For anyone tracking the Indian economy, the last week has been extremely eventful. Three sets of statistics, released by the Reserve Bank of India (RBI), National Statistical Office (NSO) and Ministry of Commerce and Industry respectively, clearly reveal the dismal state of the economy and lend credence to the view that the country is in the midst of a prolonged economic slowdown.

On 27 August 2019, the RBI released its annual report for 2018-19 wherein it projected India’s real GDP growth for FY20 at 6.9%, 50 basis points lower than its first projection. Three days later, data released by the National Statistical Office (NSO) pegged India’s GDP growth rate in the first quarter of FY20 at 5%, slowest the Indian economy has grown over a of six years. Finally, on 2 September 2019, Ministry of Commerce and Industry released numbers showing that growth in eight core sectors of the economy had slipped to 2.1 per cent during July as compared to 7.3 per cent during the corresponding month last year.

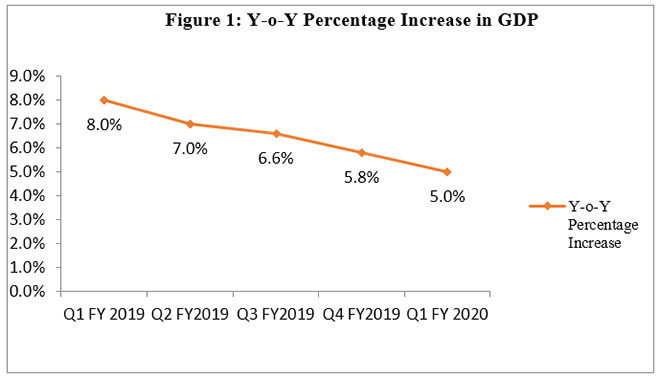

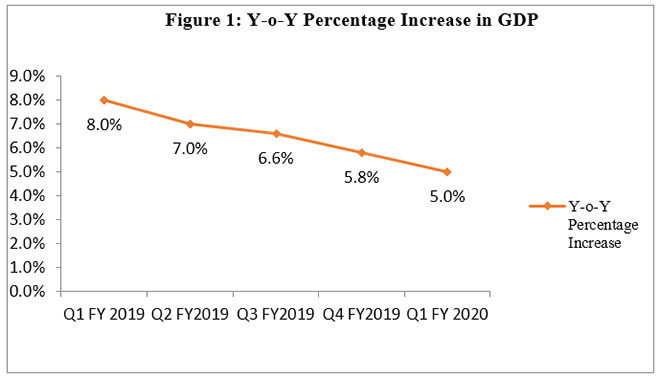

From 8% to 5%: Breaking down the deceleration in GDP growth

Source: National Statistical Office, Ministry of Statistics and Programme Implementation

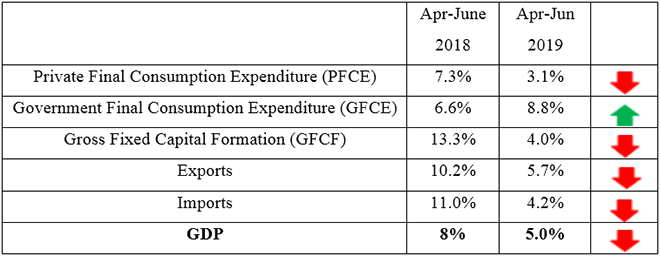

Source: National Statistical Office, Ministry of Statistics and Programme Implementation

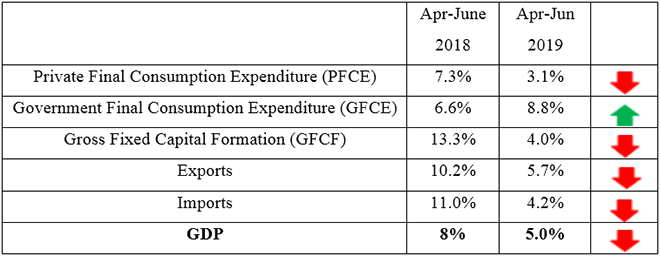

Figure 1 shows the deceleration in GDP growth from 8% in the first quarter of FY19 to 5% in FY20. A breakdown of the components of the GDP and year-on year growth comparison for the April-June quarter is shown in Table 1. Private consumption expenditure (PFCE), the mainstay of aggregate demand, dipped from 7.3% to 3.1%, this being the lowest growth in PFCE recorded since June 2012. Even investment (Gross Fixed Capital Formation), exports and imports have grown at a slower pace in quarter 1 of FY20 as compared to the first quarter of the previous year. It is only government expenditure (GFCE) that has grown at higher rate.

Table 1: Y-o-Y Percentage Change in the Components of GDP

Source: National Statistical Office, Ministry of Statistics and Programme Implementation

Source: National Statistical Office, Ministry of Statistics and Programme Implementation

However, understanding the drivers of an economic slowdown is as much a matter of sentiment as statistics. Consumer confidence, as measured by the Consumer Confidence Survey (CCS) conducted by the RBI, declined to 95.7 in July 2019 against 97.3 in May. Consumers’ perception of the economy has deteriorated, as indicated by their views on the general economic situation, employment, price level, income and spending. As demand slackens and consumers begin to consciously reduce their spending, the slowdown that the economy is already experiencing becomes self-reinforcing.

A consumption-led slowdown

The RBI Annual Report also stated that it is difficult to disentangle the prevailing economic conditions from one another and diagnose whether the Indian economy is currently facing a soft patch, a cyclical downswing or a structural slowdown. It is indeed true that complex economic conditions can rarely be explained and defined in clear-cut terms but the fact of the matter is that the average Indian cares more about jobs and wages than the terminology used for describing the turmoil in the economy. Anemic wage growth, rising unemployment and layoffs in certain sectors of the economy have not just created utter distress in the labour market but also shaken consumer confidence and choked demand. The report also points out that reduction in sales of motorcycles and tractors by 8.8 per cent and 14.1 per cent respectively during Q1 2019-20 is a clear reflection of the slowdown in rural consumption demand. In a similar vein, urban consumption demand has also slackened as observed by a contraction in passenger car sales, domestic air passenger traffic as well as consumer durables such as TV sets, hand tools, passenger vehicles, electrical apparatus and two-wheelers.

Consumption, accounting for 57% of India’s GDP, is the bedrock of the Indian economy. While there is no silver bullet that will instantly lift the gloom enshrouding the economy, the revival of consumption demand is a must to spur economic activity in the country.

Prioritising job creation and wage growth with a special focus on rural economy

The RBI Annual Report also highlighted that the slowdown was predominantly a result of slackening demand in rural areas. The pervasiveness of rural distress is clearly evident by the Q1 GDP numbers for the agriculture, forestry and fishing segment released by the NSO, which show that the segment grew at 2 per cent as opposed to 5.1 per cent in the same quarter of the previous year.

The Report also proposed the need to enhance the income levels of farmers and rethink the whole approach to the farm sector and quality of policy interventions. Along similar lines, a research report recently released by SBI pointed out that the real rural wage growth has plunged from 14.6% in FY14 to merely 1.1% in FY19. It also cited slow rural wage growth as the most crucial factor reinforcing the demand slowdown.

It is thus clear that the revival of consumption demand will be predicated largely on the government’s ability to create jobs and raise wages. One doesn’t need a formal training in economics to understand the link between employment, income and consumption—it is as logical as it is intuitive. The Rs 1.76 lakh crore windfall received from the RBI should be judiciously utilised for reviving rural demand primarily by increasing expenditure on rural infrastructure projects. This will leverage linkages to core sectors such as cement, steel and power and thus also boost employment.

As with regards to the question of rural wages and farmers’ income, the Economic Survey 2018-19 discussed the government’s target to double farmers’ income by 2022 and the same was reiterated by the Finance Minister in her budget speech. However, the survey document and the FM’s speech highlighted the programmes that have already been rolled out while no new initiatives to boost farmers’ income were mentioned. The need of the hour is to address the structural issues relating to input supplies, irrigation, technology infusion and infrastructure that are currently plaguing the rural economy.

The fact that the FM has rolled out a stimulus package to boost the economy and is expected to introduce several more in the coming days is mildly assuring. Even though it shows that the government is geared up to address the concerns ailing the economy, it also stokes apprehensions that the slowdown is deeper than what the numbers suggest. While it is true that a slowdown caused by a multitude of factors cannot be completely fixed by a single stimulus package or reform, alleviating rural distress and thereby reviving consumption demand is just the boost that the economy needs.

The author is a research intern at ORF.

The views expressed above belong to the author(s). ORF research and analyses now available on Telegram! Click here to access our curated content — blogs, longforms and interviews.

Source: National Statistical Office, Ministry of Statistics and Programme Implementation

Source: National Statistical Office, Ministry of Statistics and Programme Implementation Source: National Statistical Office, Ministry of Statistics and Programme Implementation

Source: National Statistical Office, Ministry of Statistics and Programme Implementation PREV

PREV