This article is part of the series Comprehensive Energy Monitor : India and the World

The call on natural gas

The price of natural gas and coal as fuels for power generation has increased across the world, and one of the key reasons is the weather. Cold winters and warm summers drove up demand for electricity, but it also reduced supply from renewables. This meant an unexpected call on coal and gas-based power generation capacity that drove up the price of electricity.

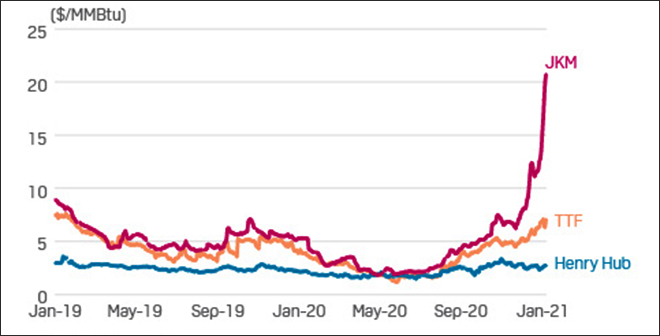

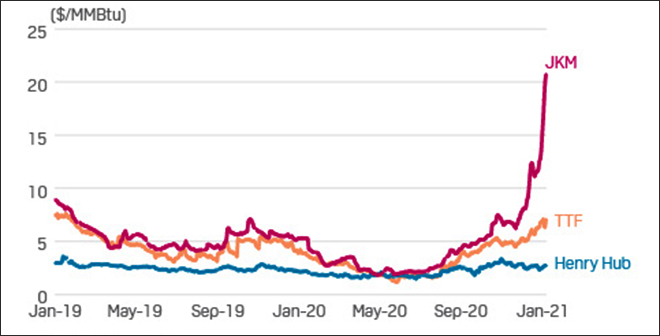

The first to hit the headlines was Europe and the United Kingdom (UK) with record high price for natural gas and electricity. In the first quarter of 2021, a cold winter along with increase in remote working pushed up demand for heating in Europe which translated into a more than 7 percent increase in the demand for natural gas (used for power generation). This was followed by the end of pandemic-related lockdowns, economic recovery, and an increase in industrial output all of which increased demand for energy. Warmer than expected summer increased the demand for cooling from households. This added to the pressure on gas demand in Europe and the UK, but gas demand was increasing across the world, particularly in LNG (liquefied natural gas) importing Asia Pacific countries. Russia reduced pipeline gas supplies to Europe because of high domestic demand or to highlight the case for Nord Stream 2 as some suspect. Gas demand is weather dependent which is why gas suppliers invest in storages that act like batteries filling in whenever needed. Storages are replenished in summer when prices are low, but this time summer was warm and household demand for cooling increased that used up gas reserves. With low gas reserves Europeans and Asians competed for LNG imports that pushed up gas prices even further.

A cold winter along with increase in remote working pushed up demand for heating in Europe which translated into a more than 7 percent increase in the demand for natural gas.

The European gas market is exposed to international market fluctuations as gas-on-gas competition underpins roughly 80 percent of the market. Though natural gas supplies only about 20 percent of Europe’s electricity, gas-fired power plants have become price-setters because of higher electricity demand. Demand for gas in Europe increased also on account of high carbon prices that meant a switch from coal to gas. But then, high gas prices made coal competitive even with high carbon prices driving up the demand for coal. Natural gas prices soared by around 280 percent in Europe in 2021 which also led to a 100 percent increase in gas prices in the USA. According to Reuters, the average LNG price for November delivery into Northeast Asia was estimated at about US $24-25/ metric million British thermal units (mmBtu), while benchmark European natural gas prices have surged to around US $25/mmBtu from around US $6-7/mmBtu at the start of the year.

Chart 1: Price of Natural Gas in Different Markets

Source: S&P Global, Note: JKM: Japan Korea Marker; TTF: Title Transfer Facility (Dutch)

Source: S&P Global, Note: JKM: Japan Korea Marker; TTF: Title Transfer Facility (Dutch)

The call on coal

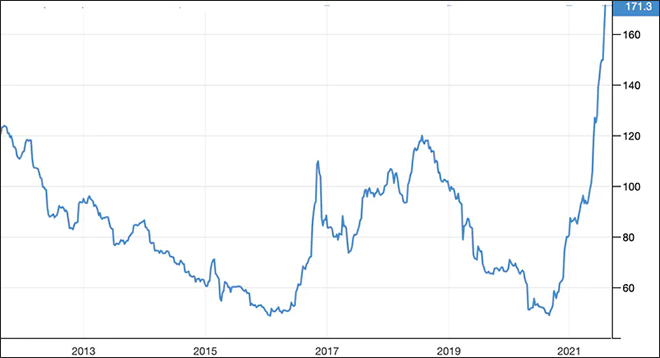

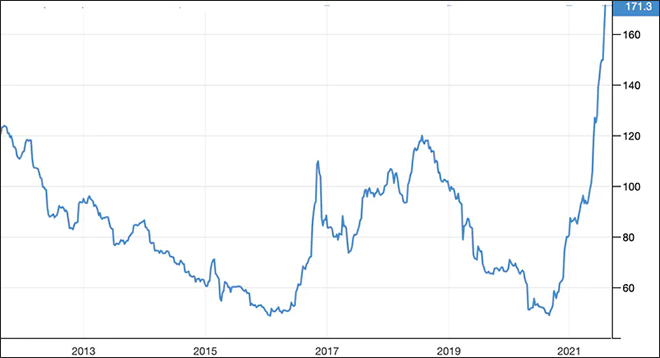

The coal story revolves around China and India that jointly account for over 65 percent of global coal use. India and China are also the world’s biggest coal importers. The price of thermal coal imports is now nearing record levels as growing demand for electricity in China and India is coming to terms with the reluctance to invest in new coal-based power generation capacity in a world heading for decarbonisation. The benchmark coal price (traded coal) was US $177.50/tonne the highest in the past 11 years in early September was more than double the level at the beginning of the year and much higher than the US $50/tonne price a year ago. Growth in demand for electricity following economic recovery and the hot summer pushed up demand for coal in India and China. China generated 13 percent more electricity in the first seven months of this year than in the same period of 2020, partly to make up for lower output from hydropower following a drought. The result was that in July, China was importing 16 percent more coal than the same month last year.

The benchmark coal price (traded coal) was US $177.50/tonne the highest in the past 11 years in early September was more than double the level at the beginning of the year and much higher than the US $50/tonne price a year ago.

In India, the economy rebounded in the first quarter of India’s financial year (April-June) that GDP (gross domestic product) grew at a record pace. Overall electricity generation rose by over 16 percent in August, while coal-fired power output increased by over 23 percent from a year earlier. According to Reuters, half of India’s 135 coal-fired power plants had less than a week’s supply of coal left, six ran out of coal and 50 had less than three days’ supply. The government intervened and asked Coal India Limited (CIL) to prioritise supplies to power plants—rather than supply aluminium, cement and steel plants—and also asked power generators to import coal. In the first eight months of 2021, coal-fired electricity generation increased by over 19 percent.

Issues

The common factor in the developments above is that the weather increased demand for electricity (heating and cooling) and decreased supply (power generation from wind, solar and hydro). Weather independent coal and gas-based generation capacity stepped in as swing producers to meet the demand for electricity in European and Asian markets. The key issue to ponder over is why the market continues to embrace coal and gas, fuels that the climate-sensitive world has criminalised.

Chart 2: Price of Traded Coal in $/tonne

Source: Trading Economics

Source: Trading Economics

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

PREV

PREV