The strategic location of the Maldives in the Indian Ocean has made it a focal point for China in the last few decades. China, adhering to its ‘string of pearls’ strategy, aims to consolidate communication lines in the Indian Ocean, considering Maldives as a crucial element. This aligns with China's objective to limit Indian presence in the region and secure a base to protect its energy imports despite relying on the Indian Ocean for over 80 percent of its oil shipments. President Mohamed Muizzu, elected in 2023, pledged to strengthen ties with China and reduce Indian influence, marking a potentially precarious juncture in India-Maldives relations, especially with the resurgence of the China-Maldives Free Trade Agreement (FTA).

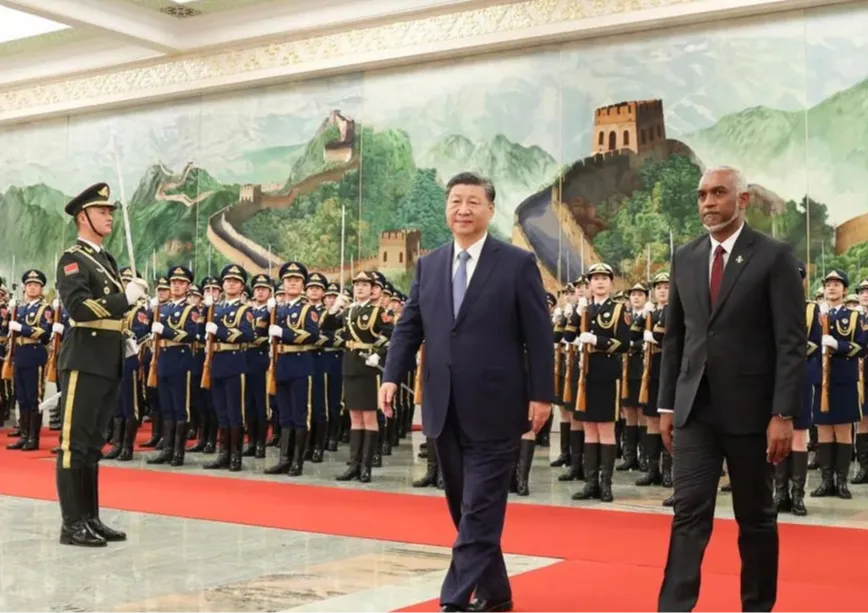

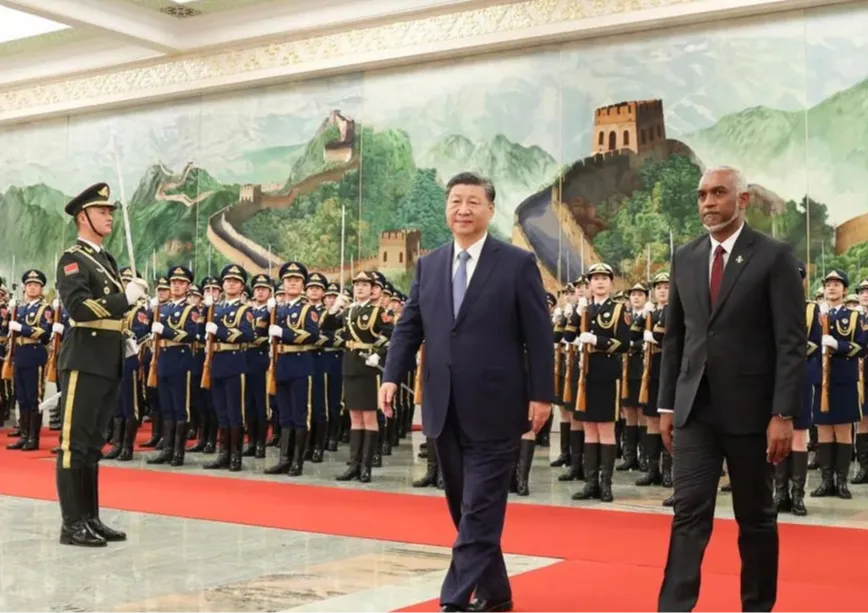

In January 2024, President Muizzu, and China's President, Xi Jinping advanced their countries' relationship to a Comprehensive Strategic Cooperative Partnership through the signing of 20 significant pacts. These agreements spanned areas such as tourism, disaster risk management, ocean economy, and the Belt and Road Initiative. This meeting underscored their dedication to activating the Free Trade Agreement (FTA) established in 2014, highlighting its role in increasing bilateral commerce, notably by augmenting the export of fish from the Maldives to China.

President Muizzu, and China's President, Xi Jinping advanced their countries' relationship to a Comprehensive Strategic Cooperative Partnership through the signing of 20 significant pacts.

With President Muizzu emphasising the enhancement of Malé-Beijing ties, there is a strong possibility that the FTA could be approved, potentially with some adjustments. An FTA typically removes all tariffs and barriers to trade between the signing nations unless exceptions are noted. It also outlines the trade conditions and fosters cooperation beyond mere bilateral trade, such as the sharing of technology, expertise, and other resources.

As of 2019, China held the greatest share in Maldivian imports, contributing a major share of government revenue. However, the elimination of tariffs will not only reduce Maldives’ revenue from China but also from countries which re-export Chinese goods. In aggregate, this will pile up the government debt, forcing the government to increase external debt or raise its domestic tax revenue. Both of these will have severe consequences for household spending, driving the economy towards contraction.

China: Heavy public debt

Table 1: Maldives’ External Debt Structure

| Year |

External debt outstanding as a % of GDP |

| Total external debt outstanding |

Central government and publicly guaranteed |

Central government |

Publicly guaranteed |

Other depository corporations |

| 2016 |

22.6 |

20.7 |

17.6 |

3.1 |

1.9 |

| 2017 |

26.1 |

23.8 |

22.8 |

1.1 |

2.2 |

| 2018 |

38.5 |

37.2 |

24.7 |

12.4 |

1.3 |

| 2019 |

41.4 |

39.6 |

25.1 |

14.5 |

1.8 |

| 2020 |

86.8 |

77.2 |

43.7 |

33.5 |

9.7 |

| 2021 |

59.1 |

51.3 |

36.6 |

14.7 |

7.8 |

| 2022 |

58.1 |

51.4 |

34.9 |

16.5 |

6.6 |

Source: MMA

The external debt to GDP ratio has soared for Maldives, revealing its growing vulnerability to debt traps. A growing burden of debt increases the pressure on the government to make ends meet, pushing it towards the vicious trap of continued borrowing, mismanagement of public resources and finally, uncontrollable inflation. The productivity of the debt-funded investments plays a major role in the compounding of the debt burden. Only when investments are directed towards capacity building and projects with returns greater than the interest on debt, does the debt become sustainable—this also serves as an indicator of risk in the country, affecting future inflows of international funds.

Sovereign-guaranteed debt requires the government to undertake a binding and unquestionable promise to repay the debt. Institutions such as the China Development Bank, the Industrial and Commercial Bank of China, and the Export-Import Bank of China are responsible for more than 60 percent of this guaranteed debt. This leads to a significant amount of interest payments to Chinese financiers, exacerbating the Maldives' financial obligations to China. As the FTA encourages increased economic cooperation between the two countries, it is anticipated that China's share in this debt could expand to levels that become unsustainable for the Maldivian government. This situation, often referred to as “debt-trap diplomacy,” might force Maldives into a position where it becomes increasingly influenced by China's strategic interests in the Maldivian economy.

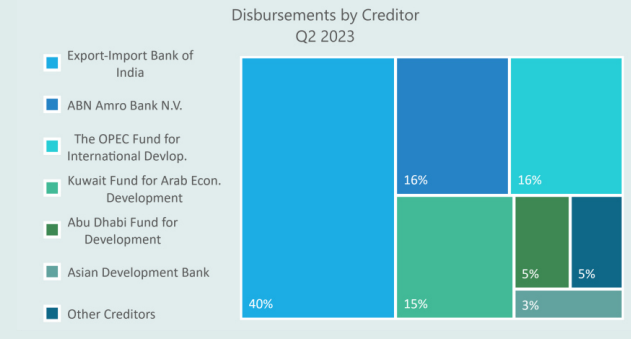

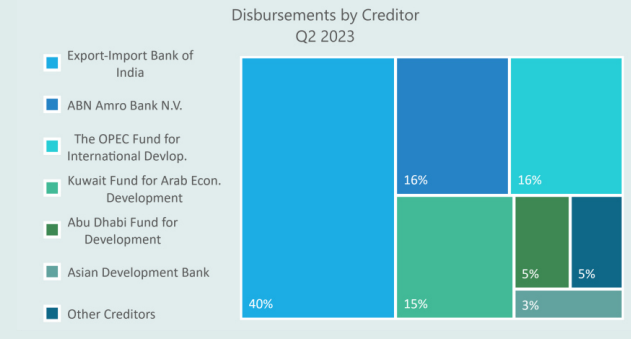

Figure 1: Disbursements of Direct Debt by Creditor

Source: Ministry of Finance, Maldives

However, of the debt directly issued by the government and disbursed, the leading share is held by the Export-Import (EXIM) Bank of India. The EXIM bank extended a line of credit (LOC) of US$ 40 million to Maldives, on behalf of the Government of India, for the development of sports infrastructure. Since the signing of this LOC in 2021, EXIM bank has extended a total of US$ 1.33 billion to Maldives, for housing projects, the Addu Development Project, and the Greater Malé Connectivity Project, among others. India’s organic development cooperation in the South Asian neighbourhood, also provided Maldives access to quality knowledge and resources. While EXIM Bank of India might seem to have a burgeoning share in the country’s debt, EXIM Bank of China’s share stands at almost double the amount in the government’s outstanding external debt.

The ambiguity of the grant makes it the subject of scepticism, as the infrastructure projects could imply projects which would provide Chinese authorities greater access to the Indian Ocean trading routes.

India has also extended several grants to the Government of Maldives (GOM), for various developmental objectives, as well as sports and youth development programmes. However, the Chinese Government has extended a single grant, for the Agreement of Economic and Technical Cooperation between GOM and the Government of People's Republic of China on Grant Aid, for social, livelihood, and infrastructure projects agreed upon and signed by both parties, of Renminbi 400 million. The ambiguity of the grant makes it the subject of scepticism, as the infrastructure projects could imply projects which would provide Chinese authorities greater access to the Indian Ocean trading routes.

Finally, while the Maldives has historic ties with India and acknowledges the significance of its cultural and economic relations, the evolving dynamics underscore the delicate balance required in navigating geopolitical complexities. The nuanced comparison of China and India's roles in the Maldivian debt structure emphasises the strategic considerations at play. As the nation charts its course forward, careful economic management, resilience-building, and diplomatic finesse will be essential in safeguarding its autonomy and stability amidst global shifts.

Arya Roy Bardhan is a Research Assistant at the Centre for New Economic Diplomacy at the Observer Research Foundation

Soumya Bhowmick is an Associate Fellow at the Centre for New Economic Diplomacy at the Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV