< lang="EN-US" style="color: #0069a6">REVIVAL OF OIL DEMAND NOT IN SIGHT

Oil News Commentary: November 2019

India

Demand

India’s diesel demand in October fell at its steepest annual rate in nearly three years, provisional government data showed, reflecting subdued industrial and economic activity during the month. Local sales of diesel, which accounts for about two-fifths of overall fuel consumption, slipped 7.4 percent year-on-year to 6.51 mt. The annual decline was the most since January 2017, according to PPAC. Demand for diesel in the world’s third biggest oil importer is seen as a measure of industrial vibrancy as it is used, for example, to fuel trucks transporting goods across the country. Sales of gasoline, or petrol, rose 8.9 percent in October from a year earlier, to 2.54 mt. However, demand for diesel is expected to recover in the next six months as the longer-than-usual monsoon season that affected transportation and industry has ended. Slowing economic and industrial activity has already led some global agencies to cut their Indian fuel demand forecasts. Growth in fuel demand in India is on course to fall to its lowest in at least six years as the economy slows and after heavy rains impacted gasoil consumption. But diesel demand is expected to recover in the next six months as a longer-than-usual monsoon season that affected transportation and industry has ended. Diesel consumption usually tapers in monsoon season as rains hit construction and mobility. Any longer-term slowdown in fast-growing India’s fuel use could dim prospects for global oil demand. India’s fuel demand fell to its lowest in more than two years in September, with consumption of diesel at its weakest since January 2017. State-owned refiners, such as IOC, BPCL and HPCL traditionally buy fuel from private companies to meet demand at the pump. But falling local demand for diesel, which accounts for about two-fifths of overall fuel consumption, is prompting state refiners to export the product. In the current fiscal year to March, IOC’s diesel exports could be more than before because of the slowdown in consumption. BPCL will export about 200,000 tonnes of diesel every month between November and March. IOC accounts for about a third of India’s refining capacity of 5 mn bpd.

About 61 percent of total households in India used LPG for cooking in India in 2018, according to the latest NSO survey report. Last year, the government had claimed around 90 percent LPG penetration across the country by December 2018. Only 48.3 percent of the rural households used LPG, while the figures were much higher in urban areas at 86.6 percent, according to the NSO’s 76th round survey on ‘Drinking Water, Sanitation, Hygiene and Housing Condition’ released. The survey was conducted for the period between July and December 2018. To be sure, the NSO asked over 100,000 households across the country about their primary source of fuel. Interestingly, 44.5 percent of the houses in villages were still using firewood, crop residue and chip for cooking as their primary source of fuel, against 5.6 percent in cities during 2018. The survey highlighted that around 13 percent households have received benefits related to LPG connections. The ministry of statistics and programme implementation said that these estimates may likely be "under-reported" because of tendency of people to give a "negative reply" to survey officers on expectation of receiving certain benefits from the government. The government claims that LPG penetration has reached 96.5 percent in the country by October this year. According to the PPAC, LPG penetration stood at 89.5 percent as of 1 December 2018. Interestingly, 44.5 percent of the houses in villages were still using firewood, crop residue and chip for cooking, against 5.6 percent in cities during 2018. The NSO has captured LPG connections for the first time in its survey, so comparison with the previous surveys was not possible. The LPG usage by households was low in major states such as Odisha (32.6 percent), Jharkhand (32.9 percent), West Bengal (42.8 percent), Rajasthan (48.1 percent), Madhya Pradesh (48.3 percent), and Uttar Pradesh (50.2 percent). Despite a huge push for the LPG distribution about 11 percent households reported receiving any benefits related to LPG connections in the past three years from when the survey was conducted.

Refinery Investments

IOC plans to double its base-oil production from Haldia refinery in West Bengal by adding a new 270,000 per annum Catalytic Dewaxing Unit at a cost of ₹10.85 bn. The availability of a hydrocracker unit and the upcoming coker block has led to substantial potential in the refinery for augmenting the base oil production volume by setting up a new base oil production facility, Base oil market is more stable than the auto fuel market and the proposed project will provide additional flexibility to the refinery during major price swings. The proposed hydroprocessing route for grade II or grade III base-oil production will lead to capability of producing 100 percent API grade III lube base oil. The project is expected to provide flexibility in crude selection. The construction of the Pachpadra refinery in Barmer is a joint venture of the state government of Rajastan and HPCL. Around 25 percent of the work has been completed and a tender of ₹100 bn has been floated for further work. The project is expected to be completed by 2022.

Saudi Arabia and the UAE discussed a planned refinery in the western Indian state of Maharashtra that will cost at least $70 bn, a figure that exceeds the initial $44 bn estimate previously announced. The two sides discussed the initiative, first announced in 2018, to develop the refinery and petrochemicals complex, which would secure the supply of 600,000 bpd of Saudi and Emirati crude oil for India’s market. The Madurai LPG bottling plant of the IOC in Mattaparai village in Dindigul district, will soon enhance its storage capacity from the current 900 (3x300) tonne by another 1,800 (3x600 mt). The plant is awaiting regulatory clearance. The plant has a capacity to fill and distribute 19,000 cylinders per day. While the annual capacity is the delivery of 60,000 cylinders, in 2018-19, it produced 93,000 cylinders, as the demand went up. The electronic carousel fills 24 cylinders per minute and 1,400 cylinders per hour. The filled cylinders are checked for valve leaks and o-ring leaks, through remote monitoring. The defective valves are replaced immediately. The plant fills domestic cylinders of 14.2 kg commercial use cylinders of 19 kg, nano cut cylinders for commercial applications, besides the smaller 5 kg cylinder. It has also started supplying jumbo LPG cylinders weighing 425 kg for commercial use.

Domestic Production

Private players stayed away from the latest oilfield auction while the government received a total of eight bids, from ONGC and Oil India Ltd for seven blocks on offer. ONGC has submitted bids for seven blocks and Oil India Ltd for one in the fourth round of the OALP, where bidding closed, according to the DGH the oil ministry arm that oversees oilfield auctions. No other company participated in the auction. This means ONGC will automatically get six blocks for lack of competition. For one block, it will have to compete with Oil India Ltd. The fourth round offered the lowest number of blocks and also received the least bids, among all the auction rounds of OALP. In the second round, 14 blocks attracted 33 bids while in the third round, 23 blocks received 42 bids. In the first, 110 bids were received for 55 blocks on offer. In three rounds together, 87 blocks have been awarded. Under OALP, a company has the freedom to carve its own blocks and let the government know about its interest in the block, which would then put that up for auction. The company, which has initially shown interest in the block, gets some preferential points during bid evaluation. The government has recently reformed the policy regime for exploration licenses to attract private capital.

Domestic Crude oil production during October 2019 was 2,738,000 tonnes which is 7.21 percent lower than target and 5.09 percent lower when compared with October 2018. Cumulative crude oil production during April-October, 2019 was 19,110, 460 tonnes which is 4.91 percent and 5.83 percent lower than target for the period and production during corresponding period of last year respectively. The government has approved a 10-year extension of the PSC to Cairn O&G of Vedanta Ltd for the Ravva block in Andhra Pradesh. The contract is now effective from 28 October for the next 10 years, Vedanta said. The approval was directed through the Directorate General of Hydrocarbons which is under the MoPNG. Ravva, the oldest producing asset in India for Cairn, becomes the first large field to get production sharing contract extension. The move will enable joint venture partners to recover about 13 mn boe of oil. The joint venture partners will invest ₹5.5 bn to drill seven Revised Field Development Plan wells targeting additional reserves of 11.7 mn boe. The company has been a pioneer in speedy adoption of cutting-edge technologies, and this was demonstrated best at Ravva where Cairn took production up from 3,000 to 50,000 boe a day and sustained this production for nine years.

Imports

The government policy is to bring down its oil import dependence from 77 percent in 2013-14, to 67 percent by 2022, when India will celebrate its 75th year of independence. But with consumption growing at a brisk pace and domestic output remaining stagnant, India’s oil import dependence has risen from 82.9 percent in 2017-18, to 83.7 percent in 2018-19, according to PPAC. Blending of ethanol in petrol has risen to 6 percent at present and the blending would rise further to 10 percent by 2022. The country’s oil consumption grew from 184.7 mt in 2015-16 to 194.6 mt in the following year and 206.2 mt in the year thereafter. In 2018-19, demand grew by 2.6 percent to 211.6 mt. India’s crude oil output fell from 36.9 mt in 2015-16 to 36 mt in 2016-17. According to PPAC, India spent $111.9 bn on oil imports in 2018-19, up from $87.8 bn in the previous fiscal year. The import bill was $64 bn in 2015-16. For the current fiscal, it projected crude oil imports to rise to 233 mt and foreign exchange spending on it to marginally increase to $112.7 bn. ONGC’s output fell to 19.6 mt in 2018-19 from 20.8 mt in the previous year. ONGC’s oil production was 20.9 mt in 2016-17 and 21.1 mt in 2015-16. Output from fields operated by private firms has dropped from 11.2 mt in 2015-16 to 9.6 mt in 2018-19.

Privatisation

The government may end the cross-holding structure existing in the oil sector as it looks to further consolidate operations of public sector enterprises and go ahead with its privatisation plan by getting a fair valuation of assets. All oil sector PSUs would be asked to exit from their investments made in equity shares of other state-owned entities. The cross-holding structure among oil PSUs was built in the late 1990s as the government sold its shares in OIL, ONGC, GAIL (India) Ltd and IOC in a bid to raise funds. Estimates suggest that if the government divests its stake by taking the entire proceeds from sale of shares cross-held by oil PSUs, it could mobilise upwards of ₹400-₹500 bn. The oil ministry has already indicated to ONGC to exit from its investments in oil refiner and marketer IOC and GAIL, while the other two would also sell all their equity in the upstream company. It is not that companies have made major gains from cross-holdings. In fact, with volatility in the oil market and the government’s decision to seek OMCs take up some burden to soften the rise in petrol and diesel prices have taken a toll on OMC shares in the past and has thus reduced the value of their investments.

Thousands of employees across India protested an upcoming stake sale at state owned refiner BPCL fearing loss of jobs and benefits. In what is seen as the biggest privatisation push in India in decades the government approved the sale of BPCL and four other state-run companies. Unions of other state-run companies such as HPCL and MRPL joined forces with BPCL workers to protest against the privatisation plans. Employees at BPCL’s Kochi refinery - the company’s largest with a capacity of 15.5 mtpa fear that privatisation will strip them of various benefits and result in job cuts. BPCL employees also marched in the financial capital of Mumbai, where the company runs another refinery, a union member at BPCL said. International energy firms such as Exxon Mobil Corp, BP Plc, Royal Dutch Shell, Rosneft Oil Co, Saudi Aramco and Abu Dhabi National Oil Company are likely to be invited to participate in privatisation of state-owned oil companies.

Regulation

The Delhi High Court sought the Centre and OMCs response on a plea alleging non-implementation of Legal Metrology rules mandating verification of the standards of fuel dispensation units as they "were liable to be easily tampered with". A notice was issued to the Consumer Affairs and Petroleum ministries, the OMCs-IOC, HPCL & BPCL-and manufacturers of the units, seeking their stand on the petition by a petroleum dealers group. The Empowered Petroleum Dealers Foundation has accused the government of not implementing the Legal Metrology rules regarding verification of the units at the place of manufacture and instead allowing the companies to do away with the requirement. It said the verification was now taking place at the time of installation at the pump when the unit has been transferred to the ownership of OMCs. The foundation, in its petition, has also said it carried out a sting, with the knowledge of the authorities and OMCs, this year which revealed the fuel dispensing units "were liable to be easily tampered with". It has sought directions to the government to ensure the law and the rules are strictly implemented. NextGen Digital Fuelling initiatives, aimed at providing greater transparency and building customer trust, has been launched by public sector BPCL. Some of the initiatives include 100 percent assured quality and quantity of fuel delivered to BPCL fuel stations through tankers, 100 percent secured payments, new retail visual identity and automated SMS updates after fuelling transactions. The NextGen Digital Fuelling Initiatives for BPCL Fuel Stations is part of the Pure for Sure programme launched by the company in 2001, at a retail outlet. The roll out of the new NextGen initiatives will happen in six cities, starting with Chennai, followed by New Delhi, Kolkata, Bengaluru, Mumbai and Hyderabad under Phase I. The second phase roll out would take place across 42 'A' and 'B' class cities next year. BPCL has over 8,600 certified Pure for Sure retail outlets across the country. Aiming at a permanent solution for the tanker vehicle accidents at Vattappara on NH 66, the district administration is planning to make a GPS system mandatory in all tanker vehicles passing through the route. The meeting has observed that the system will help police personnel deployed at the aid post in Vattappara receive prior information on the approaching LPG tanker vehicles, as they can track vehicles. Police will stop all vehicles at the aid post and they will give special guidance to avoid accidents at Vattappara hairpin, to drivers of all LPG tanker vehicles. IOC authorities have sought a time of one month for the implementation of the system in their LPG tanker vehicles.

Rest of the World

Crude Prices

Oil prices were steady, holding onto gains from the previous session, after positive comments from the US and China kept alive hopes that the world’s two largest economies are soon to agree an end their trade war. Oil prices are set to stay at around $60 a barrel in the short and medium term, and will likely increase afterwards, Norwegian energy company Equinor said. The oil market has yet to feel the inevitable supply impact from investment cuts that took place during the industry’s 2014-2016 slump.

Global Oil Demand

Growth in global oil demand is expected to slow from 2025 as fuel efficiency improves and the use of electric vehicles increases, but consumption is unlikely to peak in the next two decades, the IEA said. The Paris-based IEA, which advises Western governments on energy policy, said in its annual World Energy Outlook for the period to 2040 that demand growth would continue to increase even though there would be a marked slowdown in the 2030s. The agency’s central scenario - which incorporates existing energy policies and announced targets - is for demand for oil to rise by around 1 mn bpd on average every year to 2025, from 97 mn bpd in 2018. Demand is then seen increasing by 0.1 mn bpd a year on average during the 2030s to reach 106 mn bpd in 2040. The largest increases in oil production are seen coming from the US the world’s biggest producer, as well as Iraq and Brazil. US tight crude oil production is seen rising to 11 mn bpd in 2035 from 6 mn bpd in 2018. The share of oil production by members of OPEC plus Russia is seen falling to 47 percent for much of the next decade, a level not seen since the 1980s.

Middle East

Qatar Petroleum has informed some term crude buyers in Asia that it plans to change the way it prices its oil early next year. The producer currently prices two of its grades - Qatar Land and Qatar Marine - on a retroactive basis and this will be moved to forward pricing to align its prices with other Middle East producers such as Saudi Arabia. Qatar Petroleum is targeting to implement the price change in the first quarter. Iran has discovered a new oilfield in the southwest of the country that has the potential to boost its reserves by about a third. The field stretches over 2,400 square km in the oil-rich Khuzestan province. Iran ranks as the world’s fourth–largest reserve holder of oil, and the second-largest holder of gas reserves, according to the US EIA. Iran had an estimated 157 bn barrels of proved crude oil reserves in January 2018, the EIA said.

Russia

In October, Russia cut its oil output to 11.23 mn bpd from 11.25 mn bpd in September but it was still higher than a 11.17-11.18 mn bpd cap set for Moscow under the existing global deal. Russia’s oil production was growing slightly despite the supply curbs deal but Moscow was not aiming to be the world’s No. 1 crude producer. Currently, the US is the world’s top oil producer.

USA

Environmentally sensitive but potentially oil-rich areas of Arctic Alaska will be opened to oil development under a new Trump administration proposal to undo Obama-era protections. The proposed changes are described in a draft environmental impact statement for managing the National Petroleum Reserve in Alaska, a 9.3 mn-hectare unit of federal land on the western side of Alaska’s North Slope. The most aggressive would allow oil development in 81 percent of the reserve. Under the Obama-era management plan enacted in 2013 and currently in effect, about half the reserve is open to oil development and half is protected for its wildlife and cultural values. New oil discoveries and the westward spread of North Slope oil-field development justifies increased access for drilling. The Trump administration has taken other steps to open up Arctic Alaska territory to new oil development. The administration proposed opening vast areas of Arctic waters to oil drilling. US crude oil output from seven major shale formations is expected to rise about 49,000 bpd in December to a record 9.13 mn bpd, the US EIA said. Output at the largest formation, the Permian Basin of Texas and New Mexico, is expected to rise 57,000 bpd to 4.73 mn bpd, the smallest increase since July this year but offsetting projected declines elsewhere. Output in North Dakota and Montana’s Bakken region is expected to edge higher by 9,000 bpd to a record 1.51 mn bpd, the data showed. Meanwhile, production declines are forecast in the Eagle Ford and Anadarko basins. Production increases in the Permian and Bakken have been at the forefront of a shale boom that has helped make the US the biggest oil producer in the world, ahead of Saudi Arabia and Russia. Still, the rate of growth in the Permian has slowed as independent oil producers cut spending on new drilling and completions and focus more on earnings growth. The US Gulf of Mexico is positioned for another year of record oil production in 2020, according to Norway-based energy research firm Rystad Energy. The Gulf of Mexico’s oil production has risen every year since 2013, with an average of 104,000 bpd annually. So far in 2019, the top contributors to supply growth have been the Big Foot and Crosby fields, but the Appomattox field is expected to make a significant impact by the end of the year by ramping up towards its processing capacity of 175,000 boe/day.

US crude oil output from seven major shale formations is expected to rise about 49,000 bpd in December to a record 9.13 mn bpd, the US EIA said. Output at the largest formation, the Permian Basin of Texas and New Mexico, is expected to rise 57,000 bpd to 4.73 mn bpd, the smallest increase since July this year but offsetting projected declines elsewhere. Output in North Dakota and Montana’s Bakken region is expected to edge higher by 9,000 bpd to a record 1.51 mn bpd, the data showed. Meanwhile, production declines are forecast in the Eagle Ford and Anadarko basins. Production increases in the Permian and Bakken have been at the forefront of a shale boom that has helped make the US the biggest oil producer in the world, ahead of Saudi Arabia and Russia. Still, the rate of growth in the Permian has slowed as independent oil producers cut spending on new drilling and completions and focus more on earnings growth.

South America

Twenty-seven companies are qualified to bid in Colombia’s auction of 59 oil blocks, the ANH said, including international producers like Noble Energy and Parex Resources. Colombia hopes to sign 20 contracts as a result of the round, the ANH said. Five of the offered blocks are offshore and 24 have potential for gas production, the ANH said. The auction is the country’s second this year. Six companies won 11 contracts in the previous round, which the ANH said would generate some $500 mn in investment.

Europe

Norway’s oil industry faces thinner margins as smaller new discoveries boost per-barrel development costs, Statistics Norway (SSB) said in a report. The giant Johan Sverdrup field, discovered a decade ago, came on stream in October. It has given a much-needed boost to investment and the cash flow of oil firms, but this is proving the be the exception rather than the rule. In the Arctic Barents Sea, which went largely unexplored while oil firms drilled in the North Sea and the Norwegian Sea, results of the last 20 years have been disappointing.

Asia-Pacific

Vietnam’s BSR has inked an agreement with Azeri state energy company SOCAR to buy 5 mn barrels of crude in 2020, BSR said. SOCAR Trading will provide 5 mn barrels of Azeri Light crude to BSR’s Dung Quat refinery during the first half of 2020, BSR said. The company said Azeri crude would also become one of its strategic crude oil products from 2020, following Vietnam’s abolishment of an import tax on crude oil which took effect from November. BSR said it would import 8 mn to 10 mn barrels of West Texas Intermediate and Bonny Light crude oil in 2020 for its Dung Quat refinery. Vietnam has been relying more on imported crude due to a slowdown in domestic output as reserves at its existing fields decline, and as China’s increasingly assertive stance in the region hampers offshore exploration.

Infrastructure

Korea National Oil Corp has signed a joint venture agreement with SK Gas and Singapore’s MOL Chemical Tankers to invest in the first phase of South Korea’s oil terminal project, the country’s energy ministry said. The first phase of the oil terminal project at the port of Ulsan would cost 616.0 bn won ($530.47 mn), with the joint venture Korea Energy Terminal investing 30 percent of the total cost, while the rest will be funded through project financing, the ministry said. The oil terminal has a capacity to store 1.38 mn barrels of refined oil products and 1.35 mn barrels of LNG. The terminal is expected to be completed by March 2024 and start commercial operations from April 2024.

State oil pipeline operators of Kazakhstan and Russia have signed an agreement on compensation for 14 Kazakh companies whose oil was contaminated in the Russian pipelines, the Kazakh firm, KazTransOil, said. A total of 38 Kazakh producers have been affected by the contamination this year, it said, and work on the remaining compensation is under way. TC Energy Corp has completed repairs and restarted the Keystone oil pipeline at a 20 percent pressure reduction after spilling more than 9,000 barrels in North Dakota. The US PHMSA continues to investigate the cause of the rupture in Edinburg, North Dakota. TC Energy said the pressure restriction will remain in effect until all the elements of the integrity verification plan have been completed and approved by PHMSA. The 590,000 bpd Keystone system is an important artery for Canadian heavy crude, imported by US refiners, particularly in the Midwest. State oil pipeline operators of Kazakhstan and Russia have signed an agreement on compensation for 14 Kazakh companies whose oil was contaminated in the Russian pipelines, the Kazakh firm, KazTransOil, said. A total of 38 Kazakh producers have been affected by the contamination this year, it said, and work on the remaining compensation is under way.

| mt: million tonnes, mn: million, bn: billion, PPAC: Petroleum Planning and Analysis Cell, IOC: Indian Oil Corp, BPCL: Bharat Petroleum Corp Ltd, HPCL: Hindustan Petroleum Corp Ltd, MRPL: Mangalore Refinery and Petrochemicals Ltd, bpd: barrels per day, LPG: liquefied petroleum gas, NSO: National Statistical Office, UAE: United Arab Emirates, kg: kilogram, ONGC: Oil and Natural Gas Corp, OALP: Open Acreage Licensing Policy, DGH: Directorate General of Hydrocarbons, MoPNG: Ministry of Petroleum and Natural Gas, boe: barrels of oil equivalent, PSUs: Public Sector Undertakings, OMCs: Oil Marketing Companies, mtpa: million tonnes per annum, GPS: Global Positioning System, US: United States, IEA: International Energy Agency, OPEC: Organization of the Petroleum Exporting Countries, EIA: Energy Information Administration, ANH: National Hydrocarbons Agency, BSR: Binh Son Refining and Petrochemical Co, LNG: liquefied natural gas, PHMSA: Pipeline and Hazardous Materials Safety Administration |

NATIONAL: OIL

Oil Minister sees jet fuel, gas under GST soon to improve business climate

6 December. Oil Minister Dharmendra Pradhan hoped that Finance Minister Nirmala Sitharaman will in her Budget set the tone for bringing jet fuel and natural gas under the GST (Goods and Services Tax) regime to reduce multiplicity of taxes and improve the business climate. Under the existing structure, both natural gas and ATF (aviation turbine fuel) attract the Centre’s excise duty and a state’s value-added tax (VAT). Both these and all other levies will get subsumed under GST if they are brought under its ambit. The decision on their inclusion depends on the financial position of states as revenues from these five petroleum products constitute a substantial chunk of state government finances. According to the industry, keeping ATF and natural gas out of the GST net was increasing the cost of these products as a tax on inputs is not being credited against the sale of these products, which ultimately, adds to the cost of production. The aviation ministry has time and again sought inclusion of ATF under GST as any surge in international oil rates gets reflected in domestic jet fuel prices, leading to costlier air tickets.

Source: The Economic Times

Centre did not make any investment in Paradip Refinery in last 5 yrs: Oil Minister

5 December. Oil Minister Dharmendra Pradhan said that the Centre has made no direct investment in Paradip Refinery through budgetary allocation. Replying to a question raised by BJD Rajya Sabha MP Sasmit Patra regarding the total investment made by the Centre in Indian Oil Corp (IOC)’s Paradip Refinery in the last five years, Pradhan said there was no such investment made. Asked about the total investment made by the Centre for the development of the Petroleum Chemicals and Petrochemicals Investment Region (PCPIR) in Paradip, Pradhan stated that Odisha PCPIR was approved in December 2010 and the Memorandum of Association was signed between the Government of India and Odisha in November, 2011.

Source: The Economic Times

India’s diesel demand growth seen stuck in low gear until mid-2020

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Slow diesel demand growth signals slowing economic activity!

< style="color: #ffffff">Bad! |

4 December. India’s demand for diesel will remain subdued until the second half of 2020, when analysts expect various policy measures aimed at stimulating industrial activity to kick in and soak up excess fuel. Until consumption picks up in Asia’s third-largest economy, where economic growth has slowed to six-year lows, refiners are likely to extend their recent stretch of rare diesel exports, which have weighed on refining margins in the region. Diesel accounts for about two-fifths of refined fuel demand in India, which has grown by its slowest pace since fiscal year 2014 this year amid tight credit markets, contracting auto sales and slowing rail and air traffic. Diesel exports could climb by up to 8 million tonnes (mt) in the 2019-20 fiscal year from the 28 mt shipped the year before. Ship-tracking data compiled by Refinitiv show India’s diesel exports since the fiscal year start in April have jumped 8.9 percent from the same period in 2018 to 17.7 mt, the highest for that time since at least 2015. India consumed 83.5 mt of diesel in the 2018/19 fiscal year, the oil ministry data show, which was a record and 3 percent above the prior year’s total. Bhanu Patni, oil and gas analyst at Fitch’s local unit Indian Ratings, said diesel consumption will continue to contract for the next several months.

Source: Reuters

NATIONAL: GAS

H-Energy expects Jaigarh LNG import terminal in India to launch in first quarter 2020

6 December. Indian natural gas company H-Energy Pvt Ltd expects its liquefied natural gas (LNG) import terminal at Jaigarh to start operations in the first quarter of 2020, Rahul Tiwari, H-Energy’s senior LNG trader, said. The terminal, which is a floating storage and regasification unit (FSRU), and will be India’s first, has been delayed on several occasions, with the previous deadline the fourth quarter this year. He said that the terminal is expected to be predominantly used for term supply, with occasional spot cargoes, adding that the launch of the terminal will not create additional spot demand in India immediately. The global LNG market has been oversupplied in the past year, with current spot prices at record lows for winter, but the low price has pushed some Indian buyers on the market to procure cheap LNG. He said that stable purchases from Indian buyers will continue on subdued prices, but additional demand is unlikely as Indian regasification terminals are already running at full capacity. H-Energy’s trading office in Dubai signed a sale and purchase agreement with Malaysia’s Petronas in 2018 for the delivery of LNG to the Jaigarh terminal. The terminal is planned to be capable of handing 4 mt per year.

Source: The Economic Times

Natural gas consumption to rise 3-folds in 10 yrs for 15 percent target: Oil Minister

5 December. India’s natural gas consumption will have to rise more than three-folds in next 10 years for the environment friendly fuel’s share to increase to 15 percent in the country’s energy basket, Oil Minister Dharmendra Pradhan said. A massive $60 bn is being spent to expand gas infrastructure to meet such a demand. Natural gas currently makes up for 6.2 percent of all energy consumed in the country. To cut dependence on polluting coal and liquid fuels, the government is targeting its share to rise to 15 percent by 2020-30. The current consumption comprises 80-90 million metric standard cubic meter per day (mmscmd) of domestic output and the remaining coming by way of imports, he said. The investment is being done in building LNG import terminals, laying pipelines and expanding city gas distribution network so that the usage of non-polluting fuel in the country rises. He said natural gas, having dual advantages of being cleaner as well as a cheaper fuel (when compared with liquid fuels like diesel and furnace oil), could help steer India as a transition/ bridging fuel towards a 'low carbon future'. India presently has 38.8 million tonnes per annum (mtpa) of liquefied natural gas (LNG) import terminal capacity. This is being expanded to 52.5 mt in next 3-4 years, he said.

Source: The Economic Times

GAIL offers up to 10 LNG cargoes for loading from US

5 December. GAIL (India) Ltd has offered up to 10 liquefied natural gas (LNG) cargoes for loading in the United States (US) over early 2020 to early 2021. The cargoes are being offered on a free-on-board basis from the Sabine Pass and Cove Point LNG plants.

Source: Reuters

MNGL seeks NMC nod for setting up CNG stations

4 December. The Maharashtra Natural Gas Ltd (MNGL) has written to the Nashik Municipal Corp (NMC), seeking its nod to allow setting up CNG (compressed natural gas) stations at six locations in the city for supplying green fuel to vehicles, especially autorickshaws. The six locations identified are Tapovan, Sinnar Phata, plot near Vasant Pawar Medical College at Adgaon, plot near NMC’s fire brigade station in Panchavati, near Truck Terminus at Chehedi and plot near NMC’s water treatment plant at Pathardi. The NMC has plans to operate 400 buses, including 200 CNG buses, through private agencies.

Source: The Economic Times

NATIONAL: COAL

In a first, private sector gets coal blocks with freedom to sell 25 percent output

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Coal blocks to the private sector with freedom to sell albeit limited is a welcome step towards commercialisation!

< style="color: #ffffff">Good! |

6 December. The coal ministry allotted five coal mines to Birla Corp, Vedanta, Prakash Industries and Powerplus Traders in the first block auction in four years, which for the first time gives operators the freedom to sell 25 percent output in the market. The freedom to sell a quarter of the output is seen as the harbinger of commercial mining in the country, which has been cleared by the government. Birla Corp bagged the Bikram and Brahmapuri blocks in Madhya Pradesh, quoting prices ofRs154 andRs156 per tonne, respectively. Vedanta quotedRs1,674 per tonne for Jamkhana mine in Odisha. Prakash Industries bagged Bhaskarpara block in Chhattisgarh atRs1,100 per tonne and Powerplus Traders was allottd Jagannathpur B block in West Bengal atRs185 a tonne.

Source: The Economic Times

Rajasthan, Tamil Nadu, Karnataka to declare 'no new coal' policy

6 December. Rajasthan, Tamil Nadu and Karnataka could follow in the footsteps of Gujarat and Chhattisgarh to declare a 'no new coal' policy, a new analysis said. This implies these states will not need any new coal power plants in the future, and all of their future energy demands could be cost-effectively met by renewable and flexible based energy alone. In Rajasthan, the total installed coal capacity stands at 11.6 GW whereas renewable energy and hydro stands at 11.1 GW. In Karnataka, installed capacity of non-fossil stands at 63 percent, coal capacity stands at 9 GW whereas renewable energy and hydro stands at 17.9 GW. Similarly, in Tamil Nadu, non-fossils exceeds fossils by 2.3 GW, coal stands at 13.5 GW whereas renewable energy and hydro stands at 15.6 GW.

Source: The Economic Times

CIL to add over 400 mt production capacity over 5 yrs: Coal Minister

5 December. Coal India Ltd (CIL) has a plan to add fresh production capacity of over 400 million tonnes (mt) over the next five years, Coal Minister Pralhad Joshi said. This includes 92 mt per annum capacity from 55 greenfield projects and additional 310 mt per annum that will come from the expansion of existing 193 brownfield projects. Prior to ongoing tranche of coal allocation, coal blocks were allocated to private companies for captive use purpose only and not for the sale of coal. In the current tranche of the auction process, 25 percent of coal production has been allowed for sale of coal for private companies, he said. The coal ministry has launched portal-based monitoring of on-going projects to ensure their timely completion and has introduced mass production technologies including Powered Support Longwall technology and Continuous Miner technology in underground coal mines to boost production.

Source: The Economic Times

CIL in talks with Russian company for extraction, import of coking coal

5 December. Coal India Ltd (CIL) is in talks with Russian coal company Vostok-Coal-Diskon to participate in the extraction of coking coal and its imports from mines in the Siberian districts of Russia. VostokCoal-Diskon is developing coal extraction facilities at the Taimyr coal basin of Taymyr Peninsula in central Siberia. As a first step, CIL signed MoUs with two Russian entities in September. The first was with Far Eastern Agency for Attracting Investments and Supporting Exports, for cooperation in mining coking coal in the Russian Far East and Arctic Region. The second MoU was between CIL and Eastern Mining Company for exploring, identifying, sourcing, negotiating and consummating mutually beneficial investment opportunities in mining in the Russian Far East. These two MoUs will follow an arrangement between CIL and VostokCoal for mining and importing coal to India.

Source: The Economic Times

NATIONAL: POWER

India’s electricity demand falls for fourth straight month

10 December. India’s power demand fell 4.3 percent in November from a year ago, representing the fourth straight month of decline, government data showed, potentially reflecting a worsening industrial slowdown which has stifled overall economic growth. In October, the country’s power demand fell 13.2 percent from a year ago, its steepest monthly decline in more than 12 years, as a growth slowdown in Asia’s third-largest economy deepened. Electricity demand fell to 94.60 billion units in November, from 98.84 billion units during the same period last year, data compiled by the Central Electricity Authority (CEA) showed. For the eight months ending 30 November, India’s electricity demand was up 1.2 percent, the CEA said. Demand rose 6.4 percent during the eight months ended 30 November 2018. India’s most industrialized and electricity hungry state of Maharashtra saw demand fall 8.1 percent, the data showed.

Source: Reuters

Haryana discoms to continue with FSA in power bills

10 December. The power distribution companies (discoms) in Haryana have decided to continue with the fuel surcharge adjustment (FSA) component in the power bills. Uttar Haryana Bijli Vitran Nigam (UHBVN) has issued a circular to the subdivision offices to ensure that the FSA component be continued till further orders. The FSA component will be 37 paisa per unit in the electricity bill. The Dakshin Haryana Bijli Vitran Nigam (DHBVN), which caters to the electricity distribution to southern Haryana, will follow suit. As per records, both discoms have 66.21 lakh electricity consumers in all categories across Haryana. It includes 30.69 lakh consumers of UHBVN and 35.52 lakh consumers of DHBVN. Last year, after the distribution companies had started showing profits, Chief Minister Manohar Lal Khattar had announced to bring down the electricity tariff by waiving the FSA factor. The electricity regulator too had been asking the distribution companies to discontinue the FSA in electricity bills.

Source: The Economic Times

Madhya Pradesh Energy Minister rules out power tariff hike

10 December. Amid demands by the power distribution companies (discoms) to hike power tariff, Energy Minister Priyavrat Singh ruled out any tariff hike. Discoms have moved a petition before the Madhya Pradesh Electricity Regulatory Commission (MPERC) and sought that they should be allowed to recover aroundRs250 bn losses that were incurred during past four years till 2017-18, from the consumers by hiking tariff. Besides, these discoms in their ARR filed for year 2020-21 have also sought an increase of 5 percent in power tariff to bridge the estimated revenue gap ofRs20 bn for that financial year.

Source: The Economic Times

Another hike in electricity tariffs in Punjab likely this month

8 December. Another hike in power charges is on the cards in Punjab as the state electricity regulatory commission is all set to give a verdict on a petition filed by the state discom (distribution company) to seek a revision in tariffs. The Punjab State Power Corp Ltd (PSPCL), in its petition before the Punjab State Electricity Regulatory Commission (PSERC), sought an increase in charges as the Supreme Court recently ordered the discom to pay Nabha Power Ltd and Talwandi Sabo Power Ltd coal charges worth overRs14.20 bn.

Source: The Economic Times

Economic slowdown hits India’s peak power demand by 4 percent in November: IEX

5 December. The peak-time power demand in India fell 4 percent in November led by an ongoing economic slowdown and early onset of the winter season, according to Indian Energy Exchange (IEX), the country’s largest online power trading platform. It said that “energy met” at 3.3 billion units declined 5 percent on a year-on-year basis. November 2019 witnessed a 20 percent decline in average price of power traded through Day-Ahead contracts at the spot exchange atRs2.85 per unit as compared toRs3.58 per unit in the same month last year. Overall, the platform saw a 7 percent rise in power trade volumes in November at 3,825 million units.

Source: The Economic Times

High electricity prices hurting India’s exports: OECD

5 December. The competitiveness of India’s electricity-intensive exports has suffered from relatively high electricity prices and the lack of reliable provision in some parts of the country, according to the latest India economic survey by Organisation for Economic Co-operation and Development (OECD). The Survey said while the provision of electricity has expanded significantly and power cuts are becoming less frequent, India ranked 108th out of 141 economies in 2019 on the World Economic Forum competitiveness index for the quality of electricity supply. OECD said that several reforms, such as reducing the number of electricity prices and making retail tariffs more cost-reflective, are being implemented in some states and would likely help make industrial companies based in India more competitive.

Source: The Economic Times

Power sector PSUs earn higher profits in Delhi

4 December. The power sector PSUs (Public Sector Undertakings) in the city have earnedRs1.21 bn more in profit in 2017-18 compared to 2013-14, with Delhi Transco & Pragati Power Corp Ltd being the top profit-making companies, reveals a report by the comptroller and auditor general tabled in the assembly. According to the 2019 report, the profit earned by the PSUs wasRs8.79 bn in 2017-18 againstRs7.59 bn in 2013-14.

Source: The Economic Times

CEA to put in place a feeder code to help identify power leakages

4 December. The Central Electricity Authority (CEA) wants to put in place a feeder code that will help them to identify power leakages, which could potentially reduce distribution companies (discoms) losses. Feeders, as the name suggests, are power lines which transmits electricity from generating station to a substation, which is then distributed to end consumers. Every state discom has a feeder code, which is referred to as a feeder code. This code is similar to a vehicle number plate which helps in identifying where the vehicle has been registered. For example, the Mangalore Electricity Supply Company has a four-character alpha-numeric code. The West Bengal State Electricity Distribution Company has four character code of which three are numbers. BSES Yamuna Power Ltd has adopted 16 character code scheme which is a combination of alphabets, special characters and numbers. Variation in coding scheme of discoms creates obstacles in importing all feeders data and their operational parameters in single platform for analysis. The Universal Feeder Code will also help in identification of particular feeder and the power supply attributes related to it once it is digitally mapped.

Source: The Hindu Business L ine

10 mn families avail Madhya Pradesh’sRs1 per unit power scheme

4 December. More than 86 percent of the domestic power consumers in the Madhya Pradesh have now come under the Indira Griha Jyoti Yojana (IGJY), payingRs1 for a unit of electricity, Congress said. The total number of domestic consumers in the state is 1, 16, 97, 880. Keeping the promise made in its manifesto, the state government introduced the IGJY in February for domestic consumers, who used up to 100 units per month. Under the scheme, consumers using up to 100 units of powers had to pay onlyRs100. In September, the state cabinet extended the benefits to consumers, who used up to 150 units of power. It was implemented October onwards. In June-July 2018, the erstwhile government led by Shivraj Singh Chouhan had waived power bill dues of the unorganized sector labourers and offered electricity at a flat rate ofRs200. Congress said that in November, the number of beneficiaries of the IGJY increased by another 3.45 lakh consumers. In October, with more than 97 lakh beneficiaries, the state government had estimated that the subsidy scheme will costRs3,400 per annum to the exchequer. However, as the number of beneficiaries go beyond 10 mn, the cost could escalate toRs40 bn.

Source: The Economic Times

NATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

India must build satellite to harness solar energy from space: Former DRDO chief

9 December. India should work with friendly nations to build a solar power satellite and place it in orbit to harness solar power as the country is running out of conventional sources like coal, Former DRDO chief A Sivathanu Pillai said. He said the heat energy should be harnessed and converted into microwaves. It should be channalised to the earth. Technology should be developed, keeping in mind the living organism and birds in the earth, to safely transport the energy from the orbit to the earth, he said.

Source: The Economic Times

Andhra Pradesh government yet to reach a deal on green energy contracts

9 December. The hard-found compromise reached last month to end the impasse over Andhra Pradesh’s decision to relook at renewable energy contracts has floundered. The government led by Chief Minister Y S Jagan Mohan Reddy has upped the ante by raising doubts on the capability of the committee headed by the Union power secretary to resolve the problem. The issues assumes importance as the Andhra Pradesh government’s move has the potential to dent India’s image as a clean energy champion and comes at a time when new solar tenders of around 15,000 MW are in the pipeline.

Source: Livemint

India’s first fully solar-powered village: Irumbai in Tamil Nadu

9 December. Irumbai, a village in Vanur taluk in Villupuram district would soon become the country’s first fully solar-powered village. The Tamil Nadu Energy Development Corp (TEDA) plans to complete the work within two to three months. Once the solar farm is established, the village would be off the TANGEDCO (Tamil Nadu Generation and Distribution Corp Ltd) power grid. The excess solar energy generated by the pilot project would be sold to TANGEDCO, and the revenue generated from it would be utilized for research work. The unit has been designed to generate 150 percent of the actual power requirement of the village. The village was shortlisted after a detailed energy audit survey five years ago.

Source: The Economic Times

Solar power earnsRs10 mn for SDMC

9 December. A year after South Delhi Municipal Corp (SDMC) installed rooftop solar panels on its buildings to save energy, it earned nearlyRs10 mn by exporting surplus power to a distribution company BSES Rajdhani Power Ltd. Over the last year, SDMC generated 6,615 kW solar power from the panels installed at 152 corporation buildings.

Source: The Economic Times

India can generate 18 GW renewable energy using biomass: Singh

9 December. India can generate around 18,000 MW of renewable energy using biomass and an additional 7000-8000 MW from bagasse cogeneration in sugar mills, Power and Renewable Energy Minister R K Singh has said. The Ministry of New and Renewable Energy (MNRE) has launched a scheme to support biomass-based cogeneration in sugar mills and other industries up to March 2020. MNRE invited bids for conducting an independent evaluation of the implementation of the 'New National Biogas and Organic Manure Programme', to be implemented across 13 states of the country.

Source: The Economic Times

Temple in Gujarat switches to solar power, uses saved money to fund college

7 December. In a bid to save on electricity usage, the management of Badrinarayan temple in Gujarat’s Surat district has switched to using solar power for managing shrine’s energy consumption and are utilising the money thus saved to promote education in the region. Temple’s trustee Praveen Chandra said that the electricity bill used to be very high, so they switched to solar power. The trustee said that fifty-kilowatt capacity solar panels have been installed on the terrace of the temple with an expense ofRs25 Lakh.

Source: Business Standard

SoftBank sister firm to invest $4 bn in Gujarat’s renewable energy sector

7 December. SB Energy, a sister company of Soft Bank of Japan, has announced that it will invest $4 bn (`300 bn) in renewable energy sector in Gujarat. The announcement was made at a meeting between Chief Minister Vijay Rupani and Executive Chairman of SB Energy Manoj Kohli. The investment will be in solar energy, wind energy and other unconventional renewable energy sources, it said. The present installed capacity of renewable energy in Gujarat is 8,885 MW and the state government aims to ramp it up to 30,000 MW by 2022.

Source: Business Standard

India provides Lines of Credit for solar energy, drinking water to Guinea

7 December. India has signed agreements for providing over $190 mn in Lines of Credit for strengthening the drinking water and electricity supply and for solar projects in the West African nation of Guinea. The two countries signed the agreements for providing Lines of Credit for $170 mn for strengthening drinking water supply of Grand Conakry, and $20.22 mn for two solar projects, and also for supply of electricity and drinking water for seven public universities and solar project for electrification and refrigeration in 200 health centres. The agreements were inked during the meeting between External Affairs Minister S Jaishankar with his visiting counterpart from Guinea Mamadi Toure.

Source: The Economic Times

Modi government plans big on wind power, projects of 12 GW capacity awarded so far

6 December. Power and Renewable Energy Minister R K Singh said that by October 2019, 37,090.03 MW capacity of wind power has already been installed in the country. Further, MNRE (Ministry of New and Renewable Energy) has hitherto issued bids for 15,100 MW of wind power projects and projects with a cumulative capacity of 12,162.50 MW have been awarded. In its “Guidelines for Development of Onshore Wind Power Projects” released on 22 October 2016, the ministry has provided detailed guidelines to aid the development of wind power projects in a cost-effective and environmentally friendly way.

Source: The Economic Times

Noida Authority to set up 5 MW solar power plants at multiple locations

6 December. Rooftop solar panels generating 5 MW of electricity are in the offing at various locations of the city, Noida Authority said. A request for proposal has already been prepared to invite tenders for the work, which is estimated to be completed in 12 months at a cost of aroundRs43 lakh, the Authority said. The decision is yet to be made through e-tendering process for finalisation of contractor for installation, operation and maintenance for 25 years of the 5 MW solar photovoltaic plants, the Authority said.

Source: The Economic Times

Solar energy need of hour: Bihar CM

6 December. Bihar Chief Minister (CM) Nitish Kumar laid emphasis on promoting the use of solar energy to save environment and maintain ecological balance on the third day of his Jal Jivan Hariyali Yatra. Nitish said efforts were on to enthuse people to make optimal use of solar energy in their private buildings after the installation of solar plates on the government buildings and offices across the state. Nitish said energy could be generated through solar plates installed over ponds as well. Appreciating the new model of ponds being used for generating solar power, Nitish said the model would be implanted in chaurs (wetlands). Highlighting the benefits of the new model, Nitish said it was more beneficial for farmers.

Source: The Economic Times

MNRE misses capacity addition targets, 175 GW by 2022 in peril: Parliamentary panel

< style="color: #ffffff">QuIck Comment

< style="color: #ffffff">Capacity additions even if green in an environment of falling demand does not make economic sense!

< style="color: #ffffff">Ugly! |

6 December. The Ministry of New and Renewable Energy (MNRE) has continuously failed to achieve its yearly targets of clean energy capacity addition, which may hamper the mission of having 175 GW of renewables by 2022, a Parliamentary panel said. The Parliamentary Standing Committee on Energy has also asked the ministry to take up the issue of ambiguity and disputes related to GST (Goods and Services Tax) on renewable energy devices with the finance ministry at the earliest. On the issue of GST on renewable devices, it noted that there are lot of disputes and ambiguities regarding applicable rate of GST on solar power generating system. The committee thinks that such a situation will lead to increase in generation cost and pose a threat to the viability of the ongoing projects, ultimately hampering achievement of the targets. The panel wants that the bank should separate loan basket and limit of renewable energy sector from that of conventional power sector. It has also recommended simplification of the process of subsidy disbursement and wide publicity of benefits of having rooftop solar projects and the incentives. It noted that India achieved 1826 MW of rooftop solar capacity till 15 October 2019. India has set a target of achieving 40 GW of rooftop solar power generation capacity by 2022. The panel suggested to formulate a dedicated programme to support solar manufacturing in the country.

Source: The Economic Times

Industries can cut power costs by 60 percent using renewable energy: WWF-India

4 December. Commercial and Industrial (C&I) consumers in India can cut their electricity bills in a range between 30 percent and 60 percent by replacing grid power supply with renewable energy, according to World Wildlife Fund-India (WWF-India). C&I consumers account for 51 percent of total electricity consumption but only 3 percent of the total renewable power consumption in India. The country has made a commitment to increase its installed renewable power capacity base to 175 GW by 2022 and 450 GW by 2030, as part of its climate action plan. A bulk of the power demand from the C&I segment of consumers is met through captive power plants fired by coal and “brown” power supplied by discoms (distribution companies) 90 percent of which consists of Conventional power and 10 percent renewable power. C&I consumers currently source renewable power from rooftop solar plants, open access wind and solar power and Renewable Energy Certificates (RECs). However, many new options including Virtual Power Purchase Agreements (VPPAs) Green Tariffs, Internationally-tradable RECs have been tried in other countries.

Source: The Economic Times

Plan to bring rooftop solar scheme with KfW: Gadkari

4 December. The government is working with German financing institution KfW to bring a rooftop solar scheme that will bring down the cost of the power generated toRs2.5 per unit, Union Minister of Micro, Small and Medium Enterprise (MSME) Nitin Gadkari said.

Source: The Economic Times

LG asks for rooftop solar systems for all government buildings in Jammu and Kashmir

4 December. Lieutenant Governor (LG) G C Murmu has issued direction to provide 'roof top solar systems' to all government buildings in Jammu and Kashmir Union Territory as part of energy efficiency measures. Murmu directed to conduct audit of all 220 kilovolt (kV) and 132 kV transmission line towers and take corrective measures before the start of the next winter season to prevent damage to power structure. The Administrative Council was also apprised that the Power Development Department has fixed target of achieving 100 percent metering by installing prepaid and smart meters by March 2021.

Source: The Economic Times

INTERNATIONAL: OIL

China November crude oil imports hit record high as refiners race to use up quotas

8 December. China’s crude oil imports hit a record high on a daily basis in November, as refiners operated at high run rates to use up annual import quotas. The world’s top oil buyer imported 45.74 million tonnes (mt) of crude, equivalent to 11.13 mn barrels per day (bpd), according to the General Administration of Customs data. That compared with 10.72 mn bpd in October and 9.61 mn bpd in November last year. For the first 11 months of 2019, China brought in a total of 461.88 mt, or 10.09 mn bpd, up 10.4 percent from the same period last year, the data showed. As the year draws to a close, private refineries, known as teapot refiners, are ramping up output to use up their crude import quotas for the year in order to be able to apply for more quotas next year. State-backed oil refiners, meanwhile, have maintained stable throughput levels. Data showed that China sold 7.31 mt of refined oil products overseas in November, up 63.5 percent from a year earlier.

Source: Reuters

Mexico’s Pemex announces discovery of 'giant' crude oil deposit

7 December. Mexican state oil company Pemex said it has discovered a deposit in southeastern Mexico that could yield 500 mn barrels of crude, calling it the largest such finding in more than 30 years. Pemex aimed to extract 69,000 barrels per day (bpd) from the site by next year, and reach 110,000 bdp by 2021. President Andres Manuel Lopez Obrador has made it a top priority to revive Pemex, which has seen production steadily decline for more than a decade while its debt has grown dramatically.

Source: Reuters

China’s crude oil demand seen peaking at 705 mt around 2030

5 December. China’s crude oil demand is seen peaking at 705 million tonnes (mt) a year around 2030, according to a forecast by a research arm of state energy group China National Petroleum Corp (CNPC). Jiang Xuefeng, deputy president of CNPC Economics and Technology Research Institute (ETRI), also forecast that China’s demand for refined oil products will peak at about 380 mt around 2030.

Source: The Economic Times

Oman recommends extending oil output cuts to end-2020: Oil Minister

4 December. Oman’s Oil Minister Mohammed al-Rumhi said that his country’s delegation at talks with leading oil producers in Vienna would recommend an extension of output cuts until the end of 2020. The Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC allies including Russia and Oman, a group known as OPEC+, meet in Vienna.

Source: Reuters

INTERNATIONAL: GAS

US natural gas futures fall over 4 percent on less cold weather forecasts for December

10 December. US (United States) natural gas futures fell over 4 percent to a near two-month low on forecasts for less cold weather and heating demand through late December than previously expected. Front-month gas futures for January delivery on the New York Mercantile Exchange fell 10.2 cents, or 4.4 percent, to settle at $2.232 per million metric British thermal units (mmBtu), their lowest close since 11 October. Gas flows to liquefied natural gas (LNG) export plants rose to a record 8.2 billion cubic feet per day (bcfd) with an increase in flows to the second train at Freeport LNG’s plant in Texas, up from 7.9 bcfd on Saturday, according to Refinitiv data. That compares with an average of 7.6 bcfd. Separately, traders said Kinder Morgan Inc’s Elba Island LNG export plant in Georgia could send out its first cargo.

Source: Reuters

Chinese buyers offer to resell LNG cargoes as they struggle with weak demand

9 December. Chinese companies are offering to resell liquefied natural gas (LNG) cargoes in the spot market as they grapple with high inventory amid weak demand due to a slowing economy and a milder than usual winter. The world’s second-largest buyer of LNG is currently facing high inventory of the super-chilled fuel in some areas. About 5 to 7 LNG cargoes are being offered for resale in a month, though this could not be independently verified.

Source: The Economic Times

Saudi Aramco’s shipping arm looks to charter tankers in LNG foray

9 December. Saudi Aramco’s shipping arm Bahri has issued an Expression of Interest (EoI) to charter up to 12 liquefied natural gas (LNG) tankers from 2025, its first foray into the superchilled fuel. According to Bahri, the national shipping carrier of Saudi Arabia has six business units dealing in oil, chemicals, logistics, dry bulk, ship management and data and owns 90 vessels, including 43 very large crude carriers and 36 chemical/product tankers. Bahri’s EoI is likely part of Aramco’s expansion into LNG trading as it boosts gas production and considers expanding its LNG investments.

Source: Reuters

Russia’s 2019 gas condensate output to exceed 34 mt: Energy ministry

6 December. Russia’s gas condensate output this year is expected to reach more than 34 million tonnes (mt), the energy ministry said. Russia is part of a global oil supply pact between OPEC (Organization of the Petroleum Exporting Countries) and non-OPEC nations but wants to exclude gas condensate production from its overall liquids statistics when it comes to Moscow’s quotas under the deal. Russian Energy Minister Alexander Novak said that OPEC agreed to allow all the broader OPEC+ group to exclude condensate from oil output calculations, as OPEC does with its own figures. Condensate is a high-value light crude extracted as a by-product of gas production.

Source: Reuters

Asian LNG prices drop for second straight week on mild winter

6 December. Asian spot prices for liquefied natural gas (LNG) dropped for a second consecutive week as supply flooded the market, overshadowing demand subdued by a winter that has been milder than average. The average LNG price for January delivery into northeast Asia is estimated to be about $5.50 per million metric British thermal units (mmBtu), down 10 cents from the previous week. In the United States (US), Cheniere Energy asked US energy and safety regulators to approve a process to return to service a storage tank that leaked at its Sabine Pass LNG export plant.

Source: Reuters

INTERNATIONAL: COAL

China’s November coal imports slump 19 percent month-on-month on port curbs

8 December. China’s coal imports plunged 19 percent in November from the previous month as tighter import rules at ports curbed shipments towards the year’s end. China, the world’s top coal importer, brought in 20.78 million tonnes (mt) of the fuel last month, the General Administration of Customs data showed. That compares with 25.69 mt in October and 19.15 mt in November last year. Customs officials at several ports in Guangdong, Jiangsu and Shandong province in eastern China have halted clearance for vessels carrying coal since late October, traders said. In the first 11 months of 2019, China imported a total of 299.3 mt of coal, already exceeding 2018’s total shipments of 281.2 mt. Falling profit margins at coal mines in Indonesia, China’s second-biggest supplier behind Australia, had also discouraged miners there from selling to China last month, analysts and traders said. Benchmark coal prices for 2019 long-term contracts have been set at 535 yuan ($76) a tonne during China’s winter coal trade fair, unchanged from 2018, traders said.

Source: Reuters

Global coal-based power production set for record fall in 2019: IEEFA

5 December. Global electricity production from coal is expected to fall 3 percent in 2019, the largest drop on record, the Institute for Energy Economics and Financial Analysis (IEEFA) has estimated. In an analysis it said this would amount to a reduction of around 300 terawatt hours (TWh), more than the combined total output from coal in Germany, Spain and the UK (United Kingdom) last year. The projected fall is due to record falls in developed countries, including Germany, the EU (European Union) overall and South Korea, which are not being matched by increases elsewhere. The largest absolute reduction is taking place in the US (United States), as numerous large coal fired power plants close.

Source: The Economic Times

Canadian National Rail enters deal with Teck Resources to ship steelmaking coal

4 December. Canadian National Railway Company said it has entered a long-term deal to ship steelmaking coal from some of Teck Resources Ltd’s operations in British Columbia. Under the terms of deal, CNR will ship steelmaking coal from four of Teck’s operations in the province, between Kamloops and Neptune terminals, and other west coast ports.

Source: Reuters

INTERNATIONAL: POWER

South Africa steps up power cuts after flooding hits major plant

9 December. South Africa’s state energy company Eskom is cutting up to 6,000 MW of power from the national grid after heavy rain and flooding triggered failures at its Medupi plant, disrupting supplies to businesses and households across the country. The cut is the largest since Eskom introduced a program of rolling blackouts, known locally as load-shedding, in 2008. The company had earlier said it would cut 4,000 MW from the grid as it entered a fifth day of rolling blackouts. Eskom has total nominal capacity of around 44,000 MW. The firm said unavailable capacity had risen to about 13,000 MW, forcing it to roll out nationwide blackouts.

Source: Reuters

French power generation down 7 percent due to nationwide strike

9 December. A nationwide strike in protest over planned pension reform has reduced French electricity generation by around 4.8 GW or 7 percent of current generation capacity, data from grid operator RTE and utility EDF showed. The data showed that power generation was curtailed at five nuclear reactors and three coal-fired power generators as workers in the power sector joined the strike that has hit several sectors including public transport and schools.

Source: Reuters

INTERNATIONAL: NON-FOSSIL FUELS/ CLIMATE CHANGE TRENDS

UAE’s Al Nowais to build solar, wind plants in Egypt

10 December. Egypt signed an agreement with the UAE (United Arab Emirates)’s Al Nowais Investments for the construction of two renewable power plants, Electricity Minister Mohamed Shaker said. Al Nowais will build a 200 MW solar plant in the southern governorate of Aswan and a 500 MW wind power plant in the Red Sea city of Ras Gharib, Shaker said. Egypt will pay 2.48 cents per kilowatt of solar power and 3.1 cents for each kilowatt of wind power, Shaker said.

Source: Reuters

US must fix relations with China to combat climate change: Former New York mayor

10 December. A future US (United States) government will have to rebuild relations with China to revive international efforts to combat climate change, former New York mayor Michael Bloomberg said. Bloomberg was speaking at a UN (United Nations) climate conference in Madrid, where environment ministers are grappling with outstanding issues in the implementation of the 2015 Paris Agreement, which aims to avert catastrophic global warming. Nevertheless, former US Secretary of State John Kerry, who served under Obama and was a leading player in brokering the Paris Agreement, said the absence of US leadership was undermining global climate action.

Source: Reuters

Germany offers help to coal operators hit by climate package

10 December. Germany will allow operators of coal power stations to keep their existing carbon emissions certificates after the units have been shut down, part of a compromise designed to reduce the cost to generators of a climate change package. The government will reduce by an equivalent amount the number of new certificates issued under a trading scheme that is designed to ensure that emitters of the greenhouse gas carbon dioxide pay for the environmental impact of their activities. The compromise means the government will earn less from the emissions trading scheme. The existing operators could use their certificates for other carbon emitting activities without having to buy them anew. Germany’s landmark climate change law is slated to be approved by the cabinet on 18 December. Under those plans, all coal power stations must be closed by 2038.

Source: Reuters

Hydropower industry awarded $20 mn in EU funds

9 December. A consortium of 19 hydropower companies and organizations said it will receive European Union (EU) funding of €18 mn ($20 mn) to research the green energy form’s role, as the 28-member bloc seeks to become carbon neutral by 2050. The deal will be announced on the sidelines of the United Nations climate conference in Madrid, a day before the new European Commission lays out its “European Green Deal” policy to make Europe the first climate-neutral continent. The consortium includes EDF, Voith, and General Electric Hydro, as well as universities across Europe. Hydropower can serve as a giant battery, providing a store of energy to balance intermittent renewable energy sources. As big business grapples with reducing emissions, metal processors, such as Norsk Hydro are using hydropower to make products they can market as green. Some environmental campaigners have warned against any expansion of hydropower because of its impact on biodiversity and river systems.

Source: Reuters

France’s EDF to accelerate growth in renewable projects

9 December. France’s EDF is targeting around 30 percent of the French solar power market by 2035 and aims to develop around 1 GW of solar capacity per year from next year, the company said. EDF aimed to complete around 30 GW of installed solar generation capacity by 2035, in line with France’s long-term energy plan. France depends on nuclear power from its 58 reactors operated by EDF for around 75 percent of its electricity needs. It plans to cut the share of atomic power to 50 percent by 2035, while boosting renewables. In a long-term energy plan announced in January, France will increase renewable energy capacity - including hydro power - from 52.3 GW to 74 GW in 2023 and 113 GW in 2028, mainly by boosting wind and solar. EDF currently has around 300 MW of installed solar capacity, while its onshore wind capacity is at 1.6 GW. It has won the contract to build France’s first offshore wind project, the 480 MW Saint Nazaire wind farm expected in 2022, and the 600 MW Dunkirk offshore project. The company said the business was expected to record strong growth, faster than the 10 percent annual growth of the French renewables market. The company said that for France to meet its renewables objectives, the development of projects would have to move much faster. EDF had secured around 2,000 hectares in 2019 for its solar projects, seven times what it had two years ago.

Source: Reuters

EU fuels Indonesia trade tensions with 5-year biodiesel tariffs

9 December. The European Union (EU) imposed five-year tariffs on biodiesel from Indonesia to counter alleged subsidies to producers in the country, a move that could prompt the Indonesian government to retaliate. The EU duties on Indonesian exporters of this type of biofuel, which is made from vegetable oils and animal fats for use in diesel engines, range from 8 percent to 18 percent, the European Commission, the bloc’s executive arm, said. The five-year import taxes are the latest twist in a long-running EU trade dispute with Indonesia over biodiesel and mirror a fight the bloc has had with Argentina. Renewable-energy trade tensions between Europe and Indonesia have also grown as a result of a separate EU decision this year restricting the types of biofuels from palm oil that may be counted toward the bloc’s renewable-energy goals. In Indonesia, palm oil is the main raw material for making biodiesel.

Source: Bloomberg

China solar exports hit 58 GW in first three quarters of 2019

5 December. China’s solar module exports rose to the equivalent of 58 GW of capacity in the first three quarters of the year, compared to 41.6 GW for all of 2018, as a slowdown at home pushed panel sales overseas, the China Photovoltaic Industry Association said. The Association said that the value of the country’s solar component exports hit $17.74 bn over the first three quarters of 2019 and could exceed $20 bn for the whole year, an increase of 25 percent over 2018. US (United States) President Donald Trump’s administration implemented a four-year tariff regime on solar panels in 2018, an opening salvo in a trade war aimed at helping US manufacturers rebound from years of decline due to foreign competition.

Source: Reuters

Poland plays catch-up with launch of major renewable energy auction

5 December. Poland’s energy regulator launched a major wind and solar electricity auction, which may help the coal-reliant country speed up investment in new clean energy sources and bring it closer to the European Union (EU)’s renewables targets. Poland, which generates most of its electricity from coal, has struggled to meet an EU 2020 target of 15 percent of energy from renewables in gross final energy consumption. The ruling Law and Justice (PiS) party has supported the coal industry and in 2016 launched legislation which significantly slowed down investment in onshore wind, putting Warsaw off target for meeting the EU goals. But last year, as part of a wider policy to ease tensions with the EU, Warsaw changed direction and is the government is promoting investment in offshore wind projects and has strongly supported solar energy. Poland had a capacity of 8.8 GW installed in renewables as of the end of June 2019, the energy market regulator data shows.

Source: Reuters

Sri Lanka to launch green projects to protect ecosystem

5 December. Sri Lanka’s new interim government will launch green projects in the island country as part of a mega beautification programme to maintain the ecosystem, parliamentarian Namal Rajapaksa said. With Sri Lanka being ranked the second-worst country affected by climate change by the Global Climate Risk Index 2019, Namal said that it needed to produce more green energy and offer a more friendly habitat for animals and thus, all future investments would be encouraged to go eco-friendly. As the first step, the government said the section along the southern expressway from Matara to Matala in the south, will soon be greener when the viaducts placed there for elephant crossings are converted to vertical gardens. The spaces in between the interchanges will be used to install solar panels. The government said all future projects launched in Sri Lanka will be encouraged to have more greenery and be more environmental-friendly.

Source: The Economic Times

BP to supply renewable energy to Amazon’s Europe data centres

4 December. BP Plc said it would supply renewable energy to Amazon.com Inc’s European data centres that drive the technology giant’s cloud platform. BP will begin supplying Amazon Web Services (AWS) with renewable energy from more than 170 MW of new wind and solar projects in Sweden and Spain starting in 2021. That is enough renewable energy each year to supply over 125,000 European homes and the expectation is to grow the relationship with AWS to more than double the capacity in excess of 400 MW, BP said. The world’s top oil and gas companies are under pressure from environmental groups as well as institutional investors to fall in line with targets set in the 2015 Paris climate agreement to limit global warming. BP will provide AWS with 122 MW of new renewable power capacity from one of the largest onshore wind farms being built in Europe, in Vasternorrland, Sweden. A new solar farm in Spain, which is expected to deliver 50 MW to AWS from 2021, will also support the deal.

Source: Reuters

Growth in global carbon emissions slowed in 2019

4 December. A surprise drop in coal use in the United States (US) and Europe has helped to slow the growth of global carbon dioxide (CO2) emissions this year, with softening demand in China and India also contributing, according to a study. The report, launched at a UN (United Nations) climate summit in Madrid, showed that growing appetite for oil and gas meant the world was still far from achieving the drastic reductions in greenhouse gas emissions needed to avert catastrophic global warming. Nevertheless, coal use fell sharply in the US and Europe, helping slow the projected growth in CO2 emissions to 0.6 percent in 2019 compared with 2.1 percent the previous year. Global CO2 emissions from fossil fuels were likely to be more than 4 percent higher in 2019 than in 2015, the year when the Paris Agreement to tackle climate change was adopted.

Source: Reuters

DATA INSIGHT

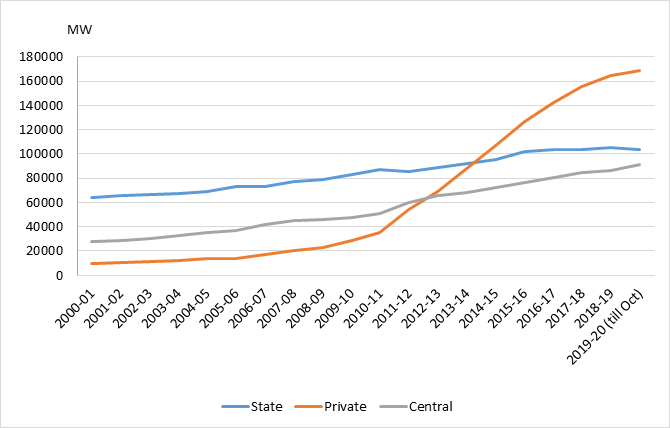

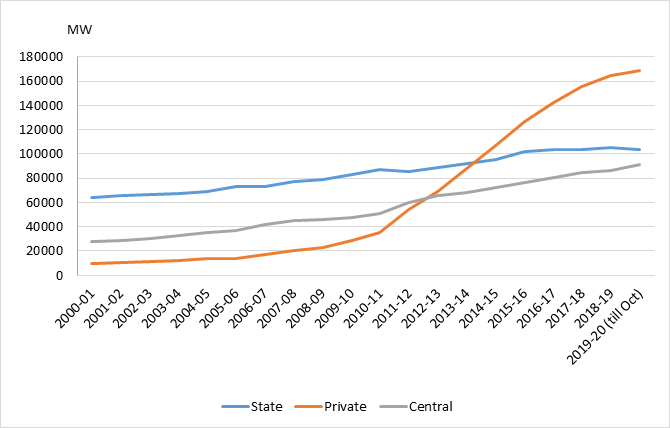

Trends in Electricity Generation Capacity: Central, State & Private

MW

| Capacity Type |

2018-19 |

2019-20

(till October) |

| State |

105,076 |

103,815 |

| Private |

164,428 |

168,858 |

| Central |

86,597 |

91,497 |

| All India |

356,101 |

364,170 |

Note: 2019-20 (till October) includes fig for renewables till September 2019.

Source: Central Electricity Authority