Amidst varying accounts on the fate of India-Russia efforts to settle bilateral payments using local currency, what has unambiguously emerged is Moscow’s disinterest in using the INR as a medium of exchange. While New Delhi seems to be putting on a brave front—faced with hurdles to its attempts to internationalise the INR—it must accept the prevailing circumstances and progress carefully.

Price stability and bilateral trade using INR

Stable prices constitute the most critical precondition for internationalising a currency. This increases the trust of foreign investors in that currency. In respect of the INR, there are major doubts given India’s chequered record with inflation (see Figure 1), notwithstanding the recent easing of retail inflation from 4.48 percent in October 2021 to an

18-month low of 4.7 percent in April 2023.

Figure 1:

Time series of India’s retail inflation rate, based on the consumer price index, over the past decade

A further worry is that internationalising the INR could curb the Reserve Bank of India’s (RBI’s) ability to manage domestic money supply and affect interest rates according to prevailing macroeconomic circumstances. Indeed, the RBI has implemented a procedure for settling only bilateral trade in INR

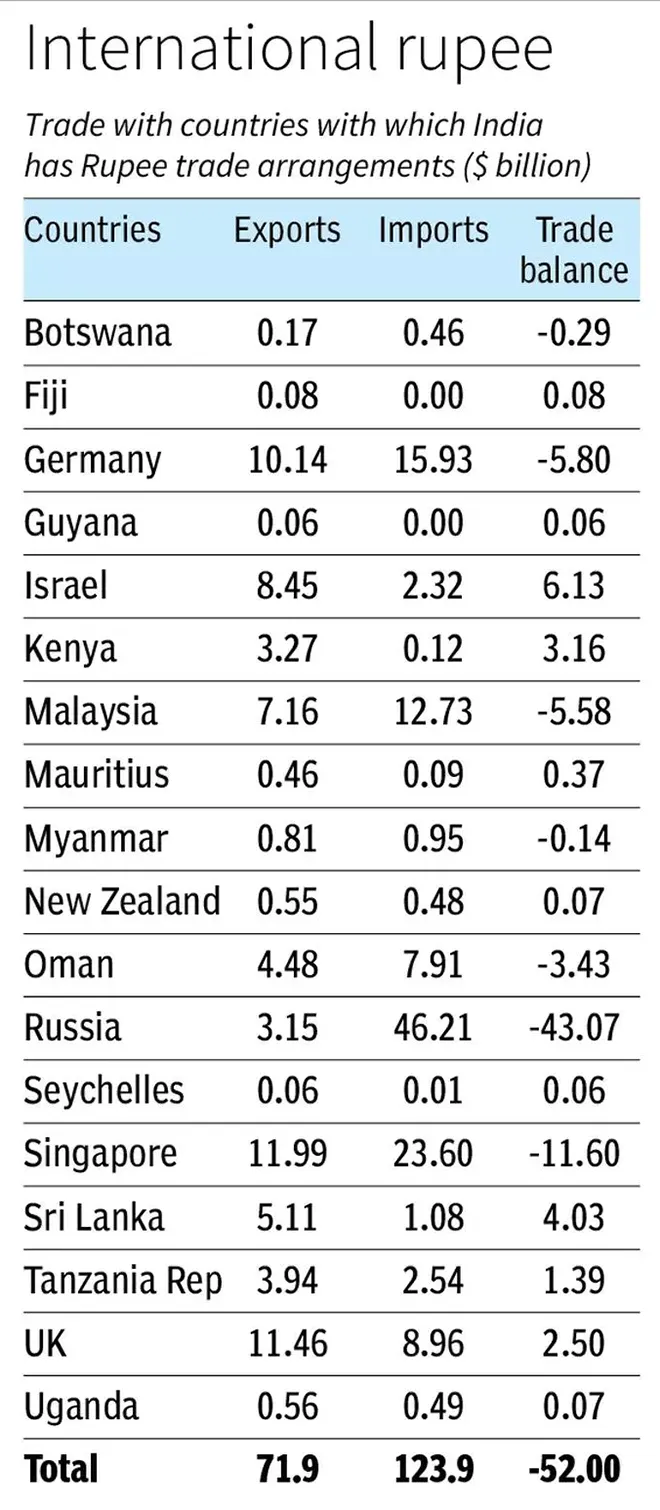

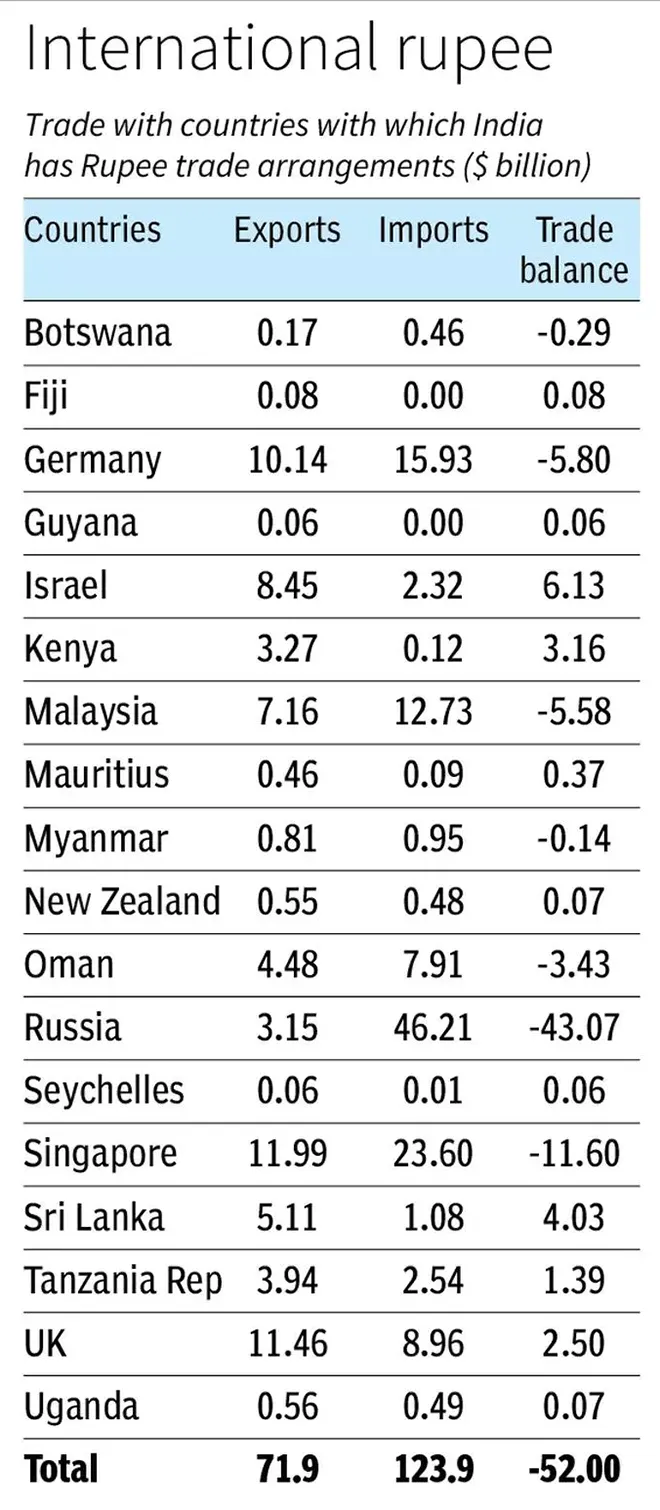

with as many as 18 countries because it appreciates that an internationalised INR would hinder the concurrent pursuit of stability in exchange rates and inflation. This is the case especially in the absence of sufficient scale and depth in domestic financial (particularly bond) markets to effectually absorb extraneous disturbances (see Table 1).

Table 1:

India’s trade balance with countries with which India has INR trade setups

Partial versus full convertibility

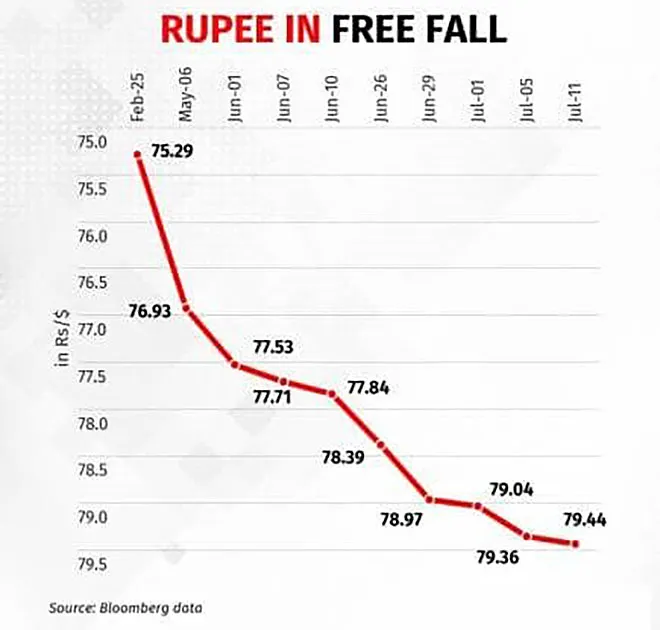

The debate surrounding India progressing to a completely convertible capital account is not new. It is the INR’s depreciation since the beginning of the Ukraine conflict, supported by India’s burgeoning import bill, that compelled New Delhi to seek alternative settlement procedures and thereby brought the issue into focus once again (see Figure 2). As far as substituting dollar-based payments is concerned, it is worth noting that a clear-cut INR-Ruble settlement mechanism is still not in place.

Figure 2:

India’s imports in billion USD

As things stand, India operates a partially convertible capital account, which entails that the INR can be swapped for foreign currencies and vice-versa for limited reasons. Measures have been implemented over time to enhance convertibility like the initiation of the Fully Accessible Route for Foreign Portfolio Investors (FPI) in public debt instruments and permitting banks to transact in non-deliverable forwards. The ceiling on the amount Indians can annually invest overseas has also been increased incrementally and presently equals US$250,000 per individual.

With full capital account convertibility, though, the INR’s exchange rate vis-à-vis other currencies would ideally be discovered only through the market mechanism, i.e., the INR would be left in a free float by the RBI. As of now, the central bank participates in the foreign exchange (forex) market to curtail wide fluctuations in the INR-US dollar exchange rate. So, a more internationalised rupee would render international trade and investment flows cheaper by reducing exchange rate risk, but would simultaneously convolute the pursuit of exchange rate predictability and domestic liquidity management through monetary policy.

China’s experience and virtuous incrementalism

Despite trying to dethrone the US dollar since 2010, Beijing has been unable to establish the RMB as a viable substitute. This is in part because success in internationalising the RMB is contingent on Beijing’s cost-benefit analysis, and the requirement for its economy’s

share in global output and trade to be sufficiently high. Moreover, the RMB’s value must command enough trust globally.

The fact that China strictly regulates capital transactions as well as domestic financial markets also hurts the RMB’s cause. This is because a smoothly operating financial market with free and transparent accommodation of forex and capital transactions and equal accessibility to domiciles and non-residents is a prerequisite for establishing a currency’s global acceptability.

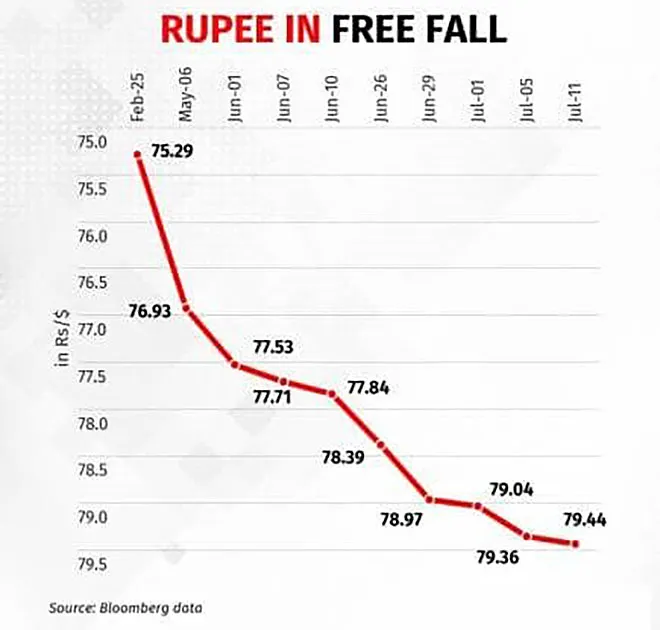

Within the prevailing global uncertainties, it is probably sensible to continue to gradually ease constraints and concurrently deepen domestic financial markets, instead of jumping headlong into complete convertibility. After all, complete convertibility would expose the Indian economy materially more to international shocks to the flow of capital. If there is a substantial surge in demand for the US dollar—as had occurred due to the onset of the Ukraine conflict—it could trigger significant depreciation of the INR and thereby cause inflation given the RBI’s limited ability to intervene effectively (see Figure 3). It must be emphasised that the sharp fall in the INR’s value last year occurred despite only partial capital account convertibility in force at present.

Figure 3:

Rupee depreciation during the early months of the Ukraine conflict

Fiscal consideration

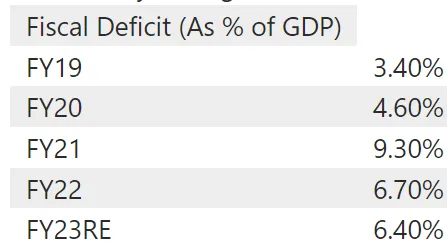

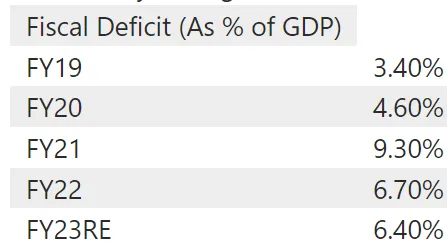

Staying the course on fiscal consolidation, the Indian government intends to curtail fiscal deficit within 4.5 percent of Gross Domestic Product (GDP) by FY2025-26, as articulated by Finance Minister Nirmala Sitharaman during her budget speech in February. Further, the

fiscal deficit is estimated to be 5.9 percent of GDP as per the budget estimate for FY2023-24. In general, though, fiscal discipline has proved a challenge, even if one takes only a cursory glance at the data from recent years (see Table 2).

Table 2:

India’s fiscal deficit as a percentage of GDP in recent years

It needs to be appreciated that India’s fiscal situation and financial architecture need to be improved significantly before migrating towards complete capital account convertibility. But from a political economy standpoint, with India heading into general elections next year, it would be overly optimistic to expect fiscal consolidation to triumph over growth considerations over the foreseeable future.

Conclusion

Internationalising the INR as well as increasing capital account convertibility should only be implemented incrementally, especially since interest rates are expected to rise more quickly in the United States (US) than in India over the next quarter to two. This would disincentivise more capital flowing out of India’s debt and equity markets.

A necessary condition for complete capital account convertibility is to enhance the degree of insulation of the central bank in times of capital exodus. Introduced last year by the RBI, the Standing Deposit Facility helps with this because it involves a collateral-free mechanism, which entails that the RBI does not have to give collateral to absorb liquidity. However, further deepening of Indian financial markets is crucial.

It is likely that the RBI intends to guarantee adequate forex buffers before embracing complete capital account convertibility. But these should arise because of higher net exports, rather than increased borrowing. If not, there is a possibility of higher liabilities rendering even higher forex reserves insufficient. Thus, export growth must outpace import growth to enable full capital account convertibility.

Aditya Bhan is a Fellow at the Observer Research Foundation

Views expressed are personal.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Amidst varying accounts on the fate of India-Russia efforts to settle bilateral payments using local currency, what has unambiguously emerged is Moscow’s disinterest in using the INR as a medium of exchange. While New Delhi seems to be putting on a brave front—faced with hurdles to its attempts to internationalise the INR—it must accept the prevailing circumstances and progress carefully.

Amidst varying accounts on the fate of India-Russia efforts to settle bilateral payments using local currency, what has unambiguously emerged is Moscow’s disinterest in using the INR as a medium of exchange. While New Delhi seems to be putting on a brave front—faced with hurdles to its attempts to internationalise the INR—it must accept the prevailing circumstances and progress carefully.

PREV

PREV