-

CENTRES

Progammes & Centres

Location

COAL SHORTAGE AMIDST PLENTY?

CIL the world’s biggest miner, has pushed back its ambitious 1 bt production target by at least two years owing to the existing ground realities. The government had earlier set a target of 1 bt coal output by FY2019-20. Although CIL has been investing towards establishing railway connectivity with its mines and procuring rakes in order to evacuate more coal, a sharp rise in renewable energy sources is compelling the miner of the dry fuel to review its earlier production goals, the company has said. CIL subsidiary Northern Coalfields and the railways are jointly investing around ₹ 60 billion in Madhya Pradesh to lay new tracks and converting the existing ones into double gauge enabling it an additional 15 mt of the fuel capacity. CIL has said that there was an urgent need to revisit its 1 bt output programme following changes in the environmental paradigm and coal demand. The company had produced 567 mt coal in FY18 and targets to produce 630 mt in the current fiscal.

India’s coal demand rose 7.5 percent to about 900 mt in the year ending March 2018. Coal is expected to remain India’s main energy source for the next three decades, even as the country encourages the use of renewable power generation. India, the third world’s biggest greenhouse gas emitter and one of the world’s largest coal producers, depends on coal for about three-fifths of its energy needs. India’s coal imports are expected to rise in 2018 after two consecutive years of decline, in what would be a setback to the government’s plans to reduce dependence on foreign supplies. India’s thermal coal imports rose by more than 15 percent in the first three months of 2018.

In the beginning of 2018-19, CIL had a pithead stock of 55.55 mt and stock at Power House end was 16.27 mt. In the 1st quarter of 2018-19, CIL dispatched a record quantity of 122.2 mt coal to Power Sector, thereby achieving a growth of 15% over the dispatch in the corresponding period of last year. The growth in dispatch of coal to Power Sector has helped coal based generation to achieve positive growth of 5.3% in the 1st quarter of 2018-19. Coal supplies to Power sector is monitored regularly by an Inter Ministerial Sub Group comprising representatives of Ministries of Power, Coal, Railways, Shipping, Central Electricity Authority, NITI Aayog, CIL etc.

CIL said it produced 177.43 mt of coal in the first four months of the ongoing fiscal, registering a growth of 14 percent. It had produced 155.53 mt of coal in the year-ago period, CIL said. In July CIL produced 40.56 mt coal, against 36.69 a year ago. The state-owned firm accounts for over 80 percent of the domestic coal production. CIL has pegged its production estimate at 630 mt in 2018-19. Coal supplies by CIL to thermal power plants perked up to 161.71 mt during the April-July period of the current fiscal, compared to 140.50 same period last financial year, it said. The increased supply was a result of higher rake loading to power sector which witnessed a growth of 12.5 percent during the referred period. With an assessment suggesting the current trend may not warrant pursuing the projected coal output target of 1 bt by 2020, the government had in April gave indication of revising the production target of the dry fuel. The government had earlier set a target of 1 bt of coal output by 2019-20 for CIL. However, the government had in December last year said that of 1.5 bt the country is expected to produce by 2022 and of this, 1 bt would come from CIL.

According to the government, the recent decision of the Union power ministry to allow states to import coal is temporary in nature. Union power ministry has recently red flagged coal shortage for power plants for the next 2-3 years and allowed states to import the fuel. There had been constant growth in coal production and dispatches by the CIL and explained that at times imports might be needed as a stop-gap arrangement for states to meet sudden rise in demand. Coal production had registered a 15.2 percent growth during the first quarter ended June 2018 to 136.87 mt and supply to power plants also jumped by 15.4 percent to 122.84 mt during the quarter. This resulted in lower coal imports by the power industry by nearly 15 percent during April-May this year. CIL is trying to rationalise coal supplies to power companies based on demand and stock lying with them in order to optimise power generation in the country.

India’s Adani Group expects an over six-fold rise in coal mining volumes by the end of fiscal year 2021, despite its struggle to develop a coal project in Australia. Adani’s coal mining volumes are expected to be 80 mt by the end of March 2021, from 12.17 mt at the end of fiscal year 2017. The group’s coal handling volumes are expected to rise 57 percent to 127 mt by the end of 2021. Higher consumption in China, along with rising Indian imports, has been a major driver behind the strong recovery seen in benchmark Australian coal prices this year. The capacity at Adani ports-operated Dhamra port, located in the mineral rich state of Odisha, will be quadrupled to 80 mt per year.

CIL will supply 4.65 mt of coal a year for the cement industry for five years through e-auctions. It had recently offered 7 mt to sponge iron firms, and received bids that were 39% higher than the notified price for the non-power sector. The company hopes to garner similar premiums from cement producers as the sector faces a shortfall as coal was diverted to fuel-starved power plants. According to the CIL, of the 4.65 mt on offer annually, 1.14 mt can be procured each year through the railways, while the rest 3.51 mt would be supplied through roadways.

CIL has identified seven coking coal assets in Australia for acquisition and is also in discussions with a few mine owners in Canada, a parliamentary panel said. The panel appreciated the work of the government in bringing down the import of non-coking coal. However, the panel was of a view that the use of indigenous coal by the imported coal-based thermal power plants is dependent on policy interventions by the Centre for allowing use of domestic coal along with imported coal as the existing consent is for use of imported coal only. The panel, while appreciating the efforts being initiated to operationalise the auctioned and allotted coal blocks, said that the issues which hinder operationalisation of these blocks should be addressed by the government in consultation with all stakeholders so that coal mine projects may commission expeditiously.

CIL has managed an average premium of 39% on 6.38 mt of coal it auctioned to sponge iron customers, helping the state-run coal monopoly get additional annual revenue of ₹ 12.48 billion for five years. If these supply contracts were awarded on nomination basis, it would have earned about ₹ 3.5 billion less, the company said. That is because the average price realised at the auction was ₹ 1,955.8/tonne, while the average notified price of the coal on offer was ₹ 1,407.6/tonne. The price is 59% higher than what is charged to power sector consumers. CIL sold 88% of the 7.27 mt in contracts for a minimum period of five years in the auction that spanned 18 days from June 26, the company said. Mahanadi Coalfields, one of the largest subsidiaries of the company, got a 50.6% premium over the notified price for 2 mt of coal that was offered and fully booked. This will help it raise sales by ₹ 3.11 billion a year. South Eastern Coalfields, which offered 3 mt of a higher grade coal, got a premium of 44.8% over notified price, which will help it add ₹ 7.19 billion a year to its revenue. Eastern Coalfields managed a premium of 31.3% by offering 50,000 tonne of coal that would fetch the company around ₹ 160 million annually. It managed an average price of ₹ 4,145/tonne at the auction.

The government’s green panel has disapproved amendments to the environment clearance sought by Bharat Coking Coal for its Jharia Coalfields in Jharkhand due to the absence of forest clearance, as per the official document. The company’s proposal was to amend the existing environment clearance given for the cluster XI group of mines that has a peak production capacity of 6.6 mtpa and Moonidih water capacity of 1.6 mtpa. The amendment sought was for change in capacities of individual mines in the cluster and lease hold areas for implementation of the master plan. The company has sought amendment for increase in capacity of two individual mines namely, Gopalichak Colliery and Kendwadih colliery without any change in combined peak production capacity of 6.6 mtpa, and in the same mine lease area of 3527.58 hectare.

Tamil Nadu’s power utility imported poor quality coal during 2012-16, resulting in excess payment of ₹ 8.14 billion, the CAG has found, recommending an investigation. The audit also found that the Tamil Nadu Generation and Distribution Corp released ₹ 57.67 billion to supplier of 60% of the coal consignments without obtaining a mandatory COO, a violation of its own tender conditions. The consignments which CAG said were without COO were from Indonesia, country of origin of coal imports in the Directorate of Revenue Intelligence letter. As per tender conditions, CAG said, the GCV of imported coal was to be 6,000 kilo calorie per kilogram. Price was to be adjusted according to a formula if GCV went below 6,000.

The government is considering the recommendations of a sub-group with regard to revision of present royalty rates on coal. The Centre had earlier set up a sub-group under the Chairmanship of Coal Additional Secretary for examining the issue of revision of royalty rates on coal and lignite. In the last three financial years and in 2018-19 (till 31 July), two mines — Marki Mangli-I and Majra in Maharashtra — have been auctioned to Topworth Urja and Metals and Jaypee Cement Corp, respectively.

Japanese utilities and global mining giant Glencore have settled an Australian thermal coal import contract for April 2018-March 2019 at $110 a tonne. The deals were struck between Glencore and Japanese utilities such as Shikoku Electric, Chugoku Electric and Kansai Electric after bilateral talks. The deal marks a breakthrough after Japan’s Tohoku Electric and Glencore, the world’s biggest exporter of seaborne thermal coal, failed earlier this year to agree an annual supply deal which had in the past been used as an industry benchmark. At $110 per tonne, the contractual price came in nearly 30 percent higher than an annual supply price a year earlier, and is 16 percent above a deal for October 2017-September 2018, reflecting a tighter global market for the world’s dominant power generation fuel. Australian spot thermal coal cargo prices have hit several six-year highs in the past months, and at $120 per tonne remain a third above this year’s lows from April, pushed up by a heatwave across the northern hemisphere this summer as well as output cuts in China, the world’s biggest consumer of coal. The deals between Japanese utilities and Glencore give coal markets welcome clarity after Tohoku and Glencore abandoned their talks on an annual contract which traditionally set prices for the region. With annual imports of around 115 mt Japan is one of the world’s biggest importers of thermal coal. Its utilities buy around 40 percent of all Australian thermal coal exports.

Three South Korean firms were caught importing coal and iron from the North last year, Seoul said. More than 35,000 tonnes of North Korean coal and iron worth 6.6 billion won ($5.8 million) were imported into the South between April and October last year, the Korea Customs Service said. News of the apparent breach comes after a UN report accused the North of evading sanctions by continuing to export coal, iron and other commodities as well as carrying out illegal ship-to-ship transfers of oil products at sea.

South Korea plans to increase its tax on thermal coal, while lowering the tax on LNG to support the use of cleaner fuels for power generation, the finance ministry said. The ministry said that it will increase the tax on thermal coal by 10 won to 46 won ($0.0412) per kilogram reflecting environmental costs of using the fossil fuel. South Korea generates more than 70 percent of its power from coal and nuclear, while renewables account for 6 percent, but the country aims to gradually phase out coal and nuclear power. The revised tax is expected to go into effect from 1 April 2019, should the government plan be approved by parliament.

At least four cargoes of US coal worth $30 million are headed to China as Beijing prepares to hit imports with hefty 25 percent tariffs, threatening a niche supply of the fuel even as China’s appetite for foreign coal shows no sign of abating. The vessels, carrying a combined 335,000 tonnes of coal, are the only confirmed cargoes in transit from the US to China, and are scheduled to land in time to avoid the new duties. The penalties will come into effect on 23 August after Washington plans to start collecting duties on Chinese products of the same value. Coal was also in the draft list issued in June. The US shipped 3.2 mt of coal to China last year, up from less than 700 tonnes in 2016, making it China’s seventh largest supplier, although well behind top supplier Australia with nearly 80 mt.

Australia’s Wesfarmers Ltd has agreed to sell its last coal asset for A$860 million ($635 million), taking advantage of a surge in coal prices, as the conglomerate embarks on the biggest overhaul of its portfolio in a decade. The sale of its 40 percent stake in the Bengalla thermal coal mine to New Hope Corp at a big profit follows Wesfarmers’ sale of its Curragh mine last December, and a less glorious exit from a disastrous foray into British hardware. New Hope agreed to pay virtually the same price for the stake from Wesfarmers as it paid in 2016, even though coal prices are more than double what they were when it bought global miner Rio Tinto’s stake in the mine. The other partners in Bengalla, Taiwan’s Taipower and Japan’s Mitsui, with 10 percent each, have pre-emptive rights to match New Hope’s offer, but didn’t exercise those rights when coal prices were much lower.

Chinese thermal coal futures surged by the most since August 2017 as traders with bets on falling prices paid up to close out their positions in the market. The most-actively traded coal futures on the ZCE, for September delivery, soared as much 5.5 percent to 622 yuan ($91.06) a tonne, the biggest intra-day percentage gain since 25 August 2017. The top 20 futures brokers in the coal contract held 13,463 more short positions than long positions, or bets for rising prices, according to data from the ZCE. Indonesia is unlikely to change its rules on domestic coal supply and pricing until 2019, amid government discussions on how Southeast Asia’s biggest economy can increase its export revenues. Proposed revisions to rules introduced in March requiring Indonesian coal miners to sell 25 percent of their thermal coal output to domestic buyers, with a price capped at $70 per tonne for coal sold to state electricity utility Perusahaan Listrik Negara.

Germany’s hard coal imports may fall for the third year in a row this year and by 12 percent from 2017 levels, importers group VDKi forecast. The group forecasts imports of 45 mt in 2018. Total imports of 51.2 mt in 2017 were already down 10.2 percent from a year earlier, and well below a full-year prediction for 2017 of 54.6 million made by VDKi a year ago. Some 70 percent of the coal imported in Europe’s biggest economy goes to power utilities, a quarter to steelmakers and the remainder to heat providers, influencing global coal trade flows and prices at landing ports. Power generation based on coal declined 20.9 percent year-on-year in the first four months of 2018, VDKi managing director Franz-Josef Wodopia said. Coal suppliers to Germany, including Russia, the US, Colombia, South Africa and Australia, stand to lose.

CIL: Coal India Ltd, bt: billion tonnes, FY: Financial Year, mt: million tonnes, CAG: Comptroller and Auditor General, COO: Certificate of Country of Origin, GCV: gross calorific value, UN: United Nations, LNG: liquefied natural gas, US: United States, ZCE: Zhengzhou Commodity Exchange

21 August. Petrol and diesel will not come under the purview of Goods and Services Tax (GST) in the immediate future as neither the central government nor any of the states are in favour on fears of heavy revenue loss. When the one-nation-one-tax regime of GST was implemented in July last year, five petro-products — petrol, diesel, crude oil, natural gas, and aviation turbine fuel (ATF) — were kept out of its purview for the time being. The Union finance ministry has not mooted any proposal to bring petrol and diesel or even natural gas under GST but took up the issue at the last GST Council meeting on 4 August based on media reports. If the two fuels are put under GST, the Centre will have to let go Rs 200 billion (Rs 20,000 crore) input tax credit it currently pockets by keeping petrol, diesel, natural gas, jet fuel and crude oil out of the GST regime. The Centre currently levies a total of Rs 19.48 per litre of excise duty on petrol and Rs 15.33 per litre on diesel. On top of this, states levy Value Added Tax (VAT) – the lowest being in Andaman and Nicobar Islands where a 6 percent sales tax is charged on both the fuel. Mumbai has the highest VAT of 39.12 percent on petrol, while Telangana levies highest VAT of 26 percent on diesel. Delhi charges a VAT of 27 percent on petrol and 17.24 percent on diesel. The total tax incidence on petrol comes to 45-50 percent and on diesel, it is 35-40 percent. Under GST, the total incidence of taxation on a particular good or a service has been kept at the same level as the sum total of central and state levies existing pre-1 July 2017. This was done by fitting them into one of the four GST tax slabs of 5, 12, 18 and 28 percent. For petrol and diesel, the total incidence of present taxation is already beyond the peak rate and if the tax rate was to be kept at just 28 percent it will result in a big loss of revenue to both centre and states. After hitting an all-time high of Rs 78.43 a litre for petrol and Rs 69.31 for diesel on 29 May, rates have marginally fallen during the subsequent days on softening in international oil prices and rupee strengthening against the US dollar. Petrol costs Rs 77.49 a litre and diesel Rs 69.04 in Delhi.

Source: Business Standard

21 August. The Indian government has asked its biggest state-owned firm, Oil and Natural Gas (ONGC), to list its overseas unit ONGC Videsh Ltd (OVL), according to the letter from the Department of Investment and Public Asset Management to ONGC. The move to float the unit – which has investments in 11 producing assets in countries including Russia, Brazil and Iran – is part of a government push to sell state-assets to raise funds. A listing would also help unlock value in the unit by improving its corporate governance and efficiency, the letter said. The letter said any state-owned firm with a positive net worth and no accumulated loss should be listed to unlock value. The Narendra Modi-led government has a target to raise a record Rs 1 trillion ($14.25 billion) from the sale of state assets in the current fiscal year ending in March 2019.

Source: Reuters

19 August. As many as 280 fuel stations and 279 LPG (liquefied petroleum gas) distributorships in the state were flooded following unprecedented rain. However, the Indian Oil Corp (IOC) assured that fuel supply position including LPG supplies was adequate in the state. But the industry is facing challenges of transportation and in the operational front, as well as in mobilization of personnel. There are 2,020 fuel stations and 610 LPG distributors in the state. According to IOC authorities, distributors and delivery personnel were wading through water to deliver LPG cylinders. In many places, cylinders were being roped together and pulled through water and brought to small vans to be taken to godowns. The oil companies are operating 24×7 control rooms to reach products across the state. There is nearly seven days fuel stock coverage for petrol and diesel, kerosene and LPG in the state. Aviation fuel is being delivered for aerial

sorties for survey and relief operations on the spot in close coordination with defence and state machinery.

Source: The Economic Times

18 August. Reliance Industries Ltd (RIL) said a short shutdown of one of the Fluid Catalytic Cracking Units (FCCUs) at its Jamnagar complex would not impact the production. Jamnagar Refining Complex has two independent crude oil refineries, each with several secondary processing units. FCCU is one such secondary processing unit, the company said. Out of the two FCCUs, one is under short shutdown, the company said.

Source: Business Standard

17 August. Crude oil shipments to Bharat Petroleum Corp Ltd (BPCL)’s Kochi refinery in southern India were delayed due to heavy rains preventing vessels from berthing. Three vessels, including two very large crude oil carriers (VLCC) and one Suezmax, carrying more than 2 million barrels of crude oil, have been waiting to unload the oil for 5 to 12 days, shipping data showed. Suezmax Sri Vishnu carrying Saudi crude has been waiting to unload since 12 August, according to the data. VLCCs Happiness I and Humanity, with Iranian oil onboard, have been floating off Kochi for 6-12 days, the data showed. The Kochi refinery which has a capacity of more than 260,000 barrels per day (bpd) is located at Ambalamugal, near Kochi in Kerala where torrential rains have left over 30,000 people homeless, destroyed crops and disrupted air, rail and road traffic within the state for a week.

Source: Reuters

16 August. India’s crude oil import bill is likely to jump by about $26 billion in 2018-19 as rupee dropping to a record low has made buying of oil from overseas costlier. Besides, the rupee hitting a record low of 70.32 to a US dollar in the opening deal will also lead to a hike in the retail selling price of petrol, diesel and cooking gas or liquefied petroleum gas (LPG). India, which imports over 80 percent of its oil needs, spent $87.7 billion (Rs 5.65 trillion) on importing 220.43 million tonne (mt) of crude oil in 2017-18. For 2018-19, the imports are pegged at almost 227 mt. The rupee has been among the worst performing currencies in Asia, witnessing 8.6 percent slump this year. Fanned by a higher oil import bill, India’s trade deficit, or the gap between exports and imports, in July widened to $18 billion, the most in more than five years. Trade shortfall puts pressure on the current account deficit (CAD), a key vulnerability for the economy. Rupee depreciation will result in higher earnings for exporters as well as domestic oil producers like Oil and Natural Gas Corp (ONGC) who bill refiners in US dollar terms. But this would result in rise in petrol and diesel prices, with full impact likely to be visible later this month. Prices of petrol and diesel were hiked by 6 paise a litre each to Rs 77.20 and Rs 68.78, respectively in Delhi. Rates are highest in two months. Fuel prices in Delhi are the cheapest in all metros and most state capitals due to lower sales tax or VAT (Value Added Tax). If oil prices continue at these levels and rupee at 70 a dollar, retail rates should go up by 50-60 paisa a litre. Petrol price had touched an all-time high of Rs 78.43 a litre on 29 May and had since receded. On that day, the diesel price had touched an all-time high of Rs 69.30. State-owned oil firms had in mid-June last year dumped 15-year practice of revising rates on 1st and 16th of every month in favour of daily price revisions.

Source: Business Standard

15 August. The government has notified a new policy requiring Oil and Natural Gas Corp Ltd (ONGC) and Oil India Ltd (OIL) to pay royalty and cess tax only to the extent of their equity holding in certain pre-1999 oil and gas fields. The ‘Policy Framework for Streamlining the Working of Production Sharing Contracts in respect of Pre-NELP and NELP Blocks’ was notified in the Gazette of India. Till now ONGC and OIL had to pay 100 percent royalty and cess tax on 11 pre-New Exploration Licensing Policy (NELP) fields that were given to private firms prior to 1999. The government had awarded some discovered oil and gas fields to private firms in the 1990s with a view to attracting investments in the country. To incentivise such investments, the liability of payment of statutory levies like royalty and cess was put on state-owned firms, who were made licensees of the blocks. ONGC and Oil India Ltd were allowed right to back in or take an interest of 30-40 percent in the fields, but were liable to pay 100 percent of the statutory levies. The new rule, which approved by the Cabinet, will apply to 11 fields like Dholka field in Gujarat that is operated by Joshi Oil and Gas. It will also apply to Hindustan Oil Exploration Company (HOEC)-operated PY-1 field in Cauvery basin. Section 42 of Income Tax allows the companies to claim 100 percent of expenditure incurred under a production sharing contract (PSC) as tax deductible for computing taxable income in the same year. While signing PSC of pre-NELP discovered fields, 13 contracts out of 28 contracts did not have provision for tax benefit under Section 42 of Income-tax Act. Now, this will bring uniformity and consistency in PSCs and provide an incentive to the contractor to make an additional investment during the extended period of PSC. The approvals given are expected to help in ensuring the expeditious development of hydrocarbon resources.

Source: Business Standard

21 August. GE Power said it has got a Rs 220 crore order to supply gas turbine and generator for a captive power unit planned at Hindustan Petroleum Corp Ltd (HPCL)’s refinery at Visakhapatnam. The order for the supply of a 6F.03 gas turbine and a generator was placed on it by Bharat Heavy Electricals Ltd (BHEL) – the principal contractor for the project. The HPCL Vizag order also marks the foray of GE’s F-class technology into India’s refinery segment, which offers a significant opportunity for technology upgrades in future, it said. GE’s gas turbine fleet in the oil and gas sector in India comprises of an installed base of approximately 2.5 GW.

Source: Business Standard

21 August. Indian Oil Corp (IOC) is now looking at newer market segments with products like gas powered iron boxes for neighbourhood launderers, value added gas for metal cutting units and bigger gas cylinders for rice mills, food factories and hotels. The company has got a big order for its Indane Nanocut-specialised LPG for cutting metals from integrated lignite mining-cum-power generation company NLC India Ltd. IOC will soon launch its liquefied petroleum gas (LPG) powered iron boxes which works out economical and also a healthy option for launderers as compared to charcoal and electricity powered iron boxes. Further the gas iron boxes are environment friendly owing to low carbon emissions and is also healthy option for the users. The oil and gas company is selling its innovative Indane Nanocut gas cylinders to units where metal cutting is involved. IOC is looking at new clients for its jumbo LPG cylinders as well as converting its existing ones.

Source: Business Standard

19 August. Coal India Ltd (CIL) expects 367 million tonnes (mt) output by the end of the current financial year from its 115 ongoing projects. The PSU (Public Sector Undertaking) accounts for over 80 percent of the domestic production. CIL said it has 65 new projects on the anvil with a “targeted capacity of 247.66 mt per year” out of which 27 are approved. It said efforts are on to augment investment in logistics and infrastructure for coal offtake adding that Operator Independent Truck Dispatch Systems are installed in 11 large opencast projects in 4 subsidiaries besides road and rail projects. The PSU has lined up Rs 9,500 crore as capital expenditure for 2018-19. The company contributed 84 percent to India’s total coal production in 2016-17.

Source: Business Standard

15 August. Coal India Ltd (CIL) arm BCCL suffered Rs 95 crore loss due to blending inferior grade coal with superior steel quality dry-fuel, the government auditor CAG (Comptroller and Auditor General) has said. Bharat Coking Coal Ltd (BCCL), one of the fossil fuel producing subsidiaries of CIL, is engaged in mining, washing and distribution of coal to meet the energy requirement of its consumers and produces both coking and non-coking coal. Coking coal having less than 18 percent ash is termed as steel grade coal, which can be used directly by consumers in the steel sector. During 2013-14 to 2015-16, BCCL fed 26.33 lakh tonnes of coking coal into its four washeries by blending 13.91 lakh tonnes of steel grade coal with 12.42 lakh tonne washery grade coal, which finally yielded only 6.64 lakh tonne of washed coal (25 percent) along with middling, slurry and rejects, it said. CAG said that this was done by BCCL despite having a memorandum of understanding (MoU) with Tata Steel and SAIL for supply of raw steel grade coking coal. The company was to supply 25 lakh tonnes of raw coking coal to Tata Steel in 2013-14, which it could not supply, it said. BCCL had also agreed to supply 12 lakh tonnes of steel grade raw coking coal to SAIL during 2014-15 to 2015-16, against which the company could supply only 1.02 lakh tonne, it said.

Source: Business Standard

20 August. Bajaj Group plans to raise about ₹ 3,000 crore through an initial public offering (IPO) of its power generation business. The company is expected to soon file a draft prospectus with capital markets regulator Securities and Exchange Board of India (SEBI) for a share sale. Bajaj has hired investment banks UBS, Edelweiss Financial Advisors Ltd and IIFL Holdings Ltd as advisers for the proposed IPO. The power business has stable operating assets, with more than ₹ 2,000 crore of earnings, before interest, taxes, depreciation and amortization. The Group’s power business comprises Bajaj Energy Ltd, which has five thermal assets of 90 MW each, totalling 450 MW in Uttar Pradesh. It also includes Lalitpur Power Generation Company Ltd, which comprises three thermal units of 660 MW each, totalling 1,980 MW, also in Uttar Pradesh.

Source: Livemint

19 August. The Central Electricity Authority (CEA) has undertaken a study to ascertain the cheapest power mix in 2030, its Chairman Pankaj Batra said. The outcome of the study will also act as components to the regulators in determining power tariffs. According to estimates by the power ministry, the share of renewable energy in India’s electricity mix is set to increase to around 55 percent by 2030. At present, renewables account for nearly 20 percent of the total installed capacity. India has committed to produce about 40 percent of its installed electricity capacity from non-fossil fuel sources by 2030. It has also set a target of adding 175 GW of renewable energy capacity by 2022. Meanwhile, the CEA is also closely working with stakeholders in building a cost-effective power evacuation infrastructure in Leh and Ladakh region of Jammu and Kashmir. It can be executed by a combination of underground cables and towers installed by airlifting, he said.

Source: The Economic Times

17 August. Bangladesh, which is importing around 700 MW of power from India, is looking to ramp up its electricity import from the country, the neighbouring nation said. The neighbouring country is aiming at importing 10,000 Mw from India. Power sector cooperation between the two countries is “not limited to transmission and supply only.” India is “supporting its neighbouring country to enhance the capacity building”, particularly, human resource development for power generation, transmission and distribution.

Source: Business Standard

17 August. West Bengal, which has been incorporating the latest technologies to reduce transmission and distribution losses, is expecting to add over 2,000 MW of power in the next five years including 300 MW of solar power, West Bengal Power Minister Sobhandeb Chattopadhyay said. He said renewable energy has become an important component in achieving energy security and to diversify the power mix. The state government has been “introducing latest technologies” to reduce transmission and distribution losses and at the same time is putting in efforts to improve the quality of power, Chattopadhyay said.

Source: Business Standard

15 August. Every house has been provided electricity in Bihar, Chief Minister (CM) Nitish Kumar announced after hoisting the national flag to mark India’s Independence Day. He recalled that a few years ago he had promised to improve the electricity situation and said that if he failed to do this, he would not seek votes in the next election.

Source: Business Standard

21 August. Small to mid-sized renewable energy companies in India are starting to look like attractive takeover targets as lenders and investors withhold funds, worried by the stiff competition, weak bond markets, low tariffs and high debt besetting the sector. The small companies’ difficulty in raising cash is keeping them away from government power project auctions, restricting their growth and crippling their ability to refinance loans, a consultant from a top global consultancy firm said. With many smaller operators being gobbled up or offering themselves for sale, the number of projects being developed could fall, potentially keeping India from its renewable energy targets, the consultant said. In a few years, there may be only a few big companies and a few regional firms active in India’s renewable sector, Rahul Goswami, managing director of Greenstone Energy Advisors, said. The trend goes back at least to 2016, when Tata Power bought solar and wind company Welspun Renewable Energy, but the pace is expected to pick up. One of India’s largest renewables companies, Greenko Group, said in June that it was buying 750 MW of solar and wind assets from Orange Renewables, because the Singapore-based company saw few opportunities for growth. The deal has yet to be closed. Tata Power said it plans to invest $5 billion to increase its renewable capacity in India fourfold over the next decade to 12 GW. More than doubling India’s renewables capacity by 2022 will require $76 billion, including debt of $53 billion, the Ministry of New and Renewable Energy said.

Source: Reuters

21 August. The Cochin International Airport Ltd (CIAL) has suffered an estimated loss of over Rs 220 crores in the floods. The CIAL management has launched rebuilding of the damaged infrastructure including 2.5 kilometre long airport walls that collapsed after Periyar river overflowed. The solar power system of the world’s first solar-powered airport has also suffered damage in the floods.

Source: The Economic Times

20 August. The river navigation department (RND) is gearing up to add new ferries to its fleet. While three new ferries will ply on the existing routes, the government is also seeking bids to launch the state’s first solar-powered ferry service. The tender for either of these is expected to be floated by the end of the month, RND said. RND said that attempts are being made to ensure that the three new ferries are aesthetically better looking than the existing ones. An expression of interest will also be published for the solar-powered ferry launch service. The ferry will run on solar energy and battery-run electric energy.

Source: The Economic Times

18 August. A switch from conventional diesel- and electric-powered irrigation pumps to solar-powered ones can help the country achieve 38 percent of its envisaged 175 GW renewable energy target by 2022. The shift to solar-powered irrigation pumps can also save enormous sums of money and generate additional income for farmers, the US (United States)-based Institute for Energy Economics & Financial Analysis (IEEFA) report said. The report said that the idea of replacing some 30 million grid-attached or diesel pumps with solar pumps is gaining traction but the pace of deployment is slow. The Government of India’s Kisan Urja Suraksha Evam Utthan Mahaabhiyan (KUSUM) scheme and the Gujarat government’s Suryashakti Kisan Yojana (SKY) are steps in the right direction for solar-powered irrigation initiatives. The KUSUM scheme mandates deployment of 2.75 million solar pumps in the first phase of its implementation.

Source: Business Standard

17 August. Imposition of safeguard duty is likely to result in some delay in project implementation of nearly 12,000 MW of under-construction solar capacities, ratings agency CRISIL said. As per CRISIL’s analysis, a 25 percent safeguard duty entails a rise in capital costs by 15-20 percent, which would have a 30-40 paise per unit impact on bid tariffs so as to maintain the same rates of return. Following a petition filed by the Indian Solar Manufacturers Association (ISMA) in December 2017, seeking imposition of safeguard duty directorate general of trade remedies (DGTR) had recommended a 70 percent safeguard duty in January 2018. DGTR reviewed the recommendations and imposed 25 percent duty for the first year followed by 20 percent in the first half of the second year and 15 percent for the rest part of the year. According to the agency, solar power capacity addition is likely to ramp up to 56,000-58,000 MW between fiscals 2019 and 2023, compared with 20,000 GW between fiscals 2014 and 2018, which will be driven by capacities allocated/tendered under the National Solar Mission, state solar policies, other schemes driven by SECI (Solar Energy Corp of India) and PSUs (Public Sector Undertakings).

Source: Business Standard

17 August. The Centre will soon call for bids for setting up a 30,000 MW solar power project in the Ladakh region subject to ‘some clarity’ on the evacuation issues, according to Central Electricity Authority (CEA) Chairman Pankaj Batra. The hilly areas of Ladakh are among the country’s most solar potential areas but transmission remains a challenge.

Source: The Hindu Business Line

17 August. GAIL (India) Ltd has sought shareholder nod to amend the charter of the company to invest in start-ups, build solar power plants and set up battery charging stations for electric vehicles (EVs) as it looks to diversify its portfolio beyond gas and petrochemicals. With the government planning to make a major shift to EVs by 2030, GAIL felt that charging infrastructure for EVs in India has not been fully developed yet.

Source: Business Standard

16 August. Strictly sticking to the slogan ‘perform or perish’, the Arunachal Pradesh government has decided to terminate 100 more hydroelectric projects allotted to various private developers, days after terminating 15 project with a total generating capacity of 1,586.4 MW of power. Chief Minister Pema Khandu said that two major hydroelectric projects would be commissioned this year – the 600 MW Kameng and the 110 MW Pare projects which will substantially overcome the power needs of the State.

Source: The Assam Tribune

15 August. Making the flood situation in Kerala more worse, The Kerala State Electricity Board (KSEB) has stopped power generation from Idamalayar hydro dam. The KSEB has been forced to stop power generation after the turbines of its generators got damaged. KSEB Chairman NS Pillai said that the power generation has been stopped due to faulty feeder line. According to KSEB, the board plans an urgent inspection inside the tunnel.

Source: The Economic Times

21 August. Brazil has relaxed local content requirements for companies developing the Libra offshore oilfield, the government said, in a move it expects will unlock $16 billion in investment for Latin America’s top oil producer. The Libra field is located in Brazil’s Santos basin in the pre-salt oil play, where billions of barrels of oil under a thick layer of salt have lured oil majors to lock in stakes. The changes will be made through an addendum to the production sharing agreement in effect for the field, which is being developed by Brazil’s state-controlled oil giant Petroleo Brasileiro, Total, Royal Dutch Shell and China’s CNPC and CNOOC. Brazilian oil regulator ANP received hundreds of requests for waivers from companies arguing they could not meet the requirements based on Brazilian market conditions, prompting Brazil’s center-right President Michel Temer’s administration to relax rules.

Source: Reuters

21 August. Oil exports from southern Iraq are on course to hit another record high this month, adding to signs that OPEC (Organization of the Petroleum Exporting Countries)’s second-largest producer is following through on the group’s agreement to raise output. Southern Iraqi exports in the first 19 days of August averaged 3.7 million barrels per day (bpd), according to ship-tracking data, up 160,000 bpd from July’s 3.54 million bpd – the existing monthly record. The increase follows June’s pact among OPEC and allied oil producers to boost supply after they had curbed output since 2017 to remove a glut. Iraq in July provided the largest increase among OPEC members that took part in the previous cuts. Northern exports have also increased in August, averaging about 350,000 bpd so far, according to shipping data, up from about 300,000 bpd in July. That is still far below levels of more than 500,000 bpd in some months of 2017. Iraq told the OPEC that it boosted production by 100,000 bpd month-on-month in July, while Saudi Arabia cut back.

Source: Reuters

21 August. Venezuela’s PDVSA and NuStar Energy LP have reached an agreement over outstanding storage fees, allowing the state-run company to resume use of a key storage terminal in the Caribbean, the US energy firm said. The terminal played a role in a legal dispute between PDVSA and ConocoPhillips, which earlier this year tried to enforce a $2 billion arbitration award by seizing some of the Venezuelan firm’s assets in the Caribbean. In May, when Conoco started legal actions to seize PDVSA’s assets on several islands where it rents or owns terminals and refineries, over 4 million barrels of Venezuelan heavy crude stored at Statia were temporarily retained under a court order.

Source: Reuters

21 August. Spirit Airlines expects it will raise passenger fares after years of lower ticket prices as the US budget carrier works to improve margins at a time of rising oil prices, Chief Executive Officer Bob Fornaro said. Fornaro, who is leaving Florida-based Spirit at the end of the year, did not say how much fares could rise but suggested any increase would be modest. North American carriers are still growing their networks but adding less capacity this year than expected, as higher oil prices pressure margins. In July, American Airlines cut its 2018 earnings forecast for the second time, hurt by higher fuel costs. Rival Delta Air Lines has also warned that fuel would squeeze its profit for the full year, but United Airlines raised its 2018 profit forecast thanks to a rise in average fares and traffic.

Source: Reuters

21 August. Rising fuel costs have dampened gasoline demand from private motorists in the United States (US), leaving the market relying on continued economic and freight expansion to boost oil use. US traffic volumes were up by just 0.3 percent on a seasonally adjusted basis in the three months from April to June compared with the same period a year earlier, according to the Federal Highway Administration. Retail gasoline prices are up by more than 55 percent from their cyclical low in February 2016, according to the US Energy Information Administration (EIA). EIA forecasts distillate consumption will increase by 170,000 bpd in 2018, while jet fuel will be up by another 30,000 bpd.

Source: Reuters

20 August. The US (United States) Department of Energy (DOE) is offering 11 million barrels of oil for sale from the nation’s Strategic Petroleum Reserve (SPR) ahead of sanctions on Iran that are expected to reduce global supplies of crude. The delivery period for the proposed sale of sour crudes will be from 1 October through 30 November, according to notice. The US government has introduced financial sanctions against Iran which, beginning in November, also target the petroleum sector of OPEC (Organization of the Petroleum Exporting Countries)’s third-largest producer. US President Donald Trump complained this year that oil prices are “artificially very high” and a potential release from the SPR, ahead of the US midterm elections in November, was widely seen as a way to bring relief to motorists who have seen gasoline prices jump in the past year. However, American drivers are unlikely to see prices at the pump fall by crude releases from the SPR because US oil production already is sky high, analysts have said. Still, prices could temporarily dip thanks to seasonal factors. Earlier this year, the DOE sold about 5.2 million barrels of oil from the SPR to five companies including top refiners Valero Energy Corp and Phillips 66. SPR crude oil samples are not available prior to deliveries, the DOE said.

Source: Reuters

20 August. Dorado, located offshore Australia, has discovered 171 million barrels of oil on a 2C basis, Carnarvon Petroleum Ltd reveals. Dorado, located offshore Australia, has discovered 171 million barrels of oil on a 2C basis, Carnarvon Petroleum Limited revealed. The 171 million barrels of oil discovered in Dorado is one of the largest oil resources ever found on the North West Shelf, Carnarvon’s Managing Director and Chief Executive Officers, Adrian Cook, said. Carnarvon Petroleum owns a 20 percent stake in the Dorado find. The company, which is based in Perth, also has interests in several other projects offshore Australia.

Source: Rigzone

17 August. Saudi state oil giant Saudi Aramco remains committed to meeting future oil demand through continued investments, the kingdom’s Energy Minister Khalid Al Falih said in a company report. Despite an improved market picture, the oil industry’s preparedness for the future remained in question as the sector had lost an estimate $1 trillion in planned investments since the start of the market downturn, Al Falih said. The company discovered two new oil fields, Sakab and Zumul, and a gas reservoir in the Sahba field, Aramco said in the report.

Source: Reuters

15 August. Chinese oil importers are shying away from buying US (United States) crude as they fear Beijing’s decision to exclude the commodity from its tariff list in a trade dispute between the world’s biggest economies may only be temporary. Not a single tanker has loaded crude oil from the US bound for China since the start of August, ship tracking data showed, compared with about 300,000 barrels per day (bpd) in June and July. To replace US oil, China has been turning to the Middle East, West Africa and Latin America, according to shipping data and traders. Although China’s biggest oil suppliers are the Middle East, Russia and West Africa, the US has become an important global supplier since it opened up its market for exports in 2016. Beyond the short-term complications of finding replacements for American oil, the Sino-US trade dispute also poses risks to economic growth.

Source: Reuters

21 August. Russian President Vladimir Putin told German Chancellor Angela Merkel during a meeting that Russia would continue pumping gas via Ukraine to the rest of Europe. The Kremlin-backed Nord Stream 2 pipeline that aims to supply Russia’s natural gas to Germany is under persistent fire by the US (United States) and Ukrainian governments. Washington is pressing Berlin to halt the project.

Source: Reuters

21 August. Electricity Generating Authority of Thailand (EGAT) is seeking to directly import liquefied natural gas (LNG) for the first time, as part of a government plan to boost competition in the power sector. Thailand joins other Asian countries such as China where LNG imports have risen exponentially over the past few years driven by strong economic growth and a push for cleaner air. EGAT is requesting expressions of interest for up to 1.5 million metric tonnes per annum (mmtpa) of LNG via Thailand’s existing Map Ta Phut LNG Receiving Terminal in the eastern part of the country, according to a document issued by the company. EGAT, the country’s largest power producer, typically buys gas from state-owned PTT, which is Thailand’s sole gas supplier and its only LNG importer. EGAT is seeking expressions of interest for the delivery of LNG through an agreement with PTT’s LNG terminal for 4 to 8 years from March 2019, according to the document. The LNG will feed its power plants, including South Bangkok, Bang Pakong and Wang Noi, as part of Thailand’s target to increase competition in the downstream gas sector. PTT will be allowed to participate in EGAT’s tendering process. Expressions of interest are due by 31 August. EGAT also acquired access to 1.5 mmtpa of regasification capacity from PTT LNG at the current terminal, over a 38-year period from 2019 to 2056, the document said. EGAT is also planning its own 5 mmtpa floating storage regasification unit (FSRU) in the Gulf of Thailand, expected to be ready by 2024, it said. The FSRU will be linked to Thailand’s existing gas pipeline network.

Source: Reuters

20 August. Poland, unlike Germany, strongly opposes Russia’s plan to build a new gas pipeline across the Baltic Sea, and shares US (United States) opinion that the project would help strengthen Moscow’s market position, Polish Foreign Minister Jacek Czaputowicz said. Berlin has given political support to the building of a new, $11 billion pipeline to bring Russian gas across the Baltic Sea called Nord Stream 2, bypassing traditional routes through Ukraine, despite qualms among other EU (European Union) states. In July US President Donald Trump publicly criticised Germany for supporting the pipeline deal with Russia. Poland buys most of the gas it consumes from Russia but has taken steps to reduce that reliance. He reiterated Poland’s concerns that Nord Stream 2 was a harmful and political project that will strengthen Russia’s dominant position in the gas market and be a threat to Ukraine.

Source: Reuters

20 August. Premier Oil will press ahead with the development of the Tolmount gas field in Britain’s North Sea, which is expected to produce around 500 billion cubic feet (bcf) of gas from late 2020. The approval of Tolmount is the latest in a series of moves by oil and gas companies showing their commitment to the North Sea, traditionally a high-cost environment which is experiencing a revival as costs have fallen. Premier expects to pay $120 million for the development, which includes a minimal facilities platform and a pipeline commissioned from Saipem leading to British energy group Centrica’s Easington terminal. Construction for the project, in which Dana Petroleum holds 50 percent, is to start this year. Centrica Storage Ld, a subsidiary of the British energy company, said it had been awarded a 120 million pound ($153 million) contract to process gas from the field which will extend the lift of its Easington gas terminal in Yorkshire until at least 2030. Centrica said it will modify the terminal so it can receive and process the gas from the Tolmount field starting in the winter of 2020 when it is scheduled to come on stream. The field is expected to produce gas for 10 to 15 years.

Source: Reuters

20 August. Norway’s Hoegh LNG has won a tender to supply a floating LNG (liquefied natural gas) import terminal for a consortium aiming to import liquefied natural gas to Australia’s east coast from 2020 in a push to boost local supply. Australian Industrial Energy, a consortium that includes Japan’s JERA and Marubeni Corp, said it signed an agreement giving it the right to lease one of Hoegh LNG’s floating storage and regasification units (FSRU), to be docked at Port Kembla. Wholesale gas prices have nearly tripled over the past two years following the opening of three LNG export plants on Australia’s east coast that have sucked gas out of the domestic market. To help fill the supply gap, Australian Industrial Energy (AIE) and AGL Energy have advanced plans to import LNG. ExxonMobil Corp, the dominant gas supplier to the southeastern market over the past several decades from gas fields in the Bass Strait, and a private firm are also considering importing LNG from around 2021 or 2022.

Source: Reuters

17 August. An ExxonMobil-operated gas project in Papua New Guinea has agreed a deal to supply liquefied natural gas (LNG) to a unit of British oil giant BP, Australia’s Oil Search Ltd said. The agreement will provide BP with about 450,000 tonnes of LNG annually over an initial three-year period, rising to about 900,000 tonnes for the following two years, Oil Search said. The company said that, on behalf of the project, ExxonMobil was in negotiations with several other parties over an additional 450,000 tonnes per year of supply. Oil Search resumed operations to produce oil at the Agogo Production Facility, which was knocked out by a major earthquake in Papua New Guinea in February.

Source: Reuters

17 August. The US (United States) energy regulator has approved a request by Cheniere Energy to feed the first gas into its new liquefied natural gas (LNG) facility in Corpus Christi, Texas, marking the beginning of a commissioning phase for the export terminal. The approval from the Federal Energy Regulatory Commission (FERC), issued, means Cheniere will be able to produce the first commissioning cargo by the fourth quarter of this year, if not earlier. Train 1 at the Corpus Christi facility will become the first LNG export terminal in Texas and the third functioning one in the US as the country ramps up the sale of the super-chilled gas to unprecedented levels in the coming years. Cheniere’s Chief Executive Officer, Jack Fusco, told analysts the facility would produce its first LNG in the fourth quarter, implying a commercial startup of the facility earlier than the slated first half of 2019. The LNG market looks out for facility startups not only because they ultimately add supply but because the commissioning cargos tend to be traded on the spot market, whereas initial commercial deliveries go to prearranged long-term buyers.

Source: Reuters

17 August. China’s Sinopec expects to ramp up natural gas supplies by 1.8 billion cubic meters (bcm) this winter to meeting increasing demand, the company said. Gas supplies for the winter of 2018 will be up 11 percent from the 15.1 bcm Sinopec provided last winter, according to company data. New supplies are mainly supported by the opening of the Tianjin receiving terminal and more production from domestic gas fields, Michael Mao, gas analyst with consultancy Sublime China, said.

Source: Reuters

17 August. Japan’s Mitsubishi Corp said it has agreed to acquire 25 percent of Bangladesh’s Summit LNG (liquefied natural gas) terminal and plans to help develop an offshore receiving site in the South Asian country. The other 75 percent of the Summit LNG terminal will remain with Summit Corp. Summit LNG’s project plans call for a floating storage and regasification unit (FSRU) to be installed off the coast of Moheshkali, where it will receive and regasify LNG procured by Petrobangla, the country’s national oil and gas company. Construction of the terminal has already begun, with commercial operation expected to start in March 2019. The planned LNG import volumes are about 3.5 million tonnes per annum, Mitsubishi said. Summit and Mitsubishi have agreed to jointly pursue other LNG projects in Bangladesh, said the Japanese company, from the supply of the super-chilled fuel to power generation.

Source: Reuters

17 August. Panama will sign an agreement with the US (United States) Treasury and Energy departments aimed at paving the way for more private investment to expand the importation and distribution of US liquefied natural gas (LNG) in Latin America. The agreement is part of a Treasury-led initiative called America Crece, incorporating the Spanish word for growth, aimed at boosting US LNG exports, developing Latin American energy resources and downstream demand. The $1.15 billion AES facility on Panama’s Caribbean coast, which is expected to begin commercial generating operations on 1 September, and LNG tank distribution operations in 2019, took in its first US LNG cargo in June.

Source: Reuters

21 August. The Trump administration moved to prop up the declining coal industry with an overhaul of Obama-era pollution rules, acknowledging that the increased emissions from aging coal-fired plants could kill hundreds more people annually and cost the country billions of dollars. The proposal broadly increases the authority given to states to decide how and how much to regulate existing coal power plants. Michelle Bloodworth, president of the American Coalition for Clean Coal Electricity, a trade group that represents coal producers, called the new rule a marked departure from the “gross overreach” of the Obama administration and said it should prevent a host of premature coal-plant retirements.

Source: Charlotte Observer

17 August. An Indonesian court has rejected a legal challenge from local residents attempting to halt the expansion of a coal power plant on the holiday island of Bali, the environmental group Greenpeace said. The legal bid claimed that the expansion – which would more than double power capacity at the site – would be a setback to the remote area’s tourism and fishing industries.

Source: Reuters

16 August. South Africa’s Exxaro Resources Ltd said half-year (H1) profit rose 8 percent, boosted by a strong performance in its core coal business. The firm said it expects the outlook for its coal business to remain stable for the second half of the year on the back of strong international coal prices and favourable trading conditions in its domestic market.

Source: Reuters

21 August. Iran said it had resumed supplies of electricity to Iraq and other neighbouring states 10 days earlier, after shortages in Iraqi cities sparked unrest in July. Tehran stopped supplying electricity to Iraq in July due to unpaid bills and because of a rise in Iranian consumption during the summer. The power shortage in Iraq sparked protests in Basra and other cities, as people blamed what they called an inept and corrupt Iraqi government. A number of protests have also broken out in Iran in recent months over regular power cuts and water shortages. Saudi Arabia offered to sell electricity to Baghdad at a discount, part of an effort by the kingdom to curb the influence of its rival Iran in Iraq.

Source: Reuters

17 August. Brazil’s Eletrobras (Centrais Eletricas Brasileiras) has delayed the auction of a power distributor based in the state of Amazonas to 26 September from 30 August, while keeping the original date for three other units, the power generation company said. Amazonas Distribuidora de Energia will be put on the block in September while Eletroacre, Ceron and Boa Vista Energia will be auctioned off in August, the company said. Eletrobras is seeking to offload heavily indebted distributors ahead of government plans to privatize the overall company.

Source: Reuters

17 August. A Bosnian regional government agreed to guarantee a €614 million ($700 million) loan from China’s Exim bank to help Bosnian utility EPBiH to add a new generating unit at its Tuzla coal-fired power plant. The amount covers 85 percent of the total value of a contract signed last November for the largest investment into Bosnia’s postwar energy infrastructure, the government of autonomous Bosniak-Croat Federation said. In 2014 EPBiH picked a consortium of China Gezhouba Group and Guandong Electric Power Design to add the 450 MW unit, but the project has been delayed by red tape and negotiations over financing. Under its guarantee terms, the government cited a 20-year loan repayment, including a five-year grace period, and a one-off payment by EPBiH of 47.6 million Bosnian marka ($27.7 million) into a regional guarantee fund. The guarantee deal is expected to receive the required approval from parliament if the issue is put to the lawmakers before Bosnia’s 7 October general election. The government said the new unit at the 715 MW Tuzla plant is necessary to replace its three outdated units, adding that the latest environment-friendly technologies will be used in its construction.

Source: Reuters

16 August. The Transmission Company of Nigeria (TCN) declared that it had cancelled many non-performing electricity transmission contracts. It also stated that four of such contracts were cancelled in the last two months. This was part of the reasons why some persons decided to stage a protest against the TCN management in Abuja. The Managing Director, TCN, Usman Mohammed, said that the recent closure of the company’s premises by the Federal Inland Revenue Service was unnecessary. He further stated that the prices of most of these non-performing contracts were highly inflated, as some of the projects were eventually completed at rates that were about 10 times less than the initial contract sum.

Source: The Punch

21 August. Indonesia made public a revised regulation that gives the country’s palm crop fund more leeway to support the expanded use of biodiesel in Southeast Asia’s largest economy. Indonesia announced plans to require all diesel fuel used in the country to contain a 20 percent bio-component from September. The move aims to reduce diesel fuel imports, boost palm oil consumption and support the rupiah currency. The revised regulation for the Estate Crop Fund, signed by President Joko Widodo and made public, widens the fund’s ability to subsidize the price gap between biodiesel and petroleum-based diesel fuel. The current retail price of diesel is 5,150 rupiah ($0.3526) per liter compared to 7,600 rupiah for unblended biodiesel. The Estate Crop Fund collects levies from palm oil exporters and the proceeds are used to finance government palm oil programs such as biodiesel and crop replanting.

Source: Reuters

21 August. South Africa’s first privately built coal-fired power plants must have the latest technology to reduce harmful emissions, Energy Minister Jeff Radebe said, as a wave of court challenges threaten to derail the projects. Environmental activists have taken legal action against the new Thabametsi and Khanyisa coal-fired projects and are also lobbying banks and developers against investing in them.

Source: Reuters

20 August. Iran urged Europe to speed up efforts to salvage a 2015 nuclear deal between Tehran and major powers that US (United States) President Donald Trump abandoned in May, saying French oil group Total has formally pulled out a major gas project. Efforts by the remaining signatories – EU (European Union) members Britain, France and Germany plus China and Russia – to avoid the agreement’s collapse are struggling as Washington has said any firms dealing with Teheran will be barred from doing business in the US.

Source: Reuters

20 August. Britain’s Drax said that its fourth biomass generation unit has started operations at its power plant in North Yorkshire. Drax converted its first three coal units to use biomass between 2013 and 2016.

Source: Reuters

17 August. EU (European Union) state aid regulators approved three Danish renewable energy schemes, worth a total €144 million ($164 million), as part of the Scandinavian country’s goal of loosening its dependence on fossil fuels by 2050. The three projects will support electricity production from wind and solar this year and next.

Source: Reuters

15 August. SIMEC Zen Energy, a unit of the Gupta group’s commodity conglomerate GFG Alliance, is building a large solar plant in South Australia as the state rolls out more solar energy to curtail high prices and guard against power blackouts. SIMEC will build a 280 MW solar project that will generate 600 gigawatt hours of power per year, it said, which is equal to around 1 percent of Australia’s annual power needs. The solar plant comes as part of a $1 billion pledge to invest in renewable energy, announced last year, after GFG Alliance bought up the state’s failing Whyalla steelworks. SIMEC expects to receive development approval in the fourth quarter and plans to start construction in the first quarter of next year.

Source: Reuters

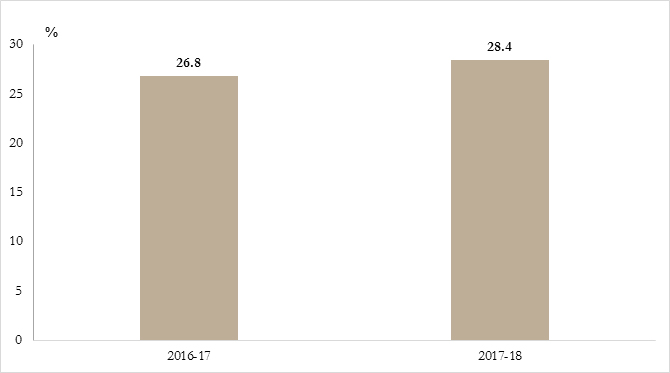

US$ Million

| Fuel Type | 2016-17 | 2017-18 | % change FY18 w.r.to FY17 |

| Crude Oil | 70,196.06 | 87,776.00 | 25.0 |

| Pet Products | 10,613.77 | 13,419.68 | 26.4 |

| LNG | 6,004.74 | 8,121.29 | 35.2 |

| Coal | 15,759.93 | 22,901.23 | 45.3 |

| Total Energy Imports (TEI) | 1,02,904.40 | 1,32,218.20 | 28.5 |

Share of Energy Imports (in Value terms) in All India Imports

Source: Compiled from Ministry of Commerce & Industry

Publisher: Baljit Kapoor

Editorial Adviser: Lydia Powell

Editor: Akhilesh Sati

Content Development: Vinod Kumar Tomar

|

OBSERVER RESEARCH FOUNDATION 20, Rouse Avenue, New Delhi- 110 002 PHONE: (011) 3533 2000, FAX: (011) 3533 2005 E-Mail: [email protected] |

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.