-

CENTRES

Progammes & Centres

Location

WEEK IN REVIEW

Ø RENEWABLE ENERGY: Modifying Solar Calculations

ANALYSIS/ISSUES

Ø Things never turn out the way you expect: Asian LNG spot prices expected to go on lasting plunge

DATA INSIGHT

Ø Sales Tax/VAT Collection from Petroleum Sector: State-wise Scenario

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· DGH backs ONGC demand for appointing expert in KG basin issue

· Vijay Kelkar wants existing regime for oil contracts

· Gas reserves at Mozambique field scaled up; ONGC, BPCL cheer

· IOC plans to build ` 300 bn refinery at Mundra

· India’s Feb Iranian oil imports fall 36 pc against Jan

· Impounding of water in NTPC's Koldam hydel project begins

· NHPC's Parbati project to supply power to the National grid

· Russia's Lukoil eyes new gas deal in Saudi Empty Quarter

· Gazprom proposes oil, gas development in Crimea

· Shell discovers oil at Limbayong field in offshore Sabah

· Salamander Energy finds gas in Indonesian well

· Petroperu to sign Talara refinery expansion contract

· Pipeline construction completes on PNG LNG project in Papua New Guinea

· CEEC wins Vietnam and Bangladeshi power plant contracts

· Gaza's power plant resumes operations

· KSA's ACWA to build $1 bn power plant in Mozambique

· Reykjavik plans to start $2 bn Ethiopian power project

· South African state coal miner seen as answer to Eskom Gap

POLICY & PRICE

· Optimism on gas prices, subsidies: OIL

· RIL gas-pricing case to be heard on March 24

· KSEB to provide 4.35 lakh connections

· CERC compensatory tariff won't burden discoms, consumers: Care

· Nuclear fuel complex to come up in Rajasthan

· Palestinians seek to drill for oil in West Bank

· Peru to open bidding on offshore oil blocks

· Azerbaijan planning third stage of Shah Deniz project after 2025

· Putin opens up Europe’s energy fault line along Oder-Neisse

· Abu Dhabi seeks Fukushima lesson in nuclear safety, Adviser says

· France’s industrial giants call for price cap on nuclear

· Japan’s first new geothermal power plant in 15 yrs to open next month

· China Africa develops mine, 300 MW power plant

· Japan regulator expedites safety checks on two reactors

· Ignoring water risks in India will imperil business: CDP

· Su-Kam makes its first solar installation in Tripura

· ACME Solar wins bids for 100 MW solar PV power projects

· Modi signals solar revolution for power market: Corporate India

· East India's first net-zero building coming up at Bhubaneswar

· California may cut gasoline demand 9 pc by 2020

· GE unit to invest 100s of millions of euros in EU renewables

· Cahill to build $241 mn waste-to-power plant in Barbados

· EU may allow renewable energy-linked aid to 62 industries

· Norway to spend oil cash on renewables says PM

· Merkel’s green push sinks German coal profits

· Bluesphere to convert organic waste into electricity

· Tech needed to combat climate change: Murkowski

· Hitachi, Daikin, Mizuho to participate in UK heat pump project

· ArcelorMittal, Tata call for Europe climate balance

WEEK IN REVIEW

RENEWABLE ENERGY

Modifying Solar Calculations

Lydia Powell, Observer Research Foundation

|

L |

ast week one of the key contenders in the elections declared that the colour of energy is saffron and that India was on the verge of a ‘saffron (solar) revolution’. He seemed to believe that the saffronisation of energy, along with most other things, is necessary to bring ‘India out of the dark ages’. If seen in the context in which these observations were made, one cannot find fault with what the leader said. Any election contender inaugurating what is labelled as India’s largest solar project would have said roughly the same thing, except perhaps he/she would have preferred a different colour and possibly also a different shape for energy. His argument is borrowed from Indian solar entrepreneurs. They are typically sons and daughters of the business and political elite in India. Having attended a university in the West they return with borrowed views that mix superficial concern for the environment with even more superficial understanding of the poor and their needs and wants. They may have failed to see energy poverty when it was staring at them directly but when they see it through the eyes of the West, they embrace it like they embrace anything that comes from that direction. But they are not blind to the profit opportunity it presents. At one stroke, not only do they get to be environmentally and politically correct but also profit out of the combination.

The rhetoric that combines scarcity and poverty and turns it into profit is also magical to aspirating leaders in India that they embrace it with little thought. The leader trying to colour energy put it something like this: India is blessed with over 300 days of sunlight and when put in the hands of the right entrepreneur (and not to mention the right politician) it would put an end to almost India’s energy scarcity and in the process save the world from climate calamity. The problem is that like most pre-election promises it scores a perfect zero on ‘considered thought’ and a perfect ten on ‘sounding good’. Sounding good is necessary especially in election speeches but this is not sufficient to make sense. Sounding good often involves merely trivialising and oversimplifying what are actually complex issues. Modifying (or de-modifying?) this simplistic narrative is necessary.

India’s energy ‘problem’ has always been framed as one of absolute scarcity. This scarcity narrative is not unique to politicians contesting elections. Many of India’s policy documents and policy analysts reiterate this idea. It is illustrated by the gap between the large and growing need for energy on the one hand and dwindling domestic energy resources on the other. For passive consumers of the scarcity rhetoric, the idea that a politician blessed with magical qualities, could convert 300 days of abundant and free sunlight into electricity for 400 million people and overcome natures injustice of having denied vital energy resources to India, is very compelling.

These 400 million people without access to electricity are the favourite constituency for every politician pushing everything from energy options to exemptions from multilateral obligations. The Prime Minister used them for pushing nuclear energy, the Environment Minister used them for getting out of climate mandates and now a politician wants to ride on their backs to electoral victory. But these 400 million lives for whom scarcity is a reality are unlikely to benefit from any of the propositions that they essentially subsidise. The narrative of scarcity is not intended to address their scarcity; it is designed to assist those in the business of combating scarcity.

Like most narratives on scarcity, the narrative on energy resource scarcity naturalises ‘scarcity’. Nature is blamed for people not having enough energy. This in turn justifies inadequate access to modern energy sources in India especially among the marginalised sections of the society and absolves the politician, the bureaucrat and the rest of the society of any responsibility. The narrative of scarcity also diverts attention from more relevant domestic political, administrative and economic inadequacies and inequalities that keep the nation and its people in perennial energy insecurity. In addition, the emphasis on absolute scarcity privileges supply based solutions. Supply based solutions facilitates the allocation of exclusive privileges to agencies in the public and private realm which seek to find, produce and supply energy, irrespective of whether it is from the sun, land or the oceans. The list of privileges offered to entice potential suppliers of energy includes but not limited to handsome capital subsidies, tax exemptions and most importantly natural resources such as land or access to land and ocean based resources.

The solar programme is not an exception, especially in the State which the said leader represents. The national and state solar programmes out-compete each other in throwing public resources at private entrepreneurs but ask for almost nothing in return. One could potentially take what is given and walk away as it comes with an early exit option. Even though the wealth to be accumulated from solar projects is unlikely to match the scale of wealth accumulated from fossil fuel resources, it could lead to substantial resource transfers from the public to the private entrepreneur. Studies have estimated that more than 60% of billionaire wealth in India (at its peak in 2008-09) was generated from ‘rent think’ industries in which natural resource extracting industries are among the most important. Even the Economist magazine which is generally not critical of wealth accumulation dedicated several pages in one of its recent issues to analysing crony-capitalism (glorified as public-private partnerships) in India and ranked India higher than China in its index of crony-capitalism.

For those who have observed the scandals arising from the allocation of exclusive privileges to extract fossil fuels, it will not be difficult to see that the solar rush is likely to end the same way with little to show by way of abundant supply. What the solar calculations reveal is that behind every politician and his rhetoric are a thousand entrepreneurs waiting to extract their pound of flesh from public resources. Rather than painting the same story with a different colour, aspiring leaders would do well to de-couple energy from all its political colours.

Views are those of the author

Author can be contacted at [email protected]

ANALYSIS/ISSUES

Things never turn out the way you expect: Asian LNG spot prices expected to go on lasting plunge

Thomas Elmar Schuppe, CIM Integrated Expert on Energy, Observer Research Foundation

|

N |

atural gas markets sometimes tend to be observed as a somewhat stoical or inertial exchange institution for natural resources. Nevertheless, this always depends on the perspective from which one is looking at it, not only according to regional or local aspects but also with regard to the timeline. Needless to say that some change can be observed for the past, however, there is more structural and fundamental change foreseeable in the years to come, surely the most crucial turnaround the “global gas market” has experienced so far still riding the unconventional wave...if it becomes true what analysts progressively project.

The initial step on the rocky and long‑lasting road towards a “global gas market” can be attributed to the onset of natural gas trade by means of LNG carriers and corresponding liquefaction and regasification infrastructure more than 50 years ago (the first liquefaction facility was set up 1964 in Algeria). This effectively has enlarged ‑ the previously regionally bounded ‑ scope of gas trade by pipeline to more or less unlimited reach in the sense that you can build up LNG regasification terminals wherever it appears technically and economically feasible. (It is a matter of course that the liquefaction facilities should be located more or less within the range of the natural gas wellhead).

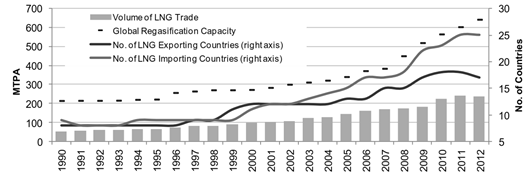

The steady expansion of the global LNG trade within the last two decades is illustrated in Figure 1: the volume of LNG traded has increased about fivefold (to more than 240 mt in 2011), global regasification capacity as well as the number of LNG exporting and importing countries have almost continuously increased; especially the import or rather regasification part has gathered pace in the last decade.

Figure 1: Development of global LNG trade

Source: IGU (2013)

Nonetheless, the “global LNG market” was not well balanced in terms of supply and demand. The number and capacity of regasification terminals “naturally” outstrips that of liquefaction trains by far. Even if average liquefaction utilization (> 80%) is more than twice as high as the global regasification utilization rate, there is a permanent undersupply (and over demand respectively) mostly driven by the surge in Asian demand in recent years. And notwithstanding of rising interregional trade there is still no uniform “global LNG market” with sufficient liquidity as well as a single pricing structure towards a widespread marked induced pricing according to its marginal cost distinguishable. Instead there are still pronounced regional LNG supply and price dynamics with quite large and persistent inter-regional spreads recognisable. However, the increasing flexibility (divertible LNG contracts as well as reloadings and re-exports respectively) and the emergence of more and more portfolio traders together facilitate spot and inter-basin trade as well.[1]

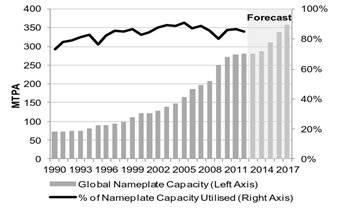

Furthermore, it is expected that internal regional market dynamics are beginning to redraw the global LNG picture for the forseeable future: first and foremost based on the ongoing shale gas boom in North America and coal seams gas in Australia (but also new LNG projects in Africa) that will lead to a significant ramp up of the overall global LNG liquefaction capacity by almost one third from 2011 until 2017 (see the ‘forecast’-part in Figure 2). Taking into account the enormous upside potential from the U.S. (due to not yet approved export licences) the increase might even end up in an addition of about 50% of global liquefaction capacity between 2011 and 2018 as CERI (2013) has recently illustrated. Paired with some LNG demand mitigating developments in the Pacific basin (particularly the gradually restart of Japanese nuclear power plant in the short run and the development of Chinese shale gas in midterm) this can turn out to rebalance the global LNG market in favour of the LNG importers and concomitantly influences prices as well as pricing in Asia’s LNG market.[2]

Figure 2: Global LNG Liquefaction Capacity 1990-2017 (Forecast 2012-2017) and Utilisation

Source: IGU (2013)

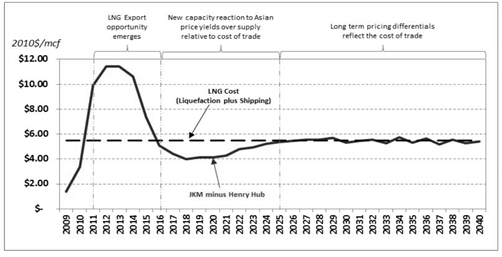

In this context a recently published study by the Rice University’s Baker Institute (Medlock III (2014)) has demonstrated the price effect of combined higher supply and somewhat curbed Asian demand quite clearly by stating that the Asian consumers might be paying even more for US LNG in 2016‑2025 in comparison with spot market purchases, because the Asian LNG spot market’s premium over Henry Hub prices might drop to the assumed cost of U.S. gas’ liquefaction plus shipping from North America to Asia (of about 5.50 US‑$/MMBtu) or even dipping below the expected price spread for a specific period. Particularly the latter is dramatically shown in the middle part of Figure 3 for the time period 2016‑2025 “new capacity reaction to Asian price yields over supply relative to cost of trade”.

Figure 3: Price Spread and LNG Transport Cost between U.S. and Asia 2009‑2040

Source: Medlock III (2014)

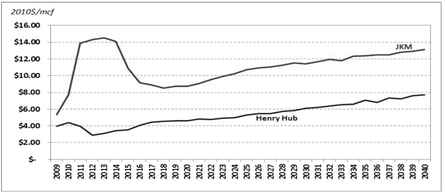

In absolute price terms the applied Rice World Gas Trade Model runs came up with a calculated price level for Asian LNG even below 12 US‑$(2010)/mcf to sustain for more than two decades, starting with a deep plunge at about 2015 down to 8.50 US‑$(2010)/mcf or so (Figure 4).[3] According to the model results the price slump already get started in 2014. The Henry Hub – JKM price spread is expected to level out at a level roughly equalling transportation and liquefaction cost from North America to Asia-Pacific, indicating a liquid and functioning global LNG market.

Figure 4: Longterm Price Projection for Henry Hub and JKM 2009-2040

Source: Medlock III (2014)

The perspective on crunching Asian spot prices is generally confirmed by Energy Aspect in their recent “Global LNG Outlook” (Energy Aspect (2014)). Based on a fundamental analysis of future developments on the supply and demand side, the research consultancies determine that Asian LNG prices will start to drift throughout the year 2015 as the impacts of greater liquefaction volumes edging into the Pacific Basin are increasingly felt. They expect that India LNG spot prices will trend down to about 10.5 US‑$/MMBtu in the last quarter of 2015, therefore being slightly above European LNG prices and at somewhat more than 6 US‑$/MMBtu above Henry Hub (reflecting roughly the cost difference as well).

To put it in a nutshell, even if these cited forecasts and models ‑ like all forecasts and models in general ‑ are fraught with some uncertainties, they nonetheless indicate that the global natural gas trade might face a profound turnaround within the near future and might turn out to develop into a more liquid and functioning market. From the perspective of an Indian LNG importer particular attention should be paid to the following issues:

(1) The global LNG market might turn out to be more dynamic than one might have expected.

(2) The long-standing view of an unbreakable seller’s market might change rapidly into one of a long lasting buyer’s market (even if scope and timing are cannot be predicted properly).

(3) Beware of signing LTC’s too early and of contracting without price re-negotiation clauses.

(4) Even now apparently “Henry-Hub plus-formula” does not automatically stand for the lowest price among future Indian LNG import options.

(5) The proposed natural gas price perceptions according to domestic production (based on the proposals of the Rangarajan Committee Report and beyond) might converge to international prices faster than one thinks.

(6) Only sufficient capacity of rLNG provides the opportunity to participate successfully in the coming buyers market conditions. However, paving the way to benefit from upside risks of LNG supply will have to start now (see Schuppe (2014)).

If one would have supposed that the established global gas market structure is unbreakable, it might turn out to be better to think twice about it.

References: CERI (2013), Global LNG: Now, never or later?, Study No. 131

Energy Aspects (2014), Up but not away, Global LNG Outlook, Feb. 2014.

IGU (2013), World LNG report – 2013 Edition, International Gas Union.

Medlock III (2014), Natural Gas Price in Asia: What to Expect and What It Means, A Research Progression from “US LNG Exports: Truth and Consequence”, James A. Baker III Institute for Public Policy, Rice University.

Schuppe (2013), “Flexibility turns out to be trump in stumbling European LNG market”, ORF Energy News Monitor, Vol. X, Issue 23, 11/23/2013 [http://orfonline.org/cms/sites/orfonline/EnergyHome]

Schuppe (2014), Future of Natural Gas in India: Paving the Way to Benefit from Upside Risks of LNG Supply, ORF Issue Brief # 67, Feb. 2014.

Views are those of the author

Author can be contacted at [email protected]

DATA INSIGHT

Sales Tax/VAT Collection from Petroleum Sector: State-wise Scenario

Akhilesh Sati, Observer Research Foundation

(in ` Crore)

|

State/UT |

2011-12 |

2012-13 |

% Change |

State/UT |

2011-12 |

2012-13 |

% Change |

|

Andhra Pradesh |

9,538 |

10,802 |

13.3 |

Nagaland |

55 |

60 |

9.5 |

|

Arunachal Pradesh |

42 |

39 |

-6.4 |

Orissa |

1,882 |

2,090 |

11.1 |

|

Assam |

1,868 |

1,945 |

4.1 |

Punjab |

2,607 |

2,834 |

8.7 |

|

Bihar |

2,461 |

2,784 |

13.1 |

Rajasthan |

4,770 |

5,351 |

12.2 |

|

Chhattisgarh |

1,704 |

1,983 |

16.4 |

Sikkim |

43 |

48 |

11.0 |

|

Goa |

572 |

377 |

-34.0 |

Tamilnadu |

9,245 |

11,288 |

22.1 |

|

Gujarat |

10,412 |

12,178 |

17.0 |

Tripura |

137 |

159 |

16.4 |

|

Haryana |

3,459 |

3,924 |

13.5 |

Uttar Pradesh |

8,870 |

10,158 |

14.5 |

|

Himachal Pradesh |

147 |

164 |

11.5 |

Uttarakhand |

722 |

810 |

12.1 |

|

Jammu & Kashmir |

742 |

844 |

13.7 |

West Bengal |

4,228 |

4,791 |

13.3 |

|

Jharkhand |

1,241 |

1,478 |

19.1 |

Andaman & Nikobar Islands |

0 |

0 |

- |

|

Karnataka |

6,164 |

7,161 |

16.2 |

Chandigarh |

68 |

70 |

2.3 |

|

Kerala |

4,088 |

4,488 |

9.8 |

Dadra Nagar Haveli |

5 |

5 |

-13.7 |

|

Madhya Pradesh |

4,528 |

5,392 |

19.1 |

Daman & Diu |

|||

|

Maharashtra |

14,815 |

16,939 |

14.3 |

Delhi |

2,395 |

2,550 |

6.5 |

|

Manipur |

76 |

82 |

8.0 |

Lakshadweep |

0 |

0 |

- |

|

Meghalaya |

4 |

2 |

-53.4 |

Pondicherry |

13 |

18 |

35.3 |

|

Mizoram |

44 |

60 |

36.3 |

TOTAL |

96945 |

110875 |

14.4 |

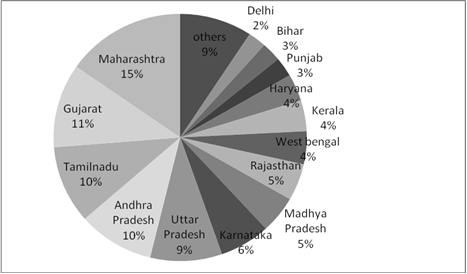

Share of States in Sales Tax/Vat Collection (for 2012-13)

Source: Petroleum Planning & Analysis Cell.

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

DGH backs ONGC demand for appointing expert in KG basin issue

March 17, 2014. Upstream regulator DGH has backed ONGC's demand for appointment of an international expert to assess if Reliance Industries was drawing out any of its gas in the KG basin. Oil and Natural Gas Corp (ONGC) says at least three wells drilled by RIL in the eastern offshore KG-D6 block are within "few hundred meters" of its gas fields and it fears the two may be sharing the same pool of reservoir. Since it has not yet begun producing from its side, ONGC feels RIL wells may be pumping out its share of gas. The Directorate General of Hydrocarbon (DGH) has asked RIL to immediately share data on the gas reservoir on its side of the block as well as production flows with ONGC. (economictimes.indiatimes.com)

Vijay Kelkar wants existing regime for oil contracts

March 14, 2014. Vijay Kelkar, chairman of the expert panel on energy security, has stuck to his position that the existing regime for oil and gas contracts that governs oil and gas fields including Reliance Industries Ltd's KG-D6 block should continue, and shrugged off allegations that parts of his report were plagiarised from a presentation from the Association of Gas and Gas Operators (AOGO). Kelkar said the committee had requested AOGO to provide data and analysis of issues that affect the sector. These were included in its interim report, which was submitted to the government in January. The controversy over plagiarism arose after the former Delhi Chief minister Arvind Kejriwal wrote to the Prime Minister complaining about the impending hike in gas prices from $4.20 to $8.40 per unit. The reference to alleged plagiarism crept into the official communication between PMO and the petroleum ministry. The committee has also been accused of going beyond its terms of reference and making recommendations on what the contractual regime should be. In the existing system, the operator of a field first recovers the development cost and the government gets its share later. The oil ministry had initiated a cabinet proposal to change this and adopt the system of revenue sharing, where the government gets paid a part of the sales proceeds the moment production starts. The change was proposed because in the revenue-sharing system, the government is not concerned about possible cost inflation by a contractor, and there would be no scope for controversies such as the one surrounding RIL's KG-D6 block, where the company has been accused of overstating costs. The company has been penalised for spending excessively on infrastructure, which turned out to be surplus after gas output fell sharply. The company strongly denies the charge and has initiated arbitration Kelkar's panel has proposed that the current system should continue. One member of the committee gave a note of dissent saying this recommendation was not in line with the terms of reference of the committee. Kelkar disagreed. Kelkar said the committee has been given more time to submit its final report, which will now be presented to the new government by the end of June. The Rangarajan committee, which submitted its report in Dec 2012 had proposed the revenue sharing regime. (economictimes.indiatimes.com)

GVK seeks ` 1.8 bn refund for surrender of gas blocks

March 13, 2014. GVK Infrastructure said it is negotiating with the government for refund of ` 180 crore spent on seven deepwater exploration blocks, which were surrendered last year. The company may also take a legal recourse if the government does not heed to the claim. Recently, GVK Oil and Gas Limited, a subsidiary of GVK, issued a termination notice to the ministry of petroleum and natural gas under the production sharing contract. The GVK-BHP Billiton consortium emerged as winners of seven deepwater exploration blocks off the west coast of India in NELP VII. GVK holds 74% stake, while BHP besides holding 26% stake, acts as operator of all the blocks. BHP had earlier announced that it exited from nine gas exploration blocks in India including those with GVK partnership.

The company is in consultations with various Government agencies including the Directorate General of Hydrocarbons on the issue and expects a positive outcome. The company has received some insurance part payment for the damages to Alakhnanda power project during the massive floods last year in Uttarakhand. (www.livemint.com)

Gas reserves at Mozambique field scaled up; ONGC, BPCL cheer

March 12, 2014. Gas reserves in Mozambique's Rovuma basin, where Indian firms hold a 30% stake have been upgraded to 45-70 trillion cubic feet (Tcf) from 35-65 Tcf, cheering Oil and Natural Gas Corp, which has invested $4 billion in the project. Bharat Petroleum Corporation (BPCL), which also holds a stake along with Oil India informed the stock exchanges that Anadarko, the operator of the block announced this month that reserves estimates had been scaled up. The field is expected to ship out its first LNG cargo in 2018. DK Sarraf, the newly anointed chairman of ONGC said that he is extremely upbeat about the development in the basin where the state-run firm's overseas arm has made its biggest ever investment. Sarraf was the managing director of ONGC Videsh when the company bought 16% in this project for $4 billion, Oil India took another 4 per cent for close to a $1 billion. BPCL already owns a 10%. The gas reservoir is seen as the third largest potential producer of liquid gas after Australia and Qatar. Sarraf said the company is negotiating with the consortium partners to participate in the liquefaction process. He said this is welcome news for India where domestic gas production has been on the decline. He said that the LNG project panned in Mozambique is strategically located to supply LNG to India at a competitive price, and participation of state-run energy companies in the project will facilitate access of LNG to the growing Indian gas market. (economictimes.indiatimes.com)

IOC plans to build ` 300 bn refinery at Mundra

March 13, 2014. Indian Oil Corp (IOC) is mulling setting up a ` 30,000 crore refinery at Mundra in Gujarat as part of a plan to increase its processing capacity to 100 million tonnes. IOC has seven refineries with a total capacity of 54.2 million tonnes and subsidiary Chennai Petroleum Corp operates a 11.5 million tonne plant. A coastal refinery would enable IOC to ship in larger quantities of heavier grades of crude oil, which are cheaper because they are more difficult to process into fuels. The Adani Group has land at Mundra which IOC can take over for the refinery. In Maharashtra, the land would have to be acquired. The company has been offered land by Adani Group at Mundra.

IOC has a 13.7 million tonne refinery at Koyali in Gujarat and does not have a presence in Maharashtra. All of its refineries are landlocked. Its first coastal refinery at Paradip in Odisha will come up later this year. IOC has plans to raise its refining capacity to 100 million tonnes by 2021-22. The Koyali refinery capacity will be increased to 18 million tonnes at a cost of ` 4,858 crore, while the Mathura plant may be expanded to 11 million tonnes from 8 million tonnes. Also, an expansion of the Panipat plant to 18 or 21 million tonnes from 15 million tonnes is being considered. The under-construction 15 million ton Paradip refinery in Odisha would be expanded to 20 million tonnes in future. IOC plans to invest ` 56,200 crore in the 12th Five Year Plan period ending March 31, 2017. ` 27,159 crore is being set aside to expand refining capacity. Betting big on petrochemicals, the company plans to set up a polypropylene unit at Paradip at a cost of ` 3,150 crore while building similar units at Gujarat and Panipat. The Paradip refinery is nearing mechanical completion and the petrochemical project will thereafter take 36-39 months to complete. (economictimes.indiatimes.com)

Transportation / Trade

Loss on diesel sales declines to ` 7.16 a litre

March 18, 2014. The loss on sales of diesel has been trimmed by more than ` 1 to ` 7.16 per litre on the back of softening international oil rates. Public sector oil firms Indian Oil Corp, Bharat Petroleum Corp and Hindustan Petroleum Corp are losing ` 7.16 on every litre of diesel sold in the second fortnight of March, down from ` 8.37 a litre in the first half of the month. The basket of crude oil that India buys has dropped to $ 105.36 per barrel from $ 106.18. Losses have also been trimmed because of the monthly increases of 50 paise a litre of diesel, excluding local sales tax or VAT. Since January 2013, diesel rates have risen by a cumulative ` 8.33. Besides diesel, oil firms are losing ` 36.34 per litre on kerosene sold through the public distribution system, up from ` 35.76 a litre last month. On cooking gas (LPG), the revenue loss or under-recovery has come down to ` 605.80 per 14.2-kg cylinder from ` 655.96 in February. Oil marketing companies are now incurring a combined daily under-recovery of ` 399 crore on the sale of diesel, PDS kerosene and domestic LPG compared with ` 411 crore daily during the previous fortnight. The three firms had together lost ` 1,00,632 crore on the sale of the three products in April-December and may end the financial year with a total under-recovery of about ` 1,40,000 crore. This compares with an under-recovery of ` 1,61,029 crore in 2012-13 and ` 1,38,541 crore in the previous fiscal. During the current financial year, oil firms lost ` 47,655 crore on sale of diesel at rates lower than cost and another Rs 30,604 crore on domestic LPG. They incurred an under-recovery of ` 22,373 crore on the sale of kerosene. (economictimes.indiatimes.com)

India’s Feb Iranian oil imports fall 36 pc against Jan

March 13, 2014. India imported about 36% less oil from Iran in February than in January, because of efforts to meet US requests to restrict purchases from Tehran to 195,000 barrels per day (bpd) in the six months to 20 July, data from trade sources showed. Washington asked New Delhi to limit Iranian oil imports to about 195,000 bpd after India and China sharply raised imports in January. India shipped in about 266,000 bpd oil from Iran, a decline of about 8.7% from a year ago, tanker arrival data showed. India lifted about 351,800 bpd from Iran in February and March loading could be about 272,250 bpd, taking overall purchases in the first quarter to about 322,200 bpd. Lifting and arrival data varies as the voyage from Iran to India takes about eight or nine days. India would be importing about 180,000 to 190,000 bpd oil from Iran in 2014/15 if sanctions remain. But a recent spurt in purchases means refiners will have to cut imports to about 110,000 bpd in April-July 20 to meet the US request.

India aims to import 10.7 million tonnes or 214,000 bpd from Iran in this fiscal year ending 31 March, a decline of about 19% from a year ago and about 3% less than the targeted 220,000 bpd. During April-February India, Iran’s top client after China, shipped in about 206,800 bpd oil from Tehran, a decline of about 24.5% from a year earlier, the data showed. To replace lost Iranian volumes, India imported about 14% more oil from Latin America in the April-February period, with the region accounting for about 19% of overall imports, up from about 17.5% a year ago. The Middle East supplied about 62.3% of India’s oil imports in April-February, slightly higher that the year ago period. Overall, India imported about 4.25 million bpd of oil in February, a decline of about 0.3% from a year earlier. (www.livemint.com)

Policy / Performance

Changes to pivot around individual consumer: O&G retailing

March 17, 2014. In two policy changes, one that is currently unravelling and another that is done, resides a promise to change the face of oil and gas retailing in India. While both pivot around giving a new deal to individuals and households, they change the way they look at this set of consumers: from buyers of products at subsidised prices to buyers of products at market-linked prices. It's a reset in engagement that demands appropriately higher service standards, and those are expected to follow. In oil retailing, the lever of change is the subtle, yet substantial, way that fuel prices are being marked to market. Petrol prices were decontrolled in June 2010. And prices of diesel - a fuel that is still heavily subsidised and ends up distorting the market - are steadily approaching market rates. As a result, the discount to petrol has dropped from as much as 42 per cent in March 2011 to 24 per cent now. Market pricing adds ballast to the business of fuel retailing, and both public and private companies are readying for this new regime in their own ways. The three public sector companies - IOC, BPCL and HPCL- are sprucing up their outlets to avoid a repeat of 2004-05, when prices were freed, and private players like Reliance and Essar entered the fray. That's also the case with cooking gas. The trigger here is the government's decision, in December 2013, to allocate more natural gas to city networks. As many as 25 cities or districts, across 10 states and two union territories, have lined up plans to set up a gas pipeline network to deliver piped gas to households on tap, replacing the unpredictable and unwieldy LPG cylinders. (economictimes.indiatimes.com)

BP, Niko may have to join Reliance Industries' arbitration to get new gas price

March 17, 2014. BP Plc and Niko Resources, the partners of Reliance Industries Ltd (RIL) in the controversial KG D-6 block, may have to join ongoing arbitration proceeding before the government could accept bank guarantees from them and allow these companies to charge higher prices for their share of gas from April 1, the petroleum ministry said. Customers will have to pay higher gas price from April 1 in keeping with a cabinet decision notified in January, but that is no guarantee that BP and Niko will also get new rates. In case the two companies are allowed to charge only the old rate while customers pay the new price, the government has several options, including depositing the difference in an escrow account. BP holds 30% interest in RIL-operated KG-D6 block while Niko holds a 10% "participating interest" which is not an equity stake as the three partners have not formed any joint venture. RIL has initiated an arbitration case against a penalty imposed by the government for a fall in output from the KG-D6 field. BP, however, said it was entitled to the new gas price as per the Cabinet decision subject to submission of a bank guarantee by the contractor. But, without the involvement of BP and Niko in arbitration, the government is not in a position to take bank guarantees from them because the Cabinet approved taking bank guarantees as a hedge against arbitration initiated by RIL. The government will not know what to do with the bank guarantee given by the two partners. The state will encash the guarantee if it wins the arbitration case against the penalty imposed on RIL for the fall in gas output. If the company wins, it will keep the money. If guarantees are furnished by BP and Niko, who are not parties to the arbitration case, the bank guarantee can neither be encashed nor returned, the petroleum ministry said. (economictimes.indiatimes.com)

Optimism on gas prices, subsidies: OIL

March 13, 2014. Oil India Ltd (OIL) has seen its stock under pressure for quite a while, with concerns on production volumes, uncertainty over subsidy burden and, recently, the government’s plan of selling its stake in Indian Oil Corporation to the company. While the concerns might continue to exert pressure in the near term, there are bigger gains likely to accrue to OIL that are not reflecting in market sentiment, say analysts. These include gas price rise, continued diesel price increases (reducing the subsidy burden) and reserve upgradation at its Mozambique assets. Given the analysts’ target price of ` 575-600, there is a potential upside of 19-24 per cent from the current ` 482. The disruption in oil and gas production in Assam due to a strike call by the All Assam Students Union since March 1 had raised concerns. By March 6, OIL’s average daily oil production had dropped to 5,000 tonnes from 9,000 tonnes, while gas production halved to 3.5 million standard cubic metres a day, leading to an estimated loss of ` 20 crore a day, according to ICICI Securities. Though the issue has been sorted and clarity is awaited on the actual loss, disruptions aggravate risks to volume expectations. Analysts at Kotak Institutional Equities believe intermittent disruption might also put at risk their assumptions of modest growth in volumes over the medium term.

OIL already has seen a decline in oil production from 3.86 million tonnes (mt) in FY12 to 3.68 mt in FY13, due to disruptions and declines from mature fields. Analysts at Antique Broking observe that if the current depressed production level persists, FY14 oil and gas production would fall to 3.56 mt and 2.6 bcm (billion cubic metres) from their current estimate of 3.63 mt and 2.65 bcm, respectively, with an earnings impact of ` 1.4 per share or 2.5 per cent. Without disruptions, however, OIL could achieve oil production of four mt annually. (www.business-standard.com)

RIL gas-pricing case to be heard on March 24

March 13, 2014. The Supreme Court will hear the Reliance gas-pricing case on March 24 after its week-long Holi recess. A three-judge bench, comprising of Justices BS Chauhan, Jasti Chelameswar and Kurian Joseph, is hearing the twin petitions filed by CPI leader Gurudas Dasgupta and NGO Common Cause, challenging the government's KG basin production sharing contract with RIL and Niko Resources. The bench has heard Dasgupta's lawyer, senior advocate Colin Gonsalves, for two days. He's yet to conclude his arguments. Dasgupta has been making a case against the gas price hike that will come into effect on April 1, contending that a contractor who "hoarded" gas could not be allowed to sell it later at a higher price. RIL has denied the charge. The price is expected to go up from $ 4.2 mmbtu to $ 8.4 mmbtu. Gonsalves argued that there was no case for a hike when the contractor has shown "persistent intransigence" in refusing to increase production. The contractor, RIL, has been producing 10 mmscd instead of 80 mmscd, he claimed. The contract should therefore be terminated and the gas fields auctioned, he argued. If the contractor had kept control over costs and not been profligate, the government would have benefitted, he claimed. RIL's advocate Harish Salve, who made intermittent interventions during Gonsalves' arguments, said that the reports by the Comptroller and Auditor General (CAG) that are being relied upon date to the "time our production started falling". He claimed that the CAG report did not reflect any of the inputs given by RIL. He also contended that the PSC was expected to give certain flexibility to RIL in the matters of technical expertise, but this was being used to give RIL a "bad name". RIL has contended that the fall in gas output is because of geological complexities. It has initiated arbitration proceedings against the government's move to impose a penalty for the fall in output, claiming that there is no provision in the PSC enabling the government to impose penalties. (economictimes.indiatimes.com)

APP allegations ‘factually incorrect’: RIL

March 13, 2014. Reliance Industries Ltd (RIL) has refuted allegations by the Aam Aadmi Party (AAP) that former oil ministers Mani Shankar Aiyar and S Jaipal Reddy were removed because they did not favour the company, saying the “malafide propaganda” was “factually incorrect”. Terming as “malafide propaganda” AAP’s allegation that Aiyar had to go because he opposed RIL’s move to raise KG-D6 capital expenditure 2.5 times, the company said Aiyar left the oil ministry in January 2006 while the revised $8.8 billion field development plan was submitted in October 2006. (indianexpress.com)

Oil ministry approaches EC on gas price hike

March 13, 2014. Union oil ministry approached the Election Commission (EC) for approval to announce near doubling of natural gas prices to about $8 from next month. The Cabinet Committee on Economic Affairs (CCEA) had decided to price all domestically produced gas by both public and private sector firms at an average price of LNG imports into India and benchmark global gas rates from 1 April 2014. The price to be applicable from 1 April is to be announced sometime next week and before that oil secretary Saurabh Chandra met chief election commissioner V.S. Sampath. Chandra submitted papers pertaining to new gas pricing formula to the Election Commission. The price formula was approved by the Cabinet months before the model code of conduct for general elections came into force. The Election Commission will give its decision after studying the case.

The pricing formula will be effective on 1 April 2014 for a period of five years. The new rates, which will change every quarter based on 12-month average of global rates and LNG import price with a lag of one quarter, will apply to all gas produced by both public sector firms like Oil and Natural Gas Corporation Ltd and private companies like Reliance Industries Ltd. The price for April to June 2014 will be calculated based on the averages for the 12 months ended 31 December 2013. The rate April is likely to be around $8 per million British thermal unit (mmBtu) as against current $4.2. After the price announcement, the bank guarantee that RIL would have to give will also be indicated. The CCEA had decided to allow RIL to almost double the price of natural gas from April 2014 provided the firm gave a bank guarantee to cover its liability if gas-hoarding charges are proved. The bank guarantee, which will be equivalent to the incremental revenue that RIL will get from the new gas price, will be encashed if it is proved that the company hoarded gas or deliberately suppressed production at the main Dhirubhai-1 and 3 (D1&D3) fields in the eastern offshore KG-D6 block since 2010-11. Considering a gas price of around $8, RIL and its partners BP Plc of the UK and Canada’s Niko Resources Ltd will have to give around $100 million in bank sureties. (www.livemint.com)

POWER

Generation

Impounding of water in NTPC's Koldam hydel project begins

March 15, 2014. The much-awaited impounding process of NTPC's 800-MW Koldam hydro-electric project on river Satluj in Bilaspur, Himachal Pradesh, has been started once again. The filling up or impounding process of reservoir had earlier been tried three times as well, but the attempts were unsuccessful. Project Director S C Pandey started the impounding process by closing the inlet gates of tunnel "Kush" after performing pooja. NTPC Chairman-cum-Managing Director Anup Rai Chaudhary on December 19th last year had started the impounding process but it failed in two days.

As per the design of the project, river Sutlej has been diverted through twin diversion tunnels 'Lav' and 'Kush' (both about 1,000 metre long) and 163-metre high rock fill dam. Earlier the river water was diverted through tunnel Kush and in the mid of tunnel Lav, control gates were constructed to control the impounding process. (economictimes.indiatimes.com)

Transmission / Distribution / Trade

NHPC's Parbati project to supply power to the National grid

March 18, 2014. NHPC's 130 MW Parbati project in Himachal Pradesh will now supply electricity to the National grid, the company has said. NHPC, country's largest hydro power generation firm, has an installed capacity of 5,987 MW. It has over 3,000 MW worth of projects which are under various stages of construction. The company is awaiting regulatory clearances for 10 projects totalling over 8,000 MW capacity. (www.business-standard.com)

Find a way to clear Delhi discoms' dues: Tribunal

March 12, 2014. The Appellate Tribunal for Electricity (ATE) directed the Delhi Electricity Regulatory Commission (DERC) to decide on a plan for clearing the past dues of the city’s three private distribution companies (discoms), worth little over ` 11,000 crore. DERC had informed the Reliance- and Tata-owned discoms of a plan to liquidate the accumulated regulatory assets (RAs) of ` 8,000 crore as on March 2012 over eight years beginning 2014-15. Reliance Infrastructure-owned BSES Yamuna Power Ltd and BSES Rajdhani Power Ltd supply power to about 70 per cent of the city’s 3.2 million consumers, while Tata Power Delhi Distribution Ltd caters to the rest. The discoms are yet to pay about ` 5,000 crore of dues to Delhi gencos and Delhi Transco, a power transmission company owned by the city government. ATE, which hears appeals against orders passed by power regulators, also said the liquidation plan would be subject to changes, depending on the outcome of a Comptroller and Auditor General of India audit of discoms’ accounts. The roadmap will also depend on any financial restructuring of the discoms as advised by DERC. (www.business-standard.com)

Arunachal’s one-shot nod for hydel, related projects pegged to MoEF stance

March 17, 2014. The empowered group of ministers (EGoM) for hydel power projects in Arunachal Pradesh will find it tough to get the ministry of environment and forests (MoEF) on board for the proposed all-at-a-time clearance mechanism for supporting infrastructure projects. At the upcoming EGoM meeting the power ministry will pitch for a simultaneous process for environmental and forest clearances as well as the approvals for land acquisition and preparation of detailed project reports (DPRs) for supporting infrastructure projects like roads and bridges. This special regime has been proposed as an alternative to the current regime of sequential approvals (for instance, forest clearance precedes the environmental one) for such projects. Rich in hydro resources, Arunachal Pradesh can potentially generate a third of India’s total hydro-power capacity. The state has already allocated 94 hydel projects totalling 41,702 MW capacity to private and public developers for implementation but most of these projects remain stuck due to lack of infrastructure like highways and bridges for transporting heavy equipment and machinery to project sites. Expeditious harnessing of the state’s 50,000 MW hydro-power potential spread over eight river basins including Sian, Kameng and Subansiri hinges on how fast the requisite infrastructure is built. Given the border dispute with China, it is also strategically important for India to ensure the proposed hydel projects in the state come on stream without delay. The EGoM, headed by finance minister P Chidambram and including ministers of defence, road transport and highways (MoRTH), power, as well as the ministry of development of North-Eastern region (Doner), is tasked with suggesting ways to expedite development of supporting infrastructure for the slew of hydel projects coming up in the state. The government is expecting the Election Commission's go-ahead for its proposed meeting, as it is keen to fast-track the projects. If the current mechanism of sequential clearances is adopted, many of these projects would be ready for use only by 2022. That means hydel project developers will also have to wait till then to start work and this could hit the viability of many projects. While the MoRTH and Doner have endorsed the power ministry's line, the MoEF is yet to express its views. The MoEF is unlikely to accept the power ministry's proposal without modifications, as it feels the proposed projects would necessitate large-scale diversion of forest land. The EGoM's task would be to find a resolution, even as it could lean a bit towards the power ministry's stand. Arunachal Pradesh has harnessed just 405 MW out of its estimated 50,000 MW potential while projects totalling to 2,710 MW are under construction. Tawang, Dibang, Lohit, Dikrong and Tirap are the state's other river basins with significant hydro-power potential. The Centre has decided to shift its focus back on harnessing of hydro-resources as the share of hydro-power in country's power mix has fallen steadily over the years. Apart from taking up development of supporting infrastructure in Arunachal Pradesh, the power ministry is also looking at making purchase of hydel power mandatory for distribution companies. (www.financialexpress.com)

India’s power sector generates international interest

March 17, 2014. There has been an increased interest in projects in the Indian power sector with international companies acquiring stakes in power projects in the country. In some instances promoters have sold assets with a view to servicing their loan obligations. The sale of two hydro power projects by the Jaypee Group is a case in point. Banks have managed to convince the promoter to sell two profitable hydro power plants, a Standard Chartered report said. The thermal power sector is among the most stressed sector, because of low availability of coal — which attracts fewer prospective buyers. India's biggest electricity generator, NTPC, recently invited expressions of interest from state electricity boards and private companies as it looks to buy coal-based power plants in India and overseas to increase power generating capacity through acquisitions. (www.financialexpress.com)

KSEB to provide 4.35 lakh connections

March 17, 2014. The Kerala State Electricity Board (KSEB) expects to provide 4.35 lakh new service electricity connections in the state in the 2014-15 fiscal. As part of improving power supply to consumers, the power utility will also be undertaking distribution-related works to the tune of ` 700 crore during the fiscal. This is part of the ` 1,300 crore annual plan approved by the KSEB. The KSEB hopes to add 4,322 km of LT distribution lines and extend 11 KV lines by another 2,665 km. Faulty electricity meters continue to be a headache. As part of the annual plan, the KSEB intends to replace 11.80 lakh meters during 2014-15. For sprucing up the transmission side, KSEB will spend ` 241 crore. In all, 21 new sub-stations are planned, including one 220 KV, six 110 KV, three 66 KV and eleven 33 KV ones. Transmission lines for 290.7 km will be freshly drawn. A sum of ` 84.10 crore has been earmarked for maintenance works of transmission installations and another ` 15 crore will be spent on systems operations. In the generation sector, the KSEB will be spending a total of ` 332 crore. Of this, ` 190 crore will be on ongoing hydel power projects, ` 30.50 crore on new hydel projects and ` 17.50 crore on existing, operational projects. (www.newindianexpress.com)

Peak power deficit for Feb at 3.3 pc: CEA

March 17, 2014. Total power demand outpaced the supply by 4,424 MW or 3.3 per cent of the demand, across the country in the month of February. Total peak power demand last month was 1,32,507 MW, of which 1,28,083 MW was met, leaving a peak power deficit -- shortfall in electricity supply when the demand is at the maximum -- at 4,424 MW, the data by the Central Electricity Authority (CEA) showed. Southern India was the most affected, registering a deficit of 5.2 per cent or 1,883 MW. Total electricity requirement of the region, comprising states of Andhra Pradesh, Karnataka, Kerala, Tamil Nadu, Puducherry, Lakshadweep, was 36,427 MW as against a supply of 34,544 MW. The north-eastern region - Assam, Meghalaya, Manipur, Arunachal Pradesh, Nagaland, Tripura and Mizoram - registered a deficit of 96 MW. The power demand was 2,025 MW and supply was 1,929 MW. The electricity requirement in eastern states, including West Bengal, Odisha, Bihar and Jharkhand, was 14,976 MW of which 14,499 MW was met, leaving the region with a shortage of 477 MW or 1.3 per cent. North Indian states/UTs - Chandigarh, Delhi, Haryana, Himachal Pradesh, Punjab, Rajasthan, Uttar Pradesh and Uttarakhand reported a peak power shortage of 2.9 per cent. Total electricity demand in the region last month was 37,895 MW, of which 36,780 MW was met, as per the data. The western region, which includes Chhattisgarh, Gujarat, Madhya Pradesh, Maharashtra and Goa, reported a power shortage of 2.1 per cent. The demand was 41,184 MW against a supply of 40,331 MW. (economictimes.indiatimes.com)

CERC compensatory tariff won't burden discoms, consumers: Care

March 16, 2014. The central electricity regulator's order for compensatory tariff to Tata Power and Adani Power has not only provided relief to producers but also ensured that discoms and consumers are not burdened by higher tariff, says a report by rating agency Care. The Central Electricity Regulatory Commission (CERC) has directed the states to pay a compensation of ` 329.45 crore to Tata Power and ` 829 crore to Adani Power for a period from April 1, 2012 to March 31, 2013 for their past losses arising out of higher coal imports. The CERC has also allowed a gross compensatory tariff of ` 0.53 per unit for Tata Power, which supplies power to Gujarat, Haryana, Maharashtra, Punjab and Rajasthan, while a provisional gross compensatory tariff of ` 0.85 per unit for Gujarat and ` 0.36 for Haryana for Adani Power. Gujarat currently draws 1,805 MW from Tata Power and 1,000 MW from Adani Power, while Haryana gets 380 MW and 1,424 MW, respectively, from both the power producers. The average increase in tariff for Gujarat discom will be 2.1 per cent, while for Haryana it will be a mere 0.2 per cent, the ratings agency said. On the other hand, for Maharashtra (760 MW), Punjab (475 MW) and Rajasthan (380 MW), the tariffs will increase by 0.3 per cent, 1.6 per cent and 0.6 per cent, respectively. (economictimes.indiatimes.com)

Nuclear fuel complex to come up in Rajasthan

March 16, 2014. India is setting up a second nuclear fuel complex (NFC) to reprocess atomic fuel in view of growing number of atomic reactors in the country. The NFC will come up next to Rawabhata nuclear plant in Kota, Rajasthan, at a cost of ` 2,400 crore. The proposal was cleared by cabinet committee on security earlier this month. The Department of Atomic Energy (DAE) said the new arrangement has been made keeping in mind the fuel supply required to meet the demand, which will soon come up in the country. Under the 12th Five-Year Plan, India aims to take power generation capacity from nuclear energy to more than 17,300 MW. India currently generates over 5500 MW of electricity from nuclear power. The existing NFC in Hyderabad does not have the capacity to meet the growing demands of fuel of future reactors which will come up in the country by next decade. (www.livemint.com)

` 492 bn Odisha, Tamil Nadu UMPPs postponed

March 14, 2014. The award of two 4,000 MW ultra mega power projects (UMPPs), entailing mega investment of ` 49,200 crore, has been pushed by two-and-a-half months to June, with the shortlisted firms requesting more time for price bids. Power Finance Corporation (PFC), the power ministry’s arm which manages the bidding for the UMPPs, had in December 2013 shortlisted nine companies for the Odisha UMPP and eight companies for the Tamil Nadu UMPP in the Request For Qualification (RFQ) stage. The Request For Proposals (RFPs) were to come by February 26. The projects are now likely to be awarded only after the general elections in May. The nine companies in the race for the Odisha UMPP are NTPC, Tata Power, NHPC, Adani Power, JSW Energy, Jindal Power, Sterlite Infraventures, CLP India, and Larsen & Toubro (L&T). Eight companies — Adani Power, CLP India, GMR Energy, Jindal Power, JSW Energy, L&T, NTPC, and Sterlite Infraventures — are to give price bids for the Tamil Nadu project. The Odisha UMPP, which will come up at Bedabahal in Sundargarh district, is a pit-head project, based on domestic coal to be sourced from allocated captive coal blocks, with an expected investment of around ` 25,000 crore. The Kancheepuram UMPP is a coastal project based on imported coal to be set up in Kancheepuram district, with an investment of ` 24,200 crore. The project would be India’s third coastal UMPP after Mundra in Gujarat (Tata Power) and Krishnapatnam in Andhra Pradesh, operated by Reliance Power. PFC had kicked off bidding for the two UMPPs in September 2013. Applications for pre-qualification were opened in November 2013. PFC had initially planned to award the two projects by the end of the current month. The two UMPPs are part of a bigger plan to set up 13 such large-sized projects, to bridge the gap in demand and supply of power. (www.business-standard.com)

Meghalaya govt proposes 90 pc power tariff hike

March 13, 2014. The Meghalaya government has proposed a whopping 90 per cent hike in power tariff to meet sky-rocketing purchase and transmission cost of power it projected over ` 600 crore for 2014-15, Chief Minister Mukul Sangma said. The cost of purchase of power for 2014-15 is expected to touch ` 489 crore (` 4.7 per unit) and the transmission cost would be ` 124 crore (` 1.24 per unit) apart from the salary of employees and maintenance. Stating that the present power tariff is lower than Assam (` 3.58-` 6.15 per unit), West Bengal (` 3.75-` 6.9 per unit) and Tripura (` 4.11-` 7.96 per unit), Mukul said the cost per unit in Meghalaya is ` 2.6 up to ` 3.75. Defending the move to hike the present tariff with an increase of almost 90 per cent, the Chief Minister said the hike is essential so that the corporation is able to meet its expenditure to sustain its operations and thereby continue to serve its consumers and the state. He also said that the government estimated that 57 per cent of its revenue in the financial year 2014-15 will be required to meet the power purchase cost alone. (news.outlookindia.com)

BJP's power policy to address 'energy poverty'

March 13, 2014. Before the Bharatiya Janata Party poll manifesto is finalised, intensive discussions are going on in the party on the scale and breadth of economic promises to which it will commit itself, including subsidies. Narendra Taneja, who has just been appointed national convenor of the BJP’s energy cell, said the Gujarat model of energy development “is inspiring” and will be replicated to the extent it can but the party is conscious that one size does not fit all. Gujarat had endemic power shortages till 2000, until it undertook massive power sector reform. Now, with installed generation capacity of 18,900 MW from thermal sources alone, Gujarat is the largest power generating state in the country. It aims to add 10,000 MW in the next five years, to touch the 30,000 MW generation capacity mark by 2017. Taneja said, on the one hand, India still had 400 million people who have no access to power, partly because they simply cannot afford it; on the other hand, there can be no growth without energy, even if it is costly. The party is yet to decide on the politically sensitive issue of subsidies, especially for oil. The BJP visualises “multidimensional modernisation” of India’s coal sector. This doesn’t mean coal import will be discouraged, only that modernisation of mining and transportation of this mineral will mean lowering future dependence on import. The party will commit itself to appointing a regulator for civil nuclear energy, including nuclear safety. Communication with people on nuclear energy will be a key element of the party’s nuclear energy policy. The party is considering incentivisation — possibly via tax breaks — of solar energy parks. The BJP will promise “genuine autonomy” to energy public sector units like Oil and Natural Gas Commission and will encourage them to innovate, explore for oil blocks both in the Bay or Bengal and abroad and sign joint ventures. Several international oil exploration companies, including BHP Billiton and Eni SpA, have exit India in frustration owing to hurdles and delays in the award of oil blocks. Consumers don’t minded paying, as long as the quality of power is good and they are consulted if prices are raised. In Gujarat, to ensure equity as well as growth, dual distribution lines were installed to supply power, based on paying capacity of the consumers. The first line provided continuous electricity at a much higher rate, whereas the second line aimed at farmers supplied electricity for limited period at a subsidised rate. Gujarat was not only able to cut down the loss but was able to report profit after this model was implemented. (www.business-standard.com)

Kejriwal's questions to Modi: Fact check

March 12, 2014. Kejriwal: Why does Gujarat purchase solar power at ` 13 per unit? Madhya Pradesh and Karnataka are buying it at ` 7.50 and ` 5 per unit, respectively. Fact: Pranav Mehta, chairman, National Solar Energy Federation of India, feels Kejriwal was not well informed on the issue. “Gujarat purchases solar power at ` 12.54 per unit. The power purchase agreements were signed in 2009-10 when the cost of production was high. Since new solar power plants have lower production costs, the price has come down to ` 7 per unit. Units in Madhya Pradesh and Karnataka were set up recently, hence the lower rates.” Kejriwal: Electricity for irrigation is a distant dream for farmers. Why do you claim 24x7 availability of electricity when farmers get power for only three hours a day? Fact: K K Bajaj, chief general manager of Consumer Education and Research Society (CERS), agrees with Kejriwal that 450,000 applications for new electricity connections are pending. However, he disagrees on the point farmers do not get 24-hour power. According to Bajaj, farmers get eight hours of electricity for irrigation, and single-phase electricity for household use round the clock. (www.business-standard.com)

INTERNATIONAL

OIL & GAS

Upstream

Russia's Lukoil eyes new gas deal in Saudi Empty Quarter

March 18, 2014. Russia's Lukoil is negotiating a deal with the world's top oil exporter Saudi Arabia to tap unconventional gas deposits in the kingdom's Empty Quarter desert region, the company's overseas unit said. Saudi Arabia has kept its vast oil reserves off-limits to foreigners, but needs natural gas to help cover domestic power demand and conserve oil for export. It invited investors a decade ago to find and produce gas in the Empty Quarter region in Saudi Arabia's southeast, also known as Rub Al Khali. But foreign companies which formed joint ventures with state oil firm Saudi Aramco to look for conventional gas, including Lukoil, Royal Dutch Shell and Sinopec, have failed to find commercially viable deposits beneath the sea of sand dunes. (www.arabianbusiness.com)

Gazprom proposes oil, gas development in Crimea

March 18, 2014. Russian state-owned energy company Gazprom has proposed to develop Crimea's oil and gas sector. The local authorities may sell the energy firm Chornomornaftohaz to a Russian company "such as Gazprom" once the region takes control the firm, which is now part of a Ukrainian state energy company. (www.rigzone.com)

Cairn confirms exploration, appraisal drilling plans for 2014

March 18, 2014. UK independent explorer Cairn Energy confirmed that it is participating in two North Sea exploration wells (Aragon and West of Kraken) in 2014, with a further exploration well (Tulla) scheduled for 2015. The field development plan (FDP) for its 25 percent-owned Kraken field in the North Sea has received approval from the UK Department of Energy and Climate Change with first oil expected in late 2016/early 2017. Cairn expects to begin drilling the first of two planned exploration wells offshore Senegal in April, while its Spanish Point appraisal well offshore Ireland is planned for drilling. Cairn said that its partner, Kosmos Energy, is expected to begin drilling one exploration well on the Cap Boujdour Contract Area in 2014. Cairn said the firm is committed to resolving its tax dispute with the Indian government. The firm announced that it was suspending a $300 million share buyback program due to its inability to sell its 10-percent stake in Cairn India because of the dispute. Proved and probable reserves booked by Cairn at December 31, 2013 amounted to 30.1 million barrels of oil equivalent (boe) – almost double the 16 million boe booked at the end of 2012. (www.rigzone.com)

Shell discovers oil at Limbayong field in offshore Sabah

March 17, 2014. Malaysia's national oil and gas company Petroliam Nasional Berhad (Petronas) and Royal Dutch Shell plc announced an oil discovery offshore Sabah, Malaysia. The discovery was made via the Limbayong-2 well during the appraisal of the Limbayong gas field by Shell. The appraisal well encountered 446 feet (136 meters) of oil bearing sands, and there are plans to conduct more appraisal work on the discovery to determine its recoverable volume. (www.rigzone.com)

Indonesia crude output drops as haze hits Chevron's Sumatra wells

March 17, 2014. Indonesia's crude oil output has dropped to 790,000 barrels per day (bpd) after haze from forest fires on the island of Sumatra forced the country's biggest producer, Chevron, to close hundreds of its wells, the country's oil and gas regulator said. Indonesia has targeted to produce 870,000 bpd of crude this year. (www.rigzone.com)

Salamander Energy finds gas in Indonesian well

March 12, 2014. Salamander Energy Plc said its West Kerendan-1 exploration well in Indonesia successfully tested for gas from the Upper Berai reservoir and that it would focus on commercializing the discovery after completing tests. The oil and gas producer, whose interests primarily are in Southeast Asia, said it would hold talks with Indonesian authorities on including the West Kerendan discovery in the Kerendan field plan of development. The enlarged field development would then become a source of incremental gas sales to the gas-fired power plant that was being constructed near the Kerendan field, Salamander said. Within the upper gas column, the well has been independently verified to contain recoverable gas in the range 133 billion cubic feet (bcf) to 682 bcf with a mid-case assessment of 313 bcf, Salamander said. The company also estimated an additional 50 bcf of recoverable gas from the lower gas column. (www.rigzone.com)

Downstream

Nigerian Navy destructs illegal oil refineries

March 18, 2014. The Nigerian Navy announced that it has destroyed around 260 illegal oil refineries and burnt about 100,000 tons of contraband fuel. The sailors destructed around 260 refineries in the Warri area of the southern Niger Delta. From oil sold between January 2012 and July 2013, the oil thefts are unrelated to around some 20 billion petrodollars allegedly missing from the Nigeria's treasury. Shell Nigeria, one of the biggest operators in the West African nation, said that it lost about $1 bn to oil thefts in 2013. The company confirmed that an under-sea pipeline leak resulted in the closure of its Forcados export terminal, which holds the capacity to handle 400,000 barrels of crude a day, while the cause of the leak is still is being investigated. (refiningandpetrochemicals.energy-business-review.com)

Petroperu to sign Talara refinery expansion contract

March 17, 2014. Peruvian state-owned petroleum firm Petroperu is planning to sign a contract with Spain-based engineering company Tecnicas Reunidas to expand the Talara refinery. The contract, which is expected to be signed in April 2014, will allow to commence work on a $3.5 bn refinery upgrade. The Talara refinery is located in northern Peru and the expansion project intends to increase the facility's output by 50% to about 96,000 barrels per day. The contract for the modernisation of the refinery would be signed next month now that technical studies and the contract framework have been established. According to Peru's government, the upgrades at the refinery will start in 2014, with completion planned in 2017. (refiningandpetrochemicals.energy-business-review.com)

Transportation / Trade

Pipeline construction completes on PNG LNG project in Papua New Guinea

March 17, 2014. The construction of 292-km onshore section of pipeline has been completed on the PNG LNG project, located in Papua New Guinea. The move is expected to allow the project to produce its first liquefied natural gas (LNG) in the mid-year of 2014. The new pipeline will transport natural gas from the Hides Gas conditioning plant to the Omati river, by connecting to the project's 407-km offshore section of pipeline and then to the LNG plant located near Port Moresby. The onshore pipeline diameter ranges from 32 inches to 34 inches and during the life of the project, around 250 billion cubic metres of gas is expected to be transported through the pipeline. (transportationandstorage.energy-business-review.com)

Muntajat signs petrochemicals transport agreement with Milaha

March 14, 2014. Qatar Chemical and Petrochemical Marketing and Distribution (Muntajat) has signed a two year agreement with Qatar Navigation (Milaha) for transporting petrochemicals exports from Qatar. The company has collaborated with Milaha, one of the oldest established companies in Qatar, to bring Qatar's chemical and petrochemical exports to the world. (refiningandpetrochemicals.energy-business-review.com)

'LNG exports by US will strengthen India's energy security'

March 13, 2014. Natural gas exports by America will help its economy grow and strengthen energy security of countries like India, a top official of a trade association said. For the first time in generations, the United States is an energy superpower. And the world, especially Europe and countries like Russia, China and India is watching closely to see if American policy makers are ready to harness that power on the international stage, American Petroleum Institute Director, Upstream and Industry Operations, Erik Milito said. Liquefied natural gas (LNG) exports will grow the US economy while strengthening the energy security of America and its allies like India and countries like Ukraine, he said. Milito said the allies of the US know that its exports will undoubtedly have an impact long before the first tanker leaves its shores, and they are eager to diversify their energy supplies with reliable, steady supplies from the United States. Oil and natural gas industry supports 9.8 million US jobs. Export of LNG could add an additional 665,000 jobs by 2035. Exports will also reduce our trade deficit, increase government revenues, and grow the economy, he said. (economictimes.indiatimes.com)

Policy / Performance

Palestinians seek to drill for oil in West Bank

March 18, 2014. The Palestinian Authority announced plans to explore for oil in the West Bank, throwing a new element of uncertainty and confusion into troubled U.S.-backed peace efforts. The Palestinians proclaimed the project, close to a small oil field in Israel, a key step toward their dream of developing the local economy and gaining independence in the West Bank. But Israel, which wields overall control of the area, gave no indication it has agreed to the plan, and far less ambitious attempts at economic development have repeatedly sputtered in large part because of Israeli restrictions. Mohammed Mustafa, the Palestinians' deputy prime minister for economic affairs, said the Palestinians were seeking proposals from international firms to explore and develop oil in the northern West Bank. He said the project was among a series of initiatives drawn up by Mideast envoy Tony Blair to help develop the Palestinian economy. (www.rigzone.com)

Peru to open bidding on offshore oil blocks

March 13, 2014. Peru will open bidding on six offshore oil blocks this month or next after having agreed to exclude state-run energy firm Petroperu from the auction at the request of private bidders. The government said the auction was put on hold after potential bidders requested changes to bidding rules. The government said Petroperu could take up to a 25 percent stake in the offshore oil blocks if commercial discoveries were made. (www.rigzone.com)

Azerbaijan planning third stage of Shah Deniz project after 2025

March 12, 2014. Partners in Shah Deniz are drawing up plans for the third development stage of the major gas project after 2025, expecting to reach peak output at about 25 billion cubic metres (bcm) of gas per year. Azerbaijan's biggest gas field, Shah Deniz is being developed by consortium partners BP, Statoil, SOCAR and others, offering an alternative gas supplier for Europe as the continent tries to wean itself off Russian energy deliveries. Shah Deniz I has been pumping gas since 2006 and has an annual production capacity of about 10 bcm of natural gas. From around 2019 Shah Deniz II is expected to produce 16 bcm of gas per year, with 10 bcm earmarked for Europe and 6 bcm for Turkey. (www.rigzone.com)

Putin opens up Europe’s energy fault line along Oder-Neisse

March 12, 2014. Vladimir Putin’s play to wrest control of Ukraine is accentuating divisions in the European Union over how to balance climate and energy policies, driving a wedge between Germany and its eastern neighbor Poland. By moving forces into the Crimea region, the Russian president caused a jump in natural gas prices from the U.K. to Germany, highlighting Europe’s dependence on gas piped through Ukrainian territory. Polish Prime Minister Donald Tusk has turned on Germany, saying that its appetite for Russian gas as it shifts to clean energy is “a threat to Europe’s security and sovereignty.” The divergence has implications for businesses as well as consumers on both sides of the Oder-Neisse Line, the post-World War II boundary first proposed by the Soviet Union at the Yalta Conference in 1945 and which still forms the present-day border between Poland and Germany. Tusk is buoyed by Poland’s shale gas reserves, ranked as Europe’s biggest by the U.S. Energy Information Administration. It estimates that Poland has technically recoverable shale-gas resources of 148 trillion cubic feet, or about as much as a quarter of the U.S. level. Polish authorities have granted about 100 licenses to foreign and domestic companies to drill for unconventional gas and have sought to revive investments from companies including Marathon Oil Corp. and Exxon Mobil Corp. (www.bloomberg.com)

POWER

CEEC wins Vietnam and Bangladeshi power plant contracts

March 18, 2014. China Energy Engineering Group Co.Ltd.(CEEC) has signed two contracts for the construction and installation of Duyen Hai Phase-Ⅲ 2x622MW coal-fired power plant in Vietnam and for the installation of Bhola 225MW combined cycle power plant in Bangladesh, respectively. Located in Duyen Hai City, Tra Vinh Province, about 200km away from Ho Chi Minh City, the Vietnam project includes two 622MW coal-fired generating units. The project owner is EVN and the construction period is 939 days. The Bangladesh project is located on Bhola Island, the People's Republic of Bangladesh, 28km away from the county seat of Bhola, consisting of two gas turbine generators, two waste heat boilers and one steam turbine generator. With a construction period of 428 days, construction work is scheduled to begin around the middle of March. One hundred and sixty-eight hours of full-load trial operation of the power plant is expected to have been completed by 16 May 2015. (fossilfuel.energy-business-review.com)

Gaza's power plant resumes operations

March 18, 2014. The Palestinian Authority ended its punishment of Hamas and allowed Gaza’s lone power plant to resume operations. The Gaza power station, which had been shut off due to a fuel shortage resumed generating electricity, a day after Israel allowed fuel deliveries into the region. The company would resume the former distribution system to households of eight hours with electricity and eight hours without. (www.israelnationalnews.com)

Greenpeace storms EDF nuclear plant at Fessenheim in East France

March 18, 2014. Police arrested dozens of anti-nuclear campaigners after they entered France’s oldest atomic plant, operator Electricite de France SA (EDF) said. Greenpeace and EDF are at odds over power generation in France, the world’s most nuclear-dependent country. Atomic plants have come under more scrutiny after the Fukushima meltdown in Japan three years ago. Germany ordered the shutting of its nuclear fleet, making it more dependent on coal. EDF was ordered to bolster safety at Fessenheim, and the plant is slated for closing in 2016. (www.bloomberg.com)

KSA's ACWA to build $1 bn power plant in Mozambique

March 17, 2014. The Government of Mozambique and a consortium led by ACWA Power signed a 25 year Concession Contract for the development of the Moatize IPP Project, a 300 MW (first phase) coal fired power project located in Tete Province, 1,500 km north of Maputo the capital city of Mozambique. The project is expected to be the first large scale greenfield power project in the country to be financed using the Project Finance framework, Apart from satisfying the electricity needs of Vale, a major industrial user in Mozambique, the power plant when in operation will also contribute a significant amount of much needed capacity into the Mozambican grid. (www.utilities-me.com)

Reykjavik plans to start $2 bn Ethiopian power project