Introduction

The core principle driving the goal of universal health coverage is to ensure that all individuals have access to comprehensive, high-quality health services that are affordable and easily accessible. The collective efforts by government agencies and industry players will help in taking accelerated steps to achieve these goals. Public-private partnerships (PPPs) represent new avenues of financing and operating for healthcare projects, thereby alleviating the strain on public funds.

The collective efforts by government agencies and industry players will help in taking accelerated steps to achieve these goals.

The imperative to attract private investors in the healthcare sector has intensified amidst the global economic crisis triggered by both manmade and natural disasters in recent years. As a response, the public sector is increasingly embracing PPPs to enhance project efficiency. This strategic shift enables the government to concentrate on policy formulation, planning, and regulatory functions while entrusting the day-to-day operations to the private sector. A well-structured PPP framework and its implementation are anticipated to enhance the delivery of healthcare services.

Employing PPP models in the healthcare sector

The private sector possesses resources, structure, efficiency, and skills that can significantly alleviate the burden on the government. By delegating tasks to the private sector, the delivery of high-quality healthcare at lower costs can be achieved. Constructing resilient healthcare systems necessitates collaborative endeavours from both the public and private sectors. This collaborative approach emphasises the importance of performance-based contracts and output-oriented targets, ensuring a more effective and goal-driven implementation of healthcare initiatives.

Table 1: Examples of Public-Private Partnerships in different countries

| Country |

PPP Project |

Project Details |

| South Africa |

Vaccine & Sera Manufacturing: Equity partnership between the Government of South Africa and Biovac Institute |

Biovac Consortium is a private company comprising of Biovac holdings, VaxIntel, Heber Biotec and Disability employment concern trust. The maximum shareholding is of Biovac Consortium, which is 52.5 percent along with the National Department of Health, South Africa. |

| Mexico |

Hospital Infrastructure: Tertiary Care Hospital—State hospital of Zumpango, Mexico |

Multiple Tertiary care hospitals were established as decentralised public organisations, granting them more management and fiscal autonomy. This status allows the hospitals to operate with greater independence in decision-making and financial matters. |

| Kingdom of Lesotho |

Hospital Infrastructure: Queen ‘Mamohato Memorial Hospital with 425 beds (390 public beds, 35 private beds) |

A consortium ‘Tsepong Ltd’ is formed by Netcare a hospital operator (South Africa) and other local private partners with US$500,000 in equity. The Development Bank of Southern Africa (DBSA) financed US$95 million, and the World Bank has provided a US$6.25-million grant through its Global Partnership for Output Based Aid. |

| Brazil |

Hospital Infrastructure: The first Brazilian public-private partnership transaction in health, the Hospital do Subúrbio in Bahia, was completed |

To improve emergency hospital services in one of the most underserved districts of Brazil. The International Finance Corp. (IFC), a member of the World Bank Group, was engaged by the local government to implement the PPP structure for this new hospital. |

| India |

Dialysis centres and equipment: Under the Government Scheme ‘Pradhan Mantri National Dialysis Program (PMNDP)’ |

Multiple private partners aligned for dialysis centres across the states. For e.g., Apollo, B Braun, Nephroplus, etc., have partnered with Indian state governments to provide haemodialysis machines in dialysis centres in PPP-mode. |

| Türkiye |

Adana Health Complex: 6 hospitals with 1550 bed capacity with financing from the International Finance Corporation (IFC). |

The IFC has funded Etlik, Kayseri and Adana projects with $163 million. For Adana Health Complex, IFC has also arranged for US$200 million in funds with a US$157-million guarantee by the multilateral Investment Guarantee Fund. 18 hospital projects are implemented in Türkiye in collaboration with private partners. The Türkiye government also gives incentives for land, availability payments and service payments. |

Source: Author’s own

Currently, healthcare PPPs are mostly focused on infrastructure projects in specialty care, diagnostics, emergency and ancillary care, etc., but future opportunities will include preventive care, home care, rehabilitation care, and healthcare technology.

Wherever the complex PPP models are not feasible, asset-light models like private partnerships in clinical services can be opted, for. e.g., PPPs for certain surgical procedures, vaccine partnerships, primary care, etc.,

Role of multilateral institutions and policymakers:

Multilateral institutions can help the countries by providing long-term funds, utilising their expertise to improve the project structures, and implementing the international best practices. For e.g., the World Bank conducts a country benchmarking exercise which analyses the PPP project governance structure at each stage of the project cycle. The United Nations Economic Commission for Europe (UNECE) has drafted best practices for PPP management in healthcare.

Multilateral institutions can help the countries by providing long-term funds, utilising their expertise to improve the project structures, and implementing the international best practices.

Public-Private Infrastructure Advisory Facility (PPIAF) administered by the World Bank helps developing-country governments strengthen policies, regulations, and institutions that enable sustainable infrastructure with private-sector participation. International institutions like the International Finance Corporation (IFC), Asian Development Bank (ADB), Asian Infrastructure Investment Bank (AIIB), the Japan External Trade Organization (JETRO) and the Japan International Cooperation Agency (JICA) are actively mobilising private financing to develop healthcare infrastructure across the countries.

The India picture:

In India, NITI Aayog reviews and provides comments on the central government’s PPP projects. The Department of Economic Affairs has also set up a public-private partnership appraisal committee for streamlining such projects. The Indian government needs to encourage more PPPsin tertiary care infrastructure in aspirational districts and tier 2 and3 towns to strengthen its healthcare system.

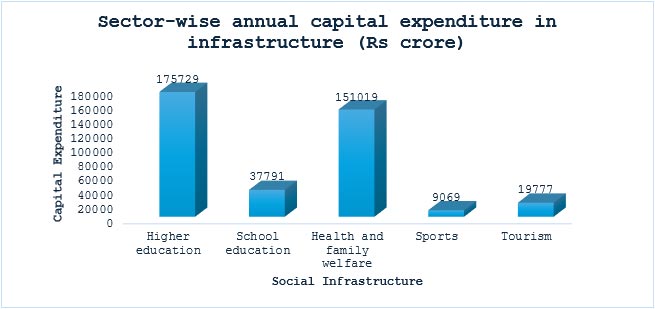

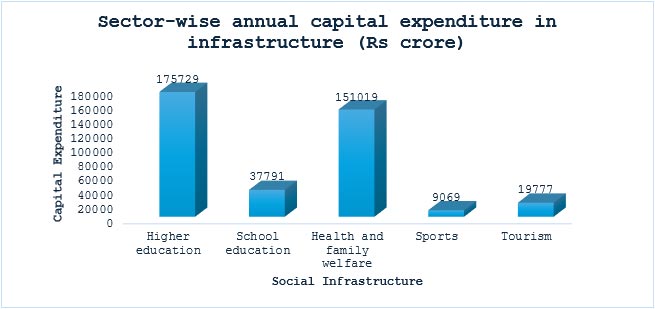

Figure 1: Capital Expenditure on Social Infrastructure from FY2020-25 under National Infrastructure Pipeline

Looking at the broaderpicture and timeline, economic sectors like roads, railways, and ports are preferred over social sectors by industry players due to theirpromising returns. However in recent years, the Indian government has taken several steps under the National Infrastructure Pipeline to improve social sector infrastructure. The capital expenditure on health infrastructure is the second largest amongst other social sectors as shown in Figure 1.

As health is a state subject in India, the majority of PPP projects undertaken in this sector fall under state government expenditure and development plans. These projects are not only restricted to hospital infrastructure, but states are also exploring various sub-segments to improve their health services outreach, for e.g., the radiology centres project of the Jharkhand governmentand HealthMap diagnostics—a joint venture between Manipal Health and Philips—nephrology dialysis units in multiple states, Vaccine on Wheels programme, and Digital Healthcare programme in Andhra Pradesh, amongst others

VGF has been proven to be a crucial tool for the Indian government to involve the private sector in addressing infrastructure challenges and stimulating economic growth throughPPPs.

One of the models which is encouraging private capital inflow in the healthcare sector in India is Viability Gap Funding (VGF). VGF has been proven to be a crucial tool for the Indian government to involve the private sector in addressing infrastructure challenges and stimulating economic growth throughPPPs. One of the notable examples under this initiative is the Odisha government’s greenfield project for developing higher secondary/tertiary hospitals in Angul (200 beds), Barbil-Keonjhar (200 beds), Bhadrak (100 beds) and Jharsuguda (100 beds) districts. These projects follow the Design Build Finance Operate and Transfer (DBFOT) model of PPP projects with a concession period of 32 years. Another example is the brownfield PPP project for the development of medical colleges in Uttar Pradesh’s six districts: Hamirpur, Hathras, Bagpat, Mahoba, Manipuri and Kasganj. The project follows the ‘Augment, Operate, Finance, Design, Maintain, Transfer’ model with an initial concession period of 33 years.

Improving outcomes: Key parameters to consider

The complex nature of the project, resource availability, and cash flow constraints affect the commercial viability of PPP projects in the healthcare sector. Therefore, a detailed economic case should be prepared while proposing PPP projects to determine their feasibility. The case should demonstrate that the PPP approach will be more cost-effective as compared to the non-PPP delivery approach and will also be commercially viable for the investors. Regular monitoring and evaluation to check the project progress with the creation of an ecosystem for managing the PPP projects will boost healthcare outcomes.

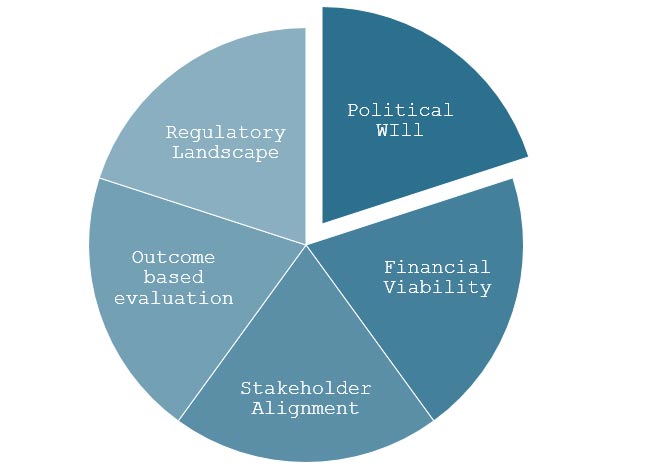

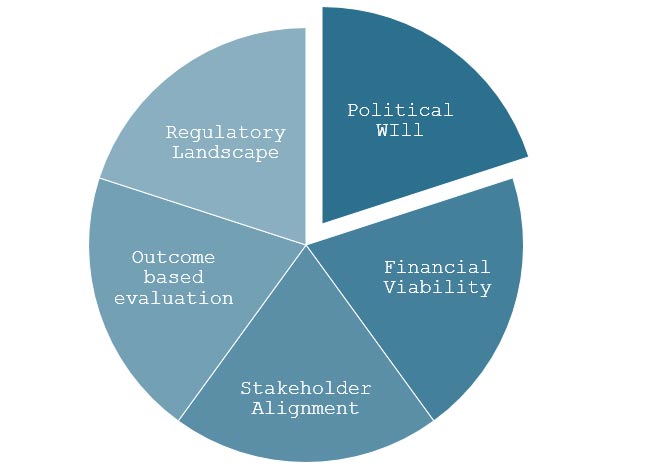

Figure 2: Critical Success Factors for Execution of Healthcare Sector PPPs

The significance of political will cannot be overlooked when discussing the ‘public’ dimension of PPP projects. It ensures the continuity of support across administrations and electoral cycles, thereby instilling confidence in private investors and lenders. Policy support and stability of governing institutions influence the implementation of PPP projects as they help in quick decision-making, favourable regulatory environment and effective allocation of resources.

Some partnerships may prove beneficial in creating value for private partners and providing value-based healthcare to patients, but increased privatisation may come with a drawback of profit-driven decision-making and inequitable access to healthcare. Therefore, the tremendous potential of the PPP approach needs to be tapped through fair and ethical practices to prevent it from becoming another case of crony capitalism.

The synergies formed through PPPs will pave the way forward for achieving the sustainable development goal (SDG) of healthcare for all.

Aboli Mandurnekar works as a Manager at Invest India, the National Investment facilitation and promotion agency of the Government of India.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV