-

CENTRES

Progammes & Centres

Location

The upcoming visit by President al-Sisi provides an opportunity to boost relations between India and Egypt

The decision to invite President Abdel Fattah al Sisi of Egypt as the Chief Guest on Republic Day is an important gesture and should go a long way in imparting fresh momentum to India’s ties with the largest country in the Arab world. Egypt matters. With a population of almost 110 million, a location that straddles Africa and Asia, a standing army that is the largest in the region, a capital that hosts the League of Arab States and a diplomatic presence that punches above its weight in global affairs, Egypt is a pivotal player. It is also a country with which India enjoyed an exceptionally close relationship in the first couple of decades after our independence. The personal equation between Prime Minister Nehru and President Nasser was legendary and the two also became the stalwarts of the nonaligned movement during the Cold War of the 1960s. At the political level, the two countries were close enough for India to send clandestine arms shipments to Egypt during the Suez crisis in 1956 and contemplate nuclear cooperation and a joint fighter project in the 1960s. It was a time when Mahatma Gandhi and Rabindranath Tagore were household names and their works were translated into Arabic by leading figures of Arab literature.

The personal equation between Prime Minister Nehru and President Nasser was legendary and the two also became the stalwarts of the nonaligned movement during the Cold War of the 1960s.

And yet, the two countries drifted apart, particularly during President Hosni Mubarak’s long innings from 1981 to 2011. According to diplomatic folklore, an apparently minor protocol gaffe over seating arrangements during the New Delhi NAM summit in 1983 was seen as a personal affront and it took all of 25 years before Mubarak could be persuaded to return to India in November 2008. Both sides promised to make up for lost time and former Prime Minister Dr Manmohan Singh visited Egypt for the NAM summit in July 2009. But by January 2011, the ‘Arab Spring’ had claimed Mubarak as its most prominent victim and there was a brief hiatus as the country moved towards a new constitution and fresh elections. The late and unlamented Mohammed Morsi, to his credit, did make ties with India a priority during his tumultuous year in office. His visit to Delhi in March 2013 did hold out some hope of a fresh boost but three months later, he too was gone.

President Sisi came into power in 2014 and Egypt again showed its intent, first through his participation in the India-Africa Forum Summit in Delhi in 2015 and again through a state visit in 2016. Prime Minister Narendra Modi was widely expected to make a return visit in 2020 but plans were upended by COVID-19. A visit by him is now well overdue. The Republic Day invitation, meanwhile, will address some of Egypt’s angst that its earnest overtures have not been reciprocated.

Some of the groundwork has been done through back-to-back visits to Cairo by Defence Minster Rajnath Singh in September 2022 and by External Affairs Minister Dr Jaishankar in October. Defence cooperation is clearly one of the themes and high-level exchanges over the last two years led to Desert Warrior, the first-ever joint tactical exercise by the air force of the two countries, with IAF sending five Mirage 2000 fighters and a refuelling aircraft to El Berigat Airbase in Egypt. The more recent exercise between the special forces is another indication of the growing willingness to work together. The Egyptians have also shown some interest in India’s Tejas fighter jets and Dhruv light attack helicopters, although this is still at a fairly preliminary stage. Equally important is the behind-the-scenes support provided by them in countering hostile moves by Pakistan at forums like the Organisation of Islamic Cooperation (OIC) and by refraining from making any adverse comment during the Nupur Sharma affair.

The Egyptians have also shown some interest in India’s Tejas fighter jets and Dhruv light attack helicopters, although this is still at a fairly preliminary stage.

Both countries also demonstrated mutual goodwill by helping each other at crucial times over the last two years. When India was hit hard by the second wave of COVID-19, Egypt responded by dispatching three plane loads of medical supplies and providing 300,000 doses of Remdesivir in May 2021. India reciprocated a year later when Egypt, the world’s largest importer of wheat, was facing a dire situation following the abrupt halt in wheat shipments from Ukraine. An initial shipment of 61,500 mt of wheat export was cleared by Delhi on 17 May 2022. The Indian response also paved the way for Egypt to visit India’s wheat growing areas and register India for regular wheat exports to the country.

Bolstered by these tailwinds, bilateral trade has grown by almost 75 percent last year to touch US$ 7 billion, although this is well below the potential, given the size of the two economies. But it is Egypt’s emerging investment scenario that offers a more interesting opportunity. Despite the discovery of substantial gas reserves in the Mediterranean basin, the country’s economy is struggling. Growth in the non-oil sector has been anaemic, foreign exchange reserves have dwindled and the Egyptian pound has been in free fall, with the International Monetary Fund (IMF) administering a bitter dose of medicine to fix some of the problems. The Gulf countries have also started to tighten their purse strings and are now switching from grants and soft loans to investments in viable public sector assets. On the surface, the picture looks grim but it hides three important facts.

First, a number of Indian companies have invested in Egypt and by and large, they have done well. The largest of these is TCI Sanmar by the Chennai-based Sanmar group. Their US$ 1.5 billion PVC and Caustic Soda plant in Port Said is the largest in the region and the group is planning to further expand the facility. The Aditya Birla group’s carbon black facility in Alexandria is another successful example. As are the significant manufacturing facilities set up by groups like Asian Paints, Dabur, UFlex Films, Bajaj Auto, and a host of others.

The Gulf countries have also started to tighten their purse strings and are now switching from grants and soft loans to investments in viable public sector assets.

Second, after several abortive starts and forced by the gravity of the economic crisis, the Egyptian government finally seems to be getting serious about implementing both economic and administrative reforms. Indian companies are positive in their feedback, with some saying quite candidly that after years of apathy, they are finally being heard and action is being taken to make ease of doing business a reality.

And third, the ambitious plans to develop the Suez Canal Economic Zone into a global manufacturing hub are now gathering critical mass. Gurgaon-based ReNew Power seems to be the first off the blocks from India and has signed an agreement to set up a Green Hydrogen facility with an annual capacity of 220,000 tons at a staggering investment of US$ 8 billion. It is clearly driven by attractive tax incentives, cheap and abundant land, 365 days of sun to produce the solar energy needed for the electrolysers, and the strategic location that makes it easy to access the European markets.

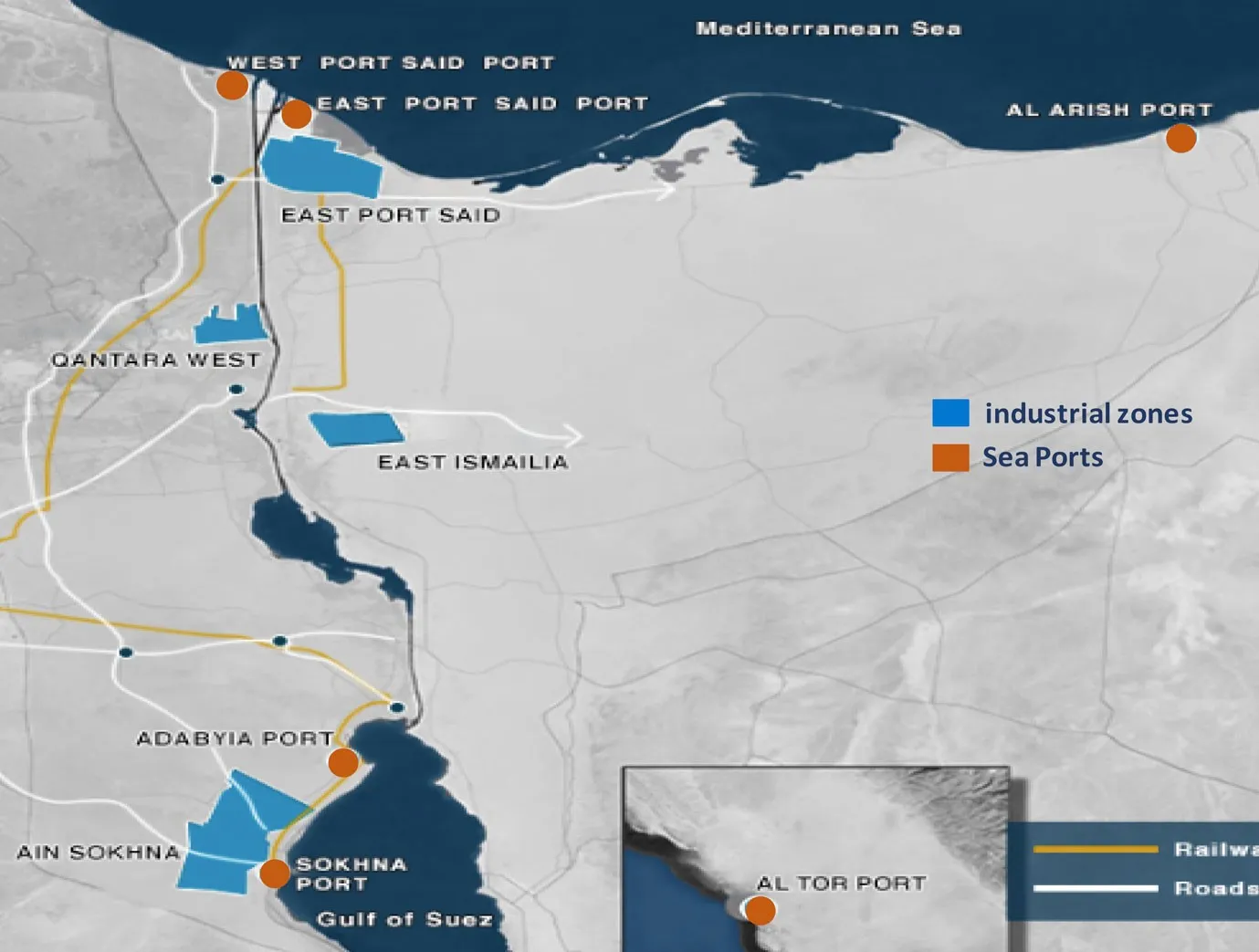

The 455 sq. km SCZONE merits a closer look by Indian companies. It sits astride both banks of the Suez Canal, a strategic waterway that connects the Mediterranean with the Red Sea to provide the shortest link between European and Asian markets. The 18,000 ships that traverse the canal annually account for 20 percent of global container trade. In addition to its locational advantage, Egypt has also boosted its attractiveness through a series of free trade agreements that Africa (ACFTA; AGADIR; COMESA), Europe (EFTA), Latin America (MERCOSUR) and the Arab world (GAFTA). Leveraging these attributes, Egypt is trying to secure investment into several distinct sectors including bunkering and logistics; castings; solar photovoltaics; petrochemicals, pharmaceuticals and APIs; agribusinesses; building materials; electric batteries, tires and automobiles; textiles and garments; and, most recently, green hydrogen.

Source: https://sczone.eg/about-us/

Source: https://sczone.eg/about-us/

China, as usual, has been the first to take advantage of the opportunities presented by SCZONE, seeing the canal as a vital part of its Belt and Road and Maritime Silk Road projects. Spread over an area of 7.3 sq km, it has built a vast industrial estate called Teda Suez, an entity jointly funded by the China Development Fund and the Tianjin Teda Investment Holding. In its 1.3 sq km Phase 1, it has already managed to attract 85 companies that have cumulatively invested over US$ 1 billion. Work on Phase 2 started in 2016 and has drawn significant investments into sectors like fibreglass and high-voltage transformers. Egypt’s prevailing economic vulnerability is bound to increase the clout that China enjoys over a pivotal country.

For India, a deeper economic engagement with Egypt therefore acquires an additional strategic imperative. While Egypt clearly needs to do more to market itself as an investment destination in India, it is also important for industry bodies like CII, FICCI and ASSOCHAM to take a more pro-active approach. Can South Block lend its support for such an approach by using the visit of President Sisi to pitch for a tract of land in the Ain Sokhna or Port Said sectors of the SCZONE that would form the nucleus of an Indian business cluster on the lines of a Teda Suez? ReNew Power has shown the way but it will need a joint government-industry initiative to acquire the scale needed to make an impact.

For now, there are clear indications that India under Prime Minister Modi and Egypt under President Sisi may finally be moving towards achieving some of the potential in bilateral ties that has remained unfulfilled for the last four decades.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.