-

CENTRES

Progammes & Centres

Location

Banking is the only prominent sector within the Indian economy where private corporations are dwarfed by public entities. The sector needs to be rectified for the continued health of the Indian economy.

After years of inattentiveness, the Indian government has finally turned its attention towards the ailing banking sector. While the recent recapitalisation of public sector banks has been touted by some as a remedy, there is a need for deeper dissection to find the root cause behind the quagmire of non-performing assets. To do that, however, the rationality behind the recapitalisation package must first be understood.

Banks are intermediaries in the money creation process of all economies as deposits from customers are injected back into the economy through the dispersal of loans. To preserve some liquidity for the depositors, a fraction of these deposits are stored as reserves or “capital buffers”. The problem for the banks arises when the borrowers start defaulting on their loans, eroding the capital buffer of the banks. As these losses start piling up, the banks start losing their ability to lend, invariably making the situation worse. At this point, additional deposits are not enough to revive the lending as banks are not able to sustain continued losses. The bank recapitalisation package, introduced by the government in late 2017, was a measure designed to ensure that India’s public sector banks have enough capital to survive the situation with mass defaults from non-performing assets.

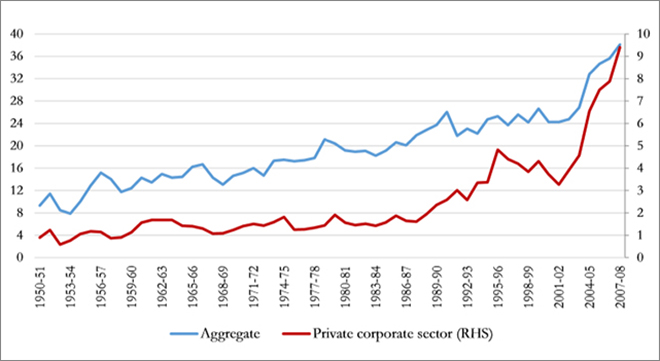

Figure 1: Gross Capital Formation (% of GDP)

Figure 1: Gross Capital Formation (% of GDP)

Source: RBI

Indian banks have been dealing with the NPA issue for some time, but it was during the start of 2016 that the dirty laundry of the public sector banks was made apparent through the RBI’s Asset Quality Review. The problem of stressed assets are normal for any soaring economy. As a country starts growing at high rates, there is burgeoning demand, due to a rise in income. The high growth rate during the first decade of the millennium increased the size of the middle class in India. The private sector saw this as an opportunity to increase their capacity, leading to over-leveraged balance sheets. New projects were launched, and crores were invested in sectors like power, steel, and telecom leading to the accumulation of capital which can be seen in the graph above (Figure 1). These new projects were also accompanied by more competition, increasing wages, and higher interest payments, however, making it difficult for these projects to sustain their profitability.

By 2013, nearly one third of all corporate debt was owned by firms who were having difficulties servicing their interest. The lack of a major crisis, such as the East Asian crisis of 1997-1998 or the credit crisis of 2008, fooled policy makers into believing that the NPA issue could be solved through restructuring and refinancing. This lack of foresight affected both banks and corporations collectively, infecting the economy for almost a decade, in what has been came to be known as India’s Twin Balance Sheet Syndrome.

While recapitalisation seems like a viable solution, it doesn’t solve the principal-agent problem that has led to the mishandling of these loans. The lack of transparency and accountability has led to the accumulation of an intractable amount of NPA’s on the balance sheets of Indian PSBs. Specifically, the lack of post disbursement supervision done by the public banks is the issue at hand. The lack of scrutiny, coupled with the bailout of these banks reinforces this irresponsible behaviour. Despite the move to refuel the banks, the fault lines have not been repaired which can easily lead to the resurfacing of the same problems that caused the situation. It is important, then, to look deeper into the crevices to cure the problem instead of simply treating the symptoms.

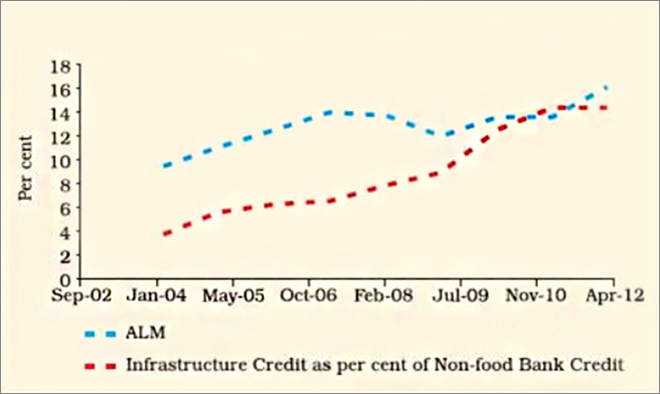

Figure 2: Trend in Asset-Liability Mismatch & Infrastructure Lending

Figure 2: Trend in Asset-Liability Mismatch & Infrastructure Lending

Source: RBI

It is clear that the first solution to the problem is efficient management of the balance sheet of the public sector banks. Long before the matter of NPAs came into the mainstream, there were issues regarding asset-liability mismatch (ASL).

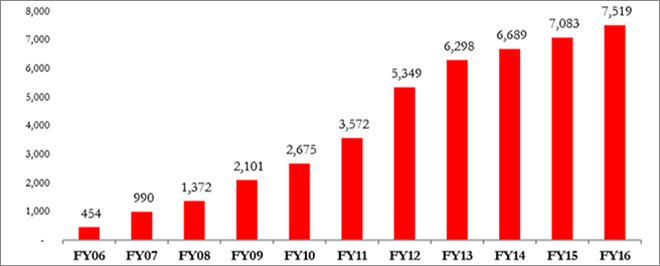

Figure 3: Debt of Top 10 Stressed Corporate Groups (Rs. Billions)

Figure 3: Debt of Top 10 Stressed Corporate Groups (Rs. Billions)

Source: RBI

A robust and liquid bond market will help in formulating an auxiliary market for financing. The current state of the market is nascent, where most of the bonds are held to maturity by a narrow set of investors. Active trading of these bonds aid in price discovery, matching the risk of non-payment with a comparable reward. Alan Green, former American Federal Reserve chairman called the bond market a spare tyre which can make emerging economies less vulnerable to the crisis by creating an alternate market for finance. Additionally, it solves the issue of the mismatch in the tenure of the assets and liabilities as the firms would issue debt securities which are tailor-made to the needs of a firm.

Effectiveness of monetary policy has been another long-standing issue for the RBI. The lack of returns has forced the Indian banks to widen their lending margins, which essentially means lower deposit rates and higher lending rates than what RBI has prescribed for. As a result, interest rate changes by the RBI do not reach the people. While banks are free to control their profitability, this nullifies the stimulus effect that the RBI uses to influence the monetary environment of the economy.

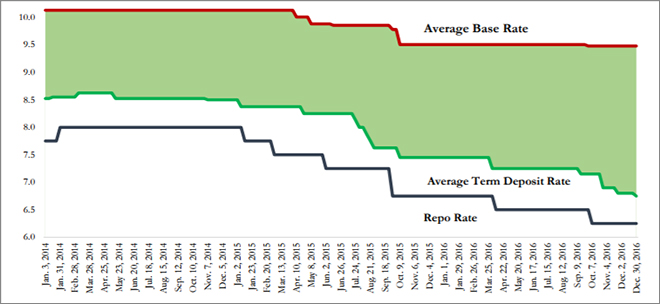

Figure 4: Average Base, Term Deposit Rate & Repo Rate over the Years

Figure 4: Average Base, Term Deposit Rate & Repo Rate over the Years

Source: RBI

There is clearly a need to increase the effectiveness of RBI’s monetary policy. The current MCLR (Marginal Cost of Fund-based Lending Rate), introduced in April 2016 is the 4th such benchmark since the deregulation of interest rates, and is already due for an update due to its unsatisfactory results which can be seen in the chart above (Figure 4). With interest rates rising among the developed economies, India is in dire need of better lending rate mechanism to shield itself from the repercussions of an external shock.

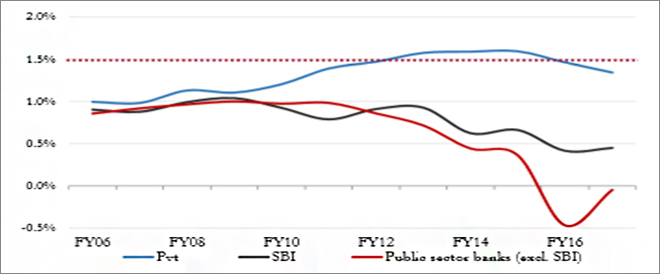

Figure 5: PSBs Return on Assets Ratio (%)

Figure 5: PSBs Return on Assets Ratio (%)

Source: RBI

Banking is the only prominent sector within the Indian economy where private corporations are dwarfed by public entities. This situation needs to be rectified for the continued health of the Indian economy as evidenced by the vast divergence between the Return on Assets of public sector banks when compared to their private counterparts (Figure 5). Arvind Subramaniam, Chief Economic Advisor to the Ministry of Finance, has backed privatisation as a key measure to make the recapitalisation package more effective, citing moral hazard and poor governance as issues that could continue to plague public sector banks

In the 1990s, China also faced similar issues due to the East Asian crisis. Its banking sector was also marred with low profitability and political influence, along with NPAs. As a response, the Chinese government identified the major elements of reforms, such as strengthening the independence of the central bank, converting state-owned banks into genuinely commercial entities, and the development of a disciplined capital market.

Now, it is time for India to venture on a similar path of reforms. The recapitalisation package is a step in the right direction, setting up the foundation for reforms. A swift follow-up is needed, however, so that the progress is not stalled.

http://indiabudget.nic.in/es2016-17/echap04.pdf

The author is a Research Intern at Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Sodaksh Khullar is a former research intern at ORF's Economy and Growth programme. He is a graduate of the Kelley School of Business, Indiana University, ...

Read More +