-

CENTRES

Progammes & Centres

Location

OIL PRICE RISK RETURNS

With global crude prices touching $80 a barrel, India’s oil minister has pressed OPEC kingpin Saudi Arabia to keep prices stable and moderate, saying that spike in rates would have a negative impact on Indian consumers as well as the economy. The rally is being attributed to a combination of factors — renewed US sanctions on third-largest OPEC producer Iran, shrinking supplies from Venezuela and the IEA saying that a global surplus has finally been eliminated due to output cuts by the OPEC and its allies. The fuel price breached the all-time high levels touched in 2013 and was priced at ₹ 76.24 /litre and ₹ 84.07/litre in Delhi and Mumbai respectively.

The Indian oil ministry expressed concern about the rise oil prices but said it was too early to predict the impact of US sanctions on his country’s imports of Iranian oil after Washington withdrew from the Iran nuclear deal. During the last round of sanctions, India enjoyed waivers allowing limited Iranian oil imports paid for in rupees instead of US dollars. When sanctions were loosened against Tehran, India increased imports from Iran to almost 900,000 bpd in late 2016, but intake has fallen back to around 500,000 bpd this year. Indian refiners said they were in no hurry to replace Iranian oil with alternatives, counting on the fact that many Western countries have so far declined to join the US in pulling out of a nuclear deal with Tehran. IOC hopes to stick to its plans to buy as much as 180,000 bpd of oil from Iran in 2018/19, more than double the volume in the last fiscal year that ended in March. It would be difficult to replace Iranian oil given the “commercial terms” offered by Tehran, IOC said. India, which has long-standing ties with Iran but also has close political relations with the US, is Iran’s top oil client after China. Its state refiners had chalked out plans to almost double oil imports from Iran this fiscal year, drawn to the virtual free shipping on oil sales offered by Iran. The South Asian country remained a big buyer of Iranian oil even during previous Western sanctions, though it had to cut purchases to win some waivers as the trade was mostly done in US dollars. Since the 2015 agreement, however, Indian refiners have been settling oil dues with Iran in euros. The Indian oil ministry has not commented on the US pullout, but the foreign ministry called for diplomacy to resolve the dispute over the nuclear deal with Iran.

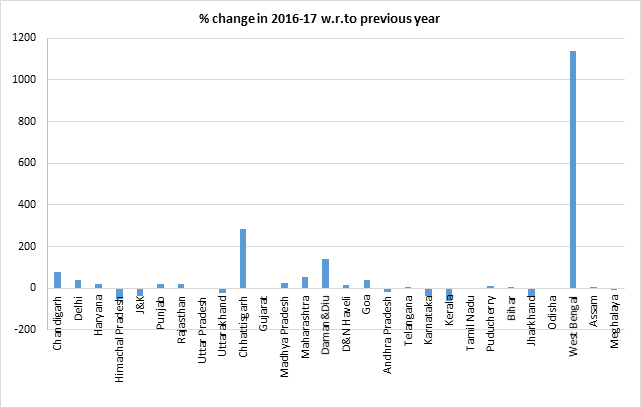

The government is not considering cutting excise duty on petrol and diesel yet as rates have not touched levels that could trigger such an action, Department of Economic Affairs said. State oil firms have not revised petrol and diesel price for almost a week now. Every rupee cut in excise duty on petrol and diesel will result in a revenue loss of ₹ 130 bn. The central government levies ₹ 19.48/litre of excise duty on petrol and ₹ 15.33/litre on diesel. State sales tax or VAT vary from state to state. In Delhi, VAT on petrol is ₹ 15.84/litre and ₹ 9.68/litre on diesel. Petrol in the national capital costs ₹ 74.63/litre the highest since September 14, 2013, when rates had hit ₹ 76.06/litre. Diesel price at ₹ 65.93/litre is the highest ever. India has the highest retail prices of petrol and diesel among South Asian nations as taxes account for half of the pump rates. The government had raised excise duty nine times between November 2014 and January 2016 to shore up finances as global oil prices fell, but then cut the tax just once in October last year by ₹ 2/litre. Subsequent to that excise duty reduction, the Centre had asked states to also lower VAT, but just four of them – Maharashtra, Gujarat, Madhya Pradesh and Himachal Pradesh – reduced rates while others including BJP-ruled ones ignored the call. In all, duty on petrol rate was hiked by ₹ 11.77/litre and that on diesel by 13.47/litre in those 15 months that helped government’s excise mop up more than double to ₹ 2.42 trillion in 2016-17 from ₹ 990 bn in 2014-15. On account of the retail price freeze on petroleum by the federal government to enhance chances of the BJP in the Karnataka elections, oil marketing companies had to let go up to ₹ 350 million per day, according to the analysis based on the average consumption of both fuels. The losses increased gradually — a rough estimate shows the markets suffered a revenue loss of more than ₹ 200 million per day in May, which for 19 days cost them about ₹ 3.8 billion. On an annualised basis, a ₹ 1 reduction in margin results in a ₹ 130 billion annual shortfall in OMC revenues. The companies would recover the loss in the coming weeks through successive upward revisions. OMCs may hedge for a bigger retail price hike this time to the tune of ₹ 1.5-2/litre over two to three weeks. Crude oil prices rose 3 percent from January to March and OMCs raised retail prices by about 5 percent during the time. But from April 1 to May 13, when oil prices rose 18 percent, OMCs increased retail prices by a mere 1-2 percent. Since the retail prices were frozen, IOC’s marketing margins reduced from an estimated ₹ 3.4/litre to ₹ 0.6/litre for petrol and from ₹ 3.8/litre to ₹ 0.8/litre for diesel, according to the analysis. OMCs have not voiced a concern as of now and are assessing the potential losses due to the margin squeeze.

The IEA said in a report that following a growth of 125 kilo barrels per day in 2017, India will see an acceleration in oil demand to 300 kilo barrels per day in 2018. This is despite a drop in global demand for oil. The Indian basket price touched its highest point since December 1, 2014, when it was seen at $76.43 a barrel. However, since the rupee value against dollar is much depreciated since then, the impact on India’s trade balance would be higher. The rupee is at 67.53 a dollar currently against ₹ 61.80 on December 1, 2014. However, India could expect some moderation in global prices if the global demand falls in the second half of 2018, according to IEA report.

India’s fuel demand in April 2018 grew 4.45 percent to 17.66 mt as compared to the corresponding month a year ago on the back of higher consumption of LPG and automobile fuels, the Petroleum Planning and Analysis Cell data showed. India’s LPG consumption in April this year grew 13 percent to 1.87 mt as compared to 1.65 mt in the corresponding month a year ago. LPG usage has grown consistently in the past 56 months, on the back of government’s push towards increasing access of LPG under Pradhan Mantri Ujjwala Yojana. The country’s petrol demand rose by 10 percent to 2.28 mt in April 2018 as compared to 2.09 mt in the corresponding month a year ago. Consumption of diesel rose by 2.66 percent to 7.15 mt last month. Also, ATF consumption grew 13.44 percent to 0.69 mt in April on the back of robust growth in domestic air traffic. Demand for polluting fuels including Furnace Oil and Petcoke fell 8.60 percent and 0.72 percent, respectively, in April as compared to the year ago period.

The government has set a target of providing LPG connections to 800,000 households in Odisha by December-end. LPG penetration in Odisha has already reached 58.55 percent till 1 May 2018 from 20 percent level in June 2014. 242,300 connections have been released in the state under the Ujjwala Yojna scheme. Currently, four bottling plants are there in Odisha and three new bottling plants are being planned to be set up in Khorda, Bolangir and Rayagada districts. Union Urban Development Minister distributed free gas connections to nearly 123 Below Poverty Line families in Mudhal village.

The Congress attacked the Modi government over rising petrol and diesel prices, and demanded they be brought under the ambit of the GST. The Congress also demanded reduction in excise duties on petroleum products imposed by the Centre and the VAT by various state governments.

The oil ministry said that they have appealed to the Odisha government to reduce the tax on petrol and diesel for the benefit of people. Petrol and diesel prices have been increased by ₹ 0.17/litre and ₹ 0.21/litre respectively in Delhi. With this, petrol prices hit a 56-month high of ₹ 76.24/litre while diesel prices touched a record high of ₹ 67.57/litre in the national capital. The price of petrol in Mumbai touched a historical high of ₹ 84.07/litre and will, with yet another marginal increase of ₹0.33/litre reach ₹ 84.40/litre. Similarly, the diesel price which touched ₹ 71.94/litre, will reach a new high of ₹ 72.21/litre. These record price levels come on the back of fuel retailers raising prices every day after resuming daily revision from May 14, two days after the Karnataka elections got over. They had stopped revising prices since April 24, ahead of the state polls, after the government informally nudged them to hold the price line. The prices of fuel in Mumbai are the highest in the country as Maharashtra levies a surcharge on fuel (₹ 9/litre for petrol and ₹ 1/litre on diesel) over and above the VAT, which is 26% on petrol and 24% on diesel.

BPCL aims to commission the LPG bottling unit at Balangir, its second in Odisha, by March 2020. The new bottling unit is being built at a cost of ₹ 1.03 billion. The facility is to be spread over 23 acres at Barkhani village, around 12 kilometre from the Bolangir railway station. The unit would have the capacity to produce 4.2 million LPG cylinders per year and cater to the requirement of the consumers in 14 districts – Balangir, Jharsuguda, Sundargarh, Sambalpur, Bargarh, Kalahandi, Sonepur, Koraput, Malkangiri, Nabarangpur, Boudh, Kandhamal. Rayagada and Nuapada. BPCL alone has an LPG customer base in Odisha of 1.53 million who consume 7.8 million cylinders in a year. By 2020, the LPG consumption in the state is poised to touch 10.5 million cylinders. LPG demand in the state is markedly growing in western and southwestern parts of the state. This geographic demand prompted BPCL to set up the new LPG bottling plant at Balangir, given the logistics advantage of the location.

The oil ministry has rejected the DGH’s recommendation that companies be permitted to carry out exploration in their producing fields irrespective of its effect on the government’s share of the profit. Officials felt the current guidelines, which are in line with a previous observation by the national auditor that such a petroleum operation could be supported only if it raised government take, didn’t need to be amended. Under the older licensing rules, companies first receive Petroleum Exploration License for a ‘contract area’. After the exploration licensing period expires, the operator must relinquish entire contract area to the government except places where discoveries have been made. Once discoveries have been appraised, a ‘Development Area’ is carved out for which operator gets PML that allows it to produce oil and gas from that area. Private players have been demanding permission to undertake exploration in ‘Development Area’, or PML area, after the exploration license has expired. In February 2013, the government unveiled a policy, allowing exploration in PML area in a ring-fenced manner, and permitting cost recovery only when the contractor proved exploration activity wouldn’t reduce the government take.

India’s government plans to propose banning burning petroleum coke as a fuel nationwide to comply with a Supreme Court request as part of a long-running case to clean the country’s air. The government proposal follows a ban ordered by the Supreme Court in October on burning petroleum coke in the region around the capital of New Delhi. The government would expand the New Delhi ban across the country while still allowing petroleum coke to be used in the limestone and cement industries. The proposal must be submitted to the court by June 30. The sulphur emissions that are usually given off when petroleum coke is burned are instead absorbed during the cement-making process. More than half of India’s petroleum coke demand of 27 mt is imported, mostly from the US, according to industry estimates.

The government has shelved the plan to privatise several key ageing fields of ONGC and OIL following strong opposition from the state-run companies and consultations between the oil ministry and the PMO. The two companies will now draw up their own proposals to boost output from the fields. The oil ministry drew up a detailed plan last year to sell up to 60% participating interest in 11 ageing fields of ONGC and four of OIL to private companies under the so called Production Enhancement Contract aimed at raising output. The plan also included another 44 older fields of ONGC and OIL that could take on private technological partners under a process managed by the government. The government planned to privatise some of the ONGC and OIL fields. Soon after the DGH, the technical arm of the oil ministry, began circulating its draft policy paper on oilfield privatisation, ONGC launched a strong protest, triggering a pause among policymakers and exchanges between the oil ministry and the PMO. ONGC had already launched a similar plan independently for two of its ageing fields in Gujarat and Assam. It is seeking partnerships with oilfield service providers under a long-term contract in which private partners will get a predetermined fee for every unit of oil and gas produced. The government now wants ONGC to use these learnings to attract more private capital and capabilities to ageing fields. The oil ministry changed its mind on the proposed policy after consultations with the PMO, which had heard all sides and didn’t want to invite controversy over a privatisation move in the fifth year of its term.

After IOC, HPCL has launched home-delivery of diesel in Mumbai and has plans to expand it to other parts of the country. IOC had in March launched home-delivery of diesel in Pune. Like IOC, HPCL too has mounted a diesel dispenser, similar to the one seen at petrol pumps, on a midsized truck along with a storage tank for delivering the fuel at customers doorsteps in Pune. Initially, the company is targeting ‘static customers’ like shopping malls and commercial establishments that use diesel in gensets for producing electricity, and transport companies with large diesel consumption. But, for home delivery of fuel, a clearance from PESO is required as both petrol and diesel are highly inflammable fuels and require adequate safety precautions. So far, PESO has given approval for doorstep delivery of diesel only on a trial basis. India currently has 61,983 petrol pumps with state-owned firms operating 90 percent of them. The country consumed 194.6 mt of fuel in 2016-17, nearly 40 percent of which was diesel. Diesel consumption in 2016-17 was 76 mt, while petrol was 23.8 mt.

A ‘retrospective’ amendment to the contract for the prolific Rajasthan Oil Block has put its operator Cairn India in a spot, as it has to shell out more to the government to retain it for another 10 years. Cairn India’s 25-year contract for exploration and production of Oil And Gas from Barmer block RJ-ON-90/1 is due for renewal on May 14, 2020, but it has to, as per a new policy, apply for a 10-year extension within this month. The government had in March last year approved a new policy for extension of Production Sharing Contracts that provided for an extension beyond the initial 25-year contract period only if companies operating the fields agree to increase the state’s share of profit by 10 percent. ONGC which as a government nominee picked up 30 percent stake in the Rajasthan block in 1995, also was of the opinion that PSC provides for an extension on same terms. ONGC had first in May 2015, then again on at least two occasions in 2016, concurred with Cairn’s interpretation of the PSC for extension of the Rajasthan contract by 10 years on same terms. After Cairn, now known as Vedanta Ltd, in February 2014 asked oil ministry for extension of PSC by 10 years, ONGC concurred with the proposal, sources said, adding that the company feels the new conditions for increased profit share is unfair.

India will work to create a network with other major oil buyers in Asia, such as China, South Korea and Japan, to negotiate better terms with sellers. Crude oil imports by China, India, Japan and South Korea alone make up more than 20 percent of global demand.

Global demand for oil is likely to moderate this year, as the price of crude nears $80 a barrel and many key importing nations no longer offer consumers generous fuel subsidies, the IEA said. The Paris-based IEA cut its forecast for global demand growth to 1.4 million bpd for 2018, from a previous estimate of 1.5 million bpd. Oil inventories in the world’s richest nations, the most transparent and easy to track, have now fallen 1 million barrels below the five-year average, the level targeted by the OPEC and its partners, as the group restrains crude output for a second year. Iran, which produces around 3.8 million bpd and is OPEC’s third-largest supplier behind Saudi Arabia and Iraq, could face severe disruption to its exports. The IEA said the previous round of sanctions, which were lifted in early 2016, cut Iran’s crude exports by more than 1 million bpd. The IEA estimates demand for OPEC’s crude will average 32.25 million bpd for the rest of 2018, compared with output of 32.12 million bpd in April. World supply, meanwhile, rose 1.78 million bpd in April from a year earlier, driven predominantly by non-OPEC production. The IEA, which advises Western governments on energy policy, expects non-OPEC supply to rise by 1.87 million bpd in 2018, up from a previous forecast of 1.8 million bpd.

US crude oil production jumped 260,000 bpd to 10.26 million bpd in February, the highest on record, the Energy Information Administration said. Production in Texas rose by 106,000 bpd to above 4 million bpd, also a record high based on the data going back to 2005. The Permian basin, which stretches across West Texas and eastern New Mexico, is the largest US oilfield. Output from North Dakota declined marginally to 1.15 million bpd, while output in the federal Gulf of Mexico rose by 89,000 bpd to 1.72 million bpd.

Oil prices are at risk for further gains due to the United States’ decision to withdraw from the 2015 Iran nuclear agreement, coupled with rising tensions in other oil-producing countries such as Saudi Arabia and Venezuela, Goldman Sachs said. The investment bank’s current forecast is for Brent crude to hit $82.50 a barrel by the summer; it is currently trading around $77 a barrel. The harsher approach by the US could result in an initial loss of about 500,000 bpd in Iran’s output, which is currently 3.8 million bpd. US Treasury Secretary said he does not anticipate major oil price hikes after renewed sanctions hit Iranian production because some countries are willing to increase output to offset such losses.

A US decision to re-impose sanctions on Iran is supporting China’s newly established crude oil futures, and may spur efforts to start trading oil in yuan rather than dollars, traders and analysts said. Since launching in March, Shanghai crude oil futures ISCc1 have seen a steady pick-up in daily trading, while open interest – the number of outstanding longer-term positions and a gauge of institutional interest – has also surged. The world’s biggest importer of crude oil, China hopes the Shanghai contract will eventually rival international benchmarks Brent LCOc1 and benchmark WTI CLc1. The ascent of Shanghai crude is aided by China’s voracious demand for oil, with imports hitting a record in April of 9.6 million barrels per day. Beijing also wants to establish the yuan in physical oil markets, which would avoid the cost of exchanging dollars and increase the use of the renmimbi in global financial trade. State-owned refining major Sinopec has already inked a Middle East import deal against Shanghai crude, with plans being developed to sign more such contracts. Reimposed sanctions on Iran could give China leverage to demand oil imports from the country be priced off Shanghai’s crude futures. However, Iranian oil is not among the types of Middle East crude deliverable through the Shanghai exchange mechanism. To price it off Shanghai futures, traders would have to agree to transact Iranian crude through buying opposite positions in Shanghai futures and then swapping those positions Exchange of Futures for Physical contract that would account for the price difference between Iranian oil and the Shanghai futures price.

Iranian Oil Minister Bijan Zangeneh said that Tehran preferred a “reasonable” crude oil price to avoid market instability. He said that “manufactured tensions” were the reason behind the current rise in oil prices. Oil prices rose about 2 percent, with Brent settling up $1.25 at $74.87 a barrel, as global supplies remained tight and the market awaited news from Washington on possible new US sanctions against Iran.

BP CEO Bob Dudley expects a flood of US shale and the reopening of OPEC taps to cool the oil market after crude rose above $80 a barrel. US President Donald Trump’s decision to exit an international nuclear deal with Iran and revive sanctions on the OPEC member country, as well as Venezuela’s plummeting output, has helped to lift oil prices to their highest since 2014. But BP sees oil falling to between $50 and $65 a barrel due to surging shale output and OPEC’s capacity to boost production, the CEO said. Crude exports from Iran, the third-largest member of the OPEC, could drop by 300,000 to 1 million bpd as a result of US sanctions, the CEO said. The 30 percent recovery in crude prices since February has given strong tailwind to oil companies such as BP, whose profits recovered last year after a three-year slump in the market.

Iran is readying the first commercial exports of its West Karoun crude oil grade for May or June, even as fresh economic sanctions against the country loom. Iran has already been shipping samples of the grade to customers since production from the West Karoun oilfields in southwest Iran nearly doubled in the past year to 300,000 bpd. A new export facility allows West Karoun to be shipped directly rather than blended with other grades. Iran used to sell crude only under long-term deals before economic sanctions were imposed in 2012, but began spot sales after sanctions were lifted in 2016 to regain market share. Iran’s effort to develop demand for West Karoun suggests Tehran hopes to sell the oil even in the face of possible new sanctions.

Russia’s energy ministry does not rule out a global oil production cut deal led by OPEC and Moscow being extended to 2019. The next meeting of OPEC members plus Russia and other non-OPEC producers is scheduled for next month in Vienna.

OPEC is looking closely at a drop in oil output from Venezuela to see if the loss of supply from the member state warrants action by the group. Falling Venezuelan output due to an economic crisis has helped the OPEC deliver a bigger cut than intended under its pact with Russia and other producers to curb supplies and remove a global glut. The pact, which began in January 2017 and runs to the end of 2018, will be reviewed when OPEC meets on June 22 to review policy. OPEC’s compliance with the deal reached an unprecedented 166 percent in April, meaning it has cut well above its target. Global inventories have eased back close to their five-year average, the measure originally targeted by OPEC and its allies. The output reductions combined with worries about supply disruptions due to US sanctions on Iran pushed oil prices above $80 a barrel last week, the highest since November 2014. Oil output in Venezuela hit a long-term low of 1.505 million bpd in April, almost 500,000 bpd below its OPEC output target.

Saudi Arabia said it is consulting other oil producers in and outside OPEC to ensure the world has adequate supplies to support economic growth after prices hit $80 a barrel for the first time since 2014. Saudi Arabian Energy Minister Khalid al-Falih said that he had called his counterparts in the United Arab Emirates, the US and Russia, as well as major oil consumer South Korea, to “coordinate global action to ease global market anxiety”. Falih also said he had reassured the executive director of the International Energy Agency of “commitment to the stability of oil markets and the global economy” and that he would contact others over the next few days. The Saudi energy ministry said that the kingdom together with other producers would ensure the availability of adequate supplies to offset any potential shortfalls.

Nearly 100 British Columbia business, labor and aboriginal leaders went to Edmonton in Alberta to show support for an oil pipeline expansion stalled by opposition from environmentalists, other aboriginals and the British Columbia government. In April, Kinder Morgan halted all non-essential work on the C$7.4 billion ($5.8 billion) expansion, which would nearly triple capacity on an existing line from Edmonton to the Vancouver area, citing the vehement opposition in British Columbia. Oil prices climbed above $80 for the first time since 2014, prompting renewed optimism from energy producers around the world. But Canadian oil trades at a steep discount to the US benchmark CLc1, made worse in recent months as rising output ran up against transportation bottlenecks.

Eni has recouped all outstanding payments that Iran owed the Italian oil company for past investments and has no plans for any new projects, CEO Claudio Descalzi said. Eni’s only remaining activity in Iran is the monthly purchase of 2 million barrels of oil as part of a contract that expires at the end of the year, Descalzi said. He said that supply could be sourced from elsewhere.

Nigeria’s government plans to create a powerful energy regulator with broad oversight of the oil and gas sector, according to draft versions of sweeping reforms known collectively as the PIB. The PIB aims to improve transparency, attract investors, stimulate growth and increase government revenues. The inability to pass the law and uncertainty around taxation has stunted investment in the west African nation, particularly in deep-water oil and gas fields. The three PIB sections yet to be passed address fiscal and administrative issues and local communities affected by the oil industry. Senate President Bukola Saraki said Nigeria’s parliament aims to pass the long-delayed PIB by the end of July. The administrative bill largely deals with the scope of the Nigerian Petroleum Regulatory Commission, which would be the main body regulating the oil and gas sector in the country. The bill sets the time limits for various kinds of licenses: three years for an exploration license, 25 years for onshore petroleum licenses and 30 years for deep offshore. The fiscal bill sets out the rates of tax and royalties for various oil and gas enterprises, as well as various breaks such as upstream gas operations receiving a tax-free period of five years from the start of production. Additional tax will also be charged when crude prices exceed $60 a barrel, the draft said. The third draft section of the PIB addresses communities that host or are affected by oil and gas sector work.

Poland’s imports of Russian oil last year fell to their lowest level since 2005, a central bank report showed, though Warsaw’s bid to diversify its energy imports also meant paying higher prices. Russian oil accounted for 76 percent of all oil purchases, down from 96 percent in 2012, as state-run refiners PKN Orlen and Lotos increased their purchases of oil from sources other than Russia. PKN Orlen signed a long-term agreement on regular oil supplies with Saudi Aramco in 2016 and since then both PKN and Lotos have also purchased oil from Iran and the US. But Poland is paying a price for its diversification. While the cost of Russian crude in December averaged $59.70 per barrel, Kazakh oil was $60.20 and US oil $65.60 a barrel, the report said. Polish refineries rely mostly n Russian oil delivered via pipelines built in the 1960s but last year every third barrel of oil imported was shipped, the report also said.

Russia has exported less crude oil to Europe this year as the quality of the fuel on offer deteriorated and tense diplomatic relations prompted it to redirect more volumes to China. Russia increased oil pipeline exports to China by almost 50 percent in January-April from a year earlier to 12.4 mt, Igor Dyomin, a spokesman for Transneft, Russia’s oil pipeline monopoly, said. The increase in oil supplies to China has resulted in a worsening quality of Europe-bound Urals blend, including an increase of unwanted sulfur content. Dyomin said that Hungary, Slovakia and Poland cut Russian oil imports by around 10 percent in January-April, and shipments to Europe via the two branches of the Soviet-built Druzhba pipeline declined by 225,000 tonnes to 15.75 mt in the first fourth months of the year.

ConocoPhillips is trying to seize PDVSA’s oil assets at the 335,000 bpd Isla refinery in Curacao, which would expand its control over the Venezuelan state-run company’s barrels for export. Under court orders to enforce a $2 billion arbitration award by the International Chamber of Commerce, the US oil firm temporarily seized about 4 million barrels of crude that PDVSA had stored on the Dutch Caribbean island of St. Eustatius and took control of a terminal on Bonaire, prompting PDVSA to move several oil tankers away from the region. Bonaire held about 800,000 barrels of fuel oil, according to a source close to the operations. In Aruba, most oil inventories belong to PDVSA’s US refining arm Citgo Petroleum.

Saudi Arabia would supply Sudan’s energy needs for five years on credit under an agreement being discussed by both governments. The deal would provide about 1.8 mt of oil a year to Sudan, which in recent months has been hit by a sharp foreign currency crisis and an acute fuel shortage that has forced people to queue at gas stations for hours. Once an oil exporter, Sudan was forced to begin importing it after the south seceded in 2011, taking with it three-quarters of the country’s oil output and its main source of foreign currency.

Iraq’s North Oil Company signed an agreement with BP to triple output from the Kirkuk fields in the north of the country, Oil Minister Jabar al-Luaibi said. Under the deal, BP will boost output capacity from six fields in the Kirkuk region to a total of more than 1 million bpd. Iraq plans to start trucking crude from Kirkuk to Iran, but the road to the border has yet to be secured from attacks by Islamic State insurgents. Kirkuk is one of the biggest and oldest oilfields in the Middle East, estimated to contain about 9 billion barrels of recoverable oil, according to BP. BP has provided technical assistance in the past to North Oil to help redevelop the Kirkuk field. Iraq, the second biggest producer in the OPEC behind Saudi Arabia, has capacity to produce almost 5 million bpd, but now produces 4.45 million bpd to comply with an OPEC-led deal to curb supplies. Most of Iraq’s crude is produced from areas managed by the central government of Baghdad, in the south, and exported from southern ports on the Gulf. The KRG exports about 300,000 bpd of crude from northern Iraq through a pipeline across Turkey.

Iraq’s crude oil exports from its southern ports averaged 3.340 million bpd in April, lower than in March, because of maintenance at loading terminals early in the month, the oil ministry said. The March average was 3.45 million bpd. Exports from the south are managed by the central government in Baghdad. The semi-autonomous Kurdistan region exports about 300,000 bpd of crude from northern Iraq through a pipeline across Turkey. There were no exports in March from the Kirkuk fields, located in northern Iraq but under the control of Baghdad, the oil ministry said. Kirkuk oil exports stopped in October, when Iraqi government troops backed by Shi’ite paramilitary forces dislodged Kurdish fighters from the region.

An international arbitration court has ordered Venezuela’s oil company PDVSA to pay ConocoPhillips $2.04 billion for early dissolution of two joint ventures for producing oil in the OPEC-member country, the US firm said. Conoco’s assets in Venezuela were expropriated in 2007 following a nationalization of the country’s oil industry led by late President Hugo Chavez. The firm left the nation after it could not reach a deal to convert its projects into joint ventures controlled by PDVSA. Conoco had sought up to $22 billion from PDVSA for the broken contracts and loss of future profits from the Hamaca and Petrozuata oil projects. French oil and gas major Total said it was interested in Saudi Arabia’s petrol station market and had signed a Memorandum of Understanding with state energy giant Saudi Aramco to look at options. Total and Aramco are considering the joint acquisition of petrol station operators in Saudi Arabia. Abu Dhabi National Oil Co acquired a license to operate petrol stations in Saudi Arabia, the company’s retail fuel unit said. Dubai’s Emirates National Oil Co also operates petrol stations in Saudi Arabia.

China’s Sinopec, Asia’s largest refiner, plans to continue to cut their Saudi Arabian crude oil purchases for June and July loadings, after slashing May shipments by 40 percent, the company’s trading arm Unipec said. Unipec said the reductions in May followed state oil company Saudi Aramco’s decision to raise its official selling prices for Arab Light crude which made the grade uncompetitive against other crudes. The unexpected price increase prompted some Asian refiners to trim imports and seek substitutes in the spot market. Sinopec’s request for a 40 percent cut in their May Saudi crude imports also coincides with scheduled maintenance at its largest refinery. Russia overtook Saudi Arabia as the top oil supplier to China in 2017.

| OPEC: Organization of the Petroleum Exporting Countries, US: United States, IEA: International Energy Agency, bpd: barrels per day, IOC: Indian Oil Corp, VAT: Value Added Tax, BJP: Bharatiya Janata Party, OMCs: Oil Marketing Companies, mt: million tonnes, LPG: liquefied petroleum gas, ATF: aviation turbine fuel, GST: Goods and Services Tax, BPCL: Bharat Petroleum Corp Ltd, DGH: Directorate General of Hydrocarbons, PML: Petroleum Mining Lease, ONGC: Oil and Natural Gas Corp, OIL: Oil India Ltd, PMO: Prime Minister’s Office, IOC: Indian Oil Corp, HPCL: Hindustan Petroleum Corp Ltd, PESO: Petroleum and Explosives Safety Organisation, PSCs: Production Sharing Contracts, CEO: Chief Executive Officer, PIB: Petroleum Industry Bill |

28 May. Prime Minister (PM) Narendra Modi said 10 crore LPG connections including 4 crore free to poor women, were given in last four years, compared to 13 crore in six decades since independence, as his government stepped up efforts to shield women and children from kitchen smoke. Launched in May 2016, the scheme aims to provide in next three years as many as 5 crore free cooking gas connections to women from extremely poor households, aimed at reducing the use of polluting fuels such as wood and dried cow dung that, according to the World Health Organization, cause 1.3 million premature deaths in India every year. The target was raised to 8 crore this year by adding two additional years. India aims to increase liquefied petroleum gas (LPG) usage to cover 80 percent of its households by March 2019, against 72.8 percent in 2017. The Prime Minister did not give a date for achieving 100 percent coverage. Modi said LPG is the cleanest and easily available source of energy that is giving women a healthier lifestyle, saving them time, helping them financially and saving the environment. As many as 45 percent of the four crore free LPG connections given under Ujwalla are to dalits, he said. Modi said more than 1,200 petrol pumps have been given to dalit families since 2014 as compared to 445 retail outlets given to such families during 2010-2014 period of the previous UPA regime. Similarly, 1,300 families got LPG distributorship as compared to 900 in the previous years. Modi said the government is targeting one lakh LPG Panchayats this year to boost the LPG refill consumption and provide a window for the benefits of cleaner fuel to become visible. Under the Pradhan Mantri Ujjwala Yojana, the government provides a subsidy of Rs 1,600 to state-owned fuel retailers for every free LPG gas connection that they install in poor rural households without one. This subsidy is intended to cover the security fee for the cylinder and the fitting charges. The beneficiary has to buy her own cooking stove and refills. To reduce the burden, the scheme allows beneficiaries to pay for the stove and the first refill in monthly installments. However, the cost of all subsequent refills has to be borne by the beneficiary household. He said 70 percent of the villages are 100 percent covered by LPG and 81 percent village are covered up to 75 percent. In his interaction with women beneficiaries from different states, he asked them if they were getting LPG refills on time and if any middlemen were asking for money. He asked them about their experience of using LPG and how it saved them time, which they can utilise for supporting the family financially by starting schemes like tiffin service.

Source: The Times of India

28 May. Encouraged by the Union Road Transport and Highways Minister Nitin Gadkari’s support to the demand for bringing fuel under GST (Goods and Services Tax) purview, online activists have shot out a fresh online missive addressed to PM (Prime Minister) Narendra Modi as part of the campaign #GST4Petrol. The online petition, now gaining ground, has also pointed out that Maharashtra Chief Minister Devendra Fadnavis has come out in support of bringing diesel and petrol under the GST purview. As many as 200 people have already signed the petition.

Source: The Times of India

28 May. States can cut petrol price by Rs 2.65 per litre and diesel by Rs 2 a litre if they decide to forego potential additional gains out of high crude oil rates, SBI’s Ecowrap report said. It said that states earn an additional revenue of Rs 2,675 crore over and above the budget estimates for every $1/barrel increase in oil prices. It said that one suggestion to further rationalise the petrol and diesel prices is to consider a pricing mechanism where VAT (Value Added Tax) is imposed on base price only by states and not on prices inclusive of the Centre’s tax.

Source: The Times of India

28 May. The oil ministry has given in-principle nod to petrol and diesel futures. SEBI (Securities and Exchange Board of India) will take the final decision on petrol and diesel futures. ICEX (Indian Commodity Exchange) had sought SEBI’s approval to launch petrol, diesel futures. Fuel prices have been on fire in the recent past. State-run oil marketers increased petrol and diesel prices for the 15th day in a row, despite a decline in crude oil rates. The revised petrol prices in metropolitan cities are – Delhi: Rs 78.27 per litre; Mumbai: Rs 86.08 per litre; Kolkata: Rs 80.76 per litre and Chennai: Rs 81.11 per litre. Meanwhile, the cost of diesel has also been increased and the revised prices in Delhi are – Rs 69.17 and Mumbai Rs 73.64 per litre. As the Centre has come under fire over fuel price hike, Union Oil Minister Dharmendra Pradhan earlier assured the public that the government will soon take out a solution to tackle the situation.

Source: The Economic Times

24 May. States have the capacity and must reduce the duty on petrol, while the Centre should create fiscal space to deal with the impact of spurt in oil prices, NITI Aayog Vice Chairman Rajiv Kumar said. The rising crude prices in the international market prompted state-owned oil companies to raise domestic prices for 11th day in a row. Petrol costs Rs 77.47 a litre in Delhi and diesel Rs 68.53 a litre. He said that it is important for them (states) to agree 10-15 percent duty cut and take home the same amount of tax revenue as budgeted. The states, he said, on an average tax petrol at 27 percent. As regards the Centre, he said they have the fiscal space and need to create more to deal with the problem of rising oil prices.

Source: Business Standard

24 May. The government may levy a windfall tax on oil producers like Oil and Natural Gas Corp (ONGC), as part of a permanent solution it is working on for moderating the spiralling retail prices of petrol and diesel. The tax, which may come in the form of a cess, will kick in the moment oil prices cross $70 per barrel. Under the scheme, oil producers, who get paid international rates for the oil they produce from domestic fields, would have to part with any revenue they earn from prices crossing $70 per barrel mark. The thinking in the government is to levy cess on all oil producers — both public and private sector — so as not to attract criticism of stifling State-owned explorers. A similar tax was considered in 2008 when oil prices were on the rise but the idea was dropped after stiff opposition from private sector firms like Cairn India. Law Minister Ravi Shankar Prasad had stated that the government will take a long-term view on the retail prices of petrol and diesel, which had touched record high instead of having an ad hoc measure. The government raised excise duty nine times between November 2014 and January 2016 to shore up finances as global oil prices fell, but then cut the tax just once in October last year by ₹ 2 a litre. The Centre levies ₹19.48 as excise duty on a litre of petrol and ₹15.33 on diesel. State sales tax or VAT (Value Added Tax) varies from state to state. Unlike excise duty, VAT is ad valorem and results in higher revenues for the State when rates move up.

Source: The Hindu

24 May. India’s Prime Minister (PM) Narendra Modi has an oil problem. And it’s set to worsen with Saudi Arabia rooting for the commodity to push through the $80 barrier. Modi’s government made the most of cheap oil by substituting any fall in prices with taxes that kept retail fuel rates unchanged for consumers and boosted the federal revenue. Now, pressure is mounting to forego some of that windfall as pump prices of gasoline and diesel hit records, likely marring the ruling party’s prospects at the national ballot in 2019. Fuel prices have started to pinch as Brent, the benchmark for more than half of the world’s oil, hit $80 a barrel. It’s still short of its all-time high of $147.50. But cutting local taxes, which account for more than half of the retail gasoline and diesel prices, would stretch government finances at a time when the subsidy burden on kerosene and cooking gas is climbing. Assuming an average oil price of $70, the fiscal 2019 subsidy would total about Rs 355 billion, or 105 billion rupees higher than budgeted, according to Kotak Institutional Equities. Meanwhile, Moody’s Investors Service estimates that fuel subsidies could total Rs 340-530 billion in fiscal 2019, the highest since fiscal 2015, if Brent crude oil prices average $60-$80 per barrel. For the Congress party, which trumped Modi’s BJP to form a coalition government in Karnataka, this is a political opportunity and the party is holding protests against rising fuel prices in the national capital and in Mumbai.

Source: Business Standard

24 May. Breaching the previous records, petrol and diesel prices in Patna climbed to Rs 83.01 and Rs 72.99 per litre, respectively. The premium quality of petrol and diesel in Patna, however, cost Rs 86.12 and Rs 76.65 per litre. Industry experts said petrol prices in Patna were the second highest in the country after Mumbai. Its prices in the state capital increased by Rs 1 per litre in the last 48 hours, whereas diesel became costlier by 57 paise per litre. Commuters who thronged the fuel stations sounded angry over the soaring prices. The steep hike in petrol prices has also given an opportunity to opposition parties to target the Narendra Modi government. Prof DM Diwakar, the head of economics division at AN Sinha Institute of Social Studies, also said international crude oil prices recorded a hike of 0.81 paise per barrel in the last 24 hours.

Source: The Times of India

23 May. Bharat Petroleum Corp Ltd (BPCL), an irregular gasoline importer, has bought more petrol, bringing its total purchases this month to 50,000 tonnes, traders said. Gasoline demand has been given a boost from not just India but also Indonesia as seasonal peak demand kicked in BPCL bought 35,000 tonnes of gasoline for May 25-30 arrival at Kochi from Oman Trading at a premium of about $3.50 a barrel It recently bought 15,000 tonnes for May 24-26 arrival at Haldia, but traders said details of that deal were not known Strong domestic demand coupled with recent refinery maintenance in India may have prompted BPCL to seek imports, traders said.

Source: Reuters

23 May. Fuel pump owners in Punjab sought reduction in taxes on petrol and diesel, alleging that higher retail prices in the state have led to smuggling of fuel from Chandigarh, where rates are comparatively lower. Pump owners further said they are suffering losses as vehicles and industries that require fuel cross over to Chandigarh-based fuel pumps to meet their petrol and diesel requirements. Petrol price in Punjab has touched Rs 82.37 per litre which is around Rs 8 per litre costlier than what is in Chandigarh. Similarly, diesel price, which is ruling at Rs 68.70 a litre in Punjab, is over Rs 2 per litre costlier than that in Chandigarh. The disparity in petrol and diesel prices has particularly hit the businesses of petrol pump owners in the border districts of Sangrur, Patiala, Bathinda, Gurdaspur, Mohali, Fathegarh Sahib, Ropar, Hoshiarpur, Gurdaspur and Mansa. Mohali has been the worst affected as it borders Chandigarh, where petrol is much cheaper. At present, tax rates on petrol and diesel in Punjab are about 36 percent and 17.22 percent, respectively. However, tax rate on petrol and diesel in Chandigarh stand at about 19.65 and 11.65 percent, respectively, Ashwinder Mongia, member of Petrol Pump Dealers’ Association of Punjab, said.

Source: Business Standard

23 May. Former Union Finance Minister P. Chidambaram claimed that the Union government can reduce the petrol price by as much as ₹ 25 a litre. Chidamabaram explained the burden of taxes on the retail price of petrol. Bonanza to central government is Rs 25 on every litre of petrol. This money rightfully belongs to the average consumer. BJP president Amit Shah said the government was concerned about the hike in fuel prices and would meet the oil companies. The retail prices of petrol and diesel are at a record high and in cities like Mumbai. The Opposition hit out at the government for the steep hike in recent days and alleged that oil companies were forced to keep the prices “artificially static” for the Karnataka elections and are now recovering from the consumers.

Source: The Hindu

23 May. The recent rally in international crude oil prices has inflated India’s crude oil import bill by 23 percent to $8.2 billion in the month of April despite the quantity of imports in the month falling by 5 percent, Petroleum Planning and Analysis Cell (PPAC) data showed. The data from the statistical arm of the oil ministry also shows the country’s total crude oil import bill in the current financial year (2018-2019) is expected to jump 24 percent to $109 billion from $88 billion last fiscal year. India imported 17.2 million tonnes (mt) of crude in the month of April, down 5 percent from 18.1 mt imported in the corresponding month last financial year. The country’s gross petroleum imports including crude oil and petroleum products also decreased to 20.2 mt in April 2018 from 20.8 mt in April 2017. However, due to the rally in the crude oil and petroleum product prices, the country’s gross petroleum import bill grew 24 percent to $9.4 billion as compared to $7.6 billion recorded in the corresponding month of the last financial year. Rising crude oil prices may worsen the country’s Current Account Deficit (CAD) to 2.5 percent in the present financial year from an estimated 1.9 percent in the last financial year, SBI Capital Markets said in a recent report. Sector analysts expect that this may lead to petroleum subsidy to fall short on the back of steady rise in crude oil prices and revised target of providing 8 crore liquefied petroleum gas (LPG) connections under Pradhan Mantri Ujjwala Yojana (PMUY). The government under Budget 2018 allocated Rs 24,933 crore as petroleum subsidy for the current financial year, a mere 2 percent increase over the revised estimate of Rs 24,460 crore allocated last financial year.

Source: The Economic Times

23 May. A return to the ‘price control’ regime for auto fuels is definitely not a solution for protecting consumers from the adverse effect of the current global oil price spike, HPCL Chairman MK Surana said. Any such move will be a setback for the ‘deregulation reform’ that took decades to materialise, he said. Surana said consumers will be better off if GST (Goods and Services Tax) were to be levied on petrol and diesel, instead of the current taxation regime of excise and VAT (Value Added Tax). Surana said the government can offer comfort to consumers by rationalising taxes it charges on auto fuel under the GST.

Source: The Hindu Business Line

29 May. The share of city gas distributors in domestic gas consumption pie is on the rise and is likely to increase in the short to medium term, according to India Ratings and Research (Ind-Ra) report on oil and gas sector. The government in the Domestic Gas Allocation Policy has accorded the highest preference to city gas distribution. Thus, the share of fertiliser sector came down gradually to around 25% in March 2018 from around 37% in November 2015 while that of city gas distributors increased to around 19% from around 11%. This has also led to an increase in pooled natural gas price for domestic urea manufacturers. Additionally, with the government focusing on expanding the city gas distribution network and higher number of cities being bid for, the city gas distribution sector is likely to grow. This would result in a lower allocation of domestic gas to the fertiliser sector. Petroleum Planning and Analysis Cell (PPAC) estimates crude import of 227 million metric tonnes (mt) in FY19. The increase in gas prices is likely to impact the fertiliser, power and city gas distribution entities which are the primary consumers of NG.

Source: Business Standard

29 May. The Petroleum and Natural Gas Regulatory Board (PNGRB) expects the proposed gas trading hub to be functional by the end of the calendar year and ratings agency CRISIL has been appointed to assist the regulator and the government in framing rules for the exchange. The hub will work in the lines of Power Exchange which determines the price based on supply and demand and market forces. Currently, the central government fixes the price of the bulk of domestically produced natural gas. The rate, arrived at using price prevalent in gas-surplus nations of US, Canada, UK, and Russia, is $3.06 per million British thermal unit for six month period beginning April 1. In comparison, the cost of imported LNG into India is around $7.5. On the current round of CGD (city gas distribution) bidding, he said it covers 86 geographical locations for selling CNG (compressed natural gas) and piped cooking gas in 174 districts in 22 states and union territories and likely to attract an investment of Rs 70,000 crore. In addition to Hyderabad, the current bidding covers 20 districts of Telangana, he said. On the infrastructure part, he said there is about 16,000 kilometre (km) of pipeline existing and operating and another 12,000 km pipeline is under construction. The PNGRB focuses on increasing the sale of natural gas in the overall energy basket from 6.2 percent to 15 percent as mandated by the government. He said the regulator will review the performance of the companies which were awarded contracts in the earlier bidding.

Source: The Economic Times

28 May. CNG price in the national capital was hiked by Rs 1.36 per kilogram (kg) as input raw material got costlier because of rupee depreciation and rise in natural gas price. CNG will cost Rs 41.97 per kg in Delhi with effect from midnight tonight following the price increase, Indraprastha Gas Ltd (IGL) said. In adjoining Noida, Greater Noida and Ghaziabad, rates were increased by Rs 1.55 to Rs 48.60 per kg. IGL said it will continue to offer a discount of Rs 1.50 per kg in the selling prices of CNG for filling between 12.30 am to 5.30 am at select outlets. Thus, the consumer price of CNG would be Rs 40.47 per kg in Delhi and Rs 47.10 per kg in Noida, Greater Noida and Ghaziabad during 12.30 am to 5.30 am at the select CNG stations across the region.

Source: Business Standard

25 May. Oil and Natural Gas Corp (ONGC) will by early 2019 quadruple the output from an offshore gas block in the Bay of Bengal that it spent a billion dollars on last year. Output from the Deendayal natural gas block off India’s east coast will reach as high as a million standard cubic metres per day by January 2019, according to ONGC. ONGC bought the Deendayal field in 2017 from Gujarat State Petroleum Corp (GSPC) while it was still undergoing test runs for commercial gas production. ONGC and Reliance Industries Ltd (RIL), along with partner BP Plc, are developing several natural gas discoveries in the KG basin. These discoveries could contribute up to 50 million cubic metres of daily output, or about a third of India’s current demand. ONGC, which meets up to 40 percent of India’s total natural gas demand, had been saddled with ageing fields and dropping production for almost a decade. But the company registered a marginal jump in production in fiscal 2016/17, and then production increased by another 6 percent last year in the year through March 2018. Analysts said the increase in output from the Deendayal field will help ONGC in clocking an increased overall output in the current fiscal year as well. The Deendayal gas field was discovered in 2005. The project was a flagship gas initiative of Indian Prime Minister Narendra Modi, who at the time was Chief Minister of Gujarat state on India’s west coast. Modi said then that the field held up to 20 trillion cubic feet (560 billion cubic meters) of natural gas, although delays and cost overruns in developing the field had some analysts questioning the quality of the investment for ONGC. ONGC will be able to monetise the gas at a higher price and with more marketing freedom under new rules meant to encourage the development of frontier offshore reserves. Prime Minister Modi has set a target of increasing the share of natural gas in India’s energy mix to 15 percent by 2030, from 6.5 percent now. Modi also wants to cut down on energy imports, especially crude oil. India consumed around 145 million cubic metres of natural gas a day, nearly 50 percent of it imported, in 2017/18. The government has projected India’s potential demand at nearly 500 million cubic metres of gas a day.

Source: Reuters

24 May. GAIL (India) Ltd has switched its focus to short-term and spot deals for the purchase of liquefied natural gas (LNG) to meet rising demand and hedge against price volatility, its chairman B. C. Tripathi said. The move from longer-term deals comes as India builds infrastructure, including pipelines and import facilities, to raise the share of gas in its energy mix to 15 percent by 2030 from the current level of about 6.5 percent. Supply under GAIL’s long-term deals with companies in the United States began this year. GAIL has deals to buy 5.8 million tonnes per annum (mtpa) of LNG from the United States (US). Price-sensitive customers in the South Asian nation have already forced renegotiation of three long-term LNG deals. From next month the company will start getting supplies under a reworked 2.5 mtpa long-term deal with Russia’s Gazprom, Tripathi said. GAIL also buys 1 mtpa from Qatar while marketing 5 mtpa procured by India’s Petronet LNG. The company will gradually ramp up supplies under the Gazprom deal and should start receiving the contracted 2.5 mtpa by 2022-2023, Tripathi said. Pricing of US LNG is linked to a formula but other charges including freight to India add an extra $2-$3 per million British thermal units, leading to GAIL scouting for destination, time and volume swap deals. In 2018/19 the state-run firm will receive 100 LNG cargoes, mostly through long-term deals, compared with 52 cargoes imported a year ago, Tripathi said. The company will bring 68 cargoes to India and trade the remainder on the global market. GAIL, which operates 11,000 kilometre (km) of pipelines, is laying 5,000 km of gas lines at a cost of 250 billion Indian rupees ($3.66 billion), Tripathi said. Tripathi said he would look at tying up new long-term supplies beyond 2022-23, when the country’s six new fertiliser plants begin operation, consuming about 3.5 mtpa of LNG.

Source: Reuters

24 May. In a major step towards bringing natural gas pipeline directly to the kitchens, the state cabinet has cleared the proposal of Green Gas Ltd (GGL), a joint venture between GAIL (India) Ltd and Indian Oil Corp (IOC), to start laying infrastructure for the project. Agra and Lucknow have been chosen as the first cities where piped natural gas (PNG) connections will be provided. A decision to the effect was taken during a cabinet meeting chaired by Chief Minister Yogi Adityanath. According to the ministry of urban development, the state cabinet has also approved guidelines for the laying of underground gas pipeline. The move will help reduce pollution and road traffic caused by transportation of gas cylinders. Standard security arrangements will be made during the laying of underground pipes within city limits.

Source: The Times of India

29 May. The management of Coal India Ltd (CIL) has decided to provide an additional 7 percent salary on basic and dearness allowance that would replenish employees’ pension fund that is facing a shortfall of Rs 25,000 crore. It is expected to cost the company an additional Rs 1000 crore annually. A gazette notification to this effect is expected soon following which it would be implemented, CIL said. The development comes a year after salaries were raised by about a fifth followed by a coal price hike in January this year.

Source: The Economic Times

28 May. Newly-elected Karnataka Chief Minister H. D. Kumaraswamy met Prime Minister (PM) Narendra Modi and flagged the issue of shortage of coal for the state’s thermal power plants. He said he had sought cooperation of the Centre for the development of the state. The current availability of coal in the state is sufficient to operate the plants for 15 days, he said.

Source: The Times of India

27 May. India’s coal import fell by 9 percent to 17.32 million tonnes (mt) in April on the back of ample supply of dry fuel from domestic sources. Import demand from thermal power plants remained low due to ample supply from domestic sources, mjunction services said. Of the 17.32 mt dry fuel imported, the import of non-coking coal was 12.3 mt, followed by coking coal at 3.5 mt, among others. The lower volume of coal and coke imports in April could be attributed to a fall in non-coking coal and pet coke imports during the month under review. Also, met coal imports remained flat on a yearly basis, and subdued compared to the previous month, mjunction services said. World Coal Association said that in FY’19 India will see rise in coal imports.

Source: The Financial Express

26 May. As electricity prices soar with demand growing, Gujarat Urja Vikas Nigam Ltd (GUVNL) has invited bids from independent power producers (IPPs) for 1,000 MW of electricity on a short-term basis, for eleven months, from August 1, 2018 to June 30, 2019. Bids have been invited under the central government’s policy allowing flexible utilization of domestic coal at power generating stations. Also known as coal tolling, this mechanism allows more fuel-efficient power producers to generate electricity using coal allocated to public sector power utilities and supply the electricity so generated back to the utility at a tariff discovered through bidding. According to the tender document released by GUVNL, its subsidiary Gujarat State Electricity Corp Ltd (GSECL) will provide coal to the successful bidder from mines allocated to GSECL. The coal will be made available from the Korea Rewa coalfield in Madhya Pradesh and Korba coalfield in Chhattisgarh. GUVNL has fixed a ceiling tariff of Rs 3.01 per unit. The last date for submitting bids is June 22.

Source: The Times of India

24 May. India’s biggest aluminium producer Vedanta Ltd may be forced to reduce output if restrictions on coal supplies to the non-power sector drag on for another week, according to its chief executive Samir Cairae for metals business in the country. Vedanta has just one day’s worth of coal stockpiles left at its Jharsuguda smelter in Odisha after a unit of Coal India Ltd (CIL) stopped supplies from 18 May, Cairae said. Mahanadi Coalfields Ltd issued orders to halt deliveries to all non-power customers following a government directive to prioritize the electricity industry. The government has prioritized supplies to power stations to boost their inventories, which are near the lowest since mid-February. The decision is set to bring industries that generate their own electricity using coal to a standstill, the Indian Captive Power Producers Association said. An aluminium smelter once shut down needs at least six months to restart, Cairae said. Vedanta will take temporary steps such as purchasing electricity from the grid to prevent a shutdown, Cairae said. Jharsuguda requires 17 million tonnes (mt) of coal a year to generate electricity at its captive power plant, half of which comes from contracts with CIL, Cairae said.

Source: Livemint

23 May. The government has accelerated exploration and drilling of coal in the northeastern states of the country, according to the coal ministry. The ministry is focussing on clean coal technologies for producing clean coal as it would stay on as a primary input for producing thermal power in near future, Anindya Sinha, project adviser in the coal ministry, said. The government has also issued directives to all coal companies to set up washeries at their coal mining plants to enable them generate Swachh Coal or clean coal for energy generation as well as meet requirements of steel plants, he said.

Source: India Today

29 May. In a bid to assist loss-making power distribution companies (discoms), the Central Electricity Regulatory Commission (CERC) has proposed that payment which they make to power generators would be according to the energy supply to discoms, rather than just plant availability. The move comes at a time when the plant load factor (PLF) or operating ratio of thermal plants is declining owing to less demand and increasing share of renewable energy, which operates at 20 percent PLF. CERC has proposed a new formula for payment to the generating companies (gencos) in its draft tariff regulations for 2019-24. In its earlier tariff policy, the CERC had proposed shifting incentives based on actual purchase of power. This was opposed by NTPC since it amounted to a situation that if power procurers do not purchase power from NTPC and it does not run its plants at 85 percent capacity, it would not be entitled to incentives. The regulated returns were linked to availability of NTPC’s plants. The power tariff paid by discom is divided into two parts — fixed cost which is the capital cost of the plant and energy tariff which is the cost of fuel. Discoms have to pay the fixed cost to the gencos with which they have signed long-term power purchase agreement, even when there is no supply. According to the tariff regulations 2012-17, a generating station has to declare availability on a daily basis. Failure to achieve the target plant availability factor leads to dis-incentive in terms of reduction of the fixed charges on proportionate basis and incentive for actual generation above the target availability factor. The target PAF is 85 percent. State-owned discoms have been reeling under debt and the reform scheme is yet to improve their loss status.

Source: Business Standard

26 May. Vice President M Venkaiah Naidu said it was not possible to ensure quality of life without electricity and asserted that renewable sources of energy should be explored. He was in the Uttar Pradesh capital to inaugurate a building of the state electricity regulatory commission. He also called on people to explore the possibility of new and renewable sources of energy. If electricity is to be given to every household, then it will have to be made so cheap that the consumer is not burdened, Naidu said. The vice-president also said it was time that one considers regulating the demand for electricity apart from focusing on energy supply aspects such as production and distribution. The commission can play an important role in determining the criteria for efficiency in the power sector and Demand Side Management (DSM), Naidu said.

Source: Business Standard

25 May. With a heat wave gripping the country– the northern states are reeling with temperatures of 44-46 degrees Celsius — the demand for electricity has soared to a record high. India recorded a cumulative power demand of 170,121 MW, which is around 8 percent higher than the same month last year. Northern and western states had the highest power demand, with Uttar Pradesh sourcing 19,082 MW, Delhi 6,029 MW, Rajasthan 10,395 MW, Gujarat 16,825 MW, and Maharashtra 23,609 MW. Leaving Jammu & Kashmir, Assam and Uttrakhand, none of the states faced any shortage in required power supply. For Delhi, 6,000 MW is a record high. In order to meet the stipulated demand, power distribution companies (discoms) in Delhi have tied up with various states through power purchase agreements (PPAs). According to the latest Load Generation Balancing report of Central Electricity Authority (CEA), power supply during this financial year is expected to be surplus, by 8.8 percent in energy terms and by 6.8 percent in peak terms, with peak demand at around 169 GW. As temperatures soared, spot power prices increased to Rs 11 per unit, averaging at around Rs 5 per unit. Power trading platform India Energy Exchange (IEX) witnessed a record high short-term power trading of 190 million units. The agency expects the demand to continue throughout the summers.

Source: Business Standard

24 May. With the Madras high court staying expansion of the Sterlite Copper unit in Tuticorin, the Tamil Nadu Pollution Control Board (TNPCB) ordered cutting of power supply to the plant, located in SIPCOT (State Industries Promotion Corp of Tamil Nadu) industrial estate on the outskirts of the port town. The TNPCB order may not have any significant impact, since the plant is already shut and has ceased operations for almost last two months. The Sterlite plant has a captive power unit for taking care of the power supply needs.

Source: The Times of India

24 May. Aiming to strengthen electrical transmission and distribution system in the city, Punjab government has sanctioned Rs 64.82 crore for the entire project of delivering electricity supply to the consumers of Punjab State Power Corp Ltd (PSPCL). The project is expected to start from September this year. At present, tendering process of the project has been initiated to outsource the work. Member parliament from Ludhiana Ravneet Singh Bittu disclosed about the development and also said that the strengthening of electrical power distribution network of Ludhiana city includes 417 power lines of 5 sub-divisions of Ludhiana city (West), CMC, Focal Point, Estate and Sunder Nagar. The project will incude replacement of low-tension line of 163.22 km and high tension lines of 626.66 kilometre (km) along with reconstruction of 1,197 high tension connections, which will be beneficial for the consumers.

Source: The Times of India

23 May. As the power sector struggles to deal with stressed generation assets worth Rs 1.74 lakh crore, power ministry secretary AK Bhalla has said that there is an urgent need to critically look at the developments in the regulatory environment in the last 15 years since the liberalisation of the sector with the introduction of the Electricity Act in 2003. Private power producers have claimed that their receivables due to various regulatory delays have swelled to more than Rs 8,000 crore. Bhalla was speaking the launch of IIT Kanpur’s Centre for Energy Regulation (CER), aimed to strengthen policy and regulatory institutions in the power sector. Discoms (distribution companies) are also largely state-held, except a few metros and industrial townships where the private model has become successful, he said. He also lamented the minuscule portion of electricity currently being traded at the exchanges, and pointed at the need to introduce derivatives and other trading tools to make the market more vibrant.

Source: The Financial Express

29 May. Manipur Deputy Chief Minister Yumnam Joykumar Singh said use of renewable energy should be considered to meet energy requirements in the state. He said energy consumption level is rising with increasing in population. He said that while non-renewable energy sources like fossil fuels will be exhausted after some decades, renewable sources like solar energy will last longer.

Source: The Times of India

28 May. Coal India Ltd (CIL) will develop its first-ever thermal power plant in the country in Odisha. The project will be implemented through CIL’s subsidiary, Mahanadi Coalfields Ltd (MCL). The power plant, which will have a capex of ₹ 13,000 crore and a capacity of 1,600 MW (2×800 MW), will come up at Sundergarh district. Power producer NTPC Ltd will be a joint venture partner and will likely have a 49 percent stake. The project has been able to get land and coal linkages and will utilise the pithead stock. NTPC will use existing power purchase agreements for the project.

Source: The Hindu Business Line

28 May. Each government house of the city having an area of 1 kanal and above will have to shell out Rs 250 per month for 1 kilowatt solar plant. Punjab governor and UT administrator V P Singh Badnore has approved the rate. The administration has decided to install at least two kilowatts solar power plant in each government house, so that it could be viable for residents to generate power. Around 350 to 400 government houses are located in 11 sectors of the city and all have ample space on their rooftops to install solar panels. All houses have an area of 1 to 6.5 kanals. According to renewable energy department, two kilowatts solar panel would generate between 200 to 250 units of power on a monthly basis. As per initial estimates, this will reduce the power bill by Rs 1,000 to Rs 1,200. The UT has again re-advertised the tender after making some changes in the rates and given 21 days’ time for interested parties to participate. The administration has planned make all government houses having an area of 1 kanal and above a solar energy-friendly house.

Source: The Economic Times

28 May. India added 269.64 MW of renewable energy capacity last month taking the total grid connected clean energy capacity to 70,053.81 MW as on April 30, according to the Ministry of New and Renewable Energy (MNRE) report. According to the report, India added 34,165 MW of wind energy, 21,885.1 MW solar energy including rooftop solar, 4,489.80 MW small hydro (of up to 25 MW) and 8,700.80 MW Biomass (Bagasse) Cogeneration as on April 30. The nation also witnessed 674.81 MW of Biomass (non-bagasse) Cogeneration)/Captive Power and 138.30 Waste to Power till April 30. India also installed off grid clean energy of 40 MW in April taking the total installed capacity in this segment to 1046.93 MW at April end this year. Under the grid connected renewable capacity, India did not add any capacity of Waste to Power and Biomass (Bagasse) Cogeneration. Similarly, under the off grid clean energy capacity, nothing was added in waste to energy and biomass gasifiers segment. However as much as 40 MW of solar photovoltaic (SPV) capacity was added in April this year. India has set and ambitious target of having 175 GW of renewable energy capacity including 100 GW of solar and 60 GW of wind energy by 2022.

Source: Business Standard

26 May. Integrators and consumers of solar power systems appealed for a single window to deal with all grid-connected solar power projects. Consumers currently need approval from the Goa energy development agency (GEDA) and the electricity department for such installations. The Goa State Solar Policy 2017 itself states that all solar and renewable power projects would be initiated through GEDA, which is the nodal agency of the Ministry of New and Renewable Energy (MNRE), and which will serve as a single window to deal with projects. Solar system integrators, who were attending the second edition of the Goa Conference on Solar Energy in the capital, also questioned the roles of the electricity department and GEDA. GEDA said the government has decided to set up a committee to resolve issues and problems faced by those in the solar power industry.

Source: The Times of India

23 May. Small African nations, which have or are yet to ratify the International Solar Alliance (ISA), are looking up to Indian support to build up solar capacity, Gambian Ambassador Jainaba Jagne said. Referring to the small population size yet high scope for solar energy and allied businesses in her country, she said that it was seeking technical support from India through ISA. She was speaking at the Fourth Smart Cities India 2018 Expo, underway at the Pragati Maidan with support from the Indian government. She said that with only 70 percent electrification in urban area and 15 percent in rural areas, there were huge business opportunities for solar companies in Gambia. Meanwhile, official representatives from Mauritius, a small African nation which is among founder-members of ISA, said that with climate change in mind, Mauritius also aimed at increasing share of solar power in its energy needs and reduce dependence on coal. The ISA was launched jointly by Prime Minister Narendra Modi and then French President Francois Hollande at the landmark 2015-Paris Climate Agreement meeting. India has 20 GW of installed solar capacity — one of the fastest growing in the world. The country has increased its solar power capacity by about eight times over the past four years. India’s wind power generation capacity is 32.8 GW. It aims to achieve 175 GW of clean energy by 2022, of which 100 GW will be solar.

Source: Business Standard

23 May. The Cabinet gave its ex-post facto approval to two separate memorandum of understandings (MoUs) with France and Morocco for cooperation in the field of renewable energy. Both sides aim to establish the basis for a cooperative institutional relationship to encourage and promote technical bilateral cooperation on new and renewable energy issues on the basis of mutual benefit, equality and reciprocity. The MoU envisages to establish a Joint Working Committee to review, monitor and discuss matters relation to areas of cooperation. The MoU aims for exchange of expertise and networking of information.

Source: Business Standard

23 May. The Bosnian unit of Indian renewable energy developer Suzlon Energy won the right to build a 25.2 MW wind farm in Bosnia to help it cut greenhouse gas emissions and meet the EU (European Union) renewable energy standards. The concession was awarded for a period of 30 years with a possibility to extend it. The wind farm, consisting of 12 turbines with 2.1 MW capacity each, will be built in Hadzici, a suburb of the Bosnian capital Sarajevo. The cost to develop the project is estimated at €30 million ($35.12 million).

Source: Reuters

29 May. Canada will buy Kinder Morgan Canada Ltd’s Trans Mountain pipeline for C$4.5 billion ($3.5 billion), the government said, hoping to save a project that faces formidable political and environmental opposition. Finance Minister Bill Morneau said purchasing the pipeline was the only way to ensure that a planned expansion could proceed. The pipeline, running from the oil sands of Alberta to a port in the Pacific province of British Columbia, would allow Canadian crude to gain greater access to foreign markets and higher prices. The company also faced opposition from environmentalists and aboriginal groups who worried about the pipeline spilling its tar-like heavy oil.

Source: Reuters

29 May. Oil companies in Norway are raising their exploration spending more than expected, Norwegian Petroleum Directorate (NPD) chief Bente Nyland said. Firms such as Equinor and other operators are now expected to drill around 45 exploration and appraisal wells in 2018, up from an earlier forecast of around 35 for the year, Nyland said. As a result of the increased activity, the NPD may have to revise upwards its forecasts for the oil industry’s overall investments in Norway, Nyland said. Norwegian Oil Minister Terje Soeviknes said he expects to name the winners of new exploration acreage in Norway’s 24th offshore licensing round in June.

Source: Reuters

29 May. Norway’s BW LPG, the world’s largest liquid petroleum gas shipper, said it had offered to buy competitor Dorian LPG in a $1.1 billion all-stock deal in an effort to boost its earnings in a weak market. New York-listed Dorian LPG’s equity is valued at about $441 million and including debt the transaction is valued at $1.1 billion. Dorian LPG’s fleet consists of 22 very large gas carriers (VLGC) and the combined company would own 73 vessels, of which 68 would be very large gas carriers, 2 VLGCs currently under order and 3 large gas carriers if the deal goes through. BW LPG said it expected minimum annual savings of $15 million from the deal.

Source: Reuters

28 May. Petrol prices are set to rise again in June, according to an announcement by the UAE (United Arab Emirates) Fuel Price Committee. Emirates National Oil Company said the Committee’s decision to raise the cost of Special 98, Special 95 and diesel by almost 6 percent Super 98 will rise to AED2.63 a litre (up from AED2.49), Special 95 will increase to AED2.51 a litre from AED2.37 while diesel will jump to AED2.71 a litre from AED2.56. The cost hike follows a similar increase at the start of May. Fuel prices were liberalised about two years ago, so prices now move with the global market.

Source: Arabian Business