-

CENTRES

Progammes & Centres

Location

[The Problem of Plenty – International]

“On the non hydrocarbon sector the media was engrossed with news on renewable energy which is understandable given that countries are vying for the largest renewable energy share title in Paris later this year. China was said to be planning for a nationwide carbon cap and trade by 2017 which is something that India should watch. One last bit of non hydrocarbon news in September was that Chinese companies may be building nuclear plants in the UK. For China bashers this is not necessarily good news!…”

Energy News

[GOOD]

50 mt increase in coal production from CIL is a slap in the face for its critics!

Why revive Dabhol if there are no takers for its power?

[UGLY]

A call for higher electricity tariff is a call for higher inefficiency!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· The Problem of Plenty – International

ANALYSIS / ISSUES…………

· Droughts and Power Crises

DATA INSIGHT………………

· Scenario of Crude Oil, Petrol and Diesel Prices in 2014-15

[NATIONAL: OIL & GAS]

Upstream…………………………

· ONGC seeks commercial help from govt for $6 bn KG basin project

· Essar Oil targets 1.2 mmscmd gas production from Raniganj

Downstream……………………………

· HPCL seeks Mozambique gas for Gujarat LNG terminal

Transportation / Trade………………

· IOC to supply diesel to Punjab Roadways at discounted rate

· Indian oil companies pay $700 mn to Iran for oil

Policy / Performance…………………

· Gas price cut to impact fresh investments by energy companies: Moody's

· PNGRB invites bids for CNG retailing licences in 34 cities

· Non-subsidised LPG cylinder price down ` 42, jet fuel rate up 5.5 percent

· CNG price cut by 80 paise per kg, PNG by 70 paise per unit in Delhi

[NATIONAL: POWER]

Generation………………

· Adani Group to ink ` 4 bn deal to buy Welspun Group’s two coal plants

· Gelnal Hydro Electric Project yet to be officially inaugurated after 20 yrs

· CIL will produce 50 mn tonnes more coal than last year: Goyal

Transmission / Distribution / Trade……

· 33k Bengaluru households don't have power supply

· NTPC mulls selling power to Bangladesh from Assam plant

· Cabinet to consider ` 4.3 lakh crore loan recast of discoms

· Maharashtra not to purchase power from Dabhol plant

· PGCIL builds ` 8 bn transmission line linking West Bengal, Bihar

· Reliance Power to sell off three Indonesian coal mines

· Kalpataru Power bags ` 7.8 bn contracts

Policy / Performance…………………

· Maharashtra govt clears revival of RGPPL project

· PM Modi to push power price hikes

· Nitish failed to provide electricity even after 10 yrs: Goyal

· No nuclear accident in India's 21 plants in 2014-15

· Govt ensures transparency through online auction: Swarup

· GIPC inks pact for subsidy to buy imported gas

· India must make full use of Iran nuclear deal: President

· Odisha raises electricity duty rate by 1 percent on industry

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Shell starts Nigeria offshore expansion of up to 50k barrels

· Libya's oil output down to 300k bpd

· Maersk oil makes minor gas discovery offshore Norway

· Brazil produced record 2.5 mn bpd of oil in August

· Global oil demand growing at fastest pace for five years

· Lundin Petroleum finds more oil at Alta Arctic discovery

· Shell in talks with Gazprom on Yuzhno-Kirinskoye gas field

Downstream……………………

· Chile's Aconcagua refinery plans 44 day maintenance

· Russian Energy Minister proposes keeping 90 percent of gasoline on domestic market

· Paraguana refineries to restart processing units

Transportation / Trade…………

· Iraqi Kurds boost oil sales in drive for financial independence

· Belgium and Luxembourg successfully merge their gas markets

· Gazprom chief says gas exports to Europe up 23 percent in third quarter

· Egypt takes delivery of second floating LNG import terminal

Policy / Performance………………

· Russian Energy Minister says Kremlin ready to cooperate with OPEC

· OPEC Secretary-General wants cooperation with non-OPEC over surplus

· Brazil tries to shake oil industry gloom with new bidding round

· Egypt awards four offshore O&G exploration licences

· Cuts in global oil investment biggest ever this year: IEA chief

· US says BP to pay $20 bn in fines for 2010 oil spill

· British PM Cameron says could re-examine diesel subsidies

· US fines Exxon $2.6 mn for Arkansas oil pipeline leak

· Iran's cabinet approves new draft O&G contracts

· China, Iran to put brakes on oil price recovery

[INTERNATIONAL: POWER]

Generation…………………

· Southern Africa power generation investment up to $233 bn by 2027

· Ratch and Banpu bid to build 2 GW power project in Indonesia

· Seabed drilling for Wylfa Newydd nuclear power plant

Transmission / Distribution / Trade……

· Brazil launches $2 bn power transmission tender

· South Africa needs $15 bn in power transmission grid investments

· Power line to link Xinjiang and Pakistan

· Siemens to power up $268 mn of electricity transmission stations: Egypt

Policy / Performance………………

· Belgian nuclear regulator approves Doel lifetime extension to 2025

· AfDB lends €121 mn for electricity access in Senegal and neighbours

· Japan to restart second nuclear reactor

· Development banks spur $1 bn for West African energy plan

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Aditya Birla Nuvo to develop solar plants with Abraaj Group

· India leads Asia's dash for coal as emissions blow east

· Tenders to lease sea blocks for wind farms next year

· Nuclear energy not viable: German green economist

· Suzlon bags 100.8 MW repeat order from Orange Renewable

· Germany offers India $2.2 bn for solar, clean energy

· Gujarat NRE Coke gets board nod to sell wind business

· India plans to cut its carbon intensity by up to 35 percent by 2030 from 2005

· Set up fund from green savings to deal with climate change: Railway Minister

· Waste-to-energy projects to be setup under Swachh Bharat Mission

· India seeks $2.5 tn to curb fossil fuel pollution by 2030

· Jharkhand can show the path to clean environment: PM Modi

GLOBAL………………

· UK said to consider closing all coal-fired plants by 2023

· Africa could quadruple the share of renewables in energy demand by 2030

· Mainstream's 182 MW Aurora wind project approved in Chile

· Alliant weighs boosting solar power generation

· Nordex signs agreement to acquire Acciona Windpower for $880 mn

· Canada can halve methane emissions for $555 mn

· EIB links green bonds to projects in push for climate

· UAE to invest $35 bn in clean energy by 2021

[WEEK IN REVIEW]

COMMENTS………………

Briefing: International Energy

The Problem of Plenty – International

Lydia Powell and Akhilesh Sati, Observer Research Foundation

|

L |

ast week we observed that the problem of plenty is playing out differently in the domestic and international contexts. In the domestic context the problem of plenty was partly a consequence of insufficient demand but in the international context it is clearly a problem of excess supply, especially of oil and gas. But low oil prices which are often quoted as the cure for low oil prices is having an impact on supply.

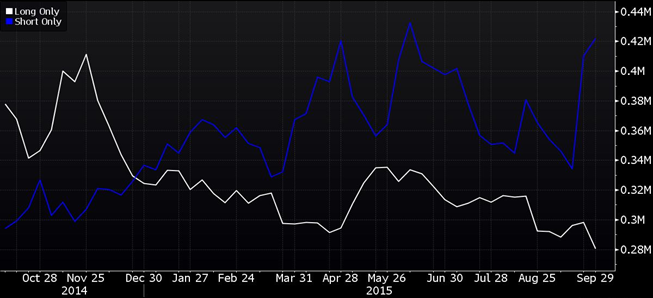

Though the physical oil market continued to show signs of weakness (too much oil) the financial or the paper market appeared volatile with large shifts in short and long positions. It appears that no one is sure how long the least efficient shale drillers in the US will last in an environment of low oil prices. According to the Financial Times, US shale drillers ran a deficit of $32 billion in the first half of 2015 equal to the entire deficit of the sector for 2014. This was followed by news from energy information & analysis (EIA) of the US that there was a meaningful reduction in US oil output. In September US production was about 9.13 million barrels per day (b/d), a 500,000 b/d reduction in output from peak production levels. The reduction in supply from the US was equal to the total output from a small country like Libya. This reduction was in spite of an increase production of conventional crude from the Gulf of Mexico. A reduction in supply is expected from other non-OPEC producers as well. According to the international energy agency (IEA) non-OPEC oil production is expected to fall by 500,000 b/d by 2016, the sharpest drop in the last 25 years.

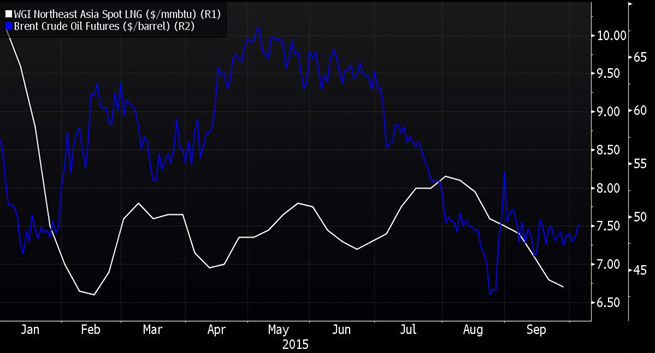

Crude Oil and LNG Prices

Source: Bloomberg

The unexpected stability of low oil prices led Goldman Sachs to predict (around mid September) that oil prices would drop to $20/bbl. But how reliable are Goldman predictions? Goldman predicted that oil prices would touch $250/bbl in 2009. The average price for crude in 2009 was about $56/bbl.

Oversupply is changing the industry in many ways. According to data from Baker Hughes the number of drilling rigs in the US has fallen by over 1100 since October 2014. Over supply and low prices has also led to a decline in investment in the sector. Moody’s said in a recent report that oil companies can expect a decline of $ 80 billion in cash flow. A Wood McKenzie report said that $ 1.5 trillion worth oil and gas projects faced the risk of a cash crunch. The report also said that only 10-11 upstream projects will be completed as opposed 50-60 which was the norm.

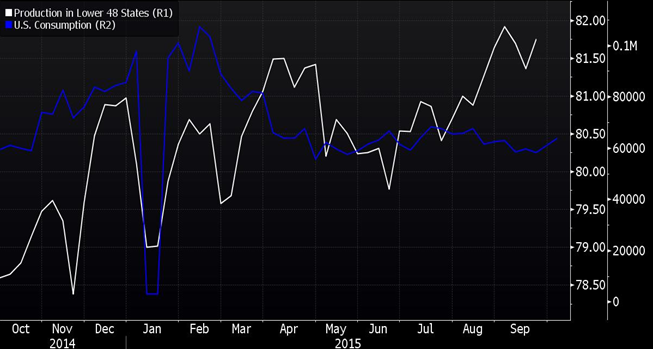

Gas Production and Consumption- USA

Source: Bloomberg

While the ‘market’ is pushing towards the logical response of reducing supply, non market forces seem to be working in the opposite direction. Among the many non market forces are China ‘energy security’ driven filling up its 600,000 million barrel Strategic Petroleum Reserves (SPR) and Russia’s geo-politics driven pumping of 10.74 million b/d which is a post Soviet record. Analysts are speculating a downward pressure on prices when China eventually winds up its SPR filling. They are also speculating on the impact of talks between Saudi Arabia and Russia on prices. Some think that Russia is colluding with weak OPEC members against the strong ones such as Saudi Arabia to cut production to increase prices. Overall no one is sure how this complicated game that mixes geo-politics with economics will play out.

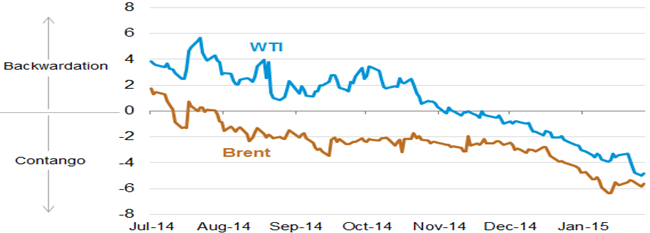

The issue of US crude oil exports continued to be debated but the commercial incentive to export crude is no longer strong. Crude oil exports from the US would have made sense (for the US companies) when WTI traded at a discount to Brent but now the discount is so small that crude exports look uninteresting commercially. But geopolitical and strategic analysts always have a view that runs counter to market views. According to them export of crude and gas from the USA will put down Putin and also reduce the clout of other energy tyrants in the Middle East.

Moving on to the European continent, North Sea oil producers were said to be facing an existential crisis. Though there have been spending cuts across the world in the oil & gas sector, the off shore oil sector has been particularly vulnerable as this sector has some of the highest costs in the world. Many of the fields are in decline and require constant injection of capital. Some are said to be facing the risk of shutting down. As many companies share infrastructure if one shuts down others may also have to shut down. The downturn in oil prices also contributed to Shell shelving its arctic drilling plans. The project had also suffered a set-back from disappointing geological results.

Crude Oil Future Trading ($/bbl)

Source: Bloomberg

There was also news on China moving towards establishing an oil price bench mark in October that could become the most important after WTI and Brent. Given that China is the biggest oil importer (and India the third largest) it makes sense to have an Asian index but as the Chinese index is to be priced in Yuan and not dollars it may take time to gain acceptance.

There was news of the problem of plenty in the LNG sector as well. According to a new report by Wood Mackenzie most US LNG projects totalling about 60 million tonnes (mt) of capacity are moving ahead. G2 LNG a new US company is said to be planning a new LNG export terminal specifically targeting countries with which US does not have a free trade agreement. The new LNG capacity in the US will add to the 140 mt capacity that is being constructed globally. Projects under construction alone can double existing LNG capacity in the next one or two years.

The glut in the gas market has led to economic and political changes. Encouraged by falling prices and growing supplies Japanese buyers are said to be refusing to sign contracts with destination clauses (contracts that prevent reselling). India’s Petronet is lifting only 70 percent of contracted capacity from Qatar and is paying about $8/mmBtu which is 36 per cent less than the contracted price. On the political side, abundant supplies have encouraged the EU to impose market manipulation charges on Russia’s Gazprom. Russia has also been pushed to settle gas prices with Ukraine.

Gas Futures Trading

Source: Bloomberg

The problem of plenty was also behind depressing commercial news on falling value of energy companies and the prospect of distressed companies putting themselves up for sale and growing prospect of consolidation in the offshore services business. Among key mergers, takeovers and impending takeovers were Shell’s takeover of British Gas (which has been approved by the EU), GE’s purchase of the power equipment business of Alstom, Oil Search’s rejection of Woodside’s bid, GE emerging as contender for Halliburton’s assets, Total’s sale of its oil sands assets to Suncor and so on. A shakeout is generally good for the sector in the long term but not necessarily in the short term, especially for those who are likely to lose their jobs.

September brought some good news (or perhaps bad news in an environment of plenty) on a major gas discovery in Egypt. According to ENI which discovered the field, it is a supergiant with over 30 trillion cubic feet of gas. This piece of good news for Egypt and ENI may be really bad news for Israel and Nobel energy as they had expected Egypt to the biggest customer for the gas from their giant gas field Leviathan.

On the non hydrocarbon sector the media was engrossed with news on renewable energy which is understandable given that countries are vying for the largest renewable energy share title in Paris later this year. China was said to be planning for a nationwide carbon cap and trade by 2017 which is something that India should watch. One last bit of non hydrocarbon news in September was that Chinese companies may be building nuclear plants in the UK. For China bashers this is not necessarily good news!

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

ANALYSIS / ISSUES……………

Droughts and Power Crises

Shankar Sharma, Power Policy Analyst

|

D |

roughts are nothing new for India. Many states in the Union such as Karnataka, Gujarath, Rajasthan, Bihar have experienced the droughts many times in the recent past. Droughts have also been associated with power crises in recent decades due to close relationship between water availability and electricity demand/generation.

India’s declaration to UNFCCC as part of COP 21 meet at Paris (in the form of INDC) says:

“India accounts for 2.4% of the world surface area, but supports around 17.5% of the world population. It houses the largest proportion of global poor (30%), around 24% of the global population without access to electricity (304 million), about 30% of the global population relying on solid biomass for cooking and 92 million without access to safe drinking water.” With about 35% of the country’s land area drought prone, the scenario of drought can visit our country time and again.

Karnataka’s case study can be a good basis for other drought prone states in the union to consider suitable action plan to minimise the impacts on electricity supply.

This year Karnataka is reported to be heading for a severe drought situation not seen in 40 years. More than 75% of the taluks in the state have officially been declared as facing drought. The state govt. has announced many desperate measures to deal with the situation. When seen in the context that about 72% of the state’s geographical area is arid or semi arid and about 52% is drought prone, it should become obvious that the drought like situation for the state is not entirely new. However, it is critical to acknowledge that the fast evolving global warming phenomenon will only exacerbate the drought like situation, and hence there is an urgent need to consider the present scenario holistically to prepare our communities to face the consequences from a long term perspective.

Whereas the urgent measures to provide drinking water, food, fodder and suitable employment opportunities in the drought affected areas should be the priority for the state, it is also critical to consider the likely impact of future droughts on all sectors of our economy and on all sections of our society in the long run. The need to develop a state action plan on climate change should be a great opportunity to consider various measures to minimise the impact of drought on our communities. In this context the large number of credible recommendations made by the civil society on Karnataka state action plan on climate change as compiled for the state pollution control board should be objectively considered to prepare the different sectors of our economy to face the future droughts.

Drought is known to have profound impact on the electric power sector, which in turn will have huge impact on agriculture, industry and commerce. In a drought year, due to low reservoir levels the hydel power output during non-monsoon months will be much less as compared to a normal monsoon year. This year with the thermal power output also not optimal due to various reasons, it is not surprising that the state is witnessing huge power cuts even before the monsoon season is over. The shortages can only be expected to become severe in the subsequent months unless appropriate measures are taken to match the demand and supply. As a matter of fact the ongoing power cuts are a continuation of the phenomenon of the last few decades.

In such a crisis like situation there is a need for everyone to carefully consider a way out of such a mess, which is affecting all aspects of our life. There are no quick-fix solutions to the problems besetting the power sector. The crisis we are in is not the making of any single government or of the omissions and commissions in one year. It is the result of the continuous failure of the concerned authorities for decades to read the writing on the wall. In the immediate context there can only be some measures to reduce the severity of the crises. However, the STATE should not leave any stone unturned in finding suitable solutions, even if it looks difficult to achieve or costly in the immediate context. No power is costlier than the costliest power in a modern society.

There is an urgent need for everyone in the state to earnestly try to minimise the consumption of water and electricity until the situation improves considerably. The following short term measures to tide over the difficulty have been advocated for in the previous years also.

Short term measures:

Ø Negotiate with the owners of captive power plants so as to make use of their idle capacity, if any, at least during the peak demand hours. For various technical reasons the cost of such power may not be much higher than the imported power.

Ø ESCOMs should procure good quality LED lamps in adequate numbers and supply them to consumers to replace the incandescent lamps at reasonable rates.

Ø Start a massive and concerted public awareness campaign on energy conservation and energy usage efficiency through electronic and print media, and with the help of credible NGOs. Appeal to the domestic consumers to save 10-15% of energy every month as compared to the consumption during corresponding months of last year.

Ø Appeal to the public to avoid using electrical appliances other than essential lighting accessories between 5.00 AM to 8.00 AM and between 6.00 PM and 9.00 PM.

Ø Mandate all commercial installations above a certain connected load, say 5 kW, to reduce their energy consumption by 10% as compared to corresponding month of the previous year until further notice.

Ø Ban the illuminated hoardings, advertisement boards and decorative lights until the situation improves.

Ø Consider banning the operation of shopping malls and other non-essential commercial establishments with connected load of, say, above 10 kW after 7.00 PM till 10.00 AM.

Ø Ban all night time sports until the situation improves. In case of the already committed national and international sports events ask the hosts to enter into agreement with private companies outside the state to buy the necessary amounts of energy and peak demand power.

Ø Consider asking all urban local bodies to disconnect power supply to every alternate street light pole in excessively illuminated areas. Minimise illumination in parks.

Ø Consult industry bodies such as FKCCI to reduce monthly energy consumption in industrial units by 5-10 % as compared to corresponding month of the previous year. Consider the option of two weekly holidays and /or one or two shifts only for industries. Such voluntary measures are likely to be better than scheduled and unscheduled power cuts.

Ø Ask all govt. offices not to use Air Conditioning where alternatives are available. Mandate them to reduce energy consumption by 10%.

Ø Mandate reduction by 50% the energy consumption of the lifts in non-essential locations.

Ø A task force in the state on electricity can go a long way in addressing the power crises not only in the short term but also to recommend/implement sustainable methods of meeting the electricity/energy demand in the long term.

Instead of spending thousands of Crores of Rupees every year to buy costly power on short term power purchase agreements, there should be adequate investment to encourage massive deployment of roof top solar PV systems on govt. buildings, commercial and residential buildings. Such solar power systems will not only help to eliminate the power deficit, but can bring many other benefits to the state.

Medium to long term measures

Whereas the above mentioned measures can give short term relief, the long term view of the demand/supply of electricity should never be ignored. It is the lack of such foresight since decades which has resulted in the present day crises.

Only concrete and focused measures will provide the lasting solution to our crises, and not the shortcuts or knee jerk reactions, which successive governments have been following. Industry experts are of the opinion that the electricity shortages in the state as experienced in the recent past and as projected for the foreseeable future are entirely avoidable. There is adequate power generating capacity in most of the states; but the crises are due to the grossly inadequate attention to manage the same efficiently. Each of the state govt. should consider convening a meeting of the ESCOMs, consumer groups, industry observers, and other interested parties early to find suitable ways to tide over the situation. The public would expect the authorities to know that without the active co-operation of the public the power sector crises cannot be overcome even in a decade.

Almost all the states in the country are facing power crises year after year even during the years of reasonably good monsoon. While the coal supply issue has acquired a crisis like situation due to flooded coal fields, strike by coal miners and steep hike in coal imports, the demand for electricity is seen as generally increasing even after a decent monsoon season due to consumptive life styles. As a matter of fact the power cuts are a continuation of the phenomenon of the last few years. No section of the consumers has remained unaffected with strong protests being reported from all over the state.

While on one hand the existing coal power plants are struggling to keep operating due to inadequate coal supply, new power plants such as hydel plants in Himalayas and coal power plants all over the country are facing stiff opposition by the locals. The situation with unreliable coal supply is most likely to continue indefinitely not only within the country but also in case of imports. Consequently the power crises are likely to get worse unless our society takes urgent corrective measures.

People have been advocating many of the following measures for almost 25 years. Late Prof. A K N Reddy of IISc is known to have provided many of these measures way back in mid 80s. Most of these measures may need concurrence of the state regulators, and is advisable to obtain the same urgently.

Most important approach should be to consider how to reduce the electricity demand without compromising on the welfare activities. Due diligence such as detailed studies and effective public consultations is required if we are to aim at finding sustainable measures as mentioned below.

· Effective and sustained awareness campaign should be launched to draw the attention of the society that there cannot be limitless supply of electricity/energy; that the cost of providing electricity/energy is going up steeply every year; that the real cost to our society of providing electricity/energy to our houses, offices, shops, irrigation pump sets, industries etc. is much more than what we are paying now; and that the highest possible efficiency and responsibility in the usage is essential.

· Through effective participation of various stake holders the realistic price of delivering electricity to the end consumers should be determined, and every consumer should be persuaded to pay the diligently determined tariff for the electricity usage which is measured accurately. Such a realistic tariff should lead to very responsible use of electricity.

· All the concerned people in the power sector, including the STATE, would do well to realize that only through an integrated energy management approach, involving optimal utilisation of the existing assets, effective demand side management, realistic levels of energy conservation, and widespread use of renewable energy resources, can the legitimate demand for electricity of every section of our society be satisfactorily met on a sustainable basis.

· T&D losses should be targeted to be reduced below 10% by 2020, and to the global best practice level by 2025. End use efficiency should be improved by making high efficiency appliances financially attractive to deploy.

· Persuade sports bodies such as cricket stadia, Hockey stadia, football stadia etc. to install solar photo voltaic panels on their roofs to generate adequate power to meet their own requirements. Such sports and entertainment bodies should be asked to generate a certain percentage of their monthly electricity requirements (say 25% of their monthly usage) through solar photo-voltaic panels installed on their roof tops.

· Through consultations with the public and the regulator, the widespread usage of roof top solar photo voltaic panels should be popularised on the premises of residences, shops, industries, schools, colleges, offices etc. not only to generate electricity for local usage, but also to export the excess electricity to the grid. This practice will drastically reduce the need for coal based, dam based and nuclear based power plants, while also reducing the need for additional transmission lines.

· Similarly, suitably designed community based solar power plants OR bio-mass power plants can reduce the pressure on the existing power grid by a huge margin; will minimize the T&D losses; accelerate the rural electrification; and can go a long way in reducing urban migration.

· Positive intervention through tariff policies has huge potential to reduce the peak hour electricity demand on the electricity grid by measures such time-of-day tariff and penalties/incentives for peak hour usage; staggering of weekly holidays and factory working hours.

· Through a carefully planned integrated energy management approach the reliance on coal based, dam based and nuclear based power plants should be gradually reduced.

· An objective costs and benefits analysis of every power project proposal, through effective public participation, will assist in ensuring real benefits to the society.

· A gradual but definitive shift to micro grid/smart grid based renewable energy system for the rural areas in the initial stage and for the entire country in the long run has become inevitable. This will require adequate investment in improving the reliability and efficiency of the electricity distribution systems.

· The concept of “Energy co-operatives” along with micro /smart grids is eminently suitable to Indian conditions where poor/middle class people can pool their resources together to contribute for larger projects of vast benefit to them.

It is high time that the concerned authorities realize that seeking to meet the electricity demand through more of coal power plants (despite the fast depleting coal reserves and in the context of many water stressed states in the country); or through building more of hydel power plants (in the already threatened Himalayas); or through life threatening nuclear reactors will be futile exercises keeping in view the hugely deleterious impacts of these conventional power sources on our communities. The frequent saga of how thermal power plants in the country are suffering due to loss of fuel supply is a clear indication of the difficult days ahead for the entire country. At a time when drinking water supply has become a serious issue for thousands of our villages, even to contemplate on additional coal power plants, which will require huge quantities of fresh water, should be unacceptable. Keeping in view the massive health impacts from coal dust and coal burning, additional coal power plants should not be an option at all for states like Karnataka which have no coal reserve of their own.

A paradigm shift in the way our society looks at demand/supply of electricity/energy is urgently required. In the eagerness to meet the insatiable demand of electricity in our urban areas, we should not ignore the basic requirements of rural communities such as clean air, drinking water, livelihood, absence of threat of forcible displacement etc. Are we serious about this societal obligation?

It is not only the electrical energy which requires our high priority but also all forms of energy whether it is petrol OR diesel OR LPG. With about 75% of our petroleum consumption depending on imports, and not much of our own natural gas reserves our society has a major challenge ahead to manage our demand/ supply scenario. While our rural areas are struggling to get even life line energy supplies, the urban areas are splurging on energy sources. This situation cannot continue indefinitely. Our society has to address this challenge early before the things get out of control.

It is also evident that the society cannot rely on the STATE and its agencies alone to ensure us the required level of energy security. At the levels of individuals and communities there is a lot we can do to address the serious energy/electricity supply crises. Some such measures we can consider not only to reduce the energy demand of the society but also to curb global warming are:

1. Reduce energy consumption at individual levels: drive smart; walk wherever feasible; switch off electrical appliances at the wall socket when not really required.

2. Write to the political leaders now. Urge them to raise electricity/energy economy standards.

3. Support clean, renewable energy; use solar water heaters and roof top solar PV panels.

4. Replace incandescent light bulbs with LEDs with or without govt. subsidies.

5. Saving energy at home is good for the environment and for one’s own wallet.

6. Become a smart water consumer; adopt rain water harvesting and ground water recharging.

7. Buy only energy-efficient electronic and electrical appliances.

8. Plant a Tree, protect a forest

9. Reduce! Reuse! Recycle!

10. Mount a local campaign against global warming.

The summary of all these discussions is that India has no other option than to adopt a paradigm shift in the way we look at electricity demand and supply, by resolutely moving towards distributed renewable energy sources supported with micro/smart grids. True costs & benefits to society should be at the focus while determining the suitable technology/method to meet each MW of electricity demand.

The broader lesson should be to tailor our electricity/energy demand/supply infrastructure to suit our geographical and climatic constraints, and not to ape the consumption oriented approach of industrialised countries.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

Scenario of Crude Oil, Petrol and Diesel Prices in 2014-15

Akhilesh Sati, Observer Research Foundation

|

Month |

Crude Oil Price (Avg. Monthly Indian Basket) |

Petrol* |

Diesel* |

|

|

USD/bbl |

(INR/Litre) |

(INR/Litre) |

||

|

April |

105.56 |

40.07 |

71.84 |

55.49 |

|

May |

106.85 |

39.86 |

71.41 |

56.10 |

|

June |

109.05 |

40.97 |

71.50 |

57.28 |

|

July |

106.30 |

40.15 |

73.60 |

57.84 |

|

August |

101.89 |

39.03 |

71.42 |

58.40 |

|

September |

96.96 |

37.11 |

68.51 |

58.97 |

|

October |

86.83 |

33.50 |

67.26 |

57.56 |

|

November |

77.58 |

30.10 |

64.24 |

53.35 |

|

December |

61.21 |

24.16 |

62.33 |

51.51 |

|

January |

46.59 |

18.23 |

60.12 |

49.39 |

|

February |

56.43 |

22.02 |

57.13 |

46.53 |

|

March |

55.18 |

21.67 |

60.49 |

49.71 |

Note: Avg. Monthly Retail Selling Prices of Diesel & Petrol at Delhi

bbl- barrels; 1 bbl= 159 Litres

Source: Table - RajyaSabhaUnstarred Question No.2685 dated Aug 12, 2015

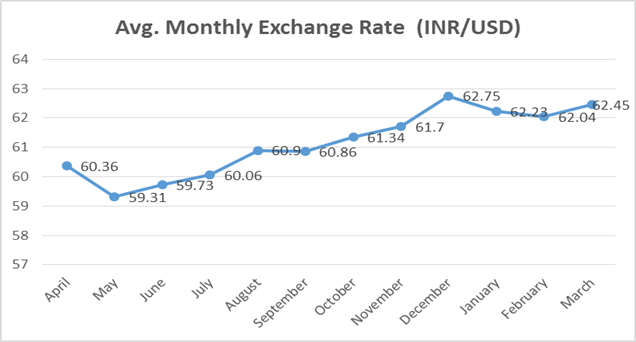

Graph- Compiled from Reserve Bank of India

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

ONGC seeks commercial help from govt for $6 bn KG basin project

October 5, 2015. Oil and Natural Gas Corporation Limited (ONGC) may seek government support for its KG basin water project due to fluctuating oil prices. The oil major company is planning to appeal for commercial support from the government for its $6 billion deep water project at the current oil prices, which have more than halved in a year to about $45 a barrel. The company is working on revamping its field development plan to cut capital spending and boost output. They aim to cut down oil production cost by $10 from $60 a barrel. Apart from the oil, as per the recently submitted field development plan report, the company aims to bring down gas production cost by $1-2 from $6-7 a unit. (www.dnaindia.com)

Essar Oil targets 1.2 mmscmd gas production from Raniganj

September 30, 2015. Essar Oil aims to produce 1.2 million standard cubic meters per day (mmscmd) of gas from the Raniganj coal bed methane asset over the next few months and ultimately up to 3 mmscmd, the company said. In the refinery business, the company is currently undertaking a turnaround shutdown, which all refineries need to undertake every three to four years. The company is continuing to derisk the balance sheet by dollarising its rupee debt. (www.sify.com)

Downstream………….

HPCL seeks Mozambique gas for Gujarat LNG terminal

October 4, 2015. Hindustan Petroleum Corporation Limited (HPCL), the country’s third biggest oil refiner, is negotiating with its partners in the Mozambique gas field, operated by Anadarko Petroleum Corporation, to bring natural gas to India for its upcoming liquefied natural gas (LNG) terminal in Gujarat. The deal will not only give HPCL access to gas, which is logistically cheaper to source, it will also give the company a cost advantage in its natural gas trading business, which it started last financial year. HPCL is looking at a strong mix of long-term and spot contracts for sourcing LNG for its terminal, unlike the current trend where most buyers are locked in long-term contracts. HPCL has an equal joint venture agreement with Shapoorji Pallonji Port Pvt. Ltd to build a five million tonnes per annum (mtpa) capacity LNG terminal at Chhara Port in Gir, Gujarat. The terminal will be built at an investment of ` 5,400 crore and is expected to be commissioned by 2019, according to HPCL’s 2014-15 annual report. The report said the commissioning of this terminal would facilitate the corporation to source LNG for its own refineries and to market natural gas for customers connected through gas pipelines. The company will look at sourcing gas from LNG aggregators and also fleet operators, such as British Petroleum Plc, Royal Dutch Shell Plc, etc. as that will give HPCL access to spot natural gas. But for the company to take full advantage of LNG sourced from Mozambique, it has to strike a deal at a very good gas price, analysts said. In the past one year, the price of spot natural gas has fallen by over half to $7 per million British thermal units (mmBtu), while firms such as Petronet LNG Limited and GAIL (India) Limited are locked in expensive long-term contracts of $12 per mmBtu. (www.livemint.com)

Transportation / Trade…………

IOC to supply diesel to Punjab Roadways at discounted rate

October 4, 2015. Indian Oil Corporation (IOC) will supply diesel at a discount of ` 1.05 per litre for five years to state owned Punjab Roadways and Punbus. Punbus and Punjab Roadways signed an agreement with IOC in this regard. IOC has agreed to provide additional infrastructure like digital tyre inflators and online diesel monitoring dispensing units for effective monitoring of diesel, which will help reduce pilferage and result in saving to Punjab Roadways and Punbus. (www.dnaindia.com)

Indian oil companies pay $700 mn to Iran for oil

September 30, 2015. Essar Oil, MRPL and other Indian refiners paid Iran USD 700 million to clear over one-tenth of their outstanding oil dues, the first payment this year ahead of easing of international sanctions against the Persian Gulf country. Essar Oil paid USD 335 million while Mangalore Refinery and Petrochemicals Limited (MRPL) paid about USD 300 million. HPCL-Mittal Energy (HMEL) and Hindustan Petroleum Corp (HPCL) made up for the remainder of the payments made. Western sanctions against Iran, which had crippled its oil revenues, are widely expected to end in 2016 if Tehran complies with terms of the deal agreed on July 14. As part of the deal, the US Treasury's Office of Foreign Assets Control (OFAC) had approved the banking mechanism for payment of USD 1.4 billion by Indian refiners in two equal installments to Tehran. The refiners deposited rupee equivalent of USD 700 million in Kolkata-based UCO Bank which transmitted the money to the Reserve Bank of India (RBI). RBI will make arrangements for its onward remittance to Iran. A second instalment of USD 700 million will be paid in October/November. The remaining USD 4 billion will be cleared in tranches after payment channels are okayed. The dues to Iran on crude oil that refiners buy have accumulated as Western sanctions blocked payment routes since 2013. About 45 percent of the oil import bill is paid in rupees in a UCO Bank branch and the rest has added up. Since February 2013, refiners like MRPL and Essar Oil have been paying 45 percent of dues on purchase of crude oil from Iran in rupees through UCO Bank, Kolkata. The remaining has been accumulating, pending finalisation of a payment route and mechanism. They had last year paid nearly USD 3 billion in six instalments through a limited payment channel following start of nuclear talks between the West and Iran. Before payment, Essar Oil owed USD 3.34 billion to Iran, MRPL USD 2.49 billion and Indian Oil Corporation USD 581 million. HMEL owed USD 97 million and HPCL another USD 29 million. Besides, about ` 17,000 crore was lying in Iranian account with UCO Bank. (timesofindia.indiatimes.com)

Policy / Performance………

Gas price cut to impact fresh investments by energy companies: Moody's

October 5, 2015. Global ratings agency Moody's has said the sharp cut in natural gas prices notified by the Indian government will not only impact Oil and Natural Gas Corporation (ONGC) but also discourage new exploration investments and fuel imports. Earlier, Standard & Poor's said the 18% cut in domestic prices of natural gas from $4.66 per unit to $3.82 per unit for six months starting October 1 will discourage oil exploration and production companies from committing new capital expenditure. India sets natural gas prices by taking a volume-weighted annual average of the rate prevailing in the US, Britain, Canada and Russia. Prices are calculated on the trailing 12 month data with a lag of one quarter. The ratings agency said India should benchmark its natural gas prices to similar gas-deficient nations instead of using rates prevalent in gas-surplus areas like the US and Canada. The agency said that fresh commitments by private oil and gas companies will remain uncertain, given that several exploration firms globally had scaled back their spending and put new projects on hold amid low hydrocarbon prices. (www.business-standard.com)

PNGRB invites bids for CNG retailing licences in 34 cities

October 5, 2015. The Petroleum and Natural Gas Regulatory Board (PNGRB) has invited bids for giving CNG retailing licences in 34 cities, including Amethi in Uttar Pradesh, Ahmedabad in Gujarat and Bhatinda in Punjab. While it is yet to award licences for previous round of bidding that happened in June this year, the Petroleum and Natural Gas Regulatory Board (PNGRB) has invited bids for development of City Gas Distribution (CGD) network in 34 cities. In a notice, PNGRB invited bids for cities in Madhya Pradesh, Gujarat, Maharashtra, Uttar Pradesh, Karnataka, Haryna, Punjab and Goa. In Gujarat, bids have been invited for allowing retailing of CNG to automobiles and piped cooking gas to households in Dahod, Patan, Banashantha, Amreli, Dahej-VagraTaluka, Ahmedabad, Anand and Panchmahal. Licences for Auraiya, Nainital, Baghpat, Amethi, Etawah, Saharanpur, Raebareli, Manipuri and Ramabai Nagar in Uttar Pradesh are also up for grab. Besides, licences for Bhiwani, Yamunagar, Rewari and Rohtak in Haryana, are on offer. Bids have also been invited for CGD licences for Jhabhua, Dhar, Rewa and Shahdol in Madhya Pradesh, Ahmadnagar in Maharashtra, Chitradurga and Gadag in Karnataka, Bhatinda, Rupnagar and Fatehgarh Sahib in Punjab and North Goa. Last date of bidding is December 14, PNGRB said. The 5th round of CGD licence bidding had received lukewarm response with no bids being received for eight out of the 20 cities on offer while single bids came in for two others. Indian Oil Corporation-Adani Gas combine has bid for a licence to retail CNG in five cities. State gas utility GAIL India Limited, through its subsidiary GAIL Gas, bid for three. Bidders were asked to quote the tariff they will charge for the pipeline network to be laid in the city and the compression charge for dispensing compressed natural gas (CNG) over the 25 years. They were also asked to quote the inch-km of steel pipelines they will lay during first five years and the number of domestic consumers proposed to be connected by piped natural gas, according to the PNGRB. Fourteen cities offered in the fourth round announced in October 2013 are yet to be awarded licences. The third round of bidding was opened in July, 2010 and concluded in February, 2011 (after extension), but final awards of some cities are yet to be made because of certain litigation involving PNGRB and a few other parties. (indiatoday.intoday.in)

Non-subsidised LPG cylinder price down ` 42, jet fuel rate up 5.5 percent

October 1, 2015. State-run oil marketing companies cut prices of non-subsidised LPG, or cooking gas by ` 42 per 14.2 kg cylinder, on a day new reduced prices also came into effect for domestic natural gas and diesel. The non-subsidised LPG cylider, which consumers purchase after exhausting their quota of subsidised cylinders, now costs ` 517.50 in Delhi. The non-subsidised LPG price was last cut by ` 25.50 on September 1, making the current reduction in rates the fourth in as many months. Oil marketers raised aviation turbine fuel (ATF), or jet fuel, price in Delhi by 5.5 percent, or ` 2,245.92 per kilolitre (kl) to ` 43,184.16 per kl. The hike follows a steep 11.7 percent cut to ` 40,938.24 per kl effected from September 1, which was the third reduction in three months. (www.newindianexpress.com)

CNG price cut by 80 paise per kg, PNG by 70 paise per unit in Delhi

October 1, 2015. CNG price in Delhi was cut by 80 paise per kg and piped cooking gas (PNG) by 70 paise per unit following an 18% reduction in natural gas prices. CNG for automobiles in Delhi will cost ` 37.20 per kg, Indraprastha Gas Limited (IGL) said. The price of CNG in adjoining towns of Noida, Greater Noida and Ghaziabad was cut by 90 paisa to ` 42.60 per kg. IGL announced reduction in its domestic piped natural gas prices. The consumer price of PNG to the households in Delhi has been reduced by ` 0.70 per standard cubic meters (scm) from ` 25.35 to ` 24.65 per scm. Due to differential tax structure in the state of Uttar Pradesh, the applicable price of domestic PNG to households in Noida, Greater Noida and Ghaziabad would be ` 26.15 per scm, which has been reduced by ` 0.90 per scm from existing ` 27.05 per scm. IGL supplies PNG to over 6,00,000 households in the region. (www.hindustantimes.com)

[NATIONAL: POWER]

Generation……………

Adani Group to ink ` 4 bn deal to buy Welspun Group’s two coal plants

October 5, 2015. Adani Group has signed an initial agreement to buy two ready to build coal fired power plants from Welspun Group for ` 400 crore. The plants — one in Uttar Pradesh and other in Madhya Pradesh — have received all the necessary clearances and can together generate 4000 MW of power. They will be transferred to the ports-to-power conglomerate along with 2,000 acres by December. Adani Group has shifted its strategy to buy ready-to-build plants with all necessary clearances and power purchase agreements, and use its core area of execution in building power plants rather than taking over running plants with heavy loans. A ready to build power plant can be completed in three years. The proposed deal with Welspun also fits well with its strategy of going across India rather than being focused on Gujarat. Adani Group had announced that it signed definite agreements to buy Avantha's Korba Power (600 MW), and Lanco Infratech's Udupi Power (1,200 MW) for a total of ` 10,500 crore to beef up its power generation portfolio. (economictimes.indiatimes.com)

Gelnal Hydro Electric Project yet to be officially inaugurated after 20 yrs

October 5, 2015. The Gelnal Hydro Electric Project along Imphal-Tamenglong road in Twilang area, Sadar Hills began functioning few days back after it was revived 20 years later. The Hydro Electric Project which was set up in 1981-1982 supplied power to the Twilang populace from 1992. However, the proposal of the former Manipur Chief Minister Rishang Keishing to inaugurate the 400 KV Gelnal Hydro Electric Project in October 1993 had been almost forgotten now. However, after much effort, Manipur Renewable Energy Development Agency (MANIREDA) had initiated measures to revive the Hydro Electric Project in Gelnal for the welfare of the people. With the enthusiastic support given by MANIREDA and the responsible department coupled with the cooperation of the people, the project was revived after more than 20 years by generating satisfactory power in the area on September 28, 2015. (www.hueiyenlanpao.com)

CIL will produce 50 mt more coal than last year: Goyal

October 4, 2015. Coal India Limited (CIL) will produce at least 50 million tonnes (mt) more coal in the current fiscal than the last financial year, Coal and Power Minister Piyush Goyal has said. The government has set an ambitious one billion tonne of production target for CIL by 2020. He said that in the last fiscal, CIL added 32 mt which is more than the cumulative growth of four years. CIL recorded an output of 37.17 mt in September, missing the target by 4.1%. The company's production target for September was 38.77 mt. CIL achieved an output of 229.54 mt in the first six months of the current fiscal, missing its target of 235.49 mt. Coal India's output target for the current fiscal is 550 mt. The company recorded an output of 494.23 mt in the last fiscal. The government had said that it is hopeful that Coal India will surpass its one billion tonne excavation target by 2020. The company accounts for over 80% of the domestic coal production. (www.business-standard.com)

Transmission / Distribution / Trade…

33k Bengaluru households don't have power supply

October 5, 2015. The country's first city to get electricity also suffers the ignominy of having nearly 33,000 households without power supply. According to the socioeconomic and caste census released recently, 32,803 of the total 23,17,877 households in Bengaluru have no power connection. Bengaluru received electricity supply in 1906, powered by a hydroelectric plant in Shivanasamudra. The situation in other urban areas of Karnataka is worse. Nearly 2.4% of households in the urban areas of the state - 1,32,849 out of the total 50,90,399 lakh households - still have no access to electricity. Bengaluru Electricity Supply Company Limited (BESCOM) said the houses without electricity supply are those under construction and in illegal slums. BESCOM initiated a project in January to provide electricity to all households that have no power supply. In Karnataka, they have found that 39 villages, mainly in the Western Ghats, have no electricity. (timesofindia.indiatimes.com)

NTPC mulls selling power to Bangladesh from Assam plant

October 4, 2015. National Thermal Power Corporation (NTPC) will consider selling electricity to Bangladesh from its upcoming 750 MW plant at Kokrajhar in Assam once the neighbouring country finalises plans to buy power from Palatana project in Tripura. For selling power to Bangladesh, separate transmission lines will be required to set up, NTPC said. NTPC said that there have been no official discussions as of now on selling electricity to Bangladesh from the Assam plant. In May, a two-day meeting of Power Secretaries of India and Bangladesh in Dhaka reviewed the progress on the neighbour’s move for import of additional 600 MW power, of which 100 MW would go from Tripura’s Palatana power project starting December 2016, while 500 MW was expected to reach in December 2017. (www.thehindubusinessline.com)

Cabinet to consider ` 4.3 lakh crore loan recast of discoms

October 4, 2015. Union Cabinet is likely to consider a proposal to recast ` 4.3 lakh crore loans of nine state power distribution companies with a view to bring down their liabilities. The debt restructuring proposal once approved would help the distribution companies in these states to access cheaper loans at an interest rate of around 9 percent, compared to around 14 percent that they are presently paying. The total loans to the discoms in the nine states -- Uttar Pradesh, Tamil Nadu, Telangana, Rajasthan, Madhya Pradesh and Jharkhand -- add up to ` 4.3 lakh crore. The Cabinet, at its meeting, would consider the Finance Ministry's proposal to recast the debt of nine state power discoms so that the companies can repay their debt easily, they said. On account of subsidised tariffs, the state electricity discoms are facing cash crunch and are incurring annual losses of about ` 60,000 crore. The debt burden has been one of the reasons for state power utilities not going in for new projects to raise electricity generation capacity. The debt liability has also forced them to not buy any additional power from new project, thereby creating peak hour deficit. The NDA government recognises power availability as key to pushing GDP growth rate to 8 percent. Meetings at the level of the Prime Minister's Office have been held to clear roadblocks to stalled projects in the sector and high debt of state utilities has been identified as the prime reason for the current state of the sector. After the debt recast, the interest liability of power distribution companies in the nine states will come down besides extension of their loan tenure. According to data by the Central Electricity Authority (CEA), country's peak power deficit -- shortage in electricity supply when demand is at its highest -- was 3.2 percent in March, 2015. The Ministry of Power has set a target of generating close to 1,100 billion units of electricity during the current financial year. Power generation during 2014-15 was 1,048.403 billion units. (timesofindia.indiatimes.com)

Maharashtra not to purchase power from Dabhol plant

October 4, 2015. The government’s move is crucial as the state distribution utility MahaVitaran was purchasing about 95 percent of power since the Dabhol project began generation in April 2006. The Bharatiya Janata Party (BJP)-led government in Maharashtra said the state was not keen to draw power from the Dabhol power project. Energy Minister Chandrashekhar Bawankule said the state was managing the power scenario with MahaGenco’s installed thermal capacity of 11,237 MW. Of the 11,237 MW, MahaGenco supplies 5,000 MW, while 4,500 MW is procured from the central pool. This apart, MahaVitaran also gets 2,400 MW from Adani Power, 1,096 MW from RattanIndia Power, 680 MW from Lanco and 500 MW from Koyana hydroelectric power. Moreover, MahaVitaran purchases 100-250 MW from power exchanges on a short-term basis. The government’s move is also crucial as the state distribution utility MahaVitaran was purchasing about 95 percent of power since the Dabhol project began generation in April 2006. MahaVitaran also gets 2,400 MW from Adani Power, 1,096 MW from RattanIndia Power, 680 MW from Lanco and 500 MW from Koyana hydroelectric power. MahaVitaran purchases 100-250 MW from power exchanges on a short-term basis. (www.rediff.com)

PGCIL builds ` 8 bn transmission line linking West Bengal, Bihar

October 1, 2015. Power Grid Corporation of India Limited (PGCIL) is building a transmission line between West Bengal and Bihar at a cost of ` 800 crore that will enhance electricity supply infrastructure. PGCIL said it has 30 acres of land at Rajarhat required for the sub-station. Besides building the new line, PGCIL is also carrying out renovation activity of the transmission lines. (indiatoday.intoday.in)

Reliance Power to sell off three Indonesian coal mines

September 30, 2015. Reliance Power has decided to sell three coal mines in Indonesia and concentrate on coal mining business in the country to support Prime Minister Narendra Modi's initiative of 'Make in India'. The company will be focusing on coal mining business and coal resources business in India. In 2008, the company through its subsidiary Reliance Coal Resources Private Limited (RCRPL) had acquired 100 percent in three coal mines in Indonesia with total reserves of two billion metric tonnes. The coal ministry through a notification had cancelled the allocation of Chhatrasal coal block for the Sasan Ultra Mega Power Project (UMPP). Reliance Power will use the equipment it had contracted for its Samalkot project in Andhra Pradesh for setting up the power plant in Bangladesh in three years from the date of signing the power purchase agreement (PPA). The company has completed phase-I of its ` 50,000 crore capital expenditure programme and now has 6,000 MW operating capacity. (economictimes.indiatimes.com)

Kalpataru Power bags ` 7.8 bn contracts

September 30, 2015. Kalpataru Power Transmission Limited (KPTL) has bagged two contracts worth ` 781 crore. The company has secured one contract for transmission line projects in international geographies Malawi and Kuwait of approximately ` 594 crore. The second contract is for a pipeline project worth around ` 187 crore from ONGC. (profit.ndtv.com)

Policy / Performance………….

Maharashtra govt clears revival of RGPPL project

October 6, 2015. The Maharashtra government approved the Centre's guidelines to revive the Ratnagiri Gas and Power Private Limited (RGPPL), which has been shut since November, 2013 due to unavailability of gas. The state Cabinet cleared a proposal in this regard. Accordingly, the government will waive customs duty, service tax, transmission charges and sales tax for the plant located in the Konkan region. These concessions, valid for two years, will cost the state exchequer about ` 350 crore. Power Minister Chandrashekhar Bawankule said there are 14,305 MW capacity gas-based power projects in the country which are not functional and RGPPL (1,964 MW) is one of them. However, the revival will lead to generation of only 500 MW from RGPPL (formerly Dabhol Power Project) from November 1, he said. The Minister said due to ` 7,800 crore debt, the gas-fired project, located in Ratnagiri district, was on the verge of being declared non-performing asset (NPA). RGPPL will be demerged into two separate companies owning the currently-defunct power plant and its LNG terminal, respectively. The central and state governments will extend financial support to the project. GAIL will provide gas under government's recently-launched scheme for stranded power utilities, while NTPC will operate it. Railways will enter into a long-term power purchase agreement with the company at a price of ` 4.7 per unit. Bawankule said out of the 500 MW to be generated from RGPPL, Railways will use 250 MW in Maharashtra, followed by Jharkhand & West Bengal (100 MW each) and Gujarat (50 MW). To raise the capacity of LNG terminal, an investment of ` 2,044 crore will be made, he said. (www.dnaindia.com)

PM Modi to push power price hikes

October 6, 2015. Prime Minister (PM) Narendra Modi is to tell states to raise electricity prices in return for access to a financial bailout package, a politically contentious move that risks a backlash from farmers and consumers long used to free or cheap power. Modi has made overhauling India's largely loss-making utilities, buckling under $66 billion of debts, a priority, convinced that if he can fix their finances he will recover his reputation as an economic reformer willing to take tough decisions. State-run electricity distributors are running out of cash and struggling to repay loans, squeezing banks' ability to spur credit growth and undermining Modi's campaign to attract more energy-hungry manufacturers to build new factories. Under a rescue package that could go to the cabinet for approval, states will be told they must work with local regulators and utilities to raise tariffs that have been kept artificially low. In return for raising prices, the eight worst affected states will be allowed to absorb up to 75 percent of the debt on the distributors' books depending on their fiscal position. After cabinet approval, states will need to strike agreements with distributors and the power ministry. In India, the price of power is a sensitive subject and generally decided by individual state regulators. New Delhi's past attempts at instigating reform, including a 2012 rescue plan under Modi's predecessor, have largely failed. Many Indians view free or cheap power as a right. Politicians appeal to key groups of voters like farmers or the poor by keeping prices low and ignoring theft, prompting scepticism about whether states will agree to any package that forces tariff hikes. Recent attempts at raising tariffs have proven politically difficult. Rajasthan state, whose utilities owe $9 billion, this year postponed an attempt to hike prices after huge opposition from its powerful farming community. But Modi successfully overhauled the power sector as chief minister in Gujarat in the mid-2000s. He saw off opposition to metering farmers and clamping down on consumer theft, and the state now enjoys reliable power supplies that the majority pay for, with low levels of theft. By linking price rises to reduced debt, the government hopes to give utilities the financial space to purchase more power and end blackouts, and to avoid future losses by ensuring they sell electricity at or above cost. S.K. Agarwal, finance director at Uttar Pradesh Power Corporation, serving a largely rural state ruled by a regional party, said he was still awaiting details of the plan, but since only the local government could decide tariffs it would object to any proposal imposed by New Delhi. (in.reuters.com)

Nitish failed to provide electricity even after 10 yrs: Goyal

October 4, 2015. Coal and Power Minister Piyush Goyal alleged that Bihar had failed to generate even a single MW electricity during the decade-long rule of Nitish Kumar government as he reminded the Chief Minister of his promise three years ago not to seek votes in Assembly polls if he failed to provide power to all households by 2015. Further charging the government with making false claims about improvement in electricity situation, Goyal claimed that the state government had misled the people as the entire supply of power at over 2800 MW in the state was taking place from the central pool and related resources. Goyal said Bihar had been the worst performing states among the eastern region with only 20 percent rural households using electricity as the primary sources for lighting. The state government had claimed to have electrified 29,000 villages for which it might have set up poles in panchayats and installed transformers, but there had been no no supply of power for consumption by the people, he said. He said that under the 11th plan (2007-2012) the Centre had sanctioned ` 2994 crore for intensive electrification in Bihar of which only 38 percent fund at ` 1132 crore was used by the state government and only 25 percent villages were electrified at 3316 against 12,828 villages and the coverage of households stood at 11 percent at 3.38 lakh dwellings against the target of 30 lakh. The Union minister alleged there was no improvement in the state government's performance in the 12th plan either as the Centre sanctioned ` 5270 crore to Biahr for electrification of 21,833 villages of which only 380 were electrified which amounted to two percent of the target. Goyal further alleged that against a target of electrification of 54 lakh households during the plan period, only 32,672 households could be electrified at even less than one percent of the target with half of the duration of 12th plan already gone. Goyal promised, according to the party's vision document for Bihar, that if elected to power the BJP-led coalition will ensure 24x7 electricity supply in all households in the state by 2019 and said that his party had great track record to deliver on its promises. He said that keeping in view Bihar's need for generation of additional power to meet requirement of all households, farmers and industries among others, the Centre had committed to provide ` 6000 crore under Prime Minister Narendra Modi's special package to Bihar for overall electrification of the state, an additional ` 4400 crore for separate feeders for farmers, ` 1244 crore as additional funds for electrification of households of weaker sections and ` 2000 crore for infrastructure. Among additional measures, the Centre has allocated coal blocks for power projects in Bihar and decided to allocate 50 percent power to be generated from the proposed Ultra Mega Power Project (UMPP) in the state to meet domestic requirement, the minister said. The ministry had alloted a separate coal block for the thermal power plant at Barh to cut the price of power from there for consumers in Bihar. (economictimes.indiatimes.com)

No nuclear accident in India's 21 plants in 2014-15

October 3, 2015. There was no report of major radiologicial discharge at any of the 21 nuclear power plants in India during 2014-15. These plants have a combined capacity of 5,780-MW. However, two fatalities were reported last year - one at Rajasthan units 7 and 8 due to fall of an object and the other at Rajasthan units 1 and 2, revealed 2014-15 annual report of the Atomic Energy Regulatory Board (AERB). The report said the radiation doses to occupational workers were well below the annual dose limit of 30 millisieverts (mSv) prescribed by AERB. The mSv is a measure of the absorption of radiation by the human body. Besides, the liquid and gaseous radioactive effluents discharged to the environment were a small fraction of the limited prescribed and the effective dose to public around the plant sites was only a small percentage of the annual limit of 1 mSv prescribed by AERB. The nuclear regulator conducted inspections at all 115 units in 21 plants with respect to radiological, industrial and fire safety aspects. These inspections were focused on implementation of various safety management systems related to the construction activities and compliance to the AERB directives on construction safety. AERB said 35 events having no safety significance and minor problems in components were reported in the nuclear power plants. Further, all nuclear power plants following the Fukushima nuclear accident in March 2011 have taken short-term and medium-term safety measures and upgrades. These plants are also in the midst of implementation of long-term measures comprising research and development studies and procurement of equipment and erection. (www.business-standard.com)

Govt ensures transparency through online auction: Swarup

October 2, 2015. Union Coal secretary Anil Swarup said the Centre adopted the online auction process to ensure transparency even as he claimed that the government has taken initiatives to increase coal output. He said the country recorded an incremental growth of 32 million tonnes of coal in 2014-15 that was more than the cumulative growth of 31 million tonnes during the previous years. Coal production continues to grow at around 9.5 percent during the current fiscal year, Swarup said. Due to consequences of increased production, thermal power plants have an average inventory of coal for more than 25 days as against 7 days last year, he said. Import of coal has already started receding, he said. Stressing that his ministry has brought total transparency by auction on web portal of the ministry, Swarup said the total estimated amount of revenue likely to be raised in respect of 32 coal mines already auctioned is ` 1,76,313 crore from auctioned blocks. Apart from this, royalty of ` 21,896 crore, upfront payment of ` 953 crore accrues to the states, he said. The auction proceeds to be transferred to the respective state governments. Eastern states would be the biggest beneficiary and would financially empower them, Swarup said. (www.thestatesman.com)

GIPC inks pact for subsidy to buy imported gas

October 1, 2015. Gujarat Industries Power Company (GIPC) has inked formal agreements for subsidy to buy expensive imported gas to produce 17.59 million units of electricity during six months period ending on March 31. The Power System Development Fund (PSDF) support agreement with the Power Ministry envisaged generation and supply of incremental 17.59 million units of electricity to the state grid during October 1, 2015 and March 31, 2016. The other agreement was signed with GAIL for supply of 39.61 million units. The power purchase agreement (PPA) sealed with Gujarat Urja Vikas Nigam Limited (GUVNL) is meant for generation and supply of incremental 17.59 million units of electricity to the state grid. (indiatoday.intoday.in)

India must make full use of Iran nuclear deal: President

September 30, 2015. Ahead of lifting of sanctions against Iran, President Pranab Mukherjee pressed for reviving the long talked about Iran-Pakistan-India (IPI) gas pipeline and using the Chabahar port to forge closer ties with the Persian Gulf nation. In a deal reached in July with the US and other world powers, Iran agreed to limit its nuclear programme in exchange of lifting of sanctions, which till now have been prohibiting Indian firms from investing in the energy-rich nation. The President said lifting of sanctions also opens up the possibility for India for implementing the International North South Corridor for a competitive and quick route to Eurasia. He also said that Central Asian States have considerable surplus energy and the Turkmenistan-Afghanistan-Pakistan-India (TAPI) gas pipeline project is worth pursuing. The President said India shares two main interests with the countries in that region, security and counter-terrorism on the one hand, and mutually beneficial economic engagement, including the use of energy and natural resources, on the other. (www.ndtv.com)

Odisha raises electricity duty rate by 1 percent on industry

September 30, 2015. The Odisha government increased the electricity duty rate by 1 percent for industry to generate revenue for upgrading power infrastructure. The state Cabinet, presided over by Chief Minister Naveen Patnaik, cleared the proposal. However, there will be no hike in the duty rates for irrigation and domestic consumers, chief secretary G C Pati said. Stating that the electricity duty rates were for the last time revised in 2006, Pati said an additional revenue of ` 300-350 crore would be generated annually. (www.business-standard.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Shell starts Nigeria offshore expansion of up to 50k barrels

October 5, 2015. Royal Dutch Shell Plc expanded oil production off Nigeria’s coast by starting the third phase of its Bonga field. That phase has a peak production capacity of about 50,000 barrels of oil equivalent, Shell said. The floating production and storage facility serving Bonga’s third phase has a capacity of more than 200,000 barrels of oil and 150 million standard cubic feet of natural gas a day. Shell has pushed on with projects close to production, such as Bonga phase 3, even as a slump in crude prices forced it to join other producers in deferring more risky exploration. (www.bloomberg.com)

Libya's oil output down to 300k bpd

October 5, 2015. Libya's oil production has dropped to 300,000 barrels per day (bpd), less than a quarter of what it produced before the 2011 fall of Muammar Gaddafi, mostly because of insecurity and closed pipelines. Before the 2011 uprising that ousted Gaddafi, Libya produced around 1.6 million bpd. But in recent years, its production has been almost constantly less than half that because of fighting or protests over jobs and salaries by local residents and workers. (in.reuters.com)

Maersk oil makes minor gas discovery offshore Norway

October 2, 2015. The Norwegian Petroleum Directorate announced that Maersk Oil Norway AS has made a minor gas/condensate discovery near the Tyrihans field in the Norwegian Sea. A preliminary estimate of the size of the discovery is between 52.97 million and 105.94 million cubic feet of recoverable oil equivalents. An assessment shows that the discovery is not profitable. (www.rigzone.com)

Brazil produced record 2.5 mn bpd of oil in August

October 1, 2015. Brazil produced a record amount of oil in August, surpassing a previous high set in December 2014, oil agency ANP said. Oil production reached 2.547 million barrels per day (bpd) in August, an increase of 9.5 percent compared to a year earlier and 3.3 percent compared to the previous month. Production of oil and gas reached 3.171 million barrels of oil equivalent per day in August, also a new record. (lta.reuters.com)

Global oil demand growing at fastest pace for five years

October 1, 2015. World oil demand surged in the first six months of 2015 compared with the same period in 2014, according to national estimates submitted to the Joint Oil Data Initiative (JODI). Petroleum demand is responding in the expected manner to a halving in the price of crude and significant declines in the price of most fuels in most consuming countries, as well as continued economic expansion in much of the world. Fifty-nine countries, accounting for 75-80 percent of global oil consumption, have submitted demand estimates for both the first half of 2014 and 2015 to JODI. Submitters include all the world’s major consumers, with the notable exceptions of Russia, Iran, Indonesia, Venezuela, Malaysia, South Africa and United Arab Emirates. Submitters reported consumption averaged 71.4 million barrels per day (bpd) in the first six months of 2015, up from 69.1 million bpd in the prior-year period, an increase of 2.3 million bpd or 3.3 percent. China accounted for slightly over half the total increase, with reported consumption of petroleum products up by 1.3 million bpd, more than 13 percent. Other countries reporting substantial increases in demand included the United States (+470,000 bpd), India (+205,000 bpd), Turkey (+180,000 bpd), Saudi Arabia (+115,000 bpd) and Korea (+100,000 bpd). Smaller increases in demand were reported by Germany (+20,000 bpd), France (+18,000 bpd), Britain (+29,000 bpd), Italy (+74,000 bpd), Spain (+26,000 bpd), Argentina (+40,000 bpd) and Poland (+40,000 bpd). (www.reuters.com)

Lundin Petroleum finds more oil at Alta Arctic discovery

September 30, 2015. Sweden's Lundin Petroleum has found oil while drilling two appraisal wells at its Alta discovery in the Arctic, the company and the Norwegian Petroleum Directorate said. The firm did not revise its resource estimate for the find, originally seen to contain between 125 and 400 million barrels of oil equivalent, but said it will drill more on the site next year. The other partners in the find are Japan's Idemitsu and DEA Norway. (www.reuters.com)

Shell in talks with Gazprom on Yuzhno-Kirinskoye gas field

September 30, 2015. Shell is in talks to join Russia's state-controlled Gazprom in tapping the Yuzhno-Kirinskoye gas field offshore Russia's Sakhalin island in the Pacific, the head of Shell's operations in the country said. The United States restricted exports, re-exports and transfers of technology and equipment to the Yuzhno-Kirinskoye field. Gazprom said that the gas field would feed the Sakhalin-2 liquefied natural gas plant expansion - a Gazprom/Shell joint venture - as well as a pipeline to China from Sakhalin. (www.reuters.com)

Downstream…………

Chile's Aconcagua refinery plans 44 day maintenance

October 6, 2015. Chile's Aconcagua oil refinery, owned by state-run ENAP, will begin planned maintenance that is intended to run for around 44 days, the company said. Located in the coastal town of Concon, near the capital Santiago, Aconcagua is one of two major refineries in the South American country. (af.reuters.com)

Russian Energy Minister proposes keeping 90 percent of gasoline on domestic market

October 6, 2015. Russian Energy Minister Alexander Novak proposed forcing companies to keep 90 percent of the gasoline they produce on the domestic market in 2016, in an effort to prevent possible shortages. In August, Russian gasoline supplies to the domestic market rose by 2.6 percent, year-on-year, compared to a 20 percent upsurge in exports. Total gasoline output was up 7.8 percent in August to 3.641 million tonnes compared with 3.377 million tonnes in the same period last year. Novak also reiterated proposals to postpone the suspension of low-quality Euro-IV gasoline domestic usage to 2017, not in 2016 as envisaged under current regulations. Russia suffered shortages of gasoline in the early months of 2011, when exports jumped, resulting in long lines of cars at petrol stations. (af.reuters.com)

Paraguana refineries to restart processing units

October 5, 2015. Venezuela's state oil company PDVSA said crude was circulating at the 955,000-barrel-per-day Paraguana Refinery Center (CRP) and that key processing units would be up and running. An electricity blackout hit the world's second-largest refining center for most of the working day. PDVSA has said an electrical system fault cut power to the 645,000 barrel-per-day Amuay installation and the nearby 310,000 bpd Cardon refinery. The OPEC country's refinery circuit has been plagued with unplanned stoppages in recent years, with power outages at Paraguana prompting PDVSA to import gasoline and diesel. Venezuela, which has the world's largest oil reserves, often says sabotage is to blame for power outages. PDVSA, under the year-long leadership of del Pino, says it is trying to modernize its refineries. (uk.reuters.com)

Transportation / Trade……….

Iraqi Kurds boost oil sales in drive for financial independence

October 5, 2015. Iraq’s Kurdish region ramped up crude exports by 27 percent in September as the semi-autonomous enclave seeks greater financial independence amid a budget dispute with the federal government in Baghdad. The Kurdistan Regional Government (KRG) exported 18.6 million barrels, or an average of 600,463 barrels a day, through the pipeline network to the Turkish port of Ceyhan, according to the KRG’s Ministry of Natural Resources. In August, the KRG exported 14.7 million barrels of crude oil to the Mediterranean port. Iraq’s minority Kurds, who historically have resisted control by governments in Baghdad, are independently developing oil reserves they say may total 45 billion barrels -- equivalent to almost a third of Iraq’s total deposits, according to BP Plc data. The KRG and the central government have traded accusations of breaches to a Dec. 2 agreement that provided for the Kurds to export their oil through the state oil company in return for cash from authorities in Baghdad. The central government denies that the Kurds supplied an agreed-upon 550,000 barrels a day and sent the KRG less cash as a result. (www.bloomberg.com)

Belgium and Luxembourg successfully merge their gas markets