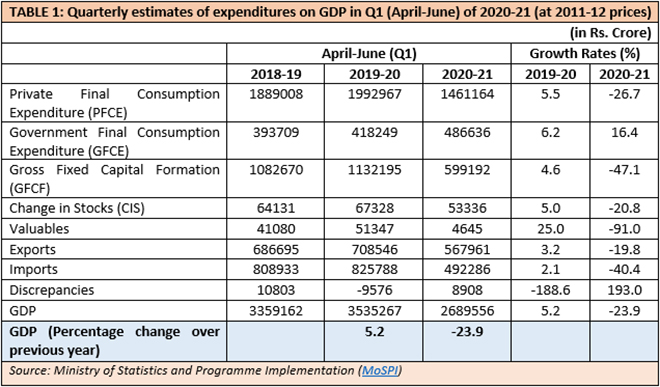

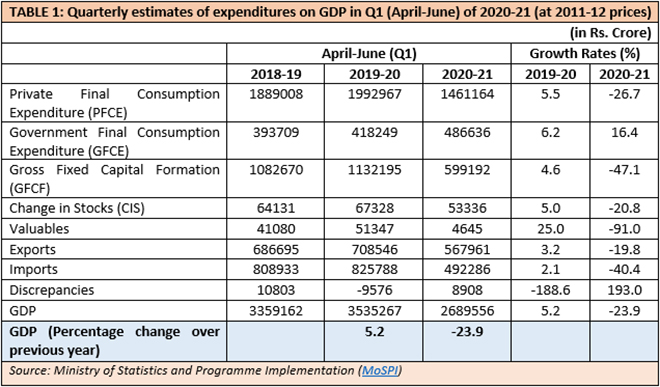

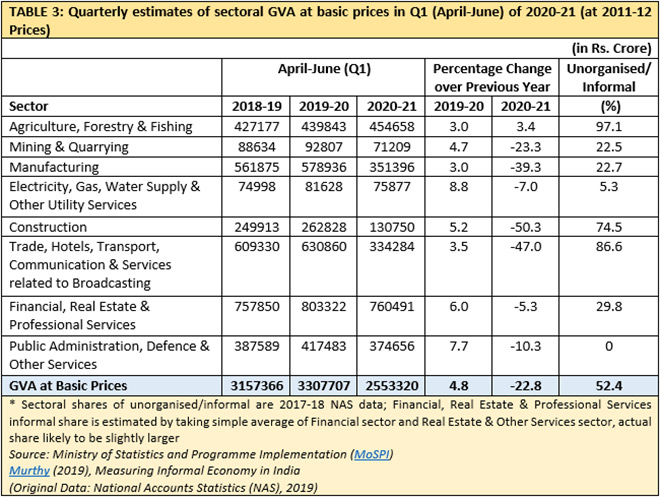

In the first quarter (Q1) of 2020-21, GDP (gross domestic product) at constant (2011-12) prices contracted 23.9% while GVA (gross value added) at constant prices contracted by 22.8% (Table 1 and 3). This quarter coincided with the nation-wide total lockdown in the wake of Covid-19 spread, beginning end of March and ending in early-June. So, the contraction was largely expected, but almost a quarter of GDP vanishing compared to last year’s first quarter came as bit of a shock to many.

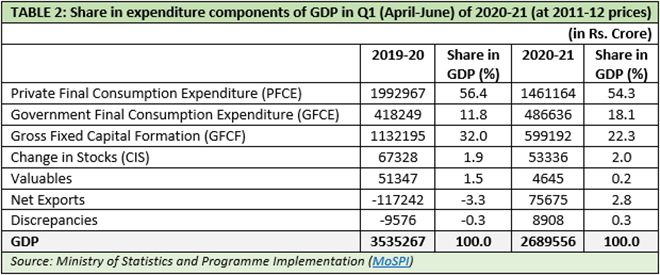

All principal components of the constituent expenditures on GDP experienced very high contractions, except for the Government Final Consumption Expenditure (GFCE). It grew 16.4% compared to the first quarter of last fiscal year. However, two principal components that generate demand in any economy, private consumption (PFCE) and investment (GFCF), experienced negative growth of -26.7% and -47.1% respectively (Table 1).

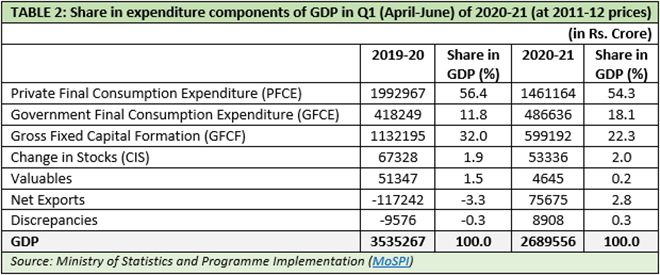

Imports decreased and took net exports to positive zone, but the important point here is that exports contracted by close to 20%. Contraction in private consumption and investment is significant because these two contributed 88.4% of the GDP in last year Q1, this year also the aggregate contribution of these two components in total GDP is 76.6%, even after contraction (Table 2).

Government consumption expenditure has increased, but its contribution to GDP was 11.8% last year and 18.1% this year. Needless to say, GFCE cannot pull up the GDP alone. Private consumption and investment have to be revived for faster economic recovery.

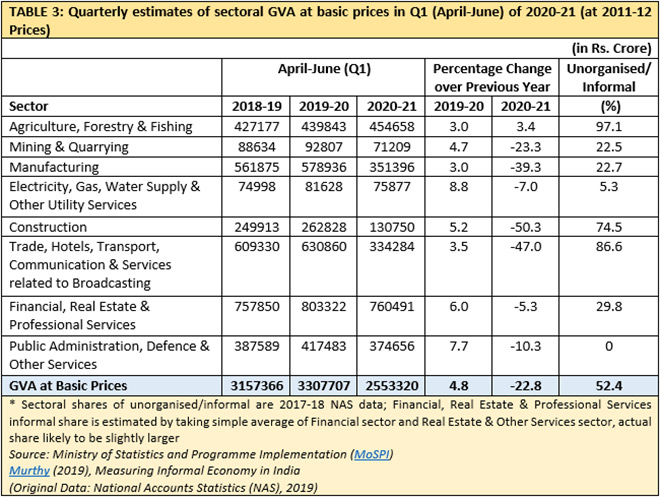

Sectoral GVAs show contraction in all sectors except agriculture, forestry and fishing. Construction is the hardest hit, followed by trade, hotels, transport, communication & services related to broadcasting and manufacturing. Share of informality in trade and other allied services is 86.6%, while construction’s unorganised/informal share is 74.5% (Table 3). Close to 50% contraction in these two sectors is likely to have negative implication for informal employment in the economy. Together with manufacturing slump, this indicates towards rise in unemployment for informal sector workers.

Loss of employment in the time of an acute economic stress is a barrier to the revival. Job losses and dwindling consumer purchasing power always lead to further slump in future consumer demand. Some of these workers may fall back on agriculture, but decreasing wages and non-profitability of agriculture nevertheless are going to take a toll on the overall purchasing power in the economy. This is not good news for future demand generation and investment.

So, if we look beyond the headline 23.9% GDP slump, the first quarter estimates underline other crucial trends, which are —

- Private consumption and investment, which contributed 88.4% in GDP in last year Q1, collapsed in the first quarter.

- Exports collapsed by around 20%, highlighting the fact that this component of GDP is unlikely to be a growth driver in near future.

- Informally driven sectors, like construction, real estate, hotels, transports and part of manufacturing, experienced large contractions. The unemployment consequences are serious.

- With consumption demand faltering even before the pandemic, all these factors are going to act as a barrier to immediate demand generation in the economy.

Historically, in all crises, in any part of the world, Keynesian fiscal intervention path ultimately rescued economies. Data clearly demonstrates that Indian economy is inside an unprecedented contraction. It is not yet late to steer towards demand-generating fiscal interventionist policy making. Any further delay can slowdown and jeopardise future recovery process.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV