-

CENTRES

Progammes & Centres

Location

It is only by reducing its unnecessary expenditure, reforming underperforming SOEs, and diversifying its economy, that Maldives can mitigate its economic problems.

In November, this year, the Maldives saw the approval of ‘2023 State Budget’ which stood at MVR 42.8 billion (US$2.7 billion approx.), and a sanction of MVR 5.8 billion (US$376 million approx.) as a supplementary budget for the remaining of 2022. Additionally, the implementation of a new tax hike of 4 percent in Tourism Goods and Services Tax (TGST) and 2 percent in Goods and Services Tax (GST) will be effective from next year. Since the country’s economy is grappling with decreasing forex reserves along with large public and external debts, revenue of MVR 3.14 billion (US$204 million approx.) is expected from the tax hike and the approved ‘State Budget’ aims to generate total revenue of MVR 32.1 Bn (US$ 2 billion approx.) next year. However, as a country that largely depends on tourism, a sudden hike in the TGST will likely backfire. As historically evident, on average, the tourism tax rate is negatively correlated with the volume of tourist arrival in a country. Besides, the economy’s heavy dependence on tourism opens the door to fiscal vulnerabilities linked to its current economic structure.

The Public Expenditure Review of the World Bank derives the country’s increased public spending from the expansion of public investments, salaries, and generous subsidies such as financing 70 percent of the country’s healthcare.

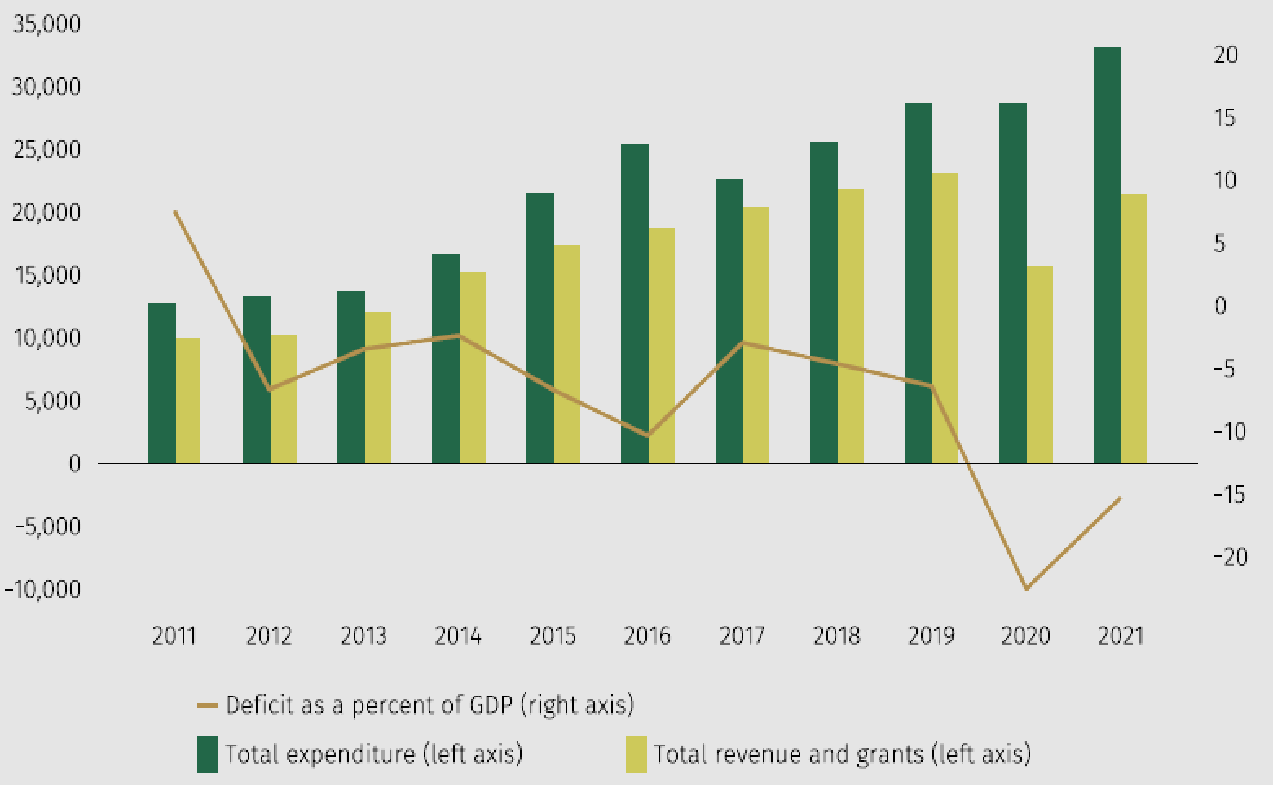

According to the Maldives’ Public Debt Bulletin, the central government⎯as of June 2022⎯ incurred an outstanding debt of MVR 86 billion that includes an external debt of MVR 32.3 billion (US$ 2 Bn approx.) while the public debt amounts to 59 percent of its Gross Domestic Product (GDP). Also hurting the economy is the increased public expenditure that precedes budget deficit and negatively counterbalances the total revenue. The Public Expenditure Review of the World Bank derives the country’s increased public spending from the expansion of public investments, salaries, and generous subsidies such as financing 70 percent of the country’s healthcare. The budget deficit has been consistent in the previous decade (2011-2020) and the trend persists till today.

Figure 1. The Maldives Government Revenue and Expenditure (2011-2021)

(Millions of rufiyaa, annual percentage change)

Source: Ministry of Finance; Maldives Monetary Authority (Annual Report 2021)

Source: Ministry of Finance; Maldives Monetary Authority (Annual Report 2021)

Funding the operating costs as capital injections for loss-making State Owned Enterprises (SOEs) has created additional room for increased expenditure. The first quarter (Q1) of 2021 saw a decrease in the overall gross profit of the SOEs by 13 percent compared to the previous year’s quarter. Although the overall net profits of the SOEs had improved in the second, third, and fourth quarters of 2021, reported net losses for most of the companies are due to high operating expenses. Addu International Airport (AIA) and Maldives Sports Corporation Limited (MSCL) are some of the regularly reported loss-making SOEs. Inefficiency in managing overheads and the inability to generate enough revenue cause a decline in the net profits of these reported underperforming SOEs.

The Maldivian economy is heavily reliant on the tourism sector contributing, on average, 18.9 percent of the country’s GDP during 2016-2020. It is followed by transportation and communication; wholesale and retail trade; and construction. Like other Small Island Developing States (SIDS), the Maldivian economy is prone to experience the direct impact of external shocks in its tourism sector. Diversification of the economy to avoid over-reliance on tourism for the country’s revenue will reduce the risk of fiscal vulnerabilities. This over-reliance is evident with a decline in the contribution towards the country’s GDP by other sectors such as the fisheries sector from 22 percent in 1978 to 4.6 percent in 2017. However, the fishery industry is still considered an important sector since it is the second largest foreign exchange earner in the nation. In addition to being the main export sector, fishing contributes to the country’s employment by employing about 30 percent of the total labour force.

However, the fishery industry is still considered an important sector since it is the second largest foreign exchange earner of the nation.

The country recently witnessed the real effect of this economic vulnerability, and the inability to diversify the economy. The COVID-19 pandemic contributed to a sharp decline in the number of tourists and generated lesser revenue for the nation. During 2020, a quarter of Maldivians lost their jobs; the real GDP growth decreased by 29.3 percent, and the economy contracted by 30 percent. The severe fall in tourism activities due to border shutdowns is largely responsible for the plummeting economy. In the same vein, accounting for up to 98 percent of the country’s physical export, the fishery industry saw a decline in its growth during 2020. There was a plunge in the demand and prices of fish; simultaneously, a decline of 46 percent in the value of fish export was recorded in March 2020.

Such economic vulnerabilities to economic shocks have often been witnessed in the Maldives. Exposure to fiscal vulnerabilities was recorded when the Maldives was hit by the Indian Ocean tsunami in 2004, the estimated damage was US$ 470 million and the impact was largely concentrated in the tourism sector. Likewise, the Financial Crisis of 2008 slowed down the Maldivian economy due to a slump in tourist arrival reporting a growth of 1 percent in the sector as compared to 12 percent in 2007.

The island’s GDP is mainly driven by its tertiary sector, especially through tourism. Thus, being an import-dependent economy importing mainly food and clothing items owing to its geographical size and isolation—the structure of the Maldives’ economy predisposes the country towards fiscal vulnerabilities.

The decision to increase the TGST from 12 percent to 16 percent has the potential to hurt the tourism competitiveness of the Maldives. The Maldives Travel Agency and Tour Operators (MATATO) and other related associations raised concern over the tax hike fearing it will adversely impact the economy. Although there exists an overall inelasticity of tourism demand in the country, increasing the existing tourism tax rate negatively influences the rate of tourist arrival from five of its main markets—China, the United Kingdom, Italy, Russia and France. These countries together represented roughly 43.2 percent of the country’s inbound tourists in 2019. The survey conducted by MATATO predicts a 10 percent drop in tourist arrival in 2023 if the government proceeds with the proposed tax rate. The prediction to generate US$ 136 million from the TGST will contrast the envisioned outcome if the tax hike negatively impacts the demand, hence, a fall in the TGST revenue.

The Maldives Travel Agency and Tour Operators (MATATO) and other related associations raised concern over the tax hike fearing it will adversely impact the economy.

The ‘2023 State Budget’ of MVR 42.8 billion (US$ 2.7 billion approx.) is MVR 5.8 billion (US$ 376 million approx.) greater than the approved ‘2022 State Budget’ of MVR 37 billion (US$ 2.4 Bn approx.). The budget deficit reported for 2022 is MVR 9.8 billion (US$ 636 million approx.) which is 11.2 percent of the GDP. The deficit is expected to reduce to MVR 8.1 billion (US$ 526 million approx.) in 2023 owing to the grants from India. Nevertheless, in the absence of such grants in 2024, the Ministry of Finance has predicted an increase in the budget deficit amounting to 9.8 percent of its GDP. Such forecasts indicate that the deficit trend will continue for some time till the structural issues are addressed.

The Maldivian economy has managed to maintain its budget deficit consistency over the years with exceeding public expenditure and limited revenue. The SOEs with large operating costs are also part of the problem. Additionally, huge reliance on tourism for its revenue further exposes the country to external shocks and financial risks. On the other hand, the objective to increase revenue through the TGST hike has the potential to damage the economy. It is only by reducing its unnecessary expenditures, reforming underperforming SOEs, and diversifying its economy can the Maldives mitigate its economic problems.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.