Quick Notes

India’s COP26 pledges: Ambitious, but ambiguous

Ambitions

A joint statement issued by Quad (Quadrilateral Security Dialogue) countries in September 2021, stated that all member states intend to update or communicate ambitious nationally determined contributions (NDCs) under the Paris Agreement before the 26th Conference of Parties, or COP26. But statements by the concerned ministers from the Indian government that followed this news reiterated historical responsibility of the western nations over climate change and repeated the issue of inadequate financial assistance from rich countries leading most observers to believe that India is not likely to make any significant change from its traditional position. The day before the speech of the Indian Prime Minister (PM) at COP26, there was news that India is likely to link any new pledges on decarbonising India’s economy to its membership in the nuclear suppliers’ group (NSG). The argument that linked NSG membership to climate action was that nuclear power, a low carbon alternative energy source could potentially replace coal as baseload power and that India would need to be a member of the exclusive NSG group to access nuclear fuel, capital, and technology. But news on the English language Chinese media did not offer any hope on NSG membership. In the end, the Indian PM surprised observers within and outside India with the following ambitious and what at this point appear to be unconditional pledges on India’s decarbonisation during his speech at COP26:

1. Increase non-fossil energy capacity to 500 GW (gigawatts) by 2030.

2. Meet 50 percent of energy requirements from renewable energy (RE) by 2030.

3. Reduce the total projected carbon emissions by 1 billion tonnes (BT) by 2030.

4. Reduce the carbon intensity of the economy by less than 45 percent.

5. Achieve net zero carbon by 2070.

Many environmentalists hailed these five pledges (“Panchamrit”) as it is expected to put India on a firm path towards decarbonisation. For commercial entities betting on green investments to pay-off handsomely, the announcements offer the comfort of certainty that government policy will protect their returns. The validity of these expectations will only be revealed in the long term but the immediate concern from a more objective point of view is the interpretation of the somewhat ambiguous pledges. The assumption at this point is that these are aspirational, non-binding pledges and the official statement on the revised NDCs will clarify some questions that the pledges raise.

Ambiguities

- Increase non-fossil energy (electricity?) capacity to 500 GW (gigawatts) by 2030: The term energy is used in the translation of the PM’s speech, but it is very likely that the reference was made to electricity. This pledge is probably linked to the existing pledge to increase RE installed capacity for power generation to 450 GW by 2030. If so, India has pledged to more than triple current non-fossil fuel capacity of about 154 GW to 500 GW in the next 9 years.

- Meet 50 percent of energy (electrical?) requirements from renewable energy (RE) by 2030: This pledge is difficult to interpret but again if the reference is to electricity rather than primary energy, then India must increase the consumption of RE (currently about 10 percent of power generation) by five times in the next nine years to meet this goal. If the reference is to primary energy, then the challenge is almost unachievable because the current share of RE in primary energy consumption is less than 2 percent.

- Reduce the total projected carbon emissions (in the business-as-usual scenario for 2030?) by 1 BT by 2030: This is a radical pledge as it promises an absolute reduction in carbon dioxide (CO2) emissions by 2030. CO2 emission from India is expected to increase from about 2.3 BT to about 2.9 BT by 2030 under current policies. If India were to reduce this by 1 BT, India will effectively return to CO2 emissions in 2007. This would mean a reduction in overall energy consumption or a spectacular increase in consumption of RE. What this would mean to the economy is best left to imagination.

- Reduce the carbon intensity of the economy by less (at least?) than 45 percent (compared to carbon intensity in 2005?): This is probably the least ambiguous of the five pledges made. One of India’s ongoing NDC commitment is to reduce India’s CO2 intensity by 33-35 percent from 2005 levels by 2030. According to government statements, India’s CO2 intensity has fallen by 28 percent compared to 2005 levels in 2020. If the drivers behind India’s reduction in CO2 emissions in the last three decades such as the shift towards less energy intensive service sector, shift in household cooking fuel from inefficient biomass to efficient petroleum and natural gas-based fuels, increase in industrial energy efficiency continue, India can achieve this goal. However, if India’s current industrial policy that is oriented towards increasing domestic manufacturing succeeds, meeting this goal will also become somewhat difficult. Manufacturing is energy intensive and consequently also carbon intensive.

- Achieve net zero carbon by 2070: This is probably the only pledge that was expected from India at COP26 because many top CO2 emitters, especially China and the USA the largest and second largest emitter of CO2 have made net zero pledges (China by 2060 and USA by 2050).

The idea of “net zero” was promoted in a 2018 special report from the Intergovernmental Panel on Climate Change (IPCC) which demanded that countries bring greenhouse gas emissions to “net-zero” by 2050 to keep global warming to within 1.5 °C of pre-industrial levels. Though net-zero was the universal language for policymakers’ intent on sealing a deal at COP26, net zero is also seen as the means to perpetuate a belief in technological salvation to diminish the sense of urgency over climate calamity. As the concept of “net zero” has built-in ambiguities, it was the safest promise a country or company could make.

Issues

India committing to “net-zero” at COP26 was unavoidable from a geo-political perspective but the offer of far more radical pledges with no “quid pro quo” is puzzling. The quick answer is probably that it is in India’s interest to protect itself against the impact of climate change by limiting carbon emissions deeply and quickly. But climate change is a global commons problem and unless all large polluting nations reciprocate with radical pledges to limit carbon emissions, the climate will change for the worse. Ideally, India’s pledges should have been hedged with the condition that other large polluters achieve net zero before 2050 and make the necessary funds available to India.

But there is another contradiction that adds to the ambiguity. India was not part of the non-binding agreement signed to phase out coal by 2030 for rich countries and 2040 for poor countries at COP26. Other large coal using nations including China, USA and Australia were also not part of the signatories. Britain, the host of COP26 wants to consign coal to history based on its own history. But Britain switched from coal to gas in the 1980s partly to spite coal unions and partly to embrace cheap new offshore natural gas. A complete switch from coal to natural gas will pose serious economic challenges to India as imported natural gas is the most expensive fuel (for power generation) at the margin. Imported gas will also mean geo-political and external trade related risks to India’s energy security.

Coal is narrowly seen as the main adjustment variable between the ‘business as usual’ and the ‘low carbon’ energy paths for India. But millions of people awaiting better quality of life through large scale industrialisation that offers well paid and secure jobs are the main adjustment variable between the two paths. If large scale industrialisation takes off in India, quality of life will improve for millions of households, but it will add to the volume of carbon content in India’s energy basket barring a miracle in clean energy technologies. India’s COP26 pledges are ambitious and ambiguous, and hopefully also aspirational (non-binding), in which case one could say there is nothing wrong in aiming high.

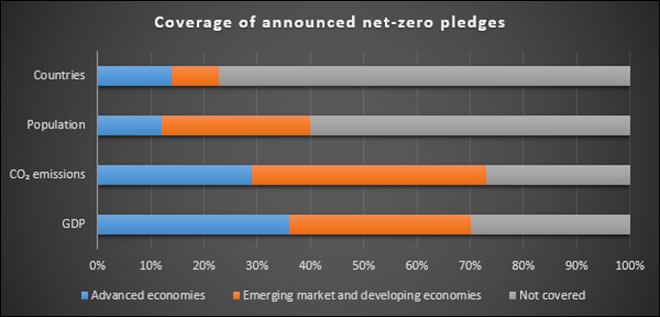

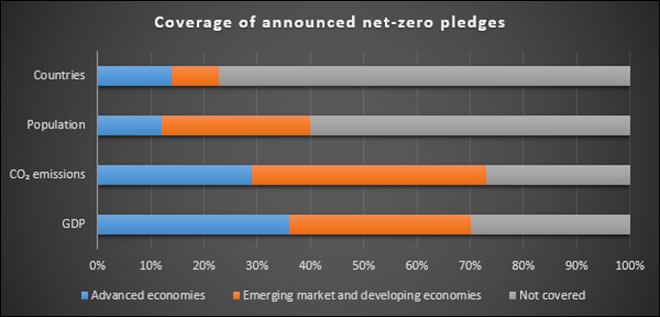

Source: International Energy Agency, 2021, Net Zero by 2050, IEA, Paris; Note: The chart does not include India’s pledge to net zero

Source: International Energy Agency, 2021, Net Zero by 2050, IEA, Paris; Note: The chart does not include India’s pledge to net zero

Monthly News Commentary: Oil

Post COVID Economic upturn boosts Demand for Petrol

India

Demand

India’s gasoil consumption slowed in the first half of September from the previous month, staying below pre-COVID levels as a pick-up in monsoon rains hit mobility and demand for fuel from the agriculture sector. Diesel sales by the country’s state fuel retailers came in at 2.1 mt during 1-15 September, a decline of about 1.5 percent from last year and down 6.8 percent from the same period in 2019. State retailers Indian Oil Corp (IOC), Hindustan Petroleum Corp (HPCL) and Bharat Petroleum Corp Ltd (BPCL) own about 90 percent of the country’s retail fuel outlets. Sales of gasoil, which accounts for about two-fifths of India’s overall refined fuel consumption, are directly linked to industrial activity in Asia's third-largest economy. In contrast, gasoline sales stayed above the pre-COVID levels at 1.02 mt as people continued to prefer using personal vehicles over public transport and shared mobility for safety reasons. India has not yet fully opened its public transport sector, which mostly use diesel. September gasoline sales were up 8.3 percent from the same period in 2019 and rose by 3.4 percent from August. India’s aviation turbine fuel demand is expected to remain subdued in the near-term as fears of a third wave of COVID-19 infections lurk in the country ahead of the upcoming festival season. Industry sources anticipate jet fuel prices to be weighed by fresh movement restrictions if cases soar. While domestic travel has picked up in recent months, a potential spike in cases could derail this recovery. Jet fuel production extended further declines in July as refineries capped production of aviation fuels on underwhelming jet fuel demand. The production fell 10.39 percent month-on-month to 604,000 tonnes. This marked the fourth consecutive decline since March with production last seen lower in October when it was 548,000 tonnes. Still, August data showed signs of improvement. Based on preliminary data from state-owned refiners, sales of jet fuel increased by nearly 20 percent month-on-month in August. S&P Global Platts Analytics expects India’s kerosene/jet fuel demand to rebound by 8 percent in 2021 but the demand will still be 40 percent below 2019 levels.

India’s gasoline demand is set to hit a record this fiscal year. The stronger-than-expected gasoline consumption growth could prompt Indian refiners to import the fuel or boost gasoil exports in coming months. Indian refineries are traditionally configured to maximise production of diesel, where demand is still below pre-COVID levels, hurt by an uneven economic recovery. The expected rise in India’s gasoline imports could support Asian refiners' margins for the fuel. The country, which has a refining surplus, has shunned gasoline imports since May and raised gasoil exports by a fifth in July from April. Sluggish diesel demand has forced some refiners to cut crude oil processing as their fuel storage were full. That reduced India's July crude oil imports to their lowest in a year. As per the International Energy Agency, changes in India’s fuel demand patterns are crucial for global oil markets as Asia's third-largest economy is seen as the main driver of rising demand for energy over the next two decades.

LPG

IOC launched ‘Indane composite cylinders’ of liquefied petroleum gas (LPG), which will allow customers to plan their next refill easily. The fibre cylinders will have a transparent component for consumers to verify the quantity of LPG supplied. While launching the composite gas cylinder for domestic use in Patna, IOC described this as a big achievement for the country.

Karnataka Congress urged the Central government to reduce the price of LPG cylinders by at least INR150 as the common people are facing “extreme hardship due to rising price of essential commodities.” The Karnataka Pradesh Congress Committee is spreading awareness through its weekly ‘Ondu Prashne’ and opposing the BJP's anti-people policies. Through ‘Ondu Prashne’ series, the party is now raising the issue of the LPG price hike that is affecting people across classes. At present, an LPG cylinder costs around INR900 (US$12) and has reached INR956 in Bidar district in the state. The Committee expects that refilling gas cylinders may skyrocket to INR1,000 (US$13.34) soon.

BPCL has created a separate platform for its cooking gas or LPG operations that runs government's subsidised LPG cylinder scheme where subsidy amount is transferred directly into the accounts of consumers. Creation of separate platform was mandated as part of the sell-off process to ring fence the new owners from this subsidy scheme that could function uninterrupted with government transferring subsidy to consumers even after privatisation of the BPCL. The government is selling its entire 52.97 percent shareholding in BPCL to a strategic investor. There were doubts among potential bidders how the subsidised cooking gas scheme would be run post the management of BPCL getting transferred to new private sector owners. If companies were to take the tab of subsidy, it would alter the valuation of BPCL. The LPG price for cooking for consumers under PAHAL (Pratyaksha Hastaantarit Laabh) is subsidised by the government wherein the subsidy quantum given to the PAHAL consumers by way of DBT, is the difference between the market-determined price and the subsidised price.

A cylinder of non-subsidised LPG is now INR25 more expensive. The price of LPG was recently hiked by oil companies. A 14.2 kg cylinder of domestic non-subsidised cooking gas is now at INR884.5 in the national capital and in Mumbai. This is the third consecutive month where prices have risen. The price of an LPG cylinder varies in each state due to state taxes. The prices of commercial LPG have also risen. The price of a 19-kg commercial cylinder in Delhi went up by INR75 to INR 1,693 (US$22.58). There has been a constant rise in the number of LPG users. As of 1 July 2021, there are 291.1 million (mn) active domestic LPG consumers, including those that avail the Pradhan Mantri Ujjwala Yojana. In 2018-19, the country had 265.4 mn customers.

Retail Prices

According to the Union Ministry of Finance, petroleum products will not be included under the Goods and Services Tax (GST). The Ministry announced a reduction in GST rate on biodiesel, which is supplied to oil marketing companies for blending with diesel, from 12 percent to 5 percent.

IOC, the country’s largest fuel retailer, announced it has partnered with Google Pay to make fuelling more rewarding for Indian Oil and Google Pay customers. The companies plan to make Indian Oil’s countrywide loyalty program XTRAREWARDS accessible on the Google Pay app as the partnership progresses.

Refining

Indian refiners are gearing up to alter their crude oil import mix in favour of lighter grades that yield more gasoline to meet a surge in demand for the motor fuel in Asia's third-largest economy. Refiners in the world’s No. 3 oil importer and consumer will increase imports of gasoline-yielding crudes from the United States (US) and West Africa, while cutting heavier sour grades from the Middle East that yield more middle distillates like diesel and kerosene. The move dovetails with an earlier push to reduce India’s reliance on Middle East crudes to enhance energy security. Indian refineries are designed to maximise diesel production mostly from Middle Eastern oil, as government-controlled prices made the middle distillate the preferred fuel for industries and trucking firms. But a narrowing price gap between gasoline and diesel, and a consumer switch to personal vehicles instead of diesel-powered public transport since the onset of the coronavirus, are helping to lift gasoline consumption. Credit rating agency Moody’s India unit ICRA expects India’s gasoline consumption to rise 14 percent to a record 31.9 million tonnes (mt) (739,000 barrels per day) in the fiscal year to end-March 2022, while diesel consumption is expected to take well into the fourth quarter or even next year to recover pre-pandemic levels.

India’s Nayara Energy hopes to operate its 400,000 barrels per day (bpd) refinery in western India at close to 100 percent capacity in 2021 as fuel demand is picking up. Nayara, part owned by Russian oil major Rosneft, cut rates at its Vadinar refinery in Gujarat state last year. India’s fuel demand is likely to rise by 9-11 percent as the economy in India is "steered towards higher growth" after the easing of the second wave of COVID-19.

ONGC (Oil and Natural Gas Corp)’s plan to complete merger of its refining subsidiary MRPL (Mangalore Refinery and Petrochemicals Ltd) with recently acquired HPCL to align its upstream and downstream operations into two verticals has got delayed. The process is now expected to be completed by FY24 as ONGC’s plan to consolidate its refining and petrochemicals business around MRPL first itself is taking a lot of time. The proposed merger would only follow this consolidation exercise. The process of merging ONGC’s two oil refining subsidiaries, HPCL and MRPL, will be started only after the company completes merging ONGC Mangalore Petrochemical Ltd (OMPL) with MRPL. As per the plan finalised earlier, MRPL may, become a subsidiary of HPCL first. Under liberal assumptions, the merger could start in 1-2 years as OMPL gets merged with MRPL by then. OMPL has now become a 100 percent subsidiary of MRPL.

Production

ONGC has pumped first gas from its deep-water U1B well in Krishna Godavari block KG-D5 in the Bay of Bengal. As per the company, the well, in KG-DWN 98/2 Block’s Cluster-2, has an estimated peak production of 1.2 million standard cubic meters per day (mmscmd) of gas. ONGC’s KG-DWN-98/2 or KG-D5 block, which sits next to Reliance Industries' KG-D6 block in the KG basin, has a number of discoveries that have been clubbed into clusters. The discoveries in the block are divided into three clusters- Cluster-1, 2 and 3. Cluster 2 is being put to production first. The Cluster 2 field is divided into two blocks namely 2A and 2B, which are expected to produce 23.52 mt of oil and 50.70 billion cubic meters (bcm) of gas. The firm is investing US$5.07 billion (bn) in developing the oil and gas discoveries in the block. It will cumulatively produce around 25 mt of oil and 45 bcm of gas with a peak production of 78,000 bpd of oil and 15 mmscmd of gas.

Imports

India’s oil imports rose to a four-month high of about 4.2 million bpd in August, recovering from the near 1-year low hit in July, as some refiners plan to boost runs in anticipation of pent-up demand around the festival season. Oil imports last month rose about 23 percent from July and about 6.2 percent from the same month last year. Indian refiners mostly buy oil about two months ahead of processing.

Rest of the World

World

Oil markets eased after a five-day rally as investors took profits on fears that higher prices may weaken fuel demand, though market sentiment remained firm amid tight supply. Brent crude futures fell 17 cents, or 0.2 percent, to US$79.36 a barrel after surging 1.8 percent and reaching its highest since October 2018. US (United States) West Texas Intermediate (WTI) crude futures dropped 9 cents, or 0.1 percent, to US$75.36 a barrel, having risen 2 percent and hitting its highest since July the previous day. Top African oil exporters Nigeria and Angola will struggle to boost output to their OPEC (Organisation of the Petroleum Exporting Countries) quota levels until at least next year as underinvestment and nagging maintenance problems continue to hobble output, sources at their respective oil firms warn.

OPEC+

OPEC member Algeria plans to increase investment in its oil and gas sector by US $2.6 bn next year to boost production by 8.9 million tonnes of oil equivalent (mtoe). Oil and gas investment in 2022 will total US $10 bn, up from US$7.4 bn this year, aiming to increase output to 195.9 mtoe from 187 mtoe. Algeria, which relies heavily on the energy sector, last year halved planned investment spending in oil and gas to US $7 bn to cope with financial pressure caused by a fall in global crude oil prices due to the pandemic. The Algerian government expects energy export earning to rise to US$33 bn this year from US$20 bn in 2020 after a rise in oil prices in international market. The government action plan includes reforms to improve the investment climate mainly in the non-energy sector to help to reduce Algeria's reliance on oil and gas which account for more than 90 percent of total export earnings and 60 percent of the state budget.

OPEC trimmed its world oil demand forecast for the last quarter of 2021 due to the Delta coronavirus variant, saying a further recovery would be delayed until next year when consumption will exceed pre-pandemic rates. The OPEC said in a report it expects oil demand to average 99.70 million bpd in the fourth quarter of 2021, down 110,000 bpd from last month’s forecast. Governments, companies and traders are closely monitoring the speed that oil demand recovers from last year’s crash. A faster return, as predicted by OPEC, could boost prices and challenge the view that the impact of the pandemic may curb consumption for longer or for good. Oil was trading above US$73 a barrel after the report was released. Prices have risen over 40 percent this year, boosted by economic recovery hopes and OPEC+ supply cuts, although concern about the Delta variant has weighed. Despite the downward revision to the fourth-quarter, OPEC said world oil demand in the whole of 2021 would rise by 5.96 million bpd or 6.6 percent, virtually unchanged from last month. The growth forecast for 2022 was adjusted to 4.15 million bpd, compared to 3.28 million bpd in last month’s report and an estimate of 4.2 million bpd given by OPEC sources during the group's last meeting on 1 September. With the latest changes, OPEC still has the highest demand growth figures among the three main oil forecasting agencies - itself, the US government and the International Energy Agency, an adviser to consuming nations which issues its latest report. The report showed OPEC output rose in August by 150,000 bpd to 26.75 million bpd, led by Iraq and Saudi Arabia. An involuntary cut in Nigeria reduced the scale of the supply boost.

OPEC+ revised up its 2022 oil demand forecast ahead of a meeting of the oil producing group, amid US pressure to raise output more quickly to support the global economy. OPEC+ sources said the group’s experts revised the 2022 oil demand growth forecast to 4.2 million barrels per day (bpd), up from the previous forecast of 3.28 million bpd. OPEC+ expects global oil demand to grow by 5.95 million bpd in 2021 after a record drop of about 9 million bpd in 2020 because of the COVID-19 pandemic.

USA & N America

Oil prices barely moved even as more supply came back online in the US Gulf of Mexico following two hurricanes, with benchmark contracts on track to post weekly gains of around 4 percent as the output recovery is seen lagging demand. Preliminary data from the US Energy Information Administration showed US crude exports in September have slipped to between 2.34 million bpd and 2.62 million bpd from 3 million bpd in late August.

Goldman Sachs said Hurricane Ida had a larger impact on oil production than on refinery demand, causing a net "bullish" impact on US and global storage levels. The investment bank described the hit to US output as "historically large" and expects almost 40 million barrels of crude production to be lost, with challenges restarting the Mars stream likely until mid-October. US refiners are coming back faster than oil production, a reverse of past storm recoveries with just three of the nine refineries completely idled, accounting for about 7 percent of Gulf Coast refining, compared to shut-ins of two-thirds of oil output. The impact on refining has been broadly in line with prior hurricanes with about 1.5 million bpd still offline and the recovery likely to “follow the usual exponential pattern of the disruptions halving every 10 days.” Concerns over the output shut-in due to Ida, helped drive oil prices above US$70 a barrel, with Brent crude trading at US$73.39, and US WTI crude at US$70.19. Goldman expects a peak demand impact only about 450,000 barrels per day from the hurricane, largely due to disruptions to downstream petrochemical plants in the Gulf of Mexico which account for a large share of petrochemical capacity.

US Sanctions

Iranian fuel and petrochemical exports have boomed in recent years despite stringent US sanctions, leaving Iran well placed to expand sales swiftly in Asia and Europe if Washington lifts its curbs. The US imposed sanctions on Iran’s oil and gas industry in 2018 to choke off the Islamic Republic's main source of revenues in a dispute with Tehran over its nuclear work. The steps crippled crude exports but not sales of fuel and petrochemicals, which are more difficult to trace. Crude can be identified as Iranian by its grade and other features, while big oil tankers are more easily tracked via satellite. Iran exported petrochemicals and petroleum products worth almost US$20 bn in 2020, twice the value of its crude exports, oil ministry and central bank figures show.

A lack of diluents to produce Venezuela's flagship crude grades took a toll on oil exports last month, forcing state-run PDVSA to declare "maximum alert" at its main terminal. The shortage of these blending feedstocks, which also reduced oil output at Venezuela's main producing region last month, has worsened recently as PDVSA turned to refining more of its light and medium crude into motor fuels. Historically, those grades were used to dilute its more abundant extra heavy crudes. Over three quarters of Venezuela's oil shipments departed for Asian destinations, mainly China and Malaysia. Political ally Cuba received about 40,000 bpd of crude and residual fuel for power generation, the PDVSA’s fuel oil exports to destinations including Turkey, China, Malaysia and the United Arab Emirates also fell, to 128,000 bpd from a peak of 274,000 bpd the previous month. But the company managed to increase exports of petroleum coke to Cuba and Europe.

Asia Pacific

According to oil major, Sinopec Corp, China’s oil consumption is likely to peak around 2026 at 800 mt, or about 16 million bpd. It is also of the view that natural gas will become China’s top fossil fuel resource around 2050.China said it will announce details of planned crude oil sales from strategic reserves in due course. The National Food and Strategic Reserves Administration issued a four-sentence statement late announcing the country will for the first time sell state crude reserves via public auction. The Chinese government may pick key plants that have direct pipeline links to reserve bases for such auctions, but there is a doubt how the sales would be priced. China, which closely guards information about its emergency stockpile, had over the years sold some reserves to state refineries on an ad-hoc basis, with prices in line with prevailing market rates.

China’s demand for spot crude appears to be recovering after nearly five months of slower purchases caused by a shortage of import quotas, drawdowns from high inventories and COVID-19 lockdowns that muted Chinese fuel consumption. Softer buying since April by the world’s top crude importer and a drop in China’s refining output to 14-month lows in July have depressed the prices of staple crude grades from West Africa and Brazil to multi-month lows. But Chinese importers are now increasing the pace of purchases and paying higher premiums to secure supplies from November onwards as lockdown restrictions ease. A sustained rebound in demand by China may tighten supplies and support global oil prices. Oil demand in the world’s No. 2 consumer looks to be on a recovery path as Beijing eases lockdown measures after largely containing several outbreaks of the COVID-19 Delta variant since it emerged in the country in July. Traders hope Beijing will soon wrap up a probe into the resale of import quotas and tax evasion by importers that has created uncertainty in the market. A fourth batch of quotas is also expected to be issued in September or October which could revive demand from independent refiners, also known as teapots, which account for a fifth of China's imports.

Pakistan has stepped up its oil and gas imports this year from last year as demand from its power sector increases amid more economic activities as coronavirus-induced restrictions are lifted. So far in 2021 through September, the South Asian country has imported at least 785,000 tonnes of fuel oil through tenders, up 52 percent from what it imported all of last year. According to Pakistan’s ministry of petroleum, its total imports of oil and refined fuels went up by 24 percent to about 10 mt in the financial year which ended in June.

Fuel prices have risen in Afghanistan’s Kabul and locals have urged the Taliban-led government to step in to prevent overcharging from companies and importers of fuel. Gas prices have risen by 15 Afs (US$0. 17) per kilo and petrol prices have risen by four Afs. Shopkeepers in Kabul claim that the fuel importing companies have hiked the fuel prices due to which the fuel prices have risen. Local residents have asked the Taliban-led government to prevent overcharging on fuel by stopping the extortion by fuel importing companies.

EU & UK

Oil company BP had temporarily closed some of its petrol forecourts in Britain after its ability to transport fuel from refineries was hit by an industry wide shortage of truck drivers. BP, which has about 1,200 branded stations across the United Kingdom, was taking action to address the issue. The Petrol Retailers Association (PRA), which represents independent forecourts that account for 65 percent of Britain’s petrol stations, said the issues appeared to be confined to London and southeast England, and appeared temporary.

Africa

Sudan expects to reach a long-term deal with Saudi Aramco for the supply of oil derivatives at preferential prices, and shipments of some products by the Saudi state oil producer have already begun. Energy specialists from the two countries signed a Memorandum of Understanding for energy in general, and the targeted agreement with Aramco would be intended at securing a "stable and sustainable" supply of oil derivatives for Sudan. The crisis has seen severe shortages of fuel and other basic commodities, though fuel shortages have eased recently. Sudan’s government reached an agreement with tribal protesters to allow the resumption of exports of landlocked South Sudan’s crude oil via a terminal on the Red Sea. The Sudanese energy and oil ministry warned that the port's oil depots would become full up in 10 days' time if the blockage continued. That would in turn force South Sudanese oil fields to halt production. The protesters have also forced the closure of a pipeline that carries imported crude to the capital Khartoum.

News Highlights: 29 September – 5 October 2021

National: Oil

India's energy demand grows at slower pace in September

1 October: India’s fuel and electricity consumption grew at a slower pace in September compared with August, government data showed, despite a recovery in factory activity. Sale of gasoil, which accounts for about two-fifths of India's refined fuel demand, by state retailers rose 0.79 percent in September, preliminary government data showed. Gasoil sales rose 16% in August compared with last year. Electricity consumption rose 0.8 percent in September, compared with 17.1 percent growth in August, data from federal grid regulator POSOCO showed. India’s factory activity improved last month as a recovery in the economy from the pandemic-induced slump boosted demand and output, a private survey showed. It was not immediately clear why there was a slump in the pace of energy demand growth. Gasoline sales rose 6.57 percent in September, compared with a 13.6 percent rise in August. Indian Oil Corp (IOC), Hindustan Petroleum Corp Ltd (HPCL) and Bharat Petroleum Corp Ltd (BPCL) own about 90 percent of the country’s retail fuel outlets.

MRPL to promote diesel door-to-door delivery with PEP Fuels

1 October: The city-based Mangalore Refinery and Petrochemicals Limited (MRPL) has entered into an agreement with PEP Fuels, a start-up company promoted by ONGC, for door-to-door delivery (DDD) of diesel. PEP Fuels is a start-up company registered with the department of promotion for industry and internal trade (DPIIT), ministry of Commerce and Industry. As per the agreement, PEP Fuels will source HSD from MRPL and deliver it at the customer’s doorstep through mobile dispensers easing the product sourcing and reducing inventory carrying costs for customers. The pep fuel online platform enables the customer to place and process orders through mobile/web, with minimum manual intervention. Based on the success of this model, MRPL intends to expand DDD services to other cities and towns shortly.

India’s oil demand to more than double by 2045: OPEC

29 September: India will remain hooked to oil for another quarter of a century, with demand seen more than doubling to 11 million barrels a day by 2045 in spite of the Narendra Modi government’s focus on faster transition to clean energy, leaving fuel consumers vulnerable to crude market volatility. According to OPEC (Organisation of the Petroleum Exporting Countries) World Oil Outlook 2021, the contribution of diesel and petrol to the country’s oil demand will rise from 51 percent to 58 percent through 2045 on the back of an expanding population, growing prosperity and rapid urbanisation between 2020 and 2045. The latest long-term market outlook from the grouping of oil exporters, which accounts for about 40 percent of global oil supply, expects oil to make up 28.6 percent of the India’s primary energy mix in 2045, marking an increase of more than 3 percentage points compared to 2020, boosted by an expected addition of 200 million passenger cars and spelling a tepid pace for adoption of electric mobility. The rising oil demand will also push up India’s dependence on imports in the face of stagnating oil and gas production. This will directly impact consumers by pushing up fuel prices when oil flares up such as in recent weeks when petrol and diesel prices have begun to crawl up as crude hit US$80 a barrel in a volatile market.

Rajasthan CM Gehlot urges Centre to reduce various fuel taxes

29 September: Rajasthan Chief Minister (CM) Ashok Gehlot demanded the Centre reduce various types of taxes on fuel to give relief to common people from rising prices. Gehlot said the Centre has imposed various types of excise duties on petrol and diesel in which states hardly get any share. Giving a break up, the CM said if price of one litre of diesel in Rajasthan is INR98.80, then centre takes INR31.80 out of it, leaving only INR21.78 in VAT to the state. Gehlot said that in view of the poor financial condition of states after COVID-19, the Centre should give relief to the common man by reducing additional excise duty, special excise duty, and agriculture cess.

National: Gas

Natural gas price increase positive for ONGC, RIL: Fitch

5 October: The 62 percent increase in natural gas prices by the Indian government will boost the profitability of upstream companies in the country and support their investment spending, Fitch Ratings said. The price for gas from fields that were assigned by the state to oil companies, mainly Oil and Natural Gas Corporation (ONGC) and Oil India Ltd (OIL), increased to US$2.90 per million metric British thermal units (mmBtu) for October 2021-March 2022, from US$1.79 per mmBtu in the previous six months. Domestically produced gas is supplied on a priority basis to certain sectors, with 30 percent of it being consumed by power producers, around 27 percent by the fertiliser sector and 19 percent by city gas distributors in FY21. The gas price increase will hit the fertiliser sector's profitability by increasing working-capital requirements, Fitch said. The government also increased the price ceiling for gas produced from deepwater and other difficult fields to US$6.13 per mmBtu from US$3.62 per mmBtu.

Torrent Gas begins gas supply for households and industries in Gorakhpur

4 October: Torrent Gas Ltd said it has commenced supply of natural gas to domestic households and industries in Uttar Pradesh (UP)’s Gorakhpur town. The state’s Chief Minister Yogi Adityanath inaugurated Phase 1 of the city gas distribution (CGD) network in Gorakhpur, the firm said. Torrent Gas, the CGD utility of the diversified Torrent Group with group revenues of INR210 bn, has been authorised by the Petroleum and Natural Gas Regulatory Board (PNGRB) to establish and operate the CGD network and provide compressed natural gas (CNG) and PNG in 15 districts across UP, including Gorakhpur. Through this investment, Torrent intends to connect over 8.25 lakh residences in UP with PNG supply and set up over 225 CNG stations in UP over the coming years.

CNG, PNG prices hiked in Delhi, other markets by IGL

1 October: CNG (compressed natural gas) price in the national capital was increased by INR2.28 per kg and piped cooking gas supplied to households by INR2.10 following a 62 percent hike in natural gas prices. This revision in prices would result in an increase of INR2.28 per kg in the consumer price of CNG in Delhi, and INR2.55 per kg in Noida, Greater Noida and Ghaziabad. The new consumer price of INR47.48 per kg in Delhi and INR53.45 per kg in Noida, Greater Noida and Ghaziabad would be effective from 6.00 am on 2 October 2021. The price of CNG being supplied by IGL (Indraprastha Gas Ltd) in Gurugram would be INR55.81 per kg; in Rewari INR56.50; Karnal and Kaithal INR54.70; Muzaffarnagar, Meerut and Shamli INR60.71; Kanpur, Fatehpur and Hamirpur INR63.97; and in Ajmer it would be INR62.41 per kg from 6.00 am on October 2. The consumer price of PNG (piped natural gas) supplied to households in Delhi has been increased by INR2.10 per cubic metre to INR33.01 per scm. The applicable price of domestic PNG to households in Noida, Greater Noida and Ghaziabad would be INR32.86 per scm (standard cubic meter).

National: Coal

India coal crisis brews as power demand surges, record global prices bite

1 October: Indian utilities are scrambling to secure coal supplies as inventories hit critical lows after a surge in power demand from industries and sluggish imports due to record global prices push power plants to the brink. Over half of India’s 135 coal-fired power plants have fuel stocks of less than three days, government data shows. Prices of power-generation fuels are surging globally as electricity demand rebounds with industrial growth, tightening supplies of coal and liquefied natural gas. India is competing against buyers such as China, the world’s largest coal consumer, which is under pressure to ramp up imports amid a severe power crunch. Rising oil, gas, coal and power prices are feeding inflationary pressures worldwide and slowing the economic recovery from the COVID-19 pandemic. India’s average weekly coal imports during August through late September - when global coal prices rallied over 40 percent to all-time highs - dropped by over 30 percent from the average for the first seven months of the year. The September Indonesia coal price benchmark was as much as seven times higher than similar quality fuel sold by Coal India Ltd (CIL) to Indian utilities. CIL said higher global prices of coal and freight rates have pushed utilities dependent on imported coal to curtail power production, resulting in higher dependence on domestic coal-fired plants. India is the world’s second largest importer of coal despite having the fourth largest reserves. Utilities make up about three-fourths of its overall consumption, with CIL accounting for over 80 percent of the country’s production.

Coal ministry mulls scheme to allow coal block owners to surrender mines

4 October: The coal ministry is planning to come up with a scheme to permit coal block allottees to surrender mines that they are not in a position to develop due to technical reasons. The proposed scheme will allow surrender of coal blocks without imposition of financial penalty or penalty on merit basis after examining the proposal by a scrutiny committee. Coal blocks surrendered under this scheme will immediately be offered for auction for commercial mining for putting the block to production early. The move would help in boosting the production of coal from the mines allocated through auction route. To meet the increased demand for coal in the country, a scheme is being formulated to allow allottees to sell up to 50 percent of the produced fuel after meeting its captive needs, the coal ministry said. The incentive to allottees will spur them to produce more coal and sell in the market. India’s total coal production registered a marginal decline of 2.02 percent to 716.084 million tonnes (mt) during the last fiscal year. The country had produced 730.874 mt of coal in FY'20, according provisional statistics of 2020-21 of the coal ministry. Of the total coal production, 671.297 mt was non-coking coal and the remaining 44.787 mt was coking coal. Public sector produced 685.951 mt while the remaining 30.133 mt was produced by the private sector.

Coal India production rises to 40.7 mt in September

2 October: CIL (Coal India Ltd)’s coal production registered a marginal rise to 40.7 million tonnes (mt) in September. The development assumes significance in the wake of country's power plants grappling with coal shortages. CIL production had stood at 40.5 mt in September 2020. CIL’s production in the April-September 2021 period increased 5.8 percent to 249.8 mt, compared with 236 mt in the year-ago period. The company's offtake also increased to 48.3 mt last month, over 46.7 mt in the corresponding month of the previous financial year. Its offtake in the April-September 2021 period also increased to 307.7 mt over 255.1 mt in the year-ago period. Coal India, which accounts for over 80 percent of the domestic coal output, is eyeing one billion tonne of production by 2023-24.

National: Power

Power cost to remain high as imported coal prices soar: Ind-Ra

4 October: Short-term power prices are likely to remain elevated in the near term on account of a continued increase in imported coal prices, according to Ind-Ra (India Ratings and Research). It noted that a large part of the increased power generation would continue to be met through coal-based plants, although coal output is not increasing to the desired level. This is reflected in low inventory stocks at power plants, and therefore, a part of the increased energy demand will have to be met through imported coal, Ind-Ra said. In light of the expected high imported coal prices, the short-term power prices in India are likely to remain elevated, it stated.

Jharkhand grants retrospective exemption in electricity duty for captive power plants

2 October: The Jharkhand government has granted retrospective exemption in electricity duty for five years from 2016 to industrial units having captive power plants, according to a notification. The exemption from 100 percent electricity duty has been granted in retrospect to new or existing industrial units. It said the notification shall be deemed to be effective from 1 April 2016 and shall be in force till 31 March 2021.

National: Non-Fossil Fuels/ Climate Change Trends

India committed to curtailing carbon emission in Antarctic atmosphere: Singh

5 October: India is committed to curtailing carbon emissions in the Antarctic atmosphere and comprehensive protection of its environment and designation as a natural reserve devoted to peace and science, Union Minister Jitendra Singh said. Singh said that India under Prime Minister Narendra Modi is committed to curtailing carbon emissions in the Antarctic atmosphere. India has already adopted the green energy initiative by experimenting with the feasibility of wind energy production and installed moderate output of Wind Energy Generators on an experimental basis, he said. Noting that India is looking forward to contributing to the evolving Climate Change Response Work Programme of the Committee for Environmental Protection, he said climate-induced carbon dioxide uptake by polar oceans causing acidification that destroys marine environments and ecosystems, gradually affecting fisheries and propelling disastrous biome shifts is one of the challenges for the next 30 years. India is committed to the comprehensive protection of the Antarctic environment and dependent and associated ecosystems, and the designation of Antarctica as a natural reserve devoted to peace and science, he said.

Centre received help from states on stubble burning: Environment Minister

3 October: The Centre has got constructive cooperation from Punjab, Haryana, Delhi and Uttar Pradesh governments on the issue of stubble burning, Union Environment Minister Bhupender Yadav said. Yadav had held a key meeting with the governments of Delhi and its neighbouring states Haryana, Punjab, Uttar Pradesh and Rajasthan on the action plan to mitigate air pollution caused by stubble burning. Yadav, who is also the minister for Forest and Climate Change and Labour and Employment, said on the issue of pollution caused by stubble burning, the Centre has got constructive cooperation from these northern states. He said discussions were held last month over the implementation of action plans by states to mitigate pollution due to agriculture stubble burning, dust, construction and demolition waste, and vehicular pollution.

Chhattisgarh CM launches cow dung based power generation project

3 October: Chhattisgarh Chief Minister (CM) Bhupesh Baghel launched an electricity generation project that uses cow dung as fuel at a farmers' event to mark Gandhi Jayanti. It will be environment-friendly and also benefit women's self-help groups engaged in dung procurement and gauthan committees, he said. On the occasion, the CM launched such cow dung powered units set up at Sikola gauthan in Durg, Bancharoda gauthan in Raipur and Rakhi gauthan in Bemetara.

Jharkhand CM calls for generating solar power in backyards, promises subsidy

2 October: Jharkhand Chief Minister (CM) Hemant Soren called on common people to generate solar power in their backyards and promised subsidy for setting up the plants for which a new scheme will be launched. He promised that the surplus power will be bought by the state government which will also help people generate additional income. Eighty-two projects worth INR2.75 bn were inaugurated, and the foundation stone for 18 schemes worth INR917.9 mn was laid. Among the inaugurated projects, a grid substation at Itkhori and 108-km-long Chatra-Latehar transmission line will provide an uninterrupted power supply to large parts of Chatra district. Asserting that his government is promoting solar power generation, he urged people to set up plants on barren lands and rooftops. The CM said that his government is preparing special plans for the development of backward districts such as Chatra, Garhwa and Latehar.

Adani Green Energy to acquire 40 MW solar project in Odisha

30 September: The Adani Renewable Energy (MH) Limited (AREMHL), a wholly-owned subsidiary of Adani Green Energy Ltd (AGEL), will acquire a 40 MW operating solar project in Odisha. The AREMHL has signed definitive agreements with Essel Green Energy Pvt Ltd to acquire 100 percent economic value in a special purpose vehicle (SPV) that owns the solar project in Odisha, the company said. The project has a long-term Power Purchase Agreement (PPA) with Solar Energy Corporation of India (SECI) for INR4.235 per unit, with remaining PPA life of about 22 years, the company said. With this acquisition, AGEL will achieve a total renewable capacity of 19.8 GW. The total portfolio includes 5.4 GW operational assets, 5.7 GW assets under construction and 8.7 GW near construction assets.

95 percent of Mumbai’s power comes from coal, GHG big concern

30 September: A transition to clean energy is critical for Indian cities, including Mumbai, to reduce air pollution, improve residents’ health and deliver climate targets aligned to Paris Agreements. The state said expectations on the target to meet 25 percent of electricity demand through renewables will be met by 2025. Air pollution (PM2.5 annual concentration) in Mumbai is more than three times above WHO guidelines. In India, business leaders estimate that employee productivity decreases by 8-10 percent on high pollution days. As Mumbai is drafting its Climate Action Plan, which is expected to be ready later this year, a greenhouse gas (GHG) inventory analysis developed under the plan has showed that the energy sector contributes the most to Mumbai’s GHG emissions, given the city’s high domestic power demand and the fact that 95 percent of Mumbai’s electricity is generated from coal.

Power Minister approves dispute avoidance mechanism for hydro power contracts

29 September: Power Minister R K Singh has approved formulation of ‘Dispute Avoidance Mechanism’ for construction contracts of central public sector enterprises (CPSEs) executing hydro power projects, the power ministry said. The dispute avoidance mechanism mandates the appointment of independent engineers having domain knowledge of the subject for a specific project can have regular oversight over the project, with open communication with all the key stakeholders that can play an effective role in the avoidance of disputes, the ministry said in a release. The hydro CPSEs had been raising concerns that the present mechanism of dispute resolution in hydro power sector did not provide adequate framework to address the conflicts between the employer and the contractor at their inception stage but only addresses it after the disputes have arisen and notified between the parties.

International: Oil

OPEC+ grapples with mixed blessing of rising crude oil prices

4 October: OPEC (Organization of the Petroleum Exporting Countries) and its key allies will meet to decide whether to ramp up oil production in a bid to calm overheated global energy prices. The market landscape has changed little since the previous 1 September meeting of the oil exporters' cartel and its allies, together known as OPEC+, with demand continuing to weigh on global crude supply. Oil prices jumped above US$80 for the first time in almost three years, handing the club, led by Saudi Arabia and Russia, both a boost and a dilemma. OPEC has been sticking to an increase in production of 400,000 barrels per day (bpd), agreed in July, but could nonetheless be tempted to open the taps further. US (United States) President Joe Biden’s administration urged such an approach in August, when National Security Advisor Jake Sullivan said the cartel was not doing "enough" to boost oil production.

PetroChina’s Gulong shale project may bolster China’s oil output

1 October: PetroChina will be spending billions of dollars to accelerate drilling of rare shale formations in northeast China that could be pivotal to sustaining oil output in the world’s largest consumer. The state-run oil and gas producer aims to kick off production at its unconventional oil project in 2025 and double its capacity by the end of this decade, company officials and analysts said. If the pilot is successful, the technologies could be replicated elsewhere to unlock China’s vast untapped shale reserves. Gulong, situated at the sprawling Songliao basin, lies within the area of PetroChina’s flagship Daqing field, China’s biggest oilfield which has been pumping for over six decades but where output is diminishing. The oil major’s plans would sustain Daqing’s role as the top producing field as well as help arrest China's declining oil production. China produces only 35,000 barrels per day (bpd) of shale oil mostly in the northern Ordos basin and northwestern Jungar basin, less than 1 percent of total output. But Gulong is touted as a more prospective project, with lower cost and higher and better quality output. The success of Gulong could hold the key to sustaining China's oil production at 4 million bpd, nearly 30 percent of its consumption, the minimum supply to power manufacturing activities and military services, analysts said.

International: Gas

Asian LNG spot price reaches record high of US$34.47 per mmBtu

1 October: Asian liquefied natural gas (LNG) spot price rose to a record high on the back of robust demand for the super-chilled fuel and low supply. A combination of low stocks and strong demand for gas have pushed up prices in Europe, while a colder than expected winter in North Asia is fuelling the price surge. Price agency S&P Global Platts said that its Japan-Korea-Marker (JKM), which is widely used as a benchmark for spot LNG contracts, rose to US$34.47 per million metric British thermal units (mmBtu). In Europe, gas storage levels remain suppressed against historical averages, constrained LNG imports and strong gas demand due to post-lockdown economic recovery. Gas price at the Dutch TTF hub, a European benchmark, rallied to new highs on supply concerns, forecasts of cold weather and short-covering ahead of the official start to the winter gas season.

International: Coal

Zimbabwe okays export of 200k tonnes of excess power coal

1 October: Zimbabwe has allowed the export of 200,000 tonnes of excess power coal because of limited intake at its biggest coal-fired power plant, which is beset by frequent breakdowns, the coal producers association said. The southern African nation’s six coal miners have a standing arrangement to supply 300,000 tonnes of coal to Hwange Power Station every month but constant breakdowns of ageing equipment mean the plant is taking in less coal. The association said the coal would be exported to other countries in southern Africa but producers could look beyond the region if port facilities were available. Zimbabwe does not usually allow the export of power coal to ensure adequate domestic supply.

China’s coal crunch is self-inflicted, costly and temporary

30 September: China is paying a high price for policies that curbed domestic coal output and imports, and led to a shortage of the fuel that still largely powers the world’s second-largest economy. The good news for Beijing is that while the scarcity of coal will cause problems for energy-intensive industries, such as steel and aluminium, the situation is likely to be resolved relatively quickly. Looking at the domestic coal situation first, its clear that supply has become an issue in 2021. Australia used to be China’s second-biggest supplier of coal, with roughly 60 percent of its shipments being thermal coal, used for power generation and by industries such as cement, and about 40 percent coking coal, used to make steel.

Norway to close its last Arctic coal mine in 2023

30 September: Norway’s state-owned coal company will close its last mine in the Arctic Svalbard archipelago in 2023, it said, causing the loss of 80 jobs and ending 120 years of exploitation. While Store Norske Spitsbergen Kullkompani (SNSK) has shut its major mines in the islands over the past two decades, it had kept the smaller Mine 7 open, primarily to ensure supplies to a local coal-fired power plant, as well as some exports. Russia operates a coal mine at its Barentsburg settlement, supplying a local power plant.

International: Non-Fossil Fuels/ Climate Change Trends

EU leaders to discuss strategic gas reserve at summit: European Commission

5 October: European Union (EU) leaders will discuss later in October the idea of setting up an EU strategic gas reserve and the decoupling of electricity prices from gas prices, the head of the European Commission Ursula von der Leyen said. She said the surge in electricity prices for European consumers was mainly a result of much more expensive gas as global demand has picked up but key European gas suppliers like Russia, have not increased the supply. She said the EU had to invest in renewable sources of energy because that would make it independent of imports and stabilise prices. But more immediate steps would be the subject of the next EU summit on 21-22 October.

Greenpeace calls for EU ban on fossil fuel ads and sponsorships

4 October: Greenpeace and other environmental groups called for a Europe-wide ban on adverts and sponsorships by oil and gas companies, comparing them to harmful tobacco promotions. The groups said they would launch protests and collect a million signatures from EU (European Union) citizens to put a law banning ads for fossil fuels before the EU Commission.

Climate activists seek to block German coal mine expansion

1 October: Environmentalists have chained themselves to giant excavators in an effort to halt the expansion of a vast open-pit coal mine in western Germany. More than 20 climate activists clambered onto the diggers in the Garzweiler lignite mine. Eight have since been removed, police said. Garzweiler, operated by utility giant RWE, has become a focus of protests by people who want Germany to stop extracting and burning coal as soon as possible. Activists and local residents said expanding the mine runs counter to Germany’s goal of reducing greenhouse gas emissions to meet the Paris climate accord’s target of capping global warming at 1.5 degrees Celsius (2.7 Fahrenheit).

Australia to provide US$180 mn in grants to promote carbon capture

30 September: The Australian government committed to provide A$250 million (US$180 million) in grants to support development of carbon capture, use and storage (CCUS) projects, part of a broader technology push to help cut carbon emissions. The grants will go toward supporting the design and construction of carbon capture hubs and shared infrastructure, backing research and commercialisation of carbon capture technologies and identifying viable carbon storage sites. Details on the spending, first announced in the government’s budget in May, come as Canberra faces international pressure to commit to net zero carbon emissions by 2050, in line with most major nations, and deepen its pledged cuts for 2030 ahead of a UN climate summit next month. Australia, heavily reliant on exports of coal and gas, has targeted carbon capture and storage (CCS) and hydrogen development to help cut emissions, while still allowing for the use of gas and coal.

Investors with US$4 tn assets aim to tackle Asian firms on climate change goals

29 September: A group of six investors with a combined US$4 trillion of assets under management, including Fidelity International, said it aims to step up engagement with big Asian companies like banks and energy producers to ensure they have a road map to meet climate change targets. Initial engagement will focus on carbon risk and coal at banks and coal-exposed power companies, the group of investors, facilitated by Singapore-based advisor Asia Research & Engagement (ARE), said. The investor group will encourage companies such as banks to commit to concrete actions like exiting from financing the most carbon-intensive fossil fuels, and stopping financing fossil-fuel expansion and related infrastructure. Measures would also include encouraging Asian power utilities to set out plans to bring their businesses in line with Paris Agreement targets.

This is a weekly publication of the Observer Research Foundation (ORF). It covers current national and international information on energy categorised systematically to add value. The year 2021 is the eighteenth continuous year of publication of the newsletter. The newsletter is registered with the Registrar of News Paper for India under No. DELENG / 2004 / 13485.

Disclaimer: Information in this newsletter is for educational purposes only and has been compiled, adapted and edited from reliable sources. ORF does not accept any liability for errors therein. News material belongs to respective owners and is provided here for wider dissemination only. Opinions are those of the authors (ORF Energy Team).

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV