-

CENTRES

Progammes & Centres

Location

PDF Download

PDF Download

Antara Vats, “Beyond the Hype: Developing Interoperability Standards for Digital Currency at the G20,” ORF Issue Brief No. 611, February 2023.

Introduction

Central Bank Digital Currency (CBDC), or public sector-issued digital currency, is increasingly gaining prominence in many parts of the globe.[1] CBDCs are poised to enhance access to financial services particularly for unbanked consumers, and facilitate market integration for emerging economies, as they can function even in regions that lack constant access to the internet.[2] They could also aid cross-border payments by prioritising policy motivations through design choices. Further, they can provide an efficient and cost-effective approach to facilitate cross-border payments by reducing the cost of maintaining multiple complex financial systems and limiting the friction caused by different time zones in processing payments.[3] CBDCs, unlike cryptocurrencies,[4] provide central banks with the ability to implement monetary policies to ensure stability and monitor inflation.

Perhaps most importantly, securing trust in digital currency backed by central banks will be easier[5] as it is coming from a single, trusted source.[6] The fall of Terra-LUNA USD,[7] a sizeable stablecoin, in May 2022, signals that economic stability provided by central banks is critical while financial systems are being reimagined to address the gaps in legacy systems.

However, CBDCs could lead to fragmentation in banking systems unless interoperability standards are incorporated in the initial stages. These standards include considerations from technical, business, regulatory and legacy perspectives; technical standards will ensure alignment on common protocols, identifiers and messaging formats to support seamless payments across different currencies, and regulatory standards will ensure consistency in regulatory guidelines over security and anonymity. Design principles—including privacy, resilience, completion, vendor neutrality, availability, finality, predictability and atomicity—will also need to be accounted for.[8]

This brief makes a case for India to leverage the opportunity of rising global interest in CBDCs, develop and outline interoperability standards on CBDCs at the G20, and ensure value alignment for cross-border payments. The brief outlines the work being done by the G20 to facilitate cross-border payments, particularly by pushing for the development of CBDCs and their interoperability standards; elaborates on the varied policy motivations of G20 economies for CBDCs, to establish challenges in aligning interoperability standards; and demonstrates why India should lead the task of outlining the interoperability principles for CBDCs.

Cross-Border Payment Infrastructures at the G20

As of 2022,[9] 105 countries across the globe were in the initial stages of exploring CBDCs, with nearly 50 of them having already started to develop and pilot their currency, while 10 have fully launched theirs. Sand Dollar,[10] a local CBDC in the Bahamas, has been in use for over a year, whereas China’s e-CNY[11] or digital renminbi has over 100 million users. Since CBDCs are largely in the developing and piloting stage, it is an opportune time to drive alignment to ensure that novel models of cross-border payments can co-exist and interact with existing national payment systems to avoid infrastructural vulnerabilities, fraudulent imitation, money laundering, and cyber-attacks.

Experiments that evaluate the efficiency and other considerations of multilateral platforms for CBDCs are well underway.[12] For instance, as part of Project mBridge, the People’s Bank of China (PBOC) partnered with the monetary authorities of Hong Kong, the United Arab Emirates (UAE) and Thailand, along with the Bank of International Settlements (BIS) Innovation Hub to test a multi-CBDC arrangement[13] using w-CBDC for cross-border payment settlements. The pilot concluded in October 2022 and demonstrated that multi-CBDC platforms can enhance the efficiency of payments, support local currencies for international payments, and reduce settlement risks. Interoperability between legacy clearing systems was ensured by the nature of the project and the common project. The project is currently at the stage of automating processes to guarantee interoperability.[14]

Moreover, central banks would be required to carefully assess and manage financial stability implications, define the authorisation process for each payment, and ensure that existing actors in the ecosystem such as intermediary banks are not adversely impacted by the use of CBDCs. The cost of developing, testing, processing and maintaining CBDCs will also be significant and would require central banks to collaborate on balancing the costs with the benefits.

At the G20, India proposed the discussion on the macroeconomic implications of CBDCs and its use cases as a priority within the finance track agenda[15] as part of the Finance and Central Bank Deputies meeting in Bengaluru in December 2022. Following India’s Finance Minister Nirmala Sitharaman’s announcement in the budget speech of 2022–23[16] on the introduction of the digital rupee (e₹) in 2022, RBI notified amendments in the Reserve Bank of India Act, 1934 to enable running the pilot and commencing[17] phased implementation of CBDCs in the wholesale and retail segments. RBI released a concept note on CBDCs in October 2022,[18] providing a background of its objectives and motivations for the e₹. The pilot test for wCBDC was conducted without any hindrances on 1 November 2022 for secondary market trades in government securities, with a total of INR 275 crores among nine banks, including the State Bank of India, Bank of Baroda, IDFC First Bank, and ICICI, through an account-based mechanism.[19] The rCBDC pilot project commenced on 1 December 2022 across four cities—New Delhi, Mumbai, Bengaluru and Bhubaneswar—using a token-based mechanism.[20]

The G20 presidencies since 2020—Saudi Arabia, Italy and Indonesia—emphasised the enhancement of cross-border payment infrastructure to ensure streamlined post-COVID recovery that prioritises the stability of financial systems by building on the work done by previous presidencies, especially since the global financial crisis of 2008.

In 2020, the Financial Stability Board[21] (FSB) and other international standard-setting organisations designed a three-stage roadmap to enhance cross-border payments for the G20. In the first stage, FSB provided an assessment of existing cross-border payment arrangements and presented the “Enhancing Cross-border Payments: Stage 1 Report to the G20”[22] to G20 Finance Ministers and Central Bank Governors (FMCBGs) in April 2020. Along with fragmented data standards limiting interoperability, inconsistent understanding of compliance requirements, differences in operating hours, differences in payment processes for each country and outdated legacy technology platforms, were identified as friction points. This report focused on utilising technological innovations and public–private partnerships to address identified gaps while remaining cautious of the risks by securing interoperability standards, legal certainty and oversight mechanisms.

In July 2020, BIS presented “Enhancing Cross-border Payments: Building Blocks of a Global Roadmap - Technical Background Report”[23] to FMCBGs, highlighting 19 building blocks across five focus areas to improve inefficiencies in current cross-border payment systems. The five focus areas are: aligning private and public sector vision on enhancing cross-border payments; coordinating oversight and regulatory frameworks; addressing existing gaps in legacy payment infrastructure and arrangements; enhancing data quality and market practices; and exploring the role of the new payment infrastructure to develop interlinkage options and enable efficient cross-currency payments. CBDC is one of the building blocks under the fifth focus area on exploring new payment infrastructures. The third and final stage provided an actionable roadmap, with “Enhancing Cross-border Payments: Stage 3 Roadmap”[24] in October 2020 providing next steps and possible timeframes. The roadmap was endorsed by the G20 economies in 2020 to address the most pressing challenges around cross-border payment systems.

The Italian Presidency of the G20 continued[25] to work on improving cross-border payments and achieving sustainable growth with the ‘three Ps’—people, planet and prosperity[26]—underpinning its approach. In October 2021,[27] Italy recognised quantitative targets for measuring and defining progress on cross-border payments in terms of cost, transparency, efficiency and access while building upon the roadmap. As such, Italy partnered with BIS on the Nexus Project[28] to connect similar instant payment systems[29] to improve transparency and reduce transaction costs as part of the workstream initiated by the G20 Saudi Presidency for enhancing cross-border payments. Ignazio Visco, Governor of the Bank of Italy, while explaining the G20’s priorities within the finance track stated that Global Stable Coins (GSCs) and CBDCs are closely related, share a transactional purpose, and may often complement each other. G20 had identified the high-level recommendations of the FSB on regulation and supervision of stablecoins under the presidency as mandatory criteria for jurisdictions developing stablecoin arrangements.[30] The recommendations emphasised the need to implement regulatory and oversight capabilities proportionate to the risks for GSCs. Italy also scheduled the first international financial architecture working group meeting to facilitate knowledge sharing on approaches to improve international payments as well as the financial and economic aspects of CBDC.

The Indonesian Presidency in 2022 identified CBDCs as one of the priority agendas[31] under the finance track and welcomed sustained discussions on CBDCs at the Third FMCBGs Meeting[32] in July 2022. The focus of the G20 TechSprint 2022[33] was on developing solutions to enrich various aspects of wCBDCs and rCBDCs for financial inclusion, enhanced distribution, programmability of money and interoperability. BIS, The International Monetary Fund (IMF) and World Bank also presented a joint report to the G20 on the “Options for Access to and Interoperability of CBDCs for Cross-border Payments”[34] in July 2022. The report highlighted the need to make decisions on interoperability at an early stage in the development cycle of CBDCs and ensure consensus with international partners on various design choices. It also presented the evaluation criteria for assessing cross-border CBDC arrangements based on principles of efficiency, resilience, assured coexistence and interoperability, financial inclusion, and absence of harm.

Policy Motivations

G20 economies such as China, Japan, India, Russia and South Korea have advanced to the development and pilot stage of CBDCs. This section expands on the interlinked yet distinct policy motivations guiding the CBDC development of most G20 economies.[35] Aspects that dominate the development of CBDCs include developing cash-like digital means of payment, boosting financial inclusion, strengthening competition between payments service providers (PSPs), enhancing efficiency, and reducing costs of providing financial services.[36]

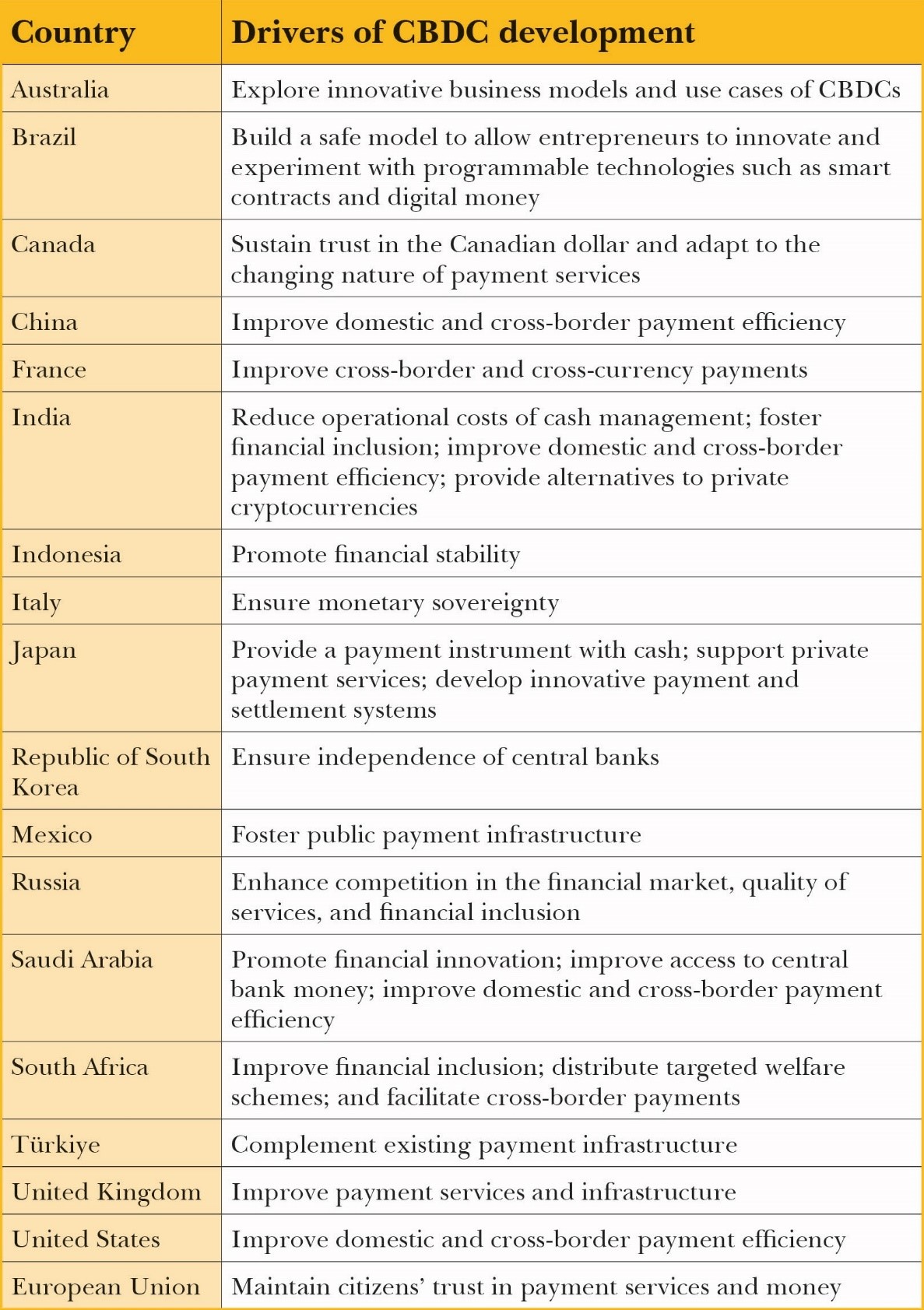

Table 1. Drivers of CBDC Design and Development in G20 Economies

Source: Author’s own, using official statements from Central Banks and other sources.

With diverse motivations guiding the development, as outlined in Table 1, aligning on interoperability standards remains a challenge. Differences in political systems and how monetary policy decisions are made by economies result in further complications. Disconnected payment systems that could result from this, such as to circumvent economic sanctions, will increase transaction costs for businesses in emerging markets.[37] For instance, Russia announced plans of doing business with China using the digital rouble[38] by 2023 following its push from the SWIFT system[39] in May 2022. PBOC is also intently expanding e-CNY’s user base beyond Russia to international trading partners,[40] particularly emerging economies, to circumvent the threat of being banned from SWIFT.

Moreover, China’s firm positioning on CBDCs may result in the United States (US) losing its leading influence over the global payments infrastructure.[41] While the dominant global payments currency is still the US Dollar, it has witnessed a gradual decline over the last two decades. According to an IMF working paper[42] published in March 2022, investments from US dollars are shifting towards e-CNY. The Biden-Harris Administration also recognises that the US cannot rely solely on stablecoins to ensure the dominance of the US Dollar and will have to consider investments in CBDCs. In the policy objectives[43] identified for the US Central Bank Digital Currency System in September 2022, the White House named the maintenance of US leadership in the global financial system and global dominance of the dollar a priority. With two completely divergent motivations steering the drive for CBDCs in both countries, the fragmentation of novel models of cross-border payments or the development of new economic blocs will limit the possibility of CBDCs to address issues with legacy financial systems.

India’s Stakes

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Antara Vats is an IIC-UChicago Fellow currently stationed at the Ministry of Electronics and IT Government of India where she works on projects related to ...

Read More +