-

CENTRES

Progammes & Centres

Location

Hydropower in India: Balancing global carbon benefits with local environmental costs

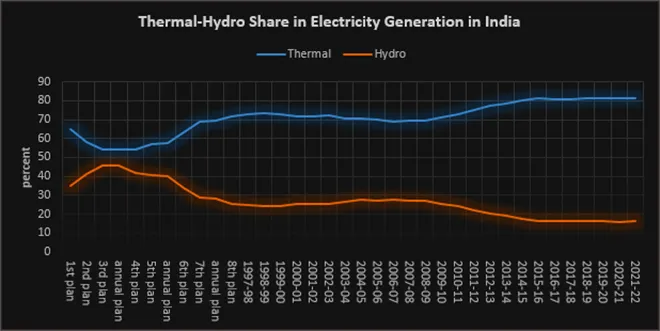

In 1947, hydropower capacity in India was about 37 percent of the total power generating capacity and over 53 percent of power generation. In the late 1960s, growth in coal-based power generation initiated the decline in hydropower’s share in both capacity and generation. In 2022, hydropower capacity of 46,512 MW (megawatts) accounted for roughly 11.7 percent of total capacity. Roughly 12 percent of power generation in 2020-21 was from hydropower.

In the first two decades since independence (1947-67), hydropower capacity addition grew by over 13 percent and power generation from hydro stations grew by 11.8 percent. In the following two decades (1967-1987) hydropower generation capacity grew by over 18 percent but hydro power generation grew only by 5.6 percent. The decline continued in the following decade (1987-2007) with both capacity addition and hydro-power generation growth falling to just over 3 percent. In 2007-2019, hydropower capacity addition grew by just over 1 percent and power generation from hydro-stations grew by under 1 percent. Specific generation or power generated per unit of capacity (a measure of economic efficiency) declined from over 4.4 in the 1960s to less than 2.5 in the early 2000s. Specific generation has improved since then reaching 3.4 in 2019-20.

In the last two decades the most significant policy push for hydropower was the 2003 plan for developing 50,000 MW of hydropower capacity. Under the plan, preliminary feasibility reports (PFRs) for 162 new hydro-electric projects were prepared. Out of these, more than half the capacity identified was in Arunachal Pradesh and about a third was in the Himalayan and North-eastern states. As of 2021, only one project of capacity of 100 MW in Sikkim has been commissioned and about 4345 MW capacity is under construction. Twelve projects of total capacity of over 3,500 MW have either been terminated or held up due to local environmental concerns. Forty projects of capacity 13633 MW have either been abandoned or delayed due to local opposition to the projects rooted in local environmental concerns. Only 37 projects got their detailed project reports (DPR) prepared with a decreased capacity of 18,487 MW against 20,435 MW as per the PFR. Seven projects are under survey and investigation; 66 projects are yet to be allotted.

In the last few years, many of India’s newer hydro-power projects on the Himalayan rivers (commissioned or under construction) have been damaged by floods and landslides. In some cases, people trapped in project sites have lost their lives or severely injured. The large body of literature critiquing the construction of hydro-projects in the Himalayan mountains highlight environmental damage imposed on local populations. Studies also point out that though recurrent floods are a natural phenomenon, they can be aggravated by anthropogenic interventions. High precipitation in the Himalayas, coupled with the sudden fall in altitude in the mountains of that region results in large volume of water gushing down river channels. Construction of hydro projects and related infrastructure such as roads often aggravate this phenomenon.

In 2020, hydropower contributed to 4,370 Terawatt-hours (TWh) of global electricity generation, the highest contribution by a renewable and low carbon energy resource. Hydropower makes the largest low carbon energy contribution to the global primary energy basket, which is 55 percent higher than that of nuclear power and larger than all other renewable energy (RE) combined. By the end of 2020, there was 160 GW (gigawatts) of pumped storage hydropower installed globally, comprising 95 per cent of all total installed energy storage. Reservoir-based hydropower projects also provide flood control and a dependable water supply for drinking and irrigation purposes.

Many hydropower plants can ramp their electricity generation up and down very rapidly as compared with other power plants such as nuclear, coal, and natural gas. Hydropower plants can also be stopped and restarted relatively smoothly. This high degree of flexibility enables them to adjust quickly to shifts in demand and to compensate for fluctuations in supply from RE sources. Today, hydropower plants account for almost 30 percent of the world’s capacity for flexible electricity supply.

Highlighting the technical and economic benefits of hydropower, the hydro-industry in India pressed for financial incentives from the government to match those received by the RE sector in India given that hydropower was both low carbon and renewable. Hydropower’s ability to rapidly ramp up or down power generation to follow load, meet peak demand, and make up for intermittent generation from RE sources whenever required strengthened the case for incentives from the government. These unique characteristics of hydropower were important in maintaining grid frequency through continuous modulation of active power, control of voltage through the supply of reactive power and the provision of spinning reserves to maintain system stability. As the share of RE in the Indian grid increases, inertia of the grid will decrease which means more hydropower capacity would be required. Hydropower demonstrated these capabilities on the 5th of April 2020 when most households in India switched off electrical lights for nine minutes. The anticipated electricity demand reduction was 12-14 GW but the actual demand loss was over 32 GW for 49 minutes, more than double the demand loss anticipated. Hydro generation stepped in increasing and then decreasing supply within few minutes. At its best hydropower decreased by over 68 percent with a peak ramp rate of 2.7 GW/minute.

In March 2019, the government approved targeted measures to promote hydropower development in India. This included (i) Inclusion of large hydro power projects as RE sources (until then only projects of less than 25 MW capacity were considered RE sources); (ii) Hydro-purchase obligation (HPO) as a separate category in the non-solar renewable purchase obligation (RPO). The annual targets set based on capacity addition plans were to be notified by the Ministry of Power (MOP) and necessary modifications were to be introduced in the tariff policy; (iii) Tariff rationalization measures including providing flexibility to the developers to determine tariff by back loading tariff after increasing project life to 40 years, increasing debt repayment period to 18 years, and introduction of escalating tariff of 2 percent (iv) Budgetary support for funding flood moderation component of hydropower projects on case-to-case basis for enabling infrastructure i.e. roads and bridges on case to case basis as per actual, limited to ₹15 million/MW for up to 200 MW projects and INR10 million/MW for above 200 MW projects.

The MOP has set the HPO at 0.18 percent for 2021-22 and proposed increase to 2.82 percent by 2029-30. This will increase the demand for hydropower (just as solar purchase obligations increased the offtake of solar power) though not all state distribution companies (discoms) have notified the HPO target. It is estimated that incremental hydropower generation capacity would have to increase by 39 percent or 18 GW to meet HPO obligations by 2030.

The hydro industry is hopeful that new financial incentives will add momentum to the hydropower sector. By 2026, roughly 12,340 MW of hydropower capacity addition is planned. Barring a few small projects in central and southern India, most are in the North and North-eastern states. This means reinvigoration of local agitations over environmental compromises. This is justified given that the massive flash floods in Uttarakhand in 2013 caused 5000 deaths, destroyed homes and damaged hydropower projects. There have been many such incidents since then. The 12th plan cautioned that “hydro-power projects on the Himalayan Rivers may not be viable even if they are looked at from a narrow economic perspective”. The Himalayas are relatively young mountains with high rates of erosion. There is little vegetation in the upper catchment to bind soil. High sediment load reduces productive life of power stations through heavy siltation. Judicial intervention following the 2013 floods led to setting up of a committee to investigate future environmental risk recommended cancellation of 23 hydro-projects in the region. Members of the committee from the Central Water Commission, and Central Electricity Authority refused to endorse conclusions of the report from the committee. The enthusiasm for hydropower given its technical capabilities in addressing the challenge of intermittency from the growing share of RE in the grid and in reducing global carbon emissions is understandable. This does not mean local environmental compromises can be dismissed as environmental fundamentalism or anti-developmentalism. The trade-off between the local and global environmental benefits of hydropower are real. The costs are local, and the benefits are global and to some extent national. It is important that the government policy, in its enthusiasm to contribute to the global public good of carbon reduction, does not ignore the cost imposed on the local environment and populations dependent on it.

India’s fuel consumption showed flattish growth in December 2021 ahead of fresh restrictions kicking in to control the surge of a new variant of coronavirus that is likely to further dampen demand. Total petroleum product consumption in December 2021 stood at 18.43 million tonnes (mt), compared with 18.36 mt in the same month last year. This after a rise in demand for transport fuel was negated by a fall in industrial fuel. The consumption was 7.6 percent higher month-on-month but was still 2.7 percent lower than pre-COVID-19 levels of 2019, according to the oil ministry’s Petroleum Planning and Analysis Cell (PPAC). As the economy continued to rebound from the deep impact of the second wave, transport fuel demand rose in December. Diesel, the most used fuel in the country accounting for almost 40 percent of all petroleum product consumption, rose 1.5 percent year-on-year to 7.305 mt and was near pre-COVID-19 demand of 7.387 mt in December 2019.

India’s crude oil imports in November rose to their highest level in 10 months as refiners stocked up to boost runs in anticipation of strong demand in the world’s third-largest oil consumer and importer. Crude oil imports last month rose 7.5 percent versus October and were also 0.5 percent higher than a year ago at 18.37 mt as per the PPAC data. The relatively high imports corresponded with the country’s crude processing hitting its highest level since February 2020 during the same month refiners operated at full capacity in hopes of a steady uptick in demand. The share of Middle Eastern oil in India’s overall crude imports rebounded to a 16-month high in November as refiners shunned costly Brent-linked long haul grades. India’s Reliance Industries Ltd, owner of the world’s biggest refining complex, imported 6 percent more oil in November than a year earlier at about 1.24 million barrels per day (bpd), according to data from shipping and industry sources. Meanwhile, India’s fuel consumption fell last month after scaling a seven-month peak in October, as demand eased after the festive season. Oil product imports dropped 26.6 percent to 3.49 mt from a year earlier, while exports jumped 26.8 percent. Of the 5.15 mt of exports in November, diesel accounted for 2.78 mt.

The Gujarat government announced a 20 percent reduction in value-added tax (VAT) on aviation turbine fuel (ATF) to bring the levy at 5 percent in a move to boost tourism in the state. The decision to reduce VAT on jet fuel was taken by Chief Minister to boost tourism in the state. VAT on jet fuel was reduced by 5 percent by the Gujarat government on 13 December.

The Jharkhand government announced a subsidy of INR25 per litre on petrol and diesel prices for people living BPL (below poverty line) in the state. The decision was taken on the occasion of a programme organised to mark two years of the Jharkhand Mukti Morcha (JMM) -led coalition government in the state. The benefits would be extended on the purchase of petrol or diesel up to 10 litres every month.

Chhattisgarh Chief Minister (CM) asked the Centre to reduce the cess levied by it on petrol and diesel instead of slashing central excise duty. Addressing a pre-budget meeting convened by Union Finance Minister, CM contended that slashing of central excise duty on petrol and diesel will lead to a reduction in the state’s share of taxes and also result in lower value added tax (VAT) collection. Cess is charged by the central government over and above the existing taxes. The Centre does not share cess with the government as it is utilised for the purpose it has been collected for.

Reliance Industries Ltd (RIL) aims to get the first cargo of oil from its new Abu Dhabi-based trading unit in December. The Indian conglomerate aims to get about 500,000 barrels of cargo of United Arab Emirates’ Das crude from RINL. Abu Dhabi National Oil Co (ADNOC) supplied one million barrels of Das crude from the cavern to RIL in October and 2 million barrels in November.

Indian Oil Corporation (IOC) is setting up a new crude oil pipeline system with a nameplate capacity of 17.5 million tonnes per annum (mtpa) from Mundra (Gujarat) to Panipat (Haryana). IOC will also build 9 crude oil tanks of 60,000 kilo litres each at Mundra, which, apart from meeting operational requirements, will also help in enhancing crude oil storage capacity in the country. The total estimated cost of the project is INR90.28 (US$1.21) billion (bn). IOC is implementing a project for capacity expansion of Panipat refinery from 15 mtpa to 25 mtpa, along with the installation of Polypropylene Unit and Catalytic Dewaxing Unit with targeted completion in the second quarter of the 2024-25 financial year. The new pipeline system and crude oil tank storage will help meet the enhanced need of crude oil requirement due to the expansion of the Panipat refinery. The crude oil pipeline project is expected to be completed in synchronization with the commissioning of Panipat refinery expansion. IOC operates a network of more than 15,000-km long crude oil, petroleum product and gas pipelines. IOC added 337 km of additional pipeline length during the year 2020-21 and plans to continuously expand the network in line with growth in business. The company achieved a throughput of 76.019 mt during 2020-21. IOC’s existing pipeline network has a throughput capacity of 94.56 mtpa of oil and 21.69 million metric standard cubic meters per day (mmscmd) of gas. Projects under implementation will further increase the length of the pipelines network to about 21,000 km, and throughput capacity to 102 25 mtpa.

Oil prices settled lower, as the market weighed supply concerns from the unrest in Kazakhstan and outages in Libya against a US (United States) jobs report that missed expectations and its potential impact on Federal Reserve policy. Brent crude settled down 24 cents, or 0.3 percent, to US$81.75 a barrel, while US West Texas Intermediate (WTI) crude was down 56 cents, or 0.7 percent, at US$78.90 a barrel. Brent gained 5.2 percent, while WTI gained 5 percent in the first week of the year, with prices at their highest since late November, spurred on by the supply concerns. Production at Kazakhstan’s top oilfield Tengiz was reduced, its operator Chevron Corp said, as some contractors disrupted train lines in support of protests taking place across the central Asian country. Production in Libya has dropped to 729,000 barrels per day (bpd) from a high of 1.3 million bpd last year, partly due to pipeline maintenance work. A barrel of oil for delivery in March was selling at a discount of as much as 70 cents to a barrel for delivery in February, the highest since November.

Global oil demand roared back in 2021 as the world began to recover from the coronavirus pandemic, and overall world consumption potentially could hit a new record in 2022 – despite efforts to bring down fossil fuel consumption to mitigate climate change. Gasoline and diesel use surged this year as consumers resumed travel and business activity picked up. According to the International Energy Agency (IEA), for 2022, crude consumption is expected to reach 99.53 million bpd, up from 96.2 million bpd this year. That would be a hair short of 2019’s daily consumption of 99.55 million barrels.

Iraq will be able to boost exports by as much as 250,000 (bpd) from the second quarter after finishing the installation of pumping stations at its Gulf ports. Iraq’s State Oil Marketing Organisation (SOMO) had exported as much as 3.7 million bpd from its southern ports in Basra, but the need to rehabilitate aging export infrastructure forced Iraq to reduce southern exports when upgrade work began from May 2020. The pandemic-driven slump in oil prices and tight Iraqi regulations resulted in delays to the projects, which were run by Basra Oil Co (BOC). According to Iraqi oil ministry work to install new pumping stations to boost export capacity from Basra took place for most of 2021. BOC also expects to complete maintenance operations to restore crude loading operations at the Khor al-Amaya port by the end of 2022, with an initial capacity of 400,000 bpd.

The increase in OPEC (Organization of the Petroleum Exporting Countries)’s oil output in December has again undershot the rise planned under a deal with allies, a survey found, highlighting capacity constraints that are limiting supply as global demand recovers from the pandemic. The OPEC pumped 27.80 million bpd in December, the survey found, up 70,000 bpd from the previous month but short of the 253,000 bpd increase allowed under the supply deal. OPEC and its allies, a group known as OPEC+, are gradually relaxing 2020’s output cuts as demand recovers from 2020’s collapse. But many smaller producers can’t raise supply and others have been wary of pumping too much in case of renewed COVID-19 setbacks. The OPEC+ agreement allowed for a 400,000 bpd production increase in December from all members, of which about 253,000 bpd is shared by the 10 OPEC members participating in the deal, OPEC figures show. With output undershooting the planned increase, OPEC’s compliance with its pledged cuts increased to 127 percent in December, the survey found, from 120 percent a month earlier. OPEC+ met and agreed to proceed with another 400,000 bpd output increase in February, suggesting the lag between actual and pledged supply could widen further without larger producers compensating for shortfalls.

ExxonMobil Corp, the largest US oil producer, said it had made two new discoveries in the Stabroek Block off Guyana’s coast, one of its top bets for production growth this decade. Guyana has been the scene of the world’s biggest offshore discoveries in years, with 10 billion barrels of recoverable oil and gas confirmed since it began production in 2019. An Exxon-led consortium is responsible for all output in the South American country.

The (US) Department of Energy said it had approved a release of 2 million barrels of crude oil to Exxon Mobil Corp from its Strategic Petroleum Reserve (SPR) as part of a previously announced plan to try to reduce gasoline prices. The Energy Department has provided a total of over seven million barrels of crude oil from its reserve to boost the nation’s fuel supply.

Oil prices rose, after government data showed US (United States) crude and fuel inventories fell, offsetting concerns that rising coronavirus cases might reduce demand. Brent crude rose 29 cents to settle at US$79.23 a barrel. US West Texas Intermediate (WTI) crude rose 58 cents to settle at US$76.56 a barrel. In the US, the average number of daily confirmed coronavirus cases hit a record high of 258,312 over the last seven days. Both oil futures contracts earlier traded at their highest in a month after US government data showed lower oil inventories. Distillate stockpiles fell by 1.7 million barrels to 122.43 million barrels, versus expectations for a 0.2 million-barrel rise, the EIA (Energy Information Administration) data showed. Oil prices have been underpinned by Ecuador, Libya and Nigeria declaring forces majeures on part of their oil production because of maintenance issues and oilfield shutdowns. According to Russia, the OPEC+ group of producers has resisted calls from Washington to boost output because it wants to provide the market with clear guidance and not deviate from policy on gradual increases to productions.

France’s TotalEnergies, Royal Dutch Shell, Malaysia’s Petronas and Qatar Energy scooped up big offshore fields in Brazil together with Petrobras, paying nearly US$2 bn to its cash-strapped government. As per the TotalEnergies, which snapped up a stake in both blocks, the investment will bring output with “costs well below US$20 per barrel of oil equivalent” and with carbon emissions rates below industry levels. Brazil attempted to auction both fields in 2019, but neither received offers, even from Petrobras. At the time, complex legal issues and rich signing bonuses kept oil majors away. This time, the bidding terms were considered more attractive, largely due to big cuts in both signing bonuses and minimum profit oil. Oil majors will be able to add production to their portfolios in the short term. Petrobras is ramping up production at Sepia to 180,000 bpd and has reached the 160,000 bpd maximum capacity at Atapu. A second platform is planned for each field. Cementing Brazil’s status as Latin Americas biggest oil producer, the two fields could boost the country’s production by 12 percent over the next six years, adding 700,000 bpd, and bringing in almost US$40 b in investment, its energy ministry said after the auction. Petrobras is set to receive US$6.2 b for past investments in the two fields.

China’s offshore oilfield cluster Bohai, run by CNOOC Ltd, has become the country’s largest crude oil producer with output hitting 30.132 mt (602,640 barrels per day) in 2021. Bohai field, off north China, overtook the country’s flagship onshore producer Daqing, in northeast China, which pumped 30 mt last year. CNOOC Ltd, the listed vehicle of China National Offshore Oil Company, produced 48.64 mt of crude oil last year, up by 3.23 mt, which accounted for up 80 percent of the national increment in crude oil production. Developed in 1965, the Bohai cluster fields are considered marginal assets with relatively high development cost and poor crude oil quality. But CNOOC has in the past two decades sharpened its exploration and development know-how, such as shortening the average drilling time to under 10 days from 57 days, and has made several major discoveries like Kenli 10-2 and Bozhong 19-6 fields. China, the world’s second-largest oil consumer which imports three quarters its oil needs, eked out a 2.5 percent increase in domestic crude output in the first 11 months of 2021 over a year earlier.

Sri Lanka will sign a deal with Lanka Indian Oil Corporation (LIOC) to restore 75 oil tanks as the country moves to secure a US$500 million (mn) fuel credit line from India, its energy ministry said. The island nation is facing dwindling foreign exchange reserves and has nearly US$4.5 bn worth of debt repayments in 2022, prompting it to look at innovative ways to bring in foreign exchange. The facility, with 99 storage tanks, is located next to a harbour off Sri Lanka’s east coast and though India and Sri Lanka agreed to jointly develop it in 1987, negotiations dragged on for decades. The cost of restoration is pegged at about US$1 mn per tank. The latest round of negotiations between the Sri Lankan government, its Indian counterpart and LIOC began in August 2020.

China has issued its first refined fuel import quotas for 2022, with gasoline and diesel volumes sharply up from a year ago, and naphtha, a petrochemicals feedstock, largely steady. As per the document from the Ministry of Commerce, under the issue, naphtha totalled 10.09 mt, including 5.75 mt issued to state-run companies and another 4.34 mt allotted to independent petrochemical producers. That compared to a total of 9.94 mt issued under the first lot of 2021. Import quotas for gasoline rose to 700,000 tonnes versus 200,000 tonnes a year earlier, and diesel was set at 750,000 tonnes, versus 200,000 tonnes under the first allotment a year ago. The quotas for gasoline and diesel were exclusively handed to state-run companies. The government is expected to release the first batch of refined fuel export quotas in January, after cutting the whole of 2021 issues by about a third versus 2020. China overall has a surplus of refined fuel products – mainly gasoline, diesel and aviation fuel – after a rapid growth in the private sector in recent years created refining overcapacity.

Malaysia’s state energy firm Petronas said that it anticipates the recovery in oil demand from the impact of the coronavirus pandemic to remain fragile and uncertain in the next few years. According to the energy firm, industry players were optimistic about economic recovery but remained cautious. After 2024, Petronas foresees a positive outlook for drilling rigs activity while continuing to enhance and upgrade capability. It also expects a steady outlook for fabrication of fixed structures and subsea facilities as it continues efforts to monetise its oil and gas resources.

China’s oil consumption is expected to keep growing for a decade on robust chemical demand, reaching a peak of about 780 mt per year by 2030, a research institute affiliated with China National Petroleum Corp (CNPC) said. Last year, the research group, called the CNPC Economics & Technology Research Institute (ETRI), said that China’s oil demand would peak at 730 mtpa by around 2025. In its latest report, the ETRI said diesel fuel, gasoline and kerosene consumption are forecast to peak sometime around 2025 at about 390 mt per year. The strong petrochemical demand will support rising consumption through to 2030. Overall oil demand will fall after 2030 as transportation consumption declines amidst the electrification of vehicles while chemical demand remains stable during the period, the ETRI said.

According to Indonesian state-energy company PT Pertamina ensuring fuel supply was its “top priority” as workers plan a ten-day strike, just when fuel demand typically increases as people travel for year-end holidays. As it seeks to short up supplies, the company has issued a tender seeking up to 1.2 million barrels of high speed diesel (HSD) for January delivery. It is unclear how many of Pertamina’s workers are expected to strike or why negotiations failed, but the union said the strike could end earlier than expected if its demands are met.

Sri Lanka plans to settle US$251 mn in oil import dues owed to Iran by bartering tea, amidst dwindling foreign reserves. Sri Lanka has to meet about US$4.5 bn in debt repayments next year, starting with a US$500 mn international sovereign bond in January, but the country’s foreign reserves had dwindled to US$1.6 bn at the end of November.

Aker BP has reached an agreement to acquire Lundin Energy’s oil and gas related activities for around NOK 125 bn (€12.4 bn), and to merge them with its exploration and production (E&P) operations to create a listed E&P company focused on the Norwegian Continental Shelf (NCS). The new company will be the second largest listed oil company on the NCS.

14 January: Indian oil refiner Hindustan Petroleum Corp (HPCL) is cautiously optimistic that the nation’s recovery from the pandemic will remain largely intact, despite a recent spike in coronavirus cases. India was hit hard by a devastating outbreak of the delta variant early last year that overwhelmed the health system, although the nation was spared a collapse in oil demand similar to 2020 after avoiding a nationwide lockdown. The economy recovered over the second half of 2021 as vaccinations rates rose, with diesel consumption climbing to a two-year high in December and gasoline use at the highest in records going back to 1998. Over the first 10 days of 2022, sales of gasoline and diesel — which together make up more than half of India’s overall petroleum consumption—dipped by 2 percent to 3 percent from a year earlier, according to preliminary estimates by refinery officials with direct knowledge of the matter. Foot traffic through the nation’s airports has also dropped, data from the Civil Aviation Ministry show. India’s refiners are also keeping crude purchases robust. Bharat Petroleum Corp Ltd (BPCL) is seeking additional volumes from Saudi Arabia for February delivery, while top processor Indian Oil Corp (IOC) recently issued a tender seeking to buy crude from West Africa to the Americas for February and March loadings.

16 January: Indian Oil Corporation (IOC), the nation’s largest oil firm, said it will invest over INR70 bn in setting up city gas distribution (CGD) networks in the cities for which it has secured a licence in the latest bidding round. IOC secured 33 percent of the demand potential that was up for grabs in the recently concluded 11th round of CGD bidding, cornering cities from Jammu to Madurai to Haldia, the firm said. Of the 61 geographical areas or GAs that received bids in the 11th round city gas distribution (CGD) bidding, IOC got 9 licenses to retail CNG (Compressed Natural Gas) to automobiles and piped cooking gas to households. Though the GAs it won were less than Megha Engineering and Infrastructures Ltd’s 15 licences and Adani Total Gas Ltd’s 14, in the terms of demand potential it got the maximum. The Petroleum and Natural Gas Regulatory Board (PNGRB) opened the bids and decided on preliminary winners. IOC’s acquired GAs include major districts like Jammu, Pathankot, Sikar, Jalgaon, Guntur (Amravati), Tuticorin, Tirunelveli, Kanyakumari, Madurai, Dharmapuri and Haldia (East Midnapore). These districts contain high demand customers across the industry-commercial-domestic spectrum for PNG (Piped Natural Gas) and CNG.

18 January: The Delhi High Court (HC) has dismissed without any relief a petition filed by Tata Power’s Delhi distribution company (discom) – TPDDL or Tata Power Delhi Distribution Ltd) – seeking to end a May 2008 agreements with NTPC Ltd for sourcing power from the latter’s Dadri-I power station in Uttar Pradesh (UP). The TPDDL petition sought the court’s direction restraining NTPC from scheduling any power from Dadri–I station or to raise any bill for the period after 30 November 2020 on the ground that the plant’s 25-year useful life and the validity of the power purchase agreement ended on that date. The court’s dismissal of the petition without any relief would make TPDDL liable to pay the amount payable since 30 November 2020 along with late payment surcharge as per Central norms. The dispute arose after TPDDL in March 2020 asked NTPC to stop scheduling power from the unit or raise any bill. The company cited Central Electricity Regulatory Authority regulations allowing distribution companies the option to exit a PPA (power purchase agreement) after 25 years of the ‘useful life’ of a plant and PPA on mutual agreement. NTPC had rejected TPDDL’s contention saying the options of ending a PPA or reworking tariffs after 25 years applies only if both parties agree. Besides, NTPC also took the stand that the ministry of power has extended the useful life of its plants to 40 years and therefore, it was not contemplating accepting or exercising such options for any of its plants across the country.

17 January: The All India Power Engineers Federation (AIPEF) said that around 15 lakh power sector employees will go on nationwide strike for two days from 23 February to protest against privatisation. The NCCOEEE (National Coordination Committee of Electricity Employees & Engineers) has decided that core committee leaders of NCCOEEE will meet Governor Punjab on 1 February and handover memorandum to him against privatization of Chandigarh UT Power Department. AIPEF Chairman Shailendra Dubey said that on call of NCCOEEE about 1.5 million power employees & engineers across the country will resort to two days strike on 23rd and 24th February against privatization policies of the central government.

16 January: India’s power consumption grew marginally at 1.5 percent in the first fortnight of January to 49.34 billion units (BU) compared to the same period a year ago, showing the impact of local restrictions imposed by states amidst the third wave of COVID-19. During 1 to 14 January in 2021, electricity consumption stood at 48.59 BU, as per power ministry data. During 1 to 14 January in 2021, electricity consumption stood at 48.59 BU, as per power ministry data. Power consumption in the entire January last year was 109.76 BU, which was 4.4 percent higher than 105.15 BU in January 2020. According to the data, peak power demand met or highest supply in a day rose to 179.59 GW during 1 to 14 January this year, compared to 178.88 GW in the same period of the previous year. It was 189.39 GW for the entire month of January 2021, and 170.97 GW in January 2020. Experts are of the view that the slowdown in power consumption growth in the first fortnight of January clearly shows the impact of local restrictions imposed by states amidst the third wave of COVID-19 which affected industrial and commercial demand. The experts opined that the power demand as well consumption would remain subdued due to local restrictions imposed by the states. Power consumption had grown by 3.4 percent in December 2021 to 109.25 BU from 105.62 BU in the same month of 2020. In November 2021, power consumption grew by 2.5 percent to 99.32 BU from 96.88 BU in November 2020. Many states had imposed lockdown restrictions after the second wave of the pandemic in April 2021, which affected the recovery in commercial and industrial power demand. Curbs were gradually lifted as the number of COVID cases fell. Power consumption witnessed a 6.6 percent year-on-year growth in May 2021 at 108.80 BU, from 102.08 BU in the same month of 2020. In June 2021, it grew nearly 9 percent to 114.48 BU, compared to 105.08 BU in the same month in 2020. In July 2021, it rose to 123.72 BU from 112.14 BU year-on, while in August power consumption surged by over 17 percent at 127.88 BU compared to 109.21 BU in the same month in 2020. Power consumption in September 2021 witnessed flat growth at 112.43 BU, mainly due to delayed monsoon.

17 January: JSW Group is planning to raise INR22 bn through bank loans to fund a 450- megawatt (MW) wind power unit in Tamil Nadu. The project is scheduled to be finished by 31 March 2023. India Ratings has assigned “A-” to proposed bank loans. The rating is anchored by the presence of a fixed-tariff power sale contract with a reasonably strong counterparty Solar Energy Corporation of India (SECI), a 100 percent government of India-owned entity.

17 January: Indian Railways is working on an ambitious project to meet the energy requirements of nearly 7000 railway stations with solar power. Railway authorities said they are already successfully generating around 121.47 MW of solar power through their existing solar rooftop capacity installed in 1,094 railway stations across the country. The 1,094 railway stations that have rooftop solar panel installations include major ones like Varanasi (redeveloped with all world-class facilities in UP), Katra in Jammu and Kashmir, New Delhi, Old Delhi, Jaipur, Secunderabad, Kolkata, Howrah, Guwahati amongst others. A 3 MW solar power generating plant has already been set up at MCF in Raebareli while 2 pilot projects have been assigned to BHEL and the Railway Energy Management Company Limited (REMCL) at Bina in Madhya Pradesh and Diwana in Haryana, to generate 1.7 MW and 2 MW of solar energy respectively. Apart from all this, another 50 MW plant is being set up on railway land in Bhilai by the Railways to generate enough solar power to meet the energy requirement of railway stations. For the same purpose, the Railways has also already tied up with the Rewa Ultra Mega Solar—a joint venture of Solar Energy Corporation of India Limited (SECI) and the Madhya Pradesh government for obtaining solar energy to meet the energy requirement of railway stations.

17 January: Tata Power Renewable Energy Limited (TPREL) said that it has commissioned two Solar Power projects of 50 MW each at Prayagraj, and Banda in Uttar Pradesh (UP). The projects have been completed by TPREL, 100 percent subsidiary of Tata Power. The plants are expected to generate more than 221.26 million units annually. The company said approximately 1,59,600 modules were used in the project at Prayagraj and the installation is expected to reduce 91,137 lakh tons of carbon emission every year.

18 January: China’s refinery output hit a record in 2021, up 4.3 percent from 2020, on robust first-half fuel demand in particular and as refiners ramped up processing to fill a supply gap after a hefty new tax closed loopholes in blending fuel imports. Total refinery throughput last year reached 703.55 million tonnes (mt), or 14.07 million barrels per day (bpd), data from the National Bureau of Statistics showed, roughly 620,000 bpd above the 2020 level. December output was 58.73 mt, or about 13.83 million bpd, down 2.1 percent on year, reversing a brief rebound in November when state refiners raised processing to plug a short-lived diesel supply crunch. Output surged nearly 11 percent on the year in first-half 2021, as a rebound in car sales bolstered gasoline use and booming domestic air travel lifted aviation fuel consumption. A hefty tax slapped on importing blending fuels like light cycle oil and bitumen mixture allowed dominant state refiners to recoup lost market share, previously eroded by cheap blending stocks. Production, however, declined in the third quarter amidst a resurgence in coronavirus cases and as a drastic cut in fuel export quotas hurt plant operations. The faster growth in last year’s throughput versus 2020’s 410,000 bpd increase came as Beijing worked to curb processing at smaller independent refiners, in oil hub Shandong in particular, indicating a shift in production increases at larger state refiners. Data showed China’s crude oil output gained 2.4 percent on year to 199 million tonnes, or 3.98 million bpd, as the industry strived to sustain a 4 million bpd mark by developing more challenging terrains to make up for depleting mature fields.

15 January: The government increased the prices of petroleum products by up to INR3 per litre effective from 16 January. The finance division said that the petroleum products were showing a fourth straight weekly gain and witnessed an increase of 6.2 percent just in the last week in the international market. The government has hiked price of petrol by INR3.01 per litre from INR144.82 to INR147.83 per litre. The government has also increased the price of HSD by INR3 per litre from INR141.62 to INR144.62 per litre. The price of kerosene oil has also witnessed an increase of INR3 per litre, taking its rate from INR113.48 to INR116.48 per litre. Kerosene oil is used in remote areas for cooking purpose where LPG is unavailable. The major user of this fuel is also the army in the remote areas of Pakistan like the country’s northern parts. According to a notification issued by the finance division back then, the price of petrol and HSD would rise by INR4 per litre for the first 15 days of January 2022.

14 January: Thailand’s PTT is seeking four cargoes of liquefied natural gas (LNG) for delivery between 27 January and 23 February. The tender, sought a on a delivered ex-ship (DES) basis, closes on 14 January.

12 January: Brazilian oil company Petrobras announced it imported a record 23 million cubic meters per day of liquefied natural gas (LNG) in 2021, a volume around 200 percent higher than the one recorded in the previous year. The record occurred during a year of strong thermoelectric demand in Brazil, due to the worst drought ever recorded in hydroelectric reservoirs in more than 90 years. Petrobras imports LNG from countries such as the United States, Trinidad & Tobago and Qatar. The former record volume for Petrobras was in 2014, when the company imported 20 million cubic meters per day of LNG.

17 January: China’s coal output hit record highs in December and in the full year of 2021, as the government continued to encourage miners to ramp up production to ensure sufficient energy supplies in the winter heating season. China, the world’s biggest coal miner and consumer, produced 384.67 million tonnes (mt) of the fossil fuel last month, up 7.2 percent year-on-year, data from the National Bureau of Statistics showed. This compared with a previous record of 370.84 mt set in November. For the full year of 2021, output touched a record 4.07 billion tonnes, up 4.7 percent on the previous year. Since October, authorities have ordered coal miners to run at maximum capacity to tame red-hot coal prices and prevent a recurrence of September’s nationwide power crunch that disrupted industrial operations and added to factory gate inflation. The most-active thermal coal futures contract on the Zhengzhou Commodity Exchange, for May delivery, was up 2.82 percent at 708 yuan per tonne. Prices have more than halved since hitting record highs in October last year. Coal traders in China shrugged off an Indonesian coal export ban as stockpiles at power plants were strong and power demand was set to weaken for the upcoming Lunar New Year holidays. Coal inventory at Chinese utilities exceeded 162 mt on 21 January, or 21 days usage, about 40 mt higher than the same period last year, the state planner National Development and Reform Commission said.

15 January: Indonesia’s state utility Perusahaan Listrik Negara (PLN) said that together with the energy ministry it was strengthening a coal delivery monitoring system to ensure enforcement of domestic sales rules and energy security. The world’s biggest thermal coal exporter introduced an export ban on 1 January as coal inventories at local power plants were at critically low levels, amidst low compliance with a so-called Domestic Market Obligation (DMO). Under the DMO, miners must sell 25 percent of their output to the local market with a price cap of $70 per tonne for power plants, below the current market price. Coal deliveries to local power plants will be monitored throughout the supply chain by PLN and the energy ministry’s mineral and coal department, and miners would receive automated warnings for any late shipments. 37 export vessels loaded with coal would be allowed to leave and that miners who met their 2021 DMO would be prioritised for exports. Eighteen of those vessels have been given clearance by the energy ministry, carrying about 1.3 million tonnes (mt) of coal, according to a transport ministry document. That represents only a fraction of the normal export volume from Indonesia, which shipped 30 million tonnes of coal in the month of January in 2021 and 2020, energy ministry data showed. Sixteen other vessels were carrying coals from miners who had not met the DMO and had therefore yet to be cleared, while three were still loading, the ministry document said. While Indonesia has started easing its coal export ban, the abrupt suspension may have already left a scar on the sector and the wider economy, highlighting the risk of regulatory uncertainty and impacting Indonesia’s trade balance. Coal comprised 14 percent of total goods exports in 2021, so should the export ban apply during all of January, Nomura said, total goods exports could be reduced by around US$4 billion, enough to shift the trade balance to a deficit from a surplus. The ban easing would be a credit positive for miners that have likely complied with their DMO requirements, because they could sell coal overseas at prices 2.5 times greater than domestic prices, Moody’s Investor Service analyst said.

15 January: South Africa’s state power provider Eskom will carry out a staggered shutdown of both units of its Koeberg nuclear power station for scheduled refuelling and maintenance, putting an already overburdened power system under additional strain.<

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.