Realising the dream to become a US$5-trillion economy by 2025 can be a landmark achievement in India’s journey so far. However, while juggling efforts to deal with the aftermath of the COVID-19 pandemic and the global headwinds of an economic downturn, India needs to set clear priorities and chart out actionable strategies to enable its transition to a global powerhouse. At the same time, while gaining relevance in global markets, India also needs to become self-reliant—ensuring higher resilience for its people and domestic markets. Being a developing country with constrained financing, India has to identify key sectors that can most effectively advance its growth agenda over the next few years. India’s assets ning various sectors of the economy are embodied in, not only its physical capital such as its factories, plants or machinery—used to produce consumer goods and services—but also its human and social capital such as health and education as well as the vast natural capital reserves that feed into the production processes. However, the productivity of all these assets is critically dependent on the developments in India’s infrastructure sector. According primary importance to India’s infrastructure sector, the Union Budget 2022–23 presented a massive

outlay for capital expenditure on key connectivity projects that are envisaged to lead India to a sustainable and resilient future. However, to milk these opportunities efficiently, India must learn from its past to build forward better.

Being a developing country with constrained financing, India has to identify key sectors that can most effectively advance its growth agenda over the next few years.

Looking back: How has India fared so far?

As such, infrastructure development serves as the

sine qua non of economic growth. Besides its obvious impact on productivity and reduction in production costs across economic sectors, adequacy of infrastructure and its efficiency of operation, play a vital role in a country’s development course, in ways such as

production diversification, trade expansion through increased competitiveness, enabling improvements in environmental conditions and

reductions in multidimensional poverty through augmentation of non-income factors.

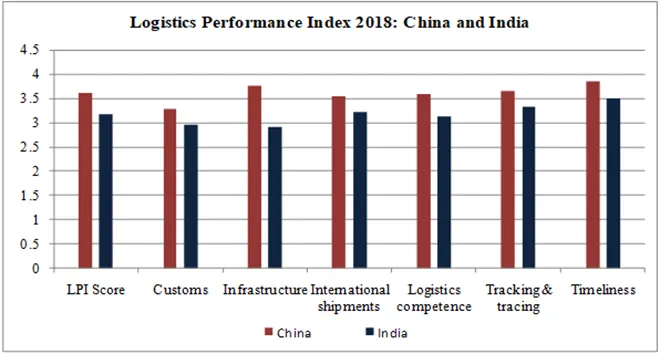

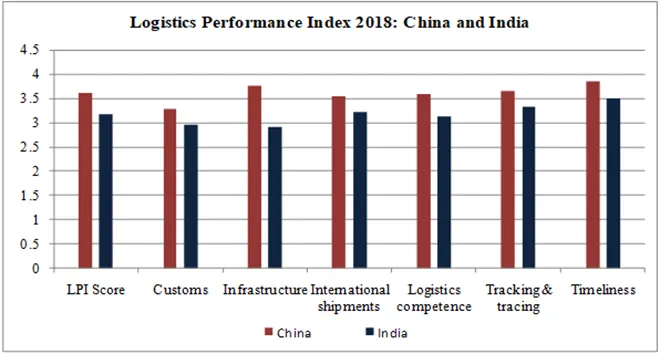

However, infrastructure development in India has historically suffered from plan implementation or operational failures as well as hefty regulatory frameworks that negatively impact the overall business environment. Especially, its logistics sector, which shall serve as the crucial link across all business sectors, has been deficient in terms of performance. The figure below presents a comparison between India and China on basis of the World Bank’s

Logistics Performance Index (LPI) 2018. Across domains such as customs, existing infrastructure (quantity), the volume of international shipments, the competence of the logistics system, tracking and tracing mechanisms, timeliness, and in terms of overall performance, China scores significantly better than India. The 2018 LPI ranks China at 26

th position with a score of 3.61, while India is placed at 44

th rank, scoring 3.18 in overall logistics performance. Among all domains, the largest divergence between India and China emerges in terms of infrastructure, which then automatically feeds into other regulatory and operational lags due to unduly high pressure on the existing capacities.

Figure 1: Logistics Performance Index Scores for China and India in 2018

Source: Author’s own, data from: World Bank

Source: Author’s own, data from: World Bank

Exploring the infrastructure-growth nexus

Investments in infrastructure development are typically undertaken by the public sector, including its operations and maintenance. These form a part of the capital expenditure from the public exchequer, contributing directly to the creation of productive assets in the economy. While government spending (both revenue and capital expenditure) generates higher levels of economic growth through demand creation, the impact in each case is strikingly different. Revenue expenditure directly leads to higher aggregate demand in the economy, feeding into subsequent rounds of market demand expansion and, in turn, higher growth, without actually altering the productive capacities of the economy. On the other hand, capital expenditure on infrastructure development, besides directly generating higher levels of aggregate demand, also leads to improvements in productivity and reductions in production costs with a commensurate increase in rates of profit and crowding-in private investments. This has been

true in the Indian context as well. INR 1 spent by the Indian government on revenue expenditure (or direct transfer payments) yields, on average, an additional INR 1 worth of income, while for capital expenditure the increase in income is about INR 2.45.

Besides, in times of economic downturns, fiscal expansion can stimulate counter-cyclical income growth. But, like for most developing countries, India’s fiscal consolidation requirements often constrain its capital expenditure—to reign in deficits which may ultimately prompt a larger impact, especially in the long run through overall output contraction. Therefore, to enable macroeconomic stabilisation through expansion of revenue expenditure,

ring-fencing of capital expenditure levels as a share of the Gross Domestic Product (GDP) becomes critical.

Revenue expenditure directly leads to higher aggregate demand in the economy, feeding into subsequent rounds of market demand expansion and, in turn, higher growth, without actually altering the productive capacities of the economy.

There is no doubt that while capital expenditure requirements for infrastructure investments are huge, with relatively longer gestation periods, their immediate and cumulative impacts are both higher. In addition to this, targeted and timely investments in infrastructure development are also extremely important. Emphasising a paradigm shift in focus on “quantity” of infrastructure to improving the “quality” of its performance, the World Bank makes three major

recommendations, including, wider applications of commercial principles such as managerial autonomy; making the sector more competitive through greater private sector engagements in the form of public-private partnerships; and, increased responsibility and accountability towards key stakeholders including end consumers. Without adequate accountability, this sector can be characterised by significant inefficiencies and capacity underutilisation.

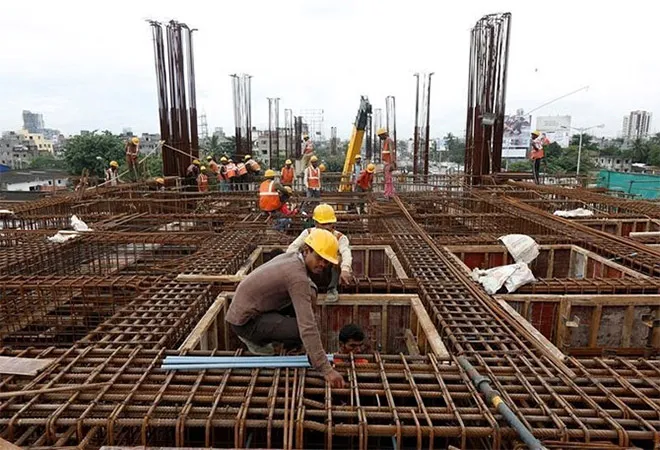

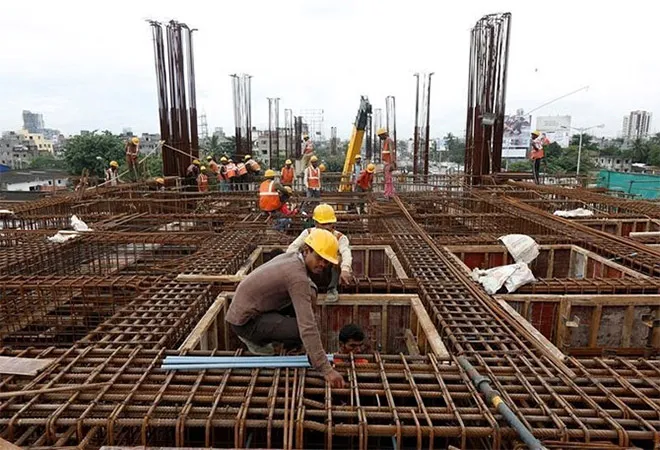

India’s priorities and actions: For advancing infrastructure development

In India, with the emergence of a large number of private players across economic sectors, quality infrastructure development to support business operations has become an area of utmost importance, demanding urgent attention from all levels of government. The infrastructure sector primarily includes physical and digital connectivity, along with power and energy. While capital expenditure in India (as a share of total expenditure) remains well below global standards, there has been a consistent

rise in investments in infrastructure projects in the last five years.

The infrastructure sector has become one of the biggest focus areas of the government, with an estimated expenditure outlay of

US$ 1.4 trillion during 2019-2023 to ensure sustainable economic growth and development in the country. Moreover, India has also joined hands with regional partners, most prominently

Japan, to advance its “Act East” agenda through a major investment push in infrastructure development. This will also likely advance its regional economic integration through functional coordination between the trading partners, reductions in transaction costs and seamless movement of goods and services within India as well as across countries.

Logistics costs in India are significantly higher compared to global standards owing to several persisting issues that need to be identified and addressed.

However, in addition to the big push for infrastructure investments in transport and digital connectivity, there is an urgent need to enable efficient coordination among different departments of the central and state governments. Logistics costs in India are significantly higher compared to global standards owing to several persisting issues that need to be identified and addressed. Only then, a

coordinated approach to infrastructure development envisioned under the ‘PM Gati Shakti National Master Plan’ initiative, can enable seamless end-to-end connectivity through multi-modal transportation networks and promote the development of industrial clusters that contribute to economic growth and development. Besides, this initiative can also create scope for aligning contending goals on industrial development and environmental concerns under the sustainable development agenda, transforming existing trade-offs into impactful synergies and enabling a green transition for India.

Moving forward, the most critical task for India will be to balance its efforts towards a big push in infrastructure investments and create an enabling environment for successful implementation and timely completion of these projects. Redemption of these complementarities in infrastructure development can be instrumental to India’s realisation of its growth potential over the decade.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Realising the dream to become a US$5-trillion economy by 2025 can be a landmark achievement in India’s journey so far. However, while juggling efforts to deal with the aftermath of the COVID-19 pandemic and the global headwinds of an economic downturn, India needs to set clear priorities and chart out actionable strategies to enable its transition to a global powerhouse. At the same time, while gaining relevance in global markets, India also needs to become self-reliant—ensuring higher resilience for its people and domestic markets. Being a developing country with constrained financing, India has to identify key sectors that can most effectively advance its growth agenda over the next few years. India’s assets ning various sectors of the economy are embodied in, not only its physical capital such as its factories, plants or machinery—used to produce consumer goods and services—but also its human and social capital such as health and education as well as the vast natural capital reserves that feed into the production processes. However, the productivity of all these assets is critically dependent on the developments in India’s infrastructure sector. According primary importance to India’s infrastructure sector, the Union Budget 2022–23 presented a massive

Realising the dream to become a US$5-trillion economy by 2025 can be a landmark achievement in India’s journey so far. However, while juggling efforts to deal with the aftermath of the COVID-19 pandemic and the global headwinds of an economic downturn, India needs to set clear priorities and chart out actionable strategies to enable its transition to a global powerhouse. At the same time, while gaining relevance in global markets, India also needs to become self-reliant—ensuring higher resilience for its people and domestic markets. Being a developing country with constrained financing, India has to identify key sectors that can most effectively advance its growth agenda over the next few years. India’s assets ning various sectors of the economy are embodied in, not only its physical capital such as its factories, plants or machinery—used to produce consumer goods and services—but also its human and social capital such as health and education as well as the vast natural capital reserves that feed into the production processes. However, the productivity of all these assets is critically dependent on the developments in India’s infrastructure sector. According primary importance to India’s infrastructure sector, the Union Budget 2022–23 presented a massive

PREV

PREV