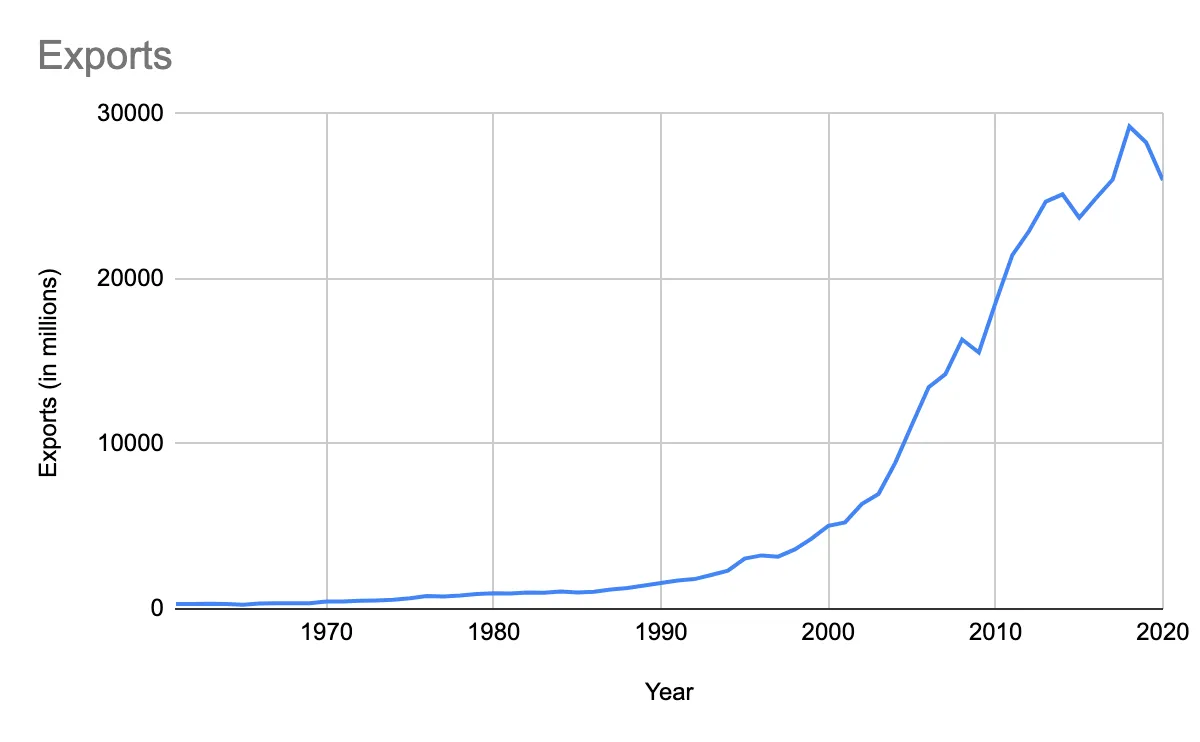

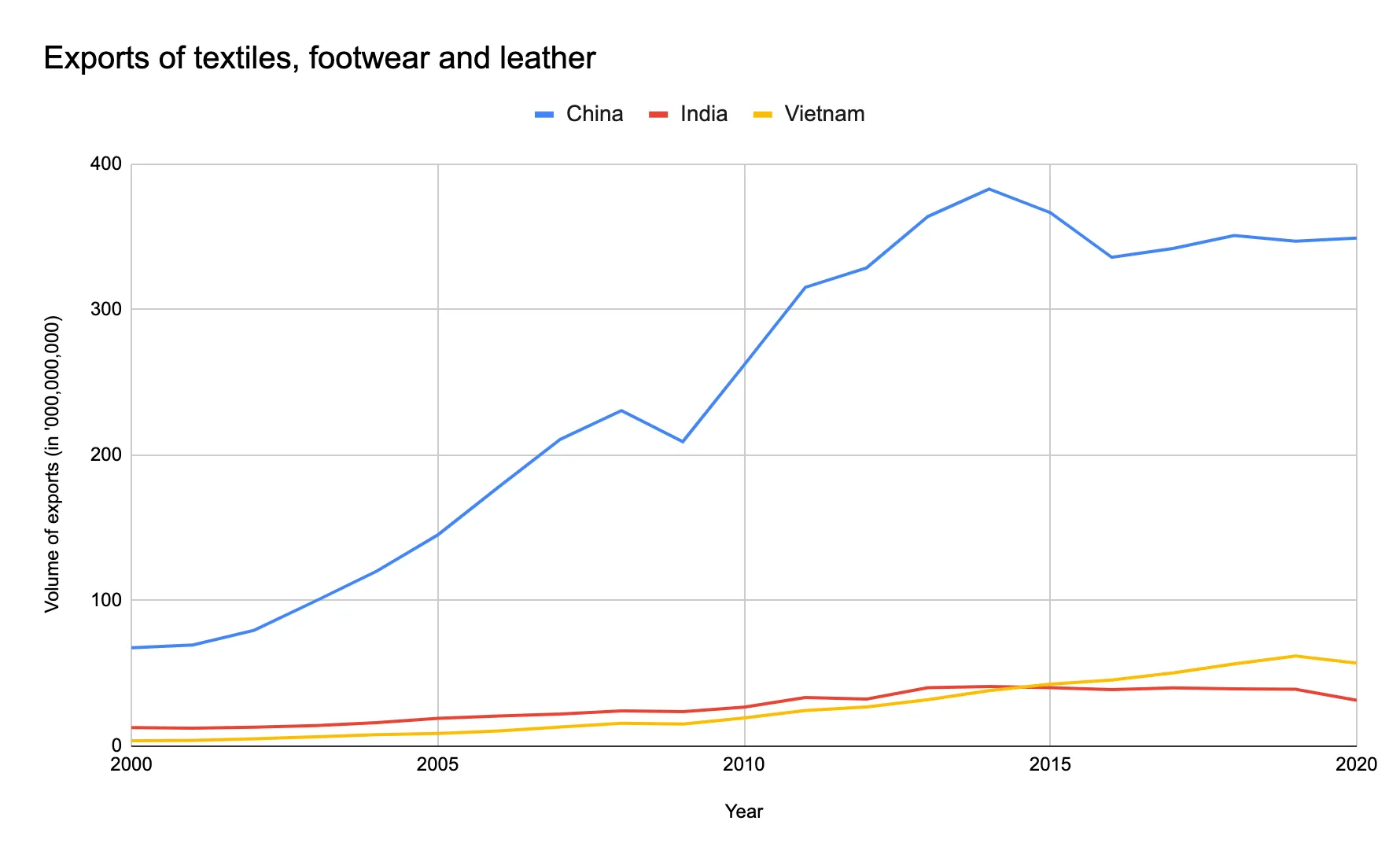

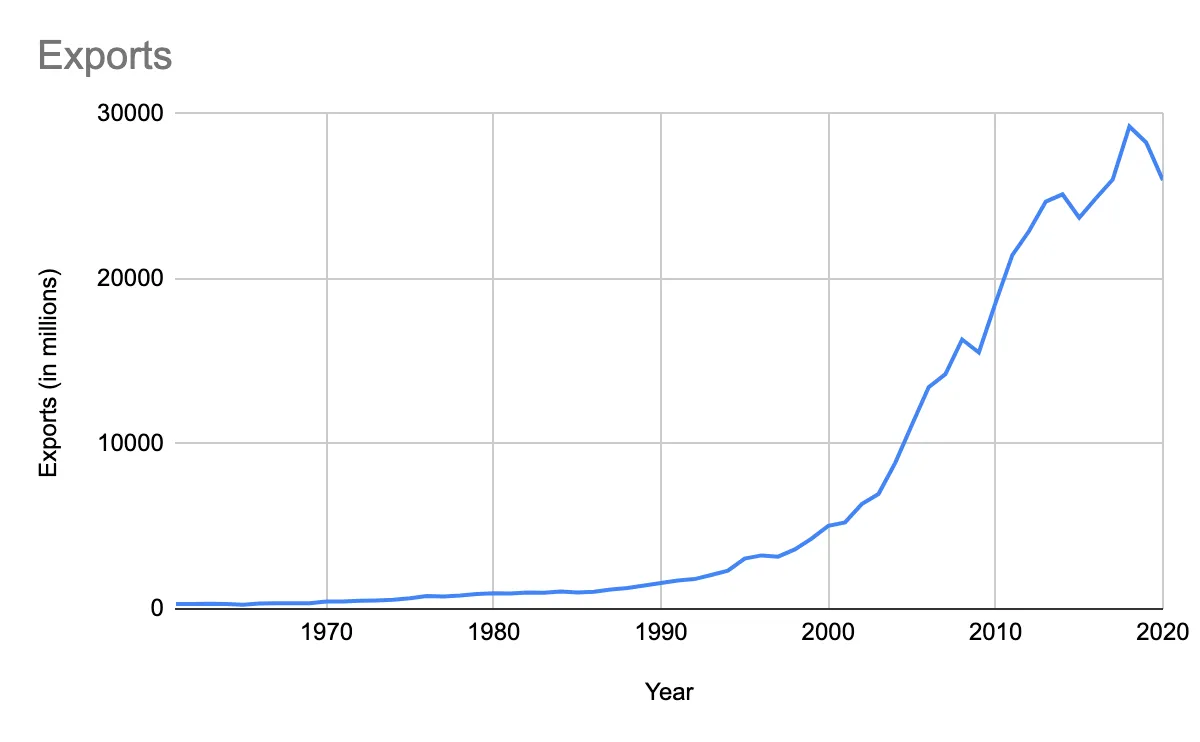

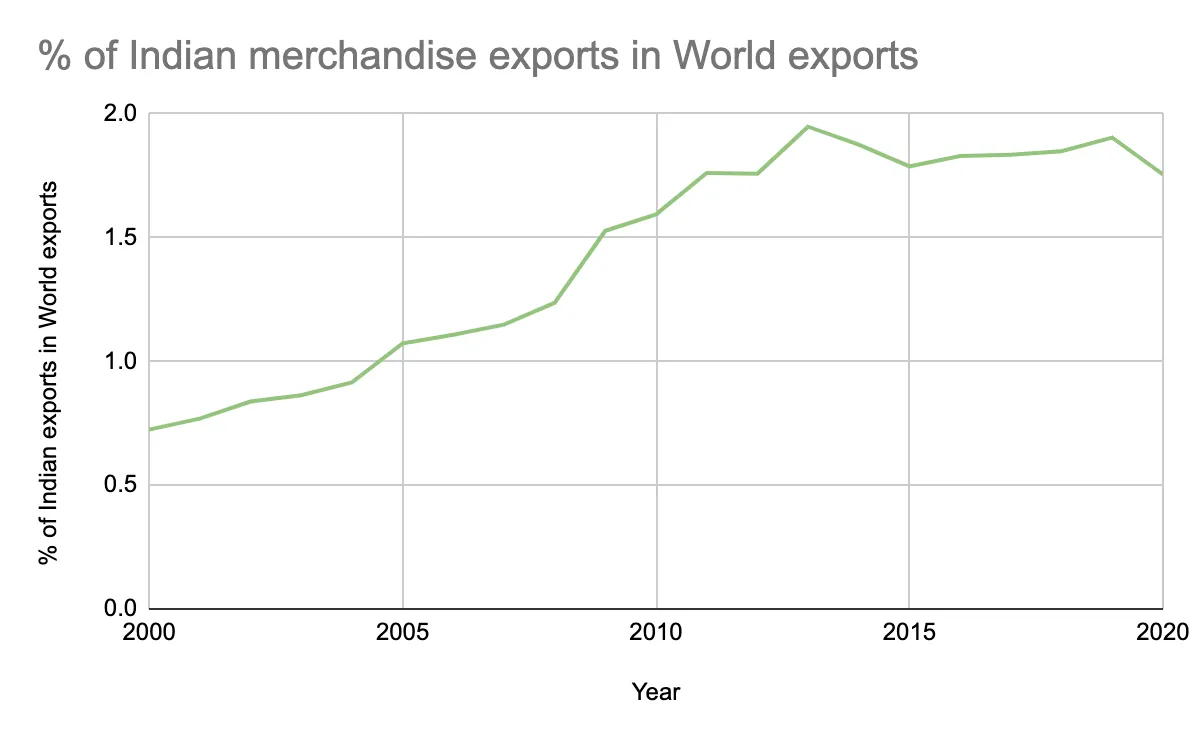

India is increasingly making its presence felt in the global market (Figure 1,2) although the components driving the export growth remain contestable. On the one end of the spectrum,

researchers present India as a case in point of premature de-industrialiser, whose growth has been largely derived from the service sector including exports. On the other end,

researchers argue that India epitomizes manufacturing export-led growth—which is the third-highest in the world preceded by China and Vietnam. However, one thing that has consensus across the spectrum is that India's performance in low-skill manufacturing remains dismal and, therefore, is missing out on an important opportunity for robust and inclusive export-led growth.

Figure 1. Increase in merchandise exports of India, 1961-2020

Source: UN COMTRADE

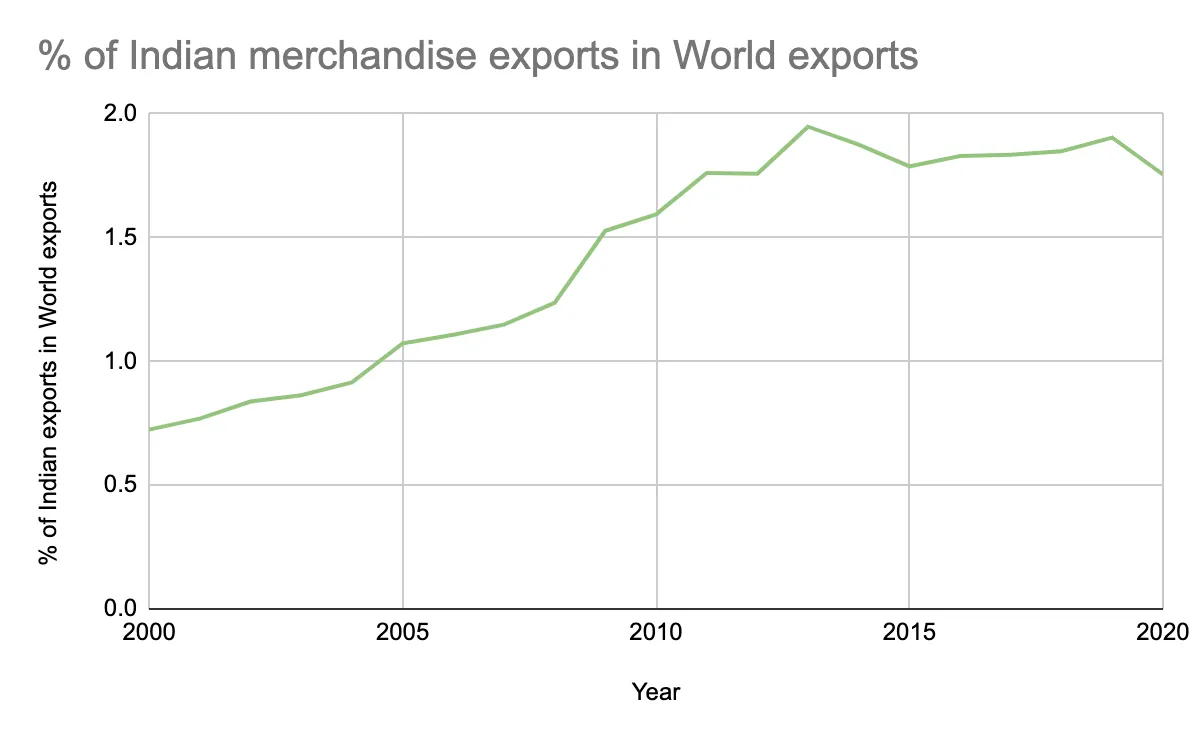

Figure 2. The increasing share of India’s merchandise exports in world exports, 2000-2020

Source: UN COMTRADE

Figure 2. The increasing share of India’s merchandise exports in world exports, 2000-2020

Source: UN COMTRADE

Source: UN COMTRADE

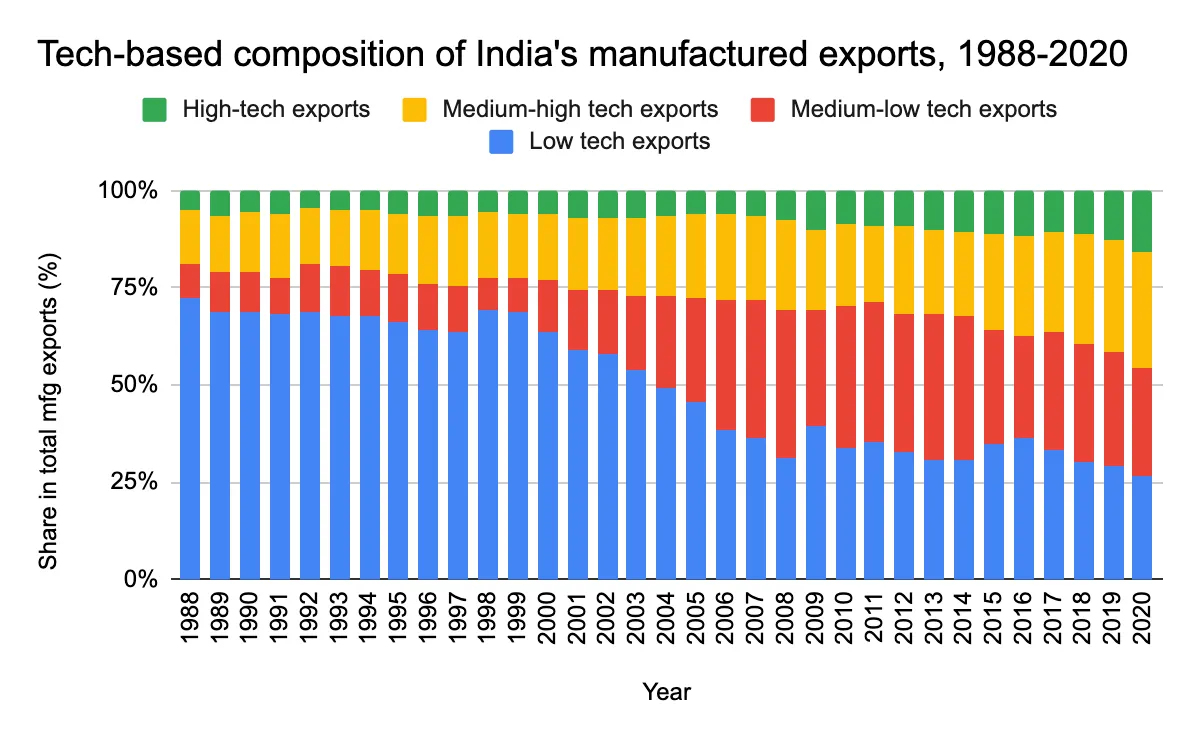

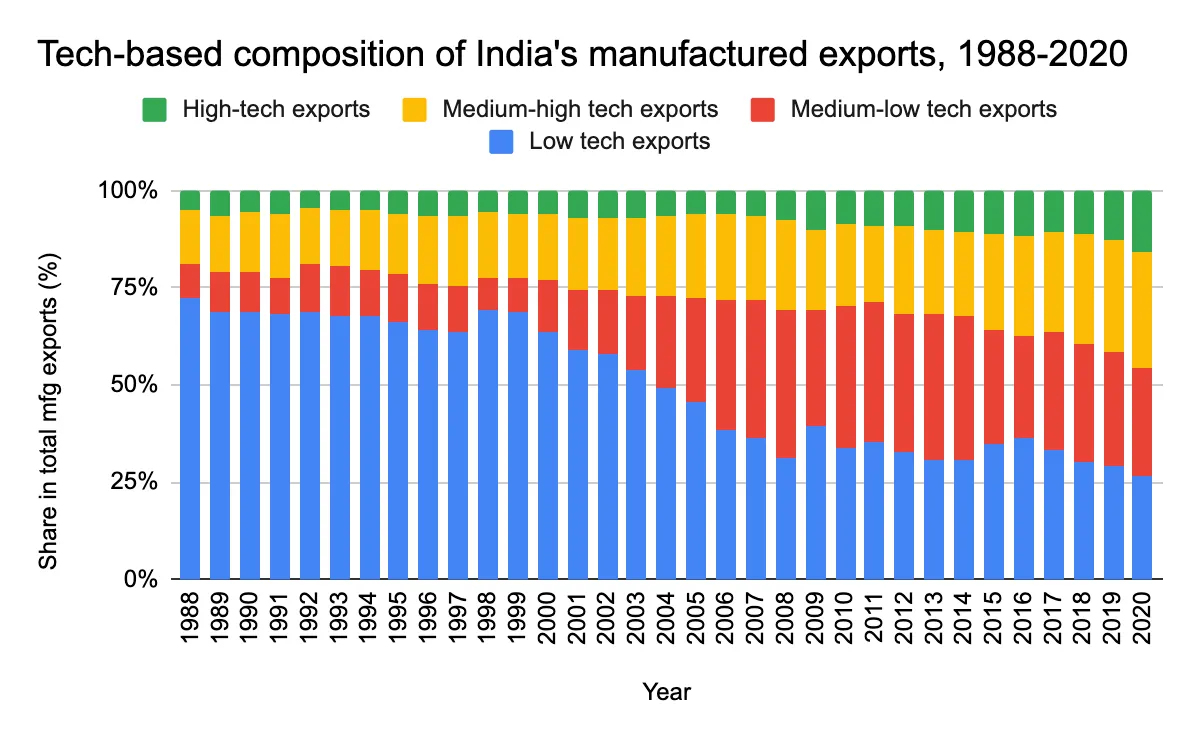

The composition of manufacturing exports has undergone drastic changes since the 1990s where high-skill manufacturing exports have been increasing and low-skill manufacturing exports have been declining.

Figure 3.

Source: Author’s own calculations using UN COMTRADE

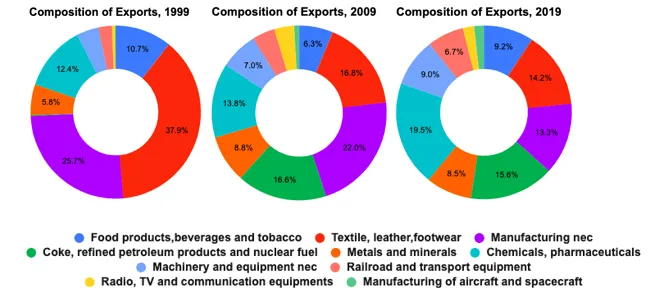

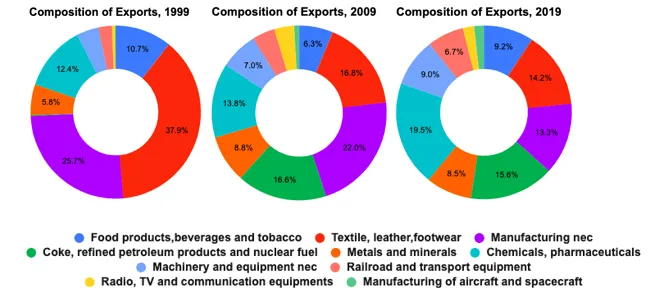

Figure 4.

Source: Author’s own calculations using UN COMTRADE

Figure 4.

Source: Author’s own calculations using UN COMTRADE

Figure 5.

Source: Author’s own calculations using UN COMTRADE

Figure 5.

Source: Author’s own calculations using UN COMTRADE

Source: Author’s own calculations using UN COMTRADE

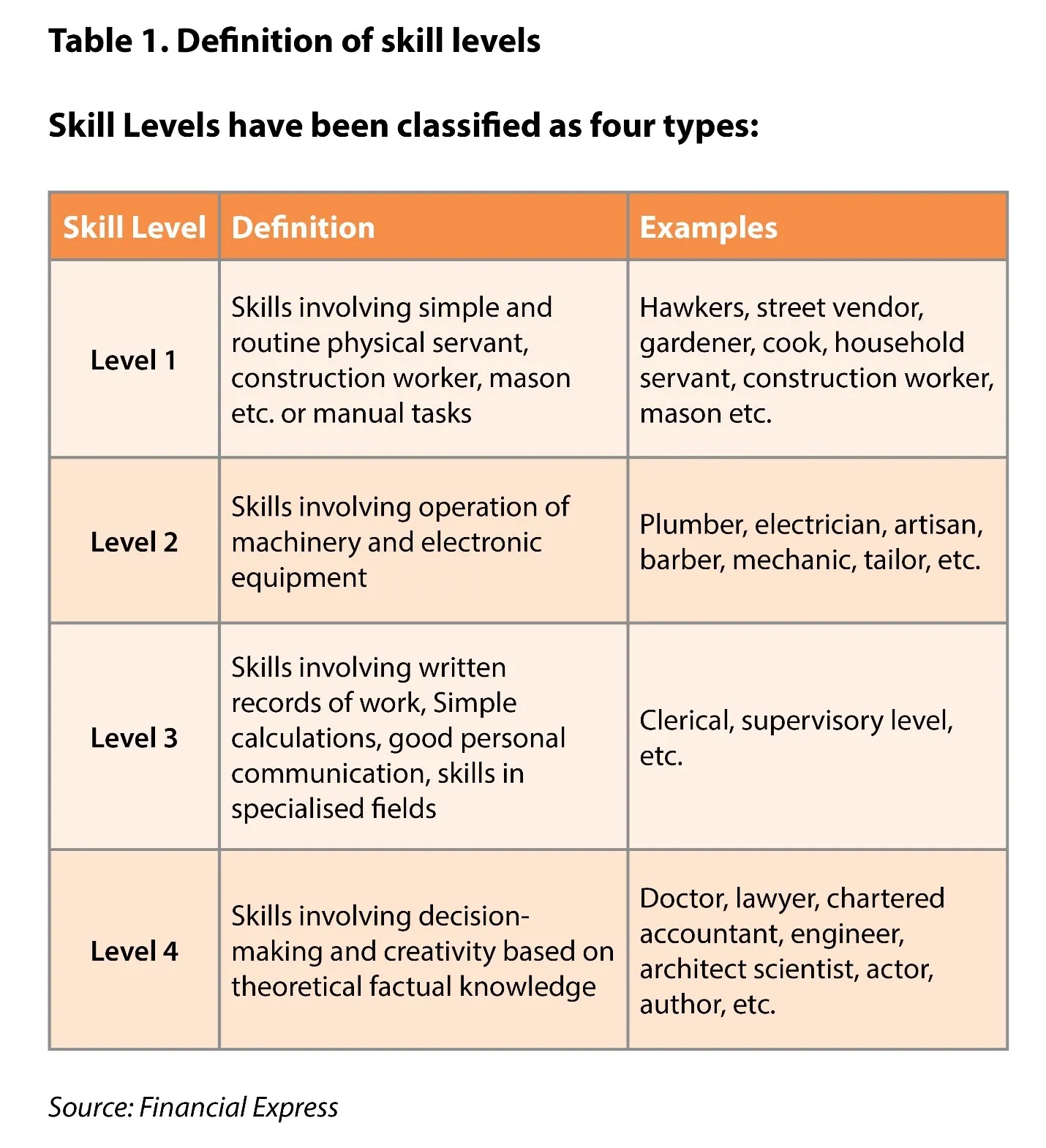

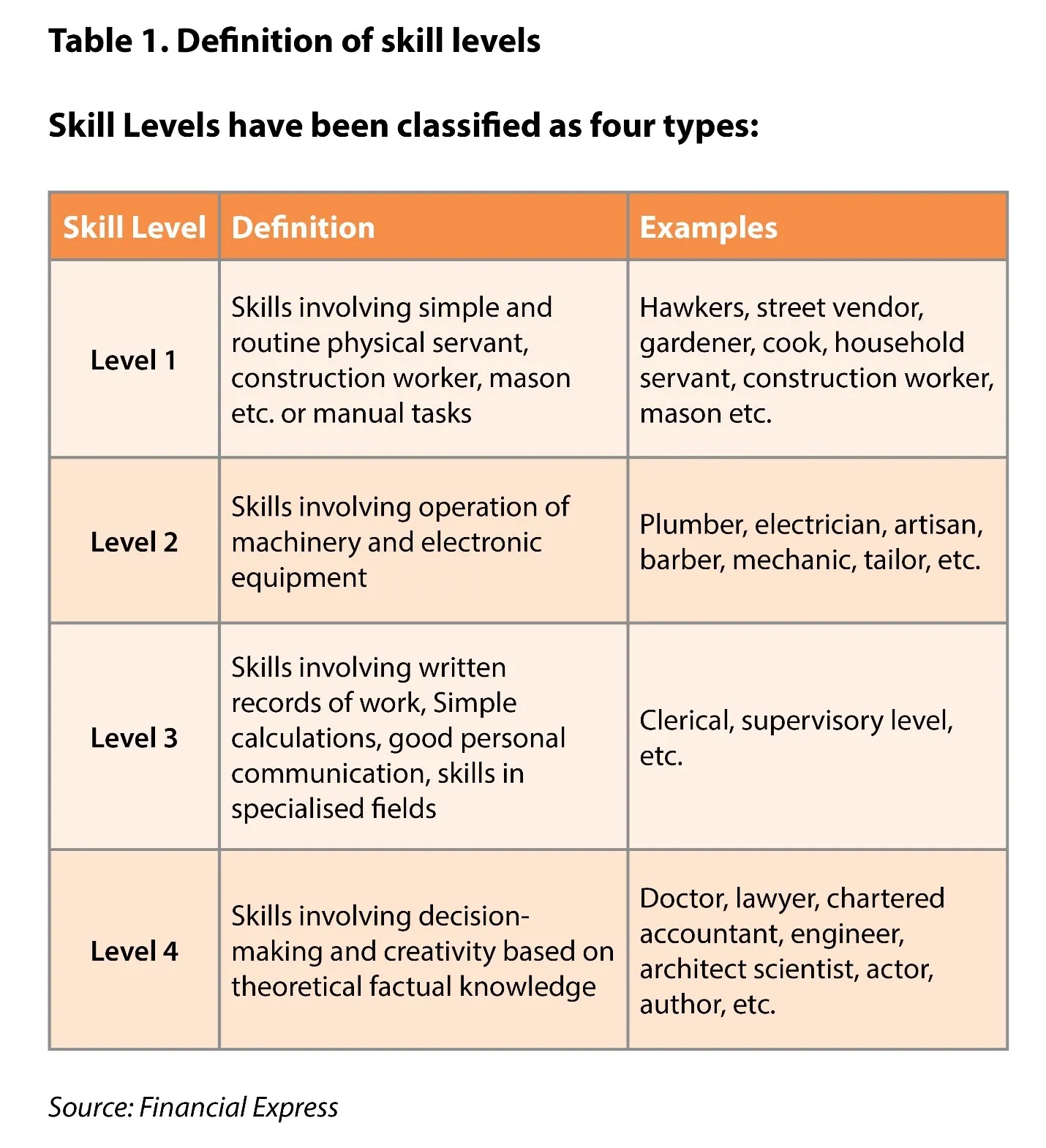

In Figure 3, the skill-based composition is done using

Chatterjee & Subramanian’s (2020) framework of skill intensity.

In Figure 4, the technology-based composition is done under OECD’s classification of manufacturing exports based on technology. This classification is in turn based on

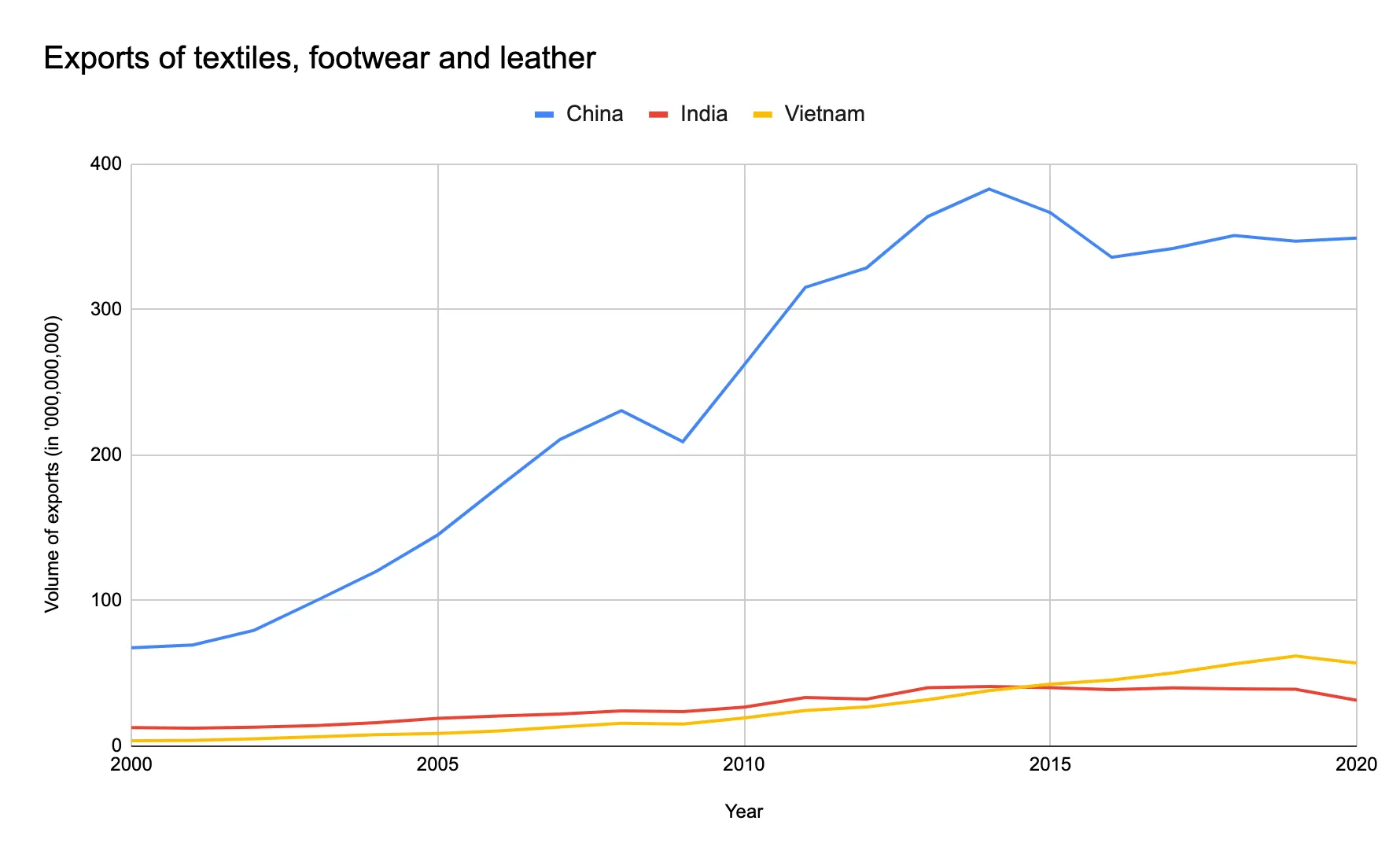

Lall’s classification. Both the figures reveal a decline in the proportion of low-skill industries. Figure 5 illustrates the changes in the composition of exports in major sectors. There is a decline in low-tech exports like textile, leather, footwear (from 37.9 percent in 1999 to 14.2 percent in 2019), and manufacturing n.e.c. (from 25.7 percent in 1999 to 13.3 percent in 2019). India is losing steam in low-skill manufacturing exports in the global market as well. Exports of textiles, footwear, and leatherwork as an illustrative case here. In Figure 6, in the exports of textiles, footwear, and leather, India and Vietnam were competing closely till 2015, post which Indian exports’ declined while Vietnam’s exports continued to rise and overtook India. China’s exports exceeded India’s and Vietnam’s for all the years by a huge magnitude.

Figure 6.

Source: UN COMTRADE

Source: UN COMTRADE

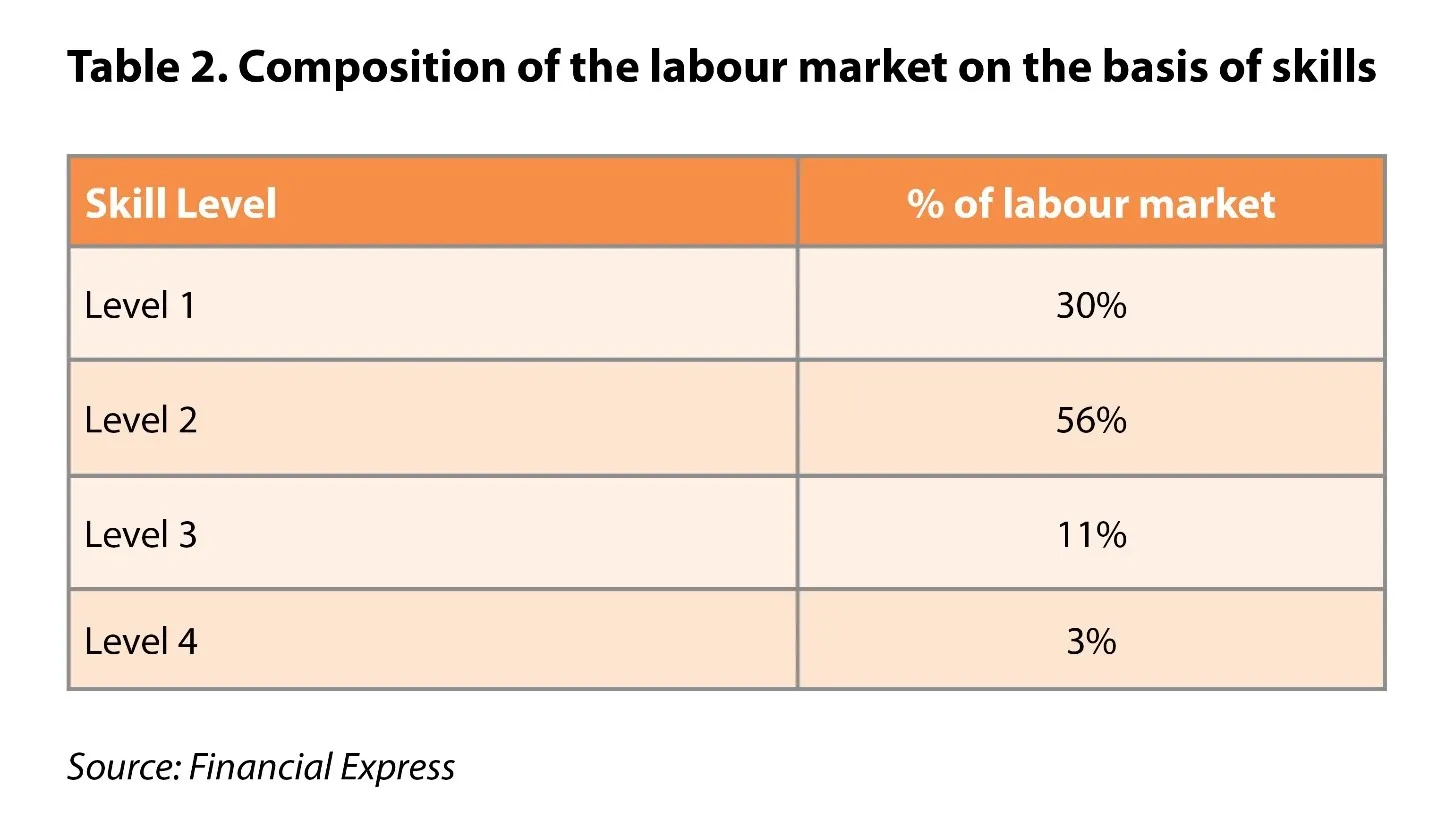

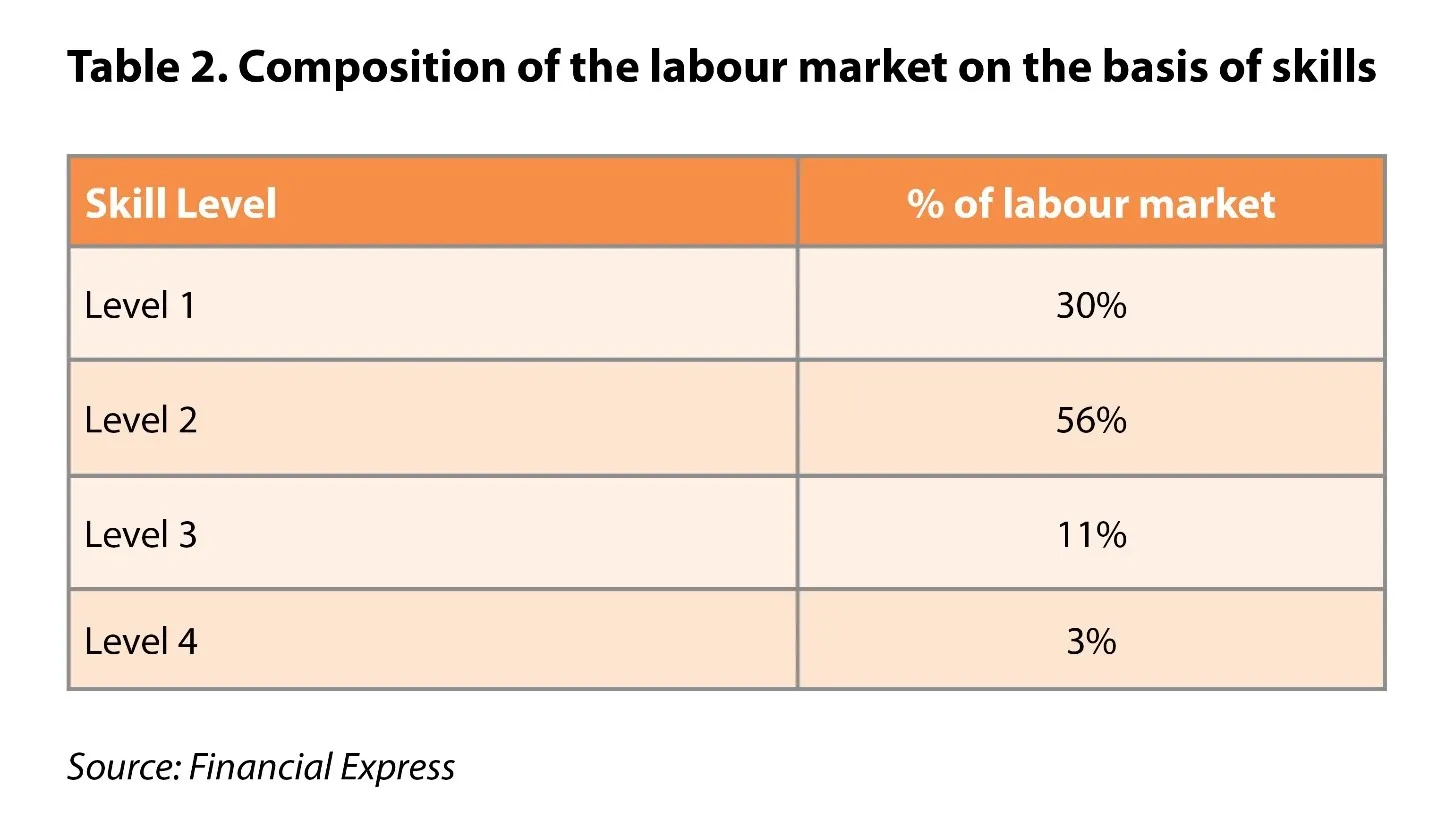

It is thus important to understand why it is particularly worrisome for India and then delve into the reasons behind the declining exports. The low-skill manufacturing sector is labour-intensive and thus, holds tremendous opportunities for job creation. With 12 million people joining the labour force on average annually, the expansion in low-skill manufacturing jobs can help ameliorate the unemployment problem to a huge extent. Vietnam, for example, generated 1.5 million jobs in an economy with less than 95 million population between 2014 and 2016 in manufacturing jobs alone, owing to their double-digit growth in labour-intensive manufacturing exports. The Economic Survey of 2021 points out that India exhibits a competitive advantage in labour-intensive low-skill sectors like apparel, textile articles, footwear, etc. However, its exports patterns in the past decade show that it has exported more capital-intensive products. On the other hand, Bangladesh has exploited its competitive advantage in labour-intensive industries, and therefore, superseded India in export growth by a difference of 7.7 percentage points in the past decade. The labour endowment is just not significant enough in India, but 52 percent of the labour market has level 2 skills which are apt for agriculture and low-skill manufacturing. Since the agricultural sector is already burdened, employing them in low-skill manufacturing seems to be the best bet skillset wise.

Chatterjee & Subramanian (2020) found that India is losing out US$140 billion annually due to missing low-scale manufacturing activity given its labour endowment.

Besides, various studies enumerate social benefits of employment in labour-intensive industries.

The Economic Survey of 2016-17 illustrated that labour-intensive industries like apparel, leather, and footwear had the highest female labour intensity (measured in terms of jobs per unit of investment).

A study also found that female education, total fertility rates, and women’s labour force participation moved positively due to the expansion of the apparel sector in Bangladesh. This is especially significant because India has one of the lowest female labour force participation amongst the developing countries, and it has been declining for the last three decades.

Reasons behind the slacking growth

Paradoxically, the government has systematically set laws and regulations in place to make its most abundant endowment, unskilled labour inaccessible, and completely unattractive for firms.

India is embracing the high-skill and IT sector and moving away from labour-intensive industries primarily because of the presence of the heavy hand of government and associated rent-seeking in the latter while sparing the former.

Mehrotra (2019) argues that one of the significant contributing factors to the proliferation of services and the IT sector is its ability to function under the Shop and Establishment Act, and therefore not be subjected to the 45 labour laws which apply to industries. Not surprisingly, India guarantees the safest employment to its people in industries albeit with no jobs available for them in the first place. One of the common features amongst the poster children of labour-intensive exports led growth like Bangladesh, Vietnam, China, etc. is that their systems are not clogged with a labyrinthine set of regulations and restrictions on hiring labour. The

OECD Economic Survey 2019 notes that since in India, labour regulations progressively become more stringent as the size of the firms expands, they incentivise firms to stay small and thus unnoticeable to the government. This stops them from exploiting economies of scale, which is an important requisite for labour-intensive manufacturing industries to achieve competitiveness and higher productivity. For example, an average garment factory in Bangladesh has about 797 employees, while Indian textile firms have about 240 employees per enterprise.

India guarantees the safest employment to its people in industries albeit with no jobs available for them in the first place.

The finished goods of the labour-intensive sector rely heavily on infrastructure and transportation, unlike services. India ranks 44th in the World Logistics Performance Index behind China and Vietnam. The Economic Survey of 2017

<1> estimated that the logistic costs of India (US$7) are far greater than the logistic cost of Bangladesh (US$3.0) or Sri Lanka (US$3.9) in getting their inputs to factories and outputs from factories to their destination. Seaport infrastructure is severely handicapped since most of the ports lack the capacity to handle large container vessels. Consequently, a large share of containers has to be trans-shipped through other ports like Colombo and Dubai, generating additional costs and delays. Unproductive regulations exacerbate the infrastructural gaps. For example, interstate freight transport by road not only require a national permit, but have to obtain approvals from each individual state’s regional transport authority. This, in turn,

adds to the costs and delays of transportation of goods.

Whilst there are other factors like tax and tariff policy, lack of free trade agreements, etc. acting as hurdles for faster export growth. Factors exclusive to low-skill manufacturing goods have been discussed above.

PLIs: A hit or miss

In the light of the concerns and inefficiencies addressed in low-skill manufacturing exports, it is important to explore the newest policy tool “production-linked incentives” schemes introduced by the Government of India in March 2020 to achieve the twin goal of incentivising manufacturing and generating employment.

- The PLIs scheme covers just one sector in the low-skill manufacturing sector—the textile and apparel sector. The PLIs are set to cover 40 products in man-made fibre apparel, 14 in man-made fibre fabrics, and 10 technical textile segments/products.

- This is in line with correcting the opposing forces where world demand is shifting strongly towards man-made fibres and against cotton-based exports, while India’s textile has veered towards cotton-based industries instead of man-made fibre apparel.

- However, the scheme seems to not be in line with the underlying causes of such inclination. The man-made fibres (principal input of man-made fibre apparel) are majorly imported and face a higher tariff compared to cotton fibres. The domestic production taxes also tend to favour cotton-based production by levying a 5-percent tax as opposed to a 12-percent tax on man-made fibre-based production.

- Therefore, the tax and tariff policy in the context of man-made fibres needs to be revised to make it inherently attractive for Indian textile industries instead of artificially pumping money from outside via incentives.

- The minimum cap on investment outlay is set to INR300 crore in phase 1 followed by INR100 crore in phase 2. This is done with the aim of reversing the incentives for firms to stay small and make expansion lucrative to achieve economies of scale.

- While the underlying reasoning that the lower productivity of MSMEs is detrimental to the sector’s growth is justified, the investment cap is a misplaced solution for the problem at hand. The existence of various disincentives in form of labour laws and MSME coddling regulations are the root causes that prevent firms from expanding. The investment cap acts as a band-aid to the open wound of a fragmented industry. The industry has to swallow the bitter pill of removal of the disincentives. It will let market forces and profitability determine a firm’s decision to expand instead of distortionary barriers placed by the government.

- The requisite radical reforms, however, seem far-fetched given the current political environment. The few benefitting from such schemes have organized themselves in powerful lobbies (for example, trade unions), while the majority at loss are scattered and lack the resources to create a dent in the policy framework.

- Therefore, the industry would remain fragmented in which various stages of production are carried out by different players leading to the dominance of MSMEs. Therefore, given the status quo, it is advisable to reduce the investment cap so the existing fragmented firms can benefit from this scheme.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

India is increasingly making its presence felt in the global market (Figure 1,2) although the components driving the export growth remain contestable. On the one end of the spectrum,

India is increasingly making its presence felt in the global market (Figure 1,2) although the components driving the export growth remain contestable. On the one end of the spectrum,

PREV

PREV