In today's geopolitically fragile world, financial regulators face an increasingly complex challenge—the weaponisation of finance by countries to manipulate financial systems, transactions, and instruments to achieve political or strategic objectives. As the world becomes more interconnected and emerging technologies reshape the financial landscape, financial tools and infrastructure are being exploited by state and non-state actors alike. This is blurring the lines between economics, politics, and security and giving rise to unknown and unprecedented threats that transcend traditional boundaries. The convergence of these twin variables—emerging technologies and unknown risks—heightens the concerns of financial regulators worldwide.

Emerging technologies and unknown risks

The rapid advancement of emerging technologies is a key contributor to the weaponisation of finance. While these technologies offer immense benefits in terms of efficiency, inclusivity, and financial innovation, they also introduce new vulnerabilities and risks. The rise of digital currencies, blockchain, fintech, and artificial intelligence (AI) has created opportunities and challenges for financial regulators.

As the world becomes more interconnected and emerging technologies reshape the financial landscape, financial tools and infrastructure are being exploited by state and non-state actors alike.

AI brings transformative capabilities to financial services, enhancing decision-making, risk assessment, and fraud detection. Yet, the opacity of AI algorithms and the potential for bias raise concerns around accountability, ethics, and the potential for unintended consequences.

Cryptocurrencies, which have gained popularity as alternative means of transacting and storing value, are also attractive tools for illicit activities, including money laundering, terror financing, and sanctions evasion because of their decentralised nature, inherent value or lack of it, and limited regulatory oversight.

Fintech platforms have disrupted traditional financial services, providing greater access and convenience to consumers. However, their rapid growth presents challenges regarding data privacy, consumer protection, and systemic risks—for example, the growing concerns about

UPI fraud.

Other risks and uncertainties

Alongside emerging technologies, financial regulators must also contend with risks arising from geopolitical uncertainties. Geopolitical tensions, trade disputes, and the use of economic sanctions as political tools can have far-reaching implications for financial systems.

Fintech platforms have disrupted traditional financial services, providing greater access and convenience to consumers.

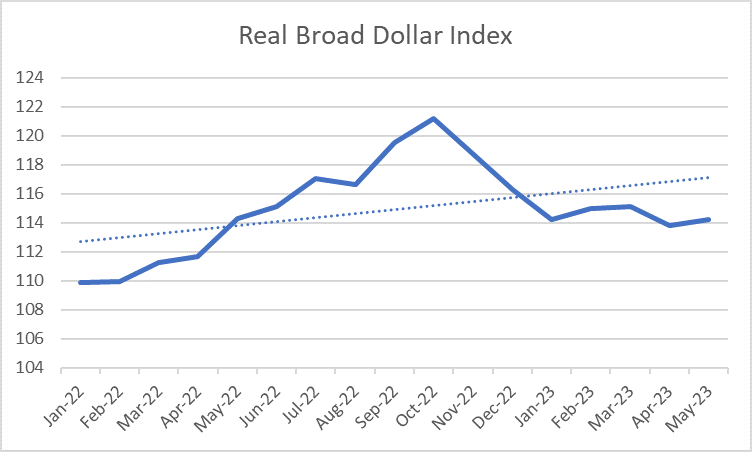

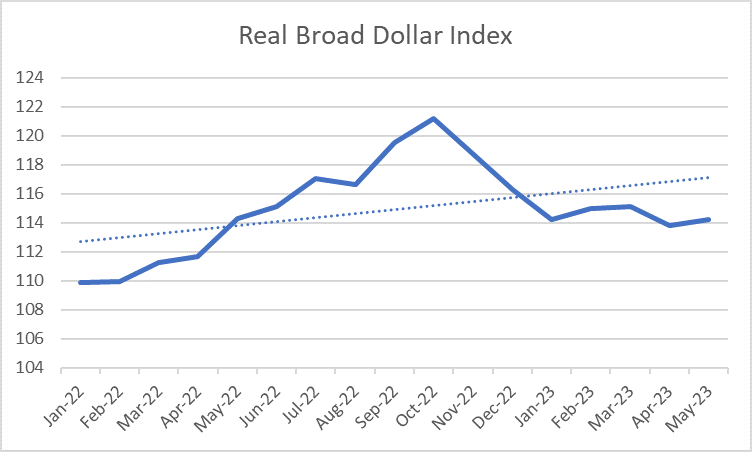

Monetary policies, originally designed to foster domestic stability and economic growth, can be utilised by nations as instruments to exert global influence. However, the manipulation of interest rates, exchange rates, and capital flows can also disrupt financial markets and destabilise economies, generating significant cross-border spillover effects. Such actions erode trust in the global financial system and escalate geopolitical tensions, creating a precarious environment for both developed and emerging economies. For example, the Federal Reserve's

successive rate hikes since March 2022 led to a

stronger dollar and impacted overseas countries' dollar reserves. The strengthening of the dollar has reverberated globally, particularly affecting nations holding significant dollar-denominated assets. The mark-to-market risks associated with treasury papers have escalated, as fluctuations in exchange rates can affect the valuation of these assets, potentially leading to financial losses and market volatility.

Source: Federal Reserve Database

Source: Federal Reserve Database

Moreover, climate change actions, particularly those related to carbon emissions and environmental regulations, have also become potential weapons in the geopolitical arena. As nations grapple with the urgent need to address climate change, the implementation of stringent policies can inadvertently impact global trade and economic relationships. Unilateral measures targeting industries or countries can provoke retaliatory actions, sparking trade conflicts and disrupting supply chains. This not only undermines international cooperation on climate change but also hampers the collective efforts required to mitigate the existential threat posed by global warming.

The weaponisation of finance and climate change actions is further exacerbated in today’s geopolitically volatile world. Increasing polarisation, nationalist backlash, and strategic rivalries have created an environment where economic measures are deployed to pursue political objectives. This intertwining of economics and politics undermines the stability of financial systems, introduces uncertainty for investors, and impedes global economic growth.

As nations grapple with the urgent need to address climate change, the implementation of stringent policies can inadvertently impact global trade and economic relationships.

Investors and lenders seek stability and predictability to make informed decisions and manage risks effectively. The weaponisation of finance introduces a new layer of complexity and risk that can deter lending activities, leading to declining lending volumes and a reduced credit flow in the economy, negatively impacting businesses, individuals, and overall economic growth. Moreover, the weaponisation of finance can create a chilling effect on international cooperation and cross-border transactions. When financial systems become entangled in geopolitical disputes and tensions, it becomes challenging to establish trust and foster collaboration between nations.

A few interconnected risks must be understood while addressing the weaponisation of finance:

- Cybersecurity: Increased digitisation of financial systems and reliance on emerging technologies have enhanced vulnerability to cyber threats. Cyberattacks targeting financial institutions, infrastructure, and transactions can disrupt operations, compromise sensitive data, and undermine trust in the financial system.

- Cross-border capital flows: The weaponisation of finance can influence cross-border capital flows. Geopolitical tensions, economic sanctions, or trade conflicts can disrupt the flow of investments and capital between countries, leading to market volatility and financial instability.

- Regulatory arbitrage: The weaponisation of finance can create opportunities for regulatory arbitrage, where actors exploit regulatory gaps or inconsistencies across jurisdictions. Such practices can lead to uneven playing fields, regulatory loopholes, and potential risks to financial stability.

- Systemic Risk: The interconnectedness of financial systems amplifies the potential for systemic risk. Disruptions or failures in one part of the financial system can quickly spread across markets, leading to contagion and systemic instability.

When financial systems become entangled in geopolitical disputes and tensions, it becomes challenging to establish trust and foster collaboration between nations.

The way forward

To address these concerns, international regulatory bodies and policymakers must collaborate to develop frameworks that promote transparency, accountability, and responsible financial behaviour. Strengthening global governance mechanisms, enhancing cooperation between regulatory agencies, and fostering open dialogue among nations are essential to mitigate the risks associated with the weaponisation of finance.

Additionally, promoting financial inclusion, supporting sustainable development, and investing in resilience-building measures can help vulnerable economies withstand the potential shocks arising from the weaponisation of finance. By empowering countries to diversify their economies, enhance their financial systems, and build resilience to external shocks, we can reduce their susceptibility to geopolitical pressures and safeguard economic stability.

Furthermore, multilateral efforts should be intensified to ensure that climate change actions are pursued through cooperative mechanisms rather than unilateral measures. By fostering dialogue, knowledge sharing, and collaborative initiatives, countries can work together to address climate change in a manner that promotes sustainable economic growth, protects vulnerable populations, and minimises the potential for geopolitical tensions. International organisations should tread carefully as they go ahead with addressing the challenges affecting the global financial system without breaching the national sovereignty of individual countries.

Regulators need to navigate these intricate webs of interconnectedness, anticipate potential shocks, and develop resilient frameworks that can withstand geopolitical turbulence.

Regulators must remain agile and adaptable, continuously monitoring and assessing the evolving landscape of emerging technologies and geopolitical developments. They must strike a balance between fostering innovation and protecting against financial crimes and their associated risks. Proactive regulation, supported by robust risk assessment frameworks, is crucial to identify potential vulnerabilities and implement necessary safeguards. Regulators need to navigate these intricate webs of interconnectedness, anticipate potential shocks, and develop resilient frameworks that can withstand geopolitical turbulence. Regulators must ensure a level playing field, prioritise cybersecurity measures and collaborate with industry stakeholders to mitigate consumer risks. They must enhance coordination and harmonisation of regulations to prevent regulatory arbitrage and maintain a level playing field for market participants.

A key aspect for regulators to ensure is the harmonisation of international policy objectives with national policy objectives. Success stories of emerging nations like

India in the digitisation space have fulfilled the broader objective

of greater financial inclusion. Public-private partnerships are also essential in combating the weaponisation of finance. Collaboration with the private sector, including financial institutions, technology firms, and industry associations, can foster innovation, share best practices, and collectively address emerging risks.

Kanishk Shetty is an intern at Observer Research Foundation

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

In today's geopolitically fragile world, financial regulators face an increasingly complex challenge—the weaponisation of finance by countries to manipulate financial systems, transactions, and instruments to achieve political or strategic objectives. As the world becomes more interconnected and emerging technologies reshape the financial landscape, financial tools and infrastructure are being exploited by state and non-state actors alike. This is blurring the lines between economics, politics, and security and giving rise to unknown and unprecedented threats that transcend traditional boundaries. The convergence of these twin variables—emerging technologies and unknown risks—heightens the concerns of financial regulators worldwide.

In today's geopolitically fragile world, financial regulators face an increasingly complex challenge—the weaponisation of finance by countries to manipulate financial systems, transactions, and instruments to achieve political or strategic objectives. As the world becomes more interconnected and emerging technologies reshape the financial landscape, financial tools and infrastructure are being exploited by state and non-state actors alike. This is blurring the lines between economics, politics, and security and giving rise to unknown and unprecedented threats that transcend traditional boundaries. The convergence of these twin variables—emerging technologies and unknown risks—heightens the concerns of financial regulators worldwide.

PREV

PREV