Quick Notes

Limiting oil price increases: Supply and demand side measures

Oil Price Increases

Brent crude price increased from US$81.75/barrel (b) on 7 January 2022 to a peak of US$127/b on 8 March 2022. It fell to about US$101.07/b on 6 April 2022 following the news of supply side measures such as release of crude from Strategic Petroleum Reserves (SPR) in developed countries. Brent crude prices on 6 April 2022 were over 50 percent higher than prices in April 2021. Though post pandemic recovery is among reasons for growth in oil demand, oil price increases have been driven mostly by sanctions on Russian oil imports since March 2022. Russia is the third largest oil producer and the largest exporter. Its exports of about

5 million barrels/day (mb/d) of crude representing roughly

12 percent of global trade. Russia also exports approximately 2.85 mb/d of petroleum products that represents around

15 percent of global refined product trade. Around 60 percent of Russia’s oil exports go to Europe and another

20 percent to China. In 2021, imports from Russia accounted for

8 percent of all US petroleum imports, consisting of 3 percent share of crude oil imports and 20 percent share of petroleum product imports.

The increases in prices are being felt everywhere. Even though crude prices are yet to hit levels seen in 2008, currency exchange rates along with taxes imposed on petroleum products have taken the retail price of petroleum products to record high levels. According to the IEA (International Energy Agency), monthly spending on oil products for transport and heating increased by more than US

$40 per household (nearly 35 percent) in developed countries and by nearly US

$20 per household (nearly 55 percent) in developing countries. In the United States, where increase in retail price of petrol affects political sentiment strongly, the average retail price of petrol has increased from less than US

$2.5/gallon (INR50.13/litre) in January 2021 to more than US

$4/per gallon (about INR80.21/litre) in March 2022. In India the retail price of petrol has crossed the psychological barrier

₹100/litre in many parts of the country sparking protests.

Supply Side Measures

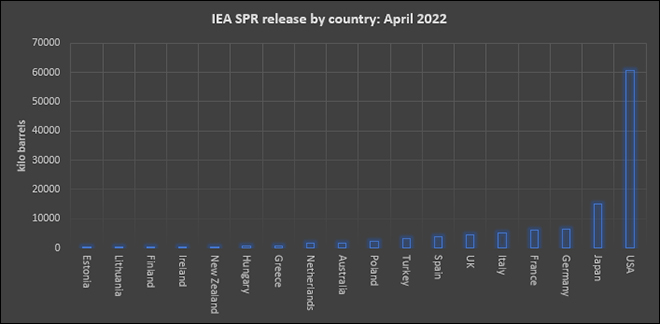

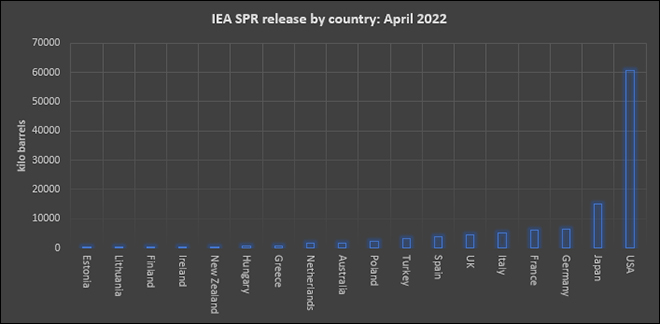

Increase in supply is one of the many means to address the problem of high oil prices. Coordinated release of SPR by developed countries that have the largest reserves, increase in supply from OPEC (oil producing and exporting countries), increase in supply from non-OPEC countries, increase in supply from Iran following relief from sanctions are among supply side measures that are being considered. On 1 March 2022, 31 member countries of the IEA agreed to release

60 million barrels of oil from their emergency reserves to send a message to global oil markets that there will be no shortfall in supplies as a result of the sanctions on Russia. In the last week of March 2022, the United States announced that it will release

1 mb/d of crude oil from the SPR from May 2022 that will continue for six months totalling 180 million barrels. Following the announcement of SPR release from the USA, Brent crude futures for May, fell by about US$5.54/b or 4.8 percent

$107.91 a barrel. The IEA members agreed to

release 120 mb/d of SPR crude on 7 April 2022. This will include 60 mb/d of crude from the release of 180 mb/d announced by the US earlier. In total IEA member countries and the USA will release 240 mb/d of their SPRs.

The announcement of the US SPR release, described as the biggest in history, was made on the same day OPEC decided to increase production by

400,000 b/d. But given that OPEC decisions are informed more by geopolitical concerns than by market fundamentals it is

unlikely that OPEC will increase supply substantially. Moreover it is not certain that OPEC countries have spare capacity to ramp up production as most have not been able to meet

existing targets. If sanctions against Iran are relaxed there is a possibility that it can make a significant

contribution to supply later in the year. There is also the possibility of increase in oil production from US shale plays but so far, the expectation that oil production from US shale producers can be

ramped up and down rapidly depending on market forces has proved to be inaccurate.

Demand Side Measures

In response to the increase in oil prices, the IEA has come out with a ten-point recommendation to

reduce oil demand in advanced economies that account for 45 percent of oil demand. The recommendations are (1) reduce driving speed on highways by 10km/h (2) work from home for up to 3 days (3) make Sundays car free (4) use

cheaper public transport (5) reduce traffic by alternating between odd and even number plated vehicles (6) increase car sharing (7) increase efficiency of freight transport (8) encourage faster adoption of electric vehicles (9)

avoid business travel (10) use high-speed overnight trains instead of planes.

According to the IEA, these ten measures, if implemented successfully, will reduce oil demand by

2.7 mb/d within 4 months and reduce the pressure on oil prices. The long-term objective of this programme is to engineer structural decline in oil demand that will put advanced countries on a secure path to

net-zero.

Challenges

While both oil supply increase and oil demand decrease are necessary to address the problem of high oil prices, they are not as straightforward to implement as they sound. Announcement of SPR release may not always result in decreasing the price of crude oil. Following the announcement by the IEA that

2mb/d of oil will be released over 30 days on 1 March 2022, the price of Brent crude increased by 4 percent from US

$101.06/b to $104.97/b reflecting concerns over the size of the release as well as doubts over the capacity to release crude as stated. In November 2021, the US government announced release of

50 mb/d of crude from mid-December, but crude prices increased by US

$11.2/b or 15 percent and the US released only 20 mb/d of crude. Analytical studies show that the effect of SPR release on prices have been modest. The cumulative effect of the SPR releases after the invasion of Kuwait in 1990 was a reduction of US

$2/b in the real price of oil after 7 months. Even if there is a reduction in oil prices in the short term, SPR release tend to

increase the real price of oil in the longer term. SPR drawdowns contribute to higher demand expectations and higher price in the longer term when reserves are replenished. Studies on the Chinese domestic oil market response show that the effects of the SPR on

suppressing domestic oil price are small in all scenarios.

Focussing on the demand side of the market could be

counterproductive to efforts of reviving the global economy after the pandemic. The IEA recommendations are addressed to OECD (organisation for economic cooperation and development) countries but accelerated growth in non-OECD countries that account for

54 percent of oil demand may offset the effect of a decrease in oil consumption in OECD countries. The IEA recommendation to shift mobility to efficient alternatives, if successful, will depress industries such as

aviation contributing to job losses. As demonstrated by the pandemic, national economies may not want to pay the price of job losses to keep oil prices down.

Loss of tax revenue from oil consumption may also affect government spending plans in OECD countries that collect substantial revenue from high taxes on oil consumption. History shows that curbs on oil demand are rarely popular and increase in supply take time. In the short term, there are few solutions to the problem of high oil prices that do not upset lifestyles for the rich and livelihoods for the poor.

Source: International Energy Agency

Source: International Energy Agency

Monthly News Commentary: Coal

Coal Demand remains Buoyant

India

Demand

South Eastern Coalfields Limited (SECL), a flagship arm of CIL, has

surpassed the last year’s coal dispatch figure by transporting 139 mt of the dry fuel so far in the current financial year. The largest coal-producing company had dispatched 138.8 mt in the last financial year 2020-21. The figure reported as on 23 February surpassed the last year’s cumulative dispatch, despite 36 days still remaining for the closure of the current fiscal 2021-22. Going by the stride, SECL is all set to record the highest-ever coal dispatch in the current financial year. The Bilaspur-headquartered miner had provided 14 percent more coal to the consumers as compared to last year. Compared to the previous year, the company had supplied 25 percent more coal to the power companies to facilitate sufficient stock.

Government aims to build digital infrastructure and introduce

new technologies to help current and future coal mines operations. The step is focussed at cutting down on import of dry fuel. The objective is to implement new technologies and build digital infrastructure to support current and future ramp-up for the mines, according to the government's draft technology road map for the coal sector. The roadmap also includes multi-speed backbone information technology and infrastructure system that allows rapid deployment of new technologies. To reduce dependency on imports, it is critical for CIL to reach the one billion tonnes target, thereby embarking on a technological transformation journey, it said. India has total coal reserves of 344.02 billion tonnes. Commercial primary energy consumption in India has risen to 700 per cent in the past four decades. Major factors for the increase in demand for energy are expanding economy, rising population and the improvement of quality of life.

The coal ministry said that a target of all India coal production of 1.2 billion tonnes up to the year 2023-24 has been fixed. The Union government has launched Single Window Clearance portal on 11.01.2021 for the coal sector to speed up the operationalisation of coal mines. It is an unified platform that facilitates grant of clearances and approvals required for starting a coal mine in India. Now, the complete process shall be facilitated through Single Window Clearance Portal, which will map not only the relevant application formats, but also process flow for grant of approvals or clearances.

India is unlikely to build any new coal-based energy capacity over the next 10 years when the country’s energy mix will tilt significantly towards cleaner sources with solar emerging the top source, the government’s internal projections from Central Electricity Authority (CEA) show. Energy storage systems will play a key supporting role in meeting the country’s energy needs by 2032, as per a study prepared by CEA, the planning wing of the Union power ministry, on future energy mix.

NTPC Ltd Chairman announced that

the country’s top power producer could build new coal-fired power plants if needed. The company said that the company was considering building nuclear power plants, but discussions were preliminary. Meanwhile, NTPC posted a 25 percent jump in quarterly profit as demand for electricity soared in one of the world’s fastest-growing economies. Demand for electricity jumped after factories and commercial establishments ramped up operations following months of slowdown caused by the pandemic. NTPC’s coal-fired plants, which account for 89 percent of the company’s standalone generation capacity, operated at an average utilization rate of about 68 percent during the period. Power producers faced one of the country’s worst coal supply disruptions during the quarter, leading to a plunge in inventories. While supplies have improved, generators such as NTPC are leaning back on imports to maintain stockpiles of the fuel that helps produce nearly 70 percent of India’s electricity.

Coal Block Auctions/ E-auction

The tussle between governments of

Rajasthan and Chhattisgarh over coal block allocation is likely to be resolved in the next few days with Rahul Gandhi meeting chief ministers of the two states. Gandhi met Ashok Gehlot and Bhupesh Baghel at his residence and held discussions to find an amicable resolution to the issue. Rajasthan is seeking allocation of Parsa coal block in Chhattisgarh for supply of coal, to which Chhattisgarh has raised certain concerns of tribals in the area. Gehlot has already written letters to Congress president Sonia Gandhi, seeking her intervention for speeding up clearances for coal mining for power plants in Rajasthan ahead of the summer season. Gehlot had said Rajasthan could face a severe power crisis due to non-availability of coal from the Chhattisgarh coal block and that may affect the party’s performance in upcoming elections.

Dalmia Cement Bharat Ltd has emerged as the highest bidder for two coal blocks in Jharkhand that were auctioned for commercial use. While Mahanadi Mines and Minerals Pvt Ltd emerged as the highest bidder for a coal block in Odisha, Yazdani Steel and Power Ltd was the highest bidder for another coal mine in the eastern state. Assam Mineral Development Corp Ltd was the highest bidder for a mine in Assam. Five coal mines were put up for auction on the first day of the auction. Four coal mines are fully explored and one block is partially explored. The total geological reserve of these five coal mines is 1,188.16 million tonnes (mt). The cumulative peak rated capacity for these coal mines is 5.944 million tonnes per annum (mtpa).

Imports

The government said the country's dependence on imports to meet thermal coal demand has sharply reduced and stressed that in the next financial year, this demand will be met from Coal India Ltd (CIL), Singareni Collieries Company Ltd and captive mines. The power ministry has projected a requirement of 727 million tonnes (mt) of domestic coal for coal-based power generation for 2022-23. CIL supplied 50.7 mt coal to power sector, achieving a growth of 24 percent in comparison to supply of 40.8 mt in January last fiscal. Indonesia has relaxed export ban and few coal vessels have already departed in the last days of January. The export ban in major period of January, has provided an opportunity to supply more domestic coal. In 2021-22 (up to January 2022), CIL has supplied coal to the tune of 441.35 mt (provisional). The total coal stock at the power plants end has increased from 10.82 mt as on 31 October 2021 to 25.31 mt as on 31 January 2022.

CIL, the world’s largest coal miner, plans to directly export output to neighbouring countries, after decades of exclusively supplying domestic consumers. The firm plans to export to Bangladesh, Nepal and Bhutan, according to a draft policy sent to the Secretary of India’s coal ministry, as a part of India’s ‘neighbourhood-first’ policy which seeks to counter China’s growing economic influence in South Asia. The proposal was confirmed by Coal India’s chairman, although a critical coal shortage in India now means the first such shipments would be unlikely until the end of this year.

Governance

The Meghalaya High Court (HC) directed state chief secretary and director general of police to

file an independent report into the alleged illegal coal mining in the state. The HC took cognizance of reports and the complaint filed by the traditional village chief of Nengchigen in Garo Hills against certain persons, including the police, alleging widespread illegal mining of coal within the clan lands. It also threatened to appoint a special investigation team (SIT) to probe the alleged illegal coal racket in the state. Chief Minister of the state had said that a process is required to be followed for setting up a CBI inquiry into the alleged illegal coal trade in the state. He said that an FIR filed in connection with the alleged illegal coal mining and transportation in West Khasi Hills will be looked into and that police will hold the necessary inquiry.

Rest of the World

Divestments

Financial institutions channelled more than US$1.5 trillion into the coal industry in loans and underwriting from January 2019 to November 2021, despite many having made net-zero pledges, a report by a group of 28 non-government organisations (NGOs) showed. Cutting coal use is a key part of global efforts to slash climate-warming greenhouse gases and bring emissions down to net zero by the middle of the century, and governments, firms and financial institutions worldwide have pledged to take action. But banks continue to fund 1,032 firms involved in the mining, trading, transportation and utilisation of coal, the research showed. Banks like to argue that they want to help their coal clients transition, but the reality is that almost none of these companies are transitioning, Katrin Ganswind, head of financial research at German environmental group Urgewald, said. The study said banks from six countries - China, the United States, Japan, India, Britain and Canada - were responsible for 86 percent of global coal financing over the period. Direct loans amounted to US$373 billion, with Japanese banks Mizuho Financial and Mitsubishi UFJ Financial - both members of the Net Zero Banking Alliance - identified as the two biggest lenders. Another US$1.2 trillion was channelled to coal firms via underwriting. The top 10 underwriters were Chinese, led by the Industrial and Commercial Bank of China (ICBC) with US$57 billion. Institutional investments in companies still developing coal assets amounted to US$469 billion, led by BlackRock with US$34 billion. BlackRock’s total coal-related share and bond holdings over the period stood at US$109 billion, the NGO report said. Comparative coal funding figures for previous years were not immediately available. Other research studies however have shown that coal investment is on the decline. The coal sector is responsible for nearly half of global greenhouse gas emissions. More than 40 countries pledged to end coal use following climate talks in Glasgow in November, though major consumers such as China, India and the United States did not sign up.

China

China recorded its biggest increase in total energy consumption and coal use in a decade in 2021, as the economy recovered from COVID-19 slowdown a year earlier, the National Bureau of Statistics (NBS) data showed. China, the world’s biggest coal burner and greenhouse gas emitter, used 5.24 billion tonnes of standard coal equivalent of energy last year, up 5.2 percent from 2020, the NBS said. The NBS said coal consumption in China rose 4.6 percent in 2021, also the strongest rate of growth in a decade.

China’s coal output returned to more than 12 mt per day as of 20 February, the National Development and Reform Commission (NRDC), a level equal to the average daily production of the fourth quarter of last year. Daily coal output in January and early February was affected by the Chinese New Year holiday. The NRDC did not give a figure for January output. Production and supply of coal in China's main production areas of Shanxi, Shaanxi and Inner Mongolia are expected to stabilise as the weather warms up, the NDRC said. Authorities have ordered coal miners to run at maximum capacity to tame red-hot coal prices and prevent a recurrence of September’s nationwide power crunch that disrupted industrial operations and added to factory gate inflation.

Rest of Asia and Asia Pacific

Origin Energy plans to shut the Australia’s biggest coal-fired power plant in 2025, seven years earlier than scheduled, as an influx of wind and solar power has made the plant uneconomic to run. Origin’s announcement to quit coal-fired power follows moves by its rivals to accelerate the closure of their coal-fired plants, all struggling with sliding power prices which have hurt plants that don't have the flexibility to switch off when there is surplus energy.

Indonesia’s export growth slowed more than expected in January, after authorities in the world’s top thermal coal exporter banned coal shipments, a move that shocked the global energy market. The January trade surplus was bigger than expected at US$930 mn, however, compared with a US$190 mn surplus seen in a poll, as imports rose more slowly than predicted.

Indonesia on 1 January suspended coal exports due to low inventory at power plants. Shipments resumed gradually from 10 January but the ban still applies to miners not compliant with domestic sales requirements. The resource-rich country has recorded a trade surplus every month since May 2020 due to an upward trend in commodity prices as countries lift COVID-19 restrictions. Exports of products classified as mineral fuel - much of which is coal - dropped by US$2 billion from December, with shipments to China, India and the Philippines most affected.

Africa

South Africa is committed to a transition to cleaner energy, but coal will for some time be vital for the country's economic growth and employment creation, Minister of Mineral Resources and Energy Gwede Mantashe said at the coal colloquium in Pretoria. Mantashe said coal accounts for about 70 percent of the primary energy consumption, 75 percent of electricity generation, and 30 percent of petroleum liquid fuels in the country’s energy mix. Mantashe said there is a potential for the country to export coal to China.

News Highlights: 2 – 8 March 2022

National: Oil

IOC signs pact with APSEZ to expand crude oil volumes at Mundra Port

8 March: Adani Ports and Special Economic Zone

(APSEZ) said it has signed an agreement with Indian Oil Corporation (IOC) towards augmentation of the latter’s crude oil volumes at Mundra. APSEZ said IOC shall expand its existing crude oil tank farm at APSEZ's Mundra Port, thus enabling it to handle and blend additional 10 million metric tonnes per annum (mmtpa) crude oil at Mundra. This will support IOC’s expansion of its Panipat refinery in Haryana. IOC is raising the capacity at its Panipat refinery by 66 percent to 25 mmtpa to meet India’s rapidly growing energy requirements. IOC is operating a crude oil tank farm in an exclusive area in Adani’s Mundra Special Economic Zone, consisting of 12 tanks with a total capacity of 720,000 kilolitres.

FM expresses concern on rising oil prices

8 March: Finance Minister (FM) Nirmala Sitharaman hinted that the current spike in international oil prices may upset provisions of her Union Budget for the fiscal year beginning 1 April as she voiced

concern over the impact of spiralling oil rates on the Indian economy. International crude oil prices shot up to 14-year high of US$140 per barrel before retracting to near US$129. But even this rate is 50 percent higher than the US$80-87 range of January when most of the Budget 2022-23 would have been prepared. India relies on overseas purchases to meet about 85 percent of its oil requirement, making it one of the most vulnerable in Asia to higher oil prices. The twin blows of oil prices, already up more than 60 percent this year, and a weakening rupee may hurt the nation’s finances, upend a nascent economic recovery and fire up inflation.

India increasing ethanol storage, targets 20 percent blended gasoline by 2025

4 March: India’s state-run fuel retailers are increasing their ethanol storage capacity by 51 percent as the nation targets to double the biofuel’s blending with gasoline to 20 percent by 2025, Indian Oil Corp (IOC) said. India is the world’s third biggest oil importer and relies on foreign suppliers to meet more than 80 percent of its demand.

India is close to achieving its target of 10 percent ethanol blended gasoline in this fiscal year ending 31 March. Last year, India brought forward its target of selling 20 percent ethanol blended fuel across the country by five years to 2025, with sales beginning in some parts of the country from April 2023. State-run companies IOC, Hindustan Petroleum Corp and Bharat Petroleum Corp own storage to hold 178 million litre of ethanol.

National: Gas

Haryana MSMEs to get 50 percent reimbursement of VAT on natural gas

8 March: In order to provide some relief to industries in NCR where norms require them to shift to cleaner fuels, the

Haryana government has proposed to reimburse 50 percent of VAT collected on natural gas purchased by MSMEs (Micro, Small and Medium Enterprises) for a period of two years. To promote industrial exports and as per the demand from exporters, the government has decided to provide freight subsidy for industrial exports, details of which will be notified separately by the industries and commerce department, Chief Minister Manohar Lal Khattar said.

Maharashtra Natural Gas starts trial operations at LNG-CNG conversion plant

5 March: The Maharashtra Natural Gas Ltd

(MNGL) has started trial operation of its LNG-CNG conversion plant at Pathardi on the outskirts of the city, after getting all the necessary permissions. The plant is expected to be commercially operational within a month. MNGL said the trials of the LNG processing plant started and around 18,000 kg CNG was produced on the first day. MNGL will bring LNG to Nashik through tankers and will convert it into CNG for vehicles and PNG for cooking. The plant will be able to produce a total of 1 lakh kg CNG per day and it will be enhanced gradually. The CNG will be supplied to the outlets in the city. Moreover, MNGL will provide adequate supply to the Nashik Mahanagar Parivahan Mahamandal Ltd (NMPML) for its CNG buses.

BPCL to invest INR39.7 bn for development of city gas distribution network in Aurangabad and Ahmednagar

2 March: Bharat Petroleum Corporation Limited

(BPCL) announced investment of INR39.72 bn for development of city gas distribution (CGD) network in two districts Maharashtra. The state-run oil PSU said that it has launched the city gas distribution (CGD) network in Aurangabad and Ahmednagar districts of Maharashtra. BPCL said that it will invest around INR16 bn over next 5 years and a total of INR40 bn for completion of full project. BPCL won geographical area (GA) of Aurangabad and Ahmednagar during ninth round of bidding of Petroleum and Natural Gas Regulatory Board (PNGRB), through a wholly owned subsidiary Bharat Gas Resources Ltd (BGRL). Despite the pandemic during last two years, the company has already started laying steel pipeline for development of PNG and CNG in the two districts, it said. BPCL has developed 21 CNG stations (15 in Ahmednagar and 6 in Aurangabad) and work is in process for 40 more CNG stations to be set up in both districts. For the industrial consumers, the connectivity in areas of Walunj and Shendre in Aurangabad and Supa in Ahmednagar is expected to be completed by September 2022, the company said.

National: Coal

Thermal coal exports to be held in 1-2yrs: Coal secretary

8 March: India is well poised to become an exporter of thermal coal in the next one-two years, Union coal secretary A K Jain said. Jain said if power demand increases by 6 percent then our country will become an exporter this year only while if the demand is 13 percent then India would still become an exporter from the next year. According to him, the coal market will become vibrant in the country. The coal production from captive mines is expected to grow from 67-68 million tonne (MT) to 130 MT next fiscal. Jain said that going forward the public sector mining behemoth Coal India will not have the luxury to keep the loss-making mines and blocks to remain competitive.

Coal India gains on reporting record coal off-take

7 March: Coal India Ltd (CIL) rose 1.22 percent to INR183.20 after the state-run coal major reported total coal supplies at 608.15 million tonnes (MT) as of 4

th March 2022.

CIL said it has moved past the previous highest coal off-take of 608.14 MT achieved in FY19. Almost all CIL subsidiaries are ahead in their respective coal off-take numbers over corresponding period last year, the company said. CIL said it is concentrating its efforts to increase its supplies further in a bid to touch 670 MT off-take mark in FY22. CIL had pipped the 575 MT total coal despatch of FY21 on 16

th February itself. Off-take ending FY20 was around 580 MT. CIL is a coal mining company engaged in the production and sale of coal. As of 31 December 2021, the Government of India held 66.13 percent stake while Life Insurance Corporation (LIC) of India held 11.01 percent stake in the company.

Coal India arm BCCL’s output up by record 61 percent in February to 3.24 MT

6 March: Coal India Ltd (CIL)’s subsidiary BCCL (Bharat Coking Coal Ltd) has posted

a record 61 percent growth in its production to 3.24 million tonne (MT) in February this year over the corresponding month last fiscal. BCCL, a Dhanbad-based subsidiary of the Maharatna public sector undertaking, also claimed that it registered the highest off-take growth of around 66 percent to 2.93 MT. The output increased by 61 percent in the last month to 3.24 MT as compared to 2.01 MT in February 2021. The coal off-take was at 2.93 MT last month, up by 66 percent from 1.76 MT in the year-ago month, BCCL said. After the 2018-19 performance, the CIL subsidiary is going to produce and dispatch over 30 MT of the dry fuel for the first time, overcoming all challenges such as market slowdown due to the COVID-19 pandemic and prolonged monsoon season, it said.

National: Power

JSW Energy signs PPA with Haryana for 240 MW Kutehr project in Himachal Pradesh

8 March: JSW Energy said that it has signed a power purchase agreement (PPA) with Haryana Power Purchase Centre (HPPC) for its 240 MW Kutehr hydro project in Himachal Pradesh. The power supply agreement will be valid for 35 years. The PPA has been signed at a levelised tariff of INR4.50/kWh (kilowatt hour). However, the company did not provide details on when the PPA will be effective. Haryana Power Purchase Centre will purchase the power on behalf of Uttar Haryana Bijli Vitran Nigam (UHBVN) and Dakshin Haryana Bijli Vitran Nigam (DHBVN). In September 2020, Haryana Electricity Regulatory Commission (HERC) had granted its approval for above procurement of power and had directed the parties to finalise the PPA.

Andhra Pradesh likely to reach 240 MU per day electricity demand by March 2023

7 March: An action plan is being implemented by the power utilities of Andhra Pradesh to meet the expected energy demand for this March-May quarter, which is forecasted at 20,143 million units (MU). This translates to a 5.6 percent increase compared to 19,066 MU for the same period in 2021. The utilities are preparing a long-term

action plan to meet the future demand of 240 MU per day by 2023. The utilities have laid a special focus on meeting the increasing electricity demand and providing uninterrupted, quality power to consumers of all categories. Grid officials of APTransco said the actual energy demand in February 2022 was 5,574 MU and the peak demand was 11,342 MW. It is forecasted that the average demand in April 2022 would be 222.8 MU per day, while the demand is expected to touch around 240 MU by March-2023 with an increase of demand by 18 MU per day.

PSPCL faces acute shortage of electricity meters

6 March: Ahead of summers, the Punjab State Power Corporation Limited

(PSPCL) is facing a challenge to supply the electricity meters to its new and existing consumers on demand. The PSPCL provides the electricity meters to its consumers for new connection and also replaces the meters that get damaged due to n number of reasons. One of the private firms has also been fined for the delay in supplying the meters to PSPCL. PSPCL chief engineer metering, R P S Randhawa said there was no shortage of meters at all. Notably, last year, the PSPCL had faced a shortage of critical equipment and materials like transformers, cables, poles and had to face the wrath of the consumers in many villages during paddy season, as the power utility failed to replace the damaged materials and provide continuous power supply in the agriculture sector. In June last year, storms left poles, transformers and wires damaged and various zones of PSPCL had reported a loss of several crores. It took many days for PSPCL to repair and re-instate the power supply due to material shortage.

Ujala scheme saved INR200 bn in power bills: PM

5 March: The government’s ‘Ujala’ LED bulb scheme has saved INR200 bn in power bills of the middle-class and poor households, PM (Prime Minister) Narendra Modi said. The Ujala scheme was launched in 2016 during Modi’s first term in office as part of a larger plan to reduce India’s carbon footprint. The scheme envisaged replacing all incandescent and CFL bulbs with more energy-efficient LED lamps. But the high price of LED bulbs, which were comparatively new in the market then, posed a challenge.

National: Non-Fossil Fuels/ Climate Change Trends

Coal India chairman wants its operations to be net zero in 3-4 years

7 March: Coal India Ltd

(CIL)’s operations aim to become net zero in three to four years, its chairman Pramod Agrawal said, although this does not extend to emissions from burning coal it produces. India has more than 170 coal-fired power stations, which together account for nearly three-quarters of electricity generation in the world's third-biggest emitter of greenhouse gases after China and the United States. Agrawal said coal users were bigger contributors to rising carbon emissions than CIL itself, which he said was often unfairly blamed for emissions of its coal.

Hydro power generation from Srisailam set to be hit for third year

3 March: Telangana is likely to lose generation of power from one of the units in

Srisailam Left Bank Hydroelectric Power Station (SLBHPS) for the third consecutive year. Even after 18 months, Telangana Genco has not been able to restore the power station fully.

Two solar parks to come up in Jaisalmer, Bikaner districts

2 March: Rajasthan has got another big success in solar energy sector.

Two new solar parks of 1,800 MW capacity will be developed in Jaisalmer and Bikaner. At present, the credit of developing the world’s largest solar park of 2,245 MW capacity in Bhadla of Jodhpur district goes to Rajasthan. Similarly, a solar park of 925MW capacity is being developed by Renewable Energy Corporation at Nokh in Jaisalmer district. 800 MW solar parks will be developed in Jaisalmer by Rajasthan Vidyut Utpadan Nigam and 1,000 MW capacity in Bikaner by Rajasthan Renewable Energy Corporation in the first phase.

International: Oil

US may act alone to ban Russian oil imports

7 March: The United States

(US) is willing to move ahead with a ban on Russian oil imports without the participation of allies in Europe. Germany, the biggest buyer of Russian crude oil, has rejected plans to ban energy imports. Germany is accelerating its plans to expand its use of alternative energy sources but cannot halt imports of Russian energy overnight, German Chancellor Olaf Scholz said. Oil prices have soared to their highest levels since 2008 due to delays in the potential return of Iranian crude to global markets and as the US and European allies consider banning Russian imports. Europe relies on Russia for crude oil and natural gas but has become more open to the idea of banning Russian products. The US relies far less on Russian crude and products, but a ban would help drive prices up and pinch US consumers already seeing increasing prices at the gas pump.

Japan unveil steps to boost oil subsidy, back small firms

4 March: Japan unveiled a raft of measures to help small and midsize firms cope with surging global fuel prices amid the Ukraine crisis,

with an increased subsidy ceiling on oil and the extension of corporate funding. Prime Minister Fumio Kishida’s cabinet approved the measures including lifting a subsidy ceiling on gasoline, diesel and kerosene to 25 yen a litre to help companies cope with rising energy prices, Chief Cabinet Secretary Hirokazu Matsuno said. Concern about Russian oil supplies, which at 4 million to 5 million barrels per day (bpd) are second only to Saudi Arabia in volume, have pushed up oil prices to levels not seen in a decade. However, some critics were sceptical the oil subsidy, which is rarely seen in other countries, will do any good to the economy, saying it will serve as nothing but politically popular gesture ahead of the looming upper house elections this summer.

New Jersey city votes to halt licenses of gas stations tied to Russia’s Lukoil

3 March: Reflecting growing animosity across the United States toward Russia after its invasion of Ukraine, lawmakers in

New Jersey’s largest city have voted to suspend the licenses of gas stations branded with the name of a major oil company based in Moscow. The Newark City Council passed a resolution 8-0 urging the city to suspend all licenses of two local Lukoil gasoline stations to show support for Ukraine.

Higher oil prices push Sri Lanka into deeper economic crisis

3 March: Sri Lanka’s already dire economic crisis has deepened as oil prices hover near US$110 a barrel. Vehicles are stranded with empty tanks, power cuts are depriving students of study time for exams and shopping mall air conditioners are being switched off to conserve energy. The South Asian island nation already was so short of hard currency that authorities had restricted imports of cars and fertilizer. It's now having to scrape into dwindling reserves to pay for ever more costly oil needed to keep the economy running. Bus services vital for many workers are also in trouble, unable to find diesel and sometimes stranding passengers mid-route. The higher oil prices are just an extra burden in what really is a foreign exchange crunch, Energy Minister Udaya Gammanpila said. He said stations also are rationing fuel to stop people from stockpiling diesel at home for their vehicles and power generators.

International: Gas

Europe must urgently cut dependence on Russian gas: Portugal

4 March: Europe must urgently diversify its natural gas supply sources to reduce its dependence on Russia, Portugal’s energy secretary of state, Joao Galamba said. Galamba said diversification efforts must be coordinated among European countries, with the help of the United States (US), Qatar, Saudi Arabia, Norway and Algeria and other gas producers. But the diversification of sources will not be enough to solve the problem, he said, explaining the continent’s logistics chains have for years been too dependent on gas flows from Eastern Europe. He said Portugal does not depend on gas pipelines from Russia as its imported LNG is transported by ships and unloaded at the deep-water port of Sines, the closest European port to the US.

International: Coal

Indonesia’s coal miners are bracing for new export curbs

8 March: Coal miners in Indonesia, the top shipper, are preparing for potential new curbs on exports, a move that would add pressure to prices already at record highs. New restrictions on overseas sales are possible in either April or August — when mine output is typically lower — to make sure local power plants have sufficient supply, according to the Indonesian Coal Mining Association. Indonesia paused exports in January after about 20 power plants warned they faced shutdowns because of dwindling stockpiles and a squeeze on fuel supply. Coal prices surged in response, before shipments resumed in February. Indonesia is the world’s biggest coal exporter by tonnage, followed closely by Australia, with Russia a distant third, according to the International Energy Agency. Power plants can face supply shortages in periods of the year when coal output is crimped by factors including heavy rain, the association said. Indonesia requires coal producers to supply at least 25 percent of output to meet local needs and sets a ceiling price for coal sold to local power plants at US$70 per ton, a policy known as the domestic market obligation rule. The higher international coal prices rise, the more likely local miners are to sell the remainder of their output overseas, which will increase the chance of another export disruption, the association said.

International: Non-Fossil Fuels/ Climate Change Trends

Australia's Victoria state sets out fast growth plan for offshore wind power

4 March: Australia’s Victoria state set targets of at least 2 gigawatts (GW) of offshore wind power by 2032, and 9 GW by 2040, setting up ambitious goals to help fill a gap in power supply as coal-fired plants shut down. Australia, heavily dependent on coal-fired power, currently has no offshore wind farms, although it has 7.4 GW of onshore wind power capacity. Victoria's offshore wind plan, which includes a 2035 target of 4 GW, follows a commitment last November by the Victorian government to provide A$40 million (US$29 million) to run feasibility and pre-construction studies for three projects, which could generate a total 4.7 GW. The most advanced of those is the A$9 billion (US$7 billion) Star of the South project, aiming for a capacity of up to 2.2 GW, led by Copenhagen Infrastructure Partners. Victoria’s coal-fired power plants are due to shut by 2045, but industry experts expect them to close well before that as coal-fired power becomes increasingly uncompetitive amid rapid growth in wind and solar capacity.

Russian forces seize Zaporizhzhia nuclear power plant: Ukraine

4 March: Russian military forces have seized the Zaporizhzhia nuclear power plant – Europe’s largest - in Ukraine's southeast, the regional state administration said. Ukraine has said Russian forces attacked the plant, setting an adjacent five-story training facility on fire. US Energy Secretary Jennifer Granholm said she had spoken with Ukraine’s energy ministry about the situation at the plant. Ukrainian emergency services said one of six nuclear power units was working.

US senators grill regulators over climate policy on natural gas projects

3 March: Top US senators from both parties grilled Democratic energy regulators who recently approved

guidelines for approving new natural gas projects that allow consideration of environmental justice, landowner and climate issues. The three Democrats on the five-member Federal Energy Regulatory Commission (FERC) voted in February to update the guidelines, for the first time since 1999, a move that analysts say could present hurdles for new gas projects. The two Republicans on the panel opposed the guidelines. The building and operation of natural gas pipelines and liquefied natural gas projects can leak methane, a powerful greenhouse gas and release particulate emissions that cause health problems. Oil, gas and coal interests and lawmakers from fossil fuel producing states have stepped up their criticism of Democratic policies on climate and pipelines since Russia’s invasion of Ukraine. The situation threatens exports of oil and gas from Russia, which produces about 10 percent of the world's crude oil and about 40 percent of Europe’s natural gas.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV