-

CENTRES

Progammes & Centres

Location

Quick Notes

Russia is the largest net exporter of fossil fuels (coal, oil and gas). It is the world’s largest oil (crude and products) exporter shipping 8 million barrels per day (b/d) into global markets and the world’s largest natural gas exporter with 210 BCM (billion cubic meters) of exports through pipeline alone. Russia is also amongst the top ten coal producers in the world accounting for over 5 percent of global output. The partial removal of Russian oil, gas, and coal from international markets has price and volume implications for the Indian energy sector.

Oil price risk is the biggest threat to the Indian economy as supply losses even in the worst cases are not likely to result in significant volume risk. Analysis shows that production losses from Russia of up to 1 mb/d (million barrels per day) will be manageable in the short term, but a more severe supply shock will need a collective response from the supply side, but this is very difficult to achieve. The worst-case estimate for the loss of supply from Russia put it at around 4 mb/d. OPEC (oil-producing and exporting countries) production increases can make up less than 40 percent of this loss. US shale production increases are constrained by capital discipline in the industry and supply increases from Iran are subject to reaching a nuclear deal. Most analysis suggests that the oil sector is likely to remain in deficit in 2022 with the supply deficit in the worst case put at about 1.3 mb/d. Crude prices are expected to remain volatile ranging from US$100/b to US$130/b.

The self-sufficiency ratio for petroleum products in India was 15.6 percent in 2020-21 which means India is dependent on imports for meeting about 85 percent of its petroleum product needs. Given the substantial impact of energy on the trade balance, India’s energy policy is closely tied to managing the impacts on the balance of trade, specifically its energy import bill. Every US$10/b increase in crude prices results in an increase of over US$15 billion in India’s net oil import bill. This will increase India’s current account deficit (CAD) by about 0.4-0.6 percent of GDP and reduce fiscal headroom with additional subsidy outgo of over US$1.9 billion. Most of the oil demand adjustment globally and in India is expected from fuels for industrial use as high input costs restrict industrial activity and manufacturing, followed by the demand for transport fuels particularly road and aviation fuels. This reduction will have significant economic consequences.

In the case of natural gas, India is likely to be exposed to both price and volume risk, especially in the case of its spot gas imports. India’s self-sufficiency ratio for natural gas in 2021-22 was 50.9 percent. Of the roughly 50 percent of imported gas LNG (liquefied natural gas) about 75-80 percent is sourced through long-term contracts and the rest through spot purchases. GAIL (India) Limited signed a purchase agreement with Cheniere Energy in 2011 for 3.5 million metric tons per annum (mtpa) from the Sabine Pass LNG facility in Louisiana. The 20-year contract term commenced in 2018. India’s Petronet has two-term supply contracts with Rasgas of Qatar for 7.5mtpa and 1 mtpa. Petronet’s contract with RasGas slated for a review in 2023, will expire in 2028. Petronet also imports 1.44 mtpa from Exxon’s Gorgon project in Australia under a term deal. Prices average around US$12/mmBtu (metric million British thermal units) for Petronet LNG’s Qatari supplies, less than half of spot LNG levels. However, any sustained increase in gas and oil prices in the international market could lead to an upward price shift in negotiations for long-term contracts. Oil-linked contracts were signed with a 10 percent slope (that defines the relationship between the oil and gas prices and multiplied by the Japanese crude cocktail [JCC] prices) of Brent crude futures in 2020 when crude prices were low. Exporters are likely to demand a higher slope in their revised contracts. Germany has signed an agreement with Qatar for LNG supplies recently. Competition from Europe (which will probably buy gas at any price) for middle eastern LNG could reduce space for favourable price negotiations by India.

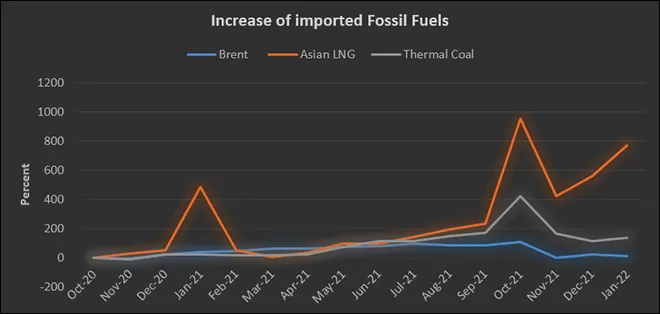

Import of LNG on the spot market means dealing with wild volatility in pricing. During the pandemic when the Japan Korea Marker (JKM) price for LNG, the benchmark for Asian spot LNG imports swung to US$18/mmBtu in February 2021 demand for spot gas from India dried up. Indian companies rescheduled or deferred LNG cargoes to avoid the current prevailing high spot prices. The JKM fell to about US$2/mmBtu in April 2020 on account of the pandemic-influenced economic slowdown but increased to over US$35/mmBtu in March 2022, an increase of over 1650 percent following the crisis in Ukraine and the related natural gas supply risks.

Indian industrial customers prefer US$5-6/mmBtu to use gas over coal with some segments such as fertiliser and city gas distribution (CGD) accepting prices of around US$10/mmBtu. Beyond this price India’s spot market purchase prospects are limited. The likelihood of higher gas prices for Asian importers will increase as Europe approaches winter. Under a scenario where Russian flows on Nord Stream 1, the Yamal-Europe pipeline, and the Ukraine routes are curtailed between April 2022 and March 2023, the ability of Europe to refill its storage is expected to be severely compromised and lead to global price increases. In this context, Indian industrial gas users are likely to substitute gas with alternative fossil fuels primarily coal and pet coke. Segments such as city gas distribution (CGD) will not be able to do so and some pass-through of global price increase to the retail consumer is inevitable. In the long run, higher gas prices will compromise India’s goal of increasing the share of gas in its primary energy basket from 6 percent to 15 percent which will mean higher carbon emissions.

Out of the 204.9 GW (gigawatt) of installed coal-fired power generation capacity in India, around 17.6 GW is designed specifically to run on imported coal. Other power plants import the fuel for blending with domestic coal. Imported coal has unexpectedly become the fallback fuel for power generation following a combination of an unprecedented heat wave, the consequent increase in power demand, a coal stock shortage at thermal power plants and a reduction in power generation by thermal plants dependent on imported coal. The result is that the government is directing thermal plants to increase imports of coal to tide over the coal crisis comes at a time when international coal prices are at unprecedented highs following the crisis in Ukraine. The price of Indonesian 4,200 kcal/kg (kilocalories per kilogram) coal increased from US$79.05/tonne (t) in February 2021 to US$91.95/t in May 2022. In the same period, the price of South African 5,500 kcal/kg coal increased from US$231.9/t FOB to US$269.5/t, whilst Australian 5,500 kcal/kg coal price increased from US$159.25/t to US$196.95/t. This will add to the pressure on India’s energy import bill which in turn will add to India’s current account deficit. The government’s decision to push power generators to import coal is sending confusing signals to lenders. Government-owned banks that had taken the signal from the Reserve Bank of India (RBI), and decided not to fund the working capital requirements of 13 imported coal-fired power plants have now agreed to finance working capital loans to buy imported coal as directed by the government. In the long term, this contradiction is likely to worsen the owes of the power sector.

The Government has projected that the overall coal demand will outstrip the domestic supply in the current financial year. Whilst the overall coal demand in 2022-23 is expected to be 1,029 million tonnes (MT), the domestic supply is estimated to be 974 MT, according to the latest medium-term projections of dry fuel by the coal ministry. In the longer term, thermal coal requirement is expected to increase to 1,500 MT in the next 18 years. Increasing domestic production of coal as planned and removing logistical constraints for coal transport could potentially reduce exposure to an increase in seaborne thermal coal prices.

According to Rays Experts, it will commission the world’s largest solar park in Rajasthan with a 3000 MWp (megawatt peak) capacity. The 9000-acre solar park will be built in Bikaner, Rajasthan. It has signed the necessary transmission agreements and obtained all approvals for the same, the company said. This is the first and the only 100 percent privately owned ultra mega solar park in the country connected to the central transmission system. All the other major solar parks built in the past are partly or fully government-owned. The company claims to be the largest solar park developer in India. This solar park will be ready-to-move infrastructure for multiple solar developers who can save huge costs and time as land, transmission lines etc are already arranged. Currently, the transmission capacity availability in the network is the biggest open risk for solar developers and this solar park addresses the same to a large extent. Due to its market presence, Rays Experts holds 100 percent market share of private solar park projects in Rajasthan and Haryana with a 95 percent customer retention ratio.

Tata Power Renewable Energy Ltd, a 100 percent subsidiary of Tata Power, has commissioned a 120 MW solar project in Masenka, Gujarat, the company said. The project will produce 3,05,247 MWh annually for the Gujarat government (GUVNL). Approximately 3.81 lakhs modules were used in the installation. The project will reduce up to 1.03 lakh tonnes of CO2 (carbon dioxide) annually. A thin-film glass on glass modules of various wattages and harnesses of capacity 440Wp to 460Wp have been used in the project. With the addition of this 120 MW, the renewables capacity in operation by Tata Power stands at 3,520 MW with 2,588 MW of solar and 932 MW of wind. Its total renewable capacity is 4,920 MW, including 1,400 MW of renewable projects under various stages of implementation.

NTPC Limited announced the beginning of commercial operation of the first part capacity of 20 MW out of 56 MW Kawas Solar PV Project in Gujarat. With this, the standalone installed and commercial capacity of NTPC has reached 54,616.68 MW. Further, the NTPC group installed and commercial capacity has touched 68,981.68 and 68,321.68 MW, respectively.

SJVN Ltd has bagged a 90 MW floating solar project worth INR5.85 bn (US$75 mn) at Omkareshwar, in Madhya Pradesh. SJVN has bagged a 90 MW Floating Solar Project at the rate of INR3.26 per Unit on a Build Own and Operate basis in a tender floated by REWA Ultra Mega Solar Ltd (RUMSL). SJVN will develop this project in the country’s largest floating solar park at Omkareshwar in the Khandwa district of Madhya Pradesh. With a total portfolio of 31,000 MW, SJVN has 19 solar power projects of around 3.3 GW capacity under operation and at different stages of development.

Azure Power, India’s leading provider of sustainable energy solutions and a major producer of renewable power, announced the successful commissioning of its Assam 90 MW solar power plant, which is the largest in Assam state. Azure Power has an operational capacity of more than 2,900 MW of high-performing renewable energy assets in India.

An MoU (Memorandum of Understanding) was signed between the Uttarakhand government and Bharat Petroleum Corporation Limited (BPCL) in the presence of the Uttarakhand Chief Minister (CM) for the growth of the renewable energy sector and other projects in the state. According to the CM, the pact would lead to progress in the field of renewable energy, especially solar energy in the hill state. As per the CM, the top priority for the state was the simplification of procedures and all possible support would be provided by the state government for encouraging the solar sector. The CM directed officers of the energy department to reform the energy policy of the state, if required, and ensure all possible cooperation and assistance to institutions and entrepreneurs, especially those who want to work in the field of solar energy. Meanwhile, BPCL said that the company will work on the development of renewable energy in Uttarakhand.

According to the Indian Renewable Energy Development Agency (IREDA), it is keen to promote more green energy projects in Odisha and has already sanctioned loans worth INR6.7 billion (bn) (US$ 87.2 mn) within one year of opening its branch in the state. The IREDA, a public sector non-banking financial institution, has been engaged in promoting, developing and extending financial assistance for projects related to new and renewable sources of energy. In August 2021, the IREDA opened a branch office in Bhubaneswar, following which the company sanctioned five hydropower projects with a total capacity of 80.5 MW and a 1.5 Megawatt (MW) energy access project. The IREDA should also encourage solar rooftops, solar heating and solar lighting systems for household use in Odisha.

As part of its long-term planning, keeping the coal crisis and future energy needs in mind, the Andhra Pradesh government has decided to procure 7,000 MW of solar power from the Solar Energy Corporation of India (SECI) at 2.49 per unit against the prevailing market exchange price of 12-16. The SECI will start supplying 3,000 MW from September 2024 in the first tranche, 3,000 MW from September 2025 in the second tranche and 1,000 MW from September 2026 in the third tranche. As per the state Energy Minister, Andhra Pradesh has decided to procure power from SECI at a highly cost-effective price compared to the market rates.

Aiming to incentivise the installation of solar energy panels, which has seen few takers in the city so far, the Delhi government is likely to increase the subsidy and ease norms to make it more lucrative for residents. At present, individuals get an incentive of INR2 per unit only if at least 1,100 units per kW (kilowatt) are generated in a year, and none of the generation is less. This condition could be removed in the new solar policy that is currently being formulated, thereby permitting everyone to avail of the benefits. Till the first week of May, only 3,168 households in Delhi had opted for rooftop solar plants. Only 50 of about 1,400 group housing societies had the plants installed on the terrace of their buildings. Delhi government could also offer subsidies on the installation of rooftop solar energy plants 40 percent on smaller ones of up to 3 kW and a little less on bigger ones to make them more affordable. Currently, the Union ministry of new and renewable energy (MNRE) provides 30 percent subsidy on benchmarked installation costs of solar panels. With only 230 MW of solar energy currently being produced in Delhi against the target of over 2,700 MW, which was set under the National Solar Power Mission in June 2015, officials said the government is keen to make it more popular amongst people.

The Himachal Pradesh government will allot 27 hydroelectricity projects of 722.4 MW combined tentative power generation capacity in Chamba, Kangra, Lahaul-Spiti, Kullu, Shimla and Kinnaur districts. It has invited bids from the private sector for running these projects on a ‘build, own, operate, and transfer (BOOT)’ basis. The developers will be required to pay the government a royalty in the form of free power from the projects. Of the 27 projects, 9 are in Chamba, 7 in Kinnaur, 5 in Kullu, 2 on the border of Chamba and Kangra, and one each in Kangra, Lahaul-Spiti, and Shimla, besides on border of Lahaul-Spiti and Chamba. Detailed reports for 7 projects are ready, whilst the preliminary feasibility reports (PFRs) for the rest are available.

According to MNRE, India plans to set up 30,000 MW of offshore wind power capacity alongside 50,000 MW of solar capacity. As per the Ministry, India has focused programs for capacity addition and accelerating the energy transition.

High on the pioneering clean energy initiative undertaken by the Prime Minister (PM) of India, which aims to make India the frontline nation globally in clean energy generation, Indian wind energy has envisioned an investment flow of over INR800 bn (US$10.50 bn) over the next few years in the Indian wind energy sector. Various wind energy companies operating in India have invested close to INR250 bn in wind energy equipment manufacturing capacity but there are still many companies who are getting equipment from outside. According to the Indian Wind Turbine Manufacturers Association (IWTMA), India is now the hottest market for clean energy projects and was hopeful that more and more companies will head to India and invest in various clean energy projects ranging from equipment, generation, transmission and services.

The Union Cabinet approved advancing the target of blending 20 percent ethanol in petrol by 5 years to 2025-26 as well as allowing more feedstocks for the production of biofuels in a bid to cut reliance on imported oil for meeting the country’s energy needs. The Cabinet, headed by Prime Minister, at its meeting approved the amendments to the National Policy on Biofuels. The main amendment is for advancing the target of blending 20 percent ethanol in petrol (20 percent ethanol, 80 percent petrol) to 2025-26 from 2030. Currently, about 10 percent of ethanol is blended in petrol. Also, more feedstocks have been allowed for the production of biofuels which can be doped with auto fuels. It also provides for promoting the production of biofuels in the country, under the Make in India programme, by units located in Special Economic Zones (SEZ)/ Export Oriented Units (EoUs). The Cabinet approved granting “permission for export of biofuels in specific cases”. The existing National Policy on Biofuels came up in 2018.

Rising concerns over energy security and climate change will galvanize a record new capacity to generate renewable power in 2022, the International Energy Agency (IEA) forecast. The IEA forecasts that 320 gigawatt (GW) will come online this year, equivalent to top European economy Germany’s total annual demand, up from a previous record of 295 GW in 2021. Last year’s additions, which were driven by the growth of solar energy in China and Europe, exceeded the Paris-based agency’s expectations it said in a new report on renewables.

Botswana has invited bids from independent power producers (IPPs) to build a 200 MW power plant as the country looks to boost power generation and increase the proportion of renewable energy. The scope of the bid covers financing, construction, operation and maintenance as well as decommissioning of the plant at the end of its economic life, according to a document published by the country’s Ministry of Minerals and Energy. Submission of bids closes on 8 June. But the country currently does not have any large-scale solar power generation and its 600 MW national energy demand is predominantly met by state-owned coal-fired plants and imports, primarily from South Africa.

California is asking solar companies, utilities and others to weigh in yet again in a long-standing process to reform the state’s key rooftop solar power incentive, the state’s public utility regulator said. The California Public Utilities Commission is seeking additional input into a proposal issued last year that was vilified by the solar panel installation sector as a job and industry killer. Specifically, the agency is asking for feedback on whether solar panel owners should help fund low-income assistance and energy efficiency programs and whether they should qualify for an additional bill credit, which would be phased out gradually, on top of the credits they receive for exporting power they do not use to the grid.

Mexico’s biggest opposition party proposed installing solar panels for free onto residential housing, staking out its renewable energy credentials as it seeks to challenge the ruling party of President Andres Manuel Lopez Obrador. The president’s plan sought to tighten the Federal Electricity Commission (CFE) control of the market at the expense of private companies. That caused friction with investors in solar and wind power generation as well as manufacturers with commitments to use more clean energy. The solar panels would be paid for by a subsidy currently going to CFE, and be free for people in the lowest energy consumption bracket. The first phase of the initiative aimed to reach around 5 million households.

Germany, Belgium, the Netherlands and Denmark pledged to build at least 150 GW of offshore wind capacity in the North Sea by 2050 to create a “green power plant” for Europe. But the task will be challenging as the European wind supply chain is struggling to make money and the pace of build-outs is being slowed by long permitting times. Some 150 GW would be enough to power 230 million European homes but the ambition is also to use the green power to make hydrogen and green fuels for heavy industries and transportation which cannot easily be directly electrified, Danish Business Minister Simon Kollerup said. The European Commission also unveiled a 210 billion euro plan for Europe to end its reliance on Russian fossil fuels by 2027, and to use the pivot away from Moscow to quicken its transition to green energy. The Commission targets 300 GW of wind at sea by 2050 up from the roughly 16 GW currently installed. Denmark’s Climate and Energy Minister Dan Jorgensen said the cost of installing 150 GW of offshore wind power would amount to hundreds of billions of dollars and would be financed mainly by private investors with small state subsidies. If the target is met, it would be an almost tenfold increase in the European Union (EU)’s offshore wind capacity, and the promise comes as the bloc tries to wean itself off planet-warming fossil fuels and its dependency on Russian energy.

30 May: Bihar government has begun the process to give Petroleum Exploration License (PEL) to assess the presence of oil reserves in Samastipur and Buxar districts in the state. Oil and Natural Gas Corporation (ONGC) has applied for the grant of PELs for Buxar and Samastipur for oil exploration and production under the Open Field Licensing Policy (OALP), additional chief secretary-cum-mines commissioner of Bihar. ONGC has paid application fees with copies of the map and schedule of the area for the grant of PELs for both blocks. The exploration for oil reserves was carried out earlier too in certain parts of Bihar but no commercial discovery was made. It, however, helped in collecting valuable geological information for further exploration.

25 May: The Uttar Pradesh (UP) government has reduced the state VAT (Value Added Tax) imposed on diesel and petrol by INR1.03 and 1.40 per litre respectively, after the Centre slashed the excise duty on the fuel three days ago. This will bring down the effective prices by INR8 on diesel and approximately INR10 on petrol. UP CM (Chief Minister) Yogi Adityanath said that the base price of petrol and diesel automatically got reduced on 22 May when the Centre reduced the excise duty on diesel and petrol by INR8 and INR6 per litre respectively. The CM added that the LPG (liquefied petroleum gas) was covered under GST (Goods and Services Tax) for which any approval to reduce tax would have to be granted by the GST council.

28 May: GAIL (India) Limited is getting regular supplies of liquefied natural gas (LNG) under a long-term deal with Russia’s Gazprom despite the geopolitical crisis, chairman and managing director Manoj Jain said. GAIL has signed a contract to import 2.85 million tonnes (MT) of LNG from a Singapore-based unit of Russia’s Gazprom.

29 May: Almost three weeks after the Centre’s advisory to the states to arrange and procure imported coal to meet mid-June to August demand (expected to be the highest in Punjab’s history), the Punjab State Power Corp Ltd (PSPCL) has placed its first coal order. It has placed an order for 1.5 lakh tonnes of coal from Indonesia, which will cost the state around INR3.50 bn. The power demand in the state has been hovering around 10,000 MW with paddy season almost a week away and will touch around 15,500 MW during the peak period. The coal imported from Indonesia costs around US$200 per tonne (INR15,000). Add another INR3,300 per tonne transportation charges from the seaport in Gujarat to Punjab, which will ultimately be borne by the consumers. In the first week of May, the union power ministry had advised the state power utilities, including Punjab, to spend more to procure imported coal to feed their thermal plants as Coal India Limited was unable to meet the growing demand.

29 May: The union power ministry has asked the Central Electricity Authority of India (CEA) to estimate the eligible quantity of domestic coal for power plants using the Shakti B policy, taking into account 10 percent imported coal for blending, which is equivalent to around 15 percent of domestic coal in terms of energy. Shakti B is a window for power plants with untied capacity to bid for coal, generate electricity with it, and sell it on the exchange under the Day Ahead Market (DAM) or DEEP portal for short-term power purchase agreements (PPAs), the power ministry said. For such power plants, the ministry has directed the CEA to calculate the amount of coal utilised (purchased under SHAKTI B window) based on a mandated blending of 10 percent by weight for generation from 15 June 2022 to 31 March 2023. This calculation of coal use for the time period gives the plants a three-week opportunity to obtain imported coal.

31 May: The Delhi government will provide free electricity connections to shops run by Kashmiri Pandits in the INA market, Deputy Chief Minister Manish Sisodia said. All expenses from the installation of transformers to electricity connections will be borne by the Kejriwal government and the entire work will be completed within a month, he said.

31 May: Power Grid Corporation of India Limited (PGCIL) said it has acquired Mohanlalganj Transmission Limited (MTL) in Uttar Pradesh for over INR90 mn. Incorporate in June 2021, MTL is the project SPV (special purpose vehicle) to establish an intra-state transmission system, PGCIL said. MTL is engaged in the business of power transmission.

30 May: India plans to reduce power generation from at least 81 coal-fired utilities over the next four years, the federal power ministry said in a letter, in an effort to replace expensive thermal generation with cheaper green energy sources. The plan aims to maximize green energy potential and save costs, the letter said, but will not involve shutting down old and expensive power plants. India has 173 coal-fired plants. India faced a crippling power crisis in April, when a rapid surge in power demand lead to a scramble for coal, forcing the country to roll back plans to cut thermal coal imports to zero. An increase in peak power consumption during the night when solar power is not available has made phasing out coal-fired generation a big challenge. The addition of alternative sources such as nuclear and hydropower have also been slow. India is the world’s second-largest consumer, producer and importer of coal, and fuel accounts for nearly 75 percent of annual electricity generation. India’s current power crisis could have been averted if its target to install 175 GW in renewable energy had been on track, think tank Climate Risk Horizons said in a report in May. India expects the plan to reduce power generation by 58 billion kilowatt hours (kWh) from the 81 utilities to save 34.7 million tonnes (MT) of coal and cut carbon emissions by 60.2 MT, the letter said.

31 May: GAIL (India) Limited will invest INR60 bn in the next three years in renewables. The investment can go up by an additional INR200 bn by 2030, it said. It is looking at almost 3 GW of renewables capacity by 2030, which will include 1 GW to start within the next three years.

31 May: Statkraft announced the commissioning of its first large-scale solar power plant in India to ramp up solar and wind power developers across the country. Nellai Solar Power plant of 76 MW is located in Tamil Nadu and will generate 120 GWh of renewable power annually, equal to the power consumption of over 500,000 homes in India. The company is focusing on developing greenfield solar projects in India. Nellai plant will support its strategy to strengthen its industrial presence in the solar segment. Statkraft said that this plant would help industries in Tamil Nadu meet their renewable energy requirement at affordable rates.

30 May: Adani Hybrid Energy Jaisalmer One Limited (AHEJOL), a subsidiary of Adani Green Energy Limited (AGEL) has commissioned a 390 MW hybrid wind-solar power plant in Jaisalmer. The country’s first-ever wind and solar hybrid power plant have entered into a Power Purchase Agreement (PPA) with the Solar Energy Corporation of India (SECI) with a tariff of INR2.69 per kWh. AGEL stated in a regulatory filing that the cost of generating electricity at 2.69 per kWh is well below the average power procurement cost (APPC) at the national level. AGEL has a 5.8 GW operational capacity, thanks to the successful commissioning. AGEL’s total renewable portfolio stands at 20.4 GW, which is well within its reach to achieve its goal of 45 GW capacity by 2030.

25 May: India’s power ministry has sought a two-year extension for utilities to install emission-cutting equipment, which if approved by the environment ministry would mark the third pushback on a commitment to clean up dirty air. Indian cities have some of the world’s most polluted air. Thermal utilities, which produce 75 percent of the country’s power, account for some 80 percent of industrial emissions of sulphur- and nitrous oxides, which cause lung diseases, acid rain and smog. India had initially set a 2017 deadline for thermal power plants to install FGD units. That was later changed to varying deadlines for different regions, ending in 2022, and further extended last year to a period ending 2025.

31 May: Some OPEC (Organization of the Petroleum Exporting Countries) members are considering the idea of suspending Russia in an oil production deal as Western sanctions hurt the nation’s ability to produce more. Exempting Russia could pave the way for Saudi Arabia, the United Arab Emirates and other OPEC members to produce more to meet the production targets. Oil prices have soared to above US$100 a barrel since the Russian invasion of Ukraine and countries including the United States have urged a hike in production to bring prices down.

31 May: Cenovus Energy and its partners said they will restart the West White Rose oilfield project off the coast of Atlantic Canada in 2023, more than two years after pausing it as the COVID-19 pandemic battered oil prices. Major construction activities on the West White Rose project, which is expected to add 14 years of production to the White Rose oilfield, were suspended in April 2020. Since then, oil prices have recovered and surged to a 13-year high in March. The decision comes just weeks after the Canadian government approved Equinor ASA’s Bay du Nord deepwater project, also off the coast of Newfoundland and Labrador, and a major boost to the economy of the eastern province. The Calgary-based company said the first oil from the platform is anticipated in the first half of 2026. Peak production is expected to be about 80,000 barrels per day by the end of 2029.

30 May: Oil prices climbed above US$121 a barrel, hitting a two-month high as China eased COVID-19 restrictions and traders priced in expectations that the European Union (EU) will eventually reach an agreement to ban Russian oil imports. EU countries failed to agree on a Russian oil import ban despite last-minute haggling before the summit got underway in Brussels. But leaders of the 27 EU countries will agree in principle to an oil embargo, a draft of their summit conclusions showed, whilst leaving the practical details and hard decisions until later. Any further ban on Russian oil would tighten a crude market already strained for supply amid rising demand for gasoline, diesel and jet fuel ahead of the peak summer demand season in the United States and Europe.

Sri Lanka will pay US$72.6 million to buy 90k tonnes of Russian oil

28 May: Sri Lanka will be paying a whopping US$72.6 million for purchasing a 90,000-tonne shipment of Russian oil docked at Colombo’s port for weeks. Energy Minister Kanchana Wijesekera said that the country intends to restart its refinery and address a crippling energy crisis. He said that the 90,000-tonne consignment was ordered through Dubai-based Coral Energy. He said that the payment would facilitate restarting the country’s sole refinery, which has been closed since 25 March. He estimates Sri Lanka to need US$568 million for paying for a dozen fuel shipments needed in June. Notably, Sri Lanka is struggling to pay US$31 million for a furnace oil shipment docked at Colombo’s port. Ceylon Petroleum Corporation (CPC) needs US$735 million to clear letters of credit for previous oil purchases.

31 May: Europe’s race to replace the Russian gas supply has threatened Australia’s plans for five gas import terminals as they compete for key infrastructure, raising the risk of a supply shortfall in Australia’s populous southeast in the next two years. France, Germany and the Netherlands amongst others will need to import liquefied natural gas (LNG) to replace pipelined gas from Russia, which has been hit by sanctions during the Ukraine conflict. European users are grabbing floating storage and regasification units (FSRUs) needed to convert LNG to gas, leaving little left for Australian import projects that aim to fill an expected gas supply gap from 2024. Although Australia is the world’s top LNG exporter, its main gas fields are far from Sydney and Melbourne and other big cities in the southeast, and the output is mostly tied to contracts with Asian users. The country is therefore proceeding with LNG import projects, but most have not yet reached the stage of locking in customers or regasification infrastructure, and are getting pipped on FSRUs by European users.

31 May: As liquefied natural gas (LNG) producers try to take advantage of a global energy shift triggered by Europe’s move to become independent from Russian gas, Latin America’s only two LNG exporters are moving in opposite directions. In Peru, LNG shipments are ramping up fast with special emphasis on Europe, where a combination of firm demand and high prices has been luring exporters this year. That is despite Peru’s political turmoil and threats to nationalize the gas industry, which roiled the sector last year. But Trinidad and Tobago, Latin America’s largest LNG producer with enough reserves and capacity to meet a portion of the incremental demand, has been unable to reverse an export fall expected to continue for a third consecutive year in 2022 as it struggles to bring more gas output online. From the Americas, LNG shipments are dominated by the United States (US), which last year exported a record 9.7 billion cubic feet per day amid booming demand and growing liquefaction capacity. The US is expected to become the world’s largest LNG exporter this year. Russia’s invasion of Ukraine and resulting shunning of its fuel in Europe have changed the preferred markets for allocating LNG cargoes, prompting producers to sign medium-to-long-term supply contracts with customers in Europe. Peru is getting ahead of its neighbour in that race. Perupetro reported a total of 37 LNG cargoes shipped from the Pisco port from November through May, with almost half of them delivered in Europe. Peru LNG, a consortium comprised of Shell, US-based Hunt Oil Corp, Japan’s Marubeni Corp and South Korea’s SK Group, is in charge of LNG exports from the country. Peru is on track to recover exports of liquefied natural gas (LNG) to pre-pandemic levels, whilst Trinidad & Tobago is set to mark its fourth consecutive year of decline in 2022

30 May: Israel is renewing offshore natural gas exploration and hopes to reach an agreement soon for exporting gas to Europe, Israel’s Energy Minister Karine Elharrar said. Elharrar had said exploration for new gas fields would be put on hold to focus on meeting renewable energy targets but due to the war in Ukraine, Europe is now looking for a quick replacement of supply from Russia. The idea, for now, is for gas to be sent to Egypt through an expanded pipeline network for liquefication and then shipped to Europe. Other options, like the long-discussed Eastmed pipeline that connected Israeli gas fields directly with Europe, are also on the table, Elharrar said.

31 May: Drummond, one of Colombia’s largest coal producers, has signed pay and benefit agreements with 10 unions through 2025, the company said. Last year the company exported 31.5 million tonnes (MT) of coal, up 6 percent from 2020 levels. Colombia is an important global coal exporter. Fossil fuels including coal and oil are a vital source of national income.

27 May: Japan reiterated its policy to reduce reliance on coal-fired electricity generation as much as possible, with plans to phase out inefficient coal power plants by 2030. Economy, Trade and Industry Minister Koichi Hagiuda made the comments when asked about an expected communique to be issued by energy, climate and environment ministers from the Group of Seven (G7) countries. A draft communique, seen by Reuters ahead of 25 to 27 May talks between the ministers, showed the group would consider committing to a phase-out of coal by 2030, though sources suggested that opposition from the United States and Japan could derail such a pledge.

26 May: The Afghan Taliban are stepping up coal exports to Pakistan and have raised duties on sales, as the group aims to generate more revenue from its mining sector in the absence of direct foreign funding. The move comes with global coal prices near record highs after top exporter Indonesia imposed a shock ban on exports earlier in 2022 and then Russia invaded Ukraine, pushing prices up further. The finance ministry said officials had collected around 3 billion Afghanis (US$33.80 million) in customs revenue on more than 16 billion Afghanis worth of coal exports in the last six months. As well as higher sales, the tax on coal exports was increased to 30 percent from 20 percent, the contents of which were confirmed by the ministry. Importing coal from Afghanistan could help Pakistan reduce costs and dependence on supplies from South Africa, which is facing logistical challenges given the higher demand for fuel from Europe. South Africa currently provides almost three-quarters of Pakistan’s coal needs, mostly for the country’s fledgling cement industry.

31 May: Vietnam’s Industry Minister Nguyen Hong Dien has told the national assembly developing nuclear power is an “inevitable trend” around the world, signalling that authorities may be considering resuming a plan to construct nuclear power plants after the programme was suspended six years ago. The Southeast Asian country, a regional manufacturing hub, shelved a plan to build its first two nuclear power plants in 2016 following the Fukushima disaster in Japan due to budget constraints. The proposed nuclear plants, with a combined capacity of 4,000 megawatt (MW), were due to be built by Russia’s Rosatom and Japan Atomic Power Co. in the central province of Ninh Thuan under the earlier plan. Dien has pledged Vietnam will boost the development of renewable energy following a commitment made in November last year to become carbon neutral by 2050, but stressed this week that it still needed a “stable energy source.” Vietnam wants to nearly double its total installed power generation capacity to 146,000 MW by 2030, according to the latest draft of its master power development plan, which is being further tweaked to take into account its carbon neutrality commitment.

26 May: Greece passed its first climate law, which sets out specific targets to fight climate change and wean itself off coal in power generation by 2028. The legislation sets interim targets for Greece to cut greenhouse emissions by at least 55 percent by 2030 and by 80 percent by 2040 before achieving zero-net emissions by 2050. It also engages the country to cut dependence on fossil fuels, including weaning off indigenous lignite or brown coal – once the main source of energy – in electricity production from 2028 onwards. This target might be brought forward to 2025, taking into account the security of supplies. Greece is planning investments worth about €10 billion to expand its power grid by 2030, whilst it speeds up the development of renewables to more than double their share in electricity production.

26 May: The extended drought in California could lead to hydropower producing 8 percent of California’s electricity generation compared with 15 percent under normal precipitation conditions, the US (United States) Energy Information Administration (EIA) said. In its supplemental outlook, the EIA expects that the dip in hydropower generation would lead to an 8 percent increase in electricity generation from natural gas, an increase in energy-related carbon dioxide (CO2) emissions by 6 percent, and a roughly 5 percent increase in wholesale electricity prices throughout the West, it said.

26 May: A Canadian financial regulator released draft guidelines to mitigate the risks of climate change as the country’s financial institutions prepare for mandatory disclosures starting in 2024. The guidelines, issued by the Office of the Superintendent of Financial Institutions (OSFI), call for annual climate-related disclosures on governance, strategy, risk management, metrics and targets, and greenhouse gas emissions, as well as a transition plan, for periods starting October 2023. They also require firms to put in place policies and practices to manage climate risks and adequately price climate risk-sensitive assets and liabilities. But they don’t yet include any capital requirement changes to mitigate these risks, and OSFI will communicate more on this after consultation on the guidelines.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.