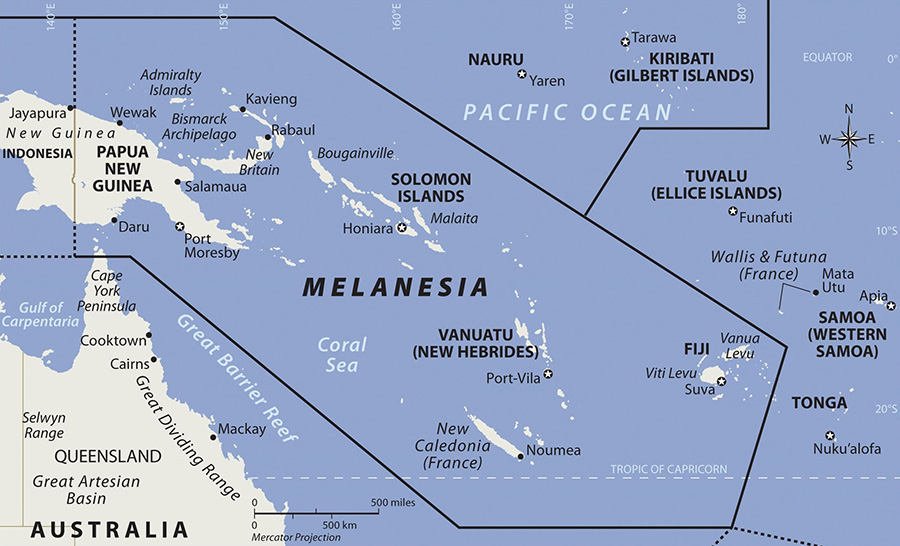

Strategic alliances and economic relationships in the South Pacific region have undergone a paradigm shift since 2018 when China’s Belt and Road Initiative (BRI) declared the region a central maritime corridor. Over the years, Chinese investments, loans, and diplomatic presence have burgeoned in the region. Today, Beijing is the Blue Pacific continent’s most significant bilateral creditor and second-largest trading partner. However, with the increasing Chinese presence there, India, Japan, the United States (US), the United Kingdom (UK), France and regional powers — Australia and New Zealand—have also intensified their engagement with the region. Critical shipping lanes, untapped blue economy resources, and mineral sources have further recalibrated the world’s attention to the Blue Pacific continent. Image 1: The region of Melanesia

Source: World Regional Geography

The region requires US$ 15 billion annually until 2035 for adequate economic development. This is where China has stepped in. Western countries have been unable to match China’s financial aid packages and lending in the region. This has proven beneficial to China, which is addressing the financing gap needed for regional economic development.

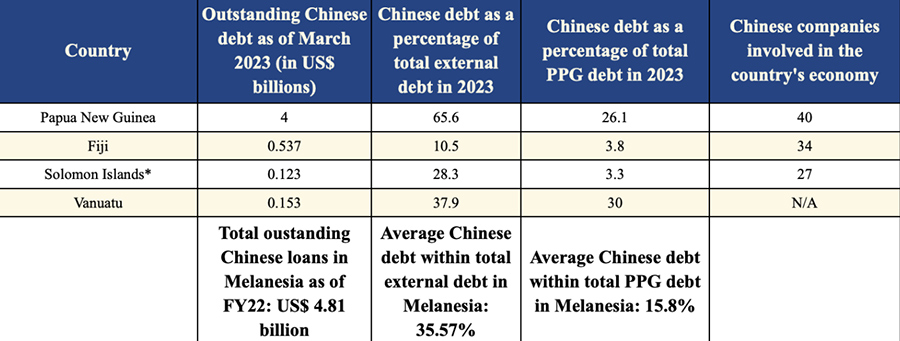

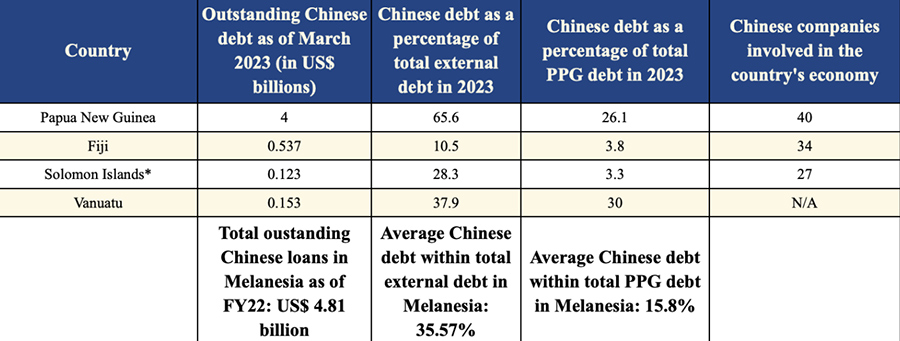

Table 1: Chinese Debt in Melanesia

Source: IMF Staff Report for 2022 Article 4 Consultation and Debt Sustainability Analysis, The Times of India, Xinhua News Agency, The Washington Post

Chinese state agencies have loaned approximately US$ 5 billion to Melanesian governments between 2017-22. On average, Chinese loans make up 35 percent of total external debt in these four countries—Papua New Guinea (PNG), Fiji, Solomon Islands, and Vanuatu. In return, Beijing expects diplomatic allegiance and creates geoeconomic advantages for itself in the Pacific Island Countries (PIC). This article examines the strategic and geoeconomic implications of China’s chequebook diplomacy in the South Pacific. For this, it focuses on the aforementioned Melanesian countries, the region’s most resource-intensive islands, and where China has invested most heavily.

Chinese investments and loans in Melanesian countries

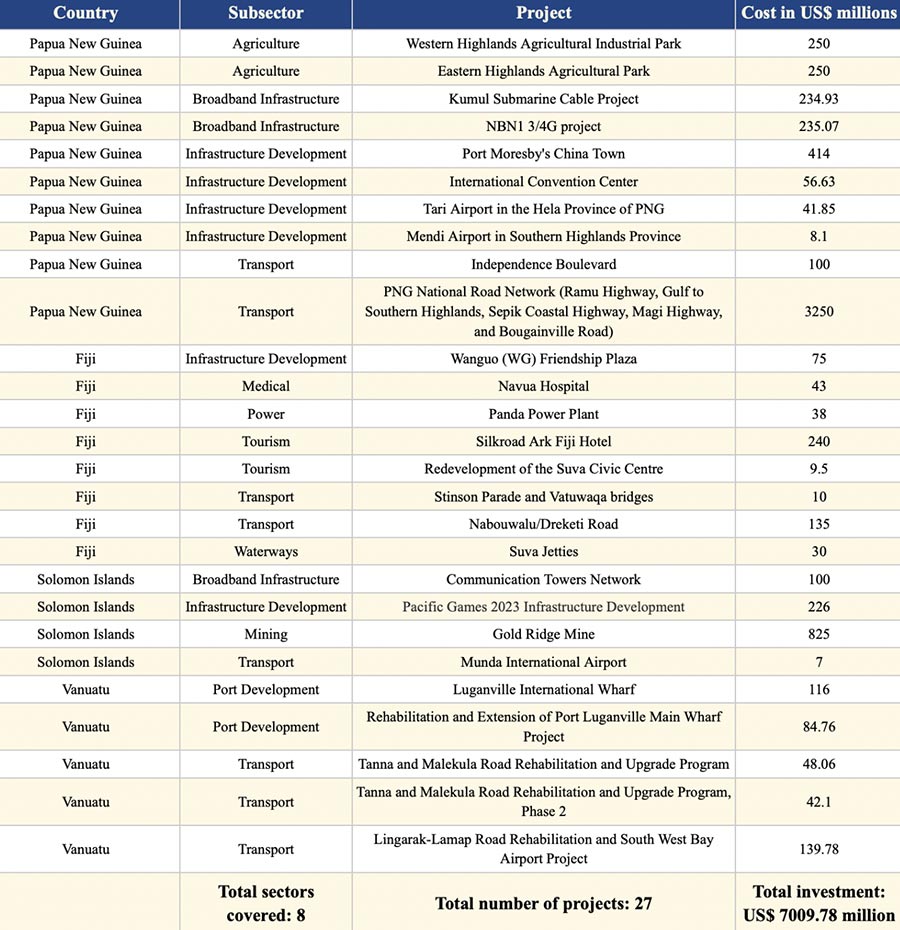

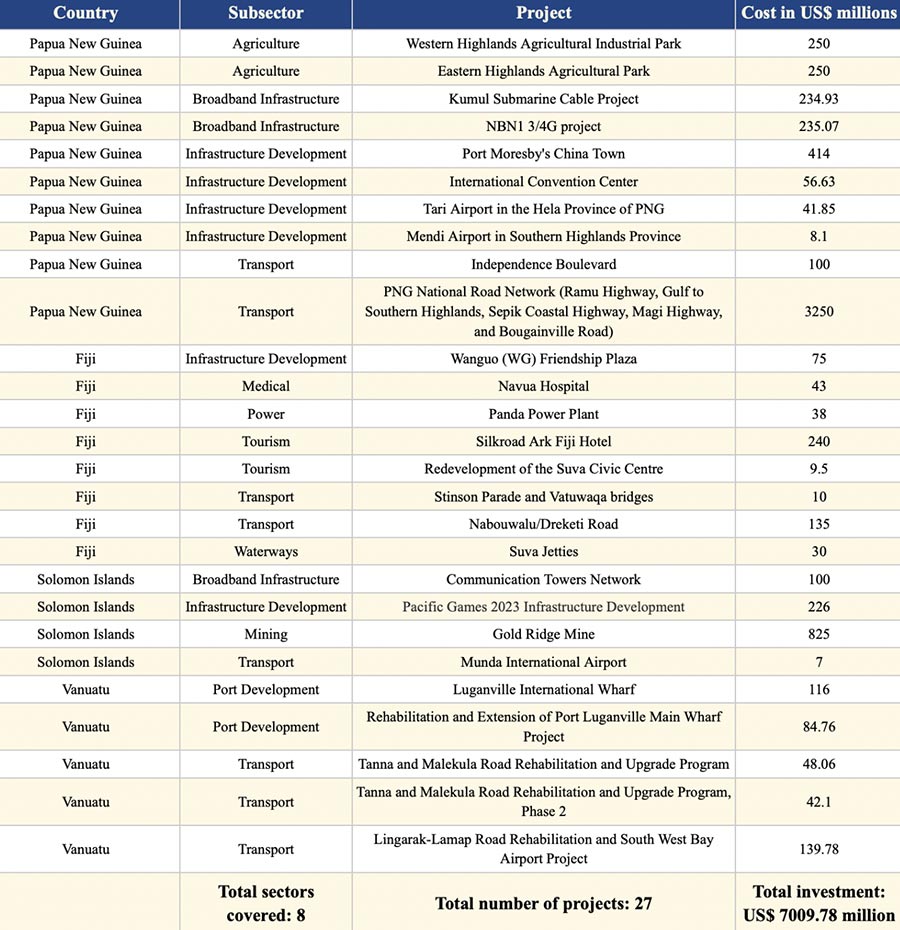

As mentioned in Table 2 given below, between 2016 and 2022, China invested close to US$ 7.01 billion in the Melanesian region. In PNG , the China EXIM bank has loaned the PNG government US$ 3.25 billion to build the island nation’s first-ever cross-country road network. A contract was signed between the two governments in 2017, and work commenced in 2018. Moreover, of the 15 China-funded projects in PNG, which cost over US$ 100 million, eight are concentrated in the energy infrastructure and transport sector, critical to any economy’s growth. Beijing’s investments in PNG gained even more momentum after 2018 when Prime Minister Peter O’Neill visited China and pledged to synergise PNG’s Development Strategic Plan 2010–2030 with the BRI and China’s Thirteenth Five-Year Plan (2016–20). As is indicated in Tables 1 and 2, PNG is the largest recipient of Chinese investments and loans at US$ 4.8 billion and US$ 4 billion, respectively. Table 2: Major Chinese projects in Melanesian Countries

Source: The National Development and Reform Commission.

However, Chinese economic largesse in the region is not just concentrated in PNG. At the same time, Fiji, Solomon Islands, and Vanuatu have also been major recipients of Chinese loans and investments under the BRI. China has invested nearly US$ 580 million in Fiji, US$ 1150 million in the Solomon Islands, and US$ 430 million in Vanuatu. In the Solomon Islands, China has built critical digital infrastructure for 3G/4G connectivity and laid down undersea cables to connect the group of islands that constitute the Solomon Islands. Besides that, China has also invested in other critical economic sectors such as transport, energy, and infrastructure. Beijing has also invested US$ 226 million in the Solomon Islands for the Pacific Island Games (PIG) 2023, for building the 10,000-seat National Stadium, residential complexes for tourists, and an international convention centre.

China has built critical digital infrastructure for 3G/4G connectivity and laid down undersea cables to connect the group of islands that constitute the Solomon Islands.

The Chinese ambassador to the Solomon Islands touted them as China’s ‘gift to the people of Solomon Islands’. Yet, these gifts come with their own caveat. These infrastructural largesses will be the highlight of the PIG 2023 and are meant to showcase what Beijing’s patronage is capable of. Thus, these gifts act as a political tool for Beijing that may influence the region’s perceptions of China. Such notions are reinforced by the fact that the West’s investment in the region is dwindling. For instance, in contrast to China’s aid for the PIG, Australia invested only US$ 17 million.

China’s political statecraft in Melanesia and its outcomes

Beijing’s economic engagements in the region are not only aimed at securing the region’s critical shipping lanes and unexplored mineral resources, but also because Beijing’s top leadership has historically viewed the region as a potential base for China’s overseas military operations. Beginning in 2001, Major General Liu Yazhou recognised the Solomon Islands as a sub-region ‘where Beijing should cultivate pro-China forces’. To these ends, China has recalibrated its strategy here and integrated political, economic, and security statecraft to pursue influence, resources, and access in the Melanesian region. China’s dedication to improving relations with the Melanesian countries is evident in the diplomats Beijing posted in the region, the upward trend in disbursing loans and investments in these countries, and the increasing number of high-level intergovernmental meetings between China and the Melanesian countries.

Between 2018 and 2022, China convinced the Solomon Islands to switch its allegiance to China, while convincing Vanuatu to cut off diplomatic relations with Taiwan.

Beijing’s representatives in these countries comprise skilled economic counsellors (such as Xue to Port Moresby, Li Keqiang to Honiara, and Qian Bo to Suva), who previously served in China’s Commerce Ministry. Additionally, defence attaché and security adviser positions were established in 2017. These deployments delivered enormous benefits to China by enabling comprehensive employment of PRC statecraft in Melanesia. During Xue’s posting between 2016 and 2022, Chinese companies established PNG as an economic stronghold with their presence doubling in numbers during his tenure, going up to 40 from 20 in 2016. More than that, Xue was instrumental in pursuing Beijing to help Port Moresby restructure its external debt worth US$ 14 billion entirely. In the Solomon Islands, posting the former Premier of the PRC and expanding economic cooperation resulted in the PRC-Solomon Islands Security Agreement 2022, an unprecedented security partnership in the region. However, the most significant benefit China has extracted from the BRI in Melanesia is its diplomatic allegiance and commitment to the ‘One China’ policy. While Port Moresby and Suva have historically been aligned with mainland China, Honiara and Vanuatu recognised Taiwan. Between 2018 and 2022, China convinced the Solomon Islands to switch its allegiance to China, while convincing Vanuatu to cut off diplomatic relations with Taiwan. In turn, Chinese BRI investments flooded the two nations. Today, China is the largest bilateral creditor and investor to both the island nations.

Conclusion

Melanesian responses to China’s growing influence in the region vary locally as well as nationally. While the four Melanesian countries recognise Beijing’s economic heft as a significant financial partner, these nations (excluding the Solomon Islands) also consider the national security implications of overtly involving China in their regional affairs. Even the Solomon Islands, which is aligned more closely with China, continues to hedge. The Melanesian countries also collectively rejected China’s “Common Development Vision”, a comprehensive security and economic partnership proposed by Beijing in 2022, citing concerns over a lack of consultation before the plan was proposed by China. The Melanesian nations in collaboration with the other Pacific nations have adopted a policy of enhanced economic engagement with China, which drives their relationship with Beijing and limits China’s interference with the region’s security interests and affairs.

Prithvi Gupta works as a Junior Fellow with the Strategic Studies Programme at Observer Research Foundation

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV