-

CENTRES

Progammes & Centres

Location

Digital payments are no longer about ensuring that money reaches the intended person or entity. Instead, the data exhaust of the transaction has become more valuable with the exponential rise in digital payments around the globe, and the lowering of cost of transactions.

Last month, The Economic Times reported that the National Payments Corporation of India (NPCI), the umbrella organisation which processes most of retail payments in India, was thinking of imposing a cap on the market share of entities on the Unified Payments Interface (UPI). The UPI is a payments architecture that allows users to make seamless funds transfers to other users at no cost, without divulging their bank account information via aliases. The report said that the NPCI was considering the move owing to the high volume of transactions through non-banking entities such as Google Pay and the Walmart-owned PhonePe. The reports also mentioned that the NPCI is looking at capping the market share at 33 percent for an individual player.

Since its inception in 2016, the UPI’s usage has exploded as non-bank players have entered the payments space in a big way. The growth in UPI payments over the years was fueled by cashbacks and other benefits as a means to acquire more users. BHIM, the payments app promoted by Prime Minister Narendra Modi after the demonetisation of ₹500 and ₹1,000 notes, was one of the first applications to have a cashback programme for UPI transactions backed by the Ministry of Electronics and Information Technology (MEITY). As of September 2019, the total number of transactions on the UPI was 955.02 million with a lion's share of the transactions coming in from Google Pay (59.75 percent) and PhonePe (24.91 percent).

However, there is now doubt on the sustainability of offering cashbacks with almost every UPI transaction. In an interview, Paytm CEO, Vijay Sharma said that his company has started scaling back its cashback promotions on P2P transactions. He admitted that the company has seen a slowdown in the number of transactions. Indeed, after MEITY stopped giving out cashbacks in March 2019, BHIM’s transactions accounted for only 1.8 percent of UPI payments in September 2019. However, as Google Pay shows no signs of scaling back their cashback offers to dominate the UPI payments space, newer players who wish to enter the game will need an enormous amount of capital to compete against larger incumbents. It is clear that big players in the digital payments market have, in a sense, “weaponised” cashbacks and created a moat around the sector, preventing new, especially smaller players, from coming in.

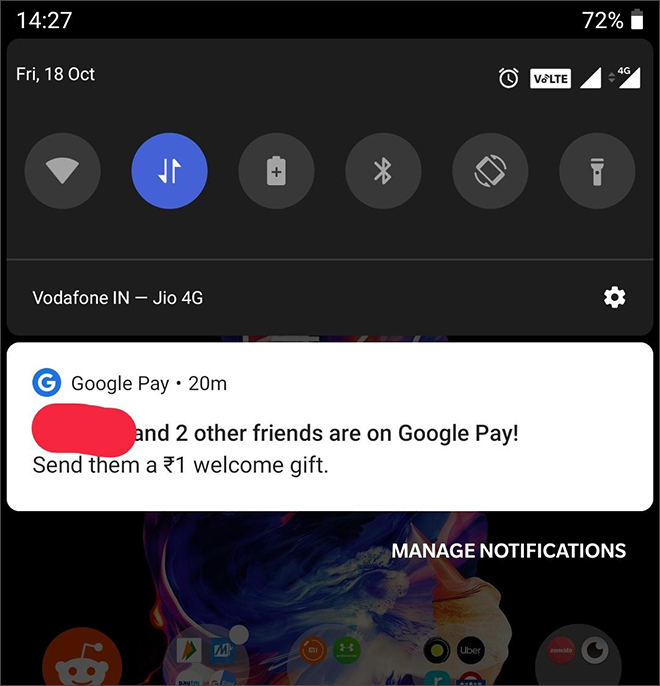

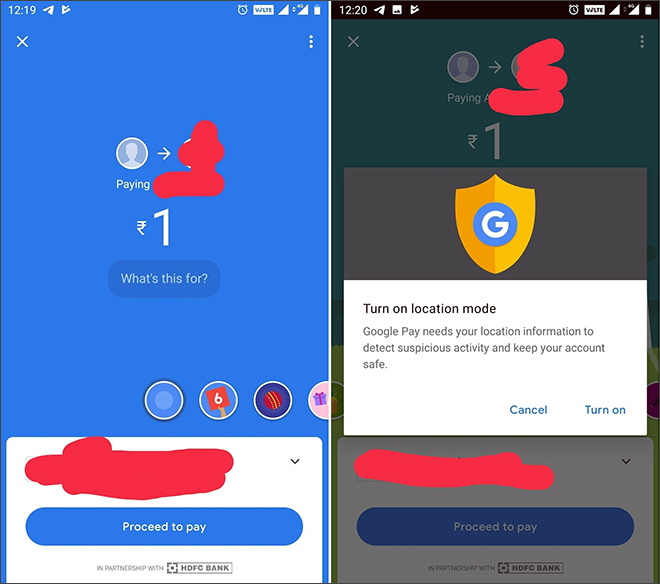

Internally, Google Pay has an initiative called Project Cruiser and has developed an in-app engagement and rewards programme to lure more users and merchants to its fold. At the heart of this programme, Google Pay is tying up its reward programmes with cashbacks — but with tactics that tempt users to ‘try their luck’. After a transaction, users are rewarded with a digital scratch card and upon “scratching” the coupon, a cashback is credited to the user’s bank account. The amounts that are given to users are randomised — some scratch cards allow users to earn in hundreds of rupees, while other users are rewarded with a message that actually says, “better luck next time.” Google Pay also nudges new users to make a one-rupee transaction when they join the ecosystem. All new users, too, are rewarded with a scratch card after s/he successfully joins in.

Privately, executives of digital payment companies have questioned Google Pay’s tactics. They say that although the number of UPI transactions have increased, the value of transactions has not kept pace, thanks largely to these small-value one-rupee transactions. However, such tactics have resulted in a “gamification” of cashback points to a luck-based lottery system. In fact, certain cashback programmes are not available to Google Pay users in Tamil Nadu as they violate state laws which ban lottery-based systems under the Tamil Nadu Prize Scheme (Prohibition) Act 1979.

There are parallels between Google Pay’s cashback systems and ‘loot box’ systems in video games — in-game purchase consisting of a virtual container that awards players with items and modifications based on chance. In the United States and the United Kingdom, there is growing concern that digital loot boxes are leading to harmful behaviour among users and should be regulated in the same vein as gambling.

Digital payments are no longer about ensuring that money reaches the intended person or entity. Instead, the data exhaust of the transaction has become more valuable with the exponential rise in digital payments around the globe, and the lowering of cost of transactions.

Traditional digital payments companies charge merchants a small fee called merchant discount rate (MDR) to ensure a transaction is carried out. With the proliferation of the UPI which reduces the cost of transaction to almost zero, combined with finance minister Nirmala Sitharaman’s Union budget announcement of moving to a regime of zero MDR, sent flutters across the payment industry. The Payments Council of India (PCI) said that moving to zero MDR would lead to the collapse of the industry and the industry would find it harder to acquire more merchants for digital payments.

Thus, as the data of a transaction becomes more valuable,more than even the transaction itself, it is worth investigating why Google Pay is so keen on offering cashbacks with such questionable design features of the application. Clearly, there seems to be much more to it than merely increasing usage.

A look at Google Pay’s Privacy Policy shows that it falls under the umbrella of all Google products including search, YouTube, Chrome Browser, and the Android operating system. Like most internet services, the privacy policy says that it will collect a broad number of data points including what is typed into a search bar, content in the form of photos and videos, purchase activity, IP addresses, sensor data and GPS location. This data, Google says, will be used to better their services and develop new products. It will also be used to show the user personalised ads, recommendations, and content. Crucially, it mentions that the data collected from the application will be used to help advertisers understand the performance of their ad campaigns.

It needs to be understood that Google, as much as it insists that it is a technology company, is an online advertising monopoly. The Holy Grail of any advertising company is to demonstrate to a potential client that an ad on their platform leads to a purchase, either online or offline. The quest for tech giants like Google is to track an online ad’s performance in the offline world. In this quest to get more data on offline purchases, Google signed a pact with MasterCard in August 2018. It can be argued that Google Pay is another attempt to get more data about its users for their offline purchases.

This can be demonstrated by the application’s insistence on asking for a user’s GPS location data when a transaction needs to be completed. If a user declines to share their location information, the transaction will not be allowed, a classic case of unethical system design forcing users to divulge more information about themselves.

Such rich data aggregation about its users will enable Google to substantially command a premium from advertisers, significantly altering the value of their advertising services. Indeed, Google keeps generating record revenue quarter after quarter and for the June 2019 quarter, its advertising revenue grew 19 percent year-on-year to $32.6 billion.

With the avenues of revenue shrinking for traditional payments companies, they won’t be able to compete with the cashbacks that Google Pay can offer. Reports say that companies such as Paytm are now trying to build their own online advertising business while PhonePe has started to cross sell other financial products such as mutual funds to augment their revenue as the payments space looks increasingly unprofitable. They will take a severe beating on their balance sheets trying to just keep up with such global monopolies. The users, however, are content with using Google Pay with its wide acceptance and getting a cashback on every transaction, with a chance to try their luck for greater benefits.

In that sense, traditional payment players are playing checkers while Google is probably playing 3D chess.

If the aim of the NPCI is to promote more competition in the UPI ecosystem, it needs to urgently reconsider its approach of capping the market share of individual players to 33 percent. This will lead to the formation of oligopolies and each player will be compelled to keep providing cashbacks to stay in the market.

Regulators should examine designs of cashback systems with greater scrutiny. While gamification is a great way to drive engagement and usage, care should be taken that they do not promote harmful, gambling-like behaviour.

In the larger context, strong privacy laws will act as a bulwark against Google which relies on tracking users both offline and online for data for their advertising business. The NPCI should carefully examine the design of UPI applications so that users are not forced into disclosing data.

Finally, there is a need for the implementation of the recommendations of the Ratan Watal Committee and create an independent payments regulator. One should keep in mind that the NPCI is not a regulator but a ‘not-for-profit’ company controlled by a number of promoter banks. In that sense, even if the NPCI passes a rule prohibiting an action on the UPI, application providers such as Google Pay are not obliged to follow it.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Shashidhar K J was a Visiting Fellow at the Observer Research Foundation. He works on the broad themes of technology and financial technology. His key ...

Read More +