-

CENTRES

Progammes & Centres

Location

India wants to raise share of natural gas in its energy mix to 15 percent in next few years from about 6.5 percent as the world’s third-biggest oil importer and consumer wants to cut its massive import bill and reduce its carbon footprint. GAIL (India) Ltd has also booked 1.5 mt a year re-gasification capacity at Dhamra LNG terminal in eastern Odisha state. The company’s current annual gas marketing portfolio comprises 14 mt. GAIL is currently is currently executing new 5,000 km of trunk pipeline across the country at an estimated cost of ₹ 250 billion. The company is also investing around ₹ 35 billion in the current financial year along with its joint venture partners and its subsidiary firm in setting up city gas distribution networks. GAIL had first started allowing open access to other entities for its pipelines in 2004. However, applications for access had to be given physically. The launch of the online portal for common carrier capacity is a step towards a functioning natural gas trading hub, the company said. Guidelines set by PNGRB the country’s downstream oil and gas regulator, stipulate providing 25 percent of the total pipeline capacity as common carrier capacity, for providing non-discriminatory open-access on first-come-first-served basis for transporting third party gas for a period of less than one year. The total earmarked common carrier capacity under GAIL’s pipelines, almost 33 percent of the capacity was used by third party transporters during the last financial year ended March 2018. Apart from re-negotiation of LNG contracts the company has started supplying gas through its own ships in the European and Middle-East markets based on delivered-ship basis. The first phase of Urja Ganga project that involves setting up gas pipelines will be commissioned in the current calendar year ahead of schedule. GAIL is the country’s largest natural gas company and operates more than 11,400 km of natural gas pipelines across the country.

A diversified supply base, the lure of fat margin, and the confidence earned with some recent overseas deals have boosted ambition at GAIL, which is now preparing to up its game in the international trade. GAIL’s gas marketing portfolio, including the locally-produced gas, is set to expand to 97 mmscmd in 2018-19 from 86 mmscmd in 2017-18, aided by overseas LNG supply. Of the 97 mmscmd, locally-produced gas comprises about 51mmscmd. Nearly a quarter of the balance 46 mmscmd of LNG supply has been tied up for sale to international customers with the remainder planned to be shipped to India. GAIL is also contemplating setting up an office in Europe to be close to customers—it already has offices in Singapore and Houston. It is planning to beef up its LNG trading desk, sharpen its hedging tools, and build a team of analysts to develop better insight into the international LNG market.

The railways signed an MoU with state gas utility GAIL to use natural gas in its workshops and production units. The aim is to replace industrial gases like dissolved acetylene, LPG and furnace oil/HSD with environment-friendly natural gas. In the first phase, around 23 workshops will use natural gas by 31 December. It will be expanded to all 54 workshops and production units, and railway establishments -- including base-kitchens, guest houses, hostels -- by 30 June next year. The use of natural gas has a potential to replace fuel worth ₹ 700 million per annum. GAIL and the Indian Railways Organization for Alternate Fuel would prepare a project report by 30 September.

ONGC has made oil and gas discoveries in Madhya Pradesh and West Bengal that may potentially open up two new sedimentary basins in the country. ONGC had previously opened six out of India's seven producing basins for commercial production. It is in the process of adding the eighth by putting Kutch offshore on the oil and gas map of India. The firm has found gas deposits in a block in Vindhyan basin in Madhya Pradesh that is being. ONGC has drilled four wells after the discovery and will now hydro-frack it by the end of the year to test commerciality of the finds. Similarly, an oil and gas discovery has been made in a well in Ashok Nagar of 24 Parganas district in West Bengal. ONGC is on the way to putting the Kutch offshore discovery to production. This would make Kutch India's eighth sedimentary basin. Cauvery was the last Category-I producing basin which was discovered in 1985. ONGC had made a significant natural gas discovery in the Gulf of Kutch off the west coast a few months back, which it plans to bring to production in 2-3 years. India has 26 sedimentary basins, of which only seven have commercial production of oil and gas. Except for the Assam shelf, ONGC opened up for commercial production all the other six basins, including Cambay, Mumbai Offshore, Rajasthan, Krishna Godavari, Cauvery, and Assam-Arakan Fold Belt. The discovery in Kutch offshore may hold about one trillion cubic feet of gas reserves.

The government may from October raise price of domestic natural gas by over 14 percent, a move that will translate into higher CNG price and increased cost of electricity and urea production. Price paid to most of the domestic producers of natural gas is likely to be hiked to $3.5/mmBtu from 1 October, from the current $3.06. Natural gas prices are set every six months based on average rates in gas-surplus nations like the United States, Russia and Canada. The price revision is likely to be announced shortly. India imports half of its gas which costs more than double the domestic rate. The $3.50/mmBtu rate would be for six months beginning 1 October and will be the highest since October 2015 to March 2016 when $3.82/mmBtu price was paid to domestic producers. The increase in price will boost earnings of producers like ONGC and RIL but will also lead to a rise in price of CNG, which uses natural gas as input. It would also lead to higher cost of urea and power production.

Royal Dutch Shell said it will acquire French oil major Total SA's 26 percent stake in the company that operates 5 mtpa Hazira LNG terminal in Gujarat. The size of the deal was however not disclosed. Hazira LNG & Port venture comprises two companies -- Hazira LNG that operates an LNG regasification terminal in Gujarat and Hazira Port, which manages a direct berthing multi-cargo port at Hazira. This portfolio action is consistent with Shell's strategy to deepen its presence in the gas value chain in India, the fourth largest LNG consumer in the world, Royal Dutch Shell said.

India has sought re-negotiation of the natural gas price it is to source through a proposed $10 billion TAPI pipeline in view of the slump in global energy markets. The four nations to the pipeline projects had in 2013 signed a gas sale purchase agreement that benchmarked the price of natural gas that Turkmenistan is to export at 55 percent of the prevailing crude oil price. This translates into a price of about $7.5/mmBtu at current oil prices at the Turkmen border. Added to this would be transit fee and transportation charges which would jack up the rates to over $10.5/mmBtu at the Indian border. For a consumer, the price would be around $13/mmBtu after adding local taxes and transportation charges. The price of Turkmen gas is more than double of the $3.6/mmBtu rate paid for post natural gas producers in India. Turkmenistan would export 90 million standard cubic meters per day of gas through TAPI, with Afghanistan getting 14 mmscmd and India and Pakistan 38 mmscmd each. India had previously used its position as world's fastest-growing energy consumer to renegotiate gas import deals with Australia, Russia and Qatar.

GE Power said it has got a ₹ 2.20 billion order to supply gas turbine and generator for a captive power unit planned at HPCL's refinery at Visakhapatnam. The order for the supply of a 6F.03 gas turbine and a generator was placed on it by BHEL - the principal contractor for the project. The HPCL Vizag order also marks the foray of GE's F-class technology into India's refinery segment, which offers a significant opportunity for technology upgrades in future, it said. GE's gas turbine fleet in the oil and gas sector in India comprises of an installed base of approximately 2.5 GW.

China appears set to once again boost its purchases of LNG for the northern winter, but unlike last year’s rush, this time the process is likely to be more organized and stable. In recent weeks there have been several indicators that China is planning on increasing the use of natural gas in winter heating, replacing boilers that use more polluting coal. Curbing winter air pollution has been a major aim of the authorities in Beijing, but they were stung by criticism last year that the switch to natural gas was made too quickly and the resulting shortages left some people without adequate heating. It’s often a challenge with China to work out exactly how official pronouncements will translate into real world action, but in all likelihood China is going to increase LNG imports in coming months. China imported about 4.55 mt of LNG in August, the highest since January, according to the shipping data.

China’s Sinopec expects to ramp up natural gas supplies by 1.8 bcm this winter to meeting increasing demand, the company said. Gas supplies for the winter of 2018 will be up 11 percent from the 15.1 bcm Sinopec provided last winter, according to company data. New supplies are mainly supported by the opening of the Tianjin receiving terminal and more production from domestic gas fields, Michael Mao, gas analyst with consultancy Sublime China, said.

China’s Sinopec Corp has teamed with Zhejiang Energy Group Company Ltd on a 3 mtpa LNG terminal in east China, with the first phase set for operation at end-2021. The project, to be built in Wenzhou of Zhejiang province, includes four tanks each able to store 200,000 cubic meters of LNG, a berth to dock tankers of 30,000 cubic meters to 266,000 cubic meters, as well as a 26 km(16 mile) pipeline. The two companies launched new entity Zhejiang Zheneng Wenzhou LNG Co Ltd that is 51 percent owned by the Zhejiang group, 41 percent by Sinopec and 8 percent by a local investment firm, Sinopec said. The Wenzhou terminal puts the Zhejiang group into China’s so-called “second-tier” of LNG players, which are local-government-backed city gas distributors that are emerging as new merchants in the global gas market.

PetroChina and local firms in southwestern Chongqing municipality started building a new underground storage for natural gas, as part of China’s efforts to boost supplies for the cleaner fuel, PetroChina’s parent CNPC said. The new facility, able to store 1.5 billion cubic meters of natural gas a year, will be built out of the depleting gas field Tongluoxia in mountainous Chongqing. Beijing has called state energy producers and local piped gas distributors to add storage facilities to cope with demand spikes, after a severe supply crunch last winter exposed the weak link in storages. When completed in 2020, the Tongluoxia storage will be able to supply 9 million cubic meters of gas Qatargas said it had agreed on a 22-year deal with PetroChina International Company, a unit of PetroChina Company, to supply China with around 3.4 mt of LNG annually, as the nation stepped up efforts to combat air pollution. The Qatari state-owned company will supply LNG from the Qatargas 2 project - a venture between Qatar Petroleum, Exxon Mobil Corp and Total - to receiving terminals across China, with the first cargo to be delivered this month. The deal allows flexibility in delivering LNG to Chinese terminals including those in Dalian, Jiangsu, Tangshan and Shenzhen, using the Qatargas fleet of 70 conventional, Q-Flex and Q-Max vessels, the company said. China requires LNG for its push to replace coal with cleaner burning natural gas, a way to reduce air pollution. After Beijing started the program last year, China has overtaken South Korea as the world’s second-biggest buyer of LNG. China’s LNG imports may surge 70 percent to 65 mt by 2020, according to consultancy SIA Energy. Last year, China imported a record 38.1 mt, 46 percent more than the previous year. Meanwhile Qatar, the world’s biggest LNG producer, is seeking buyers for a planned expansion of its output.

Russian President Vladimir Putin told German Chancellor Angela Merkel during a meeting that Russia would continue pumping gas via Ukraine to the rest of Europe. The Kremlin-backed Nord Stream 2 pipeline that aims to supply Russia’s natural gas to Germany is under persistent fire by the US and Ukrainian governments. Washington is pressing Berlin to halt the project.

Poland, unlike Germany, strongly opposes Russia’s plan to build a new gas pipeline across the Baltic Sea, and shares US opinion that the project would help strengthen Moscow’s market position. Berlin has given political support to the building of a new, $11 billion pipeline to bring Russian gas across the Baltic Sea called Nord Stream 2, bypassing traditional routes through Ukraine, despite qualms among other EU states. In July the US President criticised Germany for supporting the pipeline deal with Russia. Poland buys most of the gas it consumes from Russia but has taken steps to reduce that reliance. He reiterated Poland’s concerns that Nord Stream 2 was a harmful and political project that will strengthen Russia’s dominant position in the gas market and be a threat to Ukraine.

Russian natural gas producer Gazprom is revisiting plans to build a pipeline to South Korea across North Korea after noting signs of easing tensions on the Korean peninsula. Gazprom has long planned to build the natural gas pipeline to South Korea, but the project has not materialized amid decades of tension between the two Koreas.

LNG exports from Novatek’s Yamal terminal in the Arctic have come on stream faster than expected over the summer and exceeded volumes from Russia’s only other LNG facility, Sakhalin, for the first time in August. Novatek said it had begun commissioning the third train, or plant, and that its first two trains were running at capacity, which is 11 mtpa. Russian LNG exports amounted to 10.8 mtpa last year, almost all of which came from Gazprom’s Sakhalin-2 site. Full production at the current trains of Yamal and Sakhalin doubles Russian LNG output to just over 20 mtpa, making the country the fifth largest LNG exporter in the world.

Ghana has chosen two Chinese companies to build the infrastructure it needs to import liquefied natural gas, resurrecting the $350 million Tema terminal project that would make the country the first in sub-Saharan Africa to buy LNG. Tema LNG, backed by Africa-focused private equity firm Helios Investment, signed deals with China Harbour Engineering Company to build onshore facilities and Jiangnan Shipyard for a FSRU, the Ghanaian government said. LNG is expected to be sourced by Russian oil giant Rosneft , which has a 12-year deal to supply 1.7 mtpa with Ghana National Petroleum Corporation, although the project has had previous LNG suppliers lined up. Ghana has been trying to get an LNG import project off the ground for years, with two leading FSRU operators, Golar and Hoegh, earmarking their giant vessels for the country’s eastern Tema port only to withdraw due to delays over contracts. According to the government, the FSRU will be ready in 18 months which means first LNG imports potentially in March 2020, some 5 years after initial start dates when LNG projects were first proposed for Ghana. The terminal will be able to import 2 mtpa, leaving 0.3 mtpa of supplies either yet to be negotiated or free for spot deliveries.

Qatar Petroleum, the world’s top supplier of LNG, is talking to German energy firms Uniper and RWE about cooperating on a potential local LNG terminal. There were two ways of participating in an LNG terminal, either by securing capacity to open up supply, or by taking a stake in the terminal infrastructure. RWE, Germany’s largest power producer, said talks with Qatar Petroleum were about potential gas deliveries to Germany, not about a shareholding in a potential German LNG terminal. Germany, Europe’s largest energy consumer, shelved plans for an LNG terminal of its own a few years ago, with major operators participating in foreign projects - including Rotterdam’s Gate terminal - instead. However, talks about installing an LNG terminal have been revived in the wake of increasingly dynamic global flows of the fuel and discussions about its use in shipping to meet looming requirements for cleaner fuels. A consortium comprising Dutch gas network operator Gasunie, German tank storage provider Oiltanking and Dutch oil and chemical storage company Vopak, is currently trying to get such a project off the ground. A funding decision by the consortium, dubbed German LNG Terminal, expected by the end of 2019. Uniper said it has repeatedly pointed out that a German LNG terminal would be beneficial in light of declining gas resources in Europe, adding that Qatar Petroleum subsidiary, Qatargas, had been a strategic partner for years.

Venezuela will launch a new payment system for its heavily subsidized gasoline in border areas as part of a pilot program meant to reduce smuggling. The country’s gasoline prices, the lowest in the world, should rise to international levels.

US energy giant ConocoPhillips has asked Indonesia’s energy ministry to extend its operations in the Corridor natural gas block after its contract ends in December 2023. ConocoPhillips (Grissik) Ltd had submitted a letter regarding its Corridor plans but still needed to submit a formal proposal. Indonesia is pushing to nationalize more of its oil and gas assets as it tries to reduce imports and boost government revenue, but experts warn that this approach discourages investors and global energy companies with expertise crucial to maintaining its energy output. Corridor produced 828.4 mmcfd of natural gas on average from January to July this year and is expected to churn out 810 mmcfd in 2019, recent SKKMigas data showed.

EGAT is seeking to directly import LNG for the first time, as part of a government plan to boost competition in the power sector. Thailand joins other Asian countries such as China where LNG imports have risen exponentially over the past few years driven by strong economic growth and a push for cleaner air. EGAT is requesting expressions of interest for up to 1.5 mtpa of LNG via Thailand’s existing Map Ta Phut LNG Receiving Terminal in the eastern part of the country, according to a document issued by the company. EGAT, the country’s largest power producer, typically buys gas from state-owned PTT, which is Thailand’s sole gas supplier and its only LNG importer. EGAT is seeking expressions of interest for the delivery of LNG through an agreement with PTT’s LNG terminal for 4 to 8 years from March 2019, according to the document. The LNG will feed its power plants, including South Bangkok, Bang Pakong and Wang Noi, as part of Thailand’s target to increase competition in the downstream gas sector. PTT will be allowed to participate in EGAT’s tendering process. Expressions of interest are due by 31 August. EGAT also acquired access to 1.5 mtpa of regasification capacity from PTT LNG at the current terminal, over a 38-year period from 2019 to 2056, the document said. EGAT is also planning its own 5 mtpa FSRU in the Gulf of Thailand, expected to be ready by 2024, it said. The FSRU will be linked to Thailand’s existing gas pipeline network.

Premier Oil will press ahead with the development of the Tolmount gas field in Britain’s North Sea, which is expected to produce around 500 bcf of gas from late 2020. The approval of Tolmount is the latest in a series of moves by oil and gas companies showing their commitment to the North Sea, traditionally a high-cost environment which is experiencing a revival as costs have fallen. Premier expects to pay $120 million for the development, which includes a minimal facilities platform and a pipeline commissioned from Saipem leading to British energy group Centrica’s Easington terminal. Construction for the project, in which Dana Petroleum holds 50 percent, is to start this year. Centrica Storage Ltd, a subsidiary of the British energy company, said it had been awarded a 120 million pound ($153 million) contract to process gas from the field which will extend the lift of its Easington gas terminal in Yorkshire until at least 2030. Centrica said it will modify the terminal so it can receive and process the gas from the Tolmount field starting in the winter of 2020 when it is scheduled to come on stream. The field is expected to produce gas for 10 to 15 years. An ExxonMobil-operated gas project in Papua New Guinea has agreed a deal to supply LNG to a unit of British oil giant BP, Australia’s Oil Search Ltd said. The agreement will provide BP with about 450,000 tonnes of LNG annually over an initial three-year period, rising to about 900,000 tonnes for the following two years, Oil Search said. The company said that, on behalf of the project, ExxonMobil was in negotiations with several other parties over an additional 450,000 tonnes per year of supply. Oil Search resumed operations to produce oil at the Agogo Production Facility, which was knocked out by a major earthquake in Papua New Guinea in February.

The US energy regulator has approved a request by Cheniere Energy to feed the first gas into its new LNG facility in Corpus Christi, Texas, marking the beginning of a commissioning phase for the export terminal. The approval from the Federal Energy Regulatory Commission, issued, means Cheniere will be able to produce the first commissioning cargo by the fourth quarter of this year, if not earlier. Train 1 at the Corpus Christi facility will become the first LNG export terminal in Texas and the third functioning one in the US as the country ramps up the sale of the super-chilled gas to unprecedented levels in the coming years. Cheniere’s Chief Executive Officer, Jack Fusco, told analysts the facility would produce its first LNG in the fourth quarter, implying a commercial startup of the facility earlier than the slated first half of 2019. The LNG market looks out for facility startups not only because they ultimately add supply but because the commissioning cargos tend to be traded on the spot market, whereas initial commercial deliveries go to prearranged long-term buyers.

Japan’s Mitsubishi Corp said it has agreed to acquire 25 percent of Bangladesh’s Summit LNG terminal and plans to help develop an offshore receiving site in the South Asian country. The other 75 percent of the Summit LNG terminal will remain with Summit Corp. Summit LNG’s project plans call for a FSRU to be installed off the coast of Moheshkali, where it will receive and regasify LNG procured by Petrobangla, the country’s national oil and gas company. Construction of the terminal has already begun, with commercial operation expected to start in March 2019. The planned LNG import volumes are about 3.5 mtpa, Mitsubishi said. Summit and Mitsubishi have agreed to jointly pursue other LNG projects in Bangladesh, said the Japanese company, from the supply of the super-chilled fuel to power generation.

Panama will sign an agreement with the US Treasury and Energy departments aimed at paving the way for more private investment to expand the importation and distribution of US LNG in Latin America. The agreement is part of a Treasury-led initiative called America Crece, incorporating the Spanish word for growth, aimed at boosting US LNG exports, developing Latin American energy resources and downstream demand. The $1.15 billion AES facility on Panama’s Caribbean coast, which is expected to begin commercial generating operations on 1 September, and LNG tank distribution operations in 2019, took in its first US LNG cargo in June.

Norway’s Hoegh LNG has won a tender to supply a floating LNG import terminal for a consortium aiming to import liquefied natural gas to Australia’s east coast from 2020 in a push to boost local supply. Australian Industrial Energy, a consortium that includes Japan’s JERA and Marubeni Corp, said it signed an agreement giving it the right to lease one of Hoegh LNG’s FSRU, to be docked at Port Kembla. Wholesale gas prices have nearly tripled over the past two years following the opening of three LNG export plants on Australia’s east coast that have sucked gas out of the domestic market. To help fill the supply gap, Australian Industrial Energy and AGL Energy have advanced plans to import LNG. ExxonMobil Corp, the dominant gas supplier to the southeastern market over the past several decades from gas fields in the Bass Strait, and a private firm are also considering importing LNG from around 2021 or 2022.

PNGRB: Petroleum and Natural Gas Regulatory Board, ONGC: Oil and Natural Gas Corp, RIL: Reliance Industries Ltd, mt: million tonnes, km: kilometre, LNG: liquefied natural gas, mmscmd: million metric standard cubic meter per day, LPG: liquefied petroleum gas, HPD: high speed diesel, MoU: Memorandum of Understanding, CNG: compressed natural gas, mmBtu: million metric British thermal units, mtpa: million tonnes per annum, TAPI: Turkmenistan–Afghanistan–Pakistan–India, BHEL: Bharat Heavy Electricals Ltd, HPCL: Hindustan Petroleum Corp Ltd, bcm: billion cubic meters, CNPC: China National Petroleum Corp, US: United States, EU: European Union, mmcfd: million metric standard cubic feet per day FSRU: Floating Storage and Regasification Unit, EGAT: Electricity Generating Authority of Thailand, bcf: billion cubic feet

17 September. When petrol prices near the Rs 90 mark, Baba Ramdev, yoga guru and founder of Patanjali Ayurved, has claimed he could sell petrol and diesel at Rs 35-40 a litre if the government allows. Ramdev's tall claim that purports to show that petrol and diesel prices are not supposed to be as high as they are and can be reduced if the government wants, came along with his warning to the Narendra Modi government that rising prices can cost it dearly.

Source: The Economic Times

17 September. The Jharkhand Petrol and Diesel Association has called a strike on 1 October against the rising fuel prices. The association has demanded a decrease in the Value Added Tax (VAT). The prices of petrol and diesel in Jharkhand are currently Rs 80.80 and Rs 77.85 per litre respectively with a 22 percent VAT. Chief Minister Raghubar Das had said decreasing the VAT on diesel was not possible as the money generated from it was used for development. The rising prices have forced the Ranchi Bus Association to increase the bus fares up to Rs 30.

Source: Business Standard

17 September. Karnataka Chief Minister H D Kumaraswamy announced the coalition government's decision to cut petrol and diesel prices by Rs 2 per litre. The announcement comes in the wake of political pressure building against Kumaraswamy after Rajasthan, Andhra Pradesh and West Bengal governments reduced fuel prices. Andhra Pradesh Chief Minister N Chandrababu Naidu has cut taxes on fuel by Rs 2 and West Bengal Chief Minister Mamata Banerjee by Rs 1. Fuel prices have been climbing since 16 August. The rising fuel prices have created a political storm with the Opposition launching a scathing attack against the Narendra Modi government, which has cited international factors for it. Fuel prices are the steepest in Maharashtra and the lowest in Andaman and Nicobar.

Source: The Economic Times

13 September. Oil PSUs (Public Sector Undertakings) are scouting for discovered oil and gas fields in Russia as India looks to bolster energy ties with the resource-rich nation, Oil Minister Dharmendra Pradhan said. Indian PSUs have already invested $15 billion in picking up stakes in Russian oil and gas projects like Sakhalin-1, he said. ONGC Videsh Ltd in 2001 bought a 20 percent stake in the Sakhalin-1 project in Far East Russia. It further bought Imperial Energy a few years later and has recently invested in Vankorneft and TasYuryah along with Indian Oil Corp, Oil India Ltd and Bharat PetroResources Ltd. In return, Russian firm Rosneft has bought a majority stake in Essar Oil for $12.9 billion. Also, gas utility GAIL (India) Ltd has contracted 2.5 million tonnes per annum of LNG (liquefied natural gas) from Russia's Gazprom for 20 years, he said. India and Russia have deeply strengthened their hydrocarbon engagement and have built an 'Energy Bridge' between the two nations, he said.

Source: Business Standard

13 September. Punjab Finance Minister Manpreet Singh Badal said petroleum products should be brought under the purview of the Goods and Services Tax (GST) to maintain an uniformity in price across the country. Punjab has one of the highest rates of VAT (Value Added Tax) on petrol in the country and it is second to Maharashtra. The price of petrol in Punjab is over Rs 86 a litre, around Rs 7 per litre costlier than that in Chandigarh. The state levies about 36 percent VAT and surcharges on petrol. The Minister said that a one-day special session of the Punjab Assembly is likely to be convened in the first week of October for passing necessary amendments related to the GST.

Source: Business Standard

13 September. The ongoing Mumbai High South Redevelopment Phase III is expected to result in a cumulative increase in production of 7.547 million metric tonnes (mmt) of oil and 3.864 billion cubic meters (bcm) of gas in the next 10 years, Union Minister of State for Statistics & Programme Implementation Vijay Goel said. He said Phase III was approved in 2014 at a cost of Rs 6,068 crore and is slated for completion by March 2019. The final package involves complete topside deck replacement of 10 wellhead platforms, which has already been completed, he said. A MahaRatna company, the Oil and Natural Gas Corp (ONGC) owns and operates the Mumbai High oil and gas fields located in the Arabian Sea, around 175 kilometre north-west of Mumbai which became operational in 1974, besides having collaborations with oil and gas companies around the world.

Source: The Economic Times

12 September. Bharat Petroleum Corp Ltd (BPCL) looks to move out its liquefied petroleum gas (LPG) facility outside the Mumbai refinery location, as part of its efforts to strengthen safety measures at its facilities. The relocation of the LPG facility for the Mumbai refinery will be completed in the next two years. The relocation will help cut down truck movement near the facility by 43 percent. BPCL’s other refineries include its Kochi refinery and two others in Bina, Madhya Pradesh and Numaligarh in Assam, which are under joint ventures. BPCL’s Mumbai refinery had recorded fire accident in August, leading to a loss of about Rs 970 million. BPCL is developing an oil block in Brazil through a 50-50 joint venture with Videocon Industries. BPCL confirmed talks with various partners, including Kuwait Petroleum Corp for a partnership in its Bina refinery project. The company plans to increase its capacity at Bina from 6 million tonnes to 7.8 million tonnes (mt) and later to 15.5 mt in phases.

Source: Business Standard

12 September. The Delhi High Court (HC) refused to interfere in a public interest litigation (PIL) seeking the sale of petrol and diesel at reasonable prices instead of letting oil companies increase the rates exorbitantly. However, the court asked the government to consider an earlier representation pending before it on price rise of petrol and diesel and listed the matter for further hearing on 16 November. The petitioner has sought a directive to the Central government to fix a "fair price" of petrol and diesel in line with the Essential Commodities Act. The petitioner also alleged that the oil companies had stopped increasing the prices when the Karnataka election campaign was going on.

Source: Business Standard

17 September. From 1 October, domestically produced natural gas is set to cost more — its second steepest hike since the implementation of the New Domestic Gas policy, 2014. According to industry watchers, the price, which is revised every six months, will see an increase of 12-14 per cent from the current $3.06 per million British thermal units for the second half of FY19. Higher global crude oil and natural gas prices is seen to drive up the price at which domestically produced gas is sold in the country. The hike in natural gas price will push up the cost of compressed natural gas (CNG) and piped natural gas (PNG).

Source: The Hindu Business Line

12 September. The city residents will get the facility of compressed natural gas (CNG) by the end of this year. Pannu, a Former Chairman of Punjab Pollution Control Board, said during his earlier visits to the city, he had found several industries using garbage fuel. On other steps needed to reduce pollution in the state, Pannu said awareness was being created among farmers against paddy straw burning.

Source: The Economic Times

18 September. Coal India Ltd (CIL) has drawn up a plan to send 16 rakes per day to Tamil Nadu Generation and Distribution Corp (TANGEDCO) in view of its increased demand for the dry fuel. The state-run-miner's subsidiaries -- Mahanadi Coalfields Ltd, Eastern Coalfields Ltd and Central Coalfields Ltd will supply 13 rakes, two rakes and one rake, respectively. TANGEDCO reportedly asked for 20 rakes of coal per day. The Tamil Nadu government has decided to import about 30 lakh tonne of coal for its generation units, supply of which is expected to start from October. India's coal import is to the tune of about 200 million tonne per year. CIL has also requested Indian Railways to supply more rakes to ensure delivery of coal to TANGEDCO.

Source: Business Standard

17 September. Accusing the Modi government of promoting crony capitalism, the Congress asked it to come clean by appointing a special counsel in the Bombay High Court in a case of alleged over-invoicing of coal imports by industrialist Gautam Adani-led group. Congress spokesperson Jairam Ramesh alleged that the Gujarat government has accepted the recommendations of a three-member panel to raise the cost of power purchased from three private entities including Essar, Tatas and Adanis that will cost Rs 1.30 lakh crore in the next 30 years. He asked Prime Minister Narendra Modi whether his government would appoint a special counsel to defend the Directorate of Revenue Intelligence (DRI) for accepting its Letters Rogatory (LRs) to seek information on the alleged Rs 29,000 crore scam in over-invoicing of coal imports from Singapore. In March 2016, the DRI had initiated probe against some Adani Group firms for alleged overvaluation of coal imports from Indonesia between 2011 and 2015. He said the documents required to prove the Rs 29,000 crore coal scam are with Singapore branch of the State Bank of India (SBI). He alleged that a show cause notice has been served on four companies importing coal but not on Adani group, which is importing 80 percent of the total coal imported.

Source: Business Standard

16 September. Coal India Ltd (CIL) wants a policy on coal exports before it could finalise commercial contracts for exporting the dry fuel. Earlier, government was planning to export coal with high ash content or of higher grades. CIL was scouting for export opportunity at the time when pithead coal stock was high as close to 70 million tonne in May 2017. Pithead coal finds comparatively low interest due to evacuation and cost issues. With sudden spiralling demand from the power sector, the pithead stock had reduced to 23 million tonne now. In the recent months the miner was failing to fulfil coal demand for power and non-power sectors like aluminium and cement sector. CIL had revised its internal production target to 652 million tonne against 630 million tonne fixed earlier following pressure from the ministry to increase production.

Source: Business Standard

12 September. Coal India Ltd (CIL), which is looking to rationalise its underground mines in view of safety and financial viability, could close about 53 such mines this year, its Chairman Anil Kumar Jha said. He said manpower would "not be retrenched" if any mine is closed and workers would be re-trained and re-skilled for getting employed in other mines. The miner has 369 mines at the beginning of the current fiscal, of which 174 are underground, 177 opencast and 18 mixed mines. Coal production from underground mines in 2017-18 was 30.54 million tonnes (mt) compared to 31.48 mt during 2016-17. Production from opencast mines during 2017-18 was 94.62 percent of total raw coal production. However, the miner is also taking up new coal mining projects. A total of 11 coal blocks have been allotted to Eastern Coalfields, Bharat Coking Coal and Western Coalfields and these new blocks will help these subsidiaries produce more than 100 mt of coal per annum in the near future, he said. He said four coal mining projects with an ultimate capacity of 24.6 mt per annum and a total capital investment of Rs 4,155.46 crore were approved. He said there are 26 operational mines which are contributing more than 55-60 percent of total production. CIL has undertaken rail infrastructure projects for planned growth in production and sales and as many as 13 projects for coal evacuation have been identified, he said. He said two coking coal washeries were commissioned and plans are on the anvil to set up a non-coking coal washery in Odisha's Ib-Valley for which a letter of intention was issued.

Source: Business Standard

15 September. The Reserve Bank of India (RBI) has refused to be part of the cabinet secretary-led panel set up by the Prime Minister’s Office (PMO) in July to resolve issues of the stressed thermal power sector. The RBI has formally communicated to the government that the matter is sub judice and that its well-known views on handling loan defaults have already been articulated on many forums in the past. RBI kept away even as lenders and private companies expect the banking regulator to clarify on treatment of stressed assets till the next date of hearing on 14 November in Supreme Court (SC), which has ordered a status quo until then. The committee met for the second time after its first meeting on 31 August and discussed measures to alleviate the sectoral stress to a large extent. The terms of reference of the committee includes suggesting changes required in provisioning norms and obstacles in fuel supply, sale of electricity and payment problems that made many plants unviable. Companies had moved courts after RBI refused extension of deadline for completing resolutions of stressed power plants. While the Allahabad HC ruled in favour of RBI, the SC had ordered status quo on the projects and transferred all cases on the circular to itself.

Source: The Economic Times

15 September. Identifying that power demand and assured payment to power generating firms are major reasons for debt load, the Centre will pursue states for improving power procurement. In the second meeting of the High Level Empowered Committee (HLEC), the power ministry said it was in discussions with states for improving the power demand scenario. The HLEC has been formed under the Cabinet Secretary to formalise resolution plans for the power sector. The committee has members from the ministries of coal, power, finance and railways, and is to submit its report by 29 September. The first meeting of the HLEC was held on 31 August.

Source: Business Standard

14 September. The Himachal Pradesh State Pollution Control Board ordered the disconnection of power supply of 14 industrial units and hotels in the Shimla district. It was found that these units had been operating without obtaining a valid consent and renewal of consent as required under the provisions Section 25 of Water (Prevention and Control of Pollution) Act, 1974 and Section 21 of Air (Prevention and Control of Pollution) Act, 1981. Board’s member secretary R K Pruthi said these units were given ample opportunities to apply for the consent of the board through public notices in newspapers as well but they had failed to comply with the directions.

Source: The Economic Times

13 September. Power distribution companies in Gujarat, Uttarakhand and Andhra Pradesh are among the top performers while discoms (distribution companies) in Telangana, Haryana, and Hubli in Karnataka are severely lacking on key parameters, according to a latest study on the financial health of discoms by India Ratings. The Fitch group research agency analysed the performance of 19 discoms using data for two years – 2015-16 and 2016-17 -- and judged the discoms on key financial and operational metrics in a report. The performance indicators included power purchase cost, leverage, profitability, working capital, and operational efficiency. The report did not cover some of the largest discoms in the country including those in Uttar Pradesh, Bihar and Punjab.

Source: The Economic Times

13 September. Electricity sector regulators need to be market-oriented and stakeholder-friendly, Power Secretary Ajay Kumar Bhalla said. The government is injecting competition in the distribution sector through carriage and content separation. Once the carriage and content is separated in the distribution sector, consumers would be able to choose their power supplier as in the case of mobile telephone services. Bhalla stressed on the need for the power regulators, like state electricity commissions, to be market-oriented and stakeholder-friendly. The power ministry is taking concerted steps to simplify and rationalise power tariffs in the country through amendments in policies and provisions.

Source: Business Standard

12 September. The chances of tapping the 3,000 MW unexplored power potential in the Sutlej basin have brightened with the Centre giving nod for the laying of a transmission line near Wangtoo to evacuate power from the tribal districts of Kinnaur and Lahaul Spiti. Several mega projects have been in the pipeline but not executed for want of a transmission line. A high-level team from the Central Electricity Regulatory Authority and Powergrid visited the area to assess the feasibility of the almost 200 kilometre transmission line which would cost over Rs 3,000 crore. The state government too has shot off a letter to the power ministry following receiving the approval. Earlier, there was a proposal to have a provision for power evacuation through the Rohtang tunnel but since the move did not materialise, Himachal had been keen that a transmission line was laid to be able to evacuate power from Kinnaur and Lahaul Spiti.

Source: The Tribune

12 September. States pacing up to electrify 100 percent of the households under the Centre’s Saubhagya scheme has triggered an accelerated buying at the spot energy exchanges. Indian Energy Exchange (IEX), which has a whopping 97 percent share of online power trade has seen its volumes surging 22 percent to 14.43 billion units in April-June quarter. The power bourse closed FY18 with a trading volume of 46,214 million units, marking a CAGR (compounded annual growth rate) of 38 percent with FY2009 as the base year. Exchanges have 36 percent share in short-term power transactions. The short-term power market accounts for only 10.6 percent of the country’s total power purchase- the rest 89.4 percent is met by PPAs (power purchase agreements). Power deficit dogged the states of Jammu & Kashmir, Chhattisgarh, Gujarat, Uttar Pradesh and Puducherry in April-August. These states also witnessed rapid electrification of households under Saubhagya scheme. Jammu & Kashmir and Uttar Pradesh were saddled with the steepest AT&C (aggregate technical & commercial) losses at 53.8 percent and 37.9 percent respectively. The AT&C losses are unlikely to moderate in the year as the implementation of Saubhagya remains a top priority for states. The nationwide AT&C losses have widened to 23.1 percent in Q1 of this fiscal from 20 percent in 2017-18, a grim pointer to the slippages in the implementation of the UDAY (Ujjwal Discom Assurance Yojana) scheme. The Saubhagya or ‘Power for All’ scheme, launched in September 2017, targets 100 percent electrification of all households across the country by December 2018. At the time of the announcement of the scheme, there were 32.8 million un-electrified households. A year later, 19.5 million or nearly 60 percent of the households are still waiting to be electrified. As many as 8.8 million households were electrified during April-August period of the current fiscal. Uttar Pradesh lags other states with 31 percent of its households not electrified yet.

Source: Business Standard

12 September. A high level panel for power sector is considering payment security mechanism for private sector power generators, which has been the main cause of stress in the sector. The committee's meeting was held on 31 August, where detailed deliberations were done on ensuring payment for power supplied by private sector firms, Power Finance Corp Chairman and Managing Director (CMD) Rajeev Sharma said. He said that payments for supplied power to private sector generators has been an issue, which is one of the main reason for their stress as they are not paid for more than six months in some cases. Sharma was of the view that the state-owned firms, like NTPC Ltd, have an advantage as they get the payment well in time but private sector firms have to deal with the delay in the absence of any payment security mechanism.

Source: Business Standard

12 September. Madhya Pradesh Chief Minister (CM) Shivraj Singh Chouhan announced in Sarni town that state government will soon set up a new 660 MW power plant in Satpura. He said that government has made all preparations in the regard. He announced that two coal mines will also be started in the region to meet the requirement for the power plant.

Source: The Economic Times

18 September. Odisha Chief Minister (CM) Naveen Patnaik has launched a 'Star Rating program' for industries to strengthen State Pollution Control Board's (SPCB) regulatory efforts to reduce pollution. It is a first-of-its-kind transparency initiative to categorise industries from one to five stars compliant to pollution standards. The emerging pollution is a serious concern today and industrial pollution is the biggest contributor to that. Keeping all this in mind, the initiative was launched. It will also help citizens to identify the sources of pollution in their neighbourhood and city. Maharashtra Pollution Control Board (MPCB) has worked with researchers from Energy Policy Institute at the University of Chicago (EPIC India) and others to launch a similar program last year, but Odisha's program is first in India to utilize continually monitored emissions data captured in real time from major industrial plants.

Source: Business Standard

18 September. Gujarat's 500 MW solar tender results have delivered India's record low tariff of Rs 2.44 per kilowatt and this underpins the country's transformation to clean energy, US-based Institute for Energy Economics and Financial Analysis (IEEFA) said. Gujarat Urja Vikas Nigam Ltd (GUVNL) repealed the equivalent auction they held back in March which saw the lowest bid at an unacceptable Rs 2.99 per kilowatt. IEEFA notes the huge technology breakthrough potential of the new Pervoskite solar cells combined with bifacial modules, trackers and other innovations together which could see solar reach of up to 40 percent efficiency within a decade from sub-20 percent efficiency delivered by current Indian projects. With gains from production scalability the modules prices are on an accelerated deflation path and this will reflect on ever-lower solar tariffs in India, IEEFA forecasts declines of 10 percent annually for the next five-10 years.

Source: Business Standard

18 September. State Bank of India (SBI) announced its plan to go carbon neutral by 2030. SBI’s newly appointed Chief Financial Officer and Deputy Managing Director Prashant Kumar announced a slew of initiatives such as migrating to electric vehicles, installing solar panels on buildings and ATMs, and banning plastic in SBI office to cut down on the bank’s carbon emissions and go green. The SBI group announced the second edition of ‘SBI green marathon’ in 15 cities across the country. The Mumbai and Lucknow edition of the marathon will be organised on 28 October.

Source: The Economic Times

17 September. The Punjab State Electricity Regulatory Commission (PSERC) has decided to revise the renewable purchase obligations for Punjab State Power Corp Ltd (PSPCL) till 2022 by inviting suggestions from stakeholders while formulating the new norms. As per Section 86(1) (e) of the Electricity Act, 2003, the PSERC is to promote co-generation and generation of electricity from renewable sources of energy by providing suitable measures for connectivity with the grid and sale of power to any person. As per the proposal, Punjab is likely to seek 21 percent of its total power consumption from renewable sources by 2022. This would include 10.5 percent from non-solar renewable sources, including wind, biogas, small hydropower stations and 10.5 percent from solar generation. Till last year, the state was sourcing only 4.9 percent of renewable energy to meet the total power demand. As per the data submitted by the PSPCL, it has signed two purchase agreements for the procurement of wind power with the Solar Energy Corp of India (SECI) for 150 MW at a rate of Rs 2.72 a unit and 200 MW at a rate of Rs 2.52 a unit. As per these agreements, the said power is expected to be available in May 2019 and December 2019, respectively. The recent rates of wind power stood at Rs 2.51 per unit in the auction and that of solar power is between Rs 3.48 to Rs 3.55 per unit. The average variable charges of power bought from the independent power producers in the state for 2018-19 has been worked out to be Rs 2.45 a unit. Chairman and Managing Director (CMD) of the PSPCL Baldev Singh Sran said the corporation stood to strengthen its financial position with the increase in the renewable sources of energy. He said the move would also have a positive impact on the carbon footprint in the state.

Source: The Economic Times

15 September. Maharashtra Energy Minister Chandrashekhar Bawankule announced that the state would get 57,000 new solar farm pumps in the coming months. At present 7,500 such pumps have been installed in the state. Bawankule admitted that the target of installing 10,000 solar pumps had not been met by Maharashtra State Electricity Distribution Company Ltd (MSEDCL). Commenting on MSEDCL’s power tariff for 2018-19, he said it had not increased by more than 5% to 6%.

Source: The Economic Times

14 September. Trina Solar of China, the largest manufacturer of solar photovoltaic (PV) panels globally and India's biggest supplier, launched its Trinahome product as the country’s first solar home kit suitable for use in residences, SME (small and medium enterprises) establishments and other places like schools and hospitals. Announcing the India launch of the home kit, Trina President (Global Sales) Yin Rong Fang said while Trinahome is currently being imported from China, the company aims to assemble it locally in the coming months. The kit includes all the required solar rooftop components, includes modules, inverter, grid box and mounting system, and comes with a 25-year module performance warranty. It is available in capacities of 3 kilowatt (kW), 5 kW and 10 kW and has a dedicated app to enable customers to monitor power generation. Trina Solar India Director Gaurav Mathur said the price of the home kit would be announced soon. Mathur said that of the country's total solar energy capacity as at the end of July this year, 21.9 GW came from utility sources and only 1.2 GW from rooftop installations. Nearly 90 percent of India's solar panels are imported, while Indian manufacturers have to depend on accessories from China.

Source: Business Standard

14 September. Mahindra & Mahindra, India's leading manufacturer of utility vehicles and part of the $20.7 billion Mahindra Group, announced its commitment to become a carbon neutral company by 2040. For this, the company will be working with Environmental Defense Fund (EDF) to meet its carbon neutrality commitment. Mahindra & Mahindra will focus on energy efficiency and the use of renewable power to achieve this target. Residual emissions will be addressed through carbon sinks, the company said. Mahindra Group Chairman Anand Mahindra said science-based targets are a way of ensuring that ambition is stepped up and action is aligned to the target set by the 2015 Paris Climate Change Agreement. Using energy efficient lighting, efficient heating, ventilation, and air conditioning, motors and heat recovery projects, Mahindra & Mahindra has doubled the energy productivity of the automotive business almost 12 years ahead of schedule, the company said. The company was also the first Indian company to announce its internal carbon price of $10 per ton of carbon emitted to fund investments required to pursue the path of carbon neutrality. The company has more than 10 years of experience in creating carbon sinks. It looks forward to using this experience to deal with residual emissions in a manner that is world class and follows the best established protocols. The company is also a signatory of the science-based targets initiative which provides companies with a clear pathway for reducing emissions in line with the Paris Agreement's goal of limiting global warming to well below two degrees Celsius above pre-industrial levels. All these commitments are helping the company on its path to go carbon neutral.

Source: Business Standard

14 September. The Uttarakhand Jal Vidyut Nigam Ltd (UJVNL) would produce electricity from bagasse — leftover sugarcane waste — procured from sugar mills in Bazpur, Nadehi and Kiccha. This was decided at a meeting conducted by Chief Secretary Utpal Kumar Singh. It was decided at the meeting that the nigam would give power royalty to these sugar mills and would also undertake their modernisation. According to the state government, Bazpur sugar mill would produce 22 MW while Nadehi and Kiccha sugar mills would produce 16 MW of power each.

Source: The Economic Times

14 September. In a major relief to solar rooftop consumers, Maharashtra Electricity Regulatory Commission (MERC) has rejected the proposal of Maharashtra State Electricity Distribution Company Ltd (MSEDCL) to levy surcharge (wheeling charge) on solar rooftop prosumers at the rate of Rs 1.28 per unit. Installation of solar rooftop system brings them to lower consumption bracket and in subsidized tariff category thereby reducing MSEDCL’s revenue. More and more consumers are becoming subsidized instead of subsidizing. As of now, 65% of residential consumers use less than 100 units per month and hence are subsidized ones. Net metering of solar rooftop power will increase it further. The commission has also rejected MSEDCL’s proposal to levy surcharge on solar roof top prosumers though it has not given any reason for it. MERC has agreed to MSEDCL’s proposal of creating a separate tariff category for electric vehicle charging stations. These stations would be provided supply at high tension level and the tariff would be Rs 6 per unit. In addition, time of the day tariff will be applicable to it whereby the stations would get a discount of Rs 1.50 per unit at night while the day tariff would attract a surcharge.

Source: The Economic Times

14 September. The empowered standing committee of Patna Municipal Corp (PMC) approved a proposal to hire a Delhi-based firm to set up a solid waste management plant at Ramachak Bairiya on Patna-Gaya road. The company, AG Dauters Waste Processing Private Ltd, will set up an integrated plant based on German technology to process the solid waste generated in the city and produce energy, biodiesel and water as well. Patna mayor Sita Sahu, who chaired the meeting of the empowered standing committee, said door-to-door waste collection would also resume from 2 October.

Source: The Economic Times

13 September. Solar power agencies of the central and state governments have scrapped bids for projects aggregating 9,000 MW capacity, which will lead to a flat growth in capacity addition next year and delay the goal of achieving 1 GW of solar power capacity by 2022, industry data shows. The cancelled tenders represent half of the 18,000 MW bid out by these agencies till August. The cancellations coincide with the pace of solar capacity addition dropping 52% to 1,599 MW in the April-June period from 3,344 MW in the January-March period of 2018. Solar Energy Corp of India (SECI), the Central agency spearheading the National Solar Mission, and agencies of Maharashtra, Gujarat, Uttar Pradesh and Karnataka cancelled tenders after failing to attract tariff bids lower Rs 2.44 per unit — the lowest discovered during bidding of Rajasthan’s Bhadla solar park project in May 2017. Enthused by the rock-bottom tariff level, SECI introduced reverse bidding with a ceiling of Rs 2.50 per unit.

Source: The Economic Times

13 September. Hartek Solar said it has bagged orders for more than 100 kilowatt peak (kWp) rooftop solar projects from about 25 households in the city. With the 17 November deadline set by the UT administration for installing rooftop plants in kanal houses still two months away, the company expects more orders to come. Hartek Group Chairman and Managing Director (CMD) Hartek Singh said Hartek Solar would be targeting at least 100 rooftop solar installations in the city alone in the next six months, covering the residential, commercial and industrial categories.

Source: Business Standard

13 September. Hindustan Powerprojects is looking to acquire stressed thermal power plants, besides bidding for renewable energy projects in India. The private power producer, which had earlier put in a bid for Avantha Power’s 600 MW Jhabua power plant, has no plans to expand its capacity through new projects but is open to buys. On the renewable side, the company would bid for new projects since, thermal assets in distress were better than picking up stressed green power projects. At the same time, the company would be looking at opportunities overseas, especially in the Far East for solar power projects.

Source: Business Standard

12 September. Jharkhand government introduced electric vehicles for official use when its energy department got 20 such cars, Chief Minister Raghubar Das said. In the first phase, the energy department got 20 cars procured by the Energy Efficiency Services Ltd (EESL), a joint venture of the PSUs (Public Sector Undertakings) under the power ministry. Within the next two weeks, 30 more cars would be provided to the department, Das said. Das suggested that other departments and the common people start using such cars to make the state clean and green. Energy Department Secretary Nitin Madan Kulkarni said 12 charging stations have been set up so far in Ranchi and more charging stations will come up.

Source: The Economic Times

18 September. China’s diesel demand has peaked and gasoline will peak in 2025, while natural gas demand will increase over the next two decades to feed a massive gasification campaign, according to the research unit of China National Petroleum Corp (CNPC). China, the world’s top crude oil importer, will maintain annual crude oil production of 200 million tonnes, or about 4 million bpd, before 2030, CNPC said. Demand for diesel is waning amid moderating economic growth and tighter environmental scrutiny, while gasoline demand is capped by slowing growth in private car sales and the rise of electric and natural gas-fuelled vehicles. As additions to China’s refining capacity outpace the nation’s fuel demand growth, more than 50 million tonnes of surplus fuel is forecast for 2050, CNPC said. The country’s natural gas demand will reach 620 billion cubic metres by 2035, CNPC said.

Source: Reuters

18 September. Venezuela has sold 9.9 percent of shares in oil joint venture (JV) Sinovensa to a Chinese oil company, President Nicolas Maduro said. The OPEC (Organization of the Petroleum Exporting Countries) nation expected some $5 billion in joint investment with China to boost its crude output. Maduro said the Sinovensa sale formed part of plan to invest $5 billion over the next year in Chinese projects to double oil production and be able to send a million barrels per day to China. Venezuela’s oil production is at a 60-year low after years of little investment and crumbling infrastructure.

Source: Reuters

18 September. Oil output from seven major shale formations in the United States (US) is expected to rise by 79,000 barrels per day to 7.6 million barrels per day (mbpd) in October, the US Energy Information Administration (EIA) said. Production is expected to rise 31,000 bpd in the Permian formation of Texas and New Mexico, the EIA said. Output from five other major shale formations is expected to rise in the month. Output in the Haynesville shale, the smallest of the seven formations that the EIA tracks, was expected to be unchanged at 43,000 barrels per day in the month. Production per rig from new wells was expected to rise in all formations except for the Permian Basin, where it was expected to decline by nine barrels a day.

Source: Reuters

18 September. Oil majors Shell and Eni will be carefully monitoring a first ruling by a Milan judge in one of the energy industry’s biggest corruption scandals for clues to what might be round the corner for them. The two companies are embroiled in a long-running graft case revolving around the purchase in 2011 of one of Africa’s biggest oilfields - Nigeria’s OPL 245 - for about $1.3 billion. Nigeria’s OPL 245 is one of the biggest sources of untapped oil reserves on the African continent with reserves estimated at 9 billion barrels.

Source: Reuters

18 September. Russian Energy Minister Alexander Novak said that current high oil prices of between $70 and $80 per barrel were temporary and were mainly driven by sanctions. The long-term price would stand at around $50 per barrel. He said the $50 per barrel forecast was based on estimates by analysts and oil companies. He didn’t specify which sanctions he was referring to but oil traders are concerned about the potential impact of US sanctions on Iran and the effect on the availability of crude at the end of the year. He said that global oil markets remained “fragile” due to geopolitics and production declines in several regions and that Russia was ready to crank up oil output. He expected Russia’s oil production in 2018 to total 553 million tonnes (11.105 million barrels per day), up from around 547 million tonnes in 2017, and that production would peak at 570 million tonnes in 2021.

Source: Reuters

14 September. China’s Sinopec Corp has joined a group planning to build an oil refinery in Alberta, an enterprise that would strengthen demand for the Canadian province’s heavily discounted crude. Sinopec, formally known as China Petroleum & Chemical Corp, along with an Alberta indigenous group, China State Construction Engineering Corp and Alberta management company Teedrum, plan to build a refinery to process 167,000 barrels per day of crude into gasoline and other products, the project’s consulting firm Stantec Inc said. Most of Canada’s crude is produced in landlocked Alberta, where pipeline capacity has not expanded as rapidly as production. Resulting bottlenecks have hindered transportation to US (United States) refineries, steepening an already deep price discount for the province’s crude, which grew to a multi-year high. Sinopec’s interest is encouraging news for a Canadian sector that has seen foreign oil majors retreat over concerns about high production costs and the oil sands’ environmental toll.

Source: Reuters

13 September. Libya’s state oil firm NOC (National Oil Corp) said that it continued to manage its operations normally throughout the country, without loss of production, after a shooting attack on its Tripoli headquarters. However, the NOC has continued to function relatively normally across Libya, which relies on oil exports for most of its income. Oil output has been hit by attacks on oil facilities and blockades, though last year it partially recovered to around one million barrels per day.

Source: Reuters

13 September. World oil consumption will top 100 million barrels per day (mbpd) in the next three months, putting upward pressure on prices, although emerging market crises and trade disputes could dent this demand, the International Energy Agency (IEA) said. The Paris-based IEA maintained its forecast of strong growth in global oil demand this year of 1.4 mbpd and another 1.5 million bpd in 2019, unchanged from its previous projection. US (United States) sanctions on Iran’s energy industry, which come into force in November, have already cut supply back to two-year lows, while falling Venezuelan output and unplanned outages elsewhere will also keep the balance between supply and demand tight, the IEA said. The US and China have imposed a series of tariffs on each other’s goods since May that have unnerved equity markets, while a rising US dollar has put emerging market currencies under pressure, raising the energy bill for some of the world’s largest oil importers. Demand from nations not in the OECD (Organization for Economic Cooperation and Development) group of industrialised countries, led by China and India, is expected to rise by 1.1 mbpd to 51.6 mbpd this year and by 1.2 mbpd to 52.8 mbpd next year, the IEA said. Global demand will hit a high of 100.3 million bpd in the final quarter of this year, before moderating to 99.3 mbpd in the first quarter of next year, the IEA said. Demand for crude from the Organization of the Petroleum Exporting Countries (OPEC) will moderate in 2019 to 31.9 mbpd, from an estimated 32.3 mbpd this year, the IEA said.

Source: Reuters

13 September. Mexico has already contracted to cover a significant part of its oil hedges for 2019 that will guarantee export prices and revenues. Due to the government’s dependence on oil income to fund part of the federal budget, Mexico hedges its crude every year and the deals are closely watched by the market since the trades are big enough to affect prices.

Source: Reuters

12 September. OPEC (Organization of the Petroleum Exporting Countries) further trimmed its forecast for 2019 global oil demand growth and said the risk to the economic outlook was skewed to the downside, adding a new challenge to the group’s efforts to support the market next year. In a monthly report, the Organization of the Petroleum Exporting Countries said world oil demand next year would rise by 1.41 million barrels per day (bpd), 20,000 bpd less than last month and the second consecutive reduction in the forecast. The report provides further indication the rapid oil demand that helped OPEC and allies get rid of a supply glut will moderate in 2019. OPEC last month said global growth faced “numerous challenges”, although its latest report suggests concern about them has deepened. In the report, OPEC said its oil output rose in August by 278,000 bpd to 32.56 million bpd following the June deal. OPEC said the world will need 32.05 million bpd from its 15 members in 2019, unchanged from last month. This suggests there will be a 500,000 bpd surplus in the market should OPEC keep pumping the same amount and other things remain equal.

Source: The Economic Times

18 September. China set a 10 percent tariff on US (United States) liquefied natural gas (LNG) imports, extending a trade dispute into energy and casting a shadow over U.S. export terminals that would propel the US into the world’s second-largest LNG seller. Beijing said it would tax US products worth $60 billion effective 24 September in retaliation for tariffs imposed by US President Donald Trump in an escalating trade war. The rate was smaller than the 25 percent tariff China had touted earlier, which offered some relief and helped shares in listed US LNG companies climb. The tariffs undermine Trump’s drive to use US shale oil and natural gas to turn the United States into a global energy leader. The US is on track to export over 1,000 billion cubic feet (bcf) of gas as LNG in 2018. One billion cubic feet is enough to fuel about 5 million US homes for a day. But China, which purchased about 15 percent of all US LNG shipped in 2017, is now on track to buy less than 100 bcf of US LNG in 2018, less than last year, according to vessel tracking and US Department of Energy data. The country has taken delivery from just four vessels since June versus 17 during the first five months of the year. China imported 1.6 million tonnes, or 11 percent, of the 14.9 million tonnes of LNG exported from the US so far this year. That accounted for 5 percent of total Chinese LNG imports. The US has been looking to Europe to take on more of its natural gas as the China dispute continues. Germany said the country would decide by year-end where to locate a new LNG receiving terminal as a gesture to the Trump administration.

Source: Reuters

18 September. Germany will chose where to build a liquefied natural gas (LNG) terminal by the end of 2018 as a gesture to the United States (US) which wants to ship more gas to Europe, the economy ministry said. In a bid to deter US President Donald Trump from imposing hefty new trade tariffs on European Union (EU) goods, the EU said in July it would work to increase imports of US soybeans and LNG. Trump wants US LNG to compete with Russian natural gas exports in Europe. German firms are considering building an LNG terminal as gas demand rises in Europe and the Netherlands, one of Germany’s crucial suppliers which is winding down its giant Groningen field and plans to close it in 2030. German utility Uniper said it was ready to import LNG and distribute it should a terminal be built at Wilhelmshaven, close to its storage facilities.

Source: Reuters

17 September. US (United States)-based Cheniere Energy Inc said that it has signed a 15-year agreement to supply liquefied natural gas (LNG) to the world’s largest oil trader Vitol Group that has been steadily ramping up its presence in that market. The move by Vitol is part of a long-term objective shared by many major commodity traders to increase their traded gas volumes as emerging markets seek cleaner fuels for power generation. China in particular has soaked up what many analysts expected to be a significant LNG glut this year as it replaces some of its coal furnaces with gas-fuelled ones. Part of the drive for traders is that the LNG market is becoming increasingly liquid with more spot deals, presenting arbitrage opportunities and supply imbalances that traders thrive off. Cheniere said it will sell 700,000 tonnes of LNG per year to Vitol, starting in 2018 with a purchase price pegged to the Henry Hub monthly average, plus a fee. Last year, Vitol’s LNG traded volumes tripled to 7.4 million tonnes (mt) up from 2.6 mt in 2016. The US has become a major LNG exporter in the last two years, mostly due to the ramp-up of Cheniere’s Sabine Pass terminal in Louisiana. Houston-based Cheniere is also building the Corpus Christi terminal in Texas. Along with long-term supply deals, Vitol has been competing to build LNG import infrastructure in Southeast Asia, pitting itself against Gunvor and Trafigura in Pakistan and Bangladesh.

Source: Reuters

17 September. Russian liquefied natural gas (LNG) producer Novatek plans to sell some of its future production to China in yuan, its Chairman Leonid Mikhelson said. Novatek plans to produce 37.5 million tonnes (mt) of LNG by 2025, he said. The plan was to sell 80 percent of those supplies to Asia He said LNG demand globally could rise to 700 mt by 2030, up from 300 mt a year.

Source: Reuters

17 September. Pakistan increased natural gas prices by up to 20 percent, Petroleum Minister Chaudhry Mohammad Sarwar said, to help bridge a Rs 152 billion deficit for the two main suppliers - Sui Northern and Sui Southern. He blamed the deficit on the policies of the last government of now-jailed Prime Minister Nawaz Sharif.

Source: Reuters

18 September. Australian miner New Hope Corp said thermal coal prices would push higher in coming months, extending a rise that helped boost its profits in the last financial year. The company said its full-year pre-tax profit climbed 6 percent to A$149.5 million ($107.49 million) from $140.6 the year before, as markets for thermal coal priced in Australian dollars soared on the back of pollution-linked output curbs in major supplier China. Australian spot thermal coal cargo prices in recent months hit their highest in six years, and at $120 per tonne remain a third above lows in seen in April. New Hope, one of Australia’s main coal miners, is waiting on approval to extend its Acland operations in the state of Queensland, with regulators set to consider the move in early October. New Hope sells most of its coal to Japan and Taiwan, ahead of China. It has also seen a pick up in demand from Vietnam.

Source: Reuters

17 September. South African power utility Eskom said that it had less than 20 days of coal supplies at 10 of its 15 coal-fired power stations, posing a threat to national power supplies. Cash-strapped Eskom is critical to Africa’s most industrialised economy as it supplies more than 90 percent of its power and is one of its most indebted state firms.

Source: Reuters

16 September. German utility RWE, its works council and trade unions say they oppose plans to end coal-fired power generation in Germany around 2035, raising questions over a possible compromise between a government commission and environmentalists. Coal-to-power production both from brown coal and imported hard coal accounts for 40 percent of Germany’s total power production, making the exit from coal difficult while maintaining reliable supply to industries and households. Utility companies such as RWE and Uniper have said they are prepared, having absorbed declining coal plant revenues due to competition from renewable power and developed their own phase-out plans stretching into the 2040s. The commission will try to broker compromises and help allocate federal funds to bring new industries into regions that are now dependent on coal mining.

Source: Reuters

17 September. Shares in top global aluminum producer China Hongqiao Group tumbled a second day after its home province of Shandong announced new fees for onsite power plants. The declines came after the Shandong commodity price bureau said owners of captive power plants would have to pay 0.05 yuan ($0.0073) per kilowatt hour (kWh) of electricity generated from July 2018, rising to 0.1016 yuan per kWh after the end of 2019. China wants to curb the use of onsite coal-fired electricity plants - which provide cheaper power than the grid - as part of a campaign for cleaner air. Shandong is one of the first provinces to publish such fees after China’s top economic planner, the National Development and Reform Commission, said in July it would force factories with onsite power plants to pay fees to help fund $12 billion in cuts to commercial and industrial electricity prices.

Source: Reuters

18 September. President Vladimir Putin said that the Russian state atomic energy firm Rosatom would start the construction of two new reactors at the Paks power nuclear plant in Hungary soon. Hungary plans to expand its Paks nuclear power plant and build two Russian VVER 1200 reactors.

Source: Reuters

18 September. Carbon prices in major advanced economies are too low to cut greenhouse gas emissions and stave off the worst effects of climate change, the Organization for Economic Cooperation and Development (OECD) said. Carbon pricing, via taxes or emissions trading schemes, is used by many governments to make energy consumers pay for the costs of pollution, and to spur investment in low-carbon technology. The OECD examined carbon pricing between 2012, 2015 and 2018 in 42 OECD and G20 economies, which represent around 80 percent of global carbon emissions.

Source: Reuters

17 September. China will speed up efforts to ensure its wind and solar power sectors can compete without subsidies and achieve “grid price parity” with traditional energy sources like coal, according to new draft guidelines issued by the National Energy Administration (NEA). As it tries to ease its dependence on polluting fossil fuels, China has encouraged renewable manufacturers and developers to drive down costs through technological innovations and economies of scale. The country aims to phase out power generation subsidies, which have become an increasing burden on the state. The guidelines said some regions with cost and market advantages had already “basically achieved price parity” with clean coal-fired power and no longer required subsidies, and others should learn from their experiences. China’s solar sector is still reeling from a decision to cut subsidies and cap new capacity at 30 GW this year, down from a record 53 GW in 2017, with the government concerned about overcapacity and a growing subsidy backlog. According to the NEA, the government owed around 120 billion yuan ($17.46 billion) in subsidies to solar plants by the middle of this year.

Source: Reuters

14 September. Most new diesel vehicles exceed the legal limit for nitrogen oxide (NOx) emissions, German environmental lobby group DUH said, calling on the government to force car companies to carry out hardware retrofits of polluting cars. Almost three years after Volkswagen admitted to deliberately cheating US (United States) pollution tests, Germany’s car industry, which employs some 800,000 people and is the country’s biggest exporter, is under intense pressure to cut diesel fumes.

Source: Reuters

13 September. Procurement of solar energy by US (United States) utilities “exploded” in the first half of 2018, prompting a prominent research group to boost its five-year installation forecast despite the Trump administration’s steep tariffs on imported panels. A record 8.5 GW of utility solar projects were procured in the first six months of this year after President Donald Trump in January announced a 30 percent tariff on panels produced overseas, according to the report by Wood Mackenzie Power & Renewables and industry trade group the Solar Energy Industries Association. As a result, the research firm raised its utility-scale solar forecast for 2018 through 2023 by 1.9 GW.

Source: Reuters

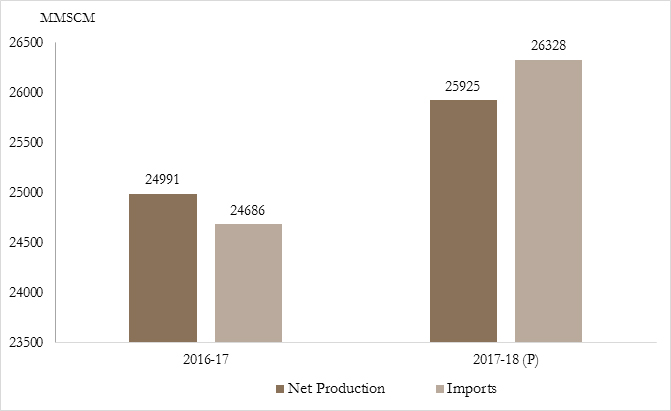

MMSCM

| Company | Gross Production | Net Production for Sale | ||

| 2016-17 | 2017-18 (P) | 2016-17 | 2017-18 (P) | |

| ONGC | 22, 088 | 23, 429 | 17, 059 | 18, 553 |

| OIL | 2, 937 | 2, 882 | 2, 412 | 2, 365 |

| Pvt/JVs | 6, 872 | 6, 338 | 5, 520 | 5, 007 |

| Total | 31, 897 | 32, 649 | 24, 991 | 25, 925 |

Availability of Natural Gas for Sale