A study authored by economists Muralidharan, Niehaus (UC San Diego) and Sukhtankar (Dartmouth College)

published in the October 2016 issue of

American Economic Review evaluated the impact of biometrically authenticated payments infrastructure in the form of smart cards on beneficiaries of NREGS (National Rural Employment Guarantee Scheme) and SSP (Social Security Pensions) in sub-districts of Andhra Pradesh (AP). While the study points out that there is limited evidence to support either the enthusiasts or the skeptics of the biometric payment systems; the randomised, controlled trial did find that they reduced leakages. These results can be instructive in the ongoing debate around the requirement of Aadhaar’s biometric-linked unique IDs to deliver social welfare schemes.

The smart cards issued by the AP government back in 2010 has a similar purpose as the Aadhaar number; however smart cards were not to act like a centralised, integrated, single proof of identity. Similar to a credit card, these smart cards consisted of an electronic chip that stored biographic and bank account details, and additionally recorded biometric information. Smart cards, unlike Aadhaar IDs did not require connectivity to a central server for authentication since they were authenticated offline. Also, while Aadhaar can be used on various platforms across states, smart cards under the AP project were restricted to NREGS and SSP beneficiaries within the state. It is worthwhile to consider if the results from this study can make the case for using smart cards or even biometric-based smart cards system (a precursor to Aadhaar, according to the study) as a substitute for Aadhaar.

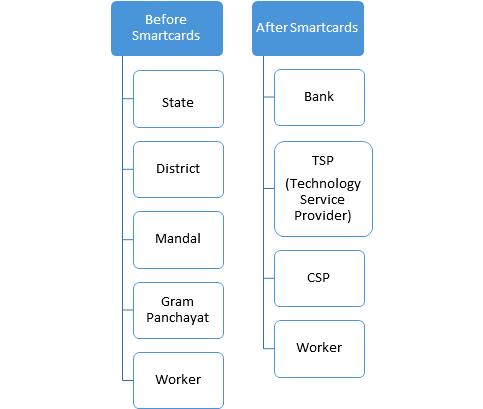

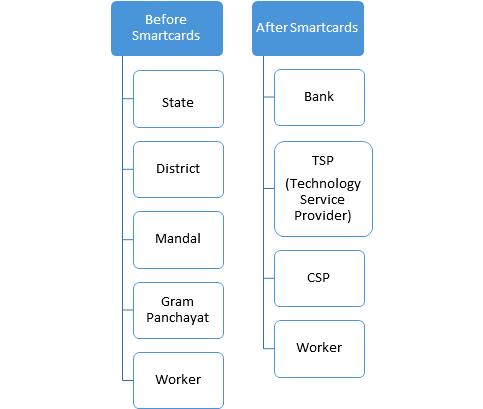

Flow of funds before and after the AP Smart Card Project

Flow of funds before and after the AP Smart Card Project

The AP Smart Card Project was India’s first large scale attempt to implement a biometric payment system and made two important interventions — organisational and technological. Organisationally, the Smart Card Project changed the parties responsible for the funds from the earlier system of district offices transferring money to post-office officials or village development officers (both government employees) located in select places, to banks transferring funds to CSPs (Customer Service Providers) who were regular people stationed in the same villages as the beneficiaries. Technologically, the project introduced smart cards with biometric details that was authenticated using a point-of- service device by the CSP. According to the study, these interventions combined led to: improved beneficiary experiences in collecting payments, increased payments received, reduced corruption and broadened access to programme benefits. All of these were achieved without any impact on fiscal outlays for the government with a majority of beneficiaries reporting that they prefer the new smart card-based system to the old.

The study makes the general case for making "technology-enabled top-down improvements" in governance, but also notes that using biometrics had a role to play in reducing corruption. One such leakage is through the creation of "quasi-ghost" workers who do exist, but who have received no work or payments, even though work is reported against their names and payments are made. The results of the study show a significant reduction in the incidence of quasi-ghost workers among smart card holders as the biometric authentication required for collecting payments made it harder for officials to siphon away money. This reduced ability of officials to report work without providing any work or payments to the worker led to them, providing more actual work and payments to workers.

Interestingly, the AP government used the smart card payment infrastructure to also serve beneficiaries without smart cards through manual payments by CSPs. However, the study found reduction in leakages for beneficiaries (both NREGS and SSP) only among households with smart cards suggesting that biometric authentication was crucial in leakage reduction.

The study concludes with the takeaway that in cases where the implementation of government programmes and policies are poor, there is potential for large returns in a relatively short period of time should governments choose to implement similar biometric payment systems for improving the delivery of social programmes.

Since the AP smart card intervention included both organisational and technological changes, some of the positive outcomes like improved payment experiences and increased access would have to be attributed to organisational changes. Therefore, not all outcomes were an effect of the change to the biometric payment system. Further, the study does not find any significant reduction in the incidence of "ghost" workers, who are workers who do not exist, but against whose names work is reported and payments are made. This suggests that using biometric authentication may not have been effective in curbing fake identities.

Overall, the results of this study can be used to support a policy of instituting a biometrically authenticated payment infrastructure for beneficiaries of welfare schemes. More importantly, the results can be used to make the case for opting for biometric smart cards like the AP government did instead of a biometric-based, national identity number as conceived under Aadhaar.

Endnotes

i. Quoted almost verbatim from p. 27 of the paper

Building State Capacity: Evidence from Biometrics Smartcards in India.

ii. The Prime Minister's Office earlier this year issued a directive to the IT Ministry to ensure that States and the Central Government stop issuing smart cards for new programmes for beneficiaries, so as to encourage usage of Aadhaar-based Direct Benefit Transfer platform instead.

PMO’s no to smart cards, insists on Aadhaar

The author is Junior Fellow at Observer Research Foundation, New Delhi.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

A study authored by economists Muralidharan, Niehaus (UC San Diego) and Sukhtankar (Dartmouth College) published in the October 2016 issue of American Economic Review evaluated the impact of biometrically authenticated payments infrastructure in the form of smart cards on beneficiaries of NREGS (National Rural Employment Guarantee Scheme) and SSP (Social Security Pensions) in sub-districts of Andhra Pradesh (AP). While the study points out that there is limited evidence to support either the enthusiasts or the skeptics of the biometric payment systems; the randomised, controlled trial did find that they reduced leakages. These results can be instructive in the ongoing debate around the requirement of Aadhaar’s biometric-linked unique IDs to deliver social welfare schemes.

The smart cards issued by the AP government back in 2010 has a similar purpose as the Aadhaar number; however smart cards were not to act like a centralised, integrated, single proof of identity. Similar to a credit card, these smart cards consisted of an electronic chip that stored biographic and bank account details, and additionally recorded biometric information. Smart cards, unlike Aadhaar IDs did not require connectivity to a central server for authentication since they were authenticated offline. Also, while Aadhaar can be used on various platforms across states, smart cards under the AP project were restricted to NREGS and SSP beneficiaries within the state. It is worthwhile to consider if the results from this study can make the case for using smart cards or even biometric-based smart cards system (a precursor to Aadhaar, according to the study) as a substitute for Aadhaar.

A study authored by economists Muralidharan, Niehaus (UC San Diego) and Sukhtankar (Dartmouth College) published in the October 2016 issue of American Economic Review evaluated the impact of biometrically authenticated payments infrastructure in the form of smart cards on beneficiaries of NREGS (National Rural Employment Guarantee Scheme) and SSP (Social Security Pensions) in sub-districts of Andhra Pradesh (AP). While the study points out that there is limited evidence to support either the enthusiasts or the skeptics of the biometric payment systems; the randomised, controlled trial did find that they reduced leakages. These results can be instructive in the ongoing debate around the requirement of Aadhaar’s biometric-linked unique IDs to deliver social welfare schemes.

The smart cards issued by the AP government back in 2010 has a similar purpose as the Aadhaar number; however smart cards were not to act like a centralised, integrated, single proof of identity. Similar to a credit card, these smart cards consisted of an electronic chip that stored biographic and bank account details, and additionally recorded biometric information. Smart cards, unlike Aadhaar IDs did not require connectivity to a central server for authentication since they were authenticated offline. Also, while Aadhaar can be used on various platforms across states, smart cards under the AP project were restricted to NREGS and SSP beneficiaries within the state. It is worthwhile to consider if the results from this study can make the case for using smart cards or even biometric-based smart cards system (a precursor to Aadhaar, according to the study) as a substitute for Aadhaar.

Flow of funds before and after the AP Smart Card Project

Flow of funds before and after the AP Smart Card Project