-

CENTRES

Progammes & Centres

Location

Will the recent tax changes alleviate the ongoing economic crisis?

The economic turmoil in Sri Lanka can be traced back to various mismanaged political moves that have snowballed into the massive crisis being witnessed in the country today. Be it the tax cuts in 2019, or the complete switch to organic farming in 2021 — with the added pressures of the pandemic, foreign debts, Chinese hegemony and the ongoing Ukraine–Russia conflict — the consequences of these policies have been disastrous for the Sri Lankan economy.

Undoubtedly, the COVID-19 pandemic generated new costs around healthcare as well as a massive increase in government expenditure on social security schemes, to mitigate poverty and unemployment. While departments struggled to shift finances around to meet these new financial burdens, the Sri Lanka government announced tax cuts at a time when the state funds were already buckling under the weight of a failing economy—traced back to the 2008 Financial Crisis and the 2009 Civil War. To meet 2019 election promises, the government proceeded to initiate deep tax cuts mere months before the pandemic made landfall. Taxpayers took a hit, with their numbers falling by around one million between 2020 and 2022.

To meet 2019 election promises, the government proceeded to initiate deep tax cuts mere months before the pandemic made landfall.

The most prominent change to the taxation system was the Value Added Tax (VAT) being brought down from 15 percent to 8 percent. While the Nation Building Tax (NBT) of 2 percent was abolished and combined with the Ports and Airport Development Levy, the tax on Telecommunication Tariffs was reduced by 2.5 percent. A few other taxes that were eliminated include the Economic Service Charge, Debit Tax on Banking and Financial Institutions, VAT on Sovereign Property, Capital Gains Tax on the Share Market, Pay As You Earn (PAYE) Tax, Credit Service Tax and the Withholding Tax on Interest Income.

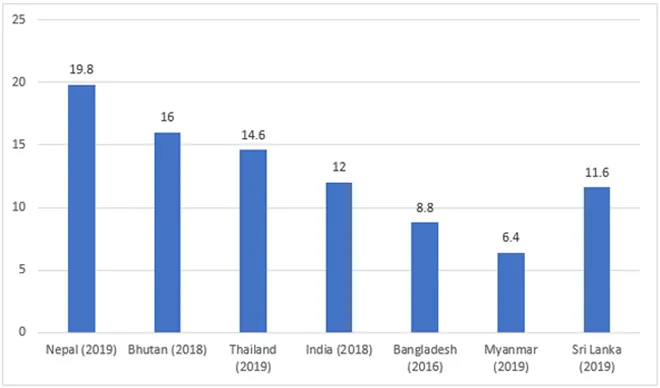

There are two reasons why the tax cuts turned out to be so detrimental to Sri Lanka. Firstly, it was extremely challenging for an economy that was already suffering from widespread tax evasion where direct taxes contribute to only about 2 percent of the GDP. While the government revenue-to-GDP ratio declined from 9.1 percent in 2020 to 8.7 percent in 2021, the tax revenue-to-GDP ratio was also reduced from 11.6 percent to as low as 7.7 percent in 2021. Secondly, among the countries in the region, Sri Lanka has a considerably low tax-to-GDP ratio which made the cuts all the more problematic.

Figure 1: Tax Revenue for the BIMSTEC Nations (Percentage of GDP)

Source: The World Bank

Source: The World Bank

Initially, the tax cuts were intended to free up disposable income and money circulation in the economy and push positive growth values in the medium and long term. In the short run, however, the lower tax revenue paired with the rising costs of the pandemic worsened the budgetary deficit which has often been shouldered by external debts. Budget deficits have risen from 9.6 percent of GDP in 2019 to 12.2 percent in 2021. The government debt-to-GDP ratio has also blown past the 100 percent mark, from 86.9 percent in 2019 to 105.6 percent in 2021.

It is pertinent to note that such fiscal deficits have been an ever-present phenomenon in the Sri Lankan economy. The average fiscal deficit has been around 6.2 percent of its GDP from 2011 to 2020. The government would finance these shortages from both domestic and foreign sources, though the latter seems to have dried up as of late. The country’s current account balance has similarly been in deficit with the average Current Account Deficit (CAD) from 2010 to 2019, being around 1.2 percent of the GDP. Current and fiscal accounts have mostly moved around together since 1970, highlighting the ‘twin deficits hypothesis’ for the Sri Lankan economy. This poses a major macroeconomic problem since it is an indicator of the nation’s reliance on foreign debts to go over the annual tide. The problem here is that it leaves the nation highly vulnerable to exogenous shocks such as the pandemic.

When Ranil Wickremesinghe took charge as Prime Minister in May 2022, the Cabinet scrambled to take steps to steady the ship. The PMO stated that public revenue losses of up to around SLR 800 million (US$ 2.22 million) were attributed directly to the 2019 and 2020 tax cuts. A taxation overhaul was announced—partially brought about by the inflation touching 39.1 percent in May 2022, compared to the previous year. Several taxes were increased and relief given to individual taxpayers was taken back. VAT was brought up to 12 percent, which alone could add SLR 650 billion (US$ 180.56 million) to government revenues.

Table 1: May 2022 Sri Lankan Tax Revisions

| Tax Head | Current | Former |

| Income Tax exemption threshold | SLR 1.8 million (US$ 4,999) | SLR 3 million (US$ 8,332) |

| VAT | 12 percent | 8 percent |

| Corporate Income Tax | 30 percent (From October 1 2022) | 24 percent |

| Telecom Levy | 15 percent | 11.25 percent |

Source: Colombo Page

An interim budget is also on the way, with the former Prime Minster Ranil Wickremesinghe stating that the expenditure would be cut “to the bone,” with funds being routed towards a two-year recovery programme. With the amendment bill slated to arrive in August, the finance ministry has amended the estimated expenditure from SLR 3.6 trillion (US$ 9.996 billion) to SLR 4.6 trillion (US$ 12.775 billion). The budget will focus on stabilising the economy in the short term. It has also proposed to allocate incentives worth SLR 200 billion (US$555 million) to low-income families and small and medium sector units as much-needed relief.

While the new taxation rates may bring in necessary funds for the government, the country needs additional support for its economy to recover. While adequate expenditure rationalisation is needed, it should be complemented with revenue maximisation along with the creation of employment opportunities. And finally, macroeconomic restructuring needs to keep inclusive progress as an important tenet since studies have shown the economic impact of the pandemic has been skewed toward women and the poorer classes.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Soumya Bhowmick is a Fellow and Lead, World Economies and Sustainability at the Centre for New Economic Diplomacy (CNED) at Observer Research Foundation (ORF). He ...

Read More +