The race among emerging economies to become the next global manufacturing hub has gained momentum in the last two years. The struggle for grabbing a larger share of the global manufacturing pie, inspired by economies envious of China’s growth driven by manufacturing, has gained impetus. This is due to the recent US-China trade tension, and the need to hedge supply chain risks in light of the COVID-19 pandemic.

As countries work towards redefining the global manufacturing order dominated by China, the manufacturing world itself is undergoing a paradigm shift driven by two critical trends, i.e., relocation and automation.

While relocation is a geographical shift, automation entails a dynamic change in the fundamental process of manufacturing. This article takes a closer look at the impact of the above trends in the backdrop of India’s attempt to become a global manufacturing hub.

While relocation is a geographical shift, automation entails a dynamic change in the fundamental process of manufacturing.

Before going further, it would be prudent to step back and understand the strategic importance of manufacturing in India’s growth story. India’s vision of a $5 trillion economy is deeply intertwined with its manufacturing growth. The ambitious “Make in India” initiative aims to increase the share of the manufacturing sector in the gross domestic product (GDP) to 25 per cent by 2022, from the current 16 per cent.

One of the key motivations to increase domestic manufacturing is driven by a need to create jobs and local value addition. The Indian government plans to create a 100 million new manufacturing sector jobs by 2022. Manufacturing jobs gain importance in India, as the proportion of formally skilled workers in India is extremely low compared to other countries.

| Table 1: Comparison of formally skilled workers across countries |

| Country |

Proportion of formally skilled workers |

| India |

4.6 % |

| China |

24% |

| US |

52% |

| UK |

68% |

| Germany |

75% |

Source: The Indian Express

A closer look at India’s skill set, shows that a high percentage of the labour market is dominated by people who are classified at Level 2 skills (skills involving operation of machinery and electronic equipment), followed by Level 1 skills (simple and routine physical tasks) and Level 3 skills (skills involving written records, calculation skills and good communication). Level 4 skills (decision making and creativity based) account for the smallest cohort.

| Table 2: Composition of labour market by skill level |

| Skill level |

~ % of labour market

|

| Level 1 |

30% |

| Level 2 |

56% |

| Level 3 |

11% |

| Level 4 |

3% |

Source: The Indian Express

Level 2 skills are mostly suited for manufacturing and agriculture; in this regard, it is imperative to note that the agriculture sector is saturated with respect to employment. It accounts for 43% employment while contributing only 17% to the GDP, leaving the industry sector to drive further employment.

| Table 3: Sector-wise GDP and employment contribution |

| Sector |

GDP |

Employment |

| Agriculture |

17% |

43.2% |

| Industry |

29.6% |

24.8% |

| Services |

54.3% |

31.9% |

Source: Statista

Given the backdrop of India’s needs, we look at the two challenges i.e. competition with countries for fighting for companies relocating and reduction in employment opportunities in manufacturing due to the rise in automation.

A monumental miss

In 2019, during the first phase of exodus from China, India failed to impress global investors. A study done by Nomura, a Japanese financial group, showcased that between April 2018 and August 2019 out of 56 companies that moved their production out of China, Vietnam emerged as the preferred destination with 26 companies shifting there, while only three moved to India. Taiwan and Thailand also fared better than India, attracting 11 and eight companies respectively.

The second wave of companies exiting China has seen Indonesia gain high traction with 27 US factories relocating to Indonesia, while India is still pushing to attract US and Japanese investments as they venture into the China plus one strategy. Despite favorable demographics and low labour costs, India has not been able to attract investments due to existing cost disabilities such as corporate tax rates, land and labour laws, infrastructure, etc.

In the case of the first manufacturing trend i.e. relocation wherein India has to overcome internal challenges as well as compete with other countries, the challenge arising from the second trend i.e. automation is a race against time.

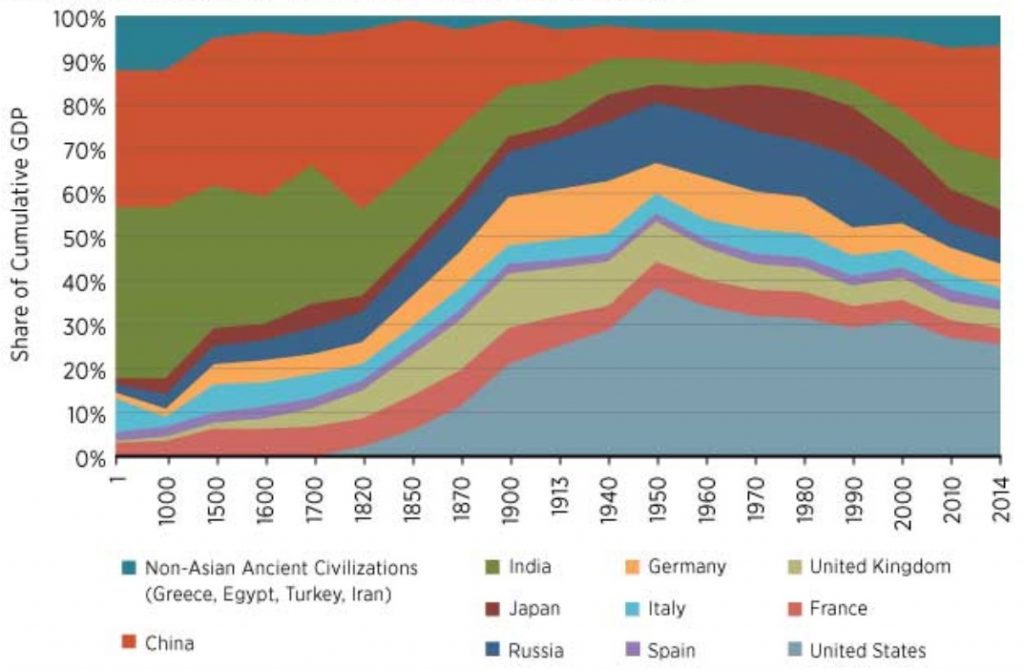

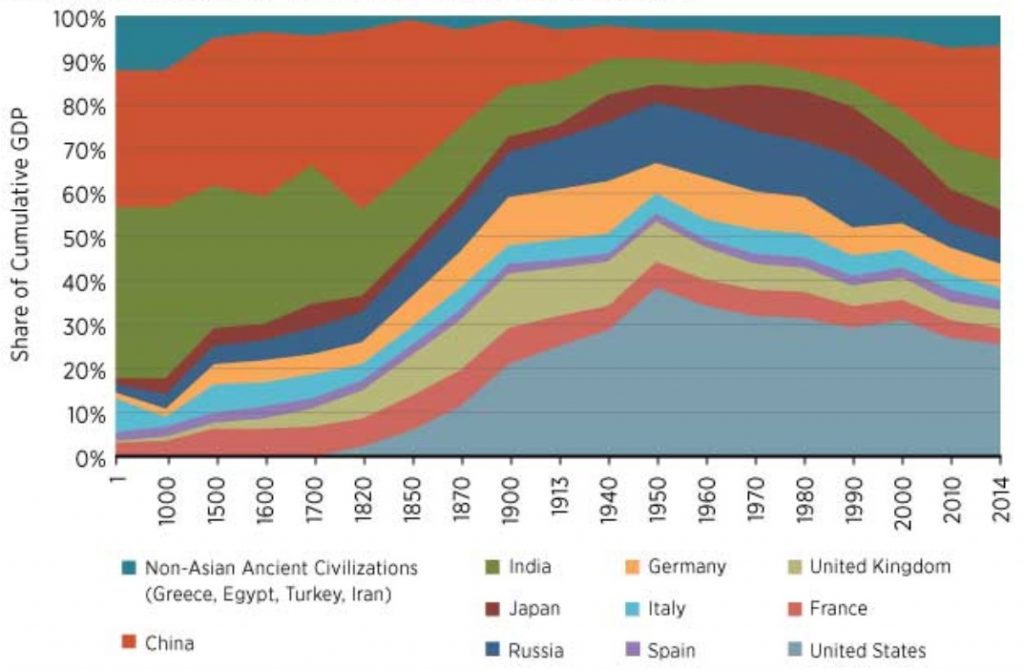

Figure 1: China’s GDP growth story

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

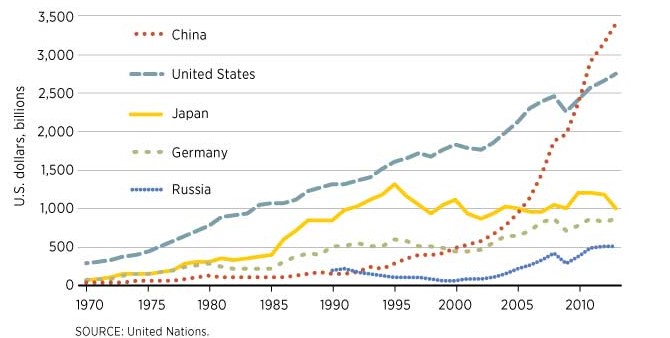

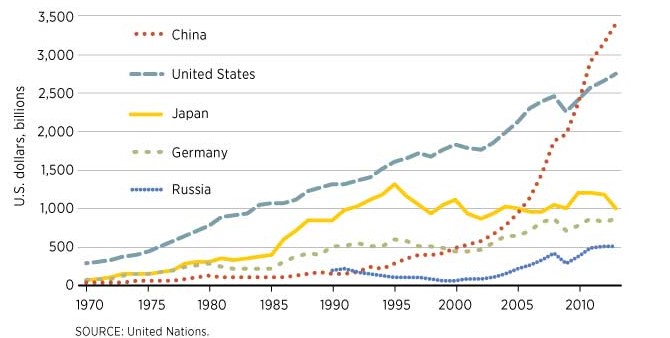

Figure 2: Manufacturing output of top 5 countries

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

China’s rise to power driven by manufacturing has been a long and arduous journey ning over five decades. During this time China was able to successfully lift millions above the poverty line by driving employment in manufacturing. With the current rise in automation — a trend that has gained strength due to COVID-19 — the manufacturing sector’s ability to absorb traditional manufacturing jobs would drastically reduce, thereby impacting one of India’s key considerations for attracting investments in this sector.

As industry — particularly the Micro, Small & Medium Enterprises (MSME) segment — face challenges with respect to absent migrant labour and social distancing, manufacturers are considering options to automate their shop floor.

A study to gauge the manufacturing industry’s mindset reveals an inclination towards increased automation in the post-COVID-19 world. As industry — particularly the Micro, Small & Medium Enterprises (MSME) segment — face challenges with respect to absent migrant labour and social distancing, manufacturers are considering options to automate their shop floor.

According to “Changing Business and Opportunities for Employer and Business Organizations”, 51.8% of activities can be automated in India. The report points out, “robotic automation is having the greatest impact, replacing low-skilled jobs and simple assembly tasks.”

Automation is likely to impact jobs with highly structured and predictable physical activities such as manufacturing.

In conclusion, as India strives to become a preferred China + ONE manufacturing destination for MNCs, it is important to step back and evaluate the merits of the same in the context of the shifting manufacturing paradigm. India should focus on sectors which tick three critical boxes i.e. automation is still distant, highly skilled manpower requirement is low and cost disabilities which effect the government’s incentive payout are relatively lower.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source:

Source:  Source:

Source:  PREV

PREV