-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Kalpit A. Mankikar, “China’s Response to ‘De-risking’ Strategy of the West,” ORF Issue Brief No. 669, November 2023, Observer Research Foundation.

Since the establishment of ties between Communist China and the United States (US) in the 1970s, there has been increasing economic interdependence between the two. More recently, the West has begun to recognise that they must alter their approach in response to a changing China. As a new German strategy paper on China noted, “China is simultaneously a partner, competitor and systemic rival.”[1] The paper notes that China is reducing its dependencies on Europe but Germany’s dependencies on China have increased; such unilateral reliance on important preliminary products and sophisticated technologies make countries vulnerable to political pressure.[2] It said Germany will aim to diversify economic relations that will bring down dependence on China in critical sectors.[3]

When Donald Trump was US president, the fashionable jargon was ‘decoupling’—disengaging from China, or reversing the four-decade-old economic intertwining. In the Joe Biden era, the focus is on ‘de-risking’—defined by US National Security Adviser Jake Sullivan as building “resilient supply chains”.[4] The West’s approach has been primarily that of instituting export restrictions on semiconductor technology, and curbs on outbound investment into advanced technology sectors in China, among others.[5]

However, Chinese commentators and strategists have a different assessment. A Xinhua commentary published in May argued that de-risking is not a climb down from the US’s previous position of decoupling, likening it to old wine repackaged in a new bottle.[6] It said the change in nomenclature stems from America’s pursuit of more allies to build a broad-based coalition that will suppress China’s growth and interfere in its internal affairs.[7] The author asserts that the US has not softened its stance, and predicts that measures to contain China will only get more stringent. These include the ‘China Competition Act 2.0’,[8] aimed at bolstering export controls and curbing US investment in China, thereby cutting off China’s access to sophisticated technology.

The economy is a key pillar of the Communist Party of China’s (CPC) legitimacy-building. Thus, there is palpable anxiety in its upper echelons, seen in the Central National Security Commission readout of May 2023 which observes a difficult situation with respect to national security, saying the Party-state must prepare to face “worst-case scenarios”.[9] In the assessment of Li Wei from the China Institute of Contemporary International Relations, China faces challenges from “unilateral trade protection” and “regional and global conflicts”.[10] Moreover, during a conference in June 2023,[a] the Chinese delegation revealed that a retired Colonel from the People’s Liberation Army had been included in an internal task force on securitising supply chains. China perceives that through ‘decoupling-de-risking’, the US is trying to stall its move up the ‘smiling curve’[b] into more lucrative areas such as product design, branding, or even research and development.[11]

The CPC has begun to invoke nationalism and frame the de-risking initiative in terms of race. Zhong Feiteng from the Chinese Academy of Social Sciences argues that de-risking and decoupling are intrinsically linked, with the ultimate goal being 'de-Sinification'—i.e., erasing Chinese identity.[12] Jin Canrong of Renmin University places China where the Soviet Union was during the Cold War, and says the US used soft power and “ideological infiltration of its elite” to defeat its rival as it did not want to wage war against a nuclear power.[13] He argues that the US has also cut emerging powers like Japan and the European Union to size. Jin assesses fundamental contradictions in the US-China dynamics in terms of the divergences in their political systems and civilisational moorings.[14] He blames ‘white’ America for its inability to accept China’s rise, and its condescending attitude towards the “black, brown, and yellow races”.

China has been using the race card in its diplomatic engagement in Asia, too. During the opening ceremony of the International Forum for Trilateral Cooperation in Qingdao in July 2023, Foreign Minister Wang Yi told diplomats from South Korea and Japan (both US allies), that they must develop a sense of autonomy from the West and cooperate with Beijing to “reinvigorate Asia”.[15] Wang asserted that Westerners could not tell the difference between nationals from China, Korea and Japan, and that Asians could not become Westerners and should know their “Asian roots”.[16]

The pushback against de-risking has also led China to penetrate new markets. There is greater diversification of investments under the Belt and Road Initiative. Russia, Turkey, Poland, Kenya and 22 other nations did not get any BRI investment between January and June 2023,[17] while countries in sub-Saharan Africa witnessed the largest growth with Namibia, Eritrea, and Tanzania recording increases of 457 percent, 359 percent, and 347 percent, respectively.[18]

Bai Ming, a researcher with China’s Ministry of Commerce has argued that, focusing solely on European and US markets for exports, given the anti-Chinese sentiment there, may not help China in the long term.[19] Bai posits that China must try to capture markets through new products and technological cooperation. Central America seems to be the testing ground of the thesis. Take the case of Honduras, which cut ties with Taipei and formalised relations with Beijing in March 2023. Following the allegiance switch, Beijing pulled out all the stops for the state visit of Honduran President Xiomara Castro. Honduras is among the latest Central American nations to join the BRI, signing in all 19 bilateral cooperation agreements with China—one related to the BRI and the others covering fields such as farming, economic and trade issues, education, science and technology, and culture.[20] The China-Honduras business session on the sidelines of the Castro visit saw 200 delegates from both nations participating.[21] Castro applied to join the BRICS-promoted New Development Bank, whose headquarters she visited in Shanghai.[22] Significantly, she also visited a facility operated by the controversial Chinese telecom giant, Huawei, whose activities in the US and Canada have raised acrimony between China and these countries.[23]

China-Honduras negotiations on a free-trade agreement are nearing fruition,[24] which will facilitate Chinese investment in Honduras in sensitive sectors such as infrastructure, energy and telecommunications. Warnings from India and the US against China’s strategy of ensnaring small states through white-elephant projects in infrastructure seem to have been ignored by a country which the US regards as part of its sphere of influence. Honduran Minister of Economic Development, Fredis Cerrato, rebutting the “debt trap” narrative, said the BRI would improve people’s living standards.[25]

Why is China worried about decoupling given that it is already the ‘factory of the world’? In 2015, it produced or assembled over 90 percent of the world’s mobile phones, more than 80 percent of its computers, 80 percent of its air-conditioners, and nearly 50 percent of its steel.[26] Yet it feels vulnerable because foreign-owned companies are critical for Chinese exports, making the economy heavily dependent on foreign direct investment (FDI).

Academics Mingtang Liu and Kellee S. Tsai have argued that the metric of economic strength has shifted from national production to value addition.[27] For example, parts of an electronic gadget may often be assembled and exported by one country, but the bulk of profits may go to trans-national companies located elsewhere. The measure of relative economic power should be arrived at by examining which nations have trans-national corporations dominating the highest end of the value chain.[c] Tsai argues that merely taking into account China’s export volumes may be misleading given how, from 2002, foreign-invested firms have made up 80 percent of its export value in medium- and advanced-technology sectors.[28]

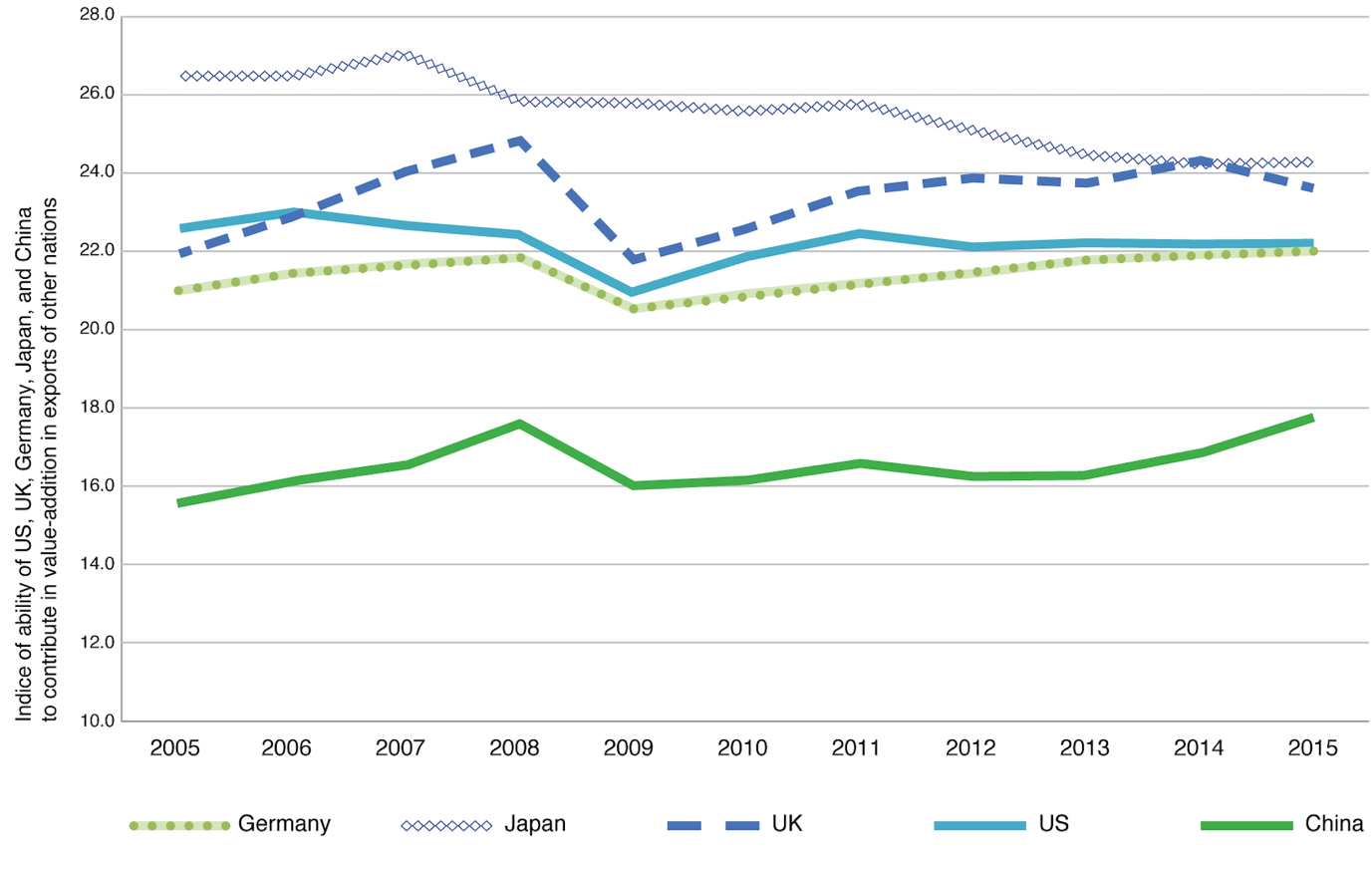

Another key vulnerability is the supply from overseas of intermediate components and goods. Industrial upgrading in global value chains is examining forward participation (value addition by a country in others’ exports) and backward participation (foreign value-addition).[29] China’s ability to contribute to value-addition in exports of other nations lags behind countries such as Germany, Japan, the US, and the United Kingdom (UK) (Fig. 1).

Fig. 1: Contributions in Value-Addition in Exports of Other Countries

[caption id="attachment_131389" align="aligncenter" width="660"] Source: Calculations by Mingtang Liu and Kellee S. Tsai based on data from OECD.[30][/caption]

Source: Calculations by Mingtang Liu and Kellee S. Tsai based on data from OECD.[30][/caption]

In sophisticated electronics items and personal computing devices, China’s forward-participation indices are merely 9 percent, whereas the backward participation indices are 24.9 percent.[31] China’s inability to contribute to value-addition of other nations’ exports and its dependence on FDI inflow are mainly due to the advanced nations controlling intellectual property rights (IPRs).[32] This makes China heavily dependent on FDI flows and supply of intermediary components from abroad, exposing it to the vagaries of geopolitical currents.

Zhang Zhixin from the China Institute of Contemporary International Relations argues that China is on a path to displacing the US (and the West, in general) as the world’s supreme economic power. Consequently, since the Trump administration, there has been a distinct aversion to China’s rise, and efforts to contain it.[33] Zhang assesses that this has led the US strategic community to display “extreme toughness” towards China, and any conciliation and arguments for cooperation are seen as “politically incorrect” and “displaying weakness”. His paper asserts that the “military-industrial complex” has a bearing on the US’s China policy, and thus the “China threat theory” is being hyped by vested interests, since the military-industrial complex benefits from an intensification of the arms race in Asia.[34]

Chinese scholars like Yan Xuetong are of the view that mistrust between the US and China will remain, leading to a de-globalisation trend, with every nation focused on increasing its separate industrial capacity.[35] The US’s Creating Helpful Incentives to Produce Semiconductors Act, for example, allocates US$52 billion to boost innovation and competitiveness in the production of semiconductor chips.[36] He maintains that the US aim is to bring manufacturing back to American soil, and to build capacity in advanced sectors where the West had earlier relinquished primacy to overseas corporations.

How should China deal with the deteriorating external environment? Scholar Jin Canrong argues that China must augment its ‘national strength’ to counter the US-led onslaught.[37] How this concept of ‘national strength’ translates into policy can be seen from Xi’s campaign for ‘China-style modernisation’ (Zhōngguó xiàndàihuà [中国式现代化]).[38] Speaking in Guangdong province in April 2023, home to the tech-powerhouse that is Shenzhen, Xi said that improving China’s self-reliance was priority, and, as a big nation, its core technology must be based on independent research.[39] He stressed that innovative businesses must be founded on independent IPR development, and that, in the face of deteriorating relations with the West, China must achieve ‘China-style modernisation’ (CSM) through integration of innovation, talent, industrial and monetary capital chains.[40]

Leveraging Guangdong’s technological base, plans are afoot to build a high-end talent hub for science and technology innovation in the Guangdong-Hong Kong-Macau Greater Bay Area.[41] Discussions in China’s Politburo in April 2023 point to its priorities: creating a modern industrial system and a better foundation of science and technology.[42] Thus, the focus in the Xi Jinping era has moved away from ‘quantity’ of economic growth to a notion of ‘high-quality growth’, upgrading the industrial base and developing new technologies. This has exacerbated in the light of recent competition with the US, and the technological curbs imposed.

Xi has made it clear this will take time and hard work. In his New Year’s Eve address to the nation as 2022 ended, he referenced the fable of yúgōng-yíshān [愚公移山], which is loosely similar to the English, “faith can move mountains”. In the fable, an elderly man, Yu Gong, sets out to remove a twin-peaked mountain[43] that blocks his access and is taunted by fellow villagers for the futility of his effort. Yu perseveres, maintaining that after his demise the task would be carried forward by each succeeding generation till the goal is achieved. Xi said that the two peaks were allegories for feudalism and imperialism, in what may be interpreted as a pointer to the West’s denial of technology to China.

There has been a sea change in the composition of start-ups in China—as shown by data from China’s Ministry of Science and Technology and research firm, Hurun. In 2017, the start-up list was dominated by e-commerce firms. About 20 percent of China’s unicorns worked in online retail, 13 percent in fintech, and 9 percent in entertainment.[44] By 2022, firms in sectors such as software, green energy, robotics, artificial intelligence, healthcare and bio-technology had taken over. China now has 50 unlisted semiconductor companies valued at over US$1 billion, where none existed in 2017.

China’s economy is closely shaped by government policy, as the example of its edu-tech sector shows. The virtual-tutoring business was one of its fastest-growing sectors in recent years—it had 27 initial public offerings (IPO) between 2019 and 2021.[45] China then conducted a crackdown, prohibiting companies that teach course content listed in the school curriculum from listing on overseas bourses and also barred foreign investment in them.[46] In 2017, there were nine such companies each valued at nearly US$1 billion; now there are hardly any. Thus, the changed composition of China’s unicorns may be indicative of a larger shift in its economy as it seeks economic securitisation through development of ‘hard’ technology rather than its already booming e-commerce sector.

China is also taking steps towards internal balancing, under which state power is being bolstered through increasing economic resources. Under its ‘dual circulation’ strategy, the role of foreign trade as a driver of the economy is being curtailed. The proportion of goods traded (exports and imports) to GDP dropped to 34 percent in 2020 from 64 percent in 2006.[47] It is diversifying sources of supply of important imports—for example, it is buying more oil from Russia, and making increased iron ore investments in Guinea and Cameroon.[48] This aims to reduce China’s dependence on crude from a volatile West Asia and on iron ore from Australia (which asked for an independent investigation into the origins of the COVID-19 pandemic).

In addition, China is promoting the concept of a ‘unified domestic market’ for production and resource use, covering land, labour, capital, technology, data, energy and the environment.[49] Guidelines issued in April 2022 seek to unify basic rules and systems for property rights, market access and fair competition,[50] thereby promoting more efficient production, distribution, circulation and consumption within China.[51] To ensure that monetary capital services the party-state’s priorities, IPOs are being segregated into three categories: ‘supported’, ‘restricted’, and ‘prohibited’.[52] ‘Supported’ IPOs include integrated circuits and advanced biomedical research, while the ‘restricted’ category covers ventures such as furnishings, apparel merchandise, and fast-food restaurant chains, and quasi-finance companies have been included in the ‘prohibited’ category. ‘Restricted’ sector companies are allowed but not encouraged by the securities regulator, whereas ‘supported’ businesses can go public as soon as their audit is done.[53]

China is augmenting state capacity in science and technology as well. Following the leadership transition after the 20th Party Congress—a key institution of the CPC that charts future policy—it was announced that a “proven track record in combating Western sanctions” would be an important factor for cadre promotions.[54] More technocrats with expertise in specialised fields such as space research and nuclear power have been promoted into the Party’s highest governing bodies—the Politburo and the Central Committee.[55]

There are plans to boost basic scientific research with more research facilities for physics, chemistry, and biology, and establishing a national laboratory system, by diversifying funding avenues for basic research through tax incentives for companies, and encouraging corporate groups and private donors to start ‘science prizes’ to nurture talent in schools.[56] In the long term, China plans to prioritise basic science subjects at the high school and college levels to “create a huge talent pool to address its strategic needs.”[57] Beyond school education, the CPC wants to nurture young talent willing to dedicate themselves to scientific research.[58] New guidelines issued in August 2023 aim at permitting young scientists to play a “pioneering role” in projects.[59] They suggest quotas for scientific-research projects, such as at least 50 percent of members should be below 40, government funding for basics research should only go to those below 35, and young scientists should be better paid.[60]

Further, under the ‘Party and State institutional reform plan’, a new Central Commission for Science and Technology has been constituted to consolidate the CPC’s hold and promote reform.[61] The commission will formulate policies and review plans for national technological development. It will determine national strategic technological tasks and important research projects, and coordinate the allocation of scientific and technological resources like national laboratories and personnel for strategic projects.[62] Its ambit includes development and integration of military-civilian technology. The Party-state thus hopes to get around the challenge of duplication of scientific effort. Sub-national authorities in China have shown a tendency to allocate money or initiate science and technology projects to boost the promotion prospects of provincial leaders, which leads to similar projects being funded in multiple locations.[63] Through the new commission, the Party is aiming to free technology development from the clutches of provincial cadres and provide long-term direction and funding for projects.

China has realised that its economic engagement with the West—whether in capital or technology inflows—is fraying. Despite being known as the factory of the world, it is still dependent on FDI inflows and intermediate components from abroad, making it vulnerable to geopolitical shocks. Thus, the CPC sees West’s de-risking as a larger design to destabilise China’s economy and effect regime change. One of the key themes of the People’s Republic’s diplomatic interactions has been a pushback on de-risking. Chinese academics foresee more stifling measures, which has led to its national security establishment calling for preparation for worst-case scenarios. China believes that the de-risking initiative lies in the US’s propensity to stymie rivals, and the latter’s perception of differences in the US and Chinese social and political systems.

It also suspects that the US has a racist mindset and cannot bear China’s rise. In its diplomatic pushback, China is playing the nationalism card vis-a-vis neighbours like South Korea and Japan, and seeking new markets across the world. Domestically, there is a clamour to increase its national strength. This reflects in Xi’s promotion of ‘Chinese-style modernisation’, which has been characterised by a shift from e-commerce and education start-ups to those that develop hard technology. Second, China’s state power is being bolstered through increasing economic resources: diversifying the sources of supply of critical imports, promoting a common domestic market and making it easier for innovators to tap into capital markets.

At an institutional level, China is promoting more science and technology cadres in top political positions, shoring up basic research and transforming its science and technology system, and overhauling the working conditions of young tech talent. It is banking on increased state capacity to have technological breakthroughs as seen in the establishment of the Party Commission on Science and Technology. However, the commission’s mandate to develop and integrate military-civilian technology is likely to cause further apprehension in the West with respect to China’s geopolitical ambitions, which will affect cooperation and collaborations in the long run.

Kalpit A. Mankikar is a Fellow with ORF’s Strategic Studies Programme.

The author thanks Satish Teeza for his assistance in tabulating the graphs and diagrams used in this brief.

[a] ORF researchers participated in this conference.

[b] The ‘smiling curve’ is a business concept related to IT manufacturing, which graphically depicts how ‘value add’ in the industry varies across the different stages of bringing a product to market. The two ends of the value chain add more value than the middle stages, making the graph of the process look like a smile.

[c] This is calculated by the trans-national index.

[1] Government of Federal Republic of Germany, Strategy on China of the Government of the Federal Republic of Germany.

[2] Government of Federal Republic of Germany, Strategy on China of the Government of the Federal Republic of Germany.

[3] Government of Federal Republic of Germany, Strategy on China of the Government of the Federal Republic of Germany

[4] White House, The Unites States government.

[6] “新华时评:炮制对华“去风险”是“脱钩论”新瓶旧酒——起底美国抹黑中国话术系列评论之 [De-risking against China is new bottle of old wine],” Xinhua, May 25, 2023.

[7] “新华时评:炮制对华“去风险”是“脱钩论”新瓶旧酒——起底美国抹黑中国话术系列评论之 [De-risking against China is new bottle of old wine],”

[8] “新华时评:炮制对华“去风险”是“脱钩论”新瓶旧酒——起底美国抹黑中国话术系列评论之 [De-risking against China is new bottle of old wine],”

[9] “习近平主持召开二十届中央国家安全委员会第一次会议强调加快推进国家安全体系和能力现代化以新安全格局保障新发展格局 [Xi Jinping presides over National Security Commission meet, emphasises need to accelerate national security system modernisation, and ensure new development pattern with a new security pattern],” Xinhua, May 30, 2023.

[10] “Xi urges accelerated efforts to modernize national security system, capacity,” Global Times, May 31, 2023.

[11] “On China, Washington can't have it both ways,” Xinhua, April 26, 2023.

[12] “钟飞腾:如何理解美西方对华“去风险 [Understand "de-risking" of the United States and the West towards China],” CFISNET.com, July 5, 2023.

[13] “金灿荣:中美关系新特点 [Jin Canrong: New features of China-US relations],” CFISNET.com, July 5, 2023.

[14] “金灿荣:中美关系新特点,” [Jin Canrong: New features of China-US relations]”

[15]“王毅:中日韩要知道自己的根在哪里,头发染得再黄、鼻子修得再尖也变不成西方人, [Wang Yi: China, Japan and South Korea need to know where their roots are, you won’t become Westerners],”IFeng News, July 4, 2023.

[16]“王毅:中日韩要知道自己的根在哪里,头发染得再黄、鼻子修得再尖也变不成西方人, [Wang Yi: China, Japan and South Korea need to know where their roots are, you won’t become Westerners]”

[17]Christoph Nedopil, China Belt and Road Initiative (BRI) Investment Report 2023 H1 – the first ten years, Shanghai, Green Finance & Development Center, FISF Fudan University, 2023.

[18] “China Belt and Road Initiative (BRI) Investment Report 2023 H1 – the first ten years”

[19] “新政陆续出台,这些省份如何当好稳外贸主力军 [How provinces can be main force in stabilising foreign trade?],” Yicai, April 10, 2023.

[20] Ministry of Foreign Affairs, The People’s Republic of China, June 12, 2023.

[21] “China, Honduras high-level business meeting held in Beijing,” Xinhua, June 11, 2023.

[22] Chen Qingqing & Bai Yunyi, “Exclusive: Honduras, China to sign 19 cooperation documents including BRI memorandum on Monday: Honduran diplomat,” Global Times, June 11, 2023.

[23] “Exclusive: Honduras, China to sign 19 cooperation documents including BRI memorandum on Monday: Honduran diplomat”

[24] Ministry of Foreign Affairs, The People’s Republic of China, June 12, 2023.

[25] Qingqing & Yunyi, “More Honduran products to be exported to China with lower cost, faster speed and more opportunities: Honduran official”

[26] European Chamber of Commerce in China, China Manufacturing 2025, 2017, Beijing, European Chamber of Commerce in China, 2017.

[27] Mingtang Liu & and Kellee S. Tsai, “Structural Power, Hegemony, and State Capitalism: Limits to China’s Global Economic Power,” Sage Journal 49, no. 2 (2020).

[28] Liu et al, “Structural Power, Hegemony, and State Capitalism: Limits to China’s Global Economic Power”

[29]Liu et al, “Structural Power, Hegemony, and State Capitalism: Limits to China’s Global Economic Power”

[30] Liu et al, “Structural Power, Hegemony, and State Capitalism: Limits to China’s Global Economic Power”

[31] Liu et al, “Structural Power, Hegemony, and State Capitalism: Limits to China’s Global Economic Power”

[32]Liu et al, “Structural Power, Hegemony, and State Capitalism: Limits to China’s Global Economic Power”

[33] “张志新:布林肯访华,为中美恢复对话提供机遇_言论 [Blinken visit and issue of Sino-US dialogue],” CFISNET.com, June 19, 2023.

[34] “张志新:布林肯访华,为中美恢复对话提供机遇_言论 [Blinken visit and issue of Sino-US dialogue],”

[35] “阎学通:中美战略竞争将走向何方 [Yan Xuetong: Direction of strategic competition between China and the United States],” Xinhua, April 28, 2023.

[36] White House, The United States Government.

[37] “金灿荣:中美关系新特点 [Jin Canrong: New features of China-US relations],”

[38] “习近平在广东考察时强调坚定不移全面深化改革扩大高水平对外开放在推进中国式现代化建设中走在前列 [In Guangdong tour, Xi pitches for reform and Chinese-style modernisation],” CCTV, April 13, 2023.

[39] “习近平在广东考察时强调坚定不移全面深化改革扩大高水平对外开放在推进中国式现代化建设中走在前列 [In Guangdong tour, Xi pitches for reform and Chinese-style modernisation],”

[40] “习近平在广东考察时强调坚定不移全面深化改革扩大高水平对外开放在推进中国式现代化建设中走在前列 [In Guangdong tour, Xi pitches for reform and Chinese-style modernisation],”

[41]“习近平在广东考察时强调坚定不移全面深化改革扩大高水平对外开放在推进中国式现代化建设中走在前列 [In Guangdong tour, Xi pitches for reform and Chinese-style modernisation],”

[42] “中共中央政治局召开会议分析研究当前经济形势和经济工作中共中央总书记习近平主持会议 [Politburo analyses the current economic situation],”Xinhua, April 28, 2023.

[43] “国家主席习近平发表二〇二三年新年贺词 [Xi delivers New Year's message in 2023],” People’s Daily, January 1, 2023.

[44] Hurun, Global Unicorn Index 2023, April 2023.

[45] “China’s techlash gains steam. Again,” The Economist, July 28, 2021.

[46] State Council, The People’s Republic of China.

[47] Hun Tran, “Dual circulation in China: A progress report,” Atlantic Council, October 24, 2022.

[48] Xiao Zibang, “Russia Overtakes Saudi Arabia as China’s Top Oil Supplier,” Bloomberg, June 20, 2022.; Danielle Balbi, “World’s Biggest Iron Deposit Lures China to Develop Pristine Mountain,” Bloomberg, 24 June 2022.; “China's Sinosteel Signs $680 Million Iron Ore Mine Deal With Cameroon,” USANews.com, May 20, 2022.

[49] State Council, The People’s Republic of China.

[50] State Council, The People’s Republic of China.

[51] State Council, The People’s Republic of China.

[52] “全面注册制时代开启!主板定位有调整,这些情况需上报证监会!建立发行人廉洁承诺机制,看八大要点 [Key rules by the China Securities Regulatory Commission],” Securities Times, Feb 1, 2023, http://www.stcn.com/article/detail/785015.html

[53] “全面注册制时代开启!主板定位有调整,这些情况需上报证监会!建立发行人廉洁承诺机制,看八大要点 [Key rules by the China Securities Regulatory Commission],”

[54] “高举伟大旗帜 谱写崭新篇章:新一届中共中央委员会和中共中央纪律检查委员会诞生记 [Hold High the Great Banner and Write a New Chapter: The Birth of the New Central Committee of the Communist Party of China and the Central Commission for Discipline Inspection of the Communist Party of China],” Xinhua, October 22, 2022.

[55] “Communique of the first plenary session of the 20th CPC Central Committee,” Xinhua, October 24, 2023.

[56] “习近平在中共中央政治局第三次集体学习时强调切实加强基础研究夯实科技自立自强根基, [Xi Jinping emphasises improving basic research and self-reliance in science and technology],”Xinhua, February 22, 2023,

[57] “习近平在中共中央政治局第三次集体学习时强调切实加强基础研究夯实科技自立自强根基, [Xi Jinping emphasises improving basic research and self-reliance in science and technology]

[58] “习近平在中共中央政治局第三次集体学习时强调切实加强基础研究夯实科技自立自强根基, [Xi Jinping emphasises improving basic research and self-reliance in science and technology]

[59] State Council, The People’s Republic of China.

[60] State Council, The People’s Republic of China.

[61] “中共中央国务院印发党和国家机构改革方案 [Party and State Institutional Reform Plan],” Xinhua, March 16, 2023.

[62] “中共中央国务院印发党和国家机构改革方案 [Party and State Institutional Reform Plan],”

[63] World Bank Group, and the Development Research Center of the State Council, P. R. China. 2019. Innovative China: New Drivers of Growth. Washington, DC: World Bank. DOI: 10.1596/978-1-4648-1335-1.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Kalpit A Mankikar is a Fellow with Strategic Studies programme and is based out of ORFs Delhi centre. His research focusses on China specifically looking ...

Read More +