-

CENTRES

Progammes & Centres

Location

A new specter is haunting the world – the specter of unemployment.

When the global epidemic of SARS continued to spread, people hoped things wouldn’t go back to normal – they wanted a new normal. They wanted their government to be better prepared for another impending outbreak, which called for changes in the frail health care system and the delicate labor market.

China’s failure to admit the true extent of the damage caused, both then (SARS) and now (COVID-19), garnered stark criticism. China sacked the mayor of Beijing, the SARS epicenter, in 2003 and the mayor of Wuhan, the COVID-19 epicenter, in 2020 against reports of underreporting the damage caused.

Even though much hasn’t changed, a lot has. Since 2003, China has become the 2nd largest economy in the world. Apart from accounting for about 16.3% of the world GDP now (as compared to 4.2% at the time of SARS), Chinese labor corresponded to about 24% of the global labor force in 2017. In 2002, China contributed 23 per cent of world GDP growth, in 2019 China contributed an estimated 38 per cent of world growth.

The lockdown and social distancing have brought the world to an unprecedented halt. Many companies have adopted work from home policy, but the adoption can’t be universal. There is huge heterogeneity across sectors which makes it difficult to prevent suspension of many supply chains. While education, information, business services related sectors have moved swiftly to remote working, such a change is hardly possible for manufacturing, construction, and agriculture.

The effect of virus outbreaks on the labor force has always been adverse. In an effort to break the chain of coronavirus, social distancing has presented itself as a shock to the labor supply, thereby disrupting global supply chains.

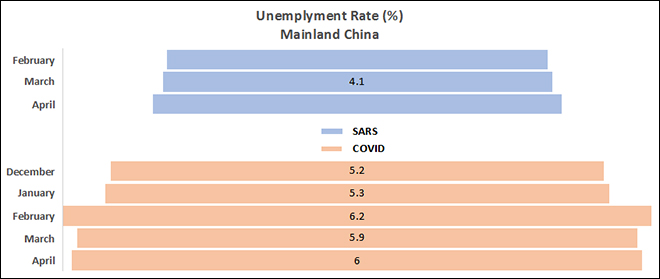

We see the difference in the outcome due to quarantine efforts in different temporal spaces, namely mainland China and Hong Kong in 2003 and 2020.

In 2003, the city of Beijing was gripped by panic and fear as the communist party called for a citywide quarantine and the labor market slacked visibly in mainland China and neighboring cities like Hong Kong.

In China, 7.75 million registered workers were unemployed by the end of March, the fourth month of the pandemic, and the unemployment rate stood at 4.1%, which had risen from 4% the previous year.

Chinese unemployment rate only takes into account the urban workers who are registered with the state, vastly underestimating the total unemployment rate. Many analysts believe that the unemployment rate in China is almost double the official published rate at many times periods in the past two decades. The actual unemployment rate was considered to be around 10%.

Source: National Bureau of Statistics

Source: National Bureau of Statistics

By the end of the February, roughly 5 million workers were laid off work and the surveyed urban unemployment rate in mainland China rose from an average of 5.2% in 2019 to 6.2% in February, but March saw a slight dip. China has enjoyed an unemployment rate between 4-5% since the past two decades and even though the figures for May aren’t available yet, there is expected to be an increase in the unemployment rate as the job market will expand, with a whopping 8.74 million fresh graduates pilling on this year. It is safe to say that there will be trouble in China if the rate of job creation isn’t amped in the coming months. The work intensity has also decreased by 6.5 hours (13%), leading to an average of 40.2 hours per week.

China survived the trade war with USA last year only to be knocked off its feet again. As grim as the current scenario looks, many analysts believe that the unemployment rate will be back on track in china by the end of the year.

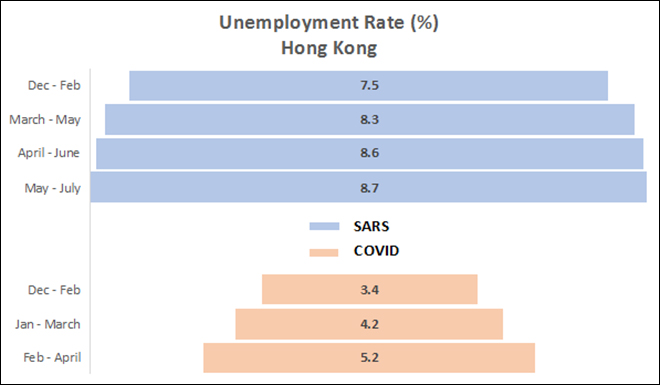

In Hong Kong, the unemployment rate increased by 1.5 percentage points from the pre to post-SARS economy. The unemployment rate went from 7.2% in the fourth quarter of 2002 to 8.7% in May-June 2003, as new graduates flooded the labor market. Very synonymous to today, the major employment shock happened to the employment of manual laborers, which fell by 8.6% in September 2003. The decrease in employment also came with a decrease in work intensity as the median working hours per week decreased by 6.25% to 45 hours per week. The labor force expansion went down 78%, from 1.8% in 2002 to 0.4% in 2003.

Data Source: Hong Kong Yearbook, Government of Hong Kong

Data Source: Hong Kong Yearbook, Government of Hong Kong

The shocks to labor force recovered by the fourth quarter of 2003 when the unemployment rate decreased to 7.3% and the work intensity increased to pre-SARS levels of 48 hours per week.

The total unemployment rate in Hong Kong has been rising for the past five months from pre-COVID rate of 3.4% to 5.2% towards the end of April. Tourism and consumption sectors were amongst the worst hit in Hong Kong. According to the Census and Statistics Department, the unemployment rate in the food and beverage sector rose to 7.5% and 6.8% for construction in March. The overall unemployment rate is much lower than 2003 levels, but it is likely to continue rising as the city grapples to hold its own during the crisis. Paul Chan Mo-po, the financial secretary of Hong Kong, doesn’t hope for a V shaped recovery as the administration revised its forecast from 0-1% due to the long raging Hong Kong protests to a dismal growth of negative 1.5-0.5% for 2020.

The overall effect of the virus seems to be less adverse than the SARS virus as the degree of damage is less this time, Hong Kong seems to have learnt a lesson in prevention.

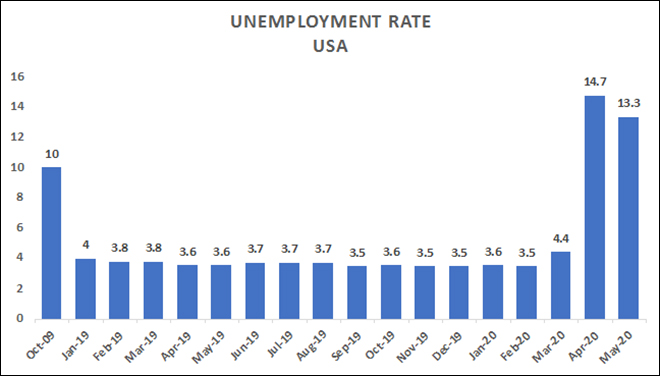

USA has been hit hard by covid-19 with the hospitality, leisure, and the travel sectors hit the hardest. The country had enjoyed an unemployment rate of 4% or below since the past few years but the jolt to the labor force increased the unemployment dramatically to 14.7% in April, higher than the levels seen in the aftermath of the 2008 financial crisis. As businesses continued to lay off workers, the 10.3 percentage point monthly increase in the unemployment rate was unprecedented.

By mid-April, almost 20 million people in the labor force had registered for jobless claims and the labor force participation rate reached its lowest since 1973 at 60.2%.

Goldman Sachs projected the unemployment rate to spike to 25%, revising their previous prediction of 15%. The new figure is comparable to the unemployment rate during the Great Depression, which peaked at 24.9%. The month of May brought in some respite to the trend as unemployement rate reduced by 1.4 percentage points.

Source: US Bureau of Labor Statistics

Source: US Bureau of Labor Statistics

Trump had promised $350 million dollars to small businesses to stay afloat and eliminate the need of layoffs, but the first-come-first-serve basis loan program turned out to be a big flop as big companies like Potbelly and Shakeshack received a payout of $10 million dollars. Banks were been accussed of profit mongering by prioritisng bigger loans by larger clients while most small businesses didn’t even make to the front of the line. According to an estimate, more than $1.8 million dollars may be required to keep small businesses afloat.

Businesses will be vary of expanding capacity in the uncertainty of the virus. The government needs to lay out policies which encourage businesses to expand to pre-crisis levels. With the crippling Airline and hospitality sectors, the government has an interesting dilemma coming its way – which businesses to bail out?

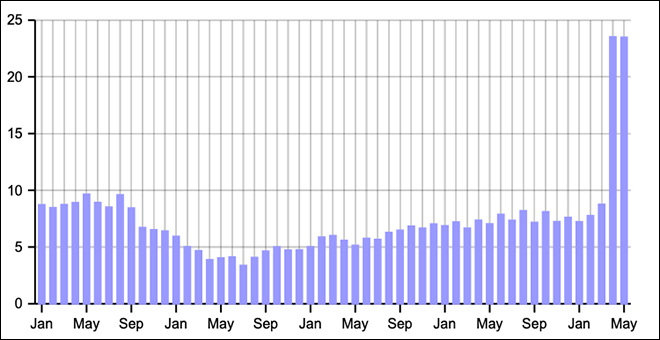

India wasn’t faring well either, with the unemployment levels at an all-time high. The unemployment rate spiked from 7.2% in January to 23.52% in April and stayed at 23.48% in May. But come June, the unemployment rate seems to have fallen back to pre-COVID levels, at 8.5% in the week ending June 21. According to the Centre for Monitoring Indian Economy (CMIE), job generation under MNREGA seems to have played a big role in reducing the rural unemployment rate.

Source: Centre for Monitoring Indian Economy (CMIE)

Source: Centre for Monitoring Indian Economy (CMIE)

Even though the official monthly unemployment rate for June isn’t available yet, the future seems to be less dismal with the sharp recovery in the moving average. Millions won’t be left behind as workers start flooding the workspaces again.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.