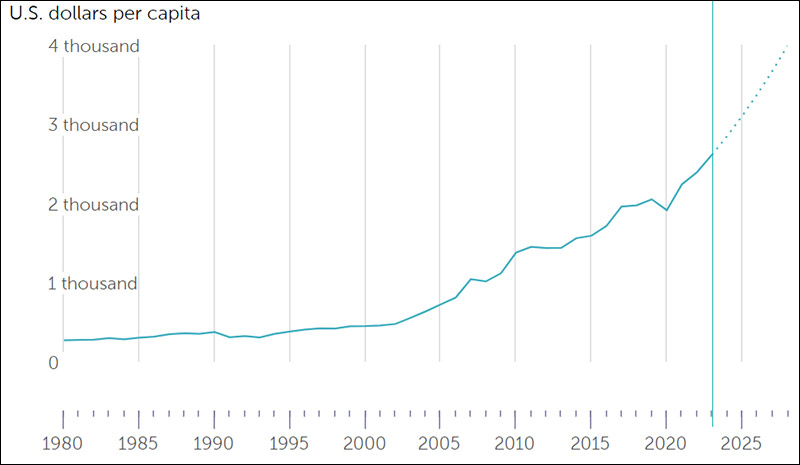

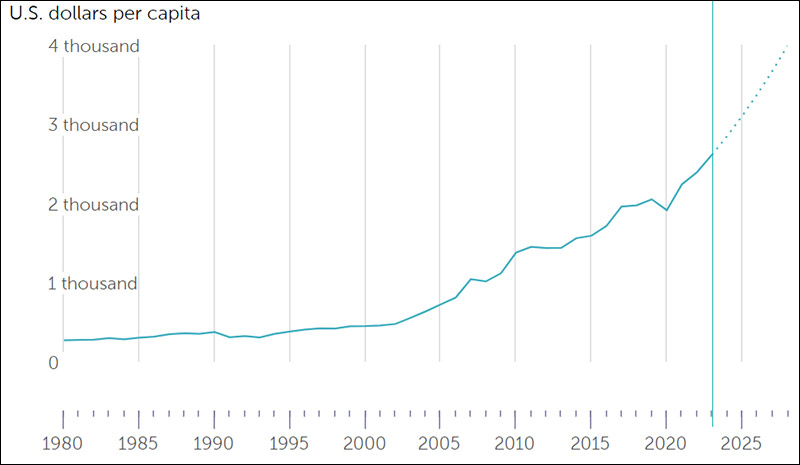

The Indian economy witnessed a great year, closing 2023 with a GDP of US$ 3.73 trillion, GDP per capita at US$ 2,610 and a projected GDP growth rate of 6.3 percent against the global average of 2.9 percent. As India is geared to become a US$ 5 trillion economy by 2027, an inquiry into the driving factors of growth along with the other vital parameters is necessary. Some of these parameters are—inflation, unemployment, investment, sectoral performance and especially, performance in terms of sustainability. A review of these indicators is undertaken to identify the strengths of the economy and highlight the endeavours that need to be emulated in 2024.

Figure 1: India's GDP per capita (in US$)

Source: International Monetary Fund

Vital parameters

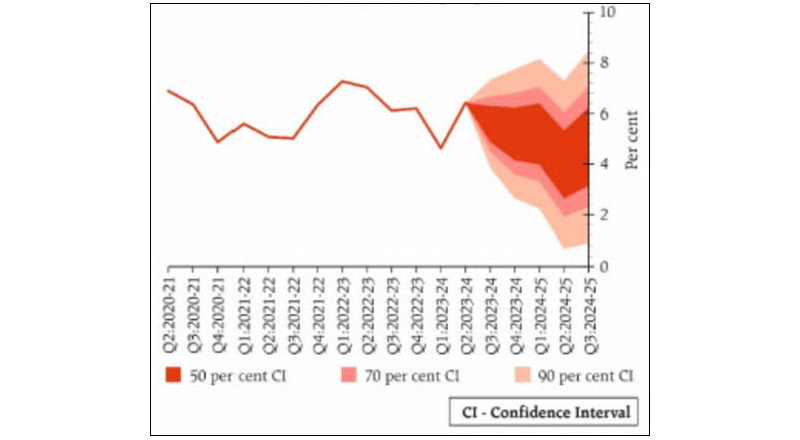

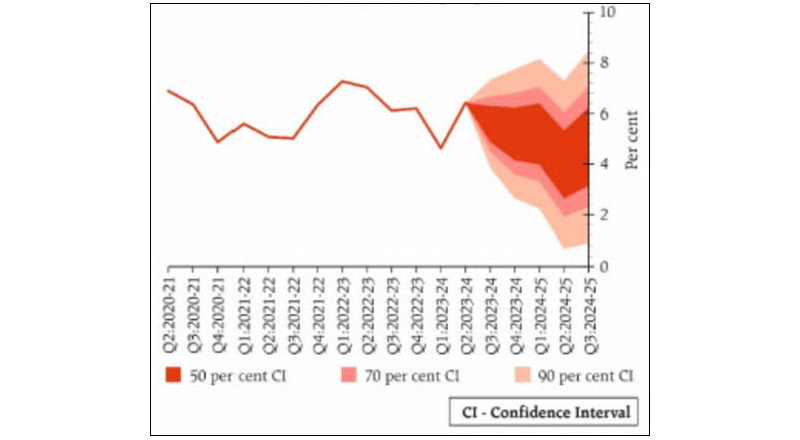

While global growth is slowing down, inflation has remained relatively stubborn. The headline Consumer Price Index (CPI) inflation fell by almost 2 percent since October 2023 as a result of cheaper fuel and a correction in commodity prices. The core inflation, which is the CPI inflation excluding food and fuel, has remained stable indicating that it is primarily food price shocks that are causing the headline inflation to deviate from the target rate of 4 percent. Double-digit inflation exhibited by cereals, pulses, and spices has kept the food inflation momentum high which is being combatted by the government through export prohibitions to stabilise domestic prices. Although global demand is stable, supply chain disruptions are expected to continue in 2024, due to geopolitical tensions, necessitating the need for regular monetary and fiscal interventions.

Figure 2: Quarterly Projection of CPI Inflation (year-on-year)

Source: Reserve Bank of India

Source: Reserve Bank of India

The Reserve Bank of India’s (RBI) neutral monetary policy stance has been praised by the International Monetary Fund (IMF), for its data-dependent approach, that can stabilise prices gradually. The INR/US$ exchange rate is expected to fluctuate in the 82-84 range, with the currency gradually settling at the lower bound. However, a marginally weaker currency should not entail much concern as this would make Indian exports more attractive. For instance, compared to November 2022, India’s trade deficit is almost half in November 2023. Although exports declined by 5.43 percent on a year-on-year basis for the period January-October, imports declined by 7.31 percent in the same period, improving the trade balance. The decline in exports was expected following the export restrictions on rice and other food commodities to stabilise domestic inflation.

The Reserve Bank of India’s (RBI) neutral monetary policy stance has been praised by the International Monetary Fund (IMF), for its data-dependent approach, that can stabilise prices gradually.

While there was a reduction in the exports of petroleum products and precious stones, there was significant growth in the exports of telecom instruments, electric machinery and drug formulations—highlighting possible key sectors for the economy. Further, on the external sector front, according to IMF estimates, both Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI) inflows have increased in 2023, and are projected to be US$ 44.4 and US$ 33.9 billion respectively, in 2024. The increase in foreign investment is a testament to the fact that India is perceived as an emerging power in the Global South that has the potential to generate a steady return on investment with a negligible risk premium. This development needs to be studied in light of the emerging sectors which have put India on an upward growth projectile.

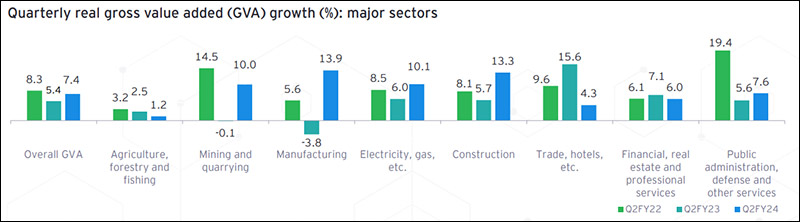

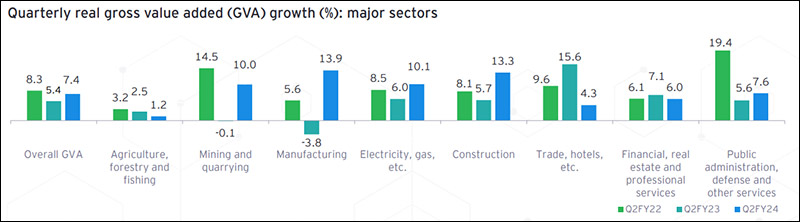

Sectoral stars

The third quarter of the calendar year 2023 saw the manufacturing sector grow at 13.9 percent, supported by double-digit growth in the steel, cement, and automobile manufacturing sectors. The infrastructure and real estate sectors have performed well while the construction sector recorded a robust quarterly growth rate of 13.3 percent. However, a slowdown has been experienced in the last quarter in the agricultural sector and services—financial and hospitality services. While the agricultural slowdown is attributable to unfavourable weather conditions and sub-par production of the kharif crop, the relative contraction in financial services can be interpreted as the growing base effect—where robust growth in the previous year has increased the base.

Figure 3: Quarterly Real Gross Value Added in major sectors

Source: EY Pulse

The manufacturing sector has the potential to grow into a US$ 1 trillion industry by 2025-26, driven by the government’s ‘Make in India’ initiative, which is further aided by multiple industry-promoting schemes such as the Production-Linked Incentive (PLI) scheme. The PLI scheme aims to attract investment in 14 key sectors to enable efficiency of scale, making Indian industries globally competitive, through heavy subsidisation which levies a huge burden on the public exchequer. The manufacturing industry which is led by the automobile, textiles, and electronics sectors, is growing in tandem with the expected rise in domestic consumers—reiterating the importance of aggregate demand in an underemployed economy. This highlights the role of consumer income in stimulating the economy, and consequently, the role of employment.

Room for improvement

According to the Periodic Labour Force Survey, the labour force participation rate (LFPR) has increased from 41.3 percent in June 2022 to 42.4 percent in June 2023. The female LFPR is still considerably low at 30.5 percent. Youth unemployment is still a daunting problem for Indian policymakers. The decoupling of industrial growth and employment can be interpreted as a result of an employability gap, where the average worker does not possess the requisite skill set to enter the workforce. While several government initiatives exist to promote the training of workers, policies should be addressed to increase awareness about the available avenues and simplify the transformation process. Although the unemployment rate is on the decline, it needs to be minimised to ensure that the total benefits of the demographic dividend are extracted.

The decoupling of industrial growth and employment can be interpreted as a result of an employability gap, where the average worker does not possess the requisite skill set to enter the workforce.

This ignites the debate about the structural path chosen by India, and whether a services-led growth path would catalyse the journey to a US$ 5 trillion economy. Raghuram Rajan, a former Governor of RBI, argues in his latest book that the spurt in manufacturing growth will last only as long as incentives are there to make Indian goods competitive. While this contradicts the infant industry argument, the services sector should not be ignored. To make industries competitive, there is a need to minimise input costs, which also includes labour, but that will hamper the sustainable development of the country by preventing inclusive growth. However, adequate investment in research and development can significantly reduce the need for subsidy schemes and allow an organic type of economic growth to shape the future of the Indian economy.

Securing sustainability

India ranks 112th among 166 countries in terms of its Sustainable Development Goals (SDG) score. It also has a very high spillover score, i.e., it has the potential to positively affect the sustainability of other nations. However, a focus on manufacturing-led growth will have serious implications for environmental quality, posing a trade-off between growth and well-being. This brings out the need for multidisciplinary research and policy coordination to ensure social-cost-less growth. India has taken several measures to promote the 2030 Agenda during its G20 Presidency and is incorporating frameworks in line with sustainability requirements, in its economic agreements. However, to ensure organic, responsible growth in 2024, the country will have to design and implement an unprecedented policy structure, which is unique to a large, developing nation in the current geopolitical setting.

Arya Roy Bardhan is a Research Assistant with the Centre for New Economic Diplomacy at Observer Research Foundation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source:

Source:

PREV

PREV