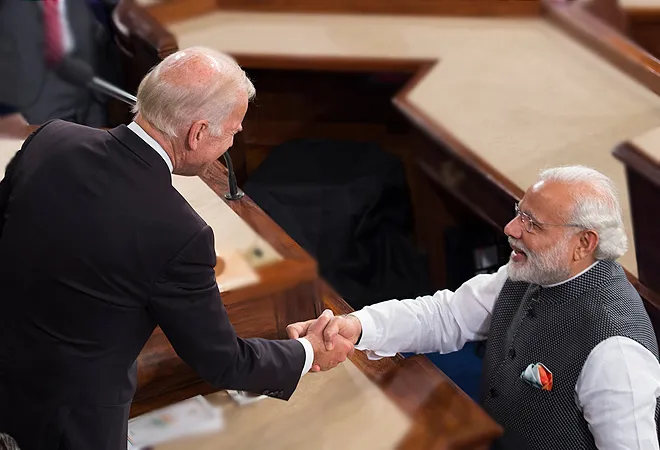

Once US President-elect Joe Biden begins to pursue his restorationist agenda on “

rescuing US foreign policy” after Donald Trump’s presidency, his agenda on US-India ties will differ. While US ties with partners across the Atlantic for instance, will warrant Biden’s

mitigation efforts, the agenda with India will pertain to furthering Trump’s record.

After all, Trump’s record on US-India ties has been constructive. In the strategic domain, this included, the

finalisation of more interoperability agreements, initiation of

convergence-based consultative ministerial dialogues, and

progress on actualising the Defence Technology and Trade Initiative. In addition, on

defence trade, the Trump administration yielded to Indian requests for specific platforms, adopted a policy to ‘front-load’ clearances for ancillary equipment, and overturned the freeze on India’s purchase of unmanned systems.

Trump’s record on US-India ties has been constructive.

However, the domain of US-India trade, which peaked at

$146.1 billion in 2019, will cause some trepidation owing to frictions witnessed in the Trump years.

Divergences under Trump

Given Trump’s focus on exacting “

fair and reciprocal” trading arrangements, his administration vocalised apprehensions against nations that had amassed trade surpluses over the US. Even though India’s trade surplus is

less than a tenth of the US-China trade imbalance, New Delhi did not escape Trump’s action against nations “

cheating” the US.

The first such action came in March 2018, with the US

levying tariffs on steel and aluminium imports. Although this was mainly aimed at guarding US industries against surplus Chinese steel and aluminium in global markets, India’s inclusion in the action indicated Trump’s intent to raise contentions with friends and foes alike. In then bringing trade divergences to the fore, the Trump administration either engaged in open derision of “

tariff king” India or acted against India’s market access into the US. A case in point is the Trump administration’s suspension of India’s benefits under the Generalised System of Preferences (GSP). Impacting Indian exports (

worth $5.7 billion) to the US, the office of the US Trade Representative (USTR)

argued that India had “implemented a wide array of trade barriers that create serious negative effects on United States commerce.”

Even though India’s trade surplus is less than a tenth of the US-China trade imbalance, New Delhi did not escape Trump’s action against nations “cheating” the US.

This honed broader implications as the decision sought to

undercut India’s rationale on other disagreements. On its

price caps on US pharmaceutical imports for instance, New Delhi has often invoked its developing economy status to underscore the need to protect its middle-income consumer base. The USTR’s

termination of India’s GSP benefits cited the Trump administration’s view of India “no longer” falling under “the statutory eligibility criteria” as a “beneficiary developing country.” Subsequently, India was also removed from USTR’s list of developing countries that “

are exempt from investigations into whether they harm American industry with unfairly subsidised exports.”

Such actions only prolonged trade negotiations and led to an expansion of US apprehensions.

Hopes for a more receptive USTR

Under Trump, USTR Robert Lighthizer honed a

conservative approach to trade negotiations. Wherein, tariffs were the proverbial ‘tip of the spear’ in the effort to employ America’s relative leverage as the world’s largest economy and arguably, the most prized market for exporting nations. There was also an evident bid to enhance America’s negotiating position by adding to the list of US apprehensions. This included, USTR’s 2019

National Trade Estimate which deemed India’s “restrictions on cross-border data flows and data localisation requirements” to be “onerous.”

Furthermore, the US failed to acknowledge India’s rationale on issues like, its insistence on the certification of dairy imports (owing to

socio-cultural reasons) or its duty on information communication technology imports (in order to

guard against cheaper Chinese tech flooding the market). Amidst increased frustrations, there were reports of the USTR also

contemplating a full-blown Section 301 investigation into India’s tariff and non-tariff trade barriers — much like the one that sparked the US’ trade war with China.

Such contentions only

hampered the prospect of a limited trade deal, which was expected to be finalised during Trump’s February 2020 visit to India.

Tariffs were the proverbial ‘tip of the spear’ in the effort to employ America’s relative leverage as the world’s largest economy and arguably, the most prized market for exporting nations.

Following the 2020 US presidential election, some even

hoped for finalising a deal in the Trump administration’s lame-duck period before Biden would take office. However, with no resolution in sight, the Biden administration will now reportedly conduct “

a fresh review of the deal,” with Biden’s nominee for USTR, Katherine Tai at the helm.

Tai

reportedly considers trade to be “like any other tool in our

domestic or foreign policy”. Wherein, she does not see it as “an end in itself”, but rather “a means to create more hope and opportunity for people.” As a sign of US policy continuity on confronting China, Tai has also conceded that the Trump administration has “not been 100% wrong on trade policies.” However, departing from Trump’s approach, she has advocated for “ ourselves and our workers and our industries and our allies faster, nimbler, be able to jump higher, be able to compete stronger, and ultimately be able to defend this open democratic way of life that we have.” This effort to adopt a multi-stakeholder and most importantly, a multilateral approach falls in line with Biden’s intended foreign policy for the middle class and to “build a united front of US allies and partners to confront China.”

In supporting this line of thinking, India could push for the reinstatement of its GSP benefits, owing to its relevance to the US-China trade dynamic.

Going beyond unfinished business

While Biden has criticised the use of tariffs, he has committed to not immediately remove Trump’s tariffs on China or scrap the ‘Phase One’ deal. Hence, on tariffs that will continue to remain in place or new ones that could be imposed (probably to exact Chinese compliance on its dues under the ‘Phase One’ deal), India’s GSP status can help dampen their impact on US manufacturers.

According to the Coalition for GSP, as US import of certain Chinese products decreased owing to Section 301 tariffs, import of some of those products from GSP-beneficiary countries “increased the most in the first quarter of 2019.” Wherein, from India specifically, “97 percent of increased” imports were on the China Section 301 lists — translating into an increase of $193 million (18 percent) worth of imports from India.

By recognising this evident complementarity between India’s GSP status and the Biden administration's effort to adopt a multilateral approach on confronting China, a precedent for moving past irritants in US-India trade can be set.

Wherein, from India specifically, “97 percent of increased” imports were on the China Section 301 lists — translating into an increase of $193 million (18 percent) worth of imports from India.

The reinstatement of India’s GSP benefits could also serve as the much-needed boost for US-India trade to capitalise on emergent opportunities. For instance, India’s Minister of Micro, Small and Medium Enterprises, Nitin Gadkari recently identified the US as a viable source to address India’s high demand for edible oils, called for collaboration on production of faux meat, and raised the prospect of importing American ethanol. Gains in these areas will also help dampen US apprehensions on limited agricultural trade with India, which a recent US Congressional report considerably focused on.

Furthermore, Trump’s over-securitisation of trade relations brought some rightful attention to the national security dimension of transnational commerce — beyond its unfettered use to spread the dogma of neoliberalism. Whereby, geoeconomic imperatives now present opportunities for India and the US to further expand the ambit of their bilateral trade.

For instance, even before the Coronavirus pandemic, Indian pharmaceutical companies catered to about 40 percent of America’s demand for generic formulations. The pandemic, however, has only accorded a fillip to bilateral pharma ties due to the need to diversify supply chains. A case in point is an American biopharmaceutical company, Gilead, has inked licensing agreements with six Indian firms to manufacture Remdesivir. Going forward, there is much scope for India and the US to expand co-operation in order to reduce their direct and indirect dependencies on China for Active Pharmaceutical Ingredients and generic drugs.

The pandemic has only accorded a fillip to bilateral pharma ties due to the need to diversify supply chains.

Lastly, although US-India energy trade has been compartmentalised under the Strategic Energy Partnership, its momentum (with hydrocarbon trade marking a 93 percent increase since 2017-18 to peak at $9.2 billion in 2019-20) has led to either sides viewing it as a means to bridge the trade deficit. Gains can now be multiplied with India’s energy security plans to store crude in America’s Strategic Petroleum Reserves, while New Delhi works on expanding its storage facilities.

Thus, beginning with a pragmatic resolution to the GSP issue, India and the US can focus on emergent opportunities and thereby, avoid past apprehensions from preoccupying their bilateral trade portfolio.

Kashish Parpiani is Fellow, and Palomi Chaturvedi is Research Intern at ORF Mumbai.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Once US President-elect Joe Biden begins to pursue his restorationist agenda on “rescuing US foreign policy” after Donald Trump’s presidency, his agenda on US-India ties will differ. While US ties with partners across the Atlantic for instance, will warrant Biden’s mitigation efforts, the agenda with India will pertain to furthering Trump’s record.

After all, Trump’s record on US-India ties has been constructive. In the strategic domain, this included, the finalisation of more interoperability agreements, initiation of convergence-based consultative ministerial dialogues, and progress on actualising the Defence Technology and Trade Initiative. In addition, on defence trade, the Trump administration yielded to Indian requests for specific platforms, adopted a policy to ‘front-load’ clearances for ancillary equipment, and overturned the freeze on India’s purchase of unmanned systems.

Once US President-elect Joe Biden begins to pursue his restorationist agenda on “rescuing US foreign policy” after Donald Trump’s presidency, his agenda on US-India ties will differ. While US ties with partners across the Atlantic for instance, will warrant Biden’s mitigation efforts, the agenda with India will pertain to furthering Trump’s record.

After all, Trump’s record on US-India ties has been constructive. In the strategic domain, this included, the finalisation of more interoperability agreements, initiation of convergence-based consultative ministerial dialogues, and progress on actualising the Defence Technology and Trade Initiative. In addition, on defence trade, the Trump administration yielded to Indian requests for specific platforms, adopted a policy to ‘front-load’ clearances for ancillary equipment, and overturned the freeze on India’s purchase of unmanned systems.