-

CENTRES

Progammes & Centres

Location

Trump’s proposed new tariffs will have a negative impact on the American economy as well as other countries that rely on trade with the US dollar

Image Source: Getty

This article is part of the series, "Reignited agendas: Trump’s return and its global repercussions"

Donald Trump being elected the 47th President of the United States has rightly sent psephologists back to the drawing board. The fact that he has returned with such a large mandate is a strong marker of growing discontent and an indictment of American foreign policy that comes at the cost of domestic concerns, which has been the Republican platform’s focus this election cycle.

The stock market’s surge seen at Trump’s return suggests that this is an area of policy where his administration tends to have the greatest clarity. ‘America First’ is as straightforward as one can get as an indication of what’s to come. It is the age-old rule that investor confidence is prompted by policy certainty, whether pro-market or otherwise. For months now, President Trump has been very clear that he intends to increase tariffs by 20 percent across the board, with an additional 60 percent for China. Besides some modest attempts at negotiating rapprochement with trade partners, the Biden years did not dramatically reverse any of Trump’s trade decisions. The predicted inflationary effects of the tariffs from Trump 1.0 never materialised to a startling extent. The tariffs continued and were sometimes increased during the Biden presidency.

President Trump has been very clear that he intends to increase tariffs by 20 percent across the board, with an additional 60 percent for China.

It is likely that the incoming Republican administration is aware that higher tariffs across the board are not “beggar thy neighbour” but rather “beggar thy self” tactics. An already beleaguered American middle class, struggling with exceptionally high costs of living, cannot afford to pay the price of higher tariffs for the benefit of a few industrialists in the United States (US) producing locally at a higher cost. Being strong on China from a dependency reduction perspective may be a good thing in the short term. However, if over relied on, these tariffs will make trade in general untenable without the right alternatives to Chinese imports. With the Carbon Border Adjustment Mechanism (CBAM) and these threatened US tariffs, the West is becoming “bad for business” and we are likely to have a full-blown trade crisis on our hands.

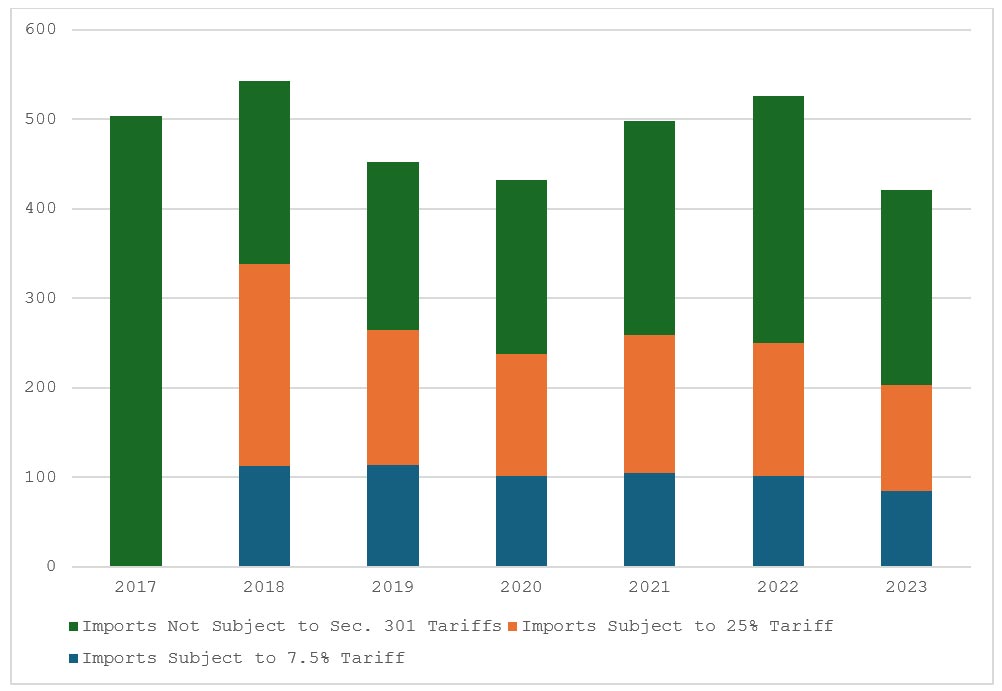

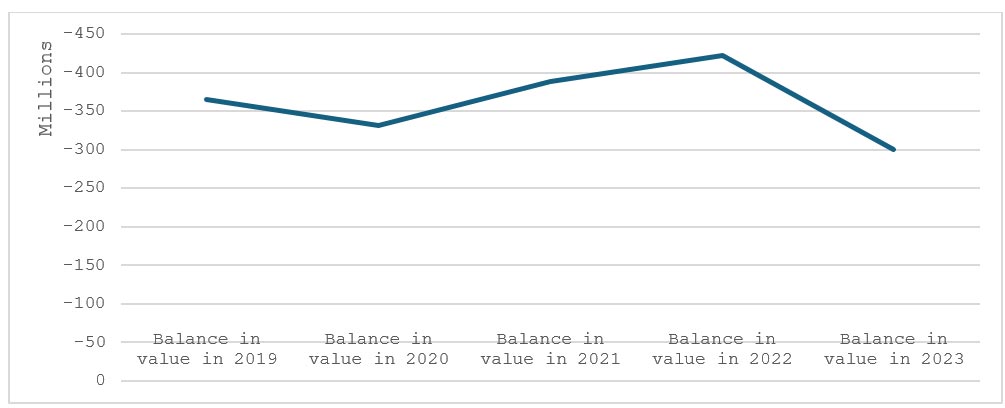

The Section 301 tariffs against China are interesting to note here, especially because they have endured through the Biden years. As seen in Figure 1, imports from China that were not subject to Section 301 tariffs remained steady, and those subject to the tariffs reduced only marginally. Meanwhile, as Figure 2 shows, in the transition between the Trump and Biden administration, the trade balance between the US and China remained negative, even widening in the 2021 to 2022 post COVID-19 pandemic period. Thus, the impact of tariffs beyond a limited reduction of dependence on China is questionable.

Figure 1: Imports Subject to Section 301 Tariffs Remain below Pre-Trade War Levels

Source: TaxFoundation

Figure 2: US-China Balance of Trade from 2019 to 2023

Source: Author Calculations based on ITC Trade Map data

There is some comfort in the fact that the ‘deal making’ tendencies of the returning President will hopefully temper tariffs that are hurting the US market, or the tariffs will be watered down based on bilateral deals. The clarity of intention vis-à-vis trade creates an odd transparency with regards to the trade policy perspective on the US. Let’s not forget that it was during the Trump years that the first attempt at a US-India trade deal was made. India has been a stable trade partner for the US regardless of who sits in the Oval Office. The practical need to de-risk supply chains from an overdependence on China will also work in favour of closer US-India trade ties.

The impact that the promised tariffs will have on US inflation is an important factor that must be kept in mind. The factory gate prices of products under the first few increases in tariffs went up by 4.1 percent in 2019, according to a study done by the Federal Reserve.

The US Council of Economic Advisors (CEA) has also noted studies which prove that across-the-board tariff increases lead to an inflationary increase of at least 0.75 percentage points. The increased production costs reduce the efficiency of domestic manufacturers as well, which is contrary to what the America First Policy is trying to achieve.

The ensuing crisis of debt due to the depreciated dollar value can have devastating consequences for emerging economies, especially those dependent on the stability of the US dollar.

This is of concern to the rest of the world because it will impact the purchasing power of countries that trade in dollar reserves. The ensuing crisis of debt due to the depreciated dollar value can have devastating consequences for emerging economies, especially those dependent on the stability of the US dollar.

While the tariff increases themselves may be inevitable, we must hope that cooler heads will prevail and that the increase in tariffs will be more gradual with space for negotiations, as was done in Trump’s early years with countries like Australia, South Korea, and Canada (amongst others) managing to gain some concessions against steel and aluminium tariffs.

Overall, there is little that can be done about the tariff imposition and domestic tax breaks.Especially because the US administration, over the past 15 years, has been one of the major reasons for dysfunction at the World Trade Organisation’s (WTO) dispute settlement body—ostensibly the only check on protectionist trade rules.

Trade with the US is now dependent on how well mutual interests will be served, and, of course, ‘The Art of the Deal.’

Jhanvi Tripathi is an Associate Fellow with the Observer Research Foundation’s (ORF) Geoeconomics Programme.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Jhanvi Tripathi is an Associate Fellow with the Observer Research Foundation’s (ORF) Geoeconomics Programme. She served as the coordinator for the Think20 India secretariat during ...

Read More +