This piece is part of the series, The Unfolding Crisis in Sri Lanka.

The present economic crisis in Sri Lanka is a major fallout of the nation’s habitual borrowing tendencies from creditor nations as well as multilateral organisations, characterised by a precarious sovereign debt structure. The external debt service payments for Sri Lanka stood at US$7 billion for what remains of this year, against the foreign reserves of US$1.9 billion at the end of March 2022. On 12 April, the country revealed that it was defaulting on its external debts to the tune of US$51 billion, awaiting a bailout from the International Monetary Fund (IMF). The Finance Ministry declared that an approximate amount of US$3 million worth of external assistance would be required over the next six months, to restore the supplies of essential goods, and at the same time lay down the recovery path for the distressed economy.

Background

The roots of Sri Lanka’s current sovereign debt crisis dates back to the early-2000s, when the World Bank promoted the nation from a low-income country to a low-middle-income country. Before Sri Lanka made the ascent to a middle-income country, a large share of the foreign debt came through concessionary funding from multilateral organisations such as the World Bank, Japan International Cooperation Agency, and the Asian Development Bank (ADB). These borrowings were characterised by favourable loan conditions such as low-interest rates (1% or less) and the longer periods for its repayment (25–40 years) which assisted in the systematic management of foreign exchange reserves.

Before Sri Lanka made the ascent to a middle-income country, a large share of the foreign debt came through concessionary funding from multilateral organisations such as the World Bank, Japan International Cooperation Agency, and the Asian Development Bank (ADB).

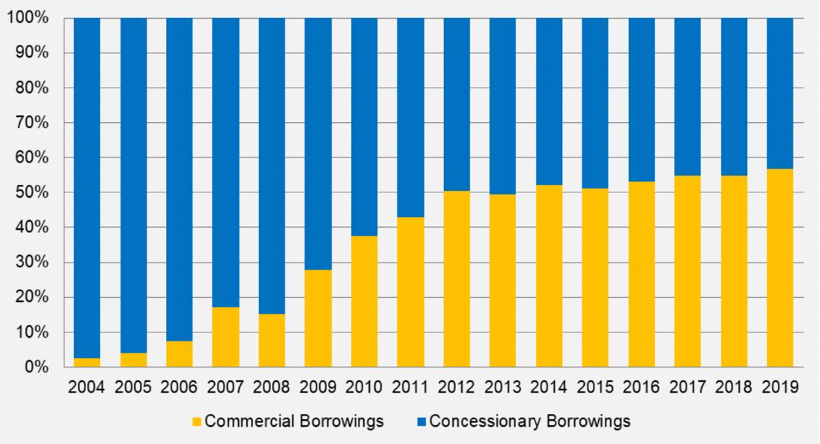

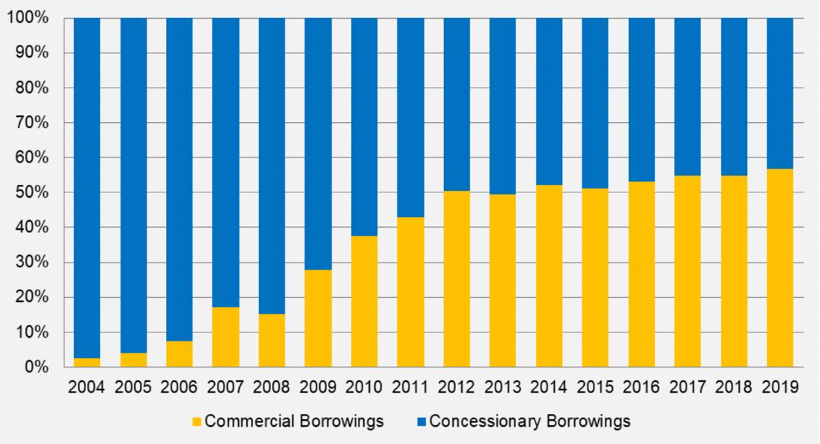

Even though Sri Lanka’s foreign debt-to-GDP ratio has witnessed reductions over the last two decades, the change in the total structure of the external debts have made the economy more at risk of currency crises in the last few years. As the nation became a middle-income country, the access to concessionary funding became scarce, and the Sri Lankan economy shifted towards an increasing proportion of commercial loans in its external debt structure. These commercial loans were mostly in the form of International Sovereign Bonds (ISBs)—instruments of capital market borrowings, and carried interest rates that were high (above 6 percent) with shorter durations of repayment (5–10 years) and no grace period. In 2007, the country issued its first ISB worth US$500 million, followed by large rounds of borrowing from international capital markets in the form of ISBs. From 2004 to 2019, the country’s commercial loans have increased from 2.5% to 56 percent of its total foreign loans, respectively (see figure 1), thereby, increasing the macroeconomic instability.

Figure 1: Sri Lanka’s Foreign Debt Composition (2004 – 2019)

Source: The Diplomat, data from the Central Bank of Sri Lanka and the Department of External Resources, Sri Lanka

Source: The Diplomat, data from the Central Bank of Sri Lanka and the Department of External Resources, Sri Lanka

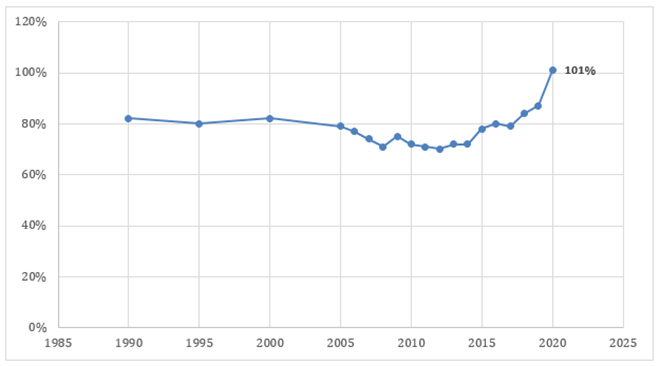

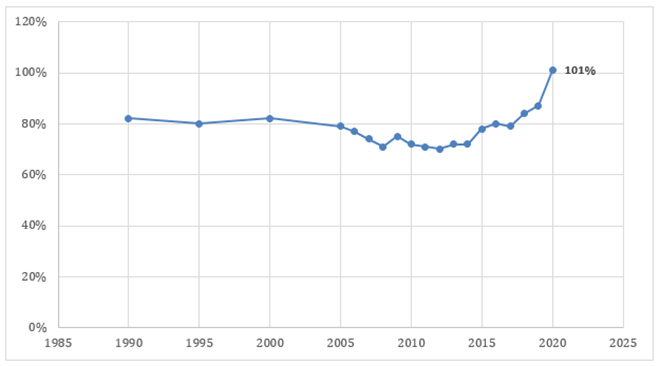

Despite the levels of domestic public debt remaining mostly stable, the foreign debt-to-GDP ratio (comprising of mostly commercial borrowings) has surged from 30 percent in 2014 to 42.6 percent in 2019. The latter has mainly contributed to Sri Lanka’s rising total debt-to-GDP ratio (domestic and external debt) which reached an all-time high of approximately 101percent of GDP in 2020 (see figure 2). Statistical estimations by a World Bank study shows that the ideal threshold for total debt-to-GDP ratio is 64 percent for emerging market economies such as Sri Lanka; and for each additional percentage point beyond this threshold is estimated to cost the annual real growth of the economy by 0.02 percentage points.

Figure 2: Total Government Debt (as percentage of GDP) in Sri Lanka (1990 – 2020)

Source: Author’s own, data from World Bank

Source: Author’s own, data from World Bank

It is fair to say that the ever-increasing foreign debt obligations for Sri Lanka has been a major contributor to the present economic woes the nation finds itself in. Firstly, there is Sri Lanka’s reliance on commercial borrowings without paying heed to the structural weaknesses in the economy—such as decreased trade levels as a percent of GDP (from 33 percent in 2000 to 13 percent in 2019), low levels of FDI (successive governments were unable to meet the targets set on the FDI front) and tax revenues that have been falling over time, amongst others—have devasted the economy in an impactful manner, due to the interactions of both the domestic and external macroeconomic factors that have turned out to be quite complicated.

Secondly, the capital inflows from China into Sri Lanka calls for a more detailed introspection before the two countries agree upon any more loan terms in the forthcoming years, especially in the context of Sri Lanka’s participation in the Chinese Belt and Road Initiative (BRI). The 2017 Hambantota port episode bears testimony to how Sri Lanka is a victim of China’s vicious ‘debt-trap diplomacy’. According to the official records, while China makes up 9.83% (US$3.4 billion) of Sri Lanka’s total foreign debt as of 2019, China’s liquidation techniques and hidden debts in various projects also exhibit the outcomes of economic imperialism shown by Beijing that are problematic for the Sri Lankan economy. The ongoing economic crisis in Sri Lanka had forced Colombo to ask for a moratorium on debt repayments in February 2022 to the visiting Chinese Foreign Minister—stirring up the matter of ‘problematic Chinese debts’ once again in the global diplomatic space. The island nation has also attempted to secure a new loan grant of around US$ 2.5 billion from China in March 2022.

The ongoing economic crisis in Sri Lanka had forced Colombo to ask for a moratorium on debt repayments in February 2022 to the visiting Chinese Foreign Minister—stirring up the matter of ‘problematic Chinese debts’ once again in the global diplomatic space.

Sri Lanka’s excessive foreign borrowing in exchange of infrastructure projects that have failed to provide high returns. Additionally, the increasing external debt servicing overwhelmed an already weak economy that was left faltering from the economic costs of the 26-year-long civil war that came to an end in 2009, and was followed by the repercussions of the global financial crisis in 2007-08, alongside continual fiscal and current account deficits. In April 2022, the Governor of the Central Bank of Sri Lanka announced that there will not be any restructuring of domestic debt (such as government securities and development bonds) at the moment, while restructuring of the external debt will be prioritised given the current situation.

Although a healthy amount of sovereign capital inflow is expected to bolster the economic growth of nations; but for Sri Lanka the sovereign debts (for example the multiple IMF bailouts) were mainly used to save the economy from the successive BOP precarities in the past. Given the wreck the Sri Lankan economy is facing, the impact of the COVID-19 pandemic on the global economy, and most importantly the low sovereign credit ratings for the Sri Lankan economy will make it extremely difficult for Sri Lanka to be on the lookout for commercial borrowings from foreign sources in the near future. Going ahead, credit diversification and the restructuring of foreign debt will be of utmost importance to the island nation.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV