-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

In the next few years, India’s GDP will continue to grow on the back of economic development, rapid urbanisation, increased infrastructure investment, improved private investment, strong industrial activity, and increasing consumption. These activities will, in turn, boost domestic mineral consumption. Compared to other developing countries, India’s use of metals is low across most metals. Therefore, the country must avoid any cap on the annual production of minerals by a miner that can be monitored by the monitoring committee.

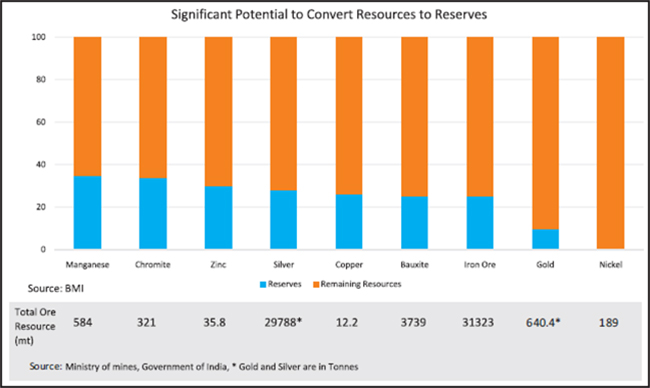

India produces around 88 minerals: four fuel-related minerals, 10 metallic minerals, 50 non-metallic minerals and 24 minor minerals. Mineral reserves—by definition a part of mineable resources that can be economically brought to production—form a small portion of the respective resources. Exploration is the foundation of value creation in mining as it broadens the pipeline of bodies for development, replenishing reserves depleted through production. It also replaces resources stranded due to uneconomic commodity prices. The following graph from the Ministry of Mines (GoI) shows the reserves and remaining resources of minerals.

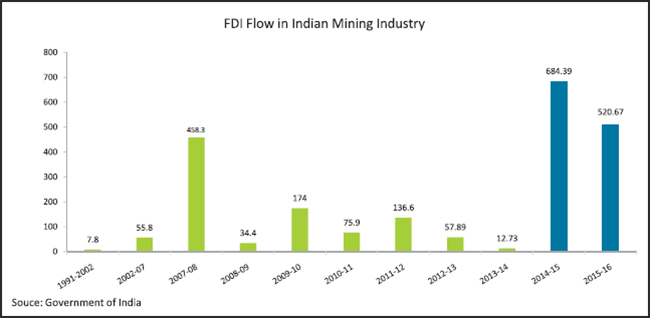

Due to reinvigorated mining-sector regulations and activities, Foreign Direct Investment (FDI) inflow into the Indian mining industry has been subdued, compared to other sectors such as telecommunications, power, machinery and transport equipment in the last ten years, even though the government allowed 100 percent FDI in the mining sector under the automatic FDI route.

The following graph shows the FDI flow in the Indian mining industry from 1991 to 2015.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Manoj Kumar was a Visiting Fellow at Observer Research Foundation at Delhi and the founder and managing partner of Hammurabi & Solomon ...

Read More +

Dr. A. K. Verma is Assistant Professor at the Department of Mining Engineering, Indian Institute of Technology (Indian School of Mines) Dhanbad. He obtained his ...

Read More +