-

CENTRES

Progammes & Centres

Location

Trump’s tariff policies have disrupted global trade and highlighted the need for more stable international economic systems

Image Source: Getty

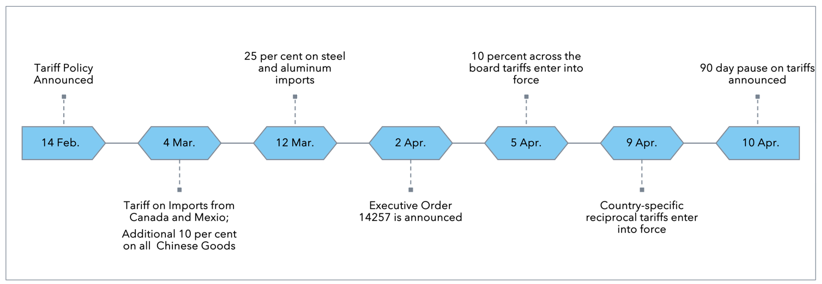

The ‘Liberation Day’ tariffs, announced and paused in the space of five days by the Trump administration in the United States (US) are a classic example of how policies built around pent-up rhetoric are harmful. Executive Order 14257 has been dubbed ‘a staggering act of self-harm’ by several experts. It has also triggered a race to the bottom between China and the US on tariffs which the rest of us can only watch. As of the writing of this piece, China has announced 125 percent tariffs to the US’s 145 percent and additional restrictions on exports of some critical minerals.

China, which only gradually opened its economy in 2001 after joining the WTO, is used to producing self-sufficiently. This is not the case with most other developing economies which have kept their markets open to competition since the GATT was first signed and therefore lost precious years where they could have built manufacturing capacity. In addition, the EU and Canada both responded with their own retaliatory tariffs of a baseline of 10 percent and further tariffs on a sectoral basis.

The EU and Canada both responded with their own retaliatory tariffs of a baseline of 10 percent and further tariffs on a sectoral basis.

In the meantime, due to negative backlash from the markets and their domestic constituency, the Trump administration has announced a 90-day pause on the tariffs and later announced a list of exemption items for imports, including from China. This is not a blanket exemption as the pause also does not impact the baseline 10 percent tariff (20 percent for China) added on 5 April 2025 but pauses the country-specific additional higher tariffs. However, this too has been caveated with a statement that there will be specific tariff announcements for the entire electronics supply chain.

President Trump has been vocal about his preference for tariffs as a tool for disciplining the US’s trade deficit. In their view, it is a tool that is being deployed for strategic and national security reasons and not just as a tool to control the flow of imports into their market. It is part of a larger strategy to revive US manufacturing.

The signs were clearly read in a few countries including India, which moved quickly after President Trump’s inauguration to reflect its willingness to negotiate a trade deal. Much buzz was created by PM Modi’s visit to the US and promises of having a trade deal by the fall of this year even as the Trump administration parallelly announced 10 percent reciprocal tariffs on all its trade partners.

Figure 1: Timeline of US Tariff Announcements: Feb 14 to April 10, 2025

Source: Author generated based on public information

The latest Executive Order announcing tariffs for partner countries will, as expected, not just impact bilateral relations with the US but also the relationship of these countries with other partners.

India, for instance, which is intended to be hit with 26 percent tariffs, will happen to have lower tariffs than some others. This, however, is not a purely positive occurrence. Some of the others being charged higher tariffs, like Vietnam (46 percent), Indonesia (32 percent), Laos (48 percent), Thailand (36 percen), Bangladesh (37 percent) and China (currently 145 percent), are also close trade partners of India. While some may see this as a competitive advantage and a chance to export more, there is another possibility to consider. Other countries hit with higher tariffs may channel their goods through countries which have comparatively lower tariffs—such as India. Anti-dumping has been a continuous issue impacting Sino-Indian trade. While this possibility is remote, it is a scenario that our policymakers must acknowledge and consider.

Large trade deficits are globally seen in a negative light perhaps due to the underlying connotation of the word itself. What deficit numbers hide are the gains that American companies make in two main ways.

First, they can save on production costs in overseas markets. The cost of production in the US is much higher due to the higher cost of basic factors of production including, land, labour, capital, and even entrepreneurship. Immediately after the tariffs were announced, several reports were released on the cost of production of an iPhone pre-tariffs (US$ 549.73) versus post-tariff (US$846.59)—a nearly 60 percent increase. Likewise, American automakers will also suffer as their cost of production adds an additional US$ 3000 per car at the minimum. This number will have changed with the further increase of tariffs on Chinese imports.

Second, they get remittances on the investments they make. If an American manufacturer uses factories in Vietnam for instance, they still get a cut of the profit when “Vietnam” sells this product to a third market. It is how American companies maintain their almost oligopolistic position in the global market across several sectors. GAFAM (Google, Apple, Facebook (Meta), Amazon, Microsoft) is the most obvious example of this, with Alibaba only briefly being an interloper in the acronym and its newer iteration of FANG to include Netflix in the mix. All these tech giants are US-based and owe their growth in large part to their international consumers.

The US may be the only country which has things to gain by maintaining a reasonable deficit with reliable partners.

A third, less obvious relationship is between the deficits and the role of the dollar. The US may be the only country which has things to gain by maintaining a reasonable deficit with reliable partners. If the Trump administration aims to maintain the role of the dollar in the international market, it will have to re-think just how bad these deficits are. If the US is paying the import bills in dollars, that means those markets have more dollars they are spending in the global market.

Fourth, and why the rush to reshore may backfire, is the lack of skill and expertise in the US to manufacture at home. Striking a balance between the demand for goods in the US market and the supply of the same from trusted partners is key—where the current administration is yet to find its footing.

The one thing this administration has been consistent about is its inconsistency in keeping to agreements. The tariffs announced against Canada and Mexico despite an already renegotiated FTA (USMCA, erstwhile NAFTA) from the first Trump administration is a case in point.

It is important to emphasise that the EO includes language on what happens in case a country decides to reduce its tariffs. Section 4 (c) of the EO contains language on what happens if a US trade partner takes steps to ‘significantly remedy non-reciprocal trade arrangements.’ The article states that in this scenario the President “may further modify the HTSUS” (Harmonized Tariff System of the United States).

The implication of this is that even if countries take measures to reduce tariffs, it does not guarantee the removal of these reciprocal tariffs, only a consideration. It is also pertinent to note that the US has pinpointed and taken exception to the non-tariff barriers that countries deploy in addition to their maintaining higher tariffs. This is also made abundantly clear in the US Trade Representative’s 2025 National Trade Estimates report. The US has responded with tariffs as a solution to even these non-tariff SPS and TBT measures.

The implication of this is that even if countries take measures to reduce tariffs, it does not guarantee the removal of these reciprocal tariffs, only a consideration.

While negotiating an interim deal is urgent and relevant, all countries negotiating with the US should be aware that it is no more than band-aid diplomacy.

It is important that countries that can negotiate with the US, should engage in it. However, there is an equally urgent need to find ways to ensure that the new restructured global economy brings better checks and balances and a stable system. With the WTO mostly abandoned, it is up to the Global South to respond to this challenge.

Jhanvi Tripathi is an Associate Fellow at the Observer Research Foundation

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Jhanvi Tripathi is an Associate Fellow with the Observer Research Foundation’s (ORF) Geoeconomics Programme. She served as the coordinator for the Think20 India secretariat during ...

Read More +