-

CENTRES

Progammes & Centres

Location

There is definitely a millennial-disruptor signature in the entire episode that is not exactly “carpe diem” in spirit.

Image Source: Mike Mozart — Flickr/CC BY 2.0

GameStop Corp. (GME) is an American company that deals in video game and gaming merchandise retailing. It is headquartered in Grapevine, Texas and has been one of the largest video game retailer in the world — operating through more than 5,000 stores across the United States of America.

GME was founded in 1984 as Babbage’s — a small education software retailer. Its most successful period as business was between 2004 and 2016. After that, it started declining as online gaming products and merchandises, like Xbox, PlayStation, and Nintendo, took the market by storm.

Since then, it has been downhill for GameStop. It is expected to announce a third straight year of losses, and sales volume have shrunk in four of the last five years.

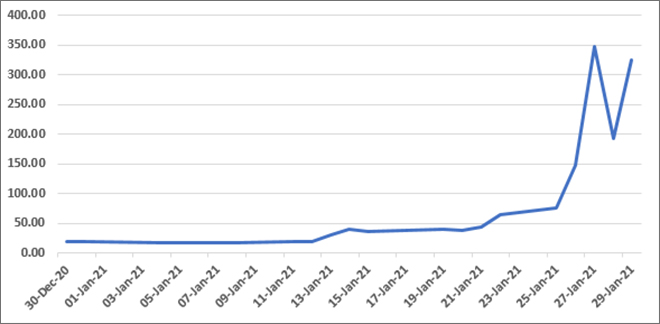

So, it came as a shocking surprise to the Wall Street that GME share price had risen more than 1,900 percent in January (Figure 1) and roughly more than 8,000 percent over the last one year. Though till 29 January 2021, closing price of the stock touched a maximum of $347.51, an intraday high on 28 January has been $483.00. To put this explosive rise in contrast — even on 4 January, 2021, the closing price of the stock has been $17.25 (stock prices are taken fromNasdaq). Four months ago, the per unit share of GME was worth $6.00.

FIGURE 1: GameStop (GME) stock closing prices in last 30 days (in US$)

Data source: Nasdaq website

Data source: Nasdaq website

Apparently, it all started in a two-million-subscriber forum “WallStreetBets” in Reddit — a social news aggregation, web content rating, and discussion website. The members of the group, predominantly millennials, randomly decided to support GameStop by buying shares. The motive, it seems, was to remove the fuse from the short-sellers’ plan to reap a financial bonanza from the declining fortunes of GameStop. It subsequently spread to other Reddit groups.

Now, what is “short-selling”? A short sale is selling of a stock which an investor or short-seller does not own. The stock is borrowed from somebody else, usually the large stock market financial behemoths (in the US). The seller or the investor later closes out the deal (‘short’ position) by returning the borrowed security to the stock lender, typically by again purchasing it in the open market.

In other words, the investors (or, the short-sellers) expect the price of that particular stock to fall, borrow those stocks, sell, and finally buy those again from the open market at a lower price. The price differential then becomes their source of profit. If the price falls, as expected, then the short-seller profits, but if the price rises later then the short-seller incurs losses.

As these Reddit millennial retail investors kept on buying GameStop and egging on others in the group to follow, the share price started climbing, as described earlier. This spectacular price climb resulted in crushing losses for some short-selling hedge funds like Melvin Capital. The fund has closed out its short position in GameStop (or, repurchased shares from open market at abundantly higher prices to return those back to original owner of the shares) on 27 January 2021. Though Melvin Capital has not confirmed the amount of losses, it had to infuse close to $3 billion capital immediately to shore up its finances. Needless to say, there are other players in the stock market that got hurt in the process.

Is GameStop the only share that is targeted by these new-age retail investors? No, there are other stocks like AMC Entertainment, Blackberry, and Nokia in discussion.

Most of these investors use fee-free mobile-based investment app like Robinhood and TD Ameritrade. In the immediate aftermath, Robinhood has stopped allowing users to buy GameStop or any of the other stocks in Reddit discussions. By a notification to the users, the app informed that investors can close their position on GameStop (by selling) but cannot buy any additional shares.

Now, what is the motive behind backing a brick-and-mortar company that is in a serious downslide? The established mainstream circle is calling this bunch of investors “amateur gamblers” out to “get rich quick.” There is definitely a millennial-disruptor signature in the entire episode that is not exactly “carpe diem” in spirit. However, a certain amount of anger against the typical Wall Street “greed” is distinctly visible all over social media. Many of these young investors have seen how big financial behemoths were bailed out after 2008 crisis and how Wall Street top executives came out unscathed, while their own families and peers bore the brunt of the financial catastrophe. Quite a few of them are trying to exact a revenge for that; many are indifferent of making any personal financial loss in this subversion of the short-selling games of hedge funds.

At least for the time being, these millennial investors have made some dent. Short of funds and in a hurry to get out of these short-selling minefields, hedge funds now have to sell the coveted shares they love to hold on to in order to buy back shares they hate (to return and close some of their untenable short positions).

Is this the beginning of a new form of “democratisation of finance”? Unlikely. Around 80 percent of total available stocks of S&P 500 companies are owned by big financial institutions in the USA. This ratio is less lopsided and significantly lower in Europe and elsewhere outside America, but in the USA this is the hard reality. The Redditors may conjure up some numbers but will always be short of required capital in their fight with Wall Street.

GameStop saga shows, in no uncertain terms, that often propagated axiom — “stock market determines the real value of a stock” — maybe quite untrue in specific situations. It also indicates towards the existing suspicion that stock market can be manipulated while staying within the rules. If Redditors can do it, then there is no good reason that others would not or do not.

If Redditors are immediately stopped by interventions (as exemplified by Robinhood app’s actions), then that also raises concern about unfair entry barrier in a purely competitive market. If bigger financial institutions’ costly mistakes are bailed out with public money (as in the aftermath of 2008 crisis) and retail investors (however ‘amateur’ or ‘subversive’) are barred from investing by not so legitimate means — then the proponents of “financial inequality” are not entirely incorrect. One can always cite the greater reason of financial stability, but the bunch of financial institutions and executives — who caused 2008 stock market crash — escaping the disaster unscathed and unpunished did a great disservice to the stability of the system. Maintaining status quo then was not a great example either.

In the name of “spreading the risk across the market” many financial innovations are invented, hailed, and implemented. But the time has really come to ask the question — are these fancy innovations helping or damaging the original objective of financial resource mobilisation in the stock market? This is an issue of introspection for not only America, but for other countries with vibrant stock markets.

In 2020, total financial assets in the world have been nearly 10 times the value of the global output of all goods and services at market exchange rates. This implies — the world is making 10 times more transactions in the financial markets than in producing and selling in brick-and-mortar economy. Has world economy evolved to a stage where financial bubbles are inevitable? While an overwhelming majority of the population has no access to these financial markets, is this lopsided financial to real output ratio a recipe for acute global financial inequality and exclusion?

A deeper introspection about the GameStop episode raises these important questions. It will be worthwhile to embark upon a journey to find answers.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Abhijit was Senior Fellow with ORFs Economy and Growth Programme. His main areas of research include macroeconomics and public policy with core research areas in ...

Read More +