Pakistan's political and economic landscape is no stranger to drama. Pakistan Tehreek-e-Insaf (PTI), the party of former Prime Minister Imran Khan, who is currently incarcerated on corruption charges, leads the 2024 Pakistan General Elections. His key opponent, Nawaz Sharif of the Pakistan Muslim League (Nawaz), known as PML-N, sparked controversy with his choice of a Gucci cap, rumoured to be worth over a hundred thousand PKR amidst Pakistan's economic struggles. The other opponent, Bilawal Bhutto Zardari, Chairman of the Pakistan People’s Party (PPP), also faced earlier allegations of misgovernance and money laundering in 2018.

PML-N has pledged to significantly increase annual exports and remittances, finalise a US$ 10 billion oil refinery deal with Saudi Arabia, and continue projects under the China-Pakistan Economic Corridor (CPEC).

Despite the political theatrics, the focus of the 2024 election extends beyond the personal dramas to the severe financial parameters facing Pakistan. Year-on-year inflation at 28 percent in January 2024, fuel price hikes, and anticipated soaring electricity bills have taken centre stage in the campaign's final stretch. PML-N has pledged to significantly increase annual exports and remittances, finalise a US$ 10 billion oil refinery deal with Saudi Arabia, and continue projects under the China-Pakistan Economic Corridor (CPEC). Meanwhile, the PPP aims to double per capita income and provide free electricity to underprivileged families.

A precarious economy

The genesis of Pakistan's economic woes lies in a convergence of factors, including the global upheaval triggered by the COVID-19 pandemic, disruptions in global supply chains, and geopolitical tensions, particularly the conflict between Ukraine and Russia (which has deteriorated food and energy security across the developing world). This confluence of events has plunged the nation into economic disarray, marked by dwindling purchasing power, depleting foreign exchange (FOREX) reserves, and escalating civil unrest.

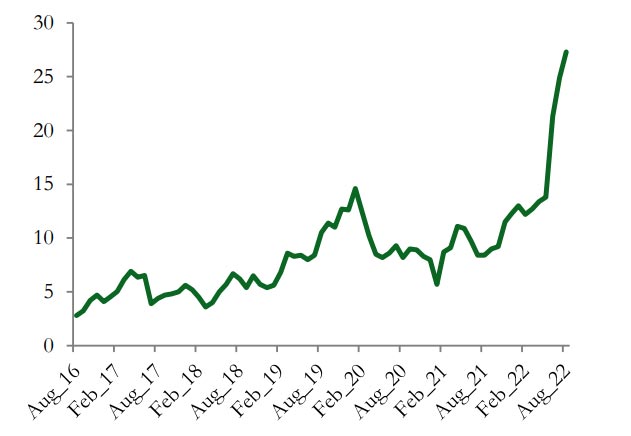

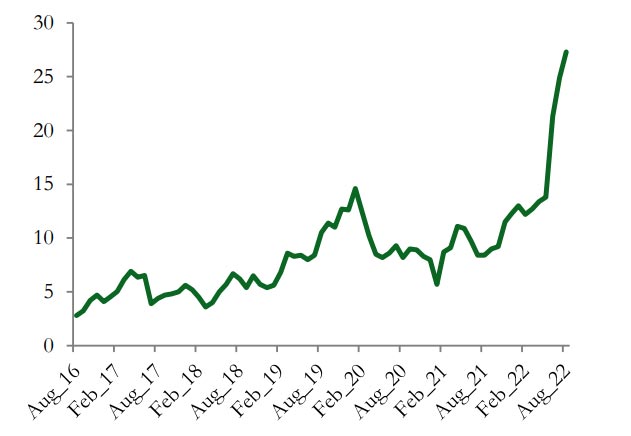

Figure 1: Pakistan's National Headline Inflation (Y-o-Y) Before and After COVID-19

Source: The World Bank

Source: The World Bank

First and foremost, Pakistan's economic challenge is the extreme decline in its FOREX reserves. In early 2023, these reserves plummeted to a historic low of just US$ 3.19 billion, a meagre sum barely covering two weeks of imports and falling significantly below the International Monetary Fund's (IMF) recommended three-month minimum. This precarious situation is further compounded by the daunting task of repaying a projected debt of US$ 73 billion by 2025, with a substantial portion owed to China and Saudi Arabia.

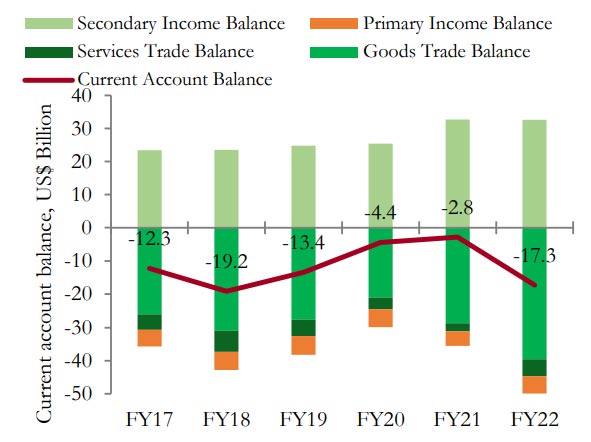

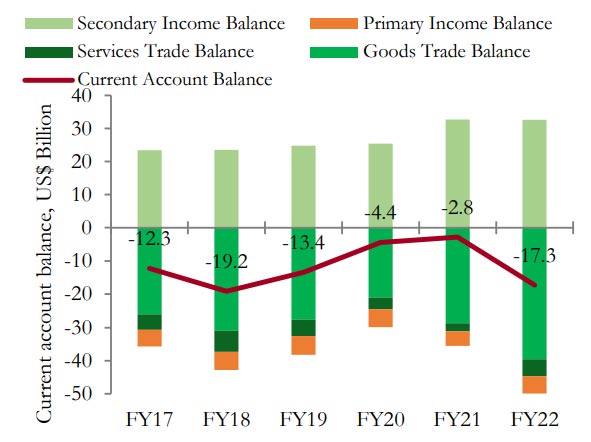

Figure 2: Pakistan's Current Account Balance (in US$ billion)

Source: The World Bank

Source: The World Bank

The dramatic devaluation of the Pakistani Rupee (PKR) further complicates the economic situation. From hopes of becoming the world's best-performing currency in October 2022 to hitting a record low in February 2023, the devaluation has far-reaching implications, impacting essential imports such as fuel, edible oil, and pulses.

Additionally, Pakistan's grey-listing by the Financial Action Task Force (FATF) has substantial economic implications, with estimated losses to its GDP since 2008 reaching US$38 billion. While the country's exclusion from the list in October 2022 provided some relief, it underscores the need for robust anti-money laundering and counter-terrorism financing reforms.

Shaky external outlook

Pakistan's external debt dynamics are intricate, reflecting historical ties with China and Saudi Arabia. The total external debt, representing a staggering 33 percent of the GDP as of December 2022, is a combination of multilateral, Paris Club, private, and commercial loans, with Chinese financial institutions holding over 30 percent of the debt. The short-term nature and high interest rates associated with some of these loans, particularly from private bonds and Chinese debt, present significant hurdles for Pakistan's debt management.

The economic complexity of CPEC, coupled with China's reluctance to restructure debt repayments, has strained negotiations with international financial institutions, including the International Monetary Fund (IMF).

Unfortunately, the China-Pakistan Economic Corridor (CPEC), envisioned as a transformative initiative in 2015, has become a central factor in Pakistan's ongoing economic crisis. The economic complexity of CPEC, coupled with China's reluctance to restructure debt repayments, has strained negotiations with international financial institutions, including the International Monetary Fund (IMF). On the one hand, experts emphasise the need for short-term financial assistance from global partners, with Pakistan having an existing IMF bailout agreement worth US$ 3 billion, contingent on tough requirements; on the other hand, the relationship between Pakistan and the IMF has been marked by challenges, seeking bailouts 22 times in the past 60 years.

Post-election scenario

Despite the economy-focused elections, numerous distractions have emerged, stemming from the electoral process's circumstances. The attention has shifted away from economic concerns due to Imran Khan's removal from power and subsequent legal entanglements. Doubts about the election's credibility have surfaced, encompassing worries about media influence, assaults on law enforcement, and the potential for manipulated results, raising the spectre of heightened political unrest and economic instability.

Navigating Pakistan's US$ 340 billion economy within a volatile political landscape raises concerns about potential economic policies that might mirror past destabilising measures. The primary challenge remains to address inflation's adverse impact on the economy and to shield citizens, especially the vulnerable population enduring prolonged inflation and unemployment, from the repercussions of stabilisation policies.

The incoming government faces multifaceted challenges, encompassing the imperative for a new IMF programme, expenditure reduction, and deficit management.

The incoming government faces multifaceted challenges, encompassing the imperative for a new IMF programme, expenditure reduction, and deficit management. As the new government charts its economic course, aligning campaign promises with the reality of a sluggish economy becomes a formidable task. There is a necessity for an urgent comprehensive plan, advocating for an expanded tax net and a departure from a consumption-based growth model. Furthermore, significant investments in climate mitigation and adaptation strategies are deemed crucial to combat the repercussions of climate change, such as floods and related disasters.

Finally, the imperative of a holistic, whole-of-nation approach is underscored for Pakistan's protracted journey towards economic recovery and sustained growth. The critical steps of decoupling economic governance from politics, implementing requisite reforms, and reevaluating international partnerships are essential for Pakistan's economic resurgence.

Soumya Bhowmick is an Associate Fellow at the Observer Research Foundation

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV