-

CENTRES

Progammes & Centres

Location

CONTENTS

WEEK IN REVIEW

Ø ENERGY: India’s Energy Imports: Is the Problem now the Solution?

Ø POWER: Power Sector Retrospection: Year 2013

DATA INSIGHT

Ø Indian Nuclear Power Scenario: Some Trends

NEWS HEADLINES AT A GLANCE

INDUSTRY DEVELOPMENTS

· ONGC to invest $3 bn more in Mozambique gas field

· Will wait till March-end to take a call on HPL: IOC

· GAIL seeks gas from East Africa to boost supply chain

· Nava Bharat to tie up funds for 300 MW Zambia power project by June

· NTPC to set up ` 170 bn power project in MP

· Shree Uttam Steel & Power to set up ` 111.5 bn mega project in Maharashtra

· Tata Power generates 3,212 million units of electricity in Q3

· Power Grid announces investment of ` 5.7 bn

· UAE-led group to buy two India power plants in deal worth $1.6 bn

· Tata Power signs pact to sell 30 pc stake in Indonesian firm

· Americas Petrogas discovers oil at Neuquén basin in Argentina

· OMV signs two new exploration licences in Pakistan

· Cameroon oil production to pass 82k bopd in 2014: SNH

· S. Korea confirms S-Oil to invest $7.5 bn in refining, petrochemical units

· Petronas to sign with India buyer March 7 for Canada gas stake

· Estonia, Finland sign accord on building joint LNG terminals

· Origin shelves $5 bn hydroelectric project in Papua New Guinea

· Vietnam builds $1.2 bn thermal power plant in the north

· Turkey plans to boost nuclear power generation

POLICY & PRICE

· Oil Ministry wants CAG to quantify loss in KG-D6 contracts

· ATF price hiked by 1 pc, non-subsidised LPG rate cut by ` 53

· Petrol and diesel rates hiked before crucial polls

· Indian, US, Japanese firms race for projects in the UAE

· Relief for Maharashtra power users finally as govt offers 20 pc rebate

· Rajasthan govt to allot 30k new domestic power connections

· TN to get first supercritical power station at ` 49.5 bn

· Decision on power rate cut in Mumbai discoms' court

· India, Russia may sign contracts for Kudankulam reactors before polls

· BP must live with $9.2 bn oil-spill deal, court says

· Oman plans big increase in natural gas output

· Europe gas storage seen enough for 45-day Ukraine supply cut

· Kazakh PM hopes for Kashagan restart 'within months'

· Singapore plans to construct second LNG terminal

· AGL’s $1.3 bn power-plant deal blocked by regulator

· RWE suffers first loss since founding of German Republic

· Iran to launch Bushehr nuclear plant’s second stage

· Cameco welcomes nuclear commitment in Japan draft policy

· J&K inks MoU for 7.5 GW solar power generation

· India’s diesel subsidy spurs pollution worse than Beijing

· REC trading volumes doubled in Feb: IEX

· Haze shrouds Malaysian capital amid forest fires and drought

· Statoil unit joins SkyNRG to boost Nordic clean jet-fuel supply

· Gamesa and Santander to build 500 MW of Mexico projects

· Malaysia’s plans to boost biofuel to help palm, Embas says

· Europe poised for mild March as warm Atlantic air cuts power use

WEEK IN REVIEW

ENERGY

India’s Energy Imports: Is the Problem now the Solution?

Lydia Powell, Observer Research Foundation

|

I |

n 2005 the then President of India declared that India should aim towards energy security by 2020 and energy independence by 2030. In 2008, the then Chairman of India’s Atomic Energy Commission said that energy independence was the need of the hour and not sustainability. Following the launch of the shale gas policy in 2013, the honourable Minister for Petroleum & Natural Gas declared said that India would become energy independent by 2030. Last week the Planning Commission threw cold water into all this enthusiasm for energy independence by declaring that India will not become ‘energy independent’ (not in these exact words though) even by 2047 if it does not change course and that energy imports would meet 84% of demand.

India’s quest for ‘self-reliance’ began with the end of British rule and the birth of India and Pakistan. When Pakistan was separated from India, it removed access to water for irrigation from the Indus canal system almost overnight. India with 82% of the population of undivided British India got only half the canal system carrying 400,000 cusecs of water and less than half of 24 million acres of land irrigated by state owned canals. The 1st and 2nd Plan documents were therefore pre-occupied with strategies for increasing ‘self-reliance’ in food production. The pursuit of ‘self-reliance’ tricked into other segments and the newly independent India consolidated its hold over the oil & gas industry which was, until then, dominated by a few Anglo-American companies. This was in line with India’s industrial policy resolution of 1948 and 1956 which clearly stated the Government’s aspiration and future plans for core industries like petroleum with all future development reserved for public sector undertakings.

India’s 3rd Five Year Plan projected nuclear energy as an option for power generation and a means for improving India’s ‘self-reliance’ in the context of energy. Following the oil shocks of the 1970s, the 6th Five Year Plan advocated ‘self-reliance’ through the development of domestic resources and pricing reforms to conserve energy. The refusal of International Oil Companies (IOCs) operating in India to comply with the Indian Government request to control the price of oil products during the 1970s oil embargoes reinforced the desire for ‘self-reliance’ among policy makers and pushed India towards nationalization of these companies. Investments in equity oil seen as a means to self-reliance was emphasised in a series of policy documents in the 2000s.

Despite the visceral dislike of imported energy, energy imports are growing at unprecedented rates. To begin with India’s import of thermal coal is growing at astonishing rates. This is a surprising outcome as we have always believed that our energy security lay in mining and using our abundant coal reserves. According to the Central Statistical Office (CSO) import of coal (thermal and coking coal) has steadily increased from 20.9 million tonnes (MT) in 2000-01 to over 130 MT in 2012-13. According to the Central Electricity Authority, thermal coal imports touched 97 MT including about 24 MT of coal imported for generating plants which were specifically designed for imported coal in 2012-13. This is an increase of 40% over the previous period. Coal imports now account for 3% of total imports in terms of value and this figure is expected to increase substantially in the future. Forecasts for coal imports in 2013-14 anticipate a significant increase. Power producers are expected to import 82 MT of coal in 2013-14 as per a statement by the Government. By 2016-17, the gap between supply and demand for thermal coal is projected to increase to 230 MT according to the Ministry of Coal.

Oil production is more or less stagnant and India is expected to meet over 78% of demand for crude oil through imports by 2017 according to the Planning Commission. In the longer term, domestic oil production is expected to decline at a rate of 1.7% from 900,000 barrels per day (bpd) in 2012 to 600,000 bbd by 2035. On the other hand, demand for oil is expected to grow at the rate of about 3.6% a year representing the largest absolute increase after China. This would mean that the share of imported crude will increase to 90% by 2035. Initiatives to increase domestic production have failed to have an impact. In the 11th plan period, India had set itself a target of 800,000 bpd but only 711,000 bpd was produced, a slip of 14%. India’s oil imports are expected to increase from 2.5 million barrels per day (mbpd) to over 6.9 mbpd by 2035.

India produced about 111 metric million standard cubic meters per day (mmscmd) of gas or about 40 BCM of gas in 2012-13 compared to 143 mmscmd in 2011-12 according to the Ministry of Petroleum & Natural Gas. Though domestic production is likely to increase in the future, imports of natural gas is projected to grow. However dramatic increases in natural gas imports that many reports project may not materialise as these are not qualified by price sensitivity of consuming sectors and they also often overlook the fact that gas can be substituted by other fossil fuels in many of its end use segments. However growth in gas imports is a realistic possibility.

But if our energy security goal is to achieve self-reliance or energy independence through a reduction in volume of imported energy, then why are we relentlessly indulging in the import of oil, gas and coal to make up for our domestic shortcomings? Is it because we do not take our stated objectives seriously or is it because we do not have a choice? It is very likely that both statements are true. The former may be dismissed as a product of our social culture that does not require us to say only what we mean. In any case, ‘energy independence’ is neither a desirable nor an achievable goal. But we need to worry about the latter as it concerns the physical access to energy, a resource that we cannot do without.

It is becoming increasingly clear that domestic production of coal and gas are inhibited by social, economic and political legacy burdens that cannot be undone quickly. Until then, import of resources such as coal and gas is likely to be the only option available to meet demand. Perversely, the problem of imports that supposedly made us energy insecure is now the solution to energy security! This is an important point that the purveyors of traditional national and energy security narratives must take note of. The energy landscape no longer looks like what it did during the cold war. The world is not divided between the bad guys who have all the oil and the good guys who need all the oil. In fact, there are no bad or good guys. There are only rich guys who can pay their energy bills and poor guys who cannot. Our energy strategy needs to consist simply of measures that will keep us from falling into the latter club!

Views are those of the author

Author can be contacted at lydia@orfonline.org

POWER

Power Sector Retrospection: Year 2013

Ashish Gupta, Observer Research Foundation

Power sector problems are well known but none of the political parties are taking genuine interest in this issue. Put simply, ‘all is not well in the power sector’. Though the generation side has flourished the distribution side performance is deteriorating both in terms of efficiency and transparency. Some good initiatives have been taken last year but implementation has been very poor. In other words, no one is really keen on fixing power sector problems as it is now an industry for rent extraction. Most of the problems are related with political issues as utilities are becoming a toy for wooing voters. It is now the best time to evaluate the performance of the power sector in the hope that the new government does not repeat the same mistakes in the coming five years!

Model State Electricity Distribution Management Responsibility Bill, 2013 - To put it bluntly, the political class does not want to learn as the recent draft Model State Electricity Distribution Management Responsibility Bill, 2013 shows. There is nothing new in this. It has simply said the same old things with some additions and new packaging. The Bill may be good on paper but it has failed to address core issues faced by the distribution sector. We need to understand a very basic point that simply incorporating responsibility clauses will not make the States more responsible. Responsibility will come only when there is transformation in the working style of the state government complemented with transparency. For that we do not need another Bill but a concrete governance system.

Distribution sector financial restructuring: This only takes forward initiatives taken in 2012 and provides some stability to the distribution side through one time settlement. Things are certainly not moving in the right direction because of the conditionality in availing the one time financial settlement mechanism. The government is again resorting to a back door strategy for pushing private participation as distribution utilities have to opt for either the franchise model or choose complete privatization. Here too politics has played a major role as the states in which ruling parties or their allies are in power have accepted the conditions but other states have been reluctant. Well the concept per se is not bad but over obsession with privatization may take things from bad to worse. The best way forward is to infuse competition! Distribution utilities must be bench marked against best practices such as those adopted by Himachal Pradesh State Distribution Company.

Power Generation: On the generation front once again improvement was witnessed. The target fixed was 930 billion units and actual achievement was 912 billion units in 2012-13. The Plant Load Factor (PLF) for the power plants too has improved in spite being old. The central sector power plants showed an average PLF of 79.2% where as private power plants PLF remained at 64.1% in 2012-13. On the whole it is a very good performance and it must continue!

Plant Availability Factor (PAF) to Plant Load Factor (PLF): The generation side that enjoyed a cushion of PAF is now crying foul as their incentives will be reduced when PAF replaced with PLF. They also have to share some percentage of profit with the distribution sector. The regulators have been criticised for favouring the generation side but it is clear that it is not the case. The recent draft tariff guidelines for transmission and distribution applicable for 2014-19 shows that they are not biased and they are very keen to strike a balance between the generation, transmission and distribution value chain. The move is genuine because generation need not be incentivized when there is no demand from the distribution side. But the generation side can recover the fixed cost through PAF. On the whole it is a very genuine move and must be implemented in true spirit!

Open Access Power to Retail consumers: Again it is a carry forward item from previous years and nothing concrete is happening in this regard. Since there is no time limit set by the regulators for the same it has remained a distant dream for the retail consumers. Hope the newly elected government will come out with a concrete plan on open access which can give some power to retail consumers which is preferable to luring them with free electricity.

Corporate Extortion: Last year we witnessed many cases where generating companies, after getting the power projects, started renegotiating tariff giving one or the other reason. Indeed it is becoming a routine practice to get a project by quoting the lower tariff and then start threatening to disrupt power production on account of expensive coal. This crony capitalistic approach must stop and the culprits should be dealt with the stick approach. Here the state governments must ensure that they will not succumb to the unethical corporate extortion practised by generation companies.

Comptroller Auditor General (CAG) Audit: The question is not whether the CAG is empowered to conduct an audit of the private distribution utilities but it is the matter of the credibility of the private sector. Indeed the situation has been created by the distribution utilities as consumers are suspicious over the working style of the discoms. If they are suffering a loss then why is there so much reluctance on their part to come clear over the cause for losses. Discoms initially came out with the statements that they are open to any scrutiny but later they refused. Now they are refusing to give supportive documents to the CAG and are complaining that they have not been given the opportunity to be heard. On the whole, in the CAG audit drama the discoms are losing credibility. Indeed they must allow the CAG to perform an audit so that they can come out with the conclusion that tariffs are not cost reflective as was reiterated in public forums by the distribution utilities. The discoms must adopt a cooperative attitude; otherwise they will always be seen with suspicion.

The Year 2013 was filed with turmoil for the power sector but the future prospects are bright. The only thing that is required is a collective and transparent approach.

Views are those of the author

Author can be contacted at ashishgupta@orfonline.org

DATA INSIGHT

Indian Nuclear Power Scenario: Some Trends

Akhilesh Sati, Observer Research Foundation

|

Location & State |

UNITS |

Capacity (MW) |

Generation (MU) |

Increase/Decrease in Generation w.r.t. previous year |

|

|

2012-13 |

2011-12 |

(in %) |

|||

|

Tarapur, Maharashtra |

TAPS-1 |

160 |

577 |

1371 |

-58 |

|

TAPS-2 |

160 |

1007 |

1337 |

-25 |

|

|

TAPS-3 |

540 |

4373 |

4325 |

1 |

|

|

TAPS-4 |

540 |

3866 |

2781 |

39 |

|

|

Rawatbhata, Rajasthan |

RAPS-1# |

100 |

- |

- |

- |

|

RAPS-2 |

200 |

1584 |

1821 |

-13 |

|

|

RAPP-3 |

220 |

1757 |

1938 |

-9 |

|

|

RAPS-4 |

220 |

1926 |

1645 |

17 |

|

|

RAPS-5 |

220 |

1760 |

1974 |

-11 |

|

|

RAPS-6 |

220 |

1819 |

1764 |

3 |

|

|

Kalpakkam, Tamil Nadu |

MAPS-1 |

220 |

1485 |

1240 |

20 |

|

MAPS-2 |

220 |

1257 |

1276 |

-1 |

|

|

Narora, Uttar Pradesh |

NAPS-1 |

220 |

1226 |

1047 |

17 |

|

NAPS-2 |

220 |

1315 |

937 |

40 |

|

|

Kakrapar, Gujarat |

KAPS-1 |

220 |

1832 |

1919 |

-5 |

|

KAPS-2 |

220 |

1639 |

1868 |

-12 |

|

|

Kaiga, Karnataka |

KAIGA-1 |

220 |

1464 |

1270 |

15 |

|

KAIGA-2 |

220 |

1270 |

1381 |

-8 |

|

|

KAIGA-3 |

220 |

1447 |

1231 |

18 |

|

|

KAIGA-4 |

220 |

1259 |

1330 |

-5 |

|

#RAPS-1 under extended shutdown since October 2004

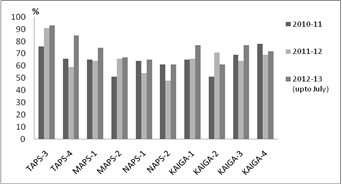

Capacity Utilisation Factor of Nuclear Power Units

Source: Compiled from Lok Sabha Un-starred Questions.

NEWS BRIEF

NATIONAL

OIL & GAS

Upstream

RIL can’t be blamed for dip in output from KG-D6 block: BP

March 3, 2014. BP does not expect any company to drill in Indian deep-sea basins at the current gas price, and endorses Reliance Industries' view that it neither hoarded gas, nor can it be blamed for the sharp decline in natural gas output from the KG-D6 block. Sashi Mukundan, who heads BP's Indian operations, remains upbeat about the global major's multi-billion investment in Reliance Industries' oil and gas blocks even though the Reliance Industries Ltd (RIL) has faced various regulatory hurdles and in the recent past has had to deal with relentless public attacks from Arvind Kejriwal's Aam Aadmi Party.

BP plans to invest $10 billion in the next five years and wants a trusting relationship with authorities. The spate of troubles for KG-D6 has not led to second thoughts, said Mukundan. Mukundan said the current price of gas makes investment in challenging, high-risk deepwater regions unviable. This would hinder gas output and encourage import of costly liquefied natural gas, Mukundan said. BP feels Reliance's response to the barrage of allegations against the company is backed by technical and geological data as well as global experiences in producing oil and gas from deep-sea fields. RIL has been blamed and penalised by the government for the sharp fall in gas production from KG-D6 and is being made to wait nervously for the final go-ahead to charge higher gas prices next month and is facing a regular barrage of attacks.

Mukundan said it is not fair to blame RIL for the fall in production because across the world, estimated output stipulated in the field-development plan (FDP) often turns out to be different from the actual outcome. Asked if the production-sharing contract (PSC) envisaged estimated production as an enforceable commitment, as interpreted by the former oil minister Jaipal Reddy and India's oil and gas regulator, Mukundan said he disagreed with this reading. (economictimes.indiatimes.com)

ONGC to invest $3 bn more in Mozambique gas field

March 2, 2014. After spending USD 4.12 billion in acquiring stake in a giant gas field in Mozambique, ONGC will invest another USD 3 billion as its share of cost of producing gas from the field and converting it into LNG. ONGC Videsh Ltd (OVL) teamed up with Oil India Ltd (OIL) to buy Videocon's 10 percent in the Rovuma Area 1 for USD 2.475 billion. Subsequently, OVL on its own bought another 10 percent stake in the same field from Anadarko Petroleum Corp of the US for USD 2.64 billion. The 10 percent stake of Videocon is currently split in 60:40 ratio and total payout for OVL for the back-to-back acquisitions is USD 4.125 billion. An estimated USD 18.4 billion will be required to bring first set of discoveries on to production and convert that gas into liquid (LNG) for ease of shipping to consuming nations like India. (zeenews.india.com)

RIL accuses ONGC of holding back KG data

February 28, 2014. Reliance Industries Ltd (RIL) rejected ONGC's complaint to the government over their adjoining fields in the Krishna-Godavari basin, alleging that the state-owned company was holding back data required to establish whether they have a common reservoir. RIL said it will now complete the initial analysis even without all the data and called a bilateral meeting on March 11 on the issue. RIL said the company was yet to receive the "complete and correct data set" despite the two parties having agreed to provide "all necessary data" by December 17 last year. The state-run explorer had sought the help of the oil ministry in July last year after it feared that two of its blocks in the east coast could be contiguous with RIL's KG-D6 block and the private operator might be drawing gas from its fields. The ministry immediately intervened and directed the two firms to exchange data and sort out the matter amicably. The two companies initially met on December 10 last year and decided to exchange data of their respective gas fields. RIL said ONGC didn't provide all the data required to interpret whether the fields were overlapping, despite RIL having provided all the data sought by ONGC. ONGC said Reliance was evading a meeting with the state firm, which is necessary to clear doubts over whether RIL was drawing natural gas from its undeveloped fields located next to the KG-D6 block. (economictimes.indiatimes.com)

Transportation / Trade

Will wait till March-end to take a call on HPL: IOC

March 2, 2014. Indian Oil Corporation (IOC), which had made a bid to buy out West Bengal government's stake in ailing Haldia Petrochemicals Limited (HPL), would wait till March 31 before taking a call on the matter. IOC had quoted a price of ` 25.10 per share for HPL's stake and was the sole bidder. IOC has learnt that the West Bengal government was in talks with TCG, the other promoter, to find a way out.

TCG, which was supposed to exercise its right of first refusal on the IOC offer, moved the Supreme Court over the controversial 155 million shares which were clubbed together with the state government's stakeholding in HPL. The apex court subsequently allowed TCG to move the arbitration cell of Paris-based International Chamber of Commerce to resolve the ownership issue of the 155 million shares. (economictimes.indiatimes.com)

GAIL seeks gas from East Africa to boost supply chain

February 27, 2014. GAIL (India) is seeking liquefied natural gas (LNG) from East African producers to diversify its supply sources. So far, GAIL has the best price contract with US-based LNG suppliers, which was at less than $12 per mmbtu on Free on Board basis.

The 6 million tonnes per annum (mtpa) supply from US was expected to commence from 2018. Currently, GAIL gets 7.5 mtpa from the West Asian suppliers. It has also firmed two contracts for 2.5 mtpa supplies by Gazprom for Russian LNG from 2018-19 and 1.5 mtpa supplies from Australia's Gorgon project, starting 2015. GAIL's contracts are based on the US' Henry Hub, Japan Crude Cocktail and Brent indices. It is now looking for contracts based on North Myrtle Beach (NMB) index. Meanwhile, Petronet is hoping to commence operation of its 5 mtpa LNG receiving terminal on the Andhra Pradesh coast in 2017, expecting the new eastern state government to give the final of the pending approvals after the elections.

Petronet said the project had received all other approvals for the Gangavaram terminal. Petronet and Gangavaram Port are to jointly develop the land-based 10 mtpa terminal for the east coast markets. (www.financialexpress.com)

Policy / Performance

Oil Ministry wants CAG to quantify loss in KG-D6 contracts

March 3, 2014. The Oil Ministry has asked Comptroller and Auditor General of India (CAG) to quantify the loss to the government caused by Reliance Industries' awarding contracts worth $2.4 billion for developing oil and gas finds in the KG-D6 block on the basis of a single bid. The ministry says any loss to the government will be deducted from the capital cost allowed for developing oil and gas fields in the eastern offshore KG-D6 block.

CAG had in its September 2011 report on the audit of RIL's expenses on the KG-D6 block asked the ministry to carefully review the award of 10 specific contracts, of which eight were to Aker Group companies, after other bidders were disqualified on technical grounds. CAG faulted RIL for awarding a $1.1 billion contract to put up a production facility at its MA oilfield in the KG-D6 block to Aker on a single-bid basis. The ministry in the letter to CAG said auditors should carry out transaction-based audit, including corrective action required. (economictimes.indiatimes.com)

ATF price hiked by 1 pc, non-subsidised LPG rate cut by ` 53

March 2, 2014. Jet fuel or ATF price has been hiked by a marginal 1 per cent while rates of non-subsidised cooking gas (LPG) have been cut by ` 53.5 per kg reflecting global trends. Aviation Turbine Fuel, or ATF, price at Delhi was hiked by ` 753.34 per kilolitre, or 1 per cent, to ` 74,825.54 per kl, according to Indian Oil Corp (IOC). The hike follows a 3 per cent cut in rates on February 1 on softening international oil rates. However, prices have gone up since then and rupee depreciated against US dollar, making imports costlier. In Mumbai, jet fuel costs ` 77,322.6 per kl as against ` 76,524.33 per kl previously, IOC said. Rates at different airports vary because of difference in local sales tax or VAT. Jet fuel constitutes over 40 per cent of an airline's operating costs and the price hike will increase the fuel cost of the cash-strapped carriers. Separately, the price of non-subsidised cooking gas (LPG), which customers buy after using up their quota of 12 subsidised cylinders, was cut by ` 53.5 per cylinder, the second straight reduction in rates since February. The 14.2-kg cooking gas cylinder that consumers buy beyond their entitled 12 bottles at subsidised rates, will now cost ` 1,080.50, down from ` 1,134, in Delhi. (economictimes.indiatimes.com)

Petrol and diesel rates hiked before crucial polls

March 1, 2014. Petrol is costlier by 73 paise a litre in Delhi and diesel by 57 paise because of rising international prices of gasoline ahead of imminent general elections where rising fuel price could become a poll issue. IOC has said petrol prices have been raised by 60 paise a litre and diesel by 50 paise across the country, but pump rates would differ from city to city depending on local levies.

Diesel prices have been raised as per the decision of the Cabinet. Despite the hike companies are still losing ` 8.37 per litre on the fuel. The Cabinet gave limited freedom to state fuel retailers to raise diesel prices in small doses every month until pump prices are aligned with market rates. (economictimes.indiatimes.com)

Govt to take over KG-D6 block if RIL shuts down production

March 1, 2014. The government will take over Reliance Industries Ltd's KG-D6 block if it shuts down production, following a suggestion by the company that this might be an option. The company, however, denied that it had any plan to do so. The company is waiting for the oil ministry to finalise the mechanism for bank guarantees, which it has to furnish to be eligible to charge higher gas rates. Bureaucrats in the petroleum ministry have been dragging their feet over this, worried about the stand of the new government, which will take over after the upcoming general election. Reliance's bank guarantees will be encashed if it is found guilty of having hoarded gas in the past. Reliance Industries said the mechanism for guarantees should not come in the way of implementing the new price. When the government notified the new gas pricing formula, which is estimated to double the existing price of $4.2 per unit, it said there would be a separate order for Reliance, which can charge the new rate after furnishing the bank guarantee. Oil ministry bureaucrats have now sought the law ministry's advice on whether Reliance's partners BP and Niko Resources would also have to furnish bank guarantees because these two companies are not parties in the arbitration between the government and Reliance. The current gas price of $4.2 was approved by an Empowered Group of Ministers (EGoM) headed by Pranab Mukherjee for five years from the day KG-D6 gas output began. Reliance's fields started production on April 1, 2009, making the gas price valid up to March 31, 2014.

Reliance, ONGC, Gujarat State Petroleum Corp and other companies demanded market-linked prices for gas. The issue was referred to the Rangarajan Committee, which recommended a formula that takes the average of international benchmarks to calculate the price. The cabinet subsequently approved the formula. (economictimes.indiatimes.com)

POWER

Generation

Nava Bharat to tie up funds for 300 MW Zambia power project by June

March 3, 2014. Nava Bharat Ventures Limited, a Hyderabad-based company with interests in power, coal mining, ferro alloys and sugar, expects to achieve financial closure (on a non-recourse basis) for its mine-mouth, coal-fired power project in Zambia by June 2014. Of the total investment of $700 million (` 4,340 crore) proposed to be infused in the project, the loan component comprises $560 million. The commissioning of the project is scheduled in the fourth quarter of FY2015, the company said.

About 65% work on the project, being developed by Nava Bharat’s unit Maamba Collieries Ltd, has been completed. It has entered into power purchase and transmission agreements with Zambian state power company Zesco for the 300 MW. (www.business-standard.com)

BHEL bags ` 79 bn order related to 1.9 GW thermal power project

March 2, 2014. State-owned power equipment maker BHEL has bagged a contract worth ` 7,900 crore related to 1,980 MW thermal power project in Jharkhand.

The contract, won through international competitive bidding, is for NTPC's 1,980 MW North Karanpura super thermal power project. The plant will have three units, each having a generation capacity of 660 MW. The key equipment for the contract will be manufactured at BHEL's Trichy, Haridwar, Bhopal, Ranipet, Hyderabad, Jhansi and Bangalore plants. (economictimes.indiatimes.com)

NTPC to set up ` 170 bn power project in MP

February 28, 2014. NTPC will lay the foundation stone for the 2,640 MW power project in Madhya Pradesh (MP), entailing an investment of ` 17,000 crore. The Bundelkhand super thermal power project, located in Chhatarpur district, would have four units - each having 660 MW generation capacity. Half of the total electricity generated from the plant would be supplied to Madhya Pradesh.

At present, the company meets about 24% of the state's total electricity requirement. This total capacity includes 50 MW solar plant at Rajgarh and 1,600 MW Gadarwara thermal project at Narsinghpur. NTPC has an installed power generation capacity of 42,464 MW. (www.business-standard.com)

Shree Uttam Steel & Power to set up ` 111.5 bn mega project in Maharashtra

February 27, 2014. Shree Uttam Steel and Power will be setting up a ` 11,156 crore mega project in Maharashtra in the Sindhudurg district, the company said. The manufacturing facility will include a 1.5 million tonne per annum of hot rolled coil unit and a 40 MW captive power plant. The company signed a memorandum of understanding with Maharashtra government for setting up this facility. (www.business-standard.com)

Tata Power generates 3,212 million units of electricity in Q3

February 26, 2014. Tata Power, the country's largest private power producer, generated 3,212 million units of electricity in the third quarter of this financial year. The company produced 10,513 million units in first nine months of 2013-14 (April-December). Tata Power, its subsidiaries and jointly controlled entities have a combined installed generation capacity of 8,560 MW, including thermal, hydro, wind and solar.

The company said subsidiaries Maithon Power Ltd and Coastal Gujarat Power Ltd contributed significantly after achieving full operations. Maithon Power operates a 1,050 MW plant and Coastal Gujarat runs a 4,000 MW project. Tata Power has installed generation capacity of 1,102 MW through clean and green energy sources. Tata Power is developing the 126 MW Dagachhu hydro power project in partnership with Bhutan. The company also announced the start of construction of the first phase of the 185 MW Shuakhevi hydro power project in Georgia, being implemented through a joint venture with Clean Energy Invest AS and IFC InfraVentures for developing hydro projects in Georgia, for sale of power primarily to Turkey. (economictimes.indiatimes.com)

Transmission / Distribution / Trade

Power Grid announces investment of ` 5.7 bn

March 3, 2014. Central transmission utility Power Grid Corporation announced investments of over ` 575 crore for two projects. The company approved an investment of ` 378.71 crore for setting up a transmission system associated with the Kakrapar Atomic Power Project, with a commissioning schedule of 32 months. The state-owned firm plans to invest more than ` 61,000 crore in the next three financial years, with a significant chunk of funds to be raised by way of bonds and debentures. (www.business-standard.com)

UAE-led group to buy two India power plants in deal worth $1.6 bn

March 2, 2014. A consortium led by Abu Dhabi National Energy Co (TAQA) has agreed to buy two Indian hydroelectric power plants from Jaiprakash Power Ventures in a deal worth about $1.6 billion, TAQA said. The group will spend $616 million on equity in the plants, and in addition take over their non-recourse project debt, bringing the total enterprise value to around $1.6 billion. The two plants, located close to each other in the northern state of Himachal Pradesh, have a combined generating capacity of 1,391 megawatts, and are near another Indian hydroelectric plant in which TAQA acquired a stake last year. Along with a lignite power plant owned by TAQA, the latest deal will bring TAQA's combined generating capacity in India to 1,741 MW. The deal, which needs regulatory and third-party approvals, is expected to close in 2014, TAQA said. (www.business-standard.com)

Tata Power signs pact to sell 30 pc stake in Indonesian firm

February 27, 2014. Tata Power announced sale of its 30 per cent stake in PT Mitratama Perkasa to Indonesia's Bakrie Group for around USD 120 million. The transaction is part of the USD 500 million deal to exit Indonesian coal company PT Arutmin and associated coal trading and infrastructure companies. Tata Power said it targets to complete the sale of PT Mitratama Perkasa in the next two months, subject to getting the requisite approvals. (economictimes.indiatimes.com)

Power experts oppose uniform rates in Mumbai

February 27, 2014. Power regulators, consumer organisations experts have raised a red flag over the viability of uniform power rates for low-end consumers with monthly consumption of up to 300 units in Mumbai. It was against the competition envisaged in the Electricity Act, 2003, they said. They also supported the observation made by PricewaterhouseCoopers in its report in July 2011 to the Maharashtra Electricity Regulatory Commission that uniformity in rates can be achieved if the enablers come into play or if the government supports the entire process via means of external support, if required. Distribution companies have been asked to prepare a map to reduce rates and bring down power rates charged to consumers in Mumbai. (www.business-standard.com)

Scindia calls off power ratings event as Gujarat discoms top again

March 4, 2014. Gujarat's strides in improving power supply is increasingly taking a political hue. It's not just in Narendra Modi's rallies, where he sarcastically asks people in UP if they are getting regular supply and proudly narrates how villagers in his state have continuous supply. Power minister Jyotiraditya Scindia seems to blow his fuse when he is called for functions where utilities are rated, and top performers turn out to be from Gujarat. For the second year in a row, all four state-run distribution companies (discoms) under Modi's government emerged as top performers in the appraisal carried out by the power ministry. The ratings, which are meant to help lenders evaluate risks but also have the potential to add to the ammunition of BJP's prime ministerial candidate, will probably be released after the general elections as Scindia himself will be busy with the campaign. In March last year, when the power ministry launched the ratings power minister Jyotiraditya Scindia abruptly left the venue without felicitating the officials of Gujarat discoms, as announced. (economictimes.indiatimes.com)

Relief for Maharashtra power users finally as govt offers 20 pc rebate

March 3, 2014. Even as state power regulator has allowed Mahavitaran to recover ` 5,022 crore worth revenue shortfall from consumers from March 1, the utility has decided against burdening the public after the poll-bound Prithviraj Chavan government agreed to give it 20 per cent subsidy. This does not mean that tariffs will come down but they will not go up either.

The state will be providing subsidy to the extent of over ` 606 crore per month or ` 7,272 crore to reduce power tariffs by around 20 per cent, the utility said. The state government in January announced a 20 per cent discount for power consumers in Maharashtra except Mumbai, but did not issue a notification in this regard so far. The move came following protests by state leaders to slash power charges following 50 per cent cut effected by erstwhile Arvind Kejriwal government in New Delhi. As per the Maharashtra Electricity Regulatory Commission (MERC) order, the regulator has approved an average increase of 17 per cent in tariffs for FY12 and FY13 so that the discom could recover the dues.

The state electricity distributor had approached the MERC seeking recovery of shortfall in its revenues for the two years which occurred due to abnormal change in sales mix that impacted Mahavitaran's cash flow during the period. The MERC had allowed recovery of ` 418.51 crore per month from consumers across all categories. The shortfall includes ` 4,000 crore against revenue and ` 1,022 crore against carrying cost. Meanwhile, MERC has directed Mahavitaran to submit a roadmap to bill unmetered agriculture pumps and also to undertake detailed study of division wise losses. (www.business-standard.com)

Indian, US, Japanese firms race for projects in the UAE

March 3, 2014. Over 116 companies from 15 countries, including India, are in the race for acquiring two high- profile utilities projects in Ras Al Khaimah emirate in the UAE. It is an unprecedented participation for independent water and power projects in the Gulf country. Companies from the US, Europe, Japan, China, India and the Middle East are in the race for the projects, with GDFSuez, Elf Energy, Abengoa (which has built Shams Energy), and ACWA Power among the top international bidders.

The tender is expected to be wrapped up in the third quarter of this year. It calls for the construction of a water desalination plant which will deliver an output of 22 million gallons per day and a power plant that will generate 40 MW per hour once operational. The projects are being developed on a 20-year guaranteed off-take agreement by Utico, the region's largest private utilities company. (www.business-standard.com)

Rajasthan govt to allot 30k new domestic power connections

March 2, 2014. The Rajasthan government will soon allot 30,000 new domestic power connections under the 'Chief Minister Power for All' programme. Out of these 30,000 connections, 15,000 would be allotted in Jodhpur Discom alone.

The details about the new connections were devised by Rajasthan Power Minister G S Khinvsar and announced in 'Field Engineers Conference' held. The conference was also attended by Chief Minister Vasundhra Raje. Raje emphasized on speeding up the grievance redressal mechanism and making it more consumer friendly. (economictimes.indiatimes.com)

Digvijaya Singh seeks ` 50 bn for hydro power project in MP

February 28, 2014. Congress general secretary Digvijaya Singh has sought a special package from Prime Minister Manmohan Singh to revive a stalled ` 5,000 crore private sector hydro-electricity project, launched during his tenure as chief minister of Madhya Pradesh (MP) in the early 1990s. Blaming the environment ministry and state-run financier Power Finance Corporation for the problems plaguing Shree Maheshwar hydel power project, Singh has told the prime minister that the country has lost ` 1,500-crore of clean energy due to the delays to the project and is losing ` 1.5 crore with every passing day - terming this a "criminal" loss that "needs to be arrested forthwith". (economictimes.indiatimes.com)

New CERC tariff order a shocker for NTPC: Fitch

February 27, 2014. The central power regulator's new tariff order for FY15-FY19 will severely hurt state-run power generator NTPC, which is likely to take a hit of 350 basis points on its pre-tax return on equity, Fitch Ratings said. As per the Central Electricity Regulatory Commission (CERC)'s new norms, to be in force for five years (April 2014 to March 2019), there will be key changes with regard to tax and calculation of incentives for thermal power plants. The rules were notified on February 21.

The key changes made by the CERC include shift in the incentive regime from the plant availability factor (PAF) to plant load factor (PLF). Incentives based on PLF would depend on actual power generation which may result in lower incomes. PLF is a measure of average capacity utilisation while PAF refers to average of daily declared capacities. The incentive for every unit of electricity generated has been kept flat at 50 paise/kWh. Based on new norms, the rating agency estimated that the new tariff order would bring down NTPC's pre-tax RoE by around 350 basis points.

However, the new incentive regime will have a limited impact on National Hydroelectric Power Corp and PowerGrid, the rating outfit noted. PLF is dependent on the ability of the state discoms' ability to off-take power from plants, the agency said. Fitch observed that none of NTPC's seven gas-based plants had PLFs over 85 percent. (zeenews.india.com)

Adani giving power at cheaper rate: Haryana Power Minister

February 27, 2014. Haryana Power Minister Ajay Yadav said Adani Group is supplying power at cheaper rate as compared to state-owned power generating units. Yadav said power was being purchased from Adani Group within the frame of policy and nothing was wrong in purchasing cheap power from outside the state. Opposition party INLD had accused the state government of deliberately purchasing electricity at higher rates to provide benefit to the private companies while shutting down its own power plants. Haryana distrubition companies had claimed that the per unit cost of power sold from several units ranged between ` 4.10 to 5.33 per unit. Supporting the Minister, newly appointed Haryana Electricity Regulatory Commission (HERC) member M S Puri said on technical ground, the efficiency of new power plants is better as compare to old power plants. The power units of Adani Group are new and if the state is getting cheap power from Adani then it is good for the state. Puri said the position of Haryana is better in terms of power availability and it is among top three states in terms of per capita power consumption, with peak load at 8,000 MW. (economictimes.indiatimes.com)

TN to get first supercritical power station at ` 49.5 bn

February 27, 2014. As a part of measures to step up power generation in Tamil Nadu, Chief Minister J Jayalalithaa laid the foundation stone for setting up a 660 MW supercritical power station at an investment of ` 4,956 crore. She laid the foundation stone for station through a video conference facility. Jayalalithaa had announced that a supercritical power station would be set up that would consume less coal for generating more power. (www.business-standard.com)

CIL, NTPC spar over ` 30 bn arrear settlement

February 27, 2014. Coal India Ltd (CIL) and its largest customer, NTPC Ltd, are at loggerheads over how to settle more than ` 3,000 crore of arrears that the power producer has run up. NTPC is ready to pay up, but CIL is opposing a formula that the government has told the two state-run companies to follow for settling the payment. The power ministry, after consulting the coal and finance ministries, has told NTPC to settle the arrears based on the three-month average gross calorific value of the coal supplied by CIL.

An independent agency is carrying out the sampling to find out the calorific value, or energy content, of the coal. CIL is in no mood to accept this method and wants the bill to be settled according to the terms of its coal supply contract with NTPC. The formula was decided at a meeting in the finance ministry in December after the arrears touched ` 4,000 crore. Since then, NTPC has paid about ` 1,000 crore as part payment. (economictimes.indiatimes.com)

Compensatory tariff by CERC for Tata, Adani may cost discoms close to ` 24 bn per annum

February 26, 2014. The electricity regulator's order for compensatory tariff to the power producers may cost close to ` 2,400 crore per annum to the utilities of five states besides compensating ` 329 crore to Tata Power and ` 829 crore to Adani Power for the past losses, customers of the plants have estimated. The burden of higher power tariff may be neutralised to some extent for utilities of Maharashtra, Gujarat, Haryana, Rajasthan and Punjab depending on their share of profit from mining operations and third party electricity sale by these two firms. Tata Power said it does not expect the CERC order to offset the impact of devaluation of the Indian rupee and higher interest payout of ` 200 crore per annum. It is claiming that its 90 paise per unit of fixed cost of production at Mundra is among the cheapest fixed cost providers in India. Industry executive said after receiving the regulator's nod for partial compensation for fuel costs due to change in coal price regime in Indonesia, both firms, are expected to approach Central Electricity Regulatory Commission (CERC) again to seek increase in another component of tariff - the fixed cost or "capacity charge". Tata Power had estimated a shortfall of capacity charges of 13 paisa per unit amounting to ` 346 crore for a year. Adani Power pegged this at ` 479 crore. CERC orders did not cover the losses of both companies on increase in fixed costs due to higher debt servicing expenses and adverse foreign exchange fluctuations. (economictimes.indiatimes.com)

Decision on power rate cut in Mumbai discoms' court

February 26, 2014. The Maharashtra government, which is under tremendous pressure from treasury and opposition party members and consumer organisations, has refused to provide a subsidy to private utilities Tata Power and Reliance Infrastructure to cut their rates in Greater Mumbai. Mumbai power consumers would therefore have to further wait for the much-debated relief in rates as the government has put the ball in the court of the distribution utilities — the BrihanMumbai Electric Supply & Transport (BEST), an arm of BrihanMumbai Municipal Corporation. These companies have been asked to provide a map for providing relief in rates to Mumbai consumers. Tata Power’s consumer base is 450,000 while it is 2.8 million for Reliance Infrastructure and one million for BEST. The government has asked Tata Power, R-Infra and BEST to revise their rates and bring it to a uniform level for consumers with a monthly consumption of 100-300 units. Besides, the government has asked these utilities to prepare a road map to bring down the existing tariff for these consumers. Further, more consumers of R-Infra are to be allowed to shift to Tata Power, whose rate is low. Chief Minister Prithviraj Chavan said the government was quite keen that consumers of 100-300 units in Mumbai be brought down to the level charged by Maharashtra State Electricity Distribution Company. Chavan informed that he had a meeting with the representatives of Tata Power, Relinace Infrastructure and BEST. According to Maharashtra Electricity Regulatory Commission’s orders issued on multi-year tariff, Tata Power’s per unit tariff for 2013-14 was revised upward, but was much lower at ` 2.13 compared to ` 3.93 a unit by Reliance Infrastructure for low-end consumers with monthly consumption up to 100 units. For consumption between 101 and 300 units, Tata Power’s tariff is ` 3.62 a unit against Reliance Infrastructure’s ` 6.84 a unit. (www.business-standard.com)

India, Russia may sign contracts for Kudankulam reactors before polls

February 26, 2014. India and Russia may sign contracts for the third and fourth rectors of the Kudankulam nuclear power plant before Lok Sabha elections, breaking the months-long deadlock over a stringent law governing nuclear accidents. The two sides are currently holding intense negotiations to give final touches to the contracts. Officials of the Nuclear Power Corporation of India Limited (NPCIL) and Russia's state atomic agency Rosatom are currently holding negotiations in Mumbai on the final contours of the contracts in order to ink them before Parliamentary polls. The chief of Rosatom S Kirienko was in Delhi on a whirlwind tour for few hours to hold negotiations on the protracted issue. The issue of contracts for Units 3 & 4 besides defence, nuclear energy and space cooperation would be discussed during Russian Deputy Prime Minister Dmitry Rogozin's day-long India visit. The contracts could be signed even after poll notification as it is an ongoing issue and there is bilateral agreement in place that enables buying nuclear reactors from Russia. This indicates that both sides want to seal the matter before a new government is sworn in at Delhi. Russia, like the US, is concerned about India's Nuclear Liability Law, which makes suppliers of nuclear fuel and related equipment liable in case of a nuclear plant accident. Differences over the issue had prevented the signing of contracts at the last minute during Prime Minister Manmohan Singh's visit to Moscow in October last year. (economictimes.indiatimes.com)

INTERNATIONAL

OIL & GAS

Upstream

Americas Petrogas discovers oil at Neuquén basin in Argentina

February 28, 2014. Americas Petrogas has discovered oil at its Agua de Afuera Vaca Muerta formation, unconventional, vertical shale exploration well, situated on the Los Toldos II block in Neuquén basin, Argentina.

The company has tested hydrocarbon production rate at 240 barrels of oil equivalent per day (boepd) from the well, while average hydrocarbon production was 216 boepd with 460 barrels of flow back water per day on a 4 mm choke, which lasted for 20 days. (explorationanddevelopment.energy-business-review.com)

OMV signs two new exploration licences in Pakistan

February 28, 2014. Austria's OMV and its joint venture partner Pakistan Petroleum Limited have signed two new exploration licences in Pakistan, OMV said. The Kuhan block in Baluchistan province will be operated by OMV, and the Margand Block, also in Baluchistan, will be operated by PPL, it said.

Both companies have a working interest of 50 percent in each block. OMV said the joint venture would start exploration in the second half of this year, consisting of seismic data acquisition and drilling of exploration wells. (www.rigzone.com)

Cameroon oil production to pass 82k bopd in 2014: SNH

February 27, 2014. Cameroon's 25 percent increase in oil production in 2014 will take daily output to just over 82,000 barrels of oil per day (bopd), the SNH state oil company said.

The increase is driven by the November 2013 start of oil production from the Mvia offshore oil field in the Douala-Kribi-Campo basin. However, output is well down levels of around 185,000 bpd in the mid 1980s.

Cameroon has launched a new bidding round for four oil blocks for the Bomana, Lungahe and Ndian River blocks in the Rio del Rey Basin and the Manyu block in the Mamfe Basin. The deadline for submissions is June 26 and the results will be released in mid-July. (www.rigzone.com)

Ukraine economy hangs on investments from Exxon to Shell

February 26, 2014. The world’s largest oil companies from Royal Dutch Shell Plc to Exxon Mobil Corp. are likely to reassess deals to drill in Ukraine where political crisis is threatening a promising source of new profits as well as the country’s drive for energy independence.

Shell and Chevron Corp. signed agreements last year to drill unexplored shale formations in Ukraine, offering the chance to upgrade the country’s energy infrastructure and boost domestic production, thus reducing the amount of gas imported from Russia.

Before the crisis erupted last year, Exxon, the largest U.S. oil company, was also close to signing a pact to explore the Black Sea. While the oil companies can spend their money in other countries, the investment, which could eventually be worth more than $10 billion, is vital to Ukraine’s quest to pull away from Russian control and revive an economy on the verge of collapse after three months of violent protest. (www.bloomberg.com)

Downstream

S. Korea confirms S-Oil to invest $7.5 bn in refining, petrochemical units

March 3, 2014. South Korea's S-Oil Corp will invest 8 trillion won ($7.49 billion) to build heavy oil upgrading and petrochemical production units, the energy ministry said. S-Oil plans to spend 5 trillion won through to 2017 to build heavy oil upgrading and petrochemical units, and then 3 trillion won later to build additional petrochemical units, the ministry said. South Korea's third-largest refiner won a tender to buy land in Ulsan from state-run Korea National Oil Corp for the facilities.

S-Oil was expanding its heavy oil upgrading unit to raise gasoline production by nearly 50 percent to up to 218,000 barrels per day. S-Oil would build a 45,000 bpd atmospheric residue desulphurization unit and an up to 70,000-bpd residue fluid catalytic cracker (RFCC), although ministry statement did not elaborate. (www.downstreamtoday.com)

Transportation / Trade

Petronas to sign with India buyer March 7 for Canada gas stake

March 4, 2014. Petroliam Nasional Bhd., Malaysia’s state oil company, will sign an agreement to sell 10 percent of its liquefied natural gas project in Canada to an Indian company on March 7, its chief executive officer (CEO) Shamsul Azhar Abbas said. Petronas, as the company is known, may also sell 15 percent stake in the Pacific NorthWest LNG project to an Asian buyer by the end of this month, CEO Shamsul Azhar Abbas said. It is allocating an additional two percent to Brunei National Petroleum Co., which already owns three percent. Petronas acquired control of the project through its C$5.2 billion ($4.7 billion) takeover of Canada’s Progress Energy Resources Corp. in 2012, making it the second-biggest shareholder in British Columbia’s Montney shale-gas area. The Kuala Lumpur-based company aims to reduce its share in Pacific NorthWest LNG, which runs a gas export facility, to as low as 50 percent by selling stakes to Asian gas buyers, the unit’s President Greg Kist said. Indian Oil Corp., the nation’s biggest refiner, has lined up a $900 million one-year bridge loan to fund a planned purchase of a stake in Petronas’s Canadian gas projects, three people familiar with the matter said last month. Japan Petroleum Exploration Co. bought a 10 percent stake in the project last year. The Canadian asset will produce as much as 19.68 million metric tons of LNG a year for 25 years starting in 2018, according to an application to the country’s National Energy Board. (www.bloomberg.com)

Iraq official says oil exports jump in Feb

March 3, 2014. Iraq's daily oil exports surged to 2.8 million barrels per day in February, some half million barrels more than in the previous month, as international oil companies developed fields and export infrastructure, a senior official said. The increase is crucial for Iraq, which sits atop the world's fourth largest proven reserves of conventional crude but has been struggling to rebuild the sector after years of war, sanctions, neglect and more recently, sabotage. Oil revenues make up nearly 95 percent of its budget. The country's deputy prime minister for energy, Hussain al-Shahristani, also said that average production, including the exports, exceeded 3.5 million barrels per day. He said the daily production would have reached 4 million barrels if the country's northern self-ruled Kurdish region had contributed its share of about 400,000 barrels a day to the figure, as had been estimated in the 2014 budget. The Kurds, who stopped exporting oil more than a year ago over a payment row, have sought greater control over oil in their crude-rich region, while Baghdad argues that it should be under central government control. Iraq has been struggling to develop its oil and gas sectors since the 2003 U.S.-led invasion, when deteriorated security scared many investors away. But since 2008, when security started to improve, the country has awarded more than a dozen oil and gas deals to international energy companies such as the U.S.'s Exxon Mobil, the UK's BP, France's Total and others. Daily oil production and exports have climbed steadily since 2011, nearly two years after Iraq awarded rights to develop its major oil fields to international oil companies. Oil Minister, Abdul-Karim Elaibi, said his ministry plans to pump 3.7 million barrels per day this year and to raise exports to nearly 3 million barrels per day. Iraq initially set a target of 12 million barrels a day by 2017, but it is now considering a downward revision to fewer than 10 million barrels, in part because of infrastructure bottlenecks. It later lowered targets to between 5-6 million barrels per day in 2015 and between 9-10 million barrels per day by 2020, a level that could be sustained for 20 years. (www.downstreamtoday.com)

Ukraine tension seen stoking oil, gas prices on supply risk

March 3, 2014. Oil and natural gas rose amid investor concern that escalating geopolitical tension over Ukraine could curb energy supplies. Brent crude advanced as much as 2.2 percent to $111.41 a barrel on the ICE Futures Europe exchange in London. U.K. gas for next-month delivery surged the most in more than 17 months, rising as much as 10.3 percent, to 61.95 pence a therm ($10 per million British thermal units). That’s the highest price since Jan. 31. The standoff over Ukraine, the main conduit for Russian gas to consumers in Europe, intensified over the weekend as the former Soviet state put its forces on combat readiness and Russia’s President Vladimir Putin threatened to invade. Wholesale gas costs jumped in January 2009 after Russian supplies via Ukraine halted amid a dispute over prices and transit terms. Europe’s biggest gas stockpiles for at least four years are helping damp the impact of any potential stoppages. Gas usage in the U.K. is near a 12-year low amid mild weather that cut heating demand. European gas storage was about 50 percent full on Feb. 23, against about 42 percent a year earlier, data from Gas Infrastructure Europe in Brussels show. U.K. gas slid from 68.91 pence on Dec. 31 on ICE Futures Europe. U.S. gas futures jumped as much as 2.8 percent to $4.736 per million British thermal units in electronic trading on the New York Mercantile Exchange, after sliding 25 percent.

Russia’s biggest crude grade, Urals, is shipped from ports on the Black Sea, where Russia and Ukraine share a coastline, and the Baltic Sea. Hansen estimated that the Ukraine crisis would add a risk premium of as much as $5 a barrel to crude prices. Russia receives about half of its budget revenue from sales of oil and gas. Graham Freedman, a senior analyst for European gas and power at Wood Mackenzie Consultants Ltd. in London, played down the risk of a supply disruption. (www.bloomberg.com)

Estonia, Finland sign accord on building joint LNG terminals

February 28, 2014. Estonia and Finland signed an agreement on building two new liquefied natural gas (LNG) terminals on either side of the Gulf of Finland and a pipeline connecting the two countries. The countries have competed for more than a year over a project to build a new liquefied natural gas (LNG) terminal and the Estonian Economy Minister Juhan Parts made the compromise proposal in January this year. Analysts say the region's gas demand only warrants one LNG import terminal, in terms of construction costs and gas import prices. A single LNG terminal is estimated to cost around 500 million euros ($690.58 million) and provides an alternative to gas supplies from Russia. A pipeline that would allow Finland and Estonia to share imports would cost some 100 million euros. (www.downstreamtoday.com)

Kazakh gas pipeline monopoly KazTransGas gets $700 mn China loan

February 27, 2014. Kazakhstan's gas pipeline monopoly KazTransGas signed an agreement to obtain a $700 million loan from China to expand a pipeline to boost exports of the gas to its giant neighbour. The 15-year loan was arranged by China Development Bank, KazTransGas said. It said the loan would be used to complete a second, 311-km (194 mile) stretch of a gas pipeline from southern Kazakhstan and would transport extra volumes of natural gas to China via the already existing Kazkhstan-China pipeline. (www.downstreamtoday.com)

Accidents prompt US to require tests of oil on trains

February 26, 2014. U.S. energy companies using rail to carry crude must conduct tests to help ensure the oil cargoes won’t explode or eat holes through tank cars after rising train derailments spurred new emergency rules. The order issued by the U.S. Transportation Department inspired some protests, but mainly confusion as refiners and producers tried to understand what the new requirements will mean to their operations and how broadly they will apply to shipments across the country.

Oil explorers including Continental Resources Inc. and EOG Resources Inc. will be required to test the chemical composition of all crude intended for shipment by rail. The new rules appear to reclassify some grades of oil and require stricter safety measures for transport. Crude-by-rail shipments have soared along with U.S. oil production as drillers employing new technologies cracked open shale formations faster than new pipelines were built to handle the outflows. The bonanza has increased the risk of explosions and fires because much of the new supply is more volatile than some traditional types of domestic oil. There have been 10 derailments in the past year of trains carrying crude. (www.bloomberg.com)

Winter warmth seen flooding Asia with Japanese kerosene

February 26, 2014. The mildest winter in four years is prompting Japan to export the biggest volume of kerosene in a quarter century, squeezing profits for Asian refiners while cutting fuel expenses for airlines. Japan has shipped enough of the transportation and heating fuel since December to fill a very large crude carrier, the most in at least 25 years, according to the Petroleum Association of Japan. January temperatures in Tokyo were the highest for the month since 2010. Asia’s regrade, a measure of the profit from producing kerosene or jet fuel instead of diesel, will widen to a discount of $1.50 a barrel from April to June, compared with 60 cents on Feb. 12. Record winter kerosene exports are adding to signs that unpredictable weather patterns are changing trade flows in global energy markets. While Arctic storms bolstered fuel demand and helped refiners in the U.S. reduce stockpiles, an unseasonably warm winter in Japan is pushing their Asian counterparts such as JX Holdings Inc. in Tokyo and South Korea’s SK Innovation Co. to look further afield for buyers. In Europe, natural gas prices are poised to extend a bear market amid the mildest weather since 2008.

Japan is exporting kerosene at a time when Prime Minister Shinzo Abe is seeking to drive a recovery in the world’s third-biggest economy with fiscal and monetary stimulus. Escalating fuel-import costs contributed to the nation’s record current-account deficit in December as all of Japan’s 48 operable nuclear reactors remain shut for inspections after the 2011 Fukushima disaster. Kerosene, which can be used as jet fuel, is widely used in rural areas in Asia and Africa to light lamps and as a low-cost cooking fuel. In Japan, it’s burnt in home heaters. (www.bloomberg.com)

Policy / Performance

BP must live with $9.2 bn oil-spill deal, court says

March 4, 2014. BP Plc was told by a federal appeals court to abide by terms of a $9.2 billion settlement with victims of the Gulf of Mexico oil spill after failing to satisfy judges that a claims administrator is misinterpreting the deal. BP, Europe’s second-largest oil company, must resume paying millions of dollars in business-loss claims that were temporarily halted in December while the company fought to block payments over losses not directly linked to the worst offshore spill in U.S. history, the U.S. Court of Appeals in New Orleans said. The April 2010 blowout of BP’s deep-water Macondo well off the coast of Louisiana killed 11 people and sent millions of barrels of oil into the Gulf of Mexico. BP settled with most private plaintiffs in March 2012, just before a trial on liability for the disaster. BP’s settlement estimate doesn’t include spill-related losses claimed by about 250 financial institutions, 700 casinos, 750 state and local government entities, or 900 companies harmed by the deep-water drilling ban instituted by the Obama administration after the spill, according to the claims administration’s latest report. Lawyers for spill victims say the deadline for filing additional claims won’t expire until six months after BP completes all of its appeals. (www.bloomberg.com)

Europe gas storage seen enough for 45-day Ukraine supply cut

March 4, 2014. Europe’s mildest winter since 2007 has left the region with enough natural gas in storage to cover any future disruption in flows from Ukraine for about 45 days. Ukraine, a transit point for gas accounting for about 16 percent of European demand, mobilized its army and called for foreign observers after Russian forces took control of the Crimea peninsula.

Russian President Vladimir Putin said there is no immediate need to send troops to Ukraine and he isn’t considering adding Crimea to Russia, easing concerns that the crisis may escalate. The European Union has adequate gas reserves and there is no reason for concern at the moment, the bloc’s Energy Commissioner Guenther Oettinger said. The EU hasn’t received any signals from Russia as part of the early-warning mechanism, he said. (www.bloomberg.com)

Oman plans big increase in natural gas output

March 3, 2014. Oman expects a significant increase in its natural gas output over the next five years but little improvement in oil production. Oman aims to raise gas output to an average of 120 million cubic metres per day (mcm/d) over the five-year period from 2014 through 2018. In 2013, gas production rose to an average of 102 mcm/d, up 3.7 percent from the previous year. Oman's modest gas exports have been constrained over the last few years as it has struggled to raise production quickly enough to keep pace with its own demand growth. Muscat hopes the planned start-up of BP's Khazzan tight gas project in 2017 will provide a big boost to supplies, with Khazzan alone expected to add about 28 mcm/d to gas output by 2018. (www.arabianbusiness.com)

Oil at $100 loss warning rejected by Norges Bank: Nordic Credit

March 3, 2014. Oeystein Olsen, Norway’s central bank governor, rejected industry warnings that oil at about $100 a barrel is too cheap to support growth in western Europe’s biggest crude exporter. Statoil ASA, Norway’s biggest crude producer, said it would cut planned investments by 8 percent over the next three years as the stagnant price of oil weighs on cash flow. The decision triggered a warning from the government, which owns 67 percent of Statoil, and has said that planned projects must go ahead and that it may seek to attract more competitors. While the central bank bases its gross domestic product forecasts on economic output adjusted for oil and gas income, Norway’s energy industry feeds through to all areas of its economy. Olsen has said that the government needs to cut its fiscal spending rule, which sets limits on how much of the $840 billion wealth fund can be used, to 3 percent from 4 percent. (www.bloomberg.com)

South Sudan says in control of main oil fields, output steady

March 2, 2014. South Sudan's oil production is little changed at 160,000 barrels per day, foreign workers are back at work and the government is in control of the oil fields in the main producing area of Upper Nile state, the oil minister said. Petroleum Minister Stephen Dhieu Dau was speaking on a trip to Paloch, site of an oil complex and key crude oil processing facility in the north of the country near the border with Sudan, which hosts the sole pipeline export route. (www.rigzone.com)

Kazakh PM hopes for Kashagan restart 'within months'

February 28, 2014. Kazakhstan's Prime Minister (PM) Serik Akhmetov said he hoped that the country's giant offshore oilfield Kashagan could restart output within months and produce 3 million tonnes of crude by the end of the year. The world's biggest oil discovery in 35 years, production at Kashagan began in September but was stopped just weeks later after a gas leak was detected. (www.rigzone.com)

Singapore plans to construct second LNG terminal

February 26, 2014. Singapore plans to construct the country's second liquefied natural gas (LNG) terminal in the eastern part of the island-state to enhance energy security and grow the local LNG industry, Prime Minister Lee Hsien Loong said. The proposed second LNG terminal will support new industrial sites and power plants in the area and give Singapore a strategic buffer, as well as support the development of ancillary services like LNG trading, bunkering and vessel cool-down services. (www.downstreamtoday.com)

POWER

Origin shelves $5 bn hydroelectric project in Papua New Guinea

March 3, 2014. Australia-based Origin Energy has reportedly decided not to proceed with its plans of a $5 bn Purari River hydroelectric project in Papua New Guinea. Industry analysts think that the company's decision was based on uncertainty around ownership structures. Origin Energy said that the 2,500 MW capacity project will be first to deliver year-round baseload renewable power energy into mainland Australia. (hydro.energy-business-review.com)

PT Indonesia plans to build new hydro power plants

March 3, 2014. PT Indonesia Power, a subsidiary of state-owned PT PLN (Persero), is planning to build new hydro power plants in an effort to address electricity supply shortage in the country. The new plants will include PLTA Maung in Central Java with a capacity of 360 MW and PLTA Rajamandala in West Java with 47 MW apart from a number of smaller hydro power plants in Central Java. (hydro.energy-business-review.com)

Vietnam builds $1.2 bn thermal power plant in the north

March 1, 2014. Electricity of Vietnam (EVN) and Japanese contractor Marubeni Corporation has broken ground on a US$1.27 billion thermal power station in the northern province of Thai Binh. The project in the province’s Thai Thuy District is 85-percent funded by Japan International Cooperation Agency official development assistance (ODA) and the rest is funded by EVN. The station included two plants to supply a total capacity of 600 MW. Marubeni won a contract to build the major compartment, valued at $1.02 billion. The station is expected to use 1.5 million tons of anthracite coal from Quang Ninh mines. (www.thanhniennews.com)

Ontario expects 3.1 GW new power generation over next 18 months

February 28, 2014. Ontario's power grid operator said about 3,100 MW of new generation is expected to come online over the next 18 months, almost all of it renewable generation. The Independent Electricity System Operator (IESO) also said in a report it expects the province will have enough resources to meet power demand this summer even though nearly 2,000 MW of coal-fired generation retired in December. (www.reuters.com)

Turkey plans to boost nuclear power generation

February 27, 2014. Turkey aims to have 10 percent of its energy to come from nuclear generation by 2023, with two nuclear power stations already in the works. By growing its nuclear portfolio, Turkey is looking to decrease the country's need to import oil and gas to meet its energy needs. Russian firm Rosatom will build Turkey's first nuclear plant, Akkuyu, to be located in the Mersin province. The second nuclear plant will be constructed by Mitsubishi Heavy Industries and AREVA in the northern Sinop province. (www.pennenergy.com)

Transmission / Distribution / Trade

South Korea to fund power transmission line in Mozambique

March 3, 2014. The South Korea International Cooperation Agency (Koica) this year plans to fund construction of a power transmission line in Mozambique, between Maputo and Salamanga, and Chibabava and Massinga, Koica said. Koica said that the decision came after a preliminary study by South Korean technicians and the Mozambican state power company, which concluded the project, was viable. Koica will also fund an electricity training centre, and is considering a third project to reduce power outages across Mozambique. (www.macauhub.com.mo)

China mulls cross-region power transmission to curb smog

February 27, 2014. China is planning to reduce coal burning in smog-hit areas in the center and east of the country by using more non-local generated power, the State Grid said.

Power engineering institute proposals to build 12 cross-region power transmission lines have been submitted to the National Energy Administration for approval. Under the plan, the first batch of lines will be completed in 2016. Eleven of the 12 lines will be built by the State Grid, one of the two grid giants in China. (english.cri.cn)

AGL’s $1.3 bn power-plant deal blocked by regulator

March 4, 2014. AGL Energy Ltd. (AGK)’s A$1.51 billion ($1.35 billion) deal to buy government-owned power plants in Australia’s most-populous state was blocked by the nation’s antitrust regulator on concern it would reduce competition. Australia’s second-biggest electricity retailer is reviewing the ruling by the Australian Competition & Consumer Commission, Sydney-based AGL said. The company may challenge the decision in federal court, according to Commonwealth Bank of Australia and RBC Capital Markets. (www.bloomberg.com)

RWE suffers first loss since founding of German Republic

March 4, 2014. RWE AG had its first full-year loss since the foundation of the Federal Republic of Germany in 1949 as slumping power prices led to billions of euros in writedowns. The country’s largest power generator posted a net loss of 2.76 billion euros ($3.8 billion) on sales of 54.1 billion euros after a profit of 1.31 billion euros, it said. It wrote down 4.8 billion euros on assets, mainly power stations. The historic loss, the first since West Germany was forged from U.S., British and French zones of occupation after World War II, follows Chancellor Angela Merkel’s transformation of the domestic energy market toward renewables and away from nuclear. A surge in wind and solar energy, now 23 percent of generation, has curbed prices, already weakened by Europe’s economic crisis. RWE and rival EON SE are closing plants, cutting costs and dividends, and selling assets as wholesale power prices tumble, making much generation unprofitable. RWE plans to close or mothball 6,590 MW of capacity, it said, adding 2,325 MW to its target in August. It plans to cut investments to an annual 2 billion euros by 2016 from 4.62 billion euros last year. (www.bloomberg.com)

Iran to launch Bushehr nuclear plant’s second stage

March 3, 2014. Iran is planning to launch the second phase of the country’s first nuclear power plant, located in the Southern Bushehr province, in April 2014. The Bushehr power plant is a 1000MWe pressurized water reactor (PWR) initiated in 1975 through a bilateral agreement with Germany, but was completed by Russia as part of an agreement signed with Tehran in 1995, after the work was halted by the 1979 Islamic Revolution. The plant reached its full capacity by August 2012, and started producing power for the power grid in September 2013, under supervision of the International Atomic Energy Agency (IAEA). (nuclear.energy-business-review.com)

Cameco welcomes nuclear commitment in Japan draft policy