the problem has been compounded due to faulty projection about demand and advocate prudent power management to stop revenue losses. (timesofindia.indiatimes.com)

DERC-discoms tiff likely over power purchase costs

June 25, 2015. The Delhi Electricity Regulatory Commission (DERC) and the power distribution utilities are heading for a face-off over power purchase costs. In its recent order on power purchase adjustment surcharge (PPAC), the regulator disallowed power purchase and related generation costs from three central sector plants — Anta, Auraiya and Dadri Gas — for all three discoms, claiming that the discoms did not take DERC's approval before renewing the power purchase agreements (PPAs) and scheduling power from these plants. The discoms said they would approach the Appellate Tribunal of Electricity (APTEL) over the disallowance and claimed it was done only to keep the PPAC surcharge to a minimal amount. The agreements were made as per Central Electricity Regulatory Commission regulations for 25 years with no exit clause, they said. The discoms have also repeatedly proposed surrender of power from these stations and Tata Power Delhi has even proposed to the Delhi government surrender of its entire share from Anta, Auraiya and Dadri Gas forever with immediate effect, DERC has pointed out. (timesofindia.indiatimes.com)

Policy / Performance………….

AP govt to buy out power projects

June 30, 2015. With the power purchase agreements signed by the state with gas-based private power projects coming to an end in 2016, the Andhra Pradesh (AP) government has decided to buy them out at their terminal value. Recently, the AP government had cleared the proposal of the eastern and southern discoms to buy the 220 MW GVK Power project located at Jegurupadu in East Godavari district. The GVK management had entered into an agreement with the AP government in 1997 for 18 years. With the agreement ending in June 2015, the two discoms have proposed an outright purchase of the project at a terminal value to be determined by Grant Thornton, a third party audit company. According to the terms of the purchase agreement (PPA), the state has two options with regard to gas based projects. One is the buyout option, and the other is, refurbish and upgrade and get into fresh agreements with the private power producer. After GVK Power, the state has now decided to exercise the buyout option in case of three units whose term will end soon. (timesofindia.indiatimes.com)

Kejriwal’s power bill was misinterpreted: AAP govt

June 30, 2015. Amid uproar over Delhi Chief Minister Arvind Kejriwal’s power bill for April and May coming to ` 91,000, the AAP government said the bill had been misinterpreted. On June 29, an RTI query filed by advocate and activist Vivek Garg revealed that Kejriwal’s Civil Lines residence’s electricity bill for April and May was ` 91,000. The General Administration Department of the Delhi government furnished the copies to Garg. But, the Delhi BJP claimed the bill was over ` 1 lakh. The Delhi government is working to bring down power bills in the city. (www.thehindubusinessline.com)

PM to launch power development scheme in Varanasi

June 27, 2015. Prime Minister (PM) Narendra Modi will launch the Integrated Power Development Scheme (IPDS) in his Lok Sabha constituency Varanasi. The scheme, announced in the Union Budget 2014-15, aims at strengthening sub-transmission network, metering, customer care services, IT application, provisioning of solar panels and completion of the ongoing works of Restructured Accelerated Power Development and completion of the Reforms Programme (RAPDRP). Government will provide budgetary support of ` 45,800 crore over the entire implementation period of IPDS. Out of the total amount ` 1,067 crore has been sanctioned for Uttar Pradesh including ` 572 crore for Varanasi. The project envisages converting overhead lines into underground cabling in the areas around the temples and ghats in the Varanasi city. The scheme will help in reduction in Aggregate Technical and Commercial (AT&C) losses, establishment of IT enabled energy accounting/auditing system, improvement in billed energy based on metered consumption and improvement in collection efficiency. (www.business-standard.com)

MERC allows Tata, Reliance, Mahavitaran to hike power tariff in Mumbai

June 27, 2015. The Mumbai electricity regulatory authority has allowed three utilities Tata Power, Reliance Infrastructure and Mahavitaran to increase their tariff with effect from this month. Maharashtra Electricity Regulatory Commission (MERC) has approved an increase in tariff of 2.44% for Mahavitaran, while 5.2% and 3.92% for RInfra and Tata Power, respectively. The new rates will be applicable from June 1. As per the new tariff structure, Below Poverty Line consumers of Rinfra, TPC and Mahavitaran will have to pay per unit ` 2.72, ` 1.41 and 87 paise, respectively. The fixed costs for all the three utilities for this category has been increased to bring it at par to ` 10. It has also increased the fixed cost for all the three utilities for consumers using up to 100 units to ` 50 from the current ` 40. For RInfra, the new tariffs are ` 4.79 (` 4.61) for consumers using up to 100 units, ` 6.54 (` 6.31) for up to 300 units, ` 8.26 (` 7.43) for up to 500 units and ` 10.08 (` 9.25) for residents consuming more than 500 units. MERC has allowed a reduction in tariff of TPC consumers using electricity up to 300 units. For TPC, the revised tariffs are ` 2.05 (` 2.62) for consumers using up to 100 units, ` 4.21 (` 4.56) for up to 300 units, ` 8.42 (` 8.19) for up to 500 units and ` 10.63 (` 10.27) for residents consuming more than 500 units. For Mahavitaran, the new tariffs are ` 3.76 (` 3.86) for consumers using up to 100 units, ` 7.21 (` 7.20) for up to 300 units, ` 9.95 (` 9.50) for up to 500 units and ` 11.31 (` 10.33) for residents consuming more than 500 units. The Commission has, however, reduced the tariff for railway by 10% from ` 9.37 to ` 8.46. The Commission has also directed Mahavitaran to complete the metering plan for conversion of unmetered agriculture connections within a period of three years. (www.dnaindia.com)

54 percent electricity stolen or lost in Bihar: Govt

June 26, 2015. Power Minister Piyush Goyal said a whopping 54 percent electricity was either "stolen or lost" in Bihar, which "doesn't produce a single unit from its own power stations." Goyal said the state government recovered the whopping electricity losses from the honest, bill paying customers. The minister was speaking on the occasion of signing of a MoU between NTPC, National Skill Development Corporation (NSDC) and National Skill Development Fund (NSDF) to train 25,000 youths in services and manufacturing sectors over the next five years. Goyal pointed out that Bihar's demand for electricity was assessed at 2,994 MW, low even in comparison to Delhi which was just a city, but had a demand for 5,800 to 6,000 MW. The statistics provided by Goyal punched holes into the claims of Bihar chief minister Nitish Kumar that ample electricity was being supplied to all villages and efforts were on to provide it round-the-clock. In 2012, Kumar had said he would not seek votes in the Assembly polls if he failed to supply power to all villages in the state. (timesofindia.indiatimes.com)

Cabinet note moved on CBM policy

June 25, 2015. Coal secretary Anil Swarup said a cabinet note has been moved to discuss and decide on the policy for exploration of coal bed methane (CBM) from coal mines. The coal block auction policy of the government has led to the concern about CBM reserve in the mines. As per the global standard practice, globally, methane gas, which is trapped in the pores of coal, is harnessed prior to mining of coal. If it is extracted, it can be used to run industries, power stations among others. He said government always wants Coal India Ltd (CIL) to keep coal prices low for cheaper power tariff. (www.business-standard.com)

8 coal mines to be auctioned after 10 in round 3: Coal Secretary

June 24, 2015. The government will put eight more coal mines up for auction after completing the process for 10 mines in the third phase in mid-August, Coal Secretary Anil Swarup said. Swarup said that in view of the need to step up India's coal production to 1.5 billion tonnes by 2020, there is a plan to hire manpower for mining. The third round of coal mine auctions for 10 blocks will be held from August 11 to 17. Coal and Power Minister Piyush Goyal said that the government will open more than 60 coal mines across the country in the coming days. He had said the new mines were part of the overall plan for state miner Coal India to double its current production of 500 million tonnes per annum in five years to reach the country's total production target of 1,500 million tonnes by 2020. Coal India achieved a record 32 million tonnes increase in production in the last year, which led to a 12 percent increase in power production, the minister said. (www.newkerala.com)

Bangladesh to receive 1.1 GW of power from India from January

June 24, 2015. Bangladesh will begin receiving 100 MW of power from Tripura from early January. This will be in addition to the 500 MW it already receives from West Bengal and a like amount that is on the cards from the state - for a total of 1,100 MW - as the two countries enter a new phase of bilateral cooperation for regional benefit. The power from Tripura will flow with the completion of 65 transmission towers in the northeastern state by December-end. Prime Minister Narendra Modi discussed the power supply from Tripura with his Bangladesh counterpart, Sheikh Hasina. Modi has declared that India would enhance the supply of power to Bangladesh from the existing 500 MW to 1,100 MW. The minister said PGCIL would erect around 20 km of transmission lines in Tripura, while the Power Grid Company of Bangladesh (PGCB) would lay 27 km of transmission line on its side. Both the prime ministers welcomed the steps being taken to augment supply of power through Baharampur in West Bengal and Bheramara in Bangladesh, grid inter-connection from 500 MW to 1,000 MW and to operationalise the supply of 100 MW from southern Tripura's Palatana power plant to Bangladesh. Tripura Power Minister Dey said that Indian and Bangladeshi officials, after a series of meetings, finalised the various technicalities and mechanisms to supply 100 MW of power from Tripura. Tripura Chief Minister Manik Sarkar had earlier said that after the completion of two mega gas-based power projects, at least 200 MW of power would be surplus in Tripura. (www.newindianexpress.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

US crude oil production for April rises to most since 1971: EIA

June 30, 2015. U.S. crude oil production rose 9,000 barrels a day to 9.701 million barrels a day in April, the highest since May 1971, the U.S. Energy Information Administration (EIA) said. Technology for tapping shale oil has helped the U.S. unlock vast reserves of crude that were previously inaccessible, boosting production. The modest increase from last month may suggest that a production plateau is approaching, which could deal a blow to U.S. crude prices, which have been generally rallying since March. The flood of oil was one factor contributing to a price rout in the second half of last year, but production has continued at high levels even as drillers have shut in rigs in an attempt to scale back production. The EIA expects that crude production will decline on a monthly basis starting in June. Because U.S. crude production has risen, while regulations limit exports of oil but not fuel, overall petroleum product exports were the highest for April on record at 2.873 million barrels per day, according to the EIA. (www.reuters.com)

Mexico's proven and probable oil reserves dip 7 percent in 2014

June 30, 2015. Total Mexican oil and gas reserves fell last year as state-owned oil company Pemex was unable to certify enough new discoveries to compensate for current production, the country's oil regulator CNH said. Mexico's total proven and probable (2P) oil reserves slid 7.4 percent from the previous year to 22.983 billion barrels of oil equivalent (boe). Proven, probable and possible (3P) reserves fell 11.3 percent to 37.404 billion boe. In March, the CNH announced that Mexico's proven (1P) reserves fell 3.1 percent to total 13.071 billion boe. While Pemex remains the country's only oil and gas producer, a sweeping energy overhaul finalized last year ended the company's nearly 80-year-old monopoly. A so-called Round One tender is set to begin with initial contract awards next month and will mark the first time in decades that private and foreign oil companies will be able to develop fields on their own or in a consortium. (in.reuters.com)

Talks ongoing to restart closed Libyan oilfields, output stable: NOC

June 29, 2015. Negotiations to reopen Libyan oilfields are ongoing and the level of the country's production remains stable, the National Oil Corporation (NOC) said. Libyan authorities said they were trying to reopen pipelines for the El Feel and El Sharara oilfields and the port of Zueitina, blocked for weeks by protests and disputes. The OPEC country is caught in a dispute between two rival governments, one internationally recognized in the east and a self-declared one that controls Tripoli, since a group called Libyan Dawn took over the capital last year. Before the 2011 civil war that ousted Muammar Gaddafi, Libya produced 1.6 million barrels per day (bpd). Officials rarely release national production figures, but one recent estimate put it at 500,000 bpd. Negotiations to reopen oilfields and ports in Libya often drag on as the oil industry is constantly under siege from protesters seeking jobs or armed factions trying to pressure their rivals or central authorities. (www.reuters.com)

Indonesia sets oil and gas production targets for 2016

June 24, 2015. Indonesia sets the country's 2016 gas production target at 1.1 million to 1.3 million barrels of oil equivalent per day (boepd) following a meeting on the state's budget plan between the Ministry of Energy and Mineral Resources (MEMR) and the energy sector-focused Commission VII of the House of Representatives. The government proposed that Indonesian gas production in 2016 be pegged at 1.1 million to 1.2 million boepd, while legislators suggested 1.05 million to 1.3 million boepd. Both parties agreed to set Indonesia's oil production in 2016 at 800,000 to 830,000 barrels of oil per day (bopd) following extensive discussions with 10 Cooperation Contract Contractors, according to the MEMR. The 2016 oil production goal for Southeast Asia's largest country is quite in line with the target set for the current year at 825,000 bopd, which was 3.9 percent more than the 794,000 bopd in 2014. (www.rigzone.com)

Downstream…………

Grand opening held for $430 mn oil refinery at Dickinson

June 29, 2015. Officials have formally dedicated a new oil refinery in western North Dakota. Bismarck-based MDU Resources Group and Indianapolis-based Calumet Specialty Products Partners built the $430 million Dakota Prairie Refinery near Dickinson.Officials held a grand opening celebration. Gov. Jack Dalrymple and U.S. Sens. John Hoeven and Heidi Heitkamp were on hand. Crews broke ground on the refinery in March 2013. It can process 20,000 barrels of oil each day into diesel fuel and other products. It began selling the fuel in May. (www.washingtontimes.com)

Transportation / Trade……….

China’s slowing gas demand raises supply concern in Australia

June 30, 2015. China’s weakening appetite for super-cooled natural gas is raising concerns that the industry is facing a glut as global supply grows. Lower demand for gas in China and more supply moving into the country from Russia and Central Asia, on top of a downturn in the oil market, are weighing on LNG prices. The weaker-than-expected outlook hurts suppliers in countries such as Australia and Papua New Guinea. Chinese LNG buyers will probably struggle to digest all the fuel that they have agreed to purchase, according to a Citigroup Inc. report. Proposed LNG export developments face the risk of delays, the analysts wrote. China’s imports in the first three months of 2015 fell from a year earlier for the first time since 2006, the Australian government said. Competition from pipeline supplies and rising coal and renewable energy capacity will probably squeeze LNG, according to the report. Origin Energy Ltd and ConocoPhillips, developing a A$24.7 billion ($19 billion) LNG project in Australia, have faced speculation that customer China Petrochemical Corp. may seek to resell gas amid delays to an import terminal. Origin said that it expects the Chinese buyer known as Sinopec Group to fulfill its obligations. Although China’s long-term natural gas demand is forecast to rise at least threefold to more than 60 million metric tons per year by 2025 from last year’s level, “a slowdown in economic activity and higher domestic gas pricing has limited demand,” Citigroup said. (www.bloomberg.com)

Magellan Midstream and LBC to build crude oil pipeline in US

June 30, 2015. Magellan Midstream Partners has formed a 50/50 joint venture (JV) with LBC Tank Terminals, to operate crude oil storage and pipeline in the Houston Gulf Coast area in the US. Called Seabrook Logistics, the JV will construct assets, including over 700,000 barrels of new crude oil storage and other distribution infrastructure adjacent to LBC's existing terminal in Seabrook, Texas, US. The new company will also build new $95 mn pipeline, to transport crude oil to a Houston-area refinery. The pipeline will connect the new storage to an existing third party pipeline. Magellan will commission the new pipeline, while LBC will manage construction and operations of the new storage tanks and other terminal assets. The storage facility and pipeline infrastructure are scheduled to be commissioned in the first quarter of 2017. (transportationandstorage.energy-business-review.com)

OPEC oil output hits 3 year high in June on Iraq

June 30, 2015. OPEC oil supply in June has climbed to a three-year high due to record or near-record output from Iraq and Saudi Arabia, a survey found, underlining the focus of the group's top exporters on market share. The boost from the Organization of the Petroleum Exporting Countries (OPEC) puts output further above its target of 30 million barrels per day (bpd) and comes despite outages in Libya and Nigeria that curbed supplies. OPEC supply has risen in June to 31.60 million bpd from a revised 31.30 million bpd in May, according to the survey, based on shipping data and information from sources at oil companies, OPEC and consultants.

The group has raised output by more than 1.3 million bpd since it decided in November 2014 to defend market share rather than prices. A final deal between world powers and Iran over Tehran's nuclear work could add to supplies. OPEC at a meeting kept its policy unchanged, amid signs that the near-halving of oil prices since June 2014 was boosting demand and putting a dampener on the U.S. shale boom. If the total remains unrevised, June's supply would be OPEC's highest since it pumped 31.63 million bpd in June 2012, based on surveys. The biggest increase in June has come from Iraq, which has helped push OPEC output higher this year. Exports from southern Iraq have jumped to 3 million bpd after Iraq split the crude stream into two grades, Basra Heavy and Basra Light, to resolve quality issues. Some companies have increased production following the move. (www.reuters.com)

New oil bull market in sight as Brazil, Iraq cut output targets

June 30, 2015. Massive downward revisions to oil output in Brazil and Iraq have increased the risks for oil markets of going from the current feast to famine within just a few years, leading to a price spike that would give a new boost to the U.S. shale industry. Brazil and Iraq had been expected to add over 2 million barrels per day to global supply by 2020 and another 2.5 million by 2025, becoming the two biggest contributors to help meet rising global demand, according to the long-term forecast of the International Energy Agency (IEA). To put the Petrobras revision in prospective - the 1.4 million bpd figure almost equates to the current global oversupply, which arose due to a U.S. shale oil boom and a decision by OPEC to keep its taps fully open to battle for market share with rival producers. With 2015 global oil demand surprising on the upside and likely to exceed its average growth of around 1 million bpd a year over the past decade, the glut is expected to clear by the middle or the end of 2016. Beyond 2016, the balanced market may not last long. Only a year ago, the IEA saw Brazil pumping 3.7 million bpd by 2020 and Iraq some 4.6 million. Petrobras, responsible for most of the country's output, said it will pump only 2.8 million by 2020. The IEA's long-term outlook sees the need for OPEC crude to rise by 6 million bpd in the 2020s and by the same amount again by 2030 - effectively meaning the world needs to add another Saudi Arabia to its supply. (www.reuters.com)

Turkey-Russia gas pipeline deal said to stall on price clash

June 30, 2015. Russia’s plan to build a new $15 billion pipeline to Turkey is at risk of delay because of a fight over gas prices. State-run OAO Gazprom and its Turkish counterpart Botas had a six-month period to agree on prices for gas supplies between the two countries. The Ankara-based company has the right to take the matter to international arbitration. The dispute over prices means there’s no immediate prospect of signing a binding pact for the new pipeline, the second between Russia and Turkey. An agreement could be delayed until at least October. The delay is a blow to President Vladimir Putin’s plan to use the new link to ship gas to Turkey and onto Europe, bypassing existing pipelines in Ukraine. He proposed the project last year after the European Union (EU), which gets about 30 percent of its gas from Russia, blocked a similar link through Bulgaria. Gazprom doesn’t plan to extend a gas-transit contract with Ukraine after 2019 and the EU would have to accept the new route, Russian Energy Minister Alexander Novak said. (www.bloomberg.com)

Origin Energy expects Chinese LNG buyer to fulfill contract

June 29, 2015. Origin Energy Ltd expects China Petrochemical Corp to fulfill its agreement to purchase liquefied natural gas (LNG) from a A$24.7 billion ($19 billion) export project in Australia. Origin sought to reassure investors amid concern the Chinese company known as Sinopec Group may not want all the gas it agreed to buy under a long-term contract with the Australia Pacific LNG project. Sinopec Group also owns 25 percent of the venture. The development with ConocoPhillips has begun offering the initial LNG production under short-term contracts, Sydney-based Origin said. Origin said there’s flexibility over when to begin supply to Sinopec Group, which has agreed to purchase 7.6 million metric tons annually. The Australia Pacific LNG project remains on track for “sustained” production from the first unit in the second quarter of the 2016 financial year, Origin said. (www.bloomberg.com)

Gazprom plans to launch Nord Stream-2 gas pipeline project in 2019

June 29, 2015. Russian gas giant Gazprom plans to commission the Nord Stream II gas pipeline from Russia to Germany by the end of 2019. Earlier in June 2015, the group reached an agreement with Shell, E.ON and OMV on the expansion of the Nord Stream gas pipeline, linking Vyborg in Russia to Lubmin in Germany. Two new lines (stages 3 and 4), with a combined capacity of 55 billion cubic meters (bcm) per year, would double the capacity of the existing interconnection. (www.enerdata.net)

US light oil exports double in May, mostly to Europe

June 29, 2015. The United States (US) exports of ultra-light crude, also known as condensate, have doubled since the start of the year, with most shipments headed to Europe, according to traders and data from an energy consultant. The United States exported between 120,000 and 140,000 barrels per day (bpd) of condensate last month, according to traders and ClipperData, which tracks ships and terminal loadings, up from about 60,000 bpd at the start of the year. The condensate is lightly processed through stabilizers due to rules banning crude exports in the United States, now the world's third-largest oil producer. The rise comes as more companies look to take advantage of the ability to ship the oil overseas, including to places like the Netherlands, France, South Korea and Brazil. Traders have also said that the oil's quality deterred some Asian refiners. Enterprise Products Partners led the pack with 1.8 million barrels of exports per month, or 60,000 bpd. It sold a year's supply to Mitsubishi Corp and Vitol at the start of this year. BHP Billiton has been selling a 700,000-barrel cargo every month, though has delayed a plan to double exports to two cargoes a month due to production issues, traders said. BP started exports in February and also shipped out a cargo in April, said a trader who tracks the movement of U.S. condensate. It had another cargo due to load at the end of June which will head to Europe. (www.reuters.com)

China's CNPC signs contract to build second pipeline for Russian crude

June 26, 2015. Chinese state energy giant China National Petroleum Corporation (CNPC) has signed a construction contract for a second domestic pipeline to carry Russian crude oil from Mohe to Daqing. While giving no further details about the pipeline or the timeline of its construction, the contract was signed on June 19. Since 2011, Russia has been supplying China with around 300,000 barrels per day (bpd) of crude oil via a spur of the Eastern Siberia-Pacific Ocean (ESPO) oil pipeline running from Skovorodino in Russia to Mohe, from where an existing pipeline carries the oil to Daqing. In June 2013, CNPC and Russia's Rosneft agreed to double flows of ESPO crude to China by 2018. (af.reuters.com)

Anadarko in talks with Jera to supply LNG from Mozambique project

June 26, 2015. US-based oil and gas exploration company Anadarko Petroleum is negotiating a deal to supply natural gas from its LNG export project in Mozambique, to a Japanese joint venture (JV), Jera. The companies are in talks over a long-term gas import deal. Anadarko plans to source the initial ten million tons per annum (mtpa) for export from its finds in Area 1 of Rovuma Basin in the African country. The $23 bn project is planned to be commissioned by 2021. Japanese utility Toho Gas had also signed a deal with Anadarko for 0.3 mtpa of Mozambican LNG last year.

Other parties in talks with Anadarko include China's National Offshore Oil, Indonesia-based Pertamina, Thailand's PTT, the UAE and Singapore. Formed by a consortium of Tokyo Electric Power (Tepco) and Chubu Electric, Jera intends to become cheapest liquefied natural gas buyer in the region. The JV manages long-term fuel purchases for Tepco and Chubu, and is preparing to oversee LNG supply contracts and purchases from 2016. (transportationandstorage.energy-business-review.com)

Asia oil pricing change to raise trade volumes

June 26, 2015. Oil pricing agency Platts is changing how it assesses oil product values in Asian trade from July 1 in a move traders expect to boost volumes and encourage the use of regional oil storage facilities built at a cost of billions of dollars. The change in how fuel oil, diesel, jet fuel and gasoline are assessed for loadings out of Singapore and Malaysia takes a borderless approach similar to that in the world's largest oil storage hub Amsterdam-Rotterdam-Antwerp (ARA). The main change is that from July in Platts' free-on-board (FOB) Singapore price assessments - the basis for most contract and spot deals done in Asia - traders at the time of making a bid or offer for a cargo will no longer specify a loading point in Singapore or southern Malaysia. (www.reuters.com)

UAE's ADNOC finalizes July 2015-June 2016 diesel term contract

June 26, 2015. Abu Dhabi National Oil Co (ADNOC) has finalised its July 2015 to June 2016 diesel term contract with several buyers, traders said. The United Arab Emirates (UAE) company has finalised the term contracts at a premium of $2.35 a barrel over Middle East quotes, traders said. Overall volumes were not certain but buyers include Total, BP, Shell, Vitol, Petrobas and Swiss Singapore, traders said. (www.reuters.com)

CNOOC plans 4 bcm per year LNG import terminal in Wuhu

June 25, 2015. Chinese oil and gas company China National Offshore Oil Corporation (CNOOC) has signed an agreement with Huainan Mining Industry to establish a joint venture and jointly develop a 3 Mt/year (4.1 bcm/year) LNG regasification terminal in Wuhu, in the Anhui province of China. The project would be developed in three phases, with the first 1 Mt/year (1.4 bcm/year) stage commissioned as soon as 2017. The second phase of 0.5 Mt/year (0.7 bcm/year) would follow in 2020 and full capacity of 3 Mt/year would be reached in 2030. (www.enerdata.net)

Saudi Arabia loses spot as top crude supplier to India, China

June 24, 2015. Saudi Arabia lost its spot last month as India's top oil supplier to Nigeria for the first time in at least four years, according to ship tracking data, as the world's top crude exporter struggles to maintain market share in Asia. The OPEC kingpin fell behind Russia and Angola as the biggest crude supplier to China last month, data showed. The Middle East country's failure to maintain its position in some markets comes despite it leading a strategy by the Organization of the Petroleum Exporting Countries (OPEC) to keep output high to drive out competitors. In India, refiners have been switching out of long-term contracts with Middle East suppliers in favour of spot purchases, often African oil. A glut of African cargoes has emerged as the U.S. shale boom cuts American demand and accelerated as OPEC keeps output high. The share of African oil, mainly from Nigeria and Angola, jumped to 26 percent of India's total imports in May, up from around 15.5 percent in April and the highest in more than four years, according to tracking data on tanker arrivals. At the same time, the Middle East share fell to 54 percent in May from 61 percent, with Saudi Arabia supplying some 732,400 barrels per day (bpd) compared with Nigeria's 745,200 bpd. The shift comes as the gap between the international benchmark Brent and the Middle East price marker narrows. The premium for Nigerian crude over Brent has plummeted in recent months, making it more attractive. Reliance Industries got about a quarter of its oil in May from Africa, the highest in at least three years. Indian Oil Corp aims to get 70 percent of its oil needs through term volumes compared to 80 percent last year, including a deal with Kuwait halved to 100,000 bpd. Another refiner, Bharat Petroleum Corp, plans to cut its dependence on term contracts to 75 percent this fiscal year from 82 percent a year ago. Hindustan Petroleum Corp said purchases of West African oil make sense when Brent's premium over the Middle East price marker, known as Dubai swaps, is less than $2 per barrel. The spread DUB-EFS-1M has mostly hovered below that since oil prices crashed in the second half of last year and hit its lowest in two months this week at $1.32. KBC Energy's Haq estimates West African oil's share to India could average as much as 25 percent this year. (uk.reuters.com)

Policy / Performance…………

Russia-Ukraine gas talks focus on price

June 30, 2015. Russia is parrying Ukraine’s demands for a natural-gas accord with the European Union (EU) through the heating season as it maintains an offer to temporarily hold prices unchanged from July 1. Russia sees no need for new accords as it will bill Ukraine using the third-quarter price set, Russian Energy Minister Alexander Novak said before the talks with his Ukrainian counterpart, Volodymyr Demchyshyn, and the European Commission’s vice president for energy union, Maros Sefcovic. Russia is reducing the discount it offers Ukraine by 60 percent for the three months starting, after the current accord expires. That will leave gas prices, which have dropped in Europe, at the same level as this quarter.