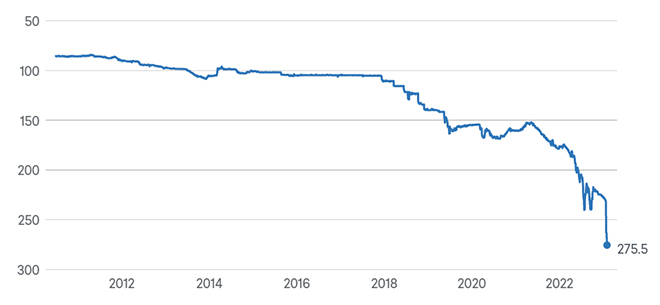

Back in October 2022, the Pakistani Rupee (PKR) seemed to be heading towards a remarkable achievement as it showed a notable appreciation of

3.9 percent, reaching PKR 219.92 per dollar. This positive trend was attributed to anticipating substantial foreign currency inflows from the International Monetary Fund (IMF) and foreign investors. Unfortunately, at that time, the Finance Ministry failed to foresee the impending volatility of the PKR. Subsequently, in February 2023, the Pakistani rupee experienced a sharp decline, plunging to a rate of 275.5 PKR per dollar and causing significant disruption in the market.

Currency crises have been common since the 1960s when the norm of fixed exchange rates under the Bretton Woods system made currencies highly susceptible to speculative attacks. However, it was not necessarily the exchange rate regime but the inherent domestic structure of the economy that drove the currency into collapse. Unfortunately, Pakistan was exposed to an increasingly volatile domestic situation which, coupled with a fixed exchange rate, international tensions and the COVID-19 pandemic, pushed the country into an inevitable currency crisis.

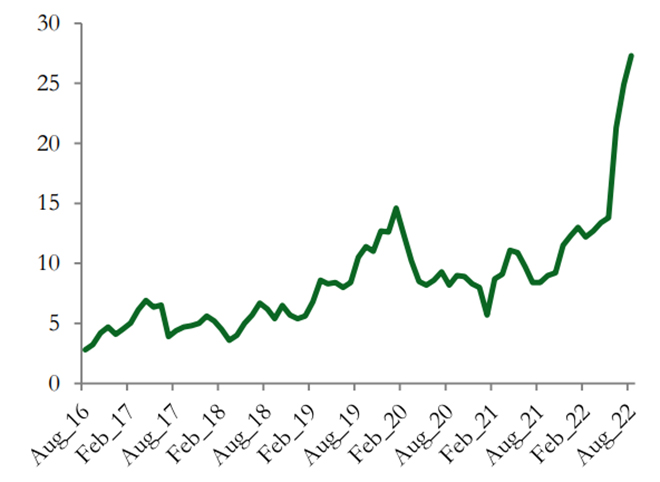

Figure 1: Pakistani Rupee per US$ (2010-Feb 2023)

Source: Council on Foreign Relations

Source: Council on Foreign Relations

The

escalating prices of essential imports in Pakistan, including fuel, edible oil, and pulses, have heavily burdened the government. As a result, the country is grappling with an inflated current account deficit and fiscal spending, leading to mounting challenges. This situation is paving the way for a longstanding issue of persistent cost-push inflation, which threatens to dominate the market. Moreover, local producers are finding it increasingly unviable to continue production due to the rising costs of inputs. Adding to the predicament, Pakistan's foreign exchange reserves are dwindling rapidly, and with no visible assistance from the International Monetary Fund (IMF) in sight, the country's citizens are confronted with a humanitarian crisis of significant proportions.

Currency crises have been common since the 1960s when the norm of fixed exchange rates under the Bretton Woods system made currencies highly susceptible to speculative attacks.

CAD and BoP vulnerabilities

Persistently high Current Account Deficits (CAD) are unsustainable and lead to major Balance of Payment (BoP) difficulties. A high CAD can generate a crisis as speculators dump the currency anticipating a fall in foreign exchange reserves, leaving the central bank incapable of defending the currency. Moreover, a deleterious effect on the scale of indebtedness weakens the country’s finances and makes it increasingly difficult to access international credit. The political upheaval adds to this by exponentially increasing the risk premium and forcing the central bank to implement restrictive monetary policies just to attract foreign capital.

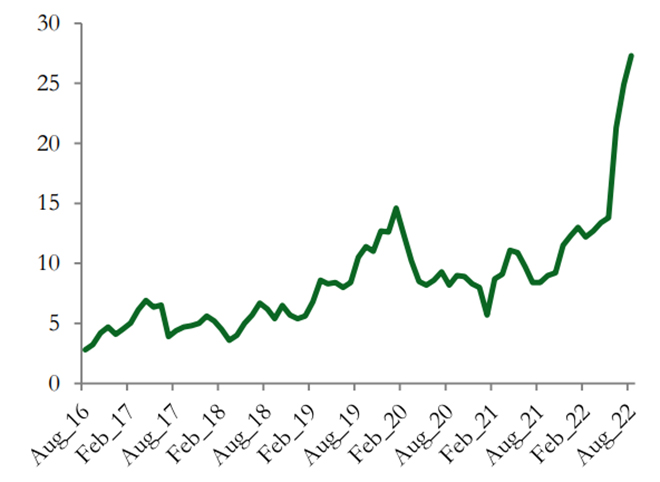

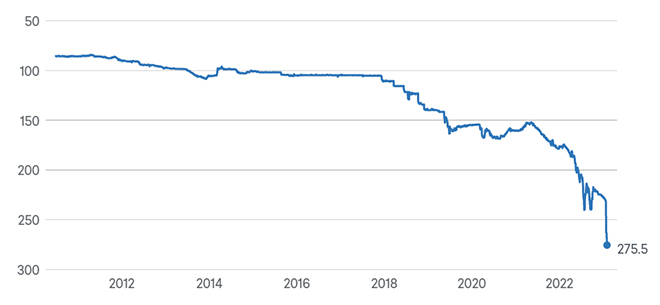

Figure 2: Pakistan's National Headline Inflation (Y-o-Y) before and after COVID-19

Source: The World Bank

Source: The World Bank

Following the removal of the

ceiling on the USD-PKR exchange rate in January 2023, as part of efforts to revive the IMF loan programme—the PKR has experienced a significant decline, reaching a record low. However, it is important to note that Pakistan's currency challenges extend beyond its recent political and economic downturn. The devaluation of the rupee against other major currencies, such as the US dollar, euro, and Indian rupee, has been an ongoing trend

since early 2018. This shift occurred when the PKR transitioned from a managed exchange rate system to a free-floating exchange rate against the dollar.

The devaluation of the rupee against other major currencies, such as the US dollar, euro, and Indian rupee, has been an ongoing trend since early 2018.

Pakistan should also be cautious of the excessive IMF lending as the large capital inflows can undermine the BoP viability in the long run. Given the debt structure of the country, it is likely that the funds will be used up to boost consumption and meet existing debt obligations. Such utilisation of funds does not add to the productive capacity, and the inefficiency leads to low returns. In the long run, it becomes increasingly difficult to procure external funds as the failure to generate foreign exchange earning capacity establishes the country as a defaulter. Hence, any further debt taken on by the government should be utilised while paying acute attention to the productive capacity of the sectors.

Inflationary pressures

By the end of 2021, the PKR had experienced a significant depreciation,

falling to 176 from 160 rupees against the US dollar compared to the previous year. Several factors contributed to this sudden decline in the value of the rupee. One key factor was the collapse of the banking system in neighbouring Afghanistan following the withdrawal of US forces in August 2021. Additionally, Pakistan's high reliance on imports for essential commodities created a supply-demand gap, further pressuring the currency. The devastating floods of 2022 and other political factors aggravated the situation, which worsened the country's foreign exchange crisis.

With exchange rates fluctuating in the 200-rupee range, Pakistan faces a struggling currency and a subsequent increase in imports, leading to soaring inflation and a rise in poverty levels. The Consumer Price Index (CPI) in Pakistan rose by

27.5 percent year-on-year in 2023, with an average inflation rate of 25.4 percent for the first seven months of the fiscal year 2022-23, compared to 10.3 percent during the corresponding period of the previous year. In an attempt to appease the IMF and resume the EFF programme, the government, led by Sharif, has raised fuel and energy prices, and implemented higher taxes, intensifying the inflationary pressures. The surge in fuel prices has also contributed to power shortages, further deterring foreign direct investment.

The demand-pull inflationary tendencies have been at play due to high demand and low supply, with imports held up at ports, exacerbating the shortage of dollars in the country.

Furthermore, Pakistan has been facing a severe

wheat crisis, leading to hoarding and stampedes in some provinces as the government struggles to provide subsidised flour supplies go, up to

PKR 160 per kilogram. The demand-pull inflationary tendencies have been at play due to high demand and low supply, with imports held up at ports, exacerbating the shortage of dollars in the country. This situation contributes to rising inflation and puts strain on consumers' income and savings.

In conclusion, Pakistan's currency crisis is rooted in a combination of domestic political and economic challenges, international tensions, natural disasters, and the lasting impact of the COVID-19 pandemic. To combat rising inflation and stabilise the PKR, the State Bank of Pakistan has increased the interest rate by 300 basis points, resulting in a cumulative increase of 1,050

basis points since January 2022. However, by early 2023, the country's foreign exchange reserves plummeted to a

10-year low of US$ 3.09 billion. The persistent inflationary tendencies and dwindling foreign exchange reserves have created a humanitarian crisis of significant proportions, and hence urgent fiscal measures are needed to address the dire situation in Pakistan.

Note – For a more detailed analysis, please see ORF Occasional Paper No. 403 “Debt ad Infinitum: Pakistan’s Macroeconomic Catastrophe”

Soumya Bhowmick is an Associate Fellow with the Centre for New Economic Diplomacy, at the Observer Research Foundation

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Back in October 2022, the Pakistani Rupee (PKR) seemed to be heading towards a remarkable achievement as it showed a notable appreciation of

Back in October 2022, the Pakistani Rupee (PKR) seemed to be heading towards a remarkable achievement as it showed a notable appreciation of

PREV

PREV