-

CENTRES

Progammes & Centres

Location

While digitalisation has proceeded, cash has not become unimportant.

More than three months have passed since the announcement by Prime Minister Narendra Modi on 8 November 2016, that high denomination notes were being demonetised. There has been much debate on whether the government has achieved its stated goals.

We do not yet know the extent of any possible fiscal windfall as the Reserve Bank of India has not released official figures on what portion of the approximately ₹15 trillion of demonetised notes were returned. Likewise, we do not yet know the extent to which depositors of illicit cash will be discovered and penalised by tax authorities.

The other remaining major rationale for demonetisation has been that it will push the economy toward greater digitalisation and formalisation as a direct consequence of the temporary cash crunch especially in the immediate aftermath of old notes ceasing to be legal tender.

While it’s not in dispute that increased digitalisation in particular is a laudable goal, what remains untested is the extent to which this actually happened. Unfortunately, much analysis has focused exclusively on data relating to the post-demonetisation period to try to draw conclusions. Thus it's now become a refrain that after rising in December 2016, various measures of digital transactions fell back again in January 2017. For example, as Livemint wrote, "

This is simply poor data analysis as it neglects a much longer data series on digitalisation predating 8 November 2016. Using data on the value of Point of Sale, Debit and Credit Card (PoS) transactions going back to April 2011, the earliest for which data is readily available, and the value of Immediate Payment Systems (IMPS) from September 2012, again the earliest for which data is available, I trace the dynamics of these two important components of digital payments. Crucially, unlike treatments which look at the raw data, my analysis accounts for the fact that the nominal money stock has grown substantially over this period. Basic economic theory suggests, as the nominal stock of money grows, its components will also grow roughly in proportion at least as a first approximation. That is why it's necessary to adjust the raw data by adjusting it relative to the money stock.

Source: Reserve Bank of India

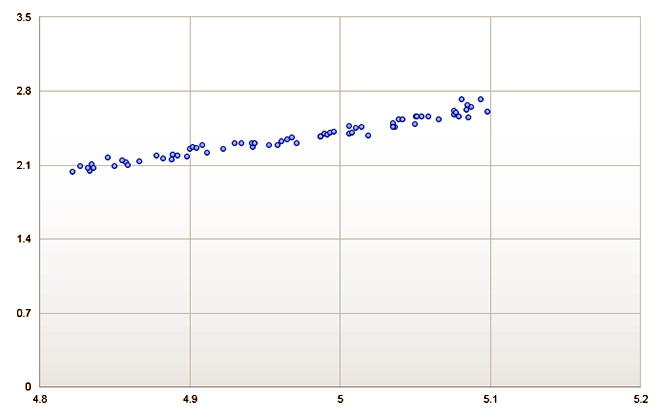

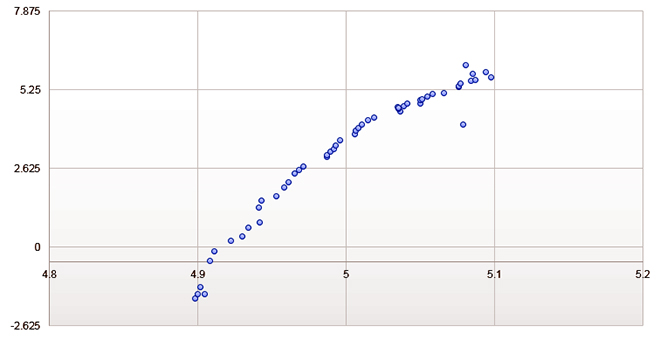

Thus, my baseline specification adjusts both PoS and IMPS by the value of M3, a broad measure of the money stock. Charts 1 and 2 depict scatter plots between PoS and IMPS respectively and M3, with all variables converted to natural logarithms which better enables tracking change over time. It's clear from eyeballing these charts that there is a very tight relationship between both these measures of digitalisation and the overall stock of money which in turn is correlated with nominal GDP. In other words, M3 helps us well predict the evolution of both PoS and IMPS. In particular, both scatter plots show a positive or upward sloping relationship, which means that even when adjusted for the stock of money, both PoS and IMPS have been increasing in importance with the latter showing an especially sharp increase since being introduced.

Source: Reserve Bank of India

This is reconfirmed through regression analysis, which shows a tight relationship between both PoS and IMPS respectively and M3. Both regressions show very high predictive power (R-squared well over 90 percent in both cases) and very low standard errors. For PoS, I compute an elasticity of just over 2, which means that a one percent increase in M3 is correlated with approximately a two percent increase in PoS (Note that this omits the last three months which only reports data on four banks). For IMPS, the elasticity is a very high 35, meaning a one percent increase in M3 is associated with a whopping 35 percent increase in IMPS. This high number must be seen in light of the recent introduction of IMPS suggesting we’re still in an early adoption phase featuring rapid growth. By contrast, PoS has been around much longer and is slowly but steadily gaining in importance.

The sharp uptick in December 2016 and the sharp drop in January 2017 are clearly outliers from the broader trend, obviously driven by the immediate short-run impact of 8 November. In fact, compared to our model, the jump in December was so large, that even though it fell back in January it's still above the trend. In particular, for PoS, December was about 13 percent higher than the model predicts and January was more than six percent higher than predicted.

The crux is that those who claim that digitalisation fell in January by looking at only two or three data points completely miss the fact that this is still more than we would have had if demonetisation hadn’t occurred! The narrative of a sharp rise and then drop in digitalisation is simply misleading and based on poor data analysis. Even a cursory analysis of long term trends shows we’re still above trend, due to demonetisation.

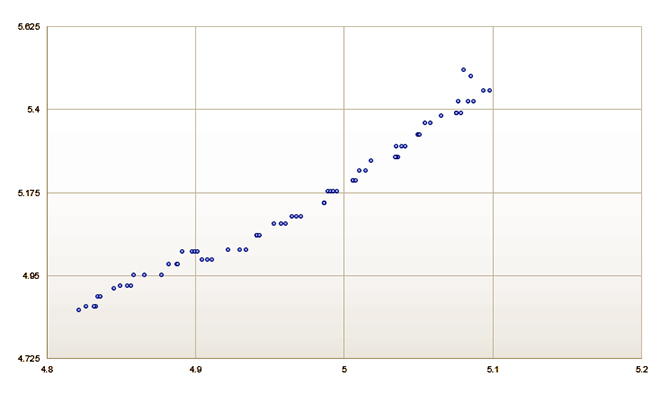

In addition, for analytical clarity, it’s necessary to distinguish two categories which are often conflated: digitalisation and the move towards a cashless economy. The analysis presented thus far clearly supports the narrative of increasing digitalisation. But the reality is that cash remains central to the Indian economy and likely will remain so for sometime to come. To check the importance of cash in the economy, I conduct a similar data analysis comparing the natural logarithm of Government Currency Liabilities to the Public (GCLP), a component of the money supply to the natural logarithm of the overall money supply itself. Chart 3 depicts a scatter plot of this relationship, which again is a tight relationship and upward sloping, meaning that cash in the hands of the public is growing as the overall stock of money is growing.

Source: Reserve Bank of India

A regression analysis (again with high R-squared and low standard errors) confirms this, giving us an elasticity of government cash liabilities as against the money supply of about 2. This means that a one percent increase in the money supply has over the last five years led to approximately a two percent increase in the amount of cash in the hands of the public. In other words, while digitalisation has proceeded, cash has not become unimportant. It's necessary to stress that this trend for cash incorporates a couple of months of data following demonetisation. If demonetisation indeed leads to less cash in the economy, we should see this elasticity fall over time.

Will a one percent rise in M3 correlate to a bigger than two percent increase in PoS going forward. That is, will the elasticity eventually and permanently increase? We simply won’t be able to answer this question until we have more data.

One thing is clear: If the Ministry of Finance (MoF) and the RBI are serious about promoting the shift to digitalisation, they're going to need to increase the incentives and reduce the costs to average citizens, everything from transactions fees to poor internet connectivity which leads to transactions failings. The push towards digitalisation requires getting the basics right. Having paid the price of considerable disruption to the economy, it's imperative that both MoF and RBI push ahead with the digitalisation drive to reap the full long-term benefits. As my research shows, digitalisation in particular has been above trend since demonetisation. Both MoF and RBI must track if this is a permanent and structural shift in behaviour. If it is, despite the initial pain, demonetisation may yet yield the long-term gains that Prime Minister Modi has spoken about.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Rupa Subramanya is a Mumbai based commentator economist and researcher. Shes co-author of Indianomix: Making Sense of Modern India Random House 2012.

Read More +