-

CENTRES

Progammes & Centres

Location

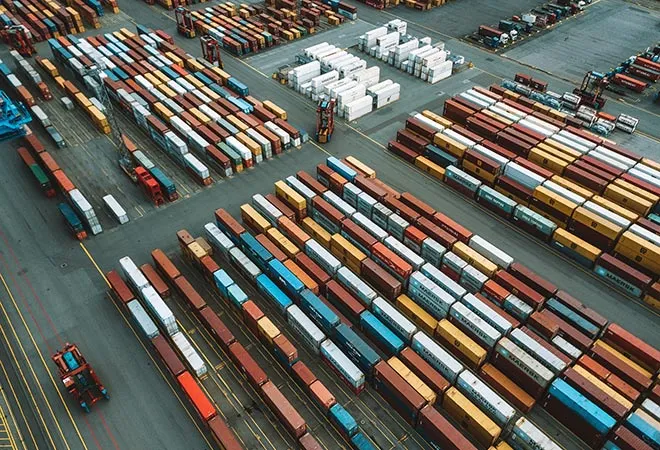

Image Source: MorBCN

Containers at the Barcelona harbor

The Global Value Chain or GVC is the new buzz word in India for boosting export growth and Commerce Minister Suresh Prabhu has mentioned its importance in his speeches frequently. Around 70 per cent of the world trade is structured within GVCs of multinational corporations. In GVC, the contribution of each participating country in the making of a product is small and is related only to value addition. The product is conceptualised and designed in an advanced country -- like the Apple I-phone which is designed in the US. The parts are made in different countries but the final product is assembled in China and is sent back to the US for marketing.

GVC has become all the more necessary because selling products that are labour intensive are becoming difficult for many developing countries and they are facing falling returns unless the producers are able to upgrade the quality of products through higher value addition.

This problem is particularly relevant to SMEs of developing countries which generally have limited pricing power and limited capabilities and options for upgrading their products.

The way they can export is to link up with international production networks but then they have to meet a wide range of increasingly stringent global standards with respect to quality, price, timely delivery and flexibility. Only some countries have been successful in integrating themselves in the GVC and China is on the forefront. Almost all big retail chains of the world get their products made in China even though shifts to other locations can be seen in recent times.

India has been able to participate in GVC in gems and jewellery, automotive parts and services. But why is it that India is not able to integrate into GVC in more items? The reasons could be many ranging from lower wages like in the garment industry of Bangladesh and the high skill levels of Bangladeshi women workers. Bangladeshi garment producers are linked to big retailers in the EU and the US like GAP, Sears, Zara, H&M etc. Other reasons could be logistics, infrastructure and ability to deliver consignments on time due to lesser regulations. Instead of entering the GVC, India could easily enter a Regional Value Chain (RVC) in garments and in many other items with neighbouring countries, especially when there is a Free Trade Agreement with the countries within the region in place.

For Regional Value Chain to take off, India will have to improve its cross border infrastructure, remove tariff and non-tariff barriers, speed up the implementation of rules for harmonisation of regulations and technical standards which could make the trade between countries of the region more fluid.

RVCs don’t demand strict norms like in GVCs because the goods cater to specifics of the local market demand and consumption patterns which may be similar for the entire region. They may be less dynamic than the GVC in transforming the economy and pushing for faster industrialisation but they have resulted in better logistic systems while incorporating indigenous firms in some regions of Africa.

They have led to enhancing integration, productivity and division of labour which is beneficial for the participating countries in terms of employment and skills available.

Once RVCs are established, the end products can also be exported globally, particularly to developed countries’ markets due to the likelihood of improvement in quality.

The participation in RVCs has been found to lay the foundation for consolidating and upgrading production processes in the participating developing countries so that they can ultimately be linked to the next step of entering the Global Value Chain.

There can be growth poles for the RVC and India can be one of the growth poles in the sub region comprising the BIMSTEC (Bay of Bengal Initiative for Multi Sectoral Technical and Economic Cooperation) member countries—India, Sri Lanka, Bangladesh, Nepal, Bhutan, Myanmar and Thailand. Thailand can be another growth pole, in case an FTA materialises between the seven member countries. These growth poles which operate like hub and spokes already are the region’s financial capitals and attract more investment than the others. They can serve as headquarter of the RVC and could take the lead in the deployment of resources, primarily by channelling foreign and intra-regional productive investments into the region. The two growth poles can create an important pathway to trigger manufacturing growth in the region which is mainly agricultural and this would transform lives and enhance incomes of the people. The RVC can be built taking into account the local regulatory and development requirements and can channel knowledge and transfer technologies within the region.

The RVC will comprise of local players from SMEs and they could be part of the new industrial learning process and act as an interface between the global value chain multinationals and the regional network of producers who will be instrumental in preparing the region’s industrial base for the upgradation of skills and infrastructure.

Problems may arise because many of the countries in the region are competitors and are not complementary allies. Most of them are producing the same kinds of goods. Even so, in the BIMSTEC sub region, there can be cooperation between Myanmar, India, Sri Lanka and Thailand in Gems and jewellery production since Myanmar, Sri Lanka and Thailand produce very good quality gems. India specializes in cutting and polishing gem stones as well as making gold, silver and studded jewellery. Similarly, in production of bamboo items which can include furniture, cloth and artefacts, there could be a RVC between North Eastern region of India, Myanmar, Thailand and Bhutan. For herbal products, there could be RVC between Nepal, India and Bhutan. For garments, there is a big potential for RVC between Sri Lanka, Bangladesh and India. Many garment producers of India have already shifted base to Bangladesh. In leather goods, there is potential RVC between India, Bangladesh and Thailand.

Apart from spreading industrialisation, there will be creation of employment opportunities and skills development in the sub region.

As is well known, today the main danger to GVC is the spread of automation and Artificial Intelligence. More and more developed nations are trying to upgrade their technology with robotics, 3D printing and AI that reduces the need for outsourcing of products to cheaper locations that use cheap semi-skilled labour. The advanced countries will only demand very highly skilled labour with which few developing countries are endowed. That is why Regional Value Chains are of great importance for the development of a sub-region like BIMSTEC.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Jayshree Sengupta was a Senior Fellow (Associate) with ORF's Economy and Growth Programme. Her work focuses on the Indian economy and development, regional cooperation related ...

Read More +

David Rusnok Researcher Strengthening National Climate Policy Implementation (SNAPFI) project DIW Germany

Read More +