-

CENTRES

Progammes & Centres

Location

The excessive dependence on a single category of RMG exports is bound to hamper the growth trends of the country.

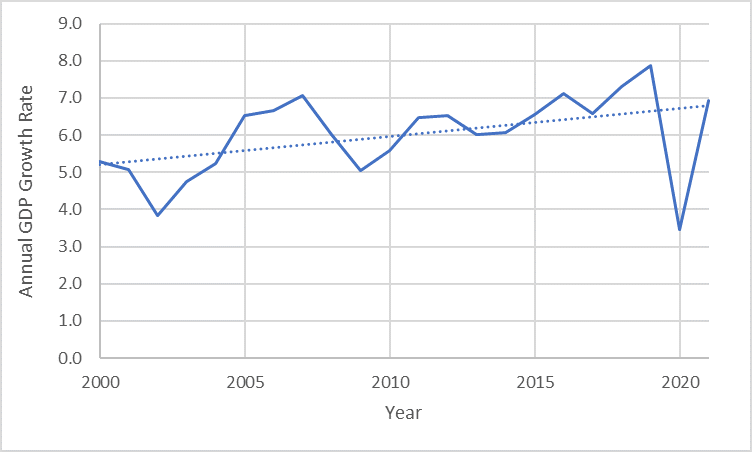

As Bangladesh celebrates its 50th anniversary as an independent nation in 2021, the country needs to look back on its journey—from being one of South Asia’s poorest nations in war 1971, right after the Great Cyclone of 1970 that killed approximately half a million Bangladeshis, to the present Asian Tiger in the making which highlight the country’s phenomenal progress in economic sectors ranging from Ready-Made Garments (RMG) to pharmaceuticals. Bangladesh experienced a low growth rate for many years—the average growth rate during 1970-1980 was about 2 percent. However, it increased in the subsequent years, surpassing the 5-percent level in 2004, which was a result of the steady structural transformation of the country from an agrarian economy to an industry and services-based one. Compared to its South Asian counterparts, Bangladesh’s growth rate surpassed Pakistan’s in 2006, and the country has consistently grown above 6 percent since 2011.

Figure 1. Bangladesh GDP Growth Rates (annual percentage) (2000- 2021)

Source: Author’s own, data from the World Bank, Annual GDP Growth

Source: Author’s own, data from the World Bank, Annual GDP Growth

Before the Liberation War of 1971, the economy of present-day Bangladesh was heavily agriculture-dominated. The agriculture sector’s share significantly declined from around 60 percent in the early 1970s to 30 percent in the 1990s and has settled at around 12 percent in recent years. This decline is countered by an increase in shares of the industry and services sector. At present, the industry comprises about 33 percent of the GDP, while the service sector is the dominant sector accounting for about 55 percent of the GDP. Bangladesh’s service sector depicted rapid growth in the 1980s, and after the economy underwent trade liberalisation in the early 1990s, the service sector surged further. However, econometric analysis using 10-year data from 2000-2010 shows that although the service sector has grown (at 6.17 percent) faster than agriculture (at 3.21 percent), the growth in industries (at 7.49 percent) has surpassed services. Between 2010 to 2021, the value added by services as a percentage of GDP has also dipped by 2.2 percentage points.

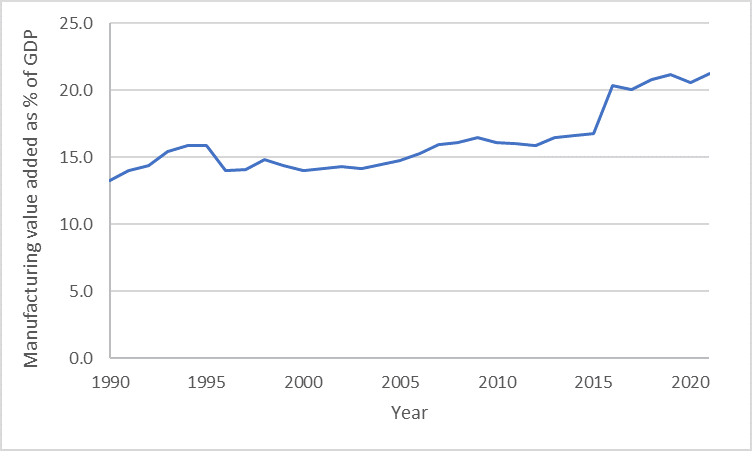

Within the domain of industries, the share of manufacturing has been continuously rising—the latter witnessed high rates of growth during the 1990s and has shown an upward trend for the last two decades. However, the growth of manufacturing is mainly attributed to the RMG—as per the World Bank statistics, textiles and clothing account for about 57 percent of overall value added in the manufacturing sector, while the share of medium and high-tech manufacturing value added has consistently fallen from 24 percent in the 1990s to 7 percent in 2019.

Figure 2. Bangladesh's Manufacturing Value Added (percentage of GDP) (1990-2021)

Source: Author’s own, data from the World Bank, Manufacturing value added (% of GDP)

Source: Author’s own, data from the World Bank, Manufacturing value added (% of GDP)

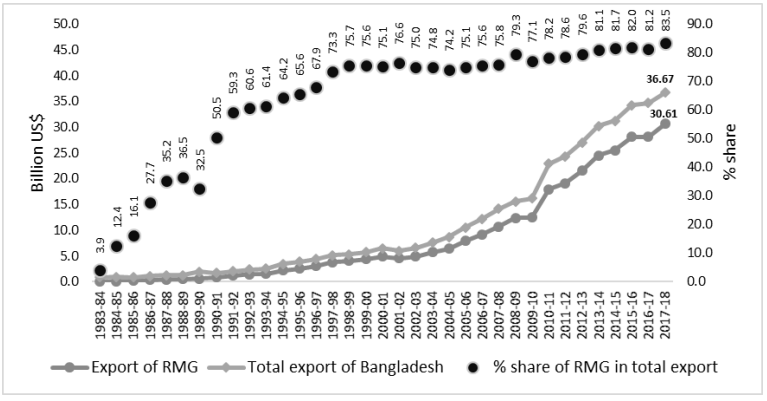

The advancement in RMG is concurrent with the skewed trade patterns of the country. RMG exports constitute about 84 percent of the total export earnings, and the exports rose at a compound annual growth rate of 7 percent—from US$14.6 billion in 2011 to US$33.1 billion in 2019. While the composition of the import basket has experienced a shift from agricultural raw materials to manufacturing raw materials, Bangladesh’s export-oriented industrialisation, largely dependent on RMG, poses macroeconomic risks for the country. Not only has the share of exports in the GDP declined from 20.2 percent in 2012 to 10.7 percent in 2021, the excessive dependence on a single category of RMG exports without diversifying into complex manufacturing products like steel, chemical, and transport equipment, among others, is bound to hamper the growth trends of the country.

Figure 3. Trend in Exports and Share of RMG in Total Exports (1983 – 2018)

Source: S. Raihan and S.S. Khan (2020), Structural transformation, inequality dynamics and inclusive growth in Bangladesh

Source: S. Raihan and S.S. Khan (2020), Structural transformation, inequality dynamics and inclusive growth in Bangladesh

Firstly, the volatility in the global demand for Bangladesh-made RMG is a major reason for concern. Bangladesh’s focus on the production of low-value garments without sufficient diversification neither in the upper portions of the same value chain nor in other segments has made the growth pattern highly susceptible to exogenous shocks such as the COVID-19 pandemic. There were signs of a slowdown in this sector in the later part of 2019, and when the pandemic-induced lockdowns started in 2020, it further amplified the issues ranging from order cancellations to payment delays. The manufacturing sector backed by RMG recovered soon after global markets opened after the initial restrictions on trade were removed. However, the demand for RMG was on the decline due to the Russia-Ukraine conflict, where a large number of garment traders couldn’t receive export receipts when Russia was banned from using SWIFT (the global payments messaging network).

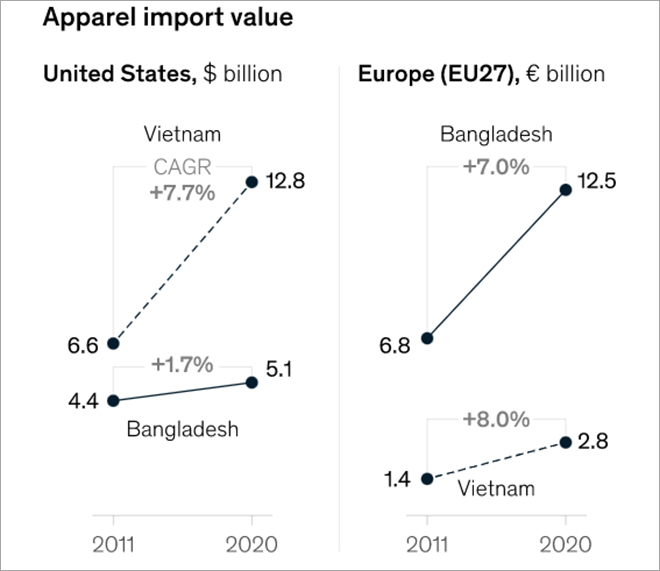

Secondly, as Bangladesh exports about 80 percent of its RMG to markets in Europe and America, the rise of Vietnam in this sphere has posed to be a major threat. On one hand, while the Preferential Trade Agreement (PTA) between Vietnam and the EU can outperform Bangladesh’s RMG exports to the EU, on the other hand, the US has strongly chosen Vietnam for sourcing materials as an alternative to China. Vietnamese apparel imports to the US were estimated to be 2.5 times that of Bangladesh’s imports to the US.

Figure 4. Growth of Apparel Imports Value from Bangladesh and Vietnam in the US and Europe (2011 – 2020)

Source: Eurostat; USITC; McKinsey Analysis

Source: Eurostat; USITC; McKinsey Analysis

Thirdly, on the supply side of RMG, the rising fuel costs are an added burden in this sector where fuel accounts for approximately 10 percent of the costs borne by the garment companies. Additionally, inflationary pressure in the Bangladesh economy has further raised the input costs of RMG leading to an increase in the prices of the finished products—thus, decreasing the price competitiveness of the commodities in the global markets. In fact, the RMG sector also depends largely on cheap unskilled labour, which provides a competitive advantage to this sector; this may not be sustainable in the longer horizon with increased labour mobility between sectors and geographies. Finally, infrastructural problems within the country combined with increasing preference for nearshoring due to speed and flexibility in the sourcing companies have started to seriously threaten the RMG sector. The 2012 Tazreen Factory fire and the 2013 Rana Plaza disaster are reminders of the extreme working conditions in the textiles industry—causing several international buyers to stop sourcing from Bangladesh.

The anti-export bias faced by the non-RMG sectors is responsible for not only limiting competition amongst the export sectors but also impeding product variations. Both export-sector diversification and infrastructural enhancement in the RMG sector are also impeded by weak private sector investments, due to the deterioration of the business environment in recent times coupled with the difficulty in credit access, especially for the small and medium-scale enterprises. Additionally, amidst rising climate change, global demand is further shifting towards sustainable products. The lack of diversification and curtailed investment in R&D to expand the domain towards climate-neutral products could put the country into deep waters with reduced exports and the corresponding impact on other macroeconomic parameters.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Soumya Bhowmick is a Fellow and Lead, World Economies and Sustainability at the Centre for New Economic Diplomacy (CNED) at Observer Research Foundation (ORF). He ...

Read More +