-

CENTRES

Progammes & Centres

Location

Not a tentative repackaging as the 23 August 2019 ‘Measures to Achieve Higher Economic Growth’ proposed but real, tangible and bold steps that ensure growth. Not feeding the fears – moral, administrative or policy – that shackle entrepreneurs’ risk-taking appetite but catalysing, encouraging and empowering them. Not a return to the policy prisons of the past but to the enabling freedoms of the future. And not missing the successive growth buses to South Korea in the 1960s, to China in the 1990s, and to Vietnam today, but stepping out and grabbing opportunities of future, such as the potential exits of US companies from China, through a paradigm shift in economic thinking, policy reframing and nation building.

In a line, what India needs today is: Narendra Singur-to-Sanand Modi.

For a government that has stepped on the governance pedal with a conviction to change, the series of announcements on 23 August 2019 by Finance Minister Nirmala Sitharaman, were expectations belied. Following months of data that had been screaming ‘bad news’ – from contracting auto sales in all sub-segments to a consistently-slowing GDP growth over the past four quarters, a trend that will continue for the next two quarters – the announcements were a policy anti-climax. Barring an additional depreciation here, a shift to a 60-day GST refund cycle going forward there, some sounds around reducing tax terrorism that we need to see evidence before accepting, or withdrawing the surcharge on capital gains that shouldn’t have been proposed in the first place, most of the 32 announcements were a work-in-progress.

To call these measures the maintenance of a “reform momentum” is really diluting the idea. Reforms are what happened almost three decades ago, when then Prime Minister P.V. Narasimha Rao and then Finance Minister Manmohan Singh, under the pressure of a severe balance of payments crisis opened the economy up with the 24 July 1991 Statement on Industrial Policy. Reforms are what Prime Minister Narendra Modi along with then Finance Minister Arun Jaitley delivered on 1 July 2017, when they brought the goods and services tax into force and through it most indirect taxes under a single tax umbrella. The introduction of the Insolvency and Bankruptcy Code law a year earlier, on 28 May 2016, was reform. You could even stretch the term to intelligent application of technology to deliver financial inclusion through the Jan Dhan Yojana on 28 August 2014 as reform. But ease of credit, operationalising the 2014 Depository Receipt Scheme by SEBI, or simplifying KYC norms are processes that are now par for the course, the basic minimum – not reforms.

A 303-seat political mandate needs more than temporary band-aids or short-term activities of governance. Such a mandate expects the government to remove economic gangrenes that have been infecting and limiting India’s growth for the past seven decades. It seeks executive amputation on any and every rent-seeking law, rule and regulation. It demands a reframing, a rethink, a redesign of every legislation that has kept India’s entrepreneurs and wealth creators under the control of those who have a zero stake in the prosperity of the system, as neither their high salaries, nor huge bungalows nor inflation-adjusted pensions are affected by any economic crisis. They have been given, by law, the powers to control the lifeline of India at no cost to their personal fortunes – the pain of the nation doesn’t even touch, leave alone affect, them.

These inspectors in areas of tax, factories, wages, labour, prices stand between the elected aspirations of the people and governance delivery by the government the people have voted for. A thick wall of inertia, limited by their personal petty interests, separates the two. They are tasked with serving the nation but do everything to the contrary. India’s growth momentum, economic freedom and wealth creation actors are trapped between bad laws and good bureaucracy on the one side and good laws and bad bureaucracy on the other. The damage of the few – if indeed they are the few – blinds us to the good service done by their own colleagues.

There is no dearth of vision in the economic leadership of Modi’s second term – Finance Minister Nirmala Sitharaman; Commerce and Railways Minister Piyush Goyal; Roads and MSME Minister Nitin Gadkari; Water Resources (a new ministry that has the potential to become an economic driver over the next few years) Minister Gajendra Singh Shekhawat. Neither is there any shortage of will. The rajasic strength with which this government has moved on two long-stagnating issues – Pakistan using terror as state policy to kill people in Kashmir and elsewhere in India through the Balakot Attack, and breaking the Constitutional stalemate around Article 370 for seven decades – is something we’ve not seen in recent times.

Having seen and experienced the government’s intent and propensity to change, we wonder why such disruptive and decisive actions are not being taken in the economic domain. Why does the government still cobble together yesterday’s ideas such as jail terms for breach in corporate social responsibility (the amendment has not been notified, nor will be, but how it entered the amendment continues to baffle the mind)? Why does it revert to 1970s mindset of price controls, as in the case of medical equipment and now possibly hygiene products? What is the kick they derive by first strangulating and then taking credit for the de-strangulation of entrepreneurs, using high taxes, again of the 1970s policy vintage, giving us the impression that under the veneer of changed political faces, the soul of the Indian State remains the same? For a government with so many creative policy ideas on the wealth redistribution side, why is it lagging the world in giving policy direction to wealth creation in India?

Let us keep our domestic ideological limitations aside. Looking outside, an opportunity stares us in the face within the confines of US-China trade tensions. Earlier, we misread these tensions as temporary, whimsical, part of a transactive-reactive diplomacy. A year later, they seem to be coagulating. In his latest tirade, US President Donald Trump has ordered US companies to exit China. What’s stopping India from reaching out? After all, when Tata Motors moved out of West Bengal following protests organised by the All India Trinamool Congress and announced that it would look for alternate options in a 2 September 2008 statement, it took then Gujarat Chief Minister Narendra Modi less than 100 hours to seal the deal to bring the plant to Sanand, driving Nano, jobs and opportunities to Gujarat, from competing states of Karnataka, Maharashtra, Uttarakhand and Orissa. An anchor plant ready, other companies such as Ford, moved their plants to Sanand.

Today, Modi needs to remember the same policy flexibility and political enthusiasm that he had for Gujarat in 2008 and apply it to India. With most US companies looking to move into Vietnam, Prime Minister Modi needs to time-travel back a decade, meet Chief Minister Modi, take economic tips from the latter and bring global companies and industrial ecosystems into India through a mix of policy welcome, easy land and greater corporate flexibility. With several large states under the governance of BJP, nudging them to articulate this welcome should not be difficult. The political hurdles removed, a dynamism of the type we saw in Balakot Attack and Article 370 should facilitate entry. As large, global corporations move to India, Indian companies would follow and the biggest economic challenge we face today – employment creation – would restart. Further, as economic stakes of global companies rise in India, the country gets more secure not only in the short term through jobs and prosperity but in the long term as a preferred business destination of global conglomerates.

The time for tinkering is over. India has tasted success in matters of security. It knows this government can disrupt its way into delivering voter aspirations. In the context of a global slowdown, those aspirations today hinge around economic growth and jobs. For which India needs private investment, domestic and global.

And to accomplish that, it needs Narendra ‘Singur-to-Sanand’ Modi to drive it. Again.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

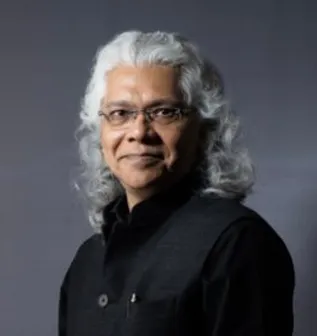

Gautam Chikermane is Vice President at Observer Research Foundation, New Delhi. His areas of research are grand strategy, economics, and foreign policy. He speaks to ...

Read More +