-

CENTRES

Progammes & Centres

Location

MUDRA scheme was launched in 2015 with the objective of providing small businesses with loans of up to Rs10 lakh. This was in order to improve credit access to nearly 51 million MSME units that exist in the country, of which only 5 million, or less than ten percent, have access to formal sources of finances. The MSME sector contributes 43% to exports and employs 40% of the workforce. Up until 2018, Rs 5.71 lakh crore of loans have been sanctioned under this programme on a total of Rs 12.27 lakh crore loans given out, as per the annual report of MUDRA 2017-18. However, recently the Reserve Bank of India has raised concerns about the levels of non-performing assets (NPAs) under the Pradhan Mantri Mudra Yojana.

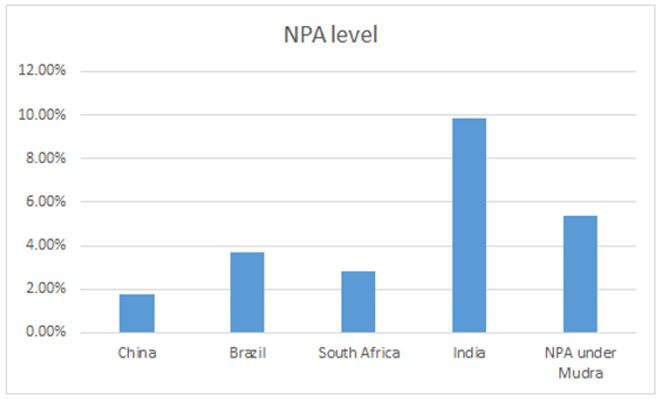

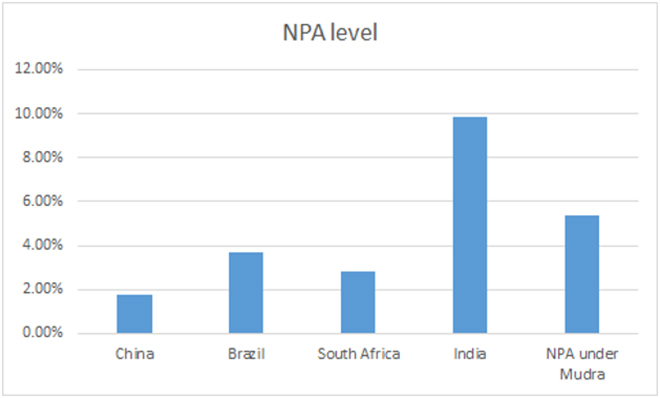

As per the annual report of Mudra, the level of NPA under the MUDRA scheme since its inception up until March 2018 stands at 5.38%. Compared to the overall banking NPA level of more than 9%, this level is lower. But, rising to the level of 5.38 % in just three years of its inception is a cause of concern. Further, it is still higher as compared to the levels that exist in other nations. For example, amongst BRICS countries, China’s NPA stands at 1.75%, Brazil’s at 3.69% and South Africa at 2.83%, while India’s NPA is a steep 9.85% as per a report by CARE ratings.

Data from report by CARE ratings

Data from report by CARE ratings

According to an RTI filed by the wire, the NPA under the Mudra scheme jumped from Rs 7,277 crore in March 2018 to Rs 16,481 crore in March 2019. The graph below shows a comparison of the level of NPA under Mudra with the individual NPA levels of 5 of the national banks with the highest overall NPA levels. This is done to put the relative size of Mudra loans in perspective. The size of NPA under Mudra is the sixth largest.

Data from RBI website

Data from RBI website

The increase in NPA under the Mudra scheme from Rs 7,277 crore in March 2018 to Rs 16,481 crore in March 2019 shows an annual growth rate of 126%. Table 2 shows how this rate compares with the annual growth rate of NPAs of the 5 national banks.

| Table 2: Annual growth rate of NPAs of top 5 National Banks | ||||

| S.No | Bank | 2017 | 2018 | 2019 |

| 1 | State Bank of India | -41% | 90% | -40% |

| 2 | Punjab National Bank | -8% | 49% | -38% |

| 3 | Canara Bank | 4% | 32% | -20% |

| 4 | Union Bank of India | 34% | 29% | -16% |

| 5 | Bank of India | -10% | 11% | -32% |

Firstly, in 2019, as per the government data, NPA has declined across the banking sector, this is also reflected in the negative annual change in NPA levels for 2019. Thus, the increase of 126% of NPA levels under Mudra does not seem to go with the overall banking trend of reducing NPA levels. Further, even if we compare with the previous years of 2018 and 2017, the level of 126% is much higher than any of the rates for all of the banks. Thus, this is a worrying sign where not only are the levels of NPA under Mudra high but the growth rate is on the higher side on a comparative basis.

The banking system is already under stress over the higher levels of NPA and Mudra loans could add and further aggravate the issue as the data above shows. The levels to which individual banks would be affected would depend on the individual exposure that they have to Mudra loans. This is especially a matter of concern given the fact that MUDRA loans are sanctioned even without a collateral attached to them. This implies that banks would have no recourse to recover loans that have defaulted. The table below gives the total amount disbursed under the Mudra scheme for the various banks in the year 2018.

| S.No. | Bank Name | Total sanctions under MUDRA IN 2018 | Total amount disbursed since inception of scheme |

| 1 | State Bank of India | 33,613 | 1,01,560 |

| 2 | Punjab National Bank | 4,964 | 19,786 |

| 3 | Canara Bank | 9,769 | 29,893 |

| 4 | Union Bank of India | 3,879 | 11,881 |

| 5 | Bank of India | 5,892 | 18,923 |

Data from Mudra website. All figures in crores.

The data for the NPA under the Mudra scheme for individual bank was not available. Reports have suggested that banks such as PNB have very high level of NPA under this category. The situation could be similar in other banks. This means that the impact of high level of NPA under Mudra will affect individual NPAs in different banks. Officials are required to conduct a pre-loan inspection and physical verification of business once the loan is sanctioned. But cases have surfaced where procedure is not followed and even fraudulent loans have been given out under the scheme. Monitoring and early warning systems in banks, especially PSBs, is essential to identify such loans which are on the verge of becoming NPAs, but it is often not present or not implemented efficiently. There is also low expertise and lack of training amongst bank officials on lending principles that would equip them while making decisions about loan disbursements.

The MSME sector will play an important role in the revival of the economy. Its share in manufacturing output, export share and employment shares are testament to this fact. It is important for the government and the banking system to ensure that NPAs do not weigh down this well intentioned scheme. If not addressed in time, the MUDRA scheme could become the next big source of NPA.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Nandini Sarma was a Junior Fellow with the Green Transitions Initiative at ORF. Her research focuses on growth trade and climate.

Read More +