-

CENTRES

Progammes & Centres

Location

[Moon Shadow will Enhance Green Power Systems – How German Energy Turnaround Manages Solar Eclipse]

“The whole system could be balanced by activating other energy sources without significant complications, doubts of interrupted supplies proved unfounded. However, power prices in Germany fluctuated considerably, but that’s what they are intended to: to send veritable signals to the market with respect to shortage of the commodity…”

Energy News

[GOOD]

Low power generation loss on account of improved fuel supply is a sign of progress in the power sector!

Re-opening of coal bids is a sign of sub-optimal auction design!

[UGLY]

The absence of policies for the solar rush illustrates the fact that governments cannot and should not make energy choices!

CONTENTS INSIGHT……

[WEEK IN REVIEW]

ANALYSIS / ISSUES…………

· Moon Shadow will Enhance Green Power Systems – How German Energy Turnaround Manages Solar Eclipse

· Importing Nuclear Albatross?

DATA INSIGHT………………

· Hydro Generation- Month-wise and Region-wise

[NATIONAL: OIL & GAS]

Upstream…………………………

· Cairn India's tax liability credit negative for Vedanta Resources: Moody's

· Not easy to start gas production in KG basin: Gujarat govt

· OVL in talks to acquire stake in two Siberian oilfields: Oil Minister

Downstream……………………………

· IOC seeks superior kerosene in unusual move

· Indian refiners restock with West African oil ahead of strategic reserve launch

· MRPL to shut 120K bpd crude unit in April

· HPCL aims to restart fire-hit gasoline unit

Transportation / Trade………………

· Indian refineries step up oil imports from newer geographies like Mexico, Iraq

· AP pips Telangana at the post, clinches gas deal with Gujarat

Policy / Performance…………………

· Sri Lanka, India to partner on oil storage project: PM Modi

· Govt committee suggests key steps for O&G sector

· Oil Ministry to give CNG marketing licence

· Govt asks GAIL to remit incremental KG-D6 gas price every month

· Govt to scrap allocation of CBM block given to GEECL

[NATIONAL: POWER]

Generation………………

· Tata Power commissions 2nd unit of Dagachhu project in Bhutan

· 960 MW hydro power project in Himachal Pradesh fails to find takers

· Work for 3, 4 units in KNPP to begin in April 2016

· Power generation loss to be at 4 year low in 2015

· Hawaii-based Company to generate electricity from outflow of Idukki reservoir

· After Land Bill, BJP and Shiv Sena pitted against each other on Jaitapur project

Transmission / Distribution / Trade……

· Investors fret as Centre defends reopening coal mine bids

· Assam-Agra transmission line to help north India this summer

· Opposition stands divided on crucial Coal, Mines Bills

· State discoms seek upto 26 percent hike in power tarrif

· World Bank grants ` 13.7 bn for power T&D network in Tripura

Policy / Performance…………………

· Govt holds back awarding 5 coal blocks from round II for examining low bids

· Electricity tariff raised nominally in Bihar

· AERB nod to NPCIL to erect major equipment at Rajasthan N-power plant

· No power cuts in TS from May: Telangana CM

· Assam may hike commercial power tariff

· Uttarakhand, Centre push for power projects

· AP to invest ` 43.6 bn in power sector

· Delhi govt eyeing coal block to set up own power plant

· No dilution of India's Nuclear Liability Act: Govt

· Cement, fertilizer companies disappointed over electricity duty

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Eni makes 'significant' gas, condensate discovery offshore Libya

· KUFPEC inks exploration agreement for Pakistan's Paharpur Block

· Triple Energy signs drilling contract with Beijing Jiuzun in China

· Japan's JX, GDF Suez find new oil in UK North Sea

· Kashagan oil production to resume in 2017: Shell

· Husky says $2.5 bn Sunrise oil sands project begins production

· Azerbaijan's oil output seen down 4 percent in 2015

Downstream……………………

· Saudi Arabia needs more oil to feed local refinery expansion

· Nigeria's Dangote Group says new $9 bn refinery seen onstream in 2017

· Ethiopian oil marketer sees $5 bn refinery within 10 yrs

· RT Global-led consortium looks to develop $2.5 bn oil refinery in Uganda

Transportation / Trade…………

· Oil heads toward bear market as glut sends price to six-year low

· Kurdish oil deal with Baghdad unravels as tensions rise

· Chile's ENAP to build $30 mn oil pipeline in Egypt

· Argentina's YPF tenders for 11 Shipments of LNG: Traders

Policy / Performance………………

· EU energy chief voices concern over Russia's Turkish pipeline plan

· Russian oligarch close to bowing to UK pressure to sell North Sea fields

· Brazil's Eletrobras approves Petrobras debt renegotiation plan

· Noble set to declare Cyprus natural gas find viable: Energy Minister

· Iran can add million barrels a day of oil if sanctions halt

· Oil & Gas UK urges further tax measures in 2015 Budget

· US LNG projects hit by energy price slide

· China, India drive global energy needs: Ex-OPEC official

· European ports set to lose LNG supply to Egypt

· Greece to seek benefits from TAP gas pipeline transit

[INTERNATIONAL: POWER]

Generation…………………

· Indonesia coal mining company set to build mine-mouth power plants

· Siemens inks US$10.5 bn power plant deal with Egypt

· Toshiba wins 688 MW STG order for coal power plant in Vietnam

Transmission / Distribution / Trade……

· Appalachian Power seeks approval to improve existing transmission facility

· Finland's Fortum to sell Swedish power grid for $6.9 bn

· PG&E to develop two new transmission substations in US

· Spanish firm to build overhead lines for Maritime Link

· AEP Ohio to build two transmission lines in US

Policy / Performance………………

· EU deadline on GE's $13 bn Alstom deal extended to August 6

· North Korea behind nuke power plant data leakage

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· Govt yet to devise policies for scaling up solar capacity to 100 GW by 2022

· GSFC introduces Sardar Package Scheme in 19 Gujarat districts

· VMC draws ` 2.5 bn plan to turn it into 'Solar City'

· Welspun to set up 100 MW solar plant in Tamil Nadu

· Govt hires PwC for solar energy scale-up plan

· Organic Recycling Systems develops green mode of generating electricity from solid waste

· Adani plans 1 GW solar power plant at Ramanathapuram

· Punjab to launch 'solar power generation scheme' for farmers

· India 3rd least efficient coal-fired power generating nation

· West Bengal CM gets green nod from Modi govt for 43 projects

GLOBAL………………

· Al Gore proposes to 'punish climate change deniers'

· Dubai introduces residential rooftop solar panel initiative

· Renewables Infrastructure Group raising money for clean power

· Brazil’s next solar power supply auction scheduled for August

· Global energy-related emissions of CO2 stalled in 2014

· Europe carbon trade would gain extra $1.1 bn from biomass

· China carbon emissions decline as 2014 global CO2 stays flat

· GDF Suez wants to double renewable capacity in Europe by 2025

· Wind power without US subsidy to become cheaper than gas

· Trina to supply India’s ACME with 48 MW of solar panels

· Southern hemisphere’s largest solar power plant set to start

· Three China solar-panel groups may lose EU duty exemption

· Danish pension funds invest in UK biomass power plant

[WEEK IN REVIEW]

ANALYSIS / ISSUES……………

Moon Shadow will Enhance Green Power Systems – How German Energy Turnaround Manages Solar Eclipse

Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

|

A |

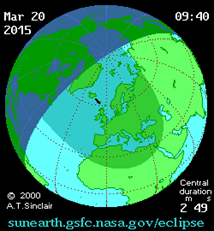

solar eclipse is admittedly a rare event. On Friday morning March 20, 2015, the moon will partially block out up to 80% of the sunlight for the first time in the era of renewables dominating German power generation capacities. This event has been widely characterized as the unprecedented stress test for the German energy system by challenging particularly the utilities and electricity grid operators to guarantee supply stability and to avoid blackouts.

In a bigger picture and against the backdrop of long term considerations according to the slow evolvement of structural changes in established power generation systems, natural phenomena as well as disasters will make inroads indeed occasionally but with some regularity over time. From the perspective of electricity generation system there are two reasons why we should give greater weight to these natural interferences: (I) Severe natural disasters like heavy storms and rains, floodings but also longer lasting droughts on the other hand are expected to increase over time triggered by the advancing effects of global climate change and local weather patterns; (II) with increasing share of renewables in total power generation of one system or country, the consequences are becoming more significant, i.e. the ramifications for Indian power supply will be larger if 100 GW of solar power capacity might be impacted (as the government plans to install till 2022 as part of total targeted renewable energy capacity of 175 GW) or some 3 GW of today, and even worse as the share of renewables will rise in total electricity generation. For example, the share of renewables in German electricity production has risen in an impressive manner to more than 26% in 2014, thereof about a fifth from photovoltaic (PV). According to Fraunhofer ISE (2015) the installed nominal capacity of PV was about 38.5 GW and the number of installations about 1.4 million in Germany end of 2014. Therefore, with PV is the largest single generation source among all types of power generation capacity in Germany and consequently of utmost importance for German electricity supply as well as associated overall generation system stability requirements.

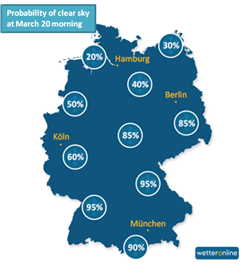

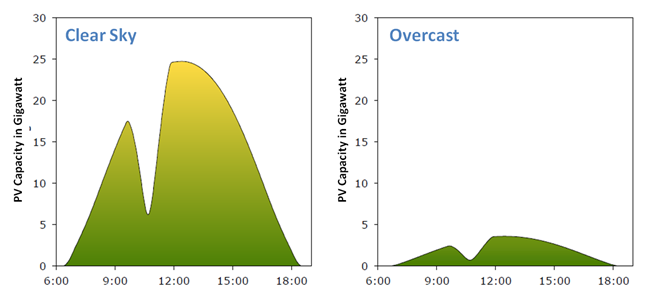

The impact of the eclipse is set to be strongly dependent from local German weather conditions on that morning between 9.30 a.m. till 12 p.m.. Based on accurate weather forecasts the system operators will have quite a good lead time to prepare accordingly for appropriate balancing mechanisms. Due to Wetter online (2015) there is a quite good probability of a clear sky for the eastern and southern parts of Germany whereas north-western stretches are likely to experience overcast sky (see graph).

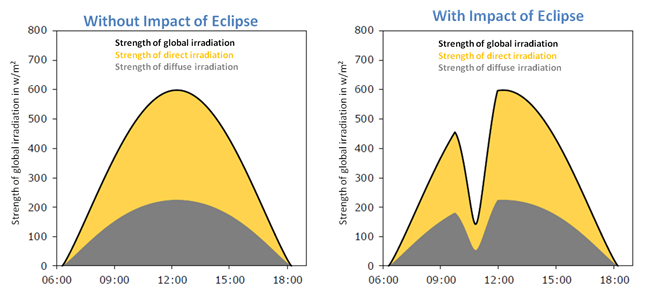

A recent study by HTW (2015) illustrates the solar irradiation strength under clear weather conditions and how it might be affected by the eclipse: within a short timeframe the maximum strength of global solar irradiation might be drastically reduced by about factor five.

Expected Course of max. Solar Irradiation Strength Without and With Eclipse Impact

(Berlin, March 20, 2015, 6 a.m. – 6 p.m.)

Source: HTW (2015), compiled by author.

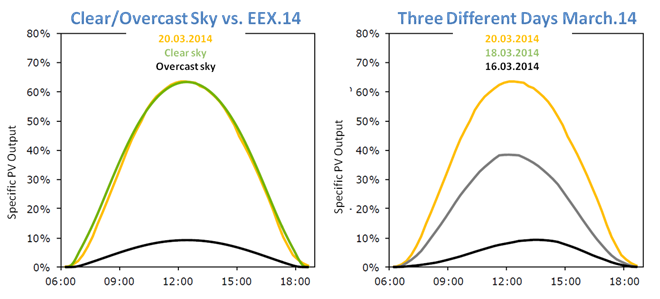

However, to which extent weather conditions impact might turn out to be considerable is shown in the simulations below: Exactly one year ago the cloudless sky ensures that almost the full specific PV output could have been realised in comparison with a cloudy day (left figure). Almost the same scope is illustrated by taking three different days within less than a week period: For example, at March 20, 2014, max. PV output has been at around 64% whereas four days before it was down to only about 9%.

Simulation of the Scope of PV Output according to Sky Conditions and at Different Days (March 2014)

Source: HTW (2015), compiled by author.

In the upshot overall German PV capacity over the course of the day (see figure below) is expected to reach at a clear day 17.5 GW (and 2.4 GW at overcast sky resp.) just before the start of the eclipse, then crushing down to a minimum of 6.2 GW (0.7 GW) just within one hour, before shooting up to about 24.6 GW (3.6 GW) at noon. This is about the fourfold level than about one hour before.

Expected Course of PV Capacity in Germany: Clear Day vs. Overcast Sky

(Berlin, March 20, 2015, 6 a.m. – 6 p.m.)

Source: HTW (2015), compiled by author.

As a result, two critical situations need to be handled within 2-3 hours: (1) When the moon passes in front of the sun, electricity production from solar plants are expected to collapse quickly according to cloud exposure, (2) when the sun appears back out of the moon shadow, the actual production is expected to rise even more because at noon the irradiation is most powerful. About 15 GW of PV output differences from one hour to the next will have to be balanced by the system operators, demand side variations left out of consideration.

All over Europe the power producer and network operator prepare for the showdown with nature’s constellations. Since European electricity grids are well interconnected failures in one region would impact other regions, however, this large grid offers extensive balancing opportunities as well. Preparations for intensive communication and cooperation are on the way, German TSOs will stay in touch all the time throughout the eclipse and have already secured additional balancing power.

HTW (2015) concludes that the balancing can be done through various measures at the generation and demand side. However, from a mere technical point of view, in Germany the fluctuations could be completely offset be pumped storage hydro power stations alone, even on a clear day with maximum requirements: Initially electricity is produced by floating the water downhill through the turbines and in the second phase the pumps draw much power from the grid to back up the water basin for storage. In addition, the use of flexible power plants like– particularly - fast starting gas power plants and besides some of the hard coal power plants could back up compensation.

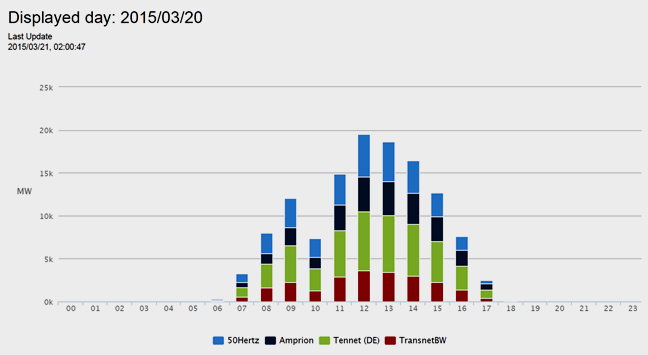

At the end of the day it turned out that the impact of the eclipse for the German power system could have been worse, which is – to tell the truth – above all a merit that belongs to the accurate and vigilant preparations of the system operators. The chart below shows data provided by European Energy Exchange (EEX (2015)) tracking the actual solar power generation from German power companies during the eclipse day: solar power capacity fell from 13GW to about 6GW as the eclipse began, then rocketed up to almost 20 GW within an hour. The whole system could be balanced by activating other energy sources without significant complications, doubts of interrupted supplies proved unfounded. However, power prices in Germany fluctuated considerably, but that’s what they are intended to: to send veritable signals to the market with respect to shortage of the commodity. According to Platts (2015) the German power for delivery the hour starting 10 a.m. for Friday (the peak of the partial solar eclipse) jumped 63% on Thursday to 49.41 Euro/MWh in the day-ahead auction on Epex Spot (European Power Exchange for power spot trading in Germany, France, Austria and Switzerland).

Actual Course of PV Capacity in Germany on March 20, 2015.

Source: EEX (2015).

It was the region’s first major eclipse since 1999; the next eclipse of this magnitude is not due in northern Europe until 2026. Notwithstanding Agora Energiewende (2015), a German think tank dealing with the Energy Turnaround, emphasises that the solar eclipse this year is only a foretaste of what is to come: with increasing shares of fluctuating renewable energy, the power system must become more flexible. In 2030 it is expected that imbalances of -10 to +15 GW will occur more often more often within one hour (as right now during the eclipse). Therefore, the whole generation mix and all other flexibility options must be aligned to these requirements. The most important options to realise flexibility are

· Demand-side management

· Flexible conventional power generation plants (e.g. natural gas fired)

· System adaptive renewable power generation plants (to become more system service friendly)

· Enhanced market integration and larger interconnected electricity networks

· Larger storage and better storage technologies

· Moderate reduction of Renewable generation feed in, Power-to-Gas, Power-to-Heat and Power-to-X (industries) solutions.

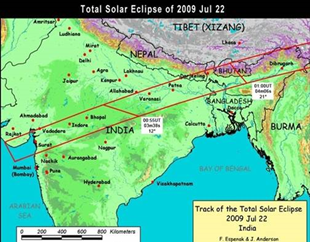

India has seen it last total solar eclipse in July 2009 (see figure). The next total one is scheduled for March 2034. By now India’s share of solar power generation in the overall electricity system is still negligible: with less than 3 GW of total installed solar-power capacity its share doesn’t exceed 2 % of power generation at present. However, the Ministry of New and Renewable Energy (MNRE) has set the course for the future and proposed to scale up grid connected solar power targets to an immense 100 MW by 2022. Even if this heroic target might not be realised, the share of solar power in total Indian electricity generation can be expected to increase steadily for various reasonable reasons. China is currently showcasing how fast a country can make inroads in solar generation and has led the world in solar installations for the last two years. It’s on its way to reach far more than 30 GW of solar power capacity by the end of 2014, about 40 times more than it had in 2010.

Indian’s power industry as well as the decisive institutions in politics and research should grasp the opportunities and learn from the European experiences in transforming the whole generation industry within few decades. Especially observations from the German Energiewende (energy turnaround) offer various starting points that ought to be taken into consideration for future planning purposes in India. The lessons learnt from the eclipse are only one module in a set of wide challenges and experiences in the German laboratory of greening the power sector. The information assembled will enhance the understanding of what will be important in a case of the eclipse, for example. India has the unique chance to avoid some of the painful restructuring experiences and to do it in a better way. This is particularly valid for long-term planning: today is important to bring the future structure of a sustainable power plant complex right on track. That is for example, to care also for system stability, appropriate balancing mechanisms and storage options, well balanced system of base load and flexible peak load (back up) power generation, demand side management, interconnected grids and market integration and pricing.

See also:

|

Energy News Monitor, Vol. X Issue. 17 |

|

Brown clouds looming on the green energy horizon in Germany |

|

Thomas Elmar Schuppe, 08 October 2013 |

|

Energy News Monitor, Vol. XI Issue. 26 |

|

The German Energiewende turns around Market Structures and Prices (part I) |

|

Thomas Elmar Schuppe, 09 December 2014 |

|

Energy News Monitor, Vol. XI Issue. 34 |

|

The German Energiewende turns around Policy Framework (Part II) |

|

Thomas Elmar Schuppe, 03 February 2015 |

Sources:

AG Energiebilanzen (2015), Bruttostromerzeugung in Deutschland ab 1990 nachEnergieträgern, Stand: 27. Februar 2015.

Agora Energiewende (2015), Die Sonnenfinsternis 2015:Vorschau auf das Stromsystem 2030. Herausforderungenfür die Stromversorgung in SystemenmithohenAnteilenan Wind- und Solarenergie, March 2015.

Bloomberg (2015a), Eclipse Tests European Power Grid Flooded by Solar Farms, by Stefan NicolaWeixinZhaRachel Morison, March 19, 2015, http://www.bloomberg.com/news/articles/2015-03-18/eclipse-tests-european-power-grid-flooded-by-solar-farms.

Bloomberg (2015b), Look What Today's Eclipse Did to German Solar Power Output, by D. Bennett, March 20, 2015, http://www.bloomberg.com/news/articles/2015-03-20/look-what-today-s-eclipse-did-to-german-solar-power-output

EEX European Energy Exchange (2015), Actual Solar Power Generation (chart), valid for 2015/03/21, http://www.eex-transparency.com/homepage/power/germany/production/usage/actual-solar-power-generation-

Financial Times (2015), Eclipse puts Europe’s fears over solar power cut in the shade, by P. Clark and A. Ram, March 20, 2015, http://www.ft.com/intl/cms/s/0/e4b482ee-ce59-11e4-86fc-00144feab7de.html?siteedition=intl#slide0

Fraunhofer ISE (2015), AktuelleFaktenzurPhotovoltaik in Deutschland, Fassungvom 7.1.2015.

HTW HochschulefürTechnik und Wirtschaft Berlin (2014), Einfluss der Sonnenfinsternis im März 2015 auf die Solarstromerzeugung in Deutschland, Oktober 2014.

Platts (2015), German power price for eclipse hour up 63%, spot down on stand-by units, March 19, 2015, http://www.platts.com/latest-news/electric-power/london/german-power-price-for-eclipse-hour-up-63-spot-26043031

Spiegel Online (2015), ExtrembelastungdurchSonnenfinsternis: Stresstestfür die Energiewende, March 16, 2015, http://www.spiegel.de/wirtschaft/service/sonnenfinsternis-ist-stresstest-fuer-die-energiewende-a-1023743.html.

Wetteronline (2015), Sonnenfinsternis gut zusehen, 19.03.2015. http://www.wetteronline.de/themen .

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS / ISSUES……………

Importing Nuclear Albatross?

M.G. Devasahayam*

|

T |

he Indo-US Nuclear jugalbandi (duet) commenced in July 2005 with the then US President George Bush and Indian Prime Minister Manmohan Singh signing an Agreement in Washington DC under Section 123 of US Atomic Energy Act-1954 that facilitated India importing nuclear reactors from USA, though not being a signatory to the Nuclear Non-proliferation Treaty (NPT).

Manmohan Singh hailed this Agreement as ‘Nuclear Renaissance’ which was an echo of a phrase coined by the nuclear industry and U.S. government officials in 2003 to boost the comeback of commercial nuclear power in the U.S. "Renaissance" had replaced "revival" as the word being used by nuclear proponents to describe their desired recovery of the nuclear industry. This was because there has not been an order of a new nuclear power plant in the U.S. since the 1979 Three Mile Island accident shattered public trust in nuclear technology. The 1986 Chernobyl nuclear disaster further damaged confidence in atomic energy worldwide. But the US nuclear industry and government were talking about "renaissance" and the Indian Prime Minister sang the same tune.

Soon thereafter India signed a safeguards agreement with the International Atomic Energy Agency (IAEA) under which all nuclear material and equipment transferred to it by USA as part of this deal shall be subject to safeguards. In August 2008, IAEA's Board of Governors approved an India-specific safeguards agreement outside NPT, thus clearing the Deal. In October, 2008 the U.S. Congress gave final approval to the Deal thus formalising nuclear cooperation between USA and India. In July 2009, New Delhi designated two projects for imported nuclear reactors from U.S. companies-Westinghouse in Mithi Virdi, Gujarat (6x1000 MW) and General Electric (GE) in Kovvada, Andhra Pradesh (6x1594 MW)-for generating power. Alongside, approval was given to Nuclear Power Corporation of India (NPCIL) to import 6x1650 MW European Pressurised Reactors (EPR) from the French company, Areva for Jaitapur site in Maharashtra. All these projects are facing fierce protest from lakhs of local people on livelihood and environmental grounds.

The mighty nuclear lobby was behind all this. But the Civil Liability for Nuclear Damage (CLND) Act passed by Parliament in August 2010 put off the US MNCs who said that seeking legal redress against nuclear suppliers is a sharp deviation from the IAEA liability regime which holds nuclear operators solely responsible in case of an accident. So conclusion of the Deal lingered.

During the ten years (2005-2015) there has been no sign of any nuclear renaissance or revival in USA. But nuclear multi-nationals along with US Government persisted in pushing it down the throat of energy-starved India and our government is playing ball. Bowing to their diktats Government of India (GoI) recently tripled its target to 63,000 MW of nuclear energy by 2032-over twelve times the present installed capacity in just seventeen years! And pronto, US President Barack Obama landed in India and along with the ‘development’-obssessed Prime Minister Narendra Modi set about tinkering India’s nuclear liability law calling it ‘breakthrough’!

Obama and Modi had made the Nuclear deal as the centre-piece of the ‘transformed’ India-US relationship and strategic partnership. The Joint Statement issued on January 25, 2015 said this about the Deal: "…the Leaders welcomed the understandings reached on the issues of civil nuclear liability and administrative arrangements for civil nuclear cooperation, and looked forward to U.S.-built nuclear reactors contributing to India’s energy security at the earliest." This is crisp and cryptic.

But not what Obama said on 27 January while addressing students and citizens at the Sri Fort Auditorium, the deemed Townhall for Delhi: "…And with the breakthroughs we achieved on this visit, we can finally move toward fully implementing our civil nuclear agreement, which will mean more reliable electricity for Indians and cleaner, non-carbon energy that helps fight climate change. And I don’t have to describe for you what more electricity means. Students being able to study at night; businesses being able to stay open longer and hire more workers; farmers being able to use mechanized tools that increase their productivity; whole communities seeing more prosperity. ….And now we have a historic opportunity with India leading the way to end the injustice of extreme poverty all around the world."

Obama seem to be living in a ‘wonderland’ without any understanding of what ‘energy security’ is and what poverty elimination means. Does he know why no nuclear power plant has come up in USA in over last three decades? He would have known if he had read MIT Report of 2003: "The prospects for nuclear energy as an option are limited by four unresolved problems: high relative costs; perceived adverse safety, environmental, and health effects; potential security risks stemming from proliferation; and unresolved challenges in long-term management of nuclear wastes." While the latter three-safety, security risks, nuclear waste-problems remain as unresolved as they were, cost of nuclear power has spiraled to such heights that rich USA is heavily subsidising it. By importing US reactors this subsidy burden will now be borne by poor India!

Mired in deep secrecy, it is virtually impossible to get any credible information out of India’s nuclear establishment to work out the true costing of nuclear power. But experts have culled out tariff projections from the estimates for Areva’s Jaitapur project. As of now no EPR is in commercial operation anywhere in the world. Estimates of costs from EPR plants under construction in Finland and France suggest that each unit may cost as much as ` 60,000 crore and at this price, six units will cost ` 3.6 lakh crore. This works out to ` 36.36 crore per MW and ` 363,600 per Kw (USD 6610 @ ` 55/- a dollar). Hopefully negotiations may bring down the price to about $ 6000/Kw.

From America, India wants to import prototype reactors that are not in operation anywhere in the world. This includes GE-Hitachi’s Economic Simplified Boiling Water Reactor, which only recently received U.S. regulatory approval and Westinghouse’s AP1000, criticized in the U.S. for supposed design failings. Prototypes usually face major teething troubles and carry greater long-term risks. Cost of these reactors also would be identical to that of Areva’s EPR and other parameters of costing would also be the same.

Table below gives first-year tariff projections of power generated from imported nuclear reactors:

|

Component |

Cost per kWh (unit) in ` |

|

Return on Equity |

3.16 |

|

Interest on market borrowings |

5.43 |

|

Interest on working capital |

0.49 |

|

Depreciation |

3.30 |

|

Fuel consumption |

0.78 |

|

Operation & Management |

1.25 |

|

Annual fuel recovery charge |

0.59 |

|

Provision for decommissioning |

0.02 |

|

Total |

15.03 |

In these projections, cost of reactor is taken as $4,000/Kw and value of dollar at ` 55/-. Component costs are worked out at actual market rates/norms laid down by Central Electricity Regulatory Commission. Provision made for decommissioning is too meager if Fukushima costs are taken into account. There is no provision for the cost of spent-fuel storage for hundreds of years.

If calculated at $6,000/Kw and ` 60 per $ the actual tariff could be as high as ` 22/- per kWh (unit). Insurance liability could further push up the costs. Tariff does not include Transmission & Distribution losses/costs which itself is high. The crash of oil and gas prices has made nuclear power’s economics totally unfavourable. Nuclear power is already the world’s most subsidy-fattened energy industry. Since the 1980s, average international costs for nuclear power have jumped from $1,000 per installed kilowatt to nearly $8,000 and are heavily subsidized.

All these are being concealed and a false picture is being presented before the public as if imported nuclear power is among the cheapest source of energy. Such is the influence of the nuclear lobby! What is worse, thousands of acres of land are being acquired for these predatory projects despite public protests and for this purpose Land Acquisition Act-2013 has been amended through Ordinance! Environmental imperatives are being cast to the wind.

Might of nuclear MNC’s is also implicit in the health and safety aspects. As early as 1959, IAEA, the atomic energy regulator, had entered into agreement with World Health Organization (WHO) which prevents the latter from reporting diseases caused by nuclear radiation. This is evident from the fact that WHO waited five years before visiting territories heavily contaminated by the Chernobyl accident and had hidden the health consequences of this catastrophe. Article 3 of the 1959 agreement states: "Whenever either organisation proposes to initiate a programme or activity on a subject in which the other organisation has or may have a substantial interest, the first party shall consult the other with a view to adjusting the matter by mutual consent." This restricted WHO from reporting on Chernobyl and information was suppressed. Japanese media believes the agreement has also prevented WHO from taking stock of the effects of the nuclear disaster in Fukushima in 2011.

As energy-hungry India is rushing to get more reactors, very less information is available on the health effects of radiation. In September 2014 Department of Atomic Energy criticised the media for reporting an RTI query reply that 2,600 people in India’s nuclear hubs have died due to cancer between 1995 and 2014. DAE gave the figure of 152 deaths. WHO could have played a significant role in resolving such confusion had it not been gagged by its agreement with IAEA.

It is this very same IAEA which is midwifing the Indo-US nuclear deal and one can only imagine the health and safety risks to which people living near nuclear plants are exposed too. In a thickly populated country like India such population would run into several millions and any accident-whether due to supplier’s defective equipment or operator’s fault-would be catastrophic. Modi-Obama ‘breakthrough’ on India’s nuclear liability requirements is to be seen in this context.

The detailed FAQ on this ‘breakthrough’ issued by Ministry of External Affairs (MEA) raises troubling questions. It contrives a model that shifts the liability risks for nuclear accidents to Indian taxpayers, thus undermining CNLD Act which holds suppliers, designers and builders liable in case of an accident. The ‘breakthrough’ compromise has been designed to circumvent the central principle enshrined in that law—the right to bring civil legal action for damages against suppliers in the event of a nuclear accident caused by defective equipment, components or designs.

How damaging it will be could be seen from Japan’s 2011 Fukushima disaster. GE of the U.S. built or designed the three Fukushima reactors that suffered core meltdowns, yet the company escaped penalties or legal action after the disaster, despite a fundamental design deficiency in the reactors, because Japan’s law indemnifies suppliers, making plant operators exclusively and fully liable. It was to avert such a situation that India’s law armed NPCIL, the state-run plant operator, with the right of recourse to suppliers. India’s sensitivity on this point reflects its bitter experience over a 1984 gas leak from a chemical plant in Bhopal that killed as many as 3,000 people shortly after the accident. The plant was owned by Union Carbide of the U.S. and the victims are still awaiting justice.

Supplier liability is a well-established legal concept, applied in many business sectors around the world to deter suppliers from taking undue risks. But the 2010 Act makes India an outlier in terms of current international standards on civil nuclear liability. The global nuclear power industry is controlled by a powerful group of a few state-controlled or state-supported private companies that push an opposite norm—that plant operators assume absolute liability so that suppliers face no downside risks. They want India to follow suit and ‘Bharat Sarkar’ has buckled.

So, the nuclear deal lying in cold storage was galvanised, signed and sealed in quick time. President Obama used his executive powers to waive the issue raised from the US side to track the nuclear material being provided. The issue of nuclear liability that India wanted was addressed through a legal contrivance called a "memorandum of law"-essentially an executive order-creating an insurance pool for ` 1500 crores with state-owned insurance companies chipping ` 750 crore and rest footed by the government with taxpayer’s money.

This arrangement, although claimed by GoI to be "squarely within our law," constitutes "a risk-transfer mechanism," as the MEA has admitted. Under the arrangement, the Indian government is effectively scrapping the right of recourse to foreign suppliers provided by CNLD Act and transferring the liability risk to taxpayers, offset partly by the modest insurance pool. U.S. officials say the two governments are in agreement over this memorandum plan, which they view as a creative solution. But how can a "memorandum of law," with no legislative mandate, reinterpret a statute in a way that effectively guts it? This question will haunt the ‘nuclear investors’. And, God forbid, if a serious accident were to occur, India would be saddled with staggering long-term costs if the estimated Fukushima disaster bill of $105 billion (` 6,30,000 crore) is any indication!

In this water-starved nation nuclear reactors are massive water-guzzlers. On all counts it is multiple whammy for the Indian populace-continuous dependence on imported uranium; prohibitively costly power; safety/environment risks; loss of land and livelihood; paltry accident cover-while nuclear MNCs laugh all the way to the bank. As for track-record, the 2x1000 MW Koodunkulam project in Tamil Nadu that commenced 30 years ago is yet to generate firm power for the grid due to defective Russian reactors imported ten years ago! What is more, setting up centralized ultra-mega-nuclear generation projects runs counter to what India really needs-transition to renewable energy led decentralized and distributed generation that only can solve India’s power crisis.

What we are importing are not technologies or equipments that will provide India energy security, end extreme poverty, increase farm production and usher in prosperity. It is nuclear albatross that could sink India’s power sector sooner than later.

* The author is a former Army and IAS officer and can be contacted at [email protected]

Courtesy: gfilesindia.com

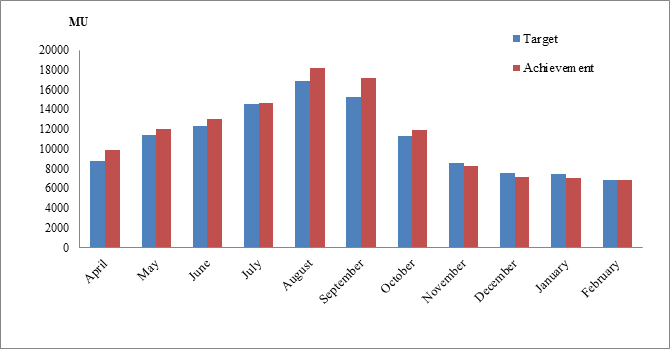

DATA INSIGHT……………

Hydro Generation- Month-wise and Region-wise

Akhilesh Sati, Observer Research Foundation

|

Particulars Region/Month |

2014-15 (Generation in MU) |

|||||||||||||

|

Apr |

May |

Jun |

Jul |

Aug |

Sept |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

Total |

||

|

Target |

NORTHERN |

4053 |

6367.29 |

7601.26 |

8292.61 |

8356.12 |

6987.44 |

4601.23 |

3429.01 |

2953.17 |

2897.58 |

2708.9 |

3556.4 |

61804 |

|

WESTERN |

1086 |

1050 |

747 |

1172 |

1850 |

2032 |

1629 |

1348 |

1312 |

1271 |

1191 |

1230 |

15918 |

|

|

SOUTHERN |

2570 |

2452 |

2034 |

2448 |

3751 |

3548 |

2907 |

2539 |

2429 |

2390 |

2156 |

2379 |

31603 |

|

|

EASTERN |

717 |

963 |

1046 |

1261 |

1489 |

1322 |

1131 |

707 |

406 |

533 |

563 |

746 |

10884 |

|

|

NORTH EASTERN |

180 |

264 |

390 |

650 |

667 |

581 |

432 |

271 |

211 |

173 |

130 |

139 |

4088 |

|

|

TOTAL ALL INDIA |

8606 |

11096.29 |

11818.26 |

13823.61 |

16113.12 |

14470.44 |

10700.23 |

8294.01 |

7311.17 |

7264.58 |

6748.9 |

8050.4 |

124297 |

|

|

IMPORT FROM BHUTAN |

207 |

279 |

535 |

759 |

767 |

737 |

579 |

299 |

210 |

156 |

125 |

147 |

4800 |

|

|

TOTAL (ALL INDIA) |

8813 |

11375.29 |

12353.26 |

14582.61 |

16880.12 |

15207.44 |

11279.23 |

8593.01 |

7521.17 |

7420.58 |

6873.9 |

8197.4 |

129097 |

|

|

Achieve -ment^ |

TOTAL (ALL INDIA) |

9845.68 |

12000.64 |

13065.66 |

14590.81 |

18193.81 |

17117.64 |

11952.24 |

8234.63 |

7190.93 |

6996.94 |

6813.41* |

- |

126002.4 |

Hydro Generation- Target and Achievement

^includes Bhutan imports

*provisional based on actual-cum-assessment

Source: Central Electricity Authority

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Cairn India's tax liability credit negative for Vedanta Resources: Moody's

March 17, 2015. Rating agency Moody's said the ` 20,465 crore tax demand raised on Cairn India is negative for its parent company Vedanta Resources. Income Tax Department has slapped a ` 20,495 crore tax demand on Cairn India Ltd for allegedly failing to pay taxes on gains made by its former parent (Cairn Energy) in a share transfer transaction about eight years ago. An adverse outcome for Vedanta in relation to the tax dispute could also lead to a ratings downgrade, it said. It said Vedanta's credit metrics are already at the lower end of its rating category. The rating agency had revised the company's ratings outlook to negative in January 2015 to reflect the company's likely lower earnings due to depressed global oil prices. Moody's said it has kept Vedanta's ratings and outlook unchanged, because it believes the tax claim will not lead to any immediate cash demand, and that the final amount could vary, given that Vedanta is challenging the liability. Cairn India, an oil and gas producer with a 59.9 percent stake held by Vedanta, had received a tax notice from the Indian revenue authorities for its alleged failure to deduct withholding tax on alleged capital gains of ` 24,500 crore made by its former parent during the fiscal year ended March 2007. While Moody's said that Cairn India's almost 60 percent reduction of its planned capital expenditure to USD 500 million for the financial year ending March 2016 is a positive development, however, lower Brent crude oil prices will negatively affect Vedanta's profitability and cash generation. Moody's expects Brent crude oil prices to average about USD 87/barrel in the year to March 2015 and around USD 57/barrel in the year to March 2016. The disputed tax liability could constrain the group's liquidity. At September 2014, Cairn India's cash balances totalled around USD 2.7 billion, accounting for one-third of the group's liquid assets. (economictimes.indiatimes.com)

Not easy to start gas production in KG basin: Gujarat govt

March 13, 2015. Gujarat government admitted in the Legislative Assembly that it was facing several technical difficulties in its oil and gas exploration project in Krishna-Godawari (KG) basin, leading to delay in start of commercial production. The Gujarat State Petroleum Corporation (GSPC) has an exploration block in the KG basin in Andhra Pradesh. Joitabhai Patel, Congress MLA from Dhanera asked the energy and petroleum minister Saurabh Patel about the progress in the exploration and reasons for delay in commencement of commercial production of gas by GSPC. Patel admitted there were several problems. KG basin is a deep sea block, which creates many technical challenges for oil exploration at a very high temperature and pressure, he said. The block has a temperature of 400 degree Fahrenheit (204 degree Celsius) and pressure of 12,000 pounds per square inch (PSI) at the bottom, and the engineering work in these circumstances takes more time, he said. Being an off-shore block, there were further geographical problems and as a result the production was yet to start, the minister said. The Gujarat government had stated in the Assembly that it had spent ` 2,847.25 crore on exploration in KG basin in the last two years. (economictimes.indiatimes.com)

OVL in talks to acquire stake in two Siberian oilfields: Oil Minister

March 11, 2015. ONGC Videsh Ltd (OVL), the overseas arm of Oil and Natural Gas Corp (ONGC), is in talks to acquire stake in two Siberian oilfields, Oil Minister Dharmendra Pradhan said. While the Minister did not name the fields, OVL was in talks for a stake in Vankor and Yurubcheno-Tokhomskoye fields. An agreement for the stake was to be signed during the visit of Russian President Vladmir Putin in December last year but differences between the two sides prevented formal signing of the pact. Russia's biggest oil company Rosneft had offered to sell 10 percent stake in the strategic Vankor oilfield in Siberia to OVL. Vankor will reach peak output of 500,000 barrels per day (bpd) or 25 million tonnes a year in 2019. The field, which has driven recent Russian output growth, pumped 435,000 bpd in September, 2014. Russia is the world's top oil producer with current output of 10.5 million bpd but its key producing region - West Siberia - is maturing. Besides Vankor, Rosneft has also made a proposal to OVL for joint development of Yurubcheno-Tokhomskoye oilfield in eastern Siberia. The field is estimated to hold 991 million barrels of oil equivalent reserves and is planned to start production in 2017. Yurubcheno-Tokhomskoye will reach a production plateau of up to 5 million tonnes a year (100,000 bpd) in 2019. OVL is interested in expanding its presence in Russia as it looks to source one million barrels per day of oil and oil-equivalent gas from Russia. (economictimes.indiatimes.com)

Downstream………….

IOC seeks superior kerosene in unusual move

March 17, 2015. Indian Oil Corp (IOC) is seeking 20,000 tonnes of superior kerosene oil for April, which traders said was rare. IOC is looking to buy the superior kerosene oil for April 6-8 arrival at Paradip, followed by Haldia. The tender closes on March 24, with offers to stay valid until March 25. The state-owned firm's Koyali refinery is undergoing heavy maintenance from now until April. It has been importing gasoline for March to May delivery, which traders said was to fill the supply gap from the refinery maintenance. In total, it has bought up to 106,000 tonnes of gasoline for March to May arrival at several ports, namely Haldia, Kochi, Paradip and Vizag. (in.reuters.com)

Indian refiners restock with West African oil ahead of strategic reserve launch

March 16, 2015. India has nearly doubled the amount of West African oil it will import in the first half of April, traders said, in a buying spree aimed at refiners building stocks ahead of purchases to fill the country's new strategic petroleum reserve (SPR). The world's fourth-largest energy consumer has stepped up purchases of the Nigerian and Angolan crude for March and April, sparking interest from a market that is watching for stockpiling after oil prices crashed by more than 60 percent between last June and January 2015. Traders said Indian state-backed refiners, led by Indian Oil Corp, booked roughly 15 million barrels of West African oil to arrive in the first part of April - double what they usually import. State-controlled refiners Bharat Petroleum and Hindustan Petroleum have also been buying West African crudes, booking several vessels over the past few weeks. The refineries said their lifting plans for March and April were as per schedule. A drive to virtually eliminate Iranian imports in March also made West African grades more attractive. India is building SPRs at three locations that together can hold more than 36 million barrels of crude to help protect the energy import-reliant economy from supply disruptions and price volatility. The International Energy Agency said that cheaper oil with help encourage India, as well as China and South Korea, to beef up strategic storage. Any effort to fill India's strategic reserves, which will amount to roughly one-third of daily global oil demand, would absorb some of the global glut of oil and could help shore up benchmark prices. Already, the spring purchases have boosted West African crude oil differentials versus the benchmark dated Brent price. Grades popular among Indian refineries, such as Bonny Light and Qua Iboe, have seen their differentials rise to their highest level since the oil price started its near 60 percent slide in June last year. (www.thehindubusinessline.com)

MRPL to shut 120K bpd crude unit in April

March 13, 2015. Mangalore Refinery and Petrochemicals Ltd (MRPL) plans to shut a 120,000 barrel per day crude distillation unit (CDU) for about 10 days from early April for planned maintenance. MRPL, a subsidiary of state-run exploration firm Oil and Natural Gas Corp (ONGC), runs a coastal refinery in Karnataka with a capacity of 300,000 bpd. The refiner plans to shut a 1.6 million tonne a year hydrocracker at the refinery that produces middle distillates such as diesel for minor work. The refiner has three CDUs and two hydrocrackers. MRPL's product supply commitments would not be affected by the shutdown. MRPL plans to shut its second hydrocrakcer of 1.2 million tonnes a year in the October-December quarter for catalyst replacement. A catalyst change typically takes 30-45 days. (in.reuters.com)

HPCL aims to restart fire-hit gasoline unit

March 13, 2015. Hindustan Petroleum Corp (HPCL) aims to restart a catalytic reformer (CCR) gasoline-making unit following a minor fire caused by a leak, the company said. HPCL's 166,000 barrels-per-day (bpd) Vizag refinery in southern India has one CCR and an isomerisation unit. The plant also has two naphtha hydrotreaters (NHT), each attached to the gasoline-making units of fluid catalytic cracker (FCC) and the CCR. The company has already re-started the NHT that had been shut down. (conomictimes.indiatimes.com)

Transportation / Trade…………

Indian refineries step up oil imports from newer geographies like Mexico, Iraq

March 17, 2015. Indian refineries have consistently reduced imports from traditional markets like Saudi Arabia and Iran and have stepped up purchases from other geographies such as Mexico, Iraq and Venezuela while building inventories, as crude prices remain weak due to lower demand. Availability of cheaper crude variants and softening of shipping cost have encouraged Indian companies to look at different sources to buy crude oil for refining, and has therefore helped them achieve a more diversified portfolio. India has also significantly cut imports from Iran, which stood at its lowest in almost 18 months in February, to keep it within the limits allowed as per the deal aimed at curtailing the latter's nuclear programme. The change in imports by Indian companies is helping the country move closer to its long pending target of diversifying its energy sources. Industry officials said while the share of imports from the Middle East would change, given the higher imports from other countries, the volume imported from OPEC may not fall drastically. (economictimes.indiatimes.com)

AP pips Telangana at the post, clinches gas deal with Gujarat

March 11, 2015. The Gujarat government has come to the rescue of Andhra Pradesh (AP) by agreeing to supply liquefied natural gas (LNG) from the Krishna-Godavari basin wells. The Gujarat State Petroleum Corporation (GSPC) has entered into an agreement with the AP government to supply 1.6 million metric square cubic metres of gas every day, with which the state will generate 300 MW power. The deal comes at a time when all the southern states are desperately scouting for gas supplies to cater to the increasing power demand in summer. Though both Telangana and Andhra Pradesh had approached GSPC, AP managed to swing the deal in its favour. (timesofindia.indiatimes.com)

Policy / Performance………

Sri Lanka, India to partner on oil storage project: PM Modi

March 13, 2015. India will help Sri Lanka develop its Trincomalee town as a regional petroleum hub and Indian Oil Corp (IOC) has reached a joint-development pact with Ceylon Petroleum Corporation, Prime Minister Narendra Modi said. The agreement as well as a task force to implement it were announced after a meeting between Modi and Sri Lankan President Maithripala Sirisena. Lanka IOC, IndianOil's subsidiary in Sri Lanka, is the only private oil company other than the Ceylon Petroleum Corporation (CPC) that operates retail petrol and diesel stations in the island nation. Lanka IOC operates about 150 petrol and diesel stations in Sri Lanka and its major facilities here include an oil terminal at Trincomalee, Sri Lanka's largest petroleum storage facility and an 18,000 tonnes per annum capacity lubricants blending plant and state-of-the-art fuels and lubricants testing laboratory at Trincomalee. (economictimes.indiatimes.com)

Govt committee suggests key steps for O&G sector

March 12, 2015. A government panel has recommended key measures such as amending public sector procurement rules, setting up manufacturing zones and targeting 50% local input in the upstream oil and gas (O&G) sector in three years, in a bid to boost local manufacturing. A steering committee with members from the ministries of oil and commerce department of industrial policy and promotion, state-run oil firms and industry bodies Ficci and CII has identified some "actionable areas" in short (one year) to medium (three year) term, oil minister Dharmendra Pradhan said. The government planned to offer a sizeable chunk of business in the oil and gas sector to local firms through a slew of measures. The government is targeting an investment of ` 6-7 lakh crore in oil and gas sector in the next five years to contribute to its 'Make in India' plan. The government had stopped giving a 10% price preference to local companies as public sector firms complained the policy had led to high costs for them. Industry bodies have been demanding review of the withdrawal of the price preference policy for oil and gas equipment makers. (economictimes.indiatimes.com)

Oil Ministry to give CNG marketing licence

March 12, 2015. Oil Ministry is looking to wrest powers to give CNG retailing licence from sectoral regulator PNGRB as it has issued draft guidelines detailing eligibility for rights to sell fuel to automobiles. The Ministry issued 'Draft Guidelines for granting Marketing Rights for CNG as Transportation Fuel, including setting up CNG Stations' wherein any entity that has invested ` 500 crore in oil and gas infrastructure can get rights/license to retail the fuel to automobiles by setting up CNG stations. While the Union government had authorised entities like Indraprastha Gas Ltd and Mahanagar Gas Ltd for retailing CNG to automobiles in Delhi and Mumbai respectively in early 2000, the Petroleum and Natural Gas Regulatory Board (PNGRB) has been doing so through bid rounds since its establishment in 2006. In the draft guidelines, the ministry stated that like the companies which invested a minimum of ` 2,000 crore in oil and gas infrastructure were granted marketing rights for petrol, diesel and ATF through the March 2002 notification, entities investing a minimum of ` 500 crore will be eligible for marketing rights for CNG. Also, entities authorised by PNGRB or Central Government would also be eligible. Since 2006, entities apply to PNGRB and not the government for rights to retail CNG alongside selling natural gas as fuel within city limits. While PNGRB has been issuing the licence to retail CNG as well as piped cooking gas (PNG), the ministry guidelines pertain only to rights to sell CNG. In 2002, Oil and Natural Gas Corp (ONGC) besides Reliance Industries, Essar Oil, Royal Dutch Shell and Numaligarh Refineries had won authorisation to set up petrol pumps to sell petrol and diesel. Besides these firms, fuel retailers Indian Oil Corp (IOC), Bharat Petroleum Corp Ltd (BPCL) and Hindustan Petroleum Corp Ltd (HPCL) as well as gas utility GAIL India Ltd will be eligible for CNG marketing rights. Firms who get CNG marketing rights will get natural gas allocation and can book capacities in existing pipelines to transport the fuel, the guidelines said. PNGRB recently opened fifth round of bidding for city gas distribution (CGD) licences even though it had issued license to entities for only first two rounds. Licences for the remainder are stuck over disputes. (economictimes.indiatimes.com)

Govt asks GAIL to remit incremental KG-D6 gas price every month

March 11, 2015. Government has asked GAIL to remit to the exchequer on a monthly basis the incremental gas price from RIL's KG-D6 field towards recovery of profit share it claims is due from the private firm. The government had in November last year hiked domestic natural gas prices by 33 percent to $ 5.61 per million British thermal unit. In case of RIL's main gas field in KG-D6 block, it, however, ordered buyers to pay the firm old rate of $ 4.2 and deposit the balance $ 1.41 in the gas pool account maintained by GAIL. The revenue collected in the gas pool account was to recover $ 195.34 million in profit petroleum due from RIL after $ 2.376 billion in cost was disallowed for KG-D6 output lagging projections. GAIL has also been directed to keep on depositing the amounts to the government's revenue account on monthly basis till the amount of additional profit petroleum due to the government is fully recovered, Oil Minister Dharmendra Pradhan said. The incremental $ 1.41 would become due to RIL if it can legally prove that Dhirubhai-1 and 3 gas output dropping to a tenth of projected 80 million cubic meters per day was due to geological reasons and not because of hoarding. RIL and its partners are paying the government statutory levy of royalty at the rate of 5 percent on the $ 4.2 gas price they got and GAIL pays the same from the gas pool account on the remainder payments of $ 1.41. Pradhan said the ministry had disallowed development cost of $ 2.376 billion because cumulative production lagged production estimates in the approved field development plan. (economictimes.indiatimes.com)

Govt to scrap allocation of CBM block given to GEECL

March 11, 2015. The Government will cancel award of a coal-bed methane (CBM) block in Tamil Nadu to Great Eastern Energy Corp Ltd (GEECL) for not fulfilling contractual requirements, Oil Minister Dharmendra Pradhan said. GEECL was awarded block MG-CBM-2008/IV for extraction of gas lying below coal seams, called CBM, under the fourth round of CBM block auction in 2010. The production sharing contract (PSC) for the block was signed on July 29, 2010. GEECL has not initiated any exploration activity on the block and the first phase of exploration expired on November 3, 2013. GEECL was awarded CBM block MG-CBM-2008/IV, measuring 667 sq km in Tamil Nadu for exploration and exploitation of CBM gas in Mannargudi area, he said. The Government has so far awarded 33 CBM blocks in four rounds of auctions. Of these, 13 blocks have either been relinquished or offered to be relinquished due to poor CBM prospectivity. GEECL has begun production from Raniganj (South) block in West Bengal and is currently producing 0.38 million standard cubic metres per day, while Oil and Natural Gas Corp (ONGC) has entered the development phase in four blocks, including Raniganj (North). Reliance Industries (RIL) has entered the development phase in its Sohagpur East and West CBM blocks in Madhya Pradesh, while Essar Oil has done the same in case of RG(E)-CBM-2001/1 block in West Bengal. Pradhan said exploration activities have not started in six oil and gas exploration blocks “due to delay in grant of Petroleum Exploration Licence (PEL) by the respective State Governments in the last two years.” Of these blocks, two are in Madhya Pradesh, one in Rajasthan and the remaining three in Gujarat. The Madhya Pradesh blocks were awarded to Deep Energy, while Focus Energy bagged rights for the Rajasthan block. The Gujarat blocks pertain to Deep Energy, Pratibha Oil and Natural Gas Pvt Ltd and Sankalp Oil and Gas Resources, he said. (www.thehindubusinessline.com)

[NATIONAL: POWER]

Generation……………

Tata Power commissions 2nd unit of Dagachhu project in Bhutan

March 17, 2015. Tata Power has successfully commissioned the second unit of 63 MW of its 126 MW Dagachhu hydro power project in Bhutan. The Dagachhu project is a joint-venture initiative between Tata Power and Druk Green Power Corp, which is owned by Royal Government of Bhutan and National Pension & Provident Fund of Bhutan. It is a run of river hydro project located in DaganaDzongkhag, Bhutan. Dagachhu Hydro Power Corp Ltd has entered into a 25 year power purchase agreement with Tata Power Trading company Ltd for selling power generated from the project. (economictimes.indiatimes.com)

960 MW hydro power project in Himachal Pradesh fails to find takers

March 17, 2015. The 960 MW Jangi-Thopan-Powari hydro power project in Himachal Pradesh has once again failed to find a suitor, compelling the State Government to again extend the last date for bid submission. The project has failed to find takers and the deadline for bid submission has been regularly extended since November 5, 2014. While Adani Power, Tata Power, Reliance Power, JSW Energy, Flex Industries and NBCC had bought tender documents, only Flex Industries had submitted a bid. Flex had also withdrawn its bid at the last minute. The new date will be announced soon but there are no changes being made to the original tender documents. Bidders for the project were required to go over and above the minimum ₹ 35 lakh/MW and were mandated to provide 12 percent free power for the first 12 years, 18 percent power for the next 18 years and 30 percent for the balance 10 years of the project’s operations. (www.thehindubusinessline.com)

Work for 3, 4 units in KNPP to begin in April 2016

March 15, 2015. The first phase of the work for setting up the third and fourth units of the Kudankulam Nuclear Power Project (KNPP) would begin in April 2016. India and Russia had signed an agreement for building units three and four of the KNPP at a cost of ` 33,000 crore. The first 1000 MWe unit at the Indo-Russian joint venture, which faced prolonged protests from anti-nuclear activists, commenced its commercial operations in December last year. The second 1,000 MWe unit has got clearance for the hot run from Atomic Energy Regulatory Board and currently undergoing "hot run" (releasing of steam into atmosphere). (zeenews.india.com)

Power generation loss to be at 4 year low in 2015

March 12, 2015. The improved supply of coal is set to bring down power generation loss in the country to a four-year low this year, Parliament was informed. The loss of generation to thermal power stations due to shortage of coal during the past three fiscal years stood at 11.6 billion unit (BU), 15.8 BU and 8.1 BU respectively, Minister of State for Coal and Power Piyush Goyal said. Till February in current fiscal, the loss was to the tune of 2.7 BU, the minister said. Coal to power firms is now supplied under a Fuel Supply Agreement (FSA) where supply of indigenous coal has been assured to the tune of 90 percent and 65 percent of committed quantity for plants commissioned up to March, 2009 and thereafter. The despatch of 348.5 million tonnes (MT) is 84 percent of committed FSA quantity of 413.37 MT during the April-February period of the current fiscal is more than the assured level of supply, the minister said. This has resulted in the number of power plants with critical stock coming down from 66 to 13 during the same period, Goyal said. Despatches by Coal India could have been better but for intermittent law and order problems particularly in Odisha and Jharkhand, mismatch between indents and wagon supply, and heavy rains during monsoon season among others have hampered the movement of the dry fuel, he said. (economictimes.indiatimes.com)

Hawaii-based Company to generate electricity from outflow of Idukki reservoir

March 12, 2015. In a novel initiative, the Kerala State Electricity Board (KSEB) has permitted Hawaii-based Natural Power Concepts company to generate power using In-stream Auger Turbine (IAT) system which can capture and convert energy from flowing water. Such a technology is being used for the first time in the country. Using this technology 0.25 MW power will be generated at the tail race of Idukki Hydro Electric project. Natural Power Concepts will bear the cost of the project by itself (which will be over ` 1 crore) and would sell the power to KSEB at a tariff determined by the Electricity Regulatory Commission. Under the IAT system, the tidal and river flow auger turbine captures greater energy from flowing water than any other rotating hydro turbine of the same diameter, while remaining wildlife friendly and impervious to debris and ice damage, the company claims.

Hence the KSEB requested the state government to relax the Kerala Small Hydro Policy 2012, which stipulates a competitive bidding while sanctioning such projects. Subsequently the state government gave nod to the request. The project will be implemented soon after getting a detailed report from the company. According to Kerala Load Dispatch Centre estimate of the total requirement of 64 million units in a day, the state generates only 20 million units, 44 million units are being imported. (www.newindianexpress.com)

After Land Bill, BJP and Shiv Sena pitted against each other on Jaitapur project

March 12, 2015. Ruling partners Bharatiya Janata Party (BJP) and Shiv Senaare pitted against each other on the development of the 9,900 MW Jaitapur nuclear power project in Maharashtra. BJP has been supporting the project development, saying nuclear power is clean power. But the Shiv Sena has stepped up its opposition against the project, saying the Centre can shift the "monstrous" project to Gujarat as it will have adverse impact on environment and people residing in its vicinity. Shiv Sena has organised a day long agitation slated for March 16 at the Jaitapur nuclear power project site in Ratnagiri district. Jaitapur project is being developed by state-run Nuclear Power Corporation of India (NPCIL). French major AREVA will initially supply two evolutionary pressurised reactors (EPRs) of 1,650 MW each and subsequently another four of the same capacity. Thackeray went on to add that the project cost and the per unit tariff of the Jaitapur project is still not known. However, he said if the project is developed in Gujarat or elsewhere in the country, Maharashtra can purchase the quantum of power that the state requires. The Jaitapur power project director S Singharoy said at present various pre-project activities are going on at the project site. Besides, NPCIL and AREVA are currently engaged in talks to reach a techno-commercial agreement. (www.business-standard.com)

Transmission / Distribution / Trade…

Investors fret as Centre defends reopening coal mine bids

March 17, 2015. The Union Coal Ministry said it would decide the fate of nine winning mine bids it was re-examining to rule out any price discrepancies, despite criticism that its move to reopen some of the tenders would hurt business sentiment. The government, which started auctioning off coal mine sites after a court said a previous method of awarding concessions was illegal, was re-examining ‘outlier’ bids for the 33 mines auctioned so far, Coal Secretary Anil Swarup said. The winning bids for the nine mines were the highest in their individual auctions, but were considered low when compared with the winning bids for other similar blocks. Swarup said the government had the right to examine bids by comparing the value for mines that have a similar quality and quantity of coal. (www.thehindu.com)

Assam-Agra transmission line to help north India this summer

March 16, 2015. A 1,800 km transmission line from Assam to Agra is likely to provide some relief to electricity-starved north India this summer, thanks to a power surplus in otherwise economically backward northeast India. The 1,800-km-long 800 Kv HVDC (high voltage direct current) transmission corridor would be operationalised by May, facilitating the supply of power from northeast India to north India, Power Grid Corporation of India Ltd (PGCIL) said. The PGCIL erected the vital transmission line from Biswanath Chariali in Assam to Agra for ` 11,000 crore, PGCIL said.

According to the PGCIL, the transmission line would be capable of transmitting 6,000 MW of electricity. The PGCIL, a "Navaratna" power transmission company, also signed a 10-year agreement with the Bharat Sanchar Nigam Limited to provide an underground telecommunication cable link in the northeastern region. The northeast is going to be power surplus and it was an enormous problem to transmit the excess power from the region to the country's power-starved regions. The eight northeastern states' off-peak and peak demand on an average is 1,500 MW to 2,500 MW against the current installed capacity of 4,730 MW. (zeenews.india.com)

Opposition stands divided on crucial Coal, Mines Bills

March 16, 2015. The Narendra Modi-led Government has managed to break the Opposition’s unity, with the Trinamool Congress, the Biju Janata Dal, and the AIADMK deciding to toe the Centre’s line in the select committees on Coal Mines (Special Provisions) Bill, 2015 and Mines and Minerals (Development and Regulation) (Amendment) Bill, 2015. The draft reports of both the committees have suggested no changes to the Bills in their present form. The divided Opposition, including Congress, Left parties and JD (U), has decided to submit dissent notes to both the reports. The SP and BSP are yet to make up their minds on the subject. In meeting of the select committee on the Coal Bill, the Opposition protested the decision not to accommodate even unanimous suggestions from the members. The BJP, particularly Energy Minister Piyush Goyal, had reached out to several Chief Ministers for an easy passage of the Bill.

Chairman of Rajya Sabha Hamid Ansari turned down the demand from the Opposition leaders that the select committees should be given an extension. Raising the matter in the Rajya Sabha, Congress leader Digvijaya Singh said the panels should not be allowed to complete the procedures on two crucial Bills within five days. The Government said it cannot be done as the Rajya Sabha has already fixed a deadline to submit the report. (www.thehindubusinessline.com)

State discoms seek upto 26 percent hike in power tarrif

March 16, 2015. Power distribution utilities in Bihar, Haryana, Madhya Pradesh and Uttarakhand have sought tariff hikes ranging from 15% to 26% from April 1, while those in Andhra Pradesh, Gujarat, Maharashtra and Telangana have asked for 3% to 8% increase, according to a report by rating agency ICRA. The report said that a few states have not sought any increase in tariff while power utilities in 14 states are yet to file their tariff petition with the electricity regulatory authorities. As per an ICRA analysis, the revenue gap projected by distribution utilities for 2015-16 is significant in most states. This is primarily because of increase in cost of power procurement and other operation and maintenance expenses proposed for FY2016 and the impact of additional cost estimate arising from final cost incurred in the previous periods based on the availability of audited accounts. The aggregate unrecovered revenue gap projected as per the tariff petitions filed by the distribution utilities in 11 states is estimated at ` 25,300 crore, of which 86% is from utilities in Andhra Pradesh, Bihar, Haryana, Punjab, Odisha and Telangana. (economictimes.indiatimes.com)

World Bank grants ` 13.7 bn for power T&D network in Tripura

March 11, 2015. The World Bank has granted ` 1,376 crore to create infrastructure in power transmission and distribution sector in Tripura. The World Bank and Power Grid Corporation of India Ltd (PGCIL) would ink an agreement March 13 next in presence of Chief Minister Manik Sarkar and state Power minister Manik De, officials of PGCIL, World Bank, Central Electricity Authority, Tripura State Electricity Corporation and Tripura power department. The World Bank has altogether granted ` 8,150 crore in the 'North Eastern Region Power System Improvement Project' for Tripura Assam, Meghalaya, Mizoram, Manipur and Nagaland, which would be operational this year itself. Under this project, power transmission and distribution and transmission sub-stations would be modernised. (economictimes.indiatimes.com)

Policy / Performance………….

Govt holds back awarding 5 coal blocks from round II for examining low bids

March 16, 2015. The government has put on hold the award of five nonoperational coal blocks bagged by companies like Hindalco Industries, Jindal Steel & Power and Jaypee Cement at close to the ceiling prices during an auction. These blocks were part of the second round of auction. Award of three producing blocks auctioned in round I has also been held back for similar reasons. A decision on those is likely to be made. The coal ministry declared the winners for eight of the 13 coal mines auctioned during March 4-9. The coal blocks whose final results were yet to be declared include the Tara mine in Chhattisgarh, for which the top bidder was Jindal Power at an offer of ` 126 per tonne, while also agreeing to forego the mining cost that power producers are allowed to pass on to consumers. At this price, revenue to the state will be less compared with other blocks auctioned to power firms in the second round. Other blocks whose awards are being held back are Brinda & Sasai (Usha Martin), Meral (Trimula Industries), Dumri (Hindalco) and Mandla South (Jaypee Cement). GMR Energy won the Ganeshpur coal mine at ` 704 per tonne and Utkal-C was bagged by Monnet Ispat & Steel at ` 770 a tonne. These companies also agreed to forego mining cost. The coal ministry is already reviewing bidding of the three coal blocks remaining to be allotted from the first round: Gare Palma IV/2&3, for which Jindal Power was the top bidder; Gare Palma IV-1 (Bharat Aluminium) and Marki Mangli III (BS Ispat). An inter-ministerial committee, chaired by coal ministry additional secretary A K Bhalla, has placed its views on these three blocks to the ministry that is expected to announce its decision on the matter. (economictimes.indiatimes.com)

Electricity tariff raised nominally in Bihar

March 16, 2015. The Bihar Energy Regulatory Commission (BERC) announced to nominally increase in the power tariffs in the state. Electricity consumers in Bihar will have to shell out 10-15 paisa per unit more with effect from next month. The increase will generate ` 113 crore for the power distribution companies (DISCOMs). Disclosing the details of the annual revenue requirement (ARR), filed by the (DISCOMs), the BERC said. Out of this amount, sum of ` 480 crore would be provided by the state government to the DISCOMs as resource gap assistance, leaving a revenue gap of ` 229 crore. In this amount, the BERC has asked the two state-owned DISCOMs to increase the revenue and garner about ` 116 crore by increasing their efficiencies. The commission has abolished Monthly Minimum Charges for the rural industrial consumers having single phase connection. The commission has also withdrawn existing flat rate of 5 percent of power factor surcharge to the LT consumers. Meanwhile, the commission has ordered the DISCOMs to make Time of Day (TOD) tariff mandatory for all HT consumers. Meanwhile, the commission has expressed concerned over the high distribution losses in the state. The DISCOMs have projected distribution losses of around 37 percent for the next fiscal. (www.business-standard.com)

AERB nod to NPCIL to erect major equipment at Rajasthan N-power plant

March 15, 2015. India's nuclear power regulator the Atomic Energy Regulatory Board (AERB) has given its clearance for the erection of major equipment at the two units of 700 MW each (7 & 8) of Rajasthan Atomic Power project. The Nuclear Power Corporation of India Ltd NPCIL), which will develop these units based on pressurized heavy water reactors (PHWRs), will however, have to strictly comply with 10 various conditions laid down by AERB while giving its approval. These two reactors are part of 19 new reactors with a total capacity of 17,400 MW where the construction will begin during the ongoing 12th five year plan. (www.business-standard.com)

No power cuts in TS from May: Telangana CM

March 15, 2015. Chief Minister (CM) K. Chandrasekhar Rao announced there will not be any power cuts in Telangana State from May this year with about 1,000 MW being added to the grid in phases. There were power cuts to industry in Telangana from January itself last year as the region in the undivided State faced a severe power crisis, but nothing of the sort was resorted to so far this year, he said. He said there might be some load shedding at the power stations from March 20 to April 20 when consumption by agriculture sector would peak. He reiterated that the State would give nine-hour uninterrupted power supply from 9 a.m. to 6 p.m. for agriculture from 2016 and would maintain 24-hour supply to all sectors from 2017. After careful consideration, the UPA government provided 53.89 percent output to Telangana from AP-based power stations and 46 percent to AP from Telangana power plants in the AP State Reorganisation Act. But, Andhra Pradesh’s reluctance to give Telangana its share of power in Hinduja and Krishnapatnam power projects proved to be a blessing in disguise, Rao said. The government had represented to the Centre to re-allot the coal block at Tadicherla in Karimnagar district, which was cancelled as part of all India cancellations last year. (www.thehindu.com)

Assam may hike commercial power tariff

March 14, 2015. The Assam Government will not hike consumer electricity prices this year, although a 7-12 percent hike for the commercial sector is under consideration, the State electricity regulatory commission said. The former general manager of State-owned Assam Petrochemicals Ltd said increasing operational expenses is the reason behind the price hike and taxing the industrial sector alone will be enough to meet the rising expenses. While the peak-hour power requirement in the State is 1,300 MW, Assam produces 700 MW of power annually, he said. The State Government is exploring avenues to produce alternate electricity as well as setting up thermal coal-based power units. The Central Government is setting up a 250-270 MW coal-based power generating station at Bongaon in Jorhat district that will cater to the North-eastern State’s electricity requirements. (www.assamtribune.com)

Uttarakhand, Centre push for power projects

March 12, 2015. In their affidavits submitted in the Supreme Court, the Uttarakhand Government and the Union Environment Ministry seem to push for hydroelectric power projects (HEPs) in the State. Work on HEPs on the Alaknanda and the Bhagirathi basins was stalled after the August, 2013 order of the Supreme Court. From the list of 24 projects that were to be reviewed, according to the Supreme Court order, the discussion in the Supreme Court has come down to six projects – NTPC’s Lata Tapovan (171 MW), GMR’s Alaknanda Badrinath (300 MW), NHPC’s Kotlibhel 1A (195 MW), THDC’s Jhellum Tamak (108 MW), and Bhyundar Ganga (24.3 MW) and Khirao Ganga (4 MW) of Super Hydro Electric Power. In its December 16, 2014 order, the Supreme Court asked that the Environment Ministry to see if the six projects, work on which is stalled after the 2013 disaster, had adequate clearances before the June, 2013 disaster. Based on the order, the Environment Ministry formed a committee of four experts to review the clearances of the six projects. (www.thehindu.com)

AP to invest ` 43.6 bn in power sector