-

CENTRES

Progammes & Centres

Location

[Energy Budget: Highlights & Comments]

“Direct benefits transfers like for domestic LPG good step but why can’t the same step can be taken for PDS kerosene, a superior and costlier fuel then LPG and which is more prone to black marketing and adulteration. Conversion of existing excise duty on petrol and diesel into road cess to fund investment in roads and other infrastructure is positive but how will this translate into development of rural India is an open question…”

Energy News

[GOOD]

If increasing coal supply is decreasing power prices, what we need is more coal, not more politics!

Arunachal’s dream of hydro-dollars may come at the cost of the environment!

[UGLY]

Why is it so difficult to withdraw LPG subsidies from the well off?

CONTENTS INSIGHT……

[WEEK IN REVIEW]

COMMENTS…………………

· Energy Budget: Highlights & Comments

· Indian Coal needs a bath

DATA INSIGHT………………

· Solar Power and Wind Mill Plants in Railways

[NATIONAL: OIL & GAS]

Upstream…………………………

· Private oil companies cut capital expenditure and cost on weak crude demand outlook for 2015-16

· Cairn India gets DGH approval for gas production in Rajasthan block

Downstream……………………………

· IOC seeks rare jet fuel cargo on planned maintenance at Koyali refinery

· Govt re-negotiating with HPCL on oil refinery: Rajasthan CM

Transportation / Trade………………

· Trans-Afghan gas pipeline may become a reality: Oil Minister

· Sahaj signs MoU with IOC

Policy / Performance…………………

· Union Cabinet will soon vet policy to develop marginal O&G fields

· No plans to withdraw LPG subsidy to well off people: Sinha

· Oil Ministry to protect ONGC on subsidy payout

· Truth about sleeping gas cylinders

· Mission launched to spot gas hydrates off East Coast

· 'Petrochemical Park' next to Kochi BPCL refinery planned

· Gujarat govt to set up two new LNG terminals of 10 MMTPA

· CCEA extends domestic LPG and PDS kerosene subsidy by one year

· India's fuel demand projected to rise 3.3 percent in 2015/16

[NATIONAL: POWER]

Generation………………

· Tata Power commissions first unit of Hydro Power Plant in Bhutan

· 160 power projects to generate 46.9 GW electricity: Arunachal Pradesh CM

· RattanIndia Power commissions 270 MW unit 4 at Amravati

· Avantha, Adani sign share purchase pact for Korba plant

Transmission / Distribution / Trade……

· Power prices slide to ` 1 per unit as Coal India steps up supply

· Power distribution losses of ` 691 bn reported in 2012-13

· Not many takers for Tripura’s surplus power

· SRM Energy to sell power plant in Cuddalore

· PGCIL to invest ` 300 bn for southern States

· Power sector in 'neck-deep' debt: Haryana govt

· Western states sell less power due to transmission bottlenecks

· GMR India to sell 500 MW power to Bangladesh from Nepal

Policy / Performance…………………

· Arunachal Pradesh will earn ` 4.4 bn annually from free power: Nabam Tuki

· Banks to rethink loan pacts with power companies

· Karnataka bullish on proposed nuclear plant, AP too is keen

· Areva ‘ready to discuss’ transfer of n-technology

· Delhi power minister wants discom-NTPC pact information

· States may have to wait a while for coal block auction bonanza

· Parliamentary panel seeks suggestions on Electricity Act amendments

· Govt decides to speed up ` 900 bn power projects

· Two of the five UMPPs proposed in Budget 2015 likely to be awarded this year

· Nuclear power way cheaper than others: Govt

· Centre committed to support Tamil Nadu on power: Goyal

· Govt to train 7 lakh people by 2018 to meet power sector needs

· Govt begins 2nd phase of coal mine auctions

[INTERNATIONAL: OIL & GAS]

Upstream……………………

· Pelikan field starts production offshore Indonesia

· Three offshore gas fields in Myanmar to shut down for maintenance in April

· Cairn Energy sees 50 percent lower rig cost sustaining Senegal drilling

· CNOOC commences oil production at Qinhuangdao 32-6 project in Bohai Bay

· BP makes second deepwater gas find off Egypt

Downstream……………………

· Chevron CEO says 'quite a bit of interest' in Hawaii refinery

· Bahrain refinery expansion to cost some $5 bn, online by 2019: Energy Minister

· Mexico's Pemex says Tula oil refinery back to normal after fire

· ADNOC to export first cargoes from expanded Ruwais refinery in March

Transportation / Trade…………

· Libya to export over 2 mn barrels of oil from east

· Oil train fires reveal problematic safety culture

· Traders cash out on tanker-stored oil as prices rise

· South Korea's GS Caltex makes first Mexican crude purchase in 25 yrs

· Five bidders for Tamoil's Collombey refinery in Switzerland

· Philippines' First Gen seeks partner for $1 bn LNG import terminal

· Canada's Enbridge reduces costs of oil sands pipelines by $320 mn

· Brazilian company to break Petrobras stranglehold on gas market

· BP to sell stake in major North Sea gas pipeline

Policy / Performance………………

· Bank of Canada to address committee on oil price drop

· Exxon, Shell's spending patterns may help them through oil price drop

· Extended US refinery strike could tighten supply balances: Fitch

· OPEC seen by Attiyah keeping oil policy unless others cut

· Kuwait expects OPEC to continue policy beyond June

· Poland expects LNG terminal to launch between Q2 & Q3

· OPEC shouldn't cut output to 'subsidize' shale: Badri

· Goldman says $40 oil call may be too low as demand surprises

· Hedge funds are losing faith in oil rally while inventory swells

· Egypt sets price for shale gas at $5.45 per mmBtu

· Statoil postpones Castberg and Snorre 2040 projects

· Spain sees energy deal as EU step to cut Russia dependence

· Bids on Peru's biggest oil block to start in April: Govt

· Indonesia expects gas demand to more than double over next 5 yrs

[INTERNATIONAL: POWER]

Generation…………………

· FirstEnergy begins maintenance work at 1.2 GW Perry nuclear facility in US

· Marubeni, Alstom win $1 bn coal power project in Thailand

· 2 foreign firms to replace Mae Moh coal plant

· Siemens completes 600 MW combined cycle power plant in Turkey

· Bahria Town, K-Electric sign power plant agreement in Karachi

· APR Energy extends 75 MW of power generation in Argentina

Transmission / Distribution / Trade……

· Eskom sees high risk of South Africa rolling power cuts

· EU urges Germany to resolve gridlock over power transmission plan

· 122 km Abaga-Kiragon power transmission line completed

Policy / Performance………………

· China approves first nuclear project since Fukushima

· Slovakia to seek up to $347 mn compensation from Enel over hydropower plant

· Ameren's Callaway nuclear power plant license extended

· China's coal usage targeted in new energy plan

· Vietnam to hike electricity prices by 7.5 percent

· Brazil acknowledges severe power generation crisis

[RENEWABLE ENERGY / CLIMATE CHANGE TRENDS]

NATIONAL…………

· First Solar plans to set up dedicated power plants for industrial use

· Govt mulls cutting subsidy by half for rooftop solar projects

· Households vital for India's energy independence: Scientist

· Telangana to call bids for 1 GW solar PV projects

· ABB India sells 1 GW of solar inverters

GLOBAL………………

· Half of new US energy capacity to be generated from wind power

· EU nations to discuss carbon market reserve proposal

· Chubu Electric unit to build biomass plant in central Japan

· EU agrees on 40 percent carbon-reduction pledge for UN climate summit

· Egypt launches new solar power plant

· Geodynamics wins environmental approvals for exploration phase of Takara geothermal project

· Enel Green Power starts up 102 MW wind farm in Mexico

· China in talks to determine top climate negotiator for Paris

[WEEK IN REVIEW]

COMMENTS………………

Energy Budget: Highlights & Comments

Akhilesh Sati & Vinod Kumar Tomar, Observer Research Foundation

· Electricity for all by 2020: Electrification, by 2020, of the remaining 20,000 villages in the country, including by off-grid solar power generation.

· Each house in the country to have basic facility of 24-hour power supply by 2022.

· A plan outlay of ` 4500 crore is proposed for Deen Dayal Upadhyay Gram Jyoti Yojana (previously RGGVY) for 2015-16.

· 5 new Ultra Mega Power Projects, each of 4000 MWs to be set up in the plug-and-play mode. All clearances and linkages will be in place before the project is awarded by a transparent auction system.

· Additional depreciation @ 20% is allowed on new plant and machinery installed by a manufacturing unit or a unit engaged in generation and distribution of power.

Electrifying India is unlikely to happen just by changing the name of an existing scheme (Rajiv Gandhi Gramin Vidyutikaran Yojana or RGGVY) to Deen Dayal Upadhyay Gram Jyoti Yojana or by re-launching failed initiatives like Ultra Mega Power Projects. Using existing infrastructure to ensure a minimum of four hours power supply in electrified villages is likely to make a far greater impact.

· Renewable energy capacity target revised to 175 GW till 2022, comprising 100,000 MW Solar, 60,000 MW Wind, 10,000 MW Biomass and 5000 MW Small Hydro.

· An outlay of ` 2410 crore for grid interactive and distributed renewable power and ` 131 crore for renewable energy for rural applications proposed for 2015-16.

· Reduction in excise duty in pig iron SG grade and Ferro-silicon-magnesium for use in the manufacture of cast components of wind operated electricity generators to nil, subject to certification by MNRE.

· Restructuring of excise duty on solar water heater and system from 12% to nil without CENVAT credit or 12.5% with CENVAT credit.

· Reduction in excise duty in round copper wire and tin alloys for use in the manufacture of solar PV ribbon for manufacture of solar PV cells to nil subject to certification by Department of Electronics and Information Technology (DeitY).

· Basic custom duty on evacuated tubes with three layers of solar selective coating for use in the manufacture of solar water heater and system is reduced to nil.

· Basic custom duty on active energy controller (AEC) for use in the manufacture of renewable power system (RPS) inverters reduced to 5%, subject to certification by MNRE.

· Scheme for Faster Adoption and manufacturing of Electric Vehicles (FAME) with an initial outlay of ` 75 crore.

· Concessions from customs and excise duties currently available on specified parts for manufacture of electrically operated vehicles and hybrid vehicles are being extended by one more year.

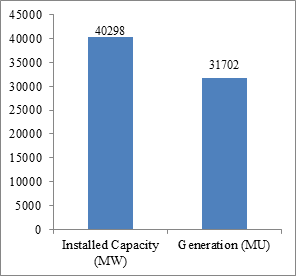

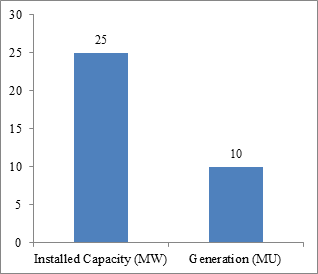

Adding on renewable energy capacity looks good especially for those wanting to push renewable energy. But when this capacity denotes more than 12% of all India capacity & generation is just around 4% then expecting rural India to pay for renewables is unfair. The rich should be mandated to use and pay for green energy. The reduction in duties for production of renewable energy devices and electric vehicles may have a positive impact if it is reflected in retail prices.

· Petroleum subsidies reduced to ` 30, 000 crore for 2015-16 from more than ` 60,000 crore for 2014-15.

· Excise & Custom Duty on Petrol & Diesel are being revised as under:

Direct benefits transfers like for domestic LPG good step but why can’t the same step can be taken for PDS kerosene, a superior and costlier fuel then LPG and which is more prone to black marketing and adulteration. Conversion of existing excise duty on petrol and diesel into road cess to fund investment in roads and other infrastructure is positive but how will this translate into development of rural India is an open question. If this does not happen we will just be adding to NPAs

|

Duty rates applicable prior upto 28.02.2015 |

Duty rates applicable with effect from 01 .03.2015 |

||||||||||

|

CENVAT ` / Litre |

SAED ` / Litre |

AED (or Road Cess) ` / Litre |

Education Cesses (as % of duties of excise) |

Total ` / Litre |

CENVAT |

SAED |

AED |

Education Cesses |

Total |

||

|

Unbranded petrol |

|||||||||||

|

8.95 |

6 |

2 |

3% |

17.46 |

5.46 |

6 |

6 |

NIL |

17.46 |

||

|

Branded petrol |

|||||||||||

|

10.10 |

6 |

2 |

3% |

18.64 |

6.64 |

6 |

6 |

NIL |

18.64 |

||

|

Unbranded Diesel |

|||||||||||

|

7.96 |

NIL |

2 |

3% |

10.26 |

4.26 |

NIL |

6 |

NIL |

10.26 |

||

|

Branded Diesel |

|||||||||||

|

14% +` 5 /litre or ` 10.25 / litre, whichever is lower |

NIL |

2 |

3% |

12.62 |

6.62 |

NIL |

6 |

NIL |

12.62 |

||

Source: www.taxguru.in

· Clean Energy Cess proposed to increase from ` 100 to ` 200 per metric tonne of coal to finance clean environment initiatives.

Wholesale price of electricity is higher than retails prices in India, an anomaly not seen anywhere else in the world. Increasing coal prices will increase whole sale prices further which will only contribute to power sector losses.

Views are those of the authors

Authors can be contacted at [email protected], [email protected]

COMMENTS………………

Ashish Gupta, Observer Research Foundation

Most of the power plants in the country are using inferior grade coal as shown in the table below. The question is very simple: why coal washing is not getting done despite its importance.

Grading of Indian Coal[1]

|

Serial number |

Grading of Coal |

Criteria |

|

1 |

Superior Grade |

Grade – (A+B+C): 5,800 Kcal/ kg |

|

2 |

Intermediate Grade |

Grade – D: below 5,800 Kcal/kg |

|

3 |

Inferior Grade |

Grade – (E+F+G): 4,000 Kcal/kg |

The Ministry of Environment & Forests and Climate Change mandated use of beneficiated coal to bring the ash content to 34 percent in the power plants through the following directions:

· Power plants located beyond 1,000 km from the pithead (there is a possibility that it will be modified to 500 km)

· Power plants located in the critically polluted areas, urban areas and in ecologically sensitive areas

· Power plants using Fluidised Bed Combustion technologies and Integrated Gasification Cycle Combustion mechanisms are exempted from the above mandates.

The country’s coal washing capacity currently stands at 131 Million Tonnes/ per annum with 17.03 percent capacity utilisation. Despite the mandate capacity utilisation of the coal washeries is low in the country and this is an issue that needs to be explored.

The trend of washed coal is given in the table below:

Production of Washed Coal during the Last Ten Years[2]

|

Washed Coking Coal |

Washed Non-Coking Coal |

|||||||

|

Year |

Production (MT) |

Growth % |

Production (MT) |

Growth % |

|

|||

|

2004-05 |

8.79 |

7.2 |

10.556 |

Not known |

||||

|

2005-06 |

8.376 |

-4.7 |

12.555 |

18.9 |

||||

|

2006-07 |

7.025 |

-16.1 |

12.688 |

1.1 |

||||

|

2007-08 |

7.171 |

2.1 |

12.686 |

0 |

||||

|

2008-09 |

7.181 |

0.1 |

13.55 |

6.8 |

||||

|

2009-10 |

6.547 |

-8.8 |

13.963 |

3 |

||||

|

2010-11 |

6.955 |

6.2 |

14.531 |

4.1 |

||||

|

2011-12 |

6.496 |

-6.6 |

15.437 |

6.2 |

||||

|

2012-13 |

6.55 |

0.8 |

14.19 |

-8.1 |

||||

|

2013-14 |

6.615 |

1 |

15.7 |

10.6 |

||||

Are there technical reasons behind under utilisation of coal washing capacity such as Run of Mine coal characteristics or is technology available is not efficient?

Are there economic concerns such as high capital costs or operating cost or poor yield or recovery?

The answers will be available only when the issue is studied in depth. This is a pressing need for the country as narratives not supported by fact such as lack of coal washing capacity being a major problem in washing coal prevail.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT……………

Solar Power and Wind Mill Plants in Railways

Akhilesh Sati, Observer Research Foundation

|

Solar / Wind Systems |

Capacity |

Details/Place/Location |

|

INSTALLED |

||

|

Wind Mill Plants |

10.5 Mega Watt (MW) |

In Tamil Nadu for Integral Coach Factory (ICF)- Chennai |

|

Solar Based Lighting Systems |

9.5 Mega Watt Peak (MWp) |

at 500 Railway Stations, 4000 Level Crossing (LC) Gates, 400 Street Lights |

|

PROPOSED |

||

|

Wind Mill Plant |

10.5 MW |

in Tamil Nadu |

|

Wind Mill Plants |

157.5 MW |

in joint venture module with Railway Energy Management Company (REMC) in wind rich States & in Rajasthan |

|

Solar Photo Voltaic Modules |

9.45 MWp |

at 2000 level crossing gates, 200 stations and 26 building roof top |

Source: Press Information Bureau

Renewables- All India

Source: CEA & MNRE

Renewables- Railways

Source: PIB

NEWS BRIEF

[NATIONAL: OIL & GAS]

Upstream……….

Private oil companies cut capital expenditure and cost on weak crude demand outlook for 2015-16

March 10, 2015. Indian energy majors are slashing their capital expenditure and have initiated cost cutting measures, responding to the weak crude prices and dismal price recovery outlook for 2015-16. Crude oil prices have plummeted almost 45% since June due to oversupply in the market. Benchmark Brent crude touched lows of $45 per barrel in January as against a high of $115 last summer. Oil has seen gains recently and reached $60 a barrel again for the first time this year but the outlook remains muted as demand is unlikely to see a pick-up. Global energy majors have cut capex, trimmed human resource and are taking severe cost saving measures, something that Indian companies have now started doing. Cairn India has reduced its capex by less than half to $500 million from $ 1.2 billion for 2015-16 and has also laid off 250 of its 1,800 staff. Reliance Industries continues with its capex plans across its businesses, but is implementing "austerity measures" in its exploration and production business, given the challenging times. Essar Energy is holding back capex plans and is also believed to be exploring cost saving steps. While state-run ONGC bucks the trend by increasing capex, it is trying to negotiate lower rates for new tenders to keep costs low. Cairn India has said it will undertake only economically viable projects, and has the board's approval for Raag Deep Gas Project, but will defer rest of the plans. It is also working on reengineering projects and re-negotiating contracts to reduce costs. The Union Budget 2015-16 stated that state-run oil firms would invest over ` 76,565 crore on capex in 2015-16, up 5% on year. Of this, ONGC alone would invest ` 36,250 crore, as against target of ` 34,813 crore in the current fiscal. Global oil and gas companies have already announced cut in capex to the extent of over $85 billion from their 2015 budgets to protect themselves from low oil prices, according to industry estimates. RBC Capital Markets said in a note that the 122 global companies in its coverage could see a 20% decline in capital expenditure in 2015 to $349.2 billion. (economictimes.indiatimes.com)

Cairn India gets DGH approval for gas production in Rajasthan block

March 9, 2015. Cairn India has obtained the regulator's nod to commercially produce gas in its prolific Rajasthan block, making it eligible to seek a longer extension after the contract for the block expires in 2020. Under the production sharing contract (PSC), a block is considered for a five-year extension if it produces oil, and for 10 years if it produces natural gas. This norm was earlier used by the regulator to turn down the request of Gurgaon-based subsidiary of London-headquartered diversified metals and mining company Vedanta Resources to extend the contract by 10 years, after the initial agreement to operate the Barmer block ends. Barmer oil block accounts for nearly a fourth of India's local oil production. But a gas discovery in the Raageshwari field in the RJ-ON-901 Barmer block will give government the flexibility to consider it a gas block and thus offer a 10-year extension. Cairn India said that it has received the management committee's approval for the Raageshwari Deep Gas Project. A managing committee comprises representatives of the upstream regulator DGH (Directorate General of Hydrocarbons) and the operator, and its approval is crucial for an operator to start commercial production in a new discovery of oil or gas. (economictimes.indiatimes.com)

Downstream………….

IOC seeks rare jet fuel cargo on planned maintenance at Koyali refinery

March 9, 2015. Indian Oil Corporation (IOC) is seeking a rare aviation turbine fuel, or jet fuel, cargo - its first such requirement in more than three years. The company is seeking about 5,000 tonnes of jet fuel for delivery into Vasco da Gama, on the west coast in Indian state of Goa, over March 25 to 28. The state-owned company's rare spot requirement is due to a planned maintenance at its Koyali refinery in Gujarat. The tender closes on March 12 and is valid until March 13. IOC had last sought a jet fuel cargo in 2011. The company is expected to secure its diesel needs from Indian private refiners such as Reliance Industries and Essar Oil with whom it has term purchase contracts. IOC is planning to shut four crude distillation units with a total capacity of 220,000 barrels-per-day and several secondary units at the Koyali refinery from March to April. (businesstoday.intoday.in)

Govt re-negotiating with HPCL on oil refinery: Rajasthan CM

March 9, 2015. Rajasthan Chief Minister (CM) Vasundhara Raje said her government is re-negotiating and reviewing Barmer Oil Refinery, the previous Congress government's high profile project in the state. A loan of ` 56,000 crore is provided to this project, but only 26 percent share is given to the state. This is a peculiar package in which ` 3,736 crore interest free loan is to be provided to HPCL for 15 years, she said. On her budget proposals, Raje said people would feel satisfied as the government had put up a roadmap for all-round development of the state and it would be pursued in next three years. (economictimes.indiatimes.com)

Transportation / Trade…………

Trans-Afghan gas pipeline may become a reality: Oil Minister

March 9, 2015. Trans-Afghanistan gas pipeline connecting Turkmenistan, Afghanistan, Pakistan and India may become a reality soon as negotiation for the ambitious project is at the final stage, Oil Minister Dharmendra Pradhan said. The Minister said government will also take a decision on a project to bring natural gas from Iran through a pipeline passing through Afghanistan and Pakistan. He said India has been procuring crude oil from 25 countries and it was not correct to say that the country was over-dependent on the Middle-East for crude supplies. The Minister said India has imported ` 5,81,111 crore worth of crude oil, ` 59,085 crore worth of petroleum products and ` 46,712 crore liquefied natural gas during 2014-15 (till December 2014). In 2013-14, India had imported ` 8,64,875 crore worth crude oil, ` 74,605 crore petroleum products and ` 51,699 crore liquefied natural gas. The Minister said in order to reduce dependence on imports of oil and gas to meet the energy needs of the growing Indian economy, a number of steps have been taken by the government for enhancing domestic production including improved oil recovery, enhanced oil recovery implemented by exploration and production companies for increasing oil recovery from fields. (economictimes.indiatimes.com)

Sahaj signs MoU with IOC

March 9, 2015. Sahaj e-Village Ltd has signed an MoU (memorandum of understanding) with Indian Oil Corp (IOC) for selling 5 kg FTL (Free Trade LPG) Indane cylinders through its Common Service Centers across the States of Assam, Bihar, Odisha, Tamil Nadu, Uttar Pradesh and West Bengal. For the first time IOC is venturing into a Pan India tie up with a private company for selling 5 kg Indane cylinders. Indane is one of the largest packed-LPG brands in the world. Having launched LPG marketing in the mid-60s, IOC has been credited with bringing about a 'kitchen revolution,' with the introduction of clean and efficient cooking fuel. As present 142 million rural Indian households use firewood and other solid fuels, such as animal dung, charcoal, crop waste and coal, as their primary source of household energy. The soot generated not only results in air pollution caused by fumes from cooking, heating and lighting activities but also shortens life spans of Indians in rural India. As per current data, 4,183 agencies had been commissioned as part of the plan to take LPG to rural India. Nearly 9.5 million of 17.8 million LPG consumers are now in rural areas, according to the corporate communication department of Indian Oil Corporation Ltd, a public-sector oil company. Sahaj is present across the 6 States of Assam, Bihar, Odisha, Tamil Nadu, Uttar Pradesh and West Bengal with more than 27000 Common Service Centers (CSCs) located across remote locations, reaching out to a rural consumer base of more than 2700,00,000. (timesofindia.indiatimes.com)

Policy / Performance………

Union Cabinet will soon vet policy to develop marginal O&G fields

March 10, 2015. The Union Cabinet will soon consider a policy to develop marginal oil and gas (O&G) fields. If approved, it will pave way for the auction of 69 smaller fields on a revenue-sharing basis, a first for the country's hydrocarbons sector. The proposed policy has been readied by the oil ministry to attract private investors to smaller fields lying unexploited for years for want of enough attention, capital and technology. Sixty-three such blocks earlier allocated to Oil and Natural Gas Corp (ONGC) and six to Oil India Ltd, both state-run firms, will get auctioned under the proposed policy. The new policy would offer a revenue-sharing model, whereby bidders can offer a certain share of revenue from the fields to the government. The ones with the offer of the highest revenue share to the government will get the block to develop. At present, all oil and gas blocks have been auctioned on a profit-sharing model, which many have blamed for allowing operators to jack up cost leaving lower than expected amount of profit for sharing with government. In the past, a profit-sharing model has led to disagreements between operator and government on project cost and resulted in legal battles. A revenue-sharing model can probably help check that. (economictimes.indiatimes.com)

No plans to withdraw LPG subsidy to well off people: Sinha

March 10, 2015. There are no plans to withdraw the facility of subsidised LPG cylinders to financially well off people, even as 1.46 lakh such consumers have voluntarily given up the subsidy, the government said. As on February 23, 2015, approximately 1.46 lakh consumers have voluntarily given up LPG subsidy on their domestic LPG connections, Minister of State for Finance Jayant Sinha said. However, government has launched an initiative for such LPG consumers to voluntarily give up their subsidy, he said. The minister said that components of cash subsidies are transferred to individuals or institutions in their bank accounts electronically on DBT platform. Accurate targeting of intended beneficiary through DBT provides full protection to the weaker sections of the society, he said. (economictimes.indiatimes.com)

Oil Ministry to protect ONGC on subsidy payout

March 9, 2015. Oil Ministry is keen to protect state-owned ONGC from subsidy burden in the March quarter as volatility in crude oil prices have taken a hit on its finances, Oil Minister Dharmendra Pradhan said. Oil and Natural Gas Corp (ONGC) met over 54 percent of the ` 67,091 crore loss that fuel retailers incurred on selling diesel, kerosene and LPG at government-controlled rates during the first nine months of the current fiscal. The government chipped in only one-third by way of cash subsidy despite slump in international oil prices leading to halving of the net price realised by ONGC. Pradhan said his ministry was "in touch" with the Finance Ministry for compensation of losses to be incurred by state oil companies during January-March quarter. Out of the ` 67,091 crore loss incurred on selling diesel at subsidised rates between April and October 17 and domestic LPG and kerosene through public distribution system (PDS) in the first nine months, the government provided ` 22,085 crore as cash subsidy. ONGC provided ` 36,300 crore while Oil India Ltd (OIL) ` 5,523 crore. Another ` 1,000 crore was provided by gas utility GAIL India Ltd. For January-March, the under-recovery or revenue loss is being pegged at around ` 7,000-8,000 crore. Pradhan said considering the volatility in crude oil prices, the interest of ONGC needs to be protected. The fall in international oil prices has meant that ONGC's realisation has dipped and after paying for fuel subsidy, which is in form of discount on crude oil it sells to refiners, it is left with only few dollars per barrel that are hardly sufficient to meets its expenditure. Oil Ministry had proposed to exempt upstream producers from payment of any further subsidy, but the proposal is yet to be accepted by the Finance Ministry. Under-recoveries or revenue retailers lose on selling fuel below cost, is projected at ` 74,773 crore in full 2014-15 fiscal. Out of this, ` 67,091 crore was in the first nine months (April-December). (economictimes.indiatimes.com)

Truth about sleeping gas cylinders

March 9, 2015. During one of the meetings that Prime Minister Narendra Modi had with secretaries of all Central Ministries, he reportedly asked the Secretary, Ministry of Petroleum and Natural Gas, if he knew that women in small towns and villages placed their domestic gas cylinders in a horizontal position when they became empty. The Secretary promptly said he would come back with details. Modi then told him that by placing the cylinder in a sleeping position, families ensured three more days of gas supply. An empty cylinder placed vertically still retains at least 3 p.c. of the LPG, which, Modi elaborated, meant that every 34th refill would come for free for oil companies. Upendra Tripathi, Secretary, New and Renewable Energy, narrated this anecdote, highlighting the Prime Minister’s awareness of the practices of thrifty rural households. A representative of a public sector oil marketing company said this may not always be true, or amount to 3 p.c. savings, although a miniscule amount of gas may remain in the cylinder if there is some wetness in it. (www.thehindu.com)

Mission launched to spot gas hydrates off East Coast

March 7, 2015. In a quest that could answer all the concerns over India’s energy security for the next century, the Geological Survey of India (GSI) in collaboration with National Institute of Oceanography (NIO) has launched an exploration to locate traces of gas hydrate reserves off the East Coast, particularly in the Krishna-Godavari offshore basin. Gas hydrates are solidified mixtures of compressed natural gas (CNG) and water that could meet the energy requirements of the entire nation. Samurdra Ratnakara, an advanced research vessel of the GSI, set off from Mangalore on the mission three weeks ago, and is likely to conclude its first phase this month. Monitored by NIO scientists, the GSI vessel would make attempts to locate the gas hydrate reserves, which are found in the shallow sediments along the continental margins at about 1-2 km below the seabed. About 20 scientists from the GSI branches in Mangalore, Kochi and Visakhapatnam along with the scientists from the Goa headquarters of the NIO, are participating in the study. In the seismic survey, it is proposed to cover an area of 19,000 sq km in the Cauvery-Mannar offshore basin, and another 6,100 sq km in the Krishna-Godavari offshore basin. The gas hydrates can expand by about 140 times under normal temperature and pressure to produce CNG for domestic and industrial usage. According to the scientists at National Geophysical Research Institute (NGRI), methane within the gas hydrates is estimated to be more than 1,500 times of the present natural gas reserves available in the country. Though it is too early, the scientists are of the view that the utilization of even 10 percent from this natural reserve is sufficient to meet the country’s energy requirement for about a century. A batch of Indian scientists from various organisations ranging from the NGRI to the NIO and the GSI to Directorate General of Hydrocarbons (DGH) have been on the mission to find out the reserves of gas hydrates for the past few years. The DGH has set itself a deadline of mid-2015 to commence commercial production of methane from gas hydrates, as part of the Gas Hydrate Programme. (www.newindianexpress.com)

'Petrochemical Park' next to Kochi BPCL refinery planned

March 7, 2015. The State Government is planning a ‘Petrochemical Park’ next to the BPCL refinery in Kochi to tap the potential of downstream industries in the petrochemical sector, Kerala Governor P Sathasivam announced in his policy address to the Assembly. The park will use feedstock from BPCL which is set to enhance its refining capacity. The government has also reiterated its commitment to assist Gas Authority of India Ltd (GAIL) to complete the LNG pipeline project calling it ‘critical to the development of the state. (www.newindianexpress.com)

Gujarat govt to set up two new LNG terminals of 10 MMTPA

March 4, 2015. Gujarat government said that it has planned to set up two new Liquefied Natural Gas (LNG) terminals of 10 Million Metric Tonnes Per Annum (MMTPA) capacity. Gujarat Chief Minister Anandiben Patel, who handles the ports portfolio, stated that two such LNG terminals are already operational in the state. At present, Gujarat has two operational LNG terminals, one at Hazira in Surat and the another at Dahej in Bharuch district. She stated that both these terminals have a combined capacity to handle 17.5 MMT LNG per annum. She stated that the Gujarat government plans to set up two more such LNG terminals to handle imported LNG. The Gujarat government plans to set up two new LNG terminals, one near Jafrabad in Amreli district and another at Mundra port in Kutch district, she said. Patel said that an LNG port terminal with Floating Storage and Re-gassification Unit (FSRU) with a capacity of 5 MMTPA would be built in Jafrabad. (economictimes.indiatimes.com)

CCEA extends domestic LPG and PDS kerosene subsidy by one year

March 4, 2015. The Cabinet Committee on Economic Affairs (CCEA) approved the extension of PDS (public distribution system) Kerosene and Domestic LPG Subsidy, 2002, and Freight Subsidy (for far-flung areas) Scheme, 2002, up to March 31, i.e. by one year. The move will likely help reduce the under-recovery of oil marketing companies. A subsidy of ` 22.58 per 14.2 kg LPG and ` 0.82/litre on kerosene sold through the public distribution system was being provided under the scheme. The freight subsidy was being provided to consumers in far-flung areas. Both schemes had ended on March 31, 2014. The Centre had deregulated the sale of non-PDS kerosene to check black-marketing of the fuel sold through the PDS. Market-priced kerosene sells for ` 27.68/litre while PDS kerosene costs ` 15.14/litre. (www.thehindubusinessline.com)

India's fuel demand projected to rise 3.3 percent in 2015/16

March 4, 2015. India's annual oil products demand is forecast to grow 3.3 percent in the next fiscal year as Prime Minister Narendra Modi's focus on local manufacturing and economic expansion will raise consumption of industrial fuels. The country is expected to consume 166.87 million tonnes of refined fuels in 2015/16 versus an estimated 161.57 million tonnes this fiscal year, according to a forecast by India's energy data body the Petroleum Planning and Analysis Cell (PPAC). Modi's "Make in India" campaign to make the country a manufacturing powerhouse, plus a push on infrastructure projects and a likely average monsoon will boost demand for industrial fuels like diesel, bitumen and petroleum coke. Indian economy is projected to grow close to 7.4 percent this fiscal year to March 31. It grew at 7.5 percent in December quarter from a year ago. In 2015/16, India's GDP is estimated to grow at 8-8.5 percent. The growth in the demand for diesel, which accounts for more than 40 percent of refined fuel consumption in India, is set to rise 4.1 percent to 71.32 million tonnes while that of gasoline is expected to grow 7.2 percent to about 19.72 million tonnes. Availability of cheaper credit after a second rate cut by Reserve Bank of India in as many months is expected to drive up the sale of vehicles. India is expected to become the world's third-largest passenger vehicle market by 2019, from sixth place currently, consultant IHS Automotive estimates. Demand for refined fuels mainly diesel will also get a boost if global oil prices remain stable at the current level of about $61 a barrel compared to about $115 in June last year. In October last year, India ended subsidies on diesel sales and since then retail prices of the fuel have been reduced by about 15 percent. India's kerosene demand is forecast to decline 3.7 percent as the federal government is encouraging use of liquefied petroleum gas, consumption of which is expected to rise 3.5 percent. Use of naphtha and fuel oil is projected to fall by 5.3 percent and 4.9 percent in the next fiscal year, the data showed. PPAC has released fuel consumption data up to January. (in.reuters.com)

[NATIONAL: POWER]

Generation……………

Tata Power commissions first unit of Hydro Power Plant in Bhutan

March 10, 2015. Tata Power commissioned 63 MW sized first unit of its 126 MW Dagachhu Hydro Power Corporation (DHPC) in Bhutan. This project is in line with Tata Power’s commitment to commission 120 MW of new Hydro Power Project this year as part of the centenary year celebration theme of Invisible Goodness, and is the first cross border project registered under UNFCCC’s Clean Development Mechanism (CDM), the company said. The Dagachhu project is a joint venture initiative between Tata Power and Druk Green Power Corporation, owned by Royal Government of Bhutan (RGoB), and National Pension & Provident Fund of Bhutan. With the commissioning of the project, Tata Power’s total hydro generation capacity stands at 513 MW and overall capacity at 8684 MW. The Dagachhu Project is 126 MW (2X63 MW) run of river hydro project located in Dagana Dzongkhag, Bhutan. The commercial flow of energy generated from the Dagachhu project to India officially started at 00:30 hours in the morning (Bhutan time) of 21th February 2015. The test run for the second unit of 63 MW will also be immediately started and expected to be completed soon. DHPC has entered into a 25 year Power Purchase Agreement (PPA) with Tata Power Trading Company Limited (TPTCL) for sale of power from the project. The power generated from the project shall be sold by TPTCL in the Indian power market. (www.business-standard.com)

160 power projects to generate 46.9 GW electricity: Arunachal Pradesh CM

March 9, 2015. Arunachal Pradesh has signed pacts with power developers to execute 160 projects, entailing total installed capacity of 46,948 MW, in the state. Chief Minister Nabam Tuki informed that the state government has inked memorandum of understandings (MoUs) and memorandum of agreements (MoAs) with power developers to execute these projects. Responding to a question from opposition leader Tamiyo Taga, Tuki disclosed that three projects -- 2000 MW Lower Subansiri Hydro Electric Project (LSHEP), 600 MW Kameng project and 110 MW Pare project -- are under execution. Works on Lower Subansiri project at Gerukamukh was stalled in December 2011 after anti-dam protagonists opposed its construction apprehending cascading affect on the people living in the downstream of the river. When Taga wanted to know the steps taken by the state to identify the developers who were not interested in executing projects despite signing the MoUs/MoAs, Tuki said that the government had already taken decision and cancelled contracts with a few developers for violating the agreements. Responding to a supplementary from BJP member Japu Deru, the Chief Minister informed that a few minor projects were executed during 1970s, 1980s and 1990s. (economictimes.indiatimes.com)

RattanIndia Power commissions 270 MW unit 4 at Amravati

March 9, 2015. RattanIndia Power, the erstwhile Indiabulls Power, said it has commissioned the fourth 270 MW unit of the 1,350 MW phase-I of its thermal plant at Amravati in Maharashtra. The company is developing a 2,700 MW coal-based plant in Amravati in two phases of 1,350 MW each. This unit is a part of the first phase of the project, it said. The first phase involves five units of 270 MW each. With the commissioning of the fourth unit, the total capacity of the first phase has increased to 1080 MW. (economictimes.indiatimes.com)

Avantha, Adani sign share purchase pact for Korba plant

March 4, 2015. Adani Power has signed a binding share purchase agreement with Avantha Power and Infrastructure to acquire 100 percent of its Korba West Power Company valued at ` 4,200 crore. Korba West Power Company Ltd (KWPCL) is a special purpose vehicle (SPV), valued at ` 4,200 crore, which has commissioned a coal-based thermal 600 MW power plant, Avantha Power and Infrastructure said. With this buy, the installed base of Adani Power will increase to 11,040 MW. The company has set a target of 20,000 MW capacity by 2020. (economictimes.indiatimes.com)

Transmission / Distribution / Trade…

Power prices slide to ` 1 per unit as Coal India steps up supply

March 9, 2015. Power prices at exchanges have dipped to nearly ` 1 per unit following monopoly miner Coal India's bid to meet annual target by pushing larger volumes in the last few weeks of the financial year amid a decline in demand. The state-run producer is trying to clear supply backlog to power plants, with the result that producers have accumulated about 20 million tonne of coal, the highest in the past few years. The surplus stock has pushed prices down by about ` 1.50 per unit over the past month. According to Coal India, by end of January, the miner was short of its annual target by about 120 million tonnes. In order to meet its yearly quota, the company produced and sold about 40 million tonnes of coal. By the end of February, though, it was still short of target by about 70 million tonnes. Coal India is unlikely to meet its annual target, officials said, although the miner is trying to sell as much as it can until March 31. Power demand is not likely to rise substantially by the end of the month as the weather is not forecast to see a rapid rise in temperatures. (economictimes.indiatimes.com)

Power distribution losses of ` 691 bn reported in 2012-13

March 9, 2015. Distribution losses, including theft, have caused a staggering ` 69,108 crore damage to power utilities in 2012-13, Power and Coal Minister Piyush Goyal said. These losses include distribution losses including theft of electricity, gap between average cost of supply and average revenue realisation, inadequate metering, poor billing and collection efficiency, the Minister said. The aggregate losses, after tax on accrual basis, incurred by utilities selling directly to the consumers was ` 69,108 crore during 2012-13, he said. The Minister said the transmission loss was the highest in Bihar at 54.63 percent and the lowest in Kerala at 9.13 percent followed by 9.53 percent in Himachal Pradesh. He said peak power shortage in the country reported by states during April-January period of the current fiscal stood at 7,006 MW. He said a target of 1,000 units per capita electricity consumption has been set for the year 2014-15 compared to 957 units in 2013-14.

Goyal said an estimated USD 250 billion investment target has been set for the power sector in next 4-5 years. Of this, USD 100 billion was planned to be used in the renewables, USD 50 billion in transmission and distribution sector, USD 60-70 billion in the power generation sector and USD 25 billion for the modernisation of old plants among others. (economictimes.indiatimes.com)

Not many takers for Tripura’s surplus power

March 9, 2015. In a country that had failed to carry out distribution sector reforms and lacks adequate transmission capacity, creating surplus electricity generation capacities may have disastrous fallout. Ask the Tripura government, that attracted the largest investment in power sector in North-East over the last decade, and you will know why. The gas resource-rich Tripura banked heavily on power capacity addition to serve the dual purpose of industrialisation and earning revenues through sale of surplus power. True to its expectation, it is now flooded with electricity but at its own peril. The first unit of 2 X 363.3 MW ONGC Tripura power (OTPC) is already commissioned. The second unit, which has been on stream for sometime, is expected to declare commerciality from this month. The 104 MW NEEPCO project is also expected to start generation from March. It means, beginning April, the total availability of power to Tripura will move up from 250 MW to 450 MW. Considering a peak demand of 250 MW in the evening hours, the State’s exportable surplus will be between 200-300 MW a day. For a State of mere ₹3,000 crore revenue budget, Tripura lost a mammoth ₹100 crore in electricity sales in 2013-14. State Power Minister Manik Dey says the loss may increase in 2014-15. This is because, in the absence of buyers, the State had to resort to either distress sale or pay up the generation utility for not lifting its quota. (www.thehindubusinessline.com)

SRM Energy to sell power plant in Cuddalore

March 9, 2015. Mumbai-based SRM Energy Ltd is planning to sell Cuddalore thermal power plant in Tamil Nadu. The power plant had been transferred to a wholly-owned subsidiary SRM Energy Tamilnadu Pvt Ltd. The parent company is in the process of implementing a 3X660-MW super critical thermal power plant based on imported coal, in Cuddalore. (www.business-standard.com)

PGCIL to invest ` 300 bn for southern States

March 7, 2015. The Power Grid Corporation of India Ltd (PGCIL) will invest ` 30,000 crore for the improvement of transmission infrastructure from northern States to southern States, Union Minister of State for Power and Coal Piyush Goyal said. Goyal said that the investment would be made over a period of two and a half years to three years. The Minister announced that Tamil Nadu would receive ` 1,000 crore under the Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY) for improving the electricity network in rural areas. Also, nine towns in the State had been chosen under the Integrated Power Development Scheme, for which ` 363 crore would be given.

Disclosing that the Finance Commission had granted ` 1,051 crore for renewable power projects, Goyal said the amount would be released this month. The Minister said it had been decided to give 100 MW of unallocated power from the second unit of the Kudankulam Nuclear Power Plant to Tamil Nadu, in addition to 100 MW from the first unit. This would mean that the State's share would be 1,125 MW out of 2,000 MW to be generated by the two units. (www.thehindu.com)

Power sector in 'neck-deep' debt: Haryana govt

March 7, 2015. The Haryana government has said that state-owned power generation and distribution companies have accumulated a massive debt of ` 38,345 crore in the last 10 years. These firms have piled up a loss of ` 27,333 crore in the past one decade, as per White Paper released by Haryana government. Unfolding the broad contents of second part of White Paper, the Haryana Chief Minister Manohar Lal Khattar said in the last ten years, the losses of state owned Haryana Power Generation Corporation increased by 500 percent and debt by 200 percent. Likewise, the losses and debts of power distribution companies Uttar Haryana Bijli Vitran Nigam and Dakshin Haryana Bijkli Vitran Nigam increased by 2,600 percent and 1,900 percent respectively.

Haryana Finance Minister Capt Abhimanyu said Haryana Power Generation Corporation Limited (HPGCL) had a cumulative loss of ` 87 crore in 2004-05. This loss increased by 500 percent to ` 438 crore in 2013-14. Since 2004-05, the company has remained in profit for four years and in losses for six years. Capt Abhimanyu said that power distribution companies -- Uttar Haryana Bijli Vitran Nigam (UHBVNL) and Dakshin Haryana Bijli Vitran Nigam (DHBVNL) remained in losses in all ten years since 2004-05. (economictimes.indiatimes.com)

Western states sell less power due to transmission bottlenecks

March 4, 2015. Western states sold a little over 1,000 million units or 27 percent less electricity in February due to power transmission bottlenecks in the region, India Energy Exchange (IEX) said. The Exchange continued to experience severe congestion on inter-state transmission system, especially on the western-southern region and western-northern region. The month of February also witnessed decrease in power demand and reduction in prices at IEX.

The average daily trade of 72 MUs (million units) was 5 percent lower than 75 MUs traded last month. Almost 2.03 BUs (Billion Units) was traded in February whereas 2.34 BUs were traded in January, 2015, IEX said. With sell bids at 3.40 BUs and buy bids at 2.89 BUs, the supply of power exceeded the demand. (economictimes.indiatimes.com)

GMR India to sell 500 MW power to Bangladesh from Nepal

March 4, 2015. Infrastructure major GMR India is to enter into an agreement with Bangladesh to export 500 MW electricity from two hydropower projects it is constructing in Nepal. GMR has already signed an agreement with the Nepal government to build the 900-MW Upper Karnali project in western Nepal and is in the final stages of acquiring permission for constructing the 600-MW Upper Marsyangdi-II project in central Nepal.

An agreement for the export of power to Bangladesh will be signed during the three-day regional energy conference starting in Kathmandu where energy ministers and officials looking after cross-border energy cooperation in India, Nepal, Bangladesh and Bhutan will be participating, according to Nepali officials. Nasrul Hamid, Bangladesh minister of state for power, energy and mineral resources, and Harvinder Manocha, GMR's country head for Nepal, will sign the relevant agreement which will be witnessed by Nepal Prime Minister Sushil Koirala. Once the memorandum of understanding is signed between the two parties, a power purchase agreement will be signed between GMR and Bangladesh Power Division. Nepali officials have welcomed the development as this will also pave the way for regional energy trading and also open avenues for other types of trading in sub-regional way. India's nod is also quite important as transmission lines would need to cross over to Bangladesh through India, and Bangladeshi officials are in talks with Indian authorities in this regard. (bdnews24.com)

Policy / Performance………….

Arunachal Pradesh will earn ` 4.4 bn annually from free power: Nabam Tuki

March 10, 2015. Arunachal Pradesh will earn revenue of ` 445 crore annually as revenue from 12 percent free power after the commissioning of three ongoing hydropower projects in the state, Chief Minister Nabam Tuki said. Tuki said the 110 MW Pare project and 600 MW Kameng project by North East Electrical Power Corporation (NEEPCO) were expected to be commissioned by this year and next year respectively. Work on the stalled on the 2000 MW Lower Subansiri hydro electric project would start soon, he said. All the power developers would have to give 12 percent free power to the state, which would get annual revenue of ` 17 crore from the Pare project, ` 95 crore from Kameng project and ` 333 crore from Lower Subansiri project, Tuki said. By harnessing all the hydropower potential, Arunachal Pradesh could be a self-reliant in the power sector and immensely benefit other states of the north east, he said. Terming Arunachal Pradesh as the 'power house' of the country with 60,000 MW hydropower potential, Tuki said the state could meet 40 percent power requirement of the nation. The state hydropower policy was in tune with the central policy and the consulting policies of other states of the country, particularly Himachal Pradesh, he said. (economictimes.indiatimes.com)

Banks to rethink loan pacts with power companies

March 10, 2015. Banks will have to rethink existing and future loan agreements with power companies if the latter get a loan for a power plant given by the government through a tender or a contract for a certain time period. According to the new accounting norms notified by the government recently, if a power company has done a power purchase agreement (PPA) with any state for such a plant, where it will get an assured return from the government, the plant may be considered a "financial asset" in the company's balance sheet. Banks give loans to power companies against the fixed assets on their balance sheets. Power companies categorise such power plants as fixed assets to avail such loans. All such power plants will be considered financial assets or intangible assets, instead of fixed assets. Most of the current PPAs (solar or otherwise) and agreements for ultra mega power projects will fall under this criterion. According to Appendix-C of the Indian Accounting Standards (IndAS) 115, relating to service-concession agreements, all such PPAs where the government controls the purchase of power and its price will be considered a fixed asset in the government's books and financial assets in the power company's books. However, in case a power company establishes a power plant on its own, and enters into a PPA with the government or any other buyer later, the power plant will remain in the power company's balance sheet as a fixed asset. If a company finds it difficult to apply this norm retrospectively, it may be allowed to apply the new norms from a transition date. The government has asked all companies, listed and unlisted, with a net worth of more than ` 500 crore, to start following these accounting standards for the accounting periods beginning April 2016. (www.business-standard.com)

Karnataka bullish on proposed nuclear plant, AP too is keen

March 10, 2015. Karnataka is ready to lock horns with Andhra Pradesh (AP) to get a nuclear power plant, which was originally meant to come up at Haripur in West Bengal. Andhra Pradesh and Karnataka have expressed readiness to offer land for the project. The positive response from the two states has come as a respite for the Union government which had approached Kerala and Odisha, apart from West Bengal, for possible nuclear plant sites. These states had, however, expressed reluctance in providing sites. The site selection committee, constituted by the Union government, had allocated the Haripur site to build the nuclear power reactor with Russian collaboration. However, the project did not take off due to stiff resistance from the locals, backed by political parties. In 2011, Rosatom, the Russian counterpart of India’s Department of Atomic Energy (DAE), asked India for an alternate site. During Russian President Vladimir Putin’s visit to India in December last year, Russia, which has offered to build 12 more nuclear power reactors, had again exerted pressure on India over the issue. Karnataka Energy Minister D K Shivakumar said that the state government has a positive approach towards the proposed 1000MW nuclear power plant. (www.newindianexpress.com)

Areva ‘ready to discuss’ transfer of n-technology

March 10, 2015. French nuclear technology company Areva SA is ready to discuss transfer of technology with the Indian Government in order to speed up the process for signing a contract for the Jaitapur nuclear power project in Maharashtra. As ‘Make in India’ has become a key policy of the Indian Government, Areva is open to any kind of technology transfer for this policy. But the components need to meet quality standards and be at a lower cost, Erwan Hinault, Chairman and Managing Director of Areva’s Indian arm said. Nuclear Power Corporation of India (NPCIL) is building the 10,000-MW power project in Jaitapur. Areva is hoping to sign a deal for supplying reactors for the project. In January 2009, a memorandum of understanding (MoU) was signed between the companies for building two EPR reactors, each having 1,650 MW capacity. But the final commercial agreement is yet to be signed. The EPR is a third generation pressurised water reactor. The main design objective of the reactor is enhanced safety. Once the agreement is signed, the entire nuclear supplier chain will open up for the Indian companies, said Hinault. In the Jaitapur project, Areva will supply the main reactor and other critical nuclear components. Six years have passed since the MoU, but the companies have not been able to reach a final commercial contract. NPCIL wants the final price of per unit of power to be ₹ 6.5 when the plant becomes operational. Hinault said regular meetings are under way with NPCIL for reaching the target of ₹ 6.5 a unit. Earlier the plan was to set up the plant by 2021, but given the delay, the commissioning could get postponed till 2024, he said. The French company had reported a loss of €4.83 billion ($5.37 billion) for its global operations for fiscal 2014. The company is putting in place a cost-cutting strategy. Hinault said the company continues to be bullish about the opportunity in India. (www.thehindubusinessline.com)

Delhi power minister wants discom-NTPC pact information

March 10, 2015. Delhi power minister Satyendar Jain has asked the power department for details of the power purchase agreements with NTPC. In a meeting, Jain said that the details of these agreements need to be studied to find out why Delhi is paying more for its power compared to other states. Drawing a parallel with Gujarat, where NTPC is supplying power at ` 2.13 per unit against Delhi, which is getting power for ` 4.14 per unit, while there might be any number of reasons, and perfectly legitimate ones, for the difference in price, it needed to be worked out whether Delhiites could pay less for their power. Delhi discoms for long have been demanding that power from central sector plants should be reallocated as per location and requirements. Discoms said that comparing Delhi's power sector with Gujarat was not feasible as the latter had invested massively in internal generation. (economictimes.indiatimes.com)

States may have to wait a while for coal block auction bonanza

March 9, 2015. Coal bearing States may have to wait longer to enjoy the financial benefits of the coal block auctions, as the Coal Mines (Special Provisions) Bill 2015 continues to face hurdles in the Rajya Sabha. The Bill was expected to be taken up, but due to the Opposition’s demand for Prime Minister’s statement on release of a separatist Kashmiri leader, it is now likely to come up. Even the Mines & Mineral Bill will now be taken up. Already passed in the Lok Sabha, both the Bills aim to replace their respective ordinances. The Ordinances have to be replaced by Acts of Parliament by April 5, but both the houses will break for a one month recess on March 20. The Centre has decided to transfer the entire proceeds from the auction of the coal blocks to host States such as Jharkhand, Odisha, West Bengal, Chhattisgarh, Madhya Pradesh and Maharashtra. (www.thehindubusinessline.com)

Parliamentary panel seeks suggestions on Electricity Act amendments

February 9, 2015. A Parliamentary panel has sought suggestions on the proposed changes to the Electricity Act which seeks to provide choice of power suppliers to consumers and propel growth in the sector. Power and Coal Minister Piyush Goyal had said that amendments to the Electricity Act, to bring in various reforms including improvement in power supply and allowing consumers to choose their supplier, should come into effect by April. The amendments proposed will promote competition, efficiency and improvement in the supply of electricity resulting in capacity addition and benefiting consumers. The Cabinet, in December, approved various amendments to the existing Electricity Act 2003. (zeenews.india.com)

Govt decides to speed up ` 900 bn power projects

March 9, 2015. While the government seeks to reform the land acquisition law this week, it has decided to fast-track 10 power projects worth ` 90,000 crore planned by state-owned companies led by NTPC, which have been held up by land-related issues, identified in the Economic Survey as the biggest hurdle for stalled public sector investments. The power ministry turned to the cabinet secretariat's project monitoring group to help bring back on track stalled investments involving over 15,600 MW of capacity and critical transmission lines for states such as Jammu & Kashmir. After factoring in the 10 projects taken up by the power ministry, 305 projects worth ` 18.85 lakh crore are now awaiting government intervention to get off the ground, including 97 public and private sector power projects with investments of ` 6.33 lakh crore. The group, set up to unlock hurdles facing big-ticket and strategic investments, has so far resolved problems facing over 200 projects worth ` 6.9 lakh crore. These included about 100 power projects worth ` 3.53 lakh crore, though some of them have come back to seek intervention on new hurdles that have emerged on their road to commissioning. NTPC is developing eight of the 10 projects that the power ministry has sought to expedite, with investments of over ` 76,000 crore at stake to generate about 15,000 MW. This includes a ` 5,000-crore joint venture between the Indian Railways and NTPC for a 1,000-MW plant at Nabinagar in Bihar, where the ministry has attributed delays to 'land acquisition and security related' issues. Of the 1,521 acres required for the plant, the joint venture has got about 1,100 acres. (economictimes.indiatimes.com)

Two of the five UMPPs proposed in Budget 2015 likely to be awarded this year

March 9, 2015. The government hopes to award two of the five ultra mega power projects (UMPPs) this year in the plug-and-play mode while the auction process for the remaining three announced in Budget 2015-16 may take at least another year to get off the ground. The first two UMPPs of 4,000 MW each, at Bedhabhal in Odisha and Cheyyur in Tamil Nadu, are ready with most clearances in place while awaiting review of the bidding norms. The auction for these projects was started in 2013 as per a model similar to the plug-and-play scheme proposed by the NDA government, but it was scrapped as private companies walked out in protest against the new bidding rules. An expert committee led by former Chief Vigilance Commissioner Pratyush Sinha is reviewing the bidding documents for the projects and is expected to submit its report to the power ministry soon. The committee has finished hearing concerns of all stakeholders, including companies, banks, electricity regulators and industry associations, which have recommended withdrawal of new norms that do not envisage ownership of the plants to the qualifying companies. The power projects will be transferred to the distribution utilities at the end of the concession period for a cost, as is done in case of other infrastructure projects in road and port sectors. Association of Power Producers said UMPPs have a great potential of success if these are offered in plug-and-play mode as stated in the Budget and the review committee balances the risk equitably. The government has identified land in Banka district of Bihar, Deogarh in Jharkhand and in Etah in Uttar Pradesh for setting up UMPPs. The sites for two additional UMPPs in Odisha have also been identified, the power ministry said. The situation will be clear by the end of March after the committee submits its report. However, auctioning projects in the plug-and-play model announced in the Budget will take longer as acquiring land as per the new law and obtaining environment and other regulatory clearances will take at least one year. Bidding process of UMPPs and their financial closure might take another year, the official said. Finance Minister Arun Jaitley had said in his budget speech that the government plans to set up five new UMPPs - requiring total investments of about ` 1 lakh crore - through the plug-and-play model, whereby unencumbered possession of land, all clearances and linkages will be in place before the projects are awarded through auction. (economictimes.indiatimes.com)

Nuclear power way cheaper than others: Govt

March 8, 2015. Nuclear power is substantially cheaper than most types of thermal sources of energy and hydro-electricity, claims the NDA government as it fast-tracked India’s nuclear energy target by three times. Soon after coming to power in July, 2014, the Narendra Modi government had set a target of tripling the existing nuclear capacity of 4780 MW in the next ten years. The government told Parliament why it made economic sense to harness the power of atom. The per unit cost of electricity from the nuclear source varies between 97-394 paise. This is comparable to non-pithead coal (375-529 paise), which is ferried to a power plant located at a distance as well as pithead coal (147-385) where the plant is located at the mine site. All other sources of thermal energy such as natural gas with and without the control of the administrative price mechanism, liquefied natural gas and liquid fuel like naptha or diesel, are far more expensive. Nuclear power plants, however, are more capital intensive than coal or gas fired plants. Four 700 MW units are under construction at Rawatbhatta in Rajasthan and Kakrapar in Gujarat. The construction of two 700 MW units in Gorakhpur in Haryana are slated to start in 2015-16. The second 1000 MW unit at the Kudankulam plant is likely to be commissioned in 2015. The large uranium mine and process plant at Tummalapalle in Andhra Pradesh is expected to start production soon. (www.deccanherald.com)

Centre committed to support Tamil Nadu on power: Goyal

March 7, 2015. The Centre is committed to supporting the power sector in Tamil Nadu including allocation of a major share of power from the Kudankulam Nuclear Power Project, as part of addressing the acute power shortage in the state, Union Coal and Power Minister Piyush Goyal. He was talking to reporters after an interaction with Tamil Nadu Chief Minister O Panneerselvam and senior government officials at the Secretariat. He complemented the government besides officials for taking steps to bring down peak energy shortages to "a very small level". (economictimes.indiatimes.com)

Govt to train 7 lakh people by 2018 to meet power sector needs

March 4, 2015. The government aims to train as many as 7 lakh people for various segments in power generation in line with its ambitious plans of producing 1,75,000 MW renewable energy 2022. National Power Training Centre (NPTI), a body under the Ministry of Power will train 7 lakh people in the next three years across various branches of the sector. NPTI in its 40 years of existence has trained 2,67,000 people. Looking at the requirements of the power sector we have decided on a three-year roadmap. We have a programme to train 7,00,000 people, Power Minister Piyush Goyal said. Under the ambitious programme the ministry will train one lakh people in the power sector in 2015-16, 2 lakh in 2016-17, and 4 lakh in 2017-18. The proposed training programme will cover manpower requirements in ramping up power generation, building transmission and sub-transmission networks among other things. Ministry of Power has set a target of generating 1,75,000 MW from renewable energy sources by 2022. Of the targeted 1,75,000 MW, lion’s share of 1,00,000 MW will come from solar power, 60,000 MW from wind, 10,000 MW from biomass and the remaining 5,000 MW from small hydro projects. At present, the solar power generation capacity is at about 2,700 MW; Wind - 21,000 MW; Small Hydro - 3,800 MW and biomass - 4,100 MW. Small hydro power projects are plants with up to 25 MW generation capacity. (www.thehindubusinessline.com)

Govt begins 2nd phase of coal mine auctions

March 4, 2015. Government began the second round of coal mine auctions by putting on offer four blocks - all in Jharkhand - with firms including Adani Power, JSW Steel, SAIL and BALCO in the race. The mines on offer are Jitpur, Moitra, Brinda and Sasai. The companies vying for Jitpur mine - earmarked for the power sector - are Adani Power, Adhunik Power and Natural Resources, Jaiprakash Power Ventures and Jindal Power. The mine was earlier allocated to Jindal Steel & Power Ltd (JSPL). For Moitra mine - earmarked for the non-power sector - the companies in the race are Jayaswal Neco Industries Ltd, JSW Steel and SAIL. It was earlier alloted to Jayaswal Neco. With regard to Brinda and Sasai coal blocks, the companies found to be technically qualified are BALCO, Easternrange Coal Mining Pvt Ltd, Sesa Sterlite and Usha Martin. The two blocks were earlier alloted to Abhijeet Infrastructure Pvt Ltd. The e-auction proceeds from the first lot of mines are over ` 1 lakh crore. (www.business-standard.com)

[INTERNATIONAL: OIL & GAS]

Upstream……………

Pelikan field starts production offshore Indonesia

March 10, 2015. UK independent energy firm Premier Oil reported the start-up of gas production from the Pelikan field in the Natuna Sea Block A offshore Indonesia. Premier said that production from Pelikan began – adding to production from the Naga field (also on Natuna Sea Block A), which started in November. Pelikan and Naga is delivering additional reserves into Singapore and the domestic Indonesian market under Premier's long-term gas contracts. The firm said that production of up to 200 billion British thermal units per day will allow it to increase operational flexibility and to respond to increase Singaporean or domestic gas demand. Premier operates Natuna Sea Block A, with a 28.67-percent stake, on behalf of partners that include KUFPEC, PTT and Petronas. (www.rigzone.com)

Three offshore gas fields in Myanmar to shut down for maintenance in April

March 10, 2015. Myanmar will shut down three of the country’s offshore gas fields for scheduled maintenance next month, the Myanma Oil and Gas Enterprise (MOGE) said. Production from the three gas fields – Yadana, Yetagun and Zawtika – will each be halted for around a week commencing in late April for annual maintenance, according to the MOGE. The Yadana gas field in Blocks M5 and M6, operated by France’s Total S.A. and which has been in commercial production since 2000, will shut down for maintenance from April 10 to April 19. Meanwhile, the planned shutdown at the Yetagun field in Blocks M12, M13 and M14 – operated by the upstream arm of Malaysia’s national oil company Petroliam Nasional Berhad (Petronas) Petronas Carigali – will take place from April 20 to April 27. (www.rigzone.com)

Cairn Energy sees 50 percent lower rig cost sustaining Senegal drilling

March 10, 2015. Cairn Energy Plc expects a slump by half in the cost of oil rigs to sustain the U.K. producer’s exploration in Senegal even after crude prices sank in previous months. Cairn and its venture partners last year found oil in two blocks off Senegal, West Africa. The company expects to generate cash in the country by 2020 or 2021, Chief Executive Officer Simon Thomson said. The oilfield-services industry is bracing for slow business this year after the value of Brent crude sank by about half in 2014. The crash in prices has forced some oil producers to delay or cancel projects, sapping demand for drilling companies and allowing their remaining customers to negotiate cheaper rates. Cairn operates three blocks off Senegal with a 40 percent working interest. ConocoPhillips has 35 percent, FAR Ltd. of Australia 15 percent and the rest is owned by Petrosen, the national oil company. (www.bloomberg.com)

CNOOC commences oil production at Qinhuangdao 32-6 project in Bohai Bay

March 10, 2015. China National Offshore Oil Corp. Ltd. (CNOOC) announced that its Qinhuangdao 32-6 comprehensive adjustment project in Bohai Bay offshore China has commenced production. The Qinhuangdao 32-6 oilfield is located at the central north of Bohai Bay with an average water depth of approximately 65 feet. The main production facilities of Qinhuangdao 32-6 comprehensive adjustment project include 4 platforms and 99 producing wells. This project is fully on-stream and expected to reach its overall development plan designed peak production of approximately 36,000 barrels per day in 2015. (www.rigzone.com)

BP makes second deepwater gas find off Egypt

March 9, 2015. BP has made a second large gas discovery off Egypt as part of a concession estimated to contain more than 5 trillion cubic feet, the energy company announced. BP Egypt's Atoll-1 is a deepwater exploration well located around 80 kilometres north of Egypt's Damietta and is the country's deepest well ever drilled, BP said. The company drilled the well at 6.4 kilometres depth and expects to go another kilometre deeper. (af.reuters.com)

Downstream…………

Chevron CEO says 'quite a bit of interest' in Hawaii refinery

March 10, 2015. Chevron Corp has seen "quite a bit of interest" among prospective buyers for its 54,000 barrel-a-day refinery in Kapolei on the Hawaiian island of Oahu, Chief Executive Officer (CEO) John Watson said. The company hired Deutsche Bank and began seeking buyers last fall for the refinery, one of the smallest in its global portfolio. (www.downstreamtoday.com)

Bahrain refinery expansion to cost some $5 bn, online by 2019: Energy Minister

March 10, 2015. An expansion of Bahrain's Sitra crude oil refinery is expected to cost around $5 billion and the facility is likely to be commissioned by 2019, the Energy Minister Abdul-Hussain bin Ali Mirza said. The increase in capacity according to the current plan is from 260,000 barrels per day to 360,000 and it will be commissioned by 2019. Bahrain lacks the ample crude oil and financial resources of the big Gulf energy exporters, and its state finances are under heavy pressure from the plunge of oil prices since last year. But Bahraini officials have said they will press ahead with key projects that are needed to develop the economy. Construction of a pipeline between Saudi Arabia and Bahrain, which will replace an ageing one and lift capacity to 350,000 bpd from 230,000, is expected to be finished by 2018, Mirza said. Previously, officials had estimated the pipeline would be completed by the third quarter of 2016. Mirza did not give a reason for the change. He said that this year Bahrain would ask companies to bid to explore offshore blocks for oil and gas. He did not give a specific date or say which companies would participate as a roadshow for investors has not taken place yet. (en-maktoob.news.yahoo.com)

Mexico's Pemex says Tula oil refinery back to normal after fire

March 6, 2015. Mexican state-owned oil company Pemex said that it had contained a fire at its Miguel Hidalgo refinery and that the facility was back to normal operations. No workers were injured, and the facility near the city of Tula in central Hidalgo state sustained only minor damages, the company said. The morning fire ignited in a leaking hydrogen compressor at the refinery's residual hydrodesulfurization plant. The refinery, Pemex's second-biggest, has a crude processing capacity of 315,000 barrels per day. (www.downstreamtoday.com)

ADNOC to export first cargoes from expanded Ruwais refinery in March

March 5, 2015. Abu Dhabi National Oil Co (ADNOC) will export its first diesel and jet fuel cargoes from the newly expanded Ruwais refinery in March, adding to a supply glut facing Asia and the Middle East, traders said. The company has sold its first diesel cargo to be loaded from Ruwais between March 12 and March 14 and its first jet fuel cargo to be loaded between March 21 to 23, the traders said. The diesel cargo was likely sold to Brazil's Petrobras and the jet fuel cargo to French oil major Total , they said, though this could not immediately be confirmed. ADNOC is currently in talks to sell a second diesel cargo to be loaded over March 22 to 24, and is expected to slowly ramp up overall exports once production is stable, they said. ADNOC's expanded Ruwais refinery is currently running at about 50 to 60 percent of its capacity, and is expected to export its first gasoline cargo in April when it starts up a residual fluid catalytic cracking (RFCC) unit. The expansion is expected to more than double the capacity of the refinery from 415,000 barrels-per-day (bpd) and will process Abu Dhabi's Murban crude oil. Once fully commissioned, the expanded refinery is expected to produce an additional 8 million tonnes a year of diesel and about 4 million tonnes a year of jet fuel. The refinery currently produces 5 million tonnes a year of diesel and 6 million tonnes a year of jet fuel. Ruwais' expansion comes at a time when new refining capacity from the Middle East, including two new refineries in Saudi Arabia, are adding to excess supply while diesel demand from major consumers such as China and Indonesia has slowed. (www.downstreamtoday.com)

Transportation / Trade……….

Libya to export over 2 mn barrels of oil from east