A decelerating world economy toppled by COVID-19

In January 2020,

IMF World Economic Outlook projected global growth to rise from an estimated 2.9% in 2019 to 3.3% in 2020, and subsequently to 3.4% in 2021. This was done after a downward revision of 0.1 percentage point for 2019 and 2020, and 0.2 percentage point for 2021 to its projected figures of growth in the October Outlook. The downward revision has been done due to negative reports of growth in a few emerging economies, including India – apart from trade tensions existing worldwide. It also recognised tentative positive signs of manufacturing and global trade bottoming out, favourable outcome of US-China trade negotiations, and diminished signs of a no-deal Brexit.

A few days back in the end of December 2019, a strange flu suddenly appeared in the Chinese city of Wuhan – all initially affected were somehow related to a “wet market” in the city. Chinese administration, in usual denying reflex action, immediately tried to hush up, only to wake up to the enormity of the threat few weeks later. The disease turned out to be a novel strain of coronavirus or COVID-19. More than 204,200 cases have been confirmed since the outbreak and the number of deaths has risen over 8,200 across 114 countries and is increasing

every day. The spread is now across the continents, and situation in countries like Italy, Iran and the USA – outside China – is quite threatening.

The intercontinental nature of this rapid spread of the virus has finally prompted WHO to declare COVID-19 as a

pandemic on 11 March 2020.

UNCTAD envisioned a probable $1 trillion global economy output loss, compared to September forecast. Another extreme “Doomsday scenario” involves a 0.5% world growth and a clear $2 trillion hit in 2020.

Even in February this year, there were hopes of a contained global outbreak. However, those hopes prove to be baseless now. Different countries of the world are now trying different measures of “social distancing” via lockdown, restricted movements and other methods of mitigation.

These imply serious disruption in trading, economic and business activities everywhere. The big question now is – how much economic disruption that will be?

A broader COVID-19 contagion and rampant disruption likely

OECD Interim Report this month on COVID-19 classifies possible scenarios in two future categories – baseline and a domino scenario.

| TABLE 1: Impact of COVID-19 on Global Economy: Two possible scenarios |

| Base scenario: temporary blow |

Domino scenario: broader contagion |

|

· Severe, short-lived downturn in China – where GDP growth would fall below 5% in 2020 after 6.1% in 2019, but would recover to 6.4% in 2021.

· In Japan, Korea, Australia also growth would be hit hard, followed by gradual recovery.

· Impact less severe in other economies but still would get hit by drop in confidence and supply chain disruption. |

· Intensity of China impact repeated in northern advanced economies severely hitting confidence, travel and spending.

· Global growth could drop to 1.5% in 2020, half the rate projected before the outbreak or even lower.

· Recovery much more delayed and gradual through 2021. |

| Source: OECD Economic Outlook, Interim Report, March 2020 |

Global trade remained weak even before the COVID-19 outbreak (

Figure 1). GDP and trade projections for the US, China and the world have been worse earlier, but improved significantly after Phase One agreement between the US and China, with the hope of improvement in 2020 (Panel B of

Figure 1). Worldwide spread of coronavirus changes everything now.

| FIGURE 1: Global trade remained weak even before COVID-19 |

|

|

* Estimates in Panel B show the combined impact of the changes in bilateral tariffs implemented by the US and China in 2019 prior to and after the Phase One Agreement and a global rise of 50 basis points in investment risk premia that persists for three years before slowly fading thereafter. All tariff shocks are maintained for six years. Impact assessment based on simulations.

Source: OECD Economic Outlook, Interim Report, March 2020 |

As trade weakened, global GDP growth also lost its momentum – particularly after 2017. Four advanced economic zones experienced deepening fall in their PMI, signifying acute slowdown (

Figure2). Panel B shows the absolute dip in both new manufacturing and services orders since middle of 2017. The outbreak could not have arrived at a more inopportune moment.

| FIGURE 2: Global growth also lost momentum earlier |

|

|

* GDP at constant prices on a PPP (Purchasing Power Parity) basis. Data for fourth quarter of 2019 are estimates. The advanced economy PMI (Purchasing Managers’ Index) series are a PPP-weighted average for Australia, Euro Zone, Japan, the UK and the US.

Source: OECD Economic Outlook, Interim Report, March 2020 |

How bad the World Economy may turn into?

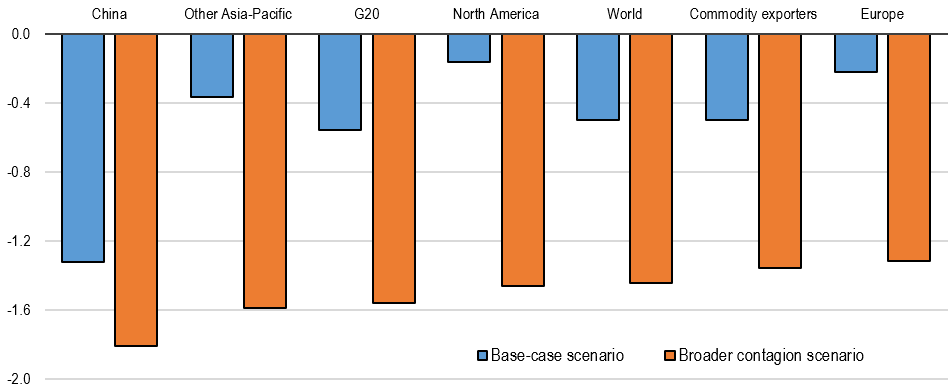

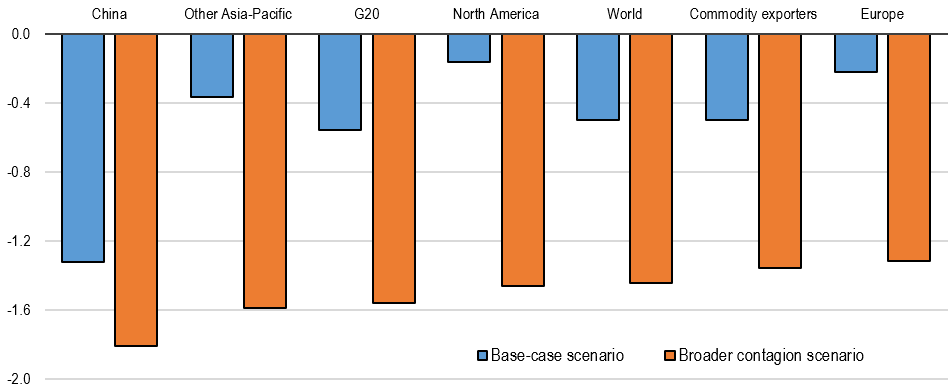

The OECD Report created the Domino scenario (broader contagion) assuming the countries affected by COVID-19 would represent over 70% of global GDP (in PPP terms).

| FIGURE 3: Illustrative coronavirus scenarios: Change in GDP growth in 2020 relative to baseline (in percentage points) |

|

|

* Simulated impact of weaker domestic demand, lower commodity and equity prices and higher uncertainty. Base-case scenario with the virus outbreak centred in China; broader contagion scenario with the outbreak spreading significantly in other parts of the Asia-Pacific region, Europe and North America. Commodity exporters include Argentina, Brazil, Chile, Russia, South Africa and other non-OECD oil producing economies.

Source: OECD Economic Outlook, Interim Report, March 2020 |

A broader contagion impact would be severe everywhere (

Figure 3). China, the epicentre, would be the most-hit, the dip in GDP of other Asia-Pacific countries GDP being 1.6%, followed by G-20, North America, commodity exporter countries and Europe. World negative impact on GDP can be 1.5%.

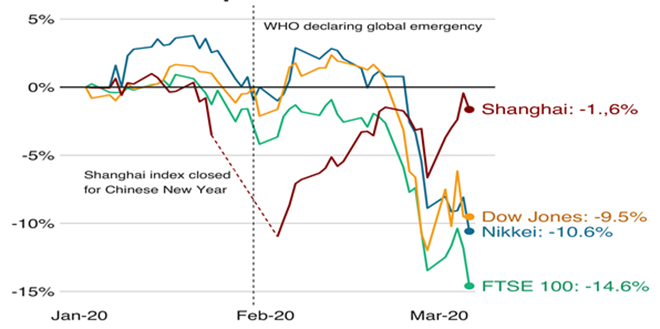

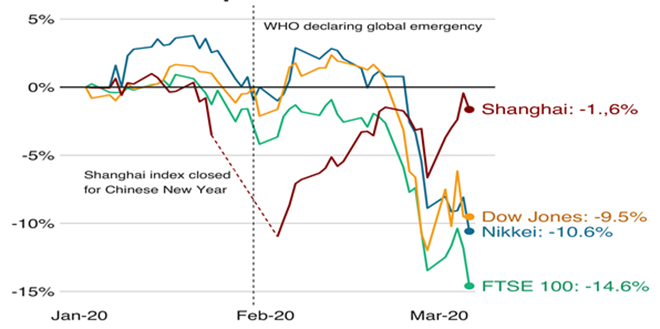

Stock markets across the world crashed in March (

Figure 4). The glaring anomaly in the trend comes from China, trying to get back to work after the initial jolt with factories and restaurants re-opening, and the investors looking into a probable big government stimulus package. The

result – China is the current best performing market, though six weeks ago it was the worst.

| FIGURE 4: Coronavirus impact on stock markets |

|

| Source: BBC News |

Global economic disruption will follow the Chinese pattern

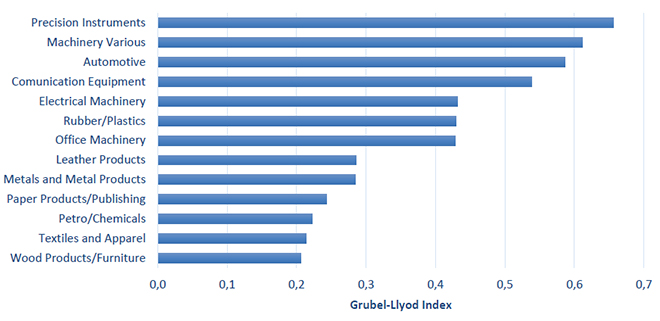

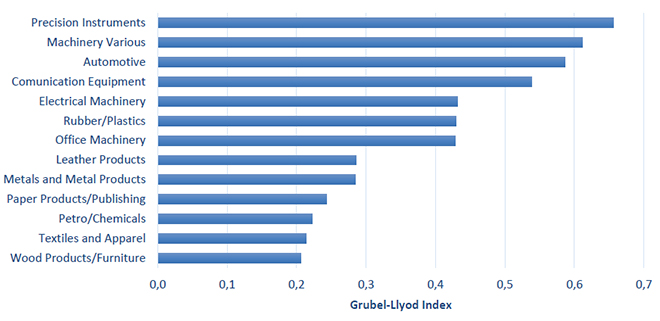

Figure 5 shows China’s current integration in global value chains across sectors, measured by the

Grubel-Llyod Index (GLI). It is pivotal in precision instruments, machinery, automotive and communication equipment value chains. COVID-19 related restrictions would disrupt and negatively affect the producers elsewhere.

Even where the global value chain integration of China is relatively less, there are sectors with Chinese dominance, for example textiles and apparel. In some of these, China is self-sufficient and production process is end-to-end – from raw material to finished products.

| FIGURE 5: China integration in global value chains, by sector (in terms of Grubel-Lloyd Index) |

|

|

* Grubel-Lloyd Index (GLI) measures intra-industry trade of a particular product.

Source: UNCTAD |

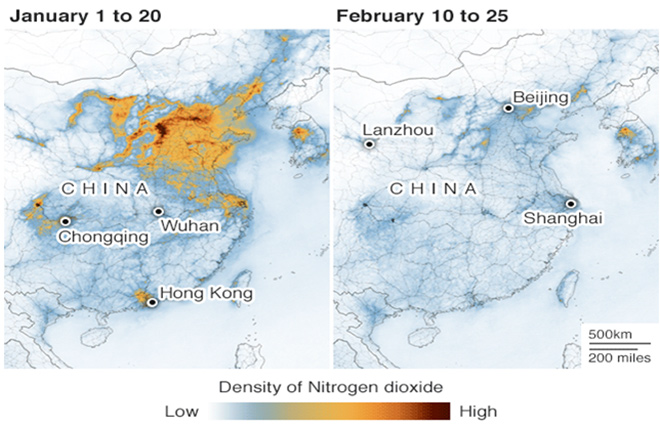

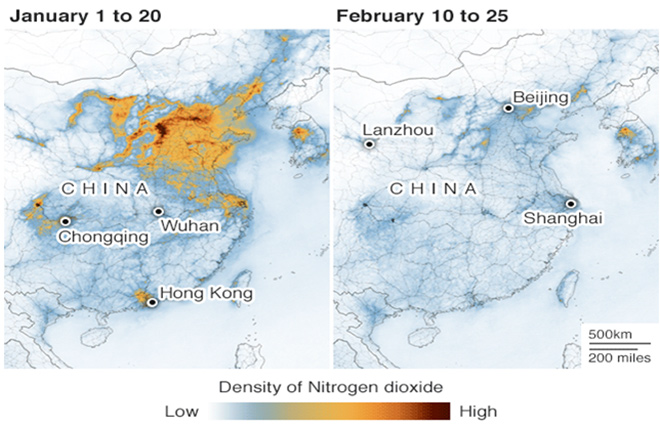

Satellite images acquired from sources, including NASA, show drastic fall in the pollution level in China (

Figure 6). Nitrogen dioxide level in lower atmosphere almost vanished in February, compared to January. The enormity of the shutdown can be realised if the vanishing of nitrogen dioxide in less than a month is considered. Being the manufacturing powerhouse of the world, sheer scale of such industrial shutdown in China is bound to create tremors in other manufacturing hubs of the world.

| FIGURE 6: Satellite images show drastic fall in pollution in China amidst slowdown |

|

|

* Pollution shown in terms of nitrogen dioxide level in lower atmosphere.

Source: BBC News |

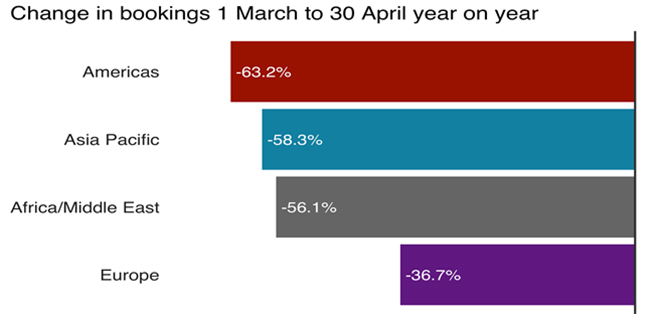

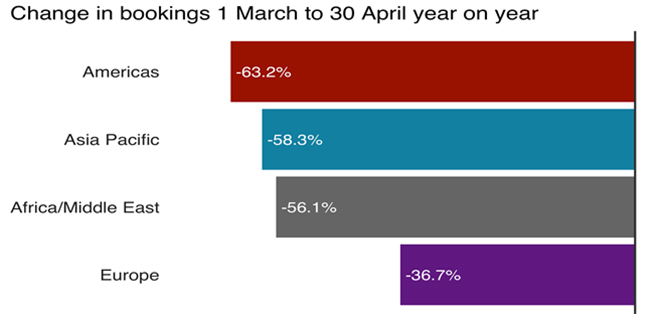

Among the hardest hit sectors, primary is travel. Change in bookings of Chinese travellers across continents show drastic drops (

Figure 7). For example, there have been 415,000 visits from China to the UK in the preceding 12 months to September 2019. Chinese travellers spend three times more than an average tourist to the UK at £1,680. A fall would obviously impact the airline, hospitality and other associated industries.

| FIGURE 7: Number of Chinese travellers to all destinations have fallen sharply |

|

| Source: BBC News |

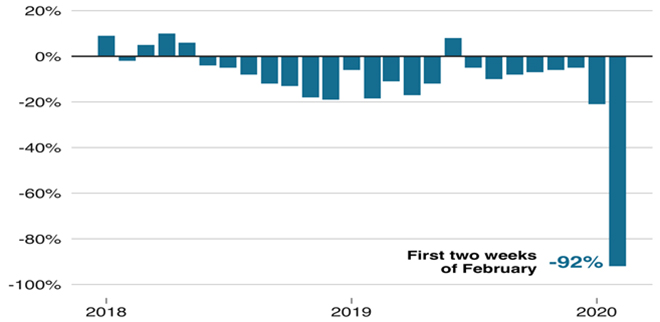

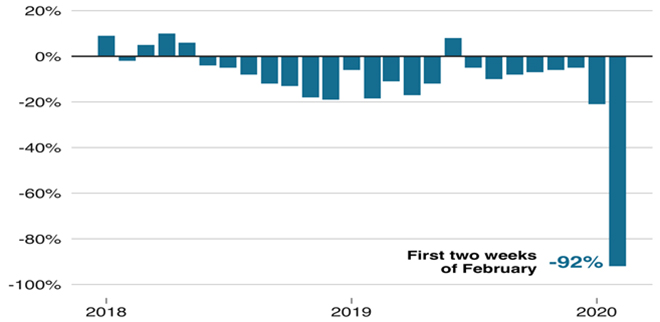

As mentioned earlier, the world economy has been in a demand slowdown, and China was no exception. Car sales growth going into the negative in 2019 is one indicator. After the outbreak in the first two weeks of February 2020 Chinese car sales dropped by a whopping -92% (

Figure 8). More upper-end carmakers, like Tesla or Geely, are now selling cars online as customers generally are staying away from showrooms. Restaurants and other shops related to recreation, shopping malls, movie business are among other sectors immediately and badly hit.

| FIGURE 8: Car sales in China drop sharply in 2020 |

|

| Source: BBC News |

Recovery would need huge international cooperation and coordination

Stopping the pandemic has obvious economic costs, not much of a choice there. However, already existing slowdown across global economy has made the situation worse. The governments of different countries have their immediate job cut out in post-pandemic recovery stage – the foremost being protecting the health and income of the most vulnerable. In China, the poorest are paying the steepest price of this outbreak – in terms of death, health hazard and economic survival.

A pandemic of this scale needs internationally coordinated actions across countries and continents, before and after. Once short-term humanitarian goals are achieved, longer-term policy actions to boost economic recovery need to be addressed. No single country is in a position to do that, and a worldwide 2020 version of

Marshall Plan can only rescue the global economy from the pits it will be in after the virus relents.

This is an abridged version of the article first published in World Commerce Review

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV